Key Insights

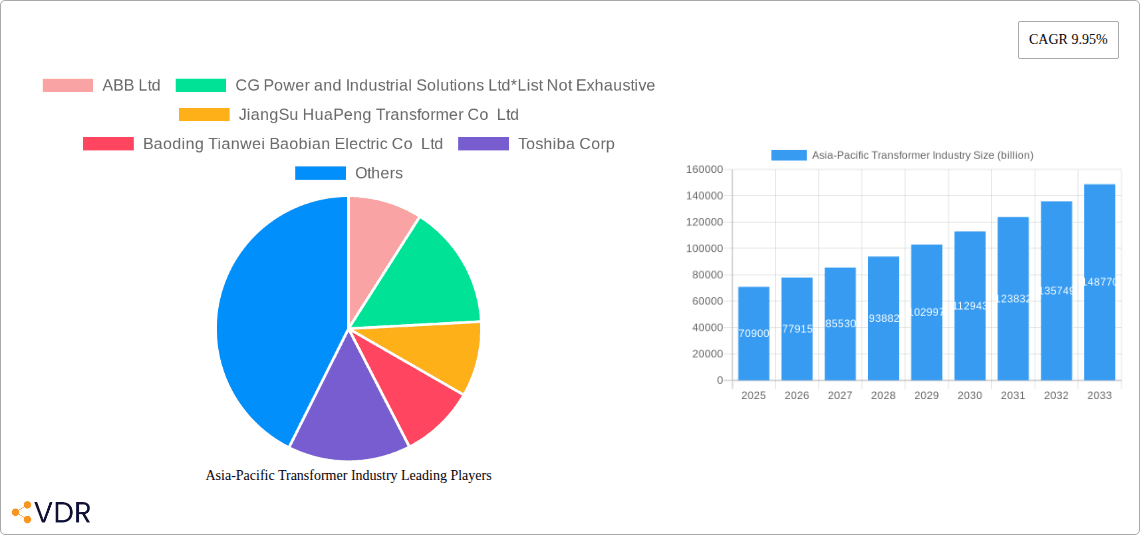

The Asia-Pacific transformer market is poised for significant expansion, projected to reach USD 70.9 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.95% during the forecast period of 2025-2033. This growth is primarily propelled by escalating investments in power generation and transmission infrastructure across the region, driven by rapid industrialization, urbanization, and a burgeoning demand for electricity. The expansion of smart grids and the increasing adoption of renewable energy sources, such as solar and wind power, are creating a substantial need for advanced and efficient transformer solutions. Furthermore, the ongoing modernization of existing power grids and the development of new industrial facilities are significant contributors to market growth. Key segments driving this expansion include large power transformers essential for high-voltage transmission, and oil-cooled transformers favored for their efficiency in demanding applications. The dominant markets within the Asia-Pacific region are expected to be China and India, owing to their extensive development projects and vast populations.

Asia-Pacific Transformer Industry Market Size (In Billion)

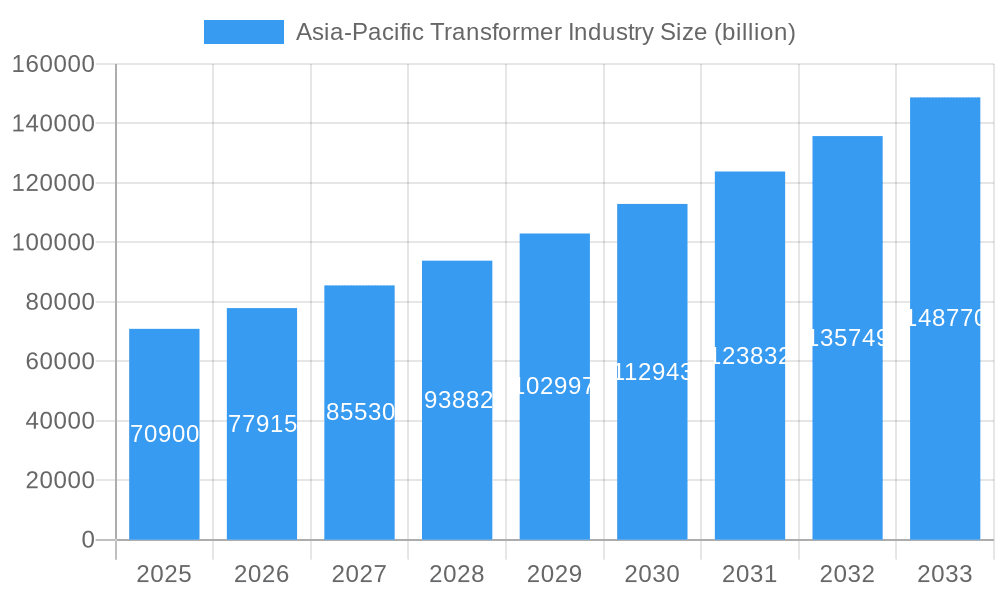

The market is characterized by a dynamic competitive landscape, with major global players like Siemens AG, ABB Ltd, and General Electric Company actively participating alongside prominent regional manufacturers such as JiangSu HuaPeng Transformer Co Ltd and CG Power and Industrial Solutions Ltd. While the market is experiencing strong growth, potential restraints include fluctuating raw material prices and stringent environmental regulations concerning transformer manufacturing and disposal, which may impact operational costs. Nevertheless, the ongoing technological advancements in transformer design, focusing on enhanced energy efficiency, reduced losses, and improved reliability, are expected to further stimulate market demand. The continuous push towards grid modernization and the integration of renewable energy further solidify the positive outlook for the Asia-Pacific transformer industry, ensuring its crucial role in powering the region's economic development.

Asia-Pacific Transformer Industry Company Market Share

Asia-Pacific Transformer Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Asia-Pacific transformer industry, offering an in-depth analysis of market structure, growth trajectories, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Covering the historical period of 2019-2024 and projecting forward to 2033 with a base year of 2025, this study provides actionable insights for stakeholders navigating this critical sector. Explore the intricate parent and child market relationships, understand evolving technological advancements, and leverage quantitative and qualitative data to inform strategic decision-making in this rapidly expanding market.

Asia-Pacific Transformer Industry Market Dynamics & Structure

The Asia-Pacific transformer industry is characterized by a moderately concentrated market, with key players like ABB Ltd, CG Power and Industrial Solutions Ltd, JiangSu HuaPeng Transformer Co Ltd, Baoding Tianwei Baobian Electric Co Ltd, Toshiba Corp, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, General Electric Company, and Panasonic Corporation holding significant sway. Technological innovation is a primary driver, fueled by the growing demand for efficient power transmission and distribution solutions, smart grid integration, and the adoption of renewable energy sources. Regulatory frameworks, largely supportive of infrastructure development and grid modernization, play a crucial role in shaping market entry and product standards. While direct competitive product substitutes are limited for core transformer functions, advancements in energy storage and advanced power electronics present potential long-term disruptions. End-user demographics are diverse, spanning utility companies, industrial manufacturers, and renewable energy developers, each with distinct power requirements. Mergers and acquisitions (M&A) trends indicate consolidation as companies seek to expand their geographical reach, technological capabilities, and product portfolios. For instance, the acquisition of smaller regional players by larger corporations aims to capture market share and enhance operational efficiencies. The increasing investment in grid upgrades and the development of smart grids are pushing for transformers with advanced monitoring and control capabilities, leading to a shift in product development focus.

Asia-Pacific Transformer Industry Growth Trends & Insights

The Asia-Pacific transformer industry is poised for robust growth, driven by a confluence of factors including rapidly expanding economies, increasing electrification rates, and a significant push towards renewable energy integration. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% from 2019 to 2033, indicating substantial expansion in both value and volume. Adoption rates of advanced transformer technologies, such as smart transformers and those designed for higher efficiency, are on an upward trajectory as utilities prioritize grid reliability and energy conservation. Technological disruptions, primarily stemming from digitalization and the Internet of Things (IoT), are transforming transformer design and functionality, enabling remote monitoring, predictive maintenance, and enhanced operational control. Consumer behavior shifts are also influencing the market; there's a growing demand for solutions that can seamlessly integrate intermittent renewable energy sources like solar and wind power into existing grids, necessitating transformers capable of handling fluctuating loads and voltage variations. The increasing urbanization and industrialization across the region are directly translating into higher electricity consumption, thereby driving the demand for new transformer installations and upgrades. Furthermore, government initiatives aimed at modernizing aging power infrastructure and expanding electricity access to underserved populations are acting as significant growth accelerators. The transition towards higher voltage transformers for long-distance power transmission and the development of specialized transformers for electric vehicle charging infrastructure are emerging trends shaping market penetration. The overall market penetration of advanced transformer solutions is expected to rise significantly as companies invest in research and development to meet these evolving demands. The projected market size for the Asia-Pacific transformer industry is estimated to reach USD XXX billion by 2033, a testament to its dynamic growth.

Dominant Regions, Countries, or Segments in Asia-Pacific Transformer Industry

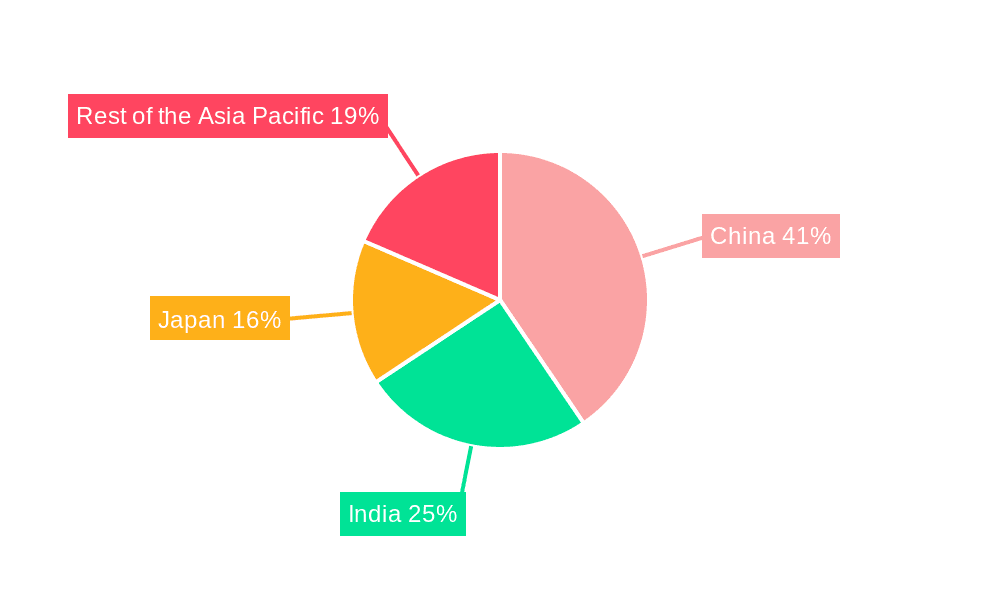

Within the Asia-Pacific transformer industry, China stands out as the dominant region and country driving market growth. Its immense industrial base, coupled with aggressive government investment in power infrastructure and renewable energy projects, has propelled its transformer market to unprecedented levels. The sheer scale of China's electricity demand, fueled by its massive population and manufacturing sector, necessitates a continuous influx of new transformers and the upgrade of existing ones.

- Market Share Dominance: China accounts for a significant portion of the total Asia-Pacific transformer market share, estimated at over XX% in recent years. This dominance is a direct result of its substantial domestic manufacturing capabilities and its role as a global supplier of power transmission and distribution equipment.

- Economic Policies and Infrastructure Investment: The Chinese government's "Belt and Road Initiative" has spurred massive infrastructure development, including power grids, across the region, creating substantial demand for transformers. Furthermore, its ambitious renewable energy targets, particularly in solar and wind power, require a vast network of transformers for integration and transmission.

- Growth Potential: Despite its current dominance, China's transformer market is expected to continue its upward trajectory, driven by ongoing grid modernization efforts, the expansion of high-speed rail networks, and the increasing adoption of electric vehicles, all of which demand robust and reliable power supply.

- Dominant Segments: Within China, Power Transformers and Distribution Transformers represent the largest segments, catering to both large-scale transmission needs and localized power delivery. The Large Power Rating category is particularly significant due to the scale of national power projects, while Oil-Cooled transformers remain prevalent due to their efficiency and cost-effectiveness in high-capacity applications.

- Technological Advancements: Chinese manufacturers are increasingly investing in research and development, producing advanced transformers with higher efficiency ratings and enhanced grid integration capabilities, further solidifying their market position. The continuous expansion of electricity generation capacity, including a significant proportion from renewable sources, directly translates into a perpetual demand for transformer solutions. The country's role as a manufacturing hub for a wide array of industries also ensures a steady demand for industrial transformers of various power ratings.

Asia-Pacific Transformer Industry Product Landscape

The Asia-Pacific transformer industry is witnessing a dynamic product landscape characterized by a strong emphasis on enhanced efficiency, reliability, and smart capabilities. Manufacturers are innovating to produce transformers that can better handle the integration of renewable energy sources, leading to the development of advanced power transformers with features like variable voltage regulation and faster response times to grid fluctuations. Distribution transformers are becoming more compact and efficient, designed for urban environments and distributed generation systems. Product innovations also extend to advanced cooling technologies, with a growing interest in hybrid cooling solutions that combine the benefits of air and oil cooling for optimal performance and environmental sustainability. The unique selling proposition for many manufacturers lies in their ability to offer customized solutions for specific grid requirements, improved energy loss reduction, and integration with digital monitoring platforms. Technological advancements are leading to transformers with longer service lives and reduced maintenance needs, catering to the growing demand for operational efficiency and cost savings across the region.

Key Drivers, Barriers & Challenges in Asia-Pacific Transformer Industry

Key Drivers

The Asia-Pacific transformer industry is propelled by several key drivers:

- Infrastructure Development & Modernization: Extensive government investments in upgrading and expanding power grids across the region, particularly in emerging economies.

- Renewable Energy Integration: The rapid growth of solar and wind power necessitates transformers capable of handling intermittent energy sources and grid stabilization.

- Industrial Growth & Urbanization: Increasing industrial output and expanding urban populations drive higher electricity consumption, demanding more transformers.

- Technological Advancements: Development of smart transformers, higher efficiency designs, and advanced materials for improved performance and reduced losses.

- Electrification Initiatives: Government programs aimed at increasing electricity access in rural and underserved areas.

Barriers & Challenges

Despite its growth, the industry faces significant barriers and challenges:

- Supply Chain Disruptions: Geopolitical factors and raw material price volatility can impact the availability and cost of essential components like copper and steel.

- Regulatory Hurdles & Standardization: Diverse and evolving regulatory landscapes across different countries can create complexities for manufacturers.

- Intense Competition & Price Pressures: A highly competitive market leads to significant price pressures, impacting profit margins.

- Skilled Workforce Shortage: A growing demand for specialized engineers and technicians in transformer design, manufacturing, and maintenance.

- Environmental Regulations: Increasing scrutiny on environmental impact and waste management in manufacturing processes.

Emerging Opportunities in Asia-Pacific Transformer Industry

Emerging opportunities within the Asia-Pacific transformer industry are multifaceted. The burgeoning demand for smart grid solutions presents a significant avenue, with opportunities in transformers equipped with advanced monitoring, control, and communication capabilities to enable real-time grid management and predictive maintenance. The expansion of electric vehicle (EV) charging infrastructure across urban and suburban areas creates a niche market for specialized charging transformers designed for high power delivery and grid integration. Furthermore, the ongoing transition of developing economies towards greater electrification and industrialization opens up vast untapped markets for basic and medium-sized transformers. The increasing focus on energy efficiency and loss reduction in power transmission and distribution presents an opportunity for manufacturers of high-efficiency transformers and those incorporating advanced materials. Finally, the integration of distributed energy resources (DERs) and microgrids, especially in remote or disaster-prone areas, offers a chance for innovative and modular transformer solutions.

Growth Accelerators in the Asia-Pacific Transformer Industry Industry

Several growth accelerators are poised to significantly bolster the Asia-Pacific transformer industry. The sustained and substantial investment in renewable energy projects across countries like China, India, and Southeast Asian nations is a primary catalyst, requiring a massive deployment of transformers for grid interconnection and power evacuation. Technological breakthroughs in areas such as amorphous core transformers and advanced insulation materials are leading to the development of more efficient and durable products, reducing energy losses and operational costs. Strategic partnerships and joint ventures between global power equipment giants and local manufacturers are facilitating technology transfer, market penetration, and the establishment of localized production capabilities. Government policies promoting grid modernization, smart grid deployment, and the adoption of energy-efficient technologies further act as powerful accelerators, creating a favorable business environment for transformer manufacturers. The increasing focus on grid resilience and reliability, particularly in the face of climate change and natural disasters, is driving demand for robust and advanced transformer solutions.

Key Players Shaping the Asia-Pacific Transformer Industry Market

- ABB Ltd

- CG Power and Industrial Solutions Ltd

- JiangSu HuaPeng Transformer Co Ltd

- Baoding Tianwei Baobian Electric Co Ltd

- Toshiba Corp

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Panasonic Corporation

Notable Milestones in Asia-Pacific Transformer Industry Sector

- October 2022: Hitachi Energy India announced a significant contract win from NTPC Renewable Energy, a subsidiary of Gujarat's future 4.75 GW renewable energy plant, to supply crucial power transformers. This milestone highlights the growing demand for transformers in large-scale renewable energy projects.

- February 2022: The Indian Ministry of Power and New and Renewable Energy approved a substantial power distribution network project worth USD 4.12 billion under the Integrated Power Distribution Programme (IPDS). This program aims to enhance the quality and reliability of power supply through a financially sustainable and operationally efficient distribution sector, indicating a significant push for transformer upgrades and new installations within India.

In-Depth Asia-Pacific Transformer Industry Market Outlook

The future outlook for the Asia-Pacific transformer industry is exceptionally promising, driven by a potent combination of factors that promise sustained and accelerated growth. The ongoing global shift towards decarbonization and increased reliance on renewable energy sources will continue to be a major demand driver, necessitating sophisticated transformers capable of seamlessly integrating these variable power sources into existing grids. Smart grid initiatives across the region are moving from nascent stages to widespread implementation, creating substantial opportunities for transformers equipped with advanced digital capabilities for enhanced monitoring, control, and predictive maintenance. Furthermore, the rapidly expanding economies of Southeast Asia and continued infrastructure development in established markets like China and India will fuel consistent demand for both power and distribution transformers. Emerging trends such as the electrification of transportation and the growing adoption of energy-efficient technologies will further augment market potential, positioning the Asia-Pacific transformer industry for significant expansion and innovation in the coming years.

Asia-Pacific Transformer Industry Segmentation

-

1. Power Rating

- 1.1. Small

- 1.2. Large

- 1.3. Medium

-

2. Cooling Type

- 2.1. Air-Cooled

- 2.2. Oil-Cooled

-

3. Transformer Type

- 3.1. Power Transformer

- 3.2. Distribution Transformer

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of the Asia-Pacific

Asia-Pacific Transformer Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of the Asia Pacific

Asia-Pacific Transformer Industry Regional Market Share

Geographic Coverage of Asia-Pacific Transformer Industry

Asia-Pacific Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Distribution Transformer Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Small

- 5.1.2. Large

- 5.1.3. Medium

- 5.2. Market Analysis, Insights and Forecast - by Cooling Type

- 5.2.1. Air-Cooled

- 5.2.2. Oil-Cooled

- 5.3. Market Analysis, Insights and Forecast - by Transformer Type

- 5.3.1. Power Transformer

- 5.3.2. Distribution Transformer

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of the Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of the Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. China Asia-Pacific Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Small

- 6.1.2. Large

- 6.1.3. Medium

- 6.2. Market Analysis, Insights and Forecast - by Cooling Type

- 6.2.1. Air-Cooled

- 6.2.2. Oil-Cooled

- 6.3. Market Analysis, Insights and Forecast - by Transformer Type

- 6.3.1. Power Transformer

- 6.3.2. Distribution Transformer

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of the Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. India Asia-Pacific Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Small

- 7.1.2. Large

- 7.1.3. Medium

- 7.2. Market Analysis, Insights and Forecast - by Cooling Type

- 7.2.1. Air-Cooled

- 7.2.2. Oil-Cooled

- 7.3. Market Analysis, Insights and Forecast - by Transformer Type

- 7.3.1. Power Transformer

- 7.3.2. Distribution Transformer

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of the Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Japan Asia-Pacific Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Small

- 8.1.2. Large

- 8.1.3. Medium

- 8.2. Market Analysis, Insights and Forecast - by Cooling Type

- 8.2.1. Air-Cooled

- 8.2.2. Oil-Cooled

- 8.3. Market Analysis, Insights and Forecast - by Transformer Type

- 8.3.1. Power Transformer

- 8.3.2. Distribution Transformer

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of the Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Rest of the Asia Pacific Asia-Pacific Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 9.1.1. Small

- 9.1.2. Large

- 9.1.3. Medium

- 9.2. Market Analysis, Insights and Forecast - by Cooling Type

- 9.2.1. Air-Cooled

- 9.2.2. Oil-Cooled

- 9.3. Market Analysis, Insights and Forecast - by Transformer Type

- 9.3.1. Power Transformer

- 9.3.2. Distribution Transformer

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of the Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CG Power and Industrial Solutions Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 JiangSu HuaPeng Transformer Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baoding Tianwei Baobian Electric Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toshiba Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Electric Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schneider Electric SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 General Electric Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Asia-Pacific Transformer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Transformer Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Transformer Industry Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 2: Asia-Pacific Transformer Industry Volume K Units Forecast, by Power Rating 2020 & 2033

- Table 3: Asia-Pacific Transformer Industry Revenue billion Forecast, by Cooling Type 2020 & 2033

- Table 4: Asia-Pacific Transformer Industry Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 5: Asia-Pacific Transformer Industry Revenue billion Forecast, by Transformer Type 2020 & 2033

- Table 6: Asia-Pacific Transformer Industry Volume K Units Forecast, by Transformer Type 2020 & 2033

- Table 7: Asia-Pacific Transformer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Transformer Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Transformer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Transformer Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Transformer Industry Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 12: Asia-Pacific Transformer Industry Volume K Units Forecast, by Power Rating 2020 & 2033

- Table 13: Asia-Pacific Transformer Industry Revenue billion Forecast, by Cooling Type 2020 & 2033

- Table 14: Asia-Pacific Transformer Industry Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 15: Asia-Pacific Transformer Industry Revenue billion Forecast, by Transformer Type 2020 & 2033

- Table 16: Asia-Pacific Transformer Industry Volume K Units Forecast, by Transformer Type 2020 & 2033

- Table 17: Asia-Pacific Transformer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Transformer Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: Asia-Pacific Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Transformer Industry Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 22: Asia-Pacific Transformer Industry Volume K Units Forecast, by Power Rating 2020 & 2033

- Table 23: Asia-Pacific Transformer Industry Revenue billion Forecast, by Cooling Type 2020 & 2033

- Table 24: Asia-Pacific Transformer Industry Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 25: Asia-Pacific Transformer Industry Revenue billion Forecast, by Transformer Type 2020 & 2033

- Table 26: Asia-Pacific Transformer Industry Volume K Units Forecast, by Transformer Type 2020 & 2033

- Table 27: Asia-Pacific Transformer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Transformer Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Transformer Industry Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 32: Asia-Pacific Transformer Industry Volume K Units Forecast, by Power Rating 2020 & 2033

- Table 33: Asia-Pacific Transformer Industry Revenue billion Forecast, by Cooling Type 2020 & 2033

- Table 34: Asia-Pacific Transformer Industry Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 35: Asia-Pacific Transformer Industry Revenue billion Forecast, by Transformer Type 2020 & 2033

- Table 36: Asia-Pacific Transformer Industry Volume K Units Forecast, by Transformer Type 2020 & 2033

- Table 37: Asia-Pacific Transformer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Transformer Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Transformer Industry Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 42: Asia-Pacific Transformer Industry Volume K Units Forecast, by Power Rating 2020 & 2033

- Table 43: Asia-Pacific Transformer Industry Revenue billion Forecast, by Cooling Type 2020 & 2033

- Table 44: Asia-Pacific Transformer Industry Volume K Units Forecast, by Cooling Type 2020 & 2033

- Table 45: Asia-Pacific Transformer Industry Revenue billion Forecast, by Transformer Type 2020 & 2033

- Table 46: Asia-Pacific Transformer Industry Volume K Units Forecast, by Transformer Type 2020 & 2033

- Table 47: Asia-Pacific Transformer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Asia-Pacific Transformer Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: Asia-Pacific Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Asia-Pacific Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Transformer Industry?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Asia-Pacific Transformer Industry?

Key companies in the market include ABB Ltd, CG Power and Industrial Solutions Ltd*List Not Exhaustive, JiangSu HuaPeng Transformer Co Ltd, Baoding Tianwei Baobian Electric Co Ltd, Toshiba Corp, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, General Electric Company, Panasonic Corporation.

3. What are the main segments of the Asia-Pacific Transformer Industry?

The market segments include Power Rating, Cooling Type, Transformer Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 70.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Distribution Transformer Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

October 2022: Hitachi Energy India announced that it has been given a contract by NTPC Renewable Energy, the wholly-owned subsidiary of Gujarat's future 4.75 gigawatts (GW) renewable energy plant, to provide power transformers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Transformer Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence