Key Insights

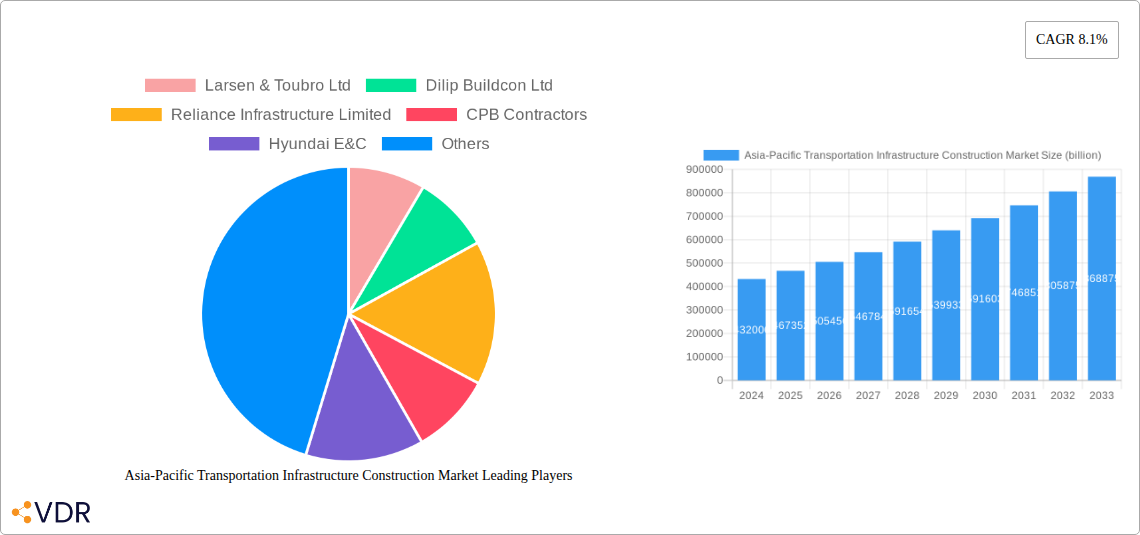

The Asia-Pacific Transportation Infrastructure Construction Market is experiencing robust growth, projected to reach an estimated USD 432 billion in 2024 and expand at a significant compound annual growth rate (CAGR) of 8.1% through 2033. This expansion is propelled by a confluence of dynamic drivers, including escalating government investments in national connectivity projects, burgeoning urbanization necessitating improved urban mobility solutions, and the critical need for modernizing aging infrastructure across key economies. The region's rapid economic development, coupled with a growing middle class and increasing inter-regional trade, further amplifies the demand for efficient and extensive transportation networks. Road and railway construction dominate the current landscape, reflecting a strategic focus on enhancing land-based connectivity for both freight and passenger movement. Emerging economies within the Asia-Pacific, particularly in Southeast Asia and India, are becoming pivotal centers of activity, attracting substantial investments and undertaking ambitious development plans.

Asia-Pacific Transportation Infrastructure Construction Market Market Size (In Billion)

The market is characterized by a strong pipeline of projects across various transportation modes, from ambitious high-speed rail networks and airport expansions to significant port development and road network upgrades. Technological advancements in construction techniques, smart infrastructure solutions, and sustainable building practices are also shaping the industry, pushing for greater efficiency and environmental responsibility. Despite the optimistic outlook, the market faces certain restraints, including the substantial capital required for large-scale projects, complexities in land acquisition, and evolving regulatory frameworks. However, the persistent demand for improved logistics, facilitated by the booming e-commerce sector and global supply chain demands, continues to drive innovation and investment. Companies like Larsen & Toubro Ltd, Dilip Buildcon Ltd, and China State Construction Engineering are at the forefront, leveraging their expertise to capitalize on the immense opportunities presented by this vital and expanding sector.

Asia-Pacific Transportation Infrastructure Construction Market Company Market Share

Asia-Pacific Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This report offers an in-depth analysis of the burgeoning Asia-Pacific transportation infrastructure construction market, a critical sector poised for significant expansion. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this research provides unparalleled insights into market dynamics, growth trends, dominant segments, and key players. We delve into the parent market encompassing all transportation infrastructure and its child markets for roads, railways, airways, and waterways, offering a holistic view of opportunities and challenges. Explore market size, CAGR, technological advancements, and strategic imperatives crucial for stakeholders seeking to capitalize on this dynamic landscape.

Asia-Pacific Transportation Infrastructure Construction Market Market Dynamics & Structure

The Asia-Pacific transportation infrastructure construction market is characterized by a moderate to high degree of concentration, with several large-scale players dominating significant portions of the project landscape. Technological innovation is a key driver, particularly in areas like intelligent transportation systems (ITS), sustainable construction materials, and advanced tunneling and bridge-building techniques. Regulatory frameworks vary significantly across the region, with some nations actively promoting foreign investment and streamlined approval processes, while others present more complex bureaucratic hurdles. Competitive product substitutes are limited in the core infrastructure construction domain; however, innovations in modular construction and pre-fabrication offer efficiency gains. End-user demographics are increasingly influenced by rapid urbanization, a growing middle class, and the burgeoning e-commerce sector, all demanding more efficient and extensive transportation networks. Merger and acquisition trends are on the rise as companies seek to consolidate market share, acquire specialized expertise, and expand their geographical reach within the region.

- Market Concentration: Dominated by a few key players, with increasing consolidation.

- Technological Innovation Drivers: ITS, sustainable materials, advanced construction techniques.

- Regulatory Frameworks: Varied across countries, impacting investment and project execution.

- Competitive Product Substitutes: Limited in core construction, but efficiency gains from modularity.

- End-User Demographics: Urbanization, growing middle class, e-commerce driving demand.

- M&A Trends: Increasing activity for market consolidation and expertise acquisition.

Asia-Pacific Transportation Infrastructure Construction Market Growth Trends & Insights

The Asia-Pacific transportation infrastructure construction market is projected to witness robust growth driven by a confluence of economic development, government initiatives, and evolving societal needs. The market size is expected to expand significantly, moving from an estimated $250 billion in 2025 to a projected $450 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5%. Adoption rates for advanced construction technologies are accelerating, spurred by the need for faster project completion and improved sustainability. Technological disruptions, such as the integration of AI in project management, advanced robotics in construction, and the increasing use of BIM (Building Information Modeling), are reshaping project planning and execution. Consumer behavior shifts are evident, with a growing demand for seamless multi-modal connectivity, reduced travel times, and environmentally conscious transportation options. Investments in smart cities and digital infrastructure are further fueling the demand for integrated transportation networks. The region's rapid economic expansion and the sheer scale of its population underscore the sustained requirement for enhanced road, rail, air, and water transport links. The ongoing development of high-speed rail networks, expansion of airport capacities, and modernization of port facilities are key indicators of this upward trajectory. Furthermore, a growing emphasis on green infrastructure and sustainable mobility solutions is creating new avenues for growth and innovation within the sector, influencing both public and private investment decisions. The report forecasts significant growth in specific sub-segments as countries prioritize modernizing their logistical capabilities to support trade and economic competitiveness.

Dominant Regions, Countries, or Segments in Asia-Pacific Transportation Infrastructure Construction Market

The Roads segment is poised to be the dominant force within the Asia-Pacific transportation infrastructure construction market, driven by its fundamental role in economic activity, freight movement, and daily commuting across the vast and diverse region. Countries like China, India, and Indonesia are spearheading this dominance, owing to their substantial population bases, rapid urbanization, and ambitious national development plans focused on improving road connectivity. The sheer volume of ongoing and planned highway projects, including expressways, national highways, and urban road networks, accounts for a significant portion of the overall infrastructure expenditure. Economic policies in these dominant nations are heavily skewed towards infrastructure development, recognizing its multiplier effect on GDP growth and job creation. For instance, China's Belt and Road Initiative has spurred massive investment in road infrastructure across multiple participating countries. India's Bharatmala Pariyojana and the National Highways Development Project are further testament to the government's commitment to enhancing road networks.

- Dominant Segment: Roads, accounting for an estimated 40-45% of the total market share.

- Key Countries: China, India, Indonesia, Vietnam.

- Key Drivers for Roads:

- Economic Policies: Government prioritization of road networks for trade and connectivity.

- Infrastructure Investment: Large-scale national and regional road development programs.

- Urbanization: Increasing demand for improved urban mobility and traffic management.

- Freight Movement: Critical for efficient supply chains and e-commerce logistics.

- Tourism Growth: Enhanced connectivity to tourist destinations.

- Market Share & Growth Potential: The roads segment is projected to maintain its leadership, with a strong growth potential driven by ongoing projects and the continuous need for network expansion and upgrades.

While Railways are experiencing significant investment, particularly in high-speed rail and urban metro systems, and Airways and Waterways are crucial for specific logistical needs, the pervasive demand and ongoing projects in road construction make it the leading segment. The scalability and accessibility of road projects, catering to both passenger and freight needs across urban and rural areas, solidify its position as the primary driver of the Asia-Pacific transportation infrastructure construction market.

Asia-Pacific Transportation Infrastructure Construction Market Product Landscape

The product landscape within the Asia-Pacific transportation infrastructure construction market is increasingly characterized by the integration of advanced materials and smart technologies. Innovations in high-strength concrete, durable asphalt mixes, and eco-friendly construction aggregates are enhancing the longevity and sustainability of infrastructure projects. Intelligent Transportation Systems (ITS) are becoming integral, encompassing sensors, communication networks, and data analytics platforms that optimize traffic flow, enhance safety, and provide real-time information to commuters and freight operators. The development of prefabricated components and modular construction techniques is also gaining traction, enabling faster construction times and reduced on-site disruption. These advancements are crucial for building resilient and efficient transportation networks capable of meeting the region's growing demands.

Key Drivers, Barriers & Challenges in Asia-Pacific Transportation Infrastructure Construction Market

Key Drivers:

- Economic Growth and Urbanization: Rapid population growth and increasing urbanization in Asia-Pacific necessitate expanded and modernized transportation networks.

- Government Initiatives and Investments: Proactive government policies and substantial public sector investments in infrastructure development are a primary growth catalyst.

- Technological Advancements: Innovations in construction techniques, materials, and digital technologies (e.g., ITS, BIM) are improving efficiency and sustainability.

- Globalization and Trade: The need for efficient logistics and supply chains to support international trade and regional economic integration.

Barriers & Challenges:

- Regulatory and Permitting Hurdles: Complex and time-consuming approval processes can significantly delay project timelines.

- Land Acquisition and Resettlement Issues: Obtaining land for large-scale infrastructure projects often involves protracted negotiations and social challenges.

- Skilled Labor Shortages: A persistent challenge in sourcing and retaining a skilled workforce capable of handling complex construction projects.

- Financing and Funding Constraints: Securing adequate and timely financing for capital-intensive infrastructure projects can be challenging, especially in developing economies.

- Environmental Concerns and Sustainability Pressures: Increasing scrutiny on the environmental impact of construction projects and the demand for sustainable practices.

- Supply Chain Disruptions: Global and regional supply chain volatility can impact the availability and cost of construction materials and equipment.

Emerging Opportunities in Asia-Pacific Transportation Infrastructure Construction Market

Emerging opportunities lie in the development of sustainable and green transportation infrastructure, including electric vehicle charging networks, high-speed rail corridors powered by renewable energy, and port infrastructure designed for efficient and eco-friendly cargo handling. The increasing adoption of autonomous vehicles and smart city initiatives presents a significant opportunity for integrated digital transportation solutions. Furthermore, the expansion of intermodal logistics hubs and the modernization of existing waterways for increased freight capacity offer substantial growth potential. Investment in climate-resilient infrastructure to withstand extreme weather events is also becoming a critical area of focus.

Growth Accelerators in the Asia-Pacific Transportation Infrastructure Construction Market Industry

Several key catalysts are accelerating the growth of the Asia-Pacific transportation infrastructure construction industry. Government-led initiatives like China's Belt and Road Initiative and India's Gati Shakti National Master Plan are injecting massive capital and strategic direction into infrastructure development. The rising adoption of Public-Private Partnerships (PPPs) is also crucial, enabling private sector expertise and financing to complement public funding. Technological breakthroughs in areas such as advanced tunneling, smart materials, and digital project management are not only improving efficiency but also paving the way for more complex and ambitious projects. Furthermore, the growing regional emphasis on connectivity and trade facilitation is driving demand for cross-border infrastructure projects, fostering greater collaboration and investment.

Key Players Shaping the Asia-Pacific Transportation Infrastructure Construction Market Market

- Larsen & Toubro Ltd

- Dilip Buildcon Ltd

- Reliance Infrastructure Limited

- CPB Contractors

- Hyundai E&C

- China State Construction Engineering

- China Communications Construction Company

- Obayashi Corporation

- Italian Thai (ITD)

- China Railway Construction Corporation

Notable Milestones in Asia-Pacific Transportation Infrastructure Construction Market Sector

- January 2023: The Indo-Japan Joint Working Group (JWG) agreed to collaborate on enhancing road infrastructure for commuters and freight, supporting India's sustainable transportation goals. This collaboration is set to drive digital transformation in Intelligent Transportation Systems (ITS) and eco-friendly mobility, reinforcing India's commitment to digitally enabled highway development.

- January 2023: China's CRRC Corporation Ltd. introduced its hydrogen urban train, the first in Asia and second globally. Capable of reaching 160 km/h with a 600 km range, the train integrates digital solutions like GoA2 automation and 5G transmission, projected to cut CO2 emissions by 10 tons annually compared to diesel.

In-Depth Asia-Pacific Transportation Infrastructure Construction Market Market Outlook

The outlook for the Asia-Pacific transportation infrastructure construction market remains exceptionally strong, fueled by sustained government commitment, increasing private sector participation, and the imperative for enhanced regional connectivity. Growth accelerators such as smart city development, the adoption of sustainable building practices, and the integration of cutting-edge digital technologies will continue to shape the market. Strategic opportunities abound in bridging infrastructure gaps in emerging economies, modernizing existing networks, and developing integrated multi-modal transport systems that enhance efficiency and reduce environmental impact. The market is poised for transformative growth, presenting significant opportunities for innovation, investment, and collaboration.

Asia-Pacific Transportation Infrastructure Construction Market Segmentation

-

1. Modes

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Waterways

Asia-Pacific Transportation Infrastructure Construction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Asia-Pacific Transportation Infrastructure Construction Market

Asia-Pacific Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population

- 3.2.2 along with a rising middle class

- 3.3. Market Restrains

- 3.3.1. Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs

- 3.4. Market Trends

- 3.4.1. Government initiatives driving transport infrastructure market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Modes

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Larsen & Toubro Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dilip Buildcon Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Infrastructure Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CPB Contractors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai E&C

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China State Construction Engineering

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Communications Construction Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Obayashi Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Italian Thai (ITD)**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Railway Construction Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Larsen & Toubro Ltd

List of Figures

- Figure 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 2: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Modes 2020 & 2033

- Table 4: Asia-Pacific Transportation Infrastructure Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Transportation Infrastructure Construction Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Asia-Pacific Transportation Infrastructure Construction Market?

Key companies in the market include Larsen & Toubro Ltd, Dilip Buildcon Ltd, Reliance Infrastructure Limited, CPB Contractors, Hyundai E&C, China State Construction Engineering, China Communications Construction Company, Obayashi Corporation, Italian Thai (ITD)**List Not Exhaustive, China Railway Construction Corporation.

3. What are the main segments of the Asia-Pacific Transportation Infrastructure Construction Market?

The market segments include Modes.

4. Can you provide details about the market size?

The market size is estimated to be USD 432 billion as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific countries are investing in infrastructure projects to improve regional connectivity and promote economic integration; The Asia Pacific region has a large and growing population. along with a rising middle class.

6. What are the notable trends driving market growth?

Government initiatives driving transport infrastructure market in India.

7. Are there any restraints impacting market growth?

Limited public budgets and difficulties in attracting private investment can hinder the financing of large-scale projects; Delays in land acquisition can significantly impact project timelines and costs.

8. Can you provide examples of recent developments in the market?

January 2023: The Indo-Japan Joint Working Group (JWG) will work together to provide the best road infrastructure for commuters and freight movement while also assisting India in meeting its sustainable transportation goals. The collaborative projects will lead to a massive digital transformation in the areas of intelligent transportation systems (ITS) and environmentally friendly mobility. India's strong commitment to collaboration with Japan in the areas of highway development, administration, and monitoring through the implementation of digitally enabled ITS services

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence