Key Insights

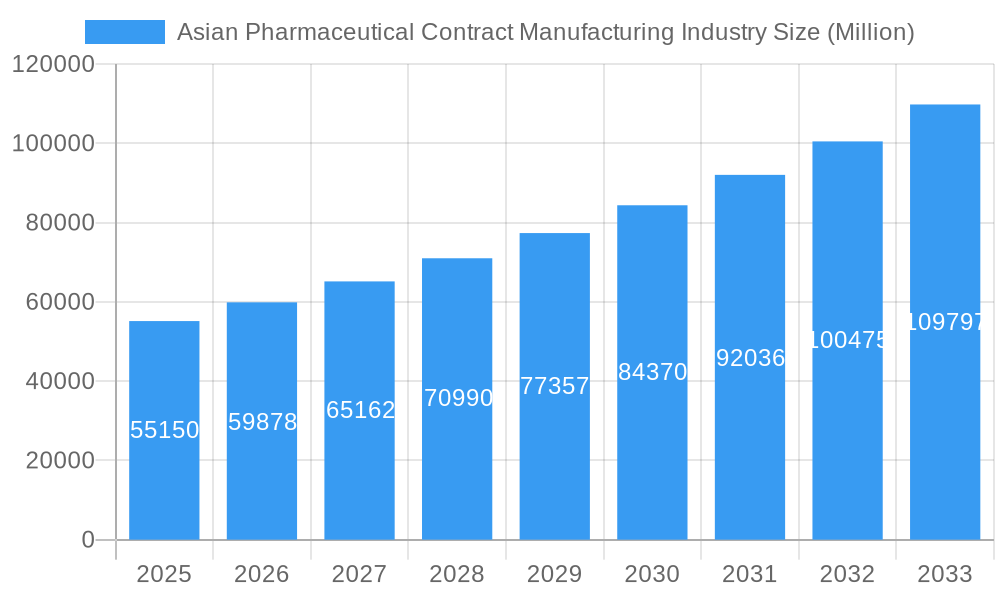

The Asian pharmaceutical contract manufacturing market, valued at $55.15 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.74% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and the rising demand for affordable pharmaceuticals across the region are stimulating outsourcing of manufacturing processes. Secondly, the robust growth of the biopharmaceutical sector, particularly in countries like China and India, is driving demand for specialized services like High Potency API (HPAPI) manufacturing and finished dosage formulation (FDF) development. Furthermore, stringent regulatory requirements and a focus on improving manufacturing efficiency are prompting pharmaceutical companies to partner with contract manufacturers possessing advanced technological capabilities and expertise. The presence of established players like Lonza, Thermo Fisher Scientific, and Catalent, alongside rapidly growing local contract manufacturers, further contributes to market dynamism.

Asian Pharmaceutical Contract Manufacturing Industry Market Size (In Billion)

Significant growth is expected in segments like injectable dose formulation secondary packaging and API manufacturing, particularly within key markets such as China, India, and Japan. These countries offer a combination of cost advantages, skilled labor, and expanding regulatory frameworks conducive to contract manufacturing operations. While challenges remain, including potential supply chain disruptions and fluctuations in raw material costs, the long-term outlook for the Asian pharmaceutical contract manufacturing industry remains extremely positive. The market’s growth trajectory is anticipated to be significantly influenced by continued innovation in drug delivery systems, the increasing focus on personalized medicine, and the rise of innovative therapeutic areas. This will create opportunities for contract manufacturers to invest in advanced technologies and expand their service portfolios to meet evolving client needs.

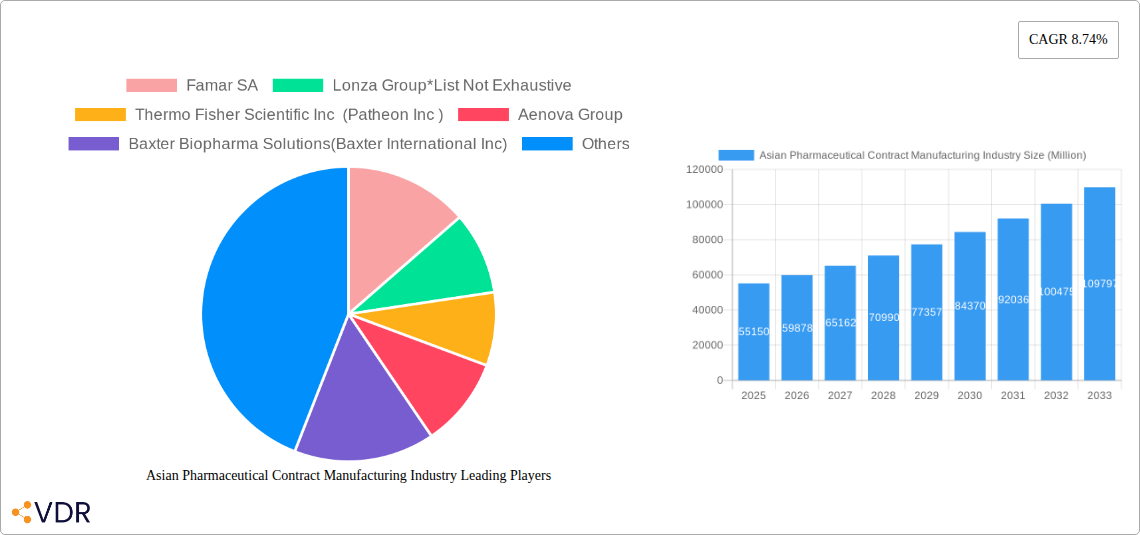

Asian Pharmaceutical Contract Manufacturing Industry Company Market Share

Asian Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asian pharmaceutical contract manufacturing industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. It delves into market dynamics, growth trends, regional dominance, key players, and emerging opportunities across various segments, including API manufacturing, HPAPI, and finished dosage formulation (FDF). The report uses 2025 as the base year and includes historical data from 2019-2024. Market values are presented in Million units.

Asian Pharmaceutical Contract Manufacturing Industry Market Dynamics & Structure

The Asian pharmaceutical contract manufacturing market is characterized by a moderately concentrated structure, with a few large players holding significant market share. However, the presence of numerous smaller, specialized contract manufacturers contributes to a dynamic and competitive landscape. Technological innovation, particularly in areas like advanced analytics, automation, and digitalization, are key drivers. Stringent regulatory frameworks, including those related to Good Manufacturing Practices (GMP) and data privacy, significantly influence market dynamics. While generic competition exists, the increasing demand for complex formulations and specialized APIs limits the impact of simple substitutes. The end-user demographics are diverse, encompassing multinational pharmaceutical companies, smaller biotech firms, and generic drug manufacturers. Mergers and acquisitions (M&A) are frequent, reflecting consolidation trends and the pursuit of scale and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation Drivers: Automation, AI-driven process optimization, and continuous manufacturing.

- Regulatory Framework: Stringent GMP guidelines, increasing focus on data security and traceability.

- Competitive Product Substitutes: Limited for specialized APIs and complex formulations.

- End-User Demographics: Diverse, including multinational and smaller pharmaceutical companies.

- M&A Trends: Increasing consolidation, driven by scale and technological synergies; xx M&A deals recorded in 2019-2024.

Asian Pharmaceutical Contract Manufacturing Industry Growth Trends & Insights

The Asian pharmaceutical contract manufacturing market is experiencing dynamic and sustained growth, propelled by a confluence of powerful economic and industry-specific forces. Escalating healthcare expenditure across the region, coupled with a strategic shift by major pharmaceutical players towards outsourcing their manufacturing operations, are significant contributors. This outsourcing trend is driven by the pursuit of enhanced operational efficiency and the desire to leverage specialized expertise and cost-effective manufacturing solutions prevalent in Asia. Technological advancements are not merely accelerating market expansion but are fundamentally reshaping it. The widespread adoption of cutting-edge solutions such as single-use technologies, which offer greater flexibility and reduced cross-contamination risks, and the implementation of continuous manufacturing processes, promising higher yields and improved product consistency, are key innovations. Furthermore, evolving consumer preferences towards highly specialized drug therapies and the burgeoning demand for complex biologics are creating new avenues for growth and specialization within the contract manufacturing sector.

Quantitatively, the market has demonstrated impressive upward trajectory. The market size expanded from xx million units in 2019 to xx million units in 2024. Projections indicate a continued upward trend, with the market expected to reach xx million units by 2033. This represents a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Notably, the market penetration for highly specialized and complex manufacturing capabilities, such as High Potency Active Pharmaceutical Ingredient (HPAPI) manufacturing, is accelerating at an impressive CAGR of xx%, highlighting the industry's commitment to innovation and advanced capabilities.

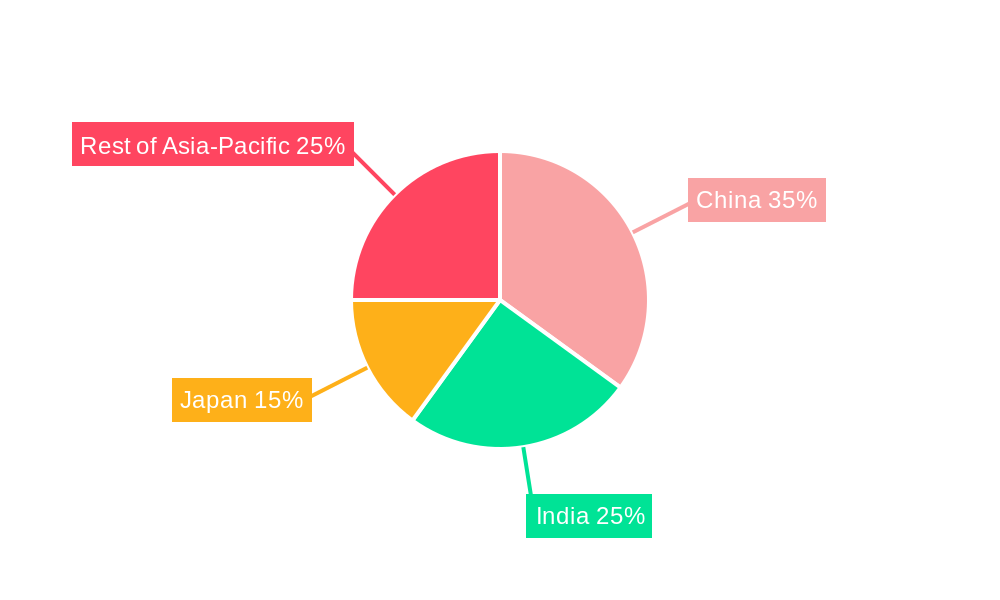

Dominant Regions, Countries, or Segments in Asian Pharmaceutical Contract Manufacturing Industry

Within the vast Asian landscape, China and India stand out as the dominant markets, commanding significant shares. Their leadership is underpinned by a synergistic combination of supportive government policies aimed at fostering pharmaceutical innovation and manufacturing, substantial investments in expanding and modernizing healthcare infrastructure, and the availability of a large and skilled workforce. Japan, while a more mature market, remains a pivotal player, distinguished by its advanced technological capabilities, unwavering commitment to stringent quality standards, and a highly sophisticated regulatory environment.

When examining market segments, Active Pharmaceutical Ingredient (API) manufacturing continues to hold the largest market share, reflecting the foundational importance of drug substance production. This is closely followed by finished dosage formulation (FDF) development and manufacturing, which encompasses the crucial steps of turning APIs into usable medicines. The segment of injectable dose formulation, particularly in its secondary packaging, is emerging as a rapidly growing area, driven by the increasing demand for parenteral therapies and biologics. Beyond the established leaders, regions like Australia and the broader Rest of Asia-Pacific are presenting substantial and increasingly attractive growth opportunities, fueled by growing pharmaceutical investments and rising domestic demand for healthcare solutions.

- Key Drivers in China & India: Proactive and supportive government policies, highly competitive cost-effective labor, and rapidly expanding healthcare infrastructure are primary catalysts.

- Key Drivers in Japan: Renowned for its cutting-edge technological adoption, rigorous quality control systems, and exceptionally high regulatory compliance standards.

- Segment Dominance: API manufacturing commands the largest market share, estimated at xx%, followed by FDF at xx% and Injectable Dose Formulation at xx%.

- Growth Potential: The Rest of Asia-Pacific region demonstrates significant untapped growth potential, driven by escalating pharmaceutical investments and a burgeoning demand for innovative healthcare solutions.

Asian Pharmaceutical Contract Manufacturing Industry Product Landscape

The product landscape is characterized by a diverse range of services, including API manufacturing, HPAPI manufacturing, and finished dosage formulation (FDF) development and manufacturing. Innovation focuses on improving efficiency, reducing costs, enhancing quality, and expanding into specialized therapeutic areas. Key innovations include single-use technologies for aseptic manufacturing, continuous manufacturing processes, and advanced analytics for process optimization. Unique selling propositions include speed to market, flexible manufacturing capabilities, and stringent quality control measures.

Key Drivers, Barriers & Challenges in Asian Pharmaceutical Contract Manufacturing Industry

Key Drivers:

- Increasing outsourcing by pharmaceutical companies to reduce operational costs and improve efficiency.

- Rising demand for complex generics and specialized drugs.

- Technological advancements driving process optimization and automation.

- Favorable government policies supporting pharmaceutical manufacturing in key Asian markets.

Challenges & Restraints:

- Stringent regulatory compliance requirements.

- Supply chain disruptions and raw material price volatility (xx% impact on API manufacturing costs).

- Intense competition from established and emerging players.

- Skilled labor shortages in some regions.

Emerging Opportunities in Asian Pharmaceutical Contract Manufacturing Industry

- Expansion into emerging markets within Asia-Pacific.

- Focus on personalized medicine and cell therapy manufacturing.

- Growth in the biologics and biosimilars manufacturing segments.

- Adoption of advanced analytics and automation technologies.

Growth Accelerators in the Asian Pharmaceutical Contract Manufacturing Industry

The Asian pharmaceutical contract manufacturing industry's trajectory is significantly amplified by a range of potent growth accelerators. Foremost among these are continuous technological breakthroughs. Innovations such as AI-driven process optimization, which allows for predictive analytics and enhanced efficiency, and the widespread implementation of continuous manufacturing processes are not just incremental improvements but are acting as fundamental catalysts for long-term, sustainable growth. Furthermore, the forging of strategic partnerships between contract manufacturers and established pharmaceutical companies is proving invaluable. These collaborations foster a fertile ground for innovation, enable the sharing of expertise, and critically, expand market reach by leveraging complementary strengths. The industry's proactive expansion into new therapeutic areas, including the rapidly evolving fields of cell and gene therapies, which require highly specialized manufacturing capabilities, is another key driver. Coupled with substantial investment in advanced manufacturing facilities equipped to handle these complex modalities, these efforts are significantly accelerating the industry's growth and enhancing its competitive edge on the global stage.

Key Players Shaping the Asian Pharmaceutical Contract Manufacturing Market

Notable Milestones in Asian Pharmaceutical Contract Manufacturing Industry Sector

- 2021: Catalent significantly expanded its manufacturing capacity in China, underscoring its commitment to the region and its growing role in the Asian pharmaceutical supply chain.

- 2022: Lonza made a strategic investment in advanced technology for HPAPI manufacturing in Singapore, highlighting the region's growing importance for high-potency drug production.

- 2023: Thermo Fisher Scientific's acquisition of a smaller contract manufacturer in India demonstrated the ongoing consolidation and strategic acquisitions within the sector, aimed at enhancing service offerings and market presence.

- 2024: Aenova launched a new state-of-the-art facility in Japan, signifying continued investment in advanced manufacturing infrastructure and a commitment to meeting the high-quality standards of the Japanese market. (Specific details of milestones would need further research and will vary based on ongoing industry developments and confidentiality.)

In-Depth Asian Pharmaceutical Contract Manufacturing Industry Market Outlook

The Asian pharmaceutical contract manufacturing market is poised for sustained growth, driven by technological advancements, strategic collaborations, and increasing demand for specialized pharmaceutical products. Significant opportunities exist in emerging markets and the development of novel therapies. Strategic investments in advanced manufacturing technologies and expansion into new geographic areas will be crucial for companies to capitalize on the market's long-term potential. The market is anticipated to maintain a robust CAGR, leading to substantial market expansion throughout the forecast period.

Asian Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

Asian Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Asian Pharmaceutical Contract Manufacturing Industry

Asian Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Outsourcing Volume by Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Injectable Dose Formulations Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Famar SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lonza Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aenova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Baxter Biopharma Solutions(Baxter International Inc)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pfizer CentreSource (Pfizer Inc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Famar SA

List of Figures

- Figure 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asian Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Indonesia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Malaysia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Singapore Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Vietnam Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Philippines Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bangladesh Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Pakistan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 8.74%.

2. Which companies are prominent players in the Asian Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Famar SA, Lonza Group*List Not Exhaustive, Thermo Fisher Scientific Inc (Patheon Inc ), Aenova Group, Baxter Biopharma Solutions(Baxter International Inc), Pfizer CentreSource (Pfizer Inc), Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asian Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.15 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Outsourcing Volume by Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Injectable Dose Formulations Holds Significant Market Share.

7. Are there any restraints impacting market growth?

; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Asian Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence