Key Insights

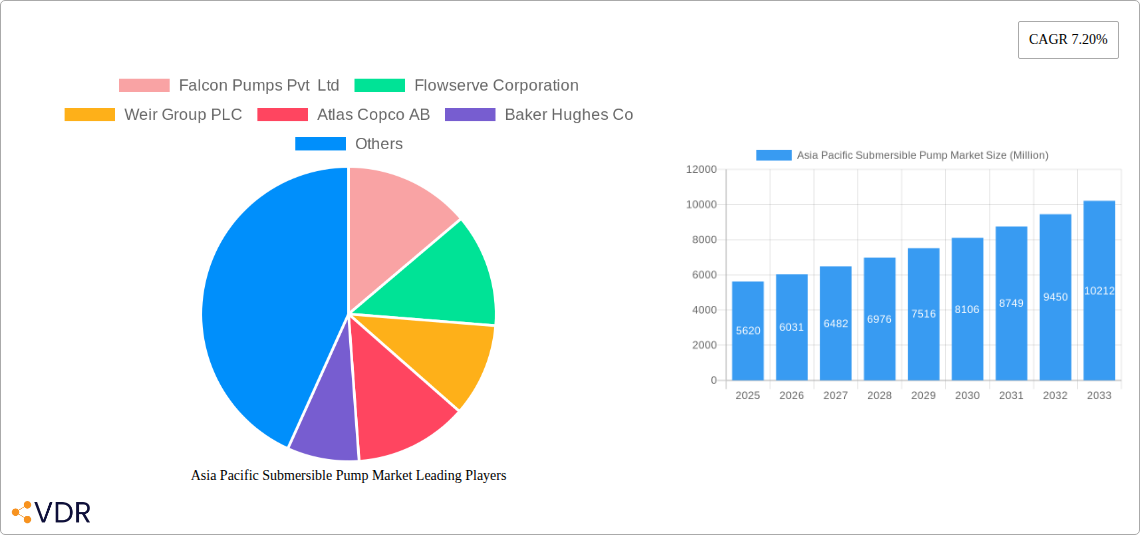

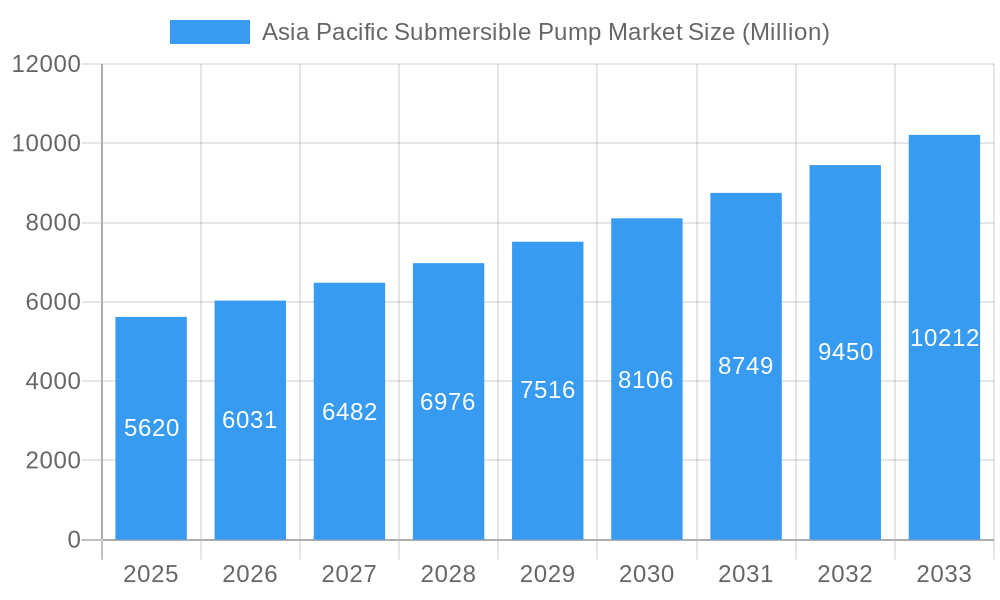

The Asia Pacific submersible pump market, valued at $5.62 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning water and wastewater treatment sector across the region, particularly in rapidly urbanizing nations like India and China, necessitates a continuous increase in submersible pump demand for efficient water management and sewage disposal. Secondly, the thriving oil and gas and mining & construction industries are significant consumers of submersible pumps for various applications, from fluid transfer to dewatering operations. The increasing adoption of electric submersible pumps, driven by sustainability concerns and government regulations promoting cleaner energy, further boosts market growth. Furthermore, advancements in pump technology, such as the development of more efficient and durable pumps with enhanced features like non-clogging capabilities, are contributing to the market's expansion. Regional variations exist, with China and India expected to dominate the market due to their large infrastructure projects and growing industrial sectors. However, other countries like Japan, South Korea, and Australia are also contributing significantly, exhibiting steady growth in their respective sectors.

Asia Pacific Submersible Pump Market Market Size (In Billion)

The market segmentation reveals significant opportunities across different drive types (electric, hydraulic, etc.), head capacity (below 50m, 50-100m, above 100m), and end-user industries. Competition is fierce, with major players such as Falcon Pumps Pvt Ltd, Flowserve Corporation, and Weir Group PLC vying for market share. However, the market also presents opportunities for smaller, specialized companies offering innovative solutions and catering to niche applications. The forecast period will likely see a continued shift toward technologically advanced and energy-efficient submersible pumps, driven by both economic and environmental considerations. Market players are likely to focus on strategic partnerships, technological advancements, and regional expansion to maintain their competitiveness within this dynamic and growing sector.

Asia Pacific Submersible Pump Market Company Market Share

Asia Pacific Submersible Pump Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific submersible pump market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. This report is crucial for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market segment. The market is segmented by drive type (Truck, Electric, Hydraulic, Other Drive Types), head (Below 50 m, Between 50 m to 100 m, Above 100 m), end-user (Water and Wastewater, Oil and Gas Industry, Mining and Construction Industry, Other End Users), and type (Borewell Submersible Pump, Openwell Submersible Pump, Non-clog Submersible Pump). The total market size is predicted to reach xx Million Units by 2033.

Asia Pacific Submersible Pump Market Dynamics & Structure

This section delves into the intricate structure of the Asia Pacific submersible pump market, examining key factors shaping its evolution. We analyze market concentration, revealing the market share held by major players and identifying potential areas for new entrants. The report also explores technological innovation drivers such as advancements in motor technology and materials science, influencing pump efficiency and durability. Regulatory frameworks, including environmental regulations and safety standards, are assessed for their impact on market growth and product development. The analysis also encompasses competitive product substitutes, such as centrifugal pumps and other pumping technologies, and their potential to disrupt market share. End-user demographics are analyzed to understand the distribution of demand across various sectors, and trends in mergers and acquisitions (M&A) activities are tracked to identify strategic shifts and consolidation within the industry.

- Market Concentration: The Asia Pacific submersible pump market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Continuous advancements in materials science, motor efficiency, and smart controls are key drivers of innovation, pushing for higher efficiency and longer lifespans.

- Regulatory Landscape: Stringent environmental regulations regarding water usage and energy consumption are shaping product development and market dynamics.

- M&A Activity: The past five years have witnessed xx M&A deals in the Asia Pacific submersible pump market, primarily focused on consolidation and expansion into new geographical areas.

- Innovation Barriers: High R&D costs and the need for specialized expertise pose significant challenges to new entrants.

Asia Pacific Submersible Pump Market Growth Trends & Insights

The Asia Pacific submersible pump market is experiencing significant growth fueled by increasing urbanization, industrialization, and agricultural activities. This section provides a detailed analysis of market size evolution, revealing a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and a projected CAGR of xx% during the forecast period (2025-2033). Adoption rates across various end-user segments are meticulously analyzed, highlighting sectors exhibiting the highest growth potential. The report examines the impact of technological disruptions, such as the increasing adoption of energy-efficient pumps and smart monitoring systems. The analysis also explores shifting consumer behaviors and preferences towards sustainable and environmentally friendly solutions.

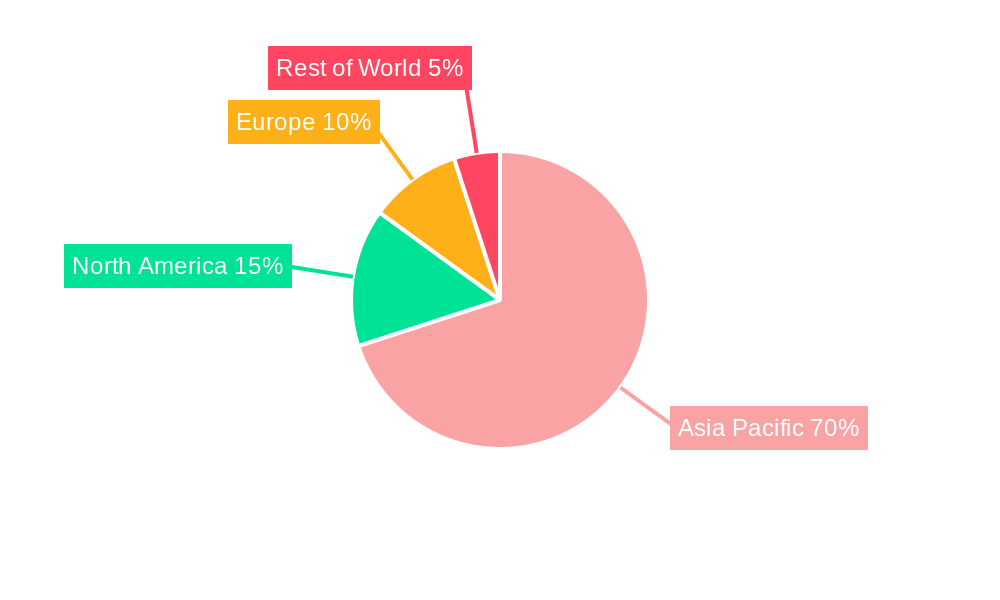

Dominant Regions, Countries, or Segments in Asia Pacific Submersible Pump Market

This section pinpoints the leading regions, countries, and segments within the Asia Pacific submersible pump market driving overall growth. India and China are identified as the dominant markets, fueled by robust infrastructure development and expanding industrial sectors. The electric drive type segment holds the largest market share owing to its cost-effectiveness and energy efficiency, while the water and wastewater end-user segment demonstrates consistent high demand. The "Below 50 m" head segment dominates due to its extensive applications in residential and agricultural settings.

- Key Drivers in India: Government initiatives promoting rural electrification and irrigation modernization are stimulating market growth.

- Key Drivers in China: Rapid industrialization and urbanization are driving demand for submersible pumps across various sectors.

- Segment Dominance: The electric drive type, owing to its cost-effectiveness and energy efficiency, commands a significant market share.

- Growth Potential: The "Above 100m" head segment exhibits high growth potential due to increasing demand in the mining and oil & gas sectors.

Asia Pacific Submersible Pump Market Product Landscape

The Asia Pacific submersible pump market showcases a diverse range of products catering to specific applications and end-user needs. Recent innovations focus on enhancing energy efficiency, durability, and ease of maintenance. Key product advancements include the integration of smart sensors for real-time monitoring, variable speed drives for optimized energy consumption, and the development of corrosion-resistant materials. These advancements are enhancing the reliability and lifespan of submersible pumps, making them more attractive across various applications.

Key Drivers, Barriers & Challenges in Asia Pacific Submersible Pump Market

Key Drivers: The primary drivers include increasing urbanization and industrialization leading to higher water demand, government initiatives promoting irrigation modernization, and the growing adoption of energy-efficient technologies. For instance, the Indian government’s PM KUSUM Yojana significantly boosts demand for solar-powered submersible pumps.

Key Challenges: Supply chain disruptions, especially concerning raw materials, pose a significant challenge. Fluctuating raw material prices impact manufacturing costs and profitability. Stringent environmental regulations related to water usage and energy consumption present compliance costs for manufacturers. Intense competition among established players and new entrants creates pressure on pricing and profit margins. The estimated impact of supply chain issues on market growth is xx% in 2024.

Emerging Opportunities in Asia Pacific Submersible Pump Market

Emerging opportunities are presented by the rising demand for water management solutions in arid and semi-arid regions. The expansion of smart agriculture practices and the increasing adoption of precision irrigation technologies create demand for advanced submersible pump systems. There's also significant potential in the development of submersible pumps tailored to specific industrial applications.

Growth Accelerators in the Asia Pacific Submersible Pump Market Industry

Long-term growth is accelerated by technological breakthroughs, such as the development of high-efficiency motors and advanced materials. Strategic partnerships between manufacturers and distributors, leading to enhanced market reach and distribution networks, further fuel market expansion. Government support through subsidies and incentives for energy-efficient pumps also contributes to increased adoption.

Key Players Shaping the Asia Pacific Submersible Pump Market Market

- Flowserve Corporation

- Weir Group PLC

- Atlas Copco AB

- Baker Hughes Co

- Havells India Ltd

- Halliburton Co

- Crompton Greaves Consumer Electricals Limited

- Sulzer AG

- Schlumberger Limited

- Shimge Pump Industry Group Co Ltd

- Falcon Pumps Pvt Ltd (Website unavailable)

- List Not Exhaustive

Notable Milestones in Asia Pacific Submersible Pump Market Sector

- September 2023: The Uttar Pradesh Government announced its goal to install more than 30,000 solar PV irrigation pumps under the PM KUSUM Yojana, allocating a budget of USD 52 million for FY 2023-24. This initiative significantly boosts the demand for solar-powered submersible pumps.

- February 2022: Shakti Pumps (India) Limited launched 4-inch Plug and Play Submersible Pumps, designed for higher efficiency and lower operational costs, driving innovation in product design.

In-Depth Asia Pacific Submersible Pump Market Outlook

The Asia Pacific submersible pump market is poised for continued robust growth, driven by sustained infrastructure development, industrial expansion, and government initiatives promoting water management and irrigation modernization. Strategic partnerships, technological advancements focusing on energy efficiency and sustainability, and the expansion into untapped markets will further propel market expansion in the coming years, creating lucrative opportunities for both established players and new entrants.

Asia Pacific Submersible Pump Market Segmentation

-

1. Type

- 1.1. Borewell Submersible Pump

- 1.2. Openwell Submersible Pump

- 1.3. Non-clog Submersible Pump

-

2. Drive Type

- 2.1. Truck

- 2.2. Electric

- 2.3. Hydraulic

- 2.4. Other Drive Types

-

3. Head

- 3.1. Below 50 m

- 3.2. Between 50 m to 100 m

- 3.3. Above 100 m

-

4. End User

- 4.1. Water and Wastewater

- 4.2. Oil and Gas Industry

- 4.3. Mining and Construction Industry

- 4.4. Other End Users

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. Rest of Asia-Pacific

Asia Pacific Submersible Pump Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Submersible Pump Market Regional Market Share

Geographic Coverage of Asia Pacific Submersible Pump Market

Asia Pacific Submersible Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Borewell Submersible Pump

- 5.1.2. Openwell Submersible Pump

- 5.1.3. Non-clog Submersible Pump

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Truck

- 5.2.2. Electric

- 5.2.3. Hydraulic

- 5.2.4. Other Drive Types

- 5.3. Market Analysis, Insights and Forecast - by Head

- 5.3.1. Below 50 m

- 5.3.2. Between 50 m to 100 m

- 5.3.3. Above 100 m

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Water and Wastewater

- 5.4.2. Oil and Gas Industry

- 5.4.3. Mining and Construction Industry

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. South Korea

- 5.6.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Borewell Submersible Pump

- 6.1.2. Openwell Submersible Pump

- 6.1.3. Non-clog Submersible Pump

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Truck

- 6.2.2. Electric

- 6.2.3. Hydraulic

- 6.2.4. Other Drive Types

- 6.3. Market Analysis, Insights and Forecast - by Head

- 6.3.1. Below 50 m

- 6.3.2. Between 50 m to 100 m

- 6.3.3. Above 100 m

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Water and Wastewater

- 6.4.2. Oil and Gas Industry

- 6.4.3. Mining and Construction Industry

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. South Korea

- 6.5.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Borewell Submersible Pump

- 7.1.2. Openwell Submersible Pump

- 7.1.3. Non-clog Submersible Pump

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Truck

- 7.2.2. Electric

- 7.2.3. Hydraulic

- 7.2.4. Other Drive Types

- 7.3. Market Analysis, Insights and Forecast - by Head

- 7.3.1. Below 50 m

- 7.3.2. Between 50 m to 100 m

- 7.3.3. Above 100 m

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Water and Wastewater

- 7.4.2. Oil and Gas Industry

- 7.4.3. Mining and Construction Industry

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. South Korea

- 7.5.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Borewell Submersible Pump

- 8.1.2. Openwell Submersible Pump

- 8.1.3. Non-clog Submersible Pump

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Truck

- 8.2.2. Electric

- 8.2.3. Hydraulic

- 8.2.4. Other Drive Types

- 8.3. Market Analysis, Insights and Forecast - by Head

- 8.3.1. Below 50 m

- 8.3.2. Between 50 m to 100 m

- 8.3.3. Above 100 m

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Water and Wastewater

- 8.4.2. Oil and Gas Industry

- 8.4.3. Mining and Construction Industry

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. South Korea

- 8.5.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Borewell Submersible Pump

- 9.1.2. Openwell Submersible Pump

- 9.1.3. Non-clog Submersible Pump

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Truck

- 9.2.2. Electric

- 9.2.3. Hydraulic

- 9.2.4. Other Drive Types

- 9.3. Market Analysis, Insights and Forecast - by Head

- 9.3.1. Below 50 m

- 9.3.2. Between 50 m to 100 m

- 9.3.3. Above 100 m

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Water and Wastewater

- 9.4.2. Oil and Gas Industry

- 9.4.3. Mining and Construction Industry

- 9.4.4. Other End Users

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. South Korea

- 9.5.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Submersible Pump Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Borewell Submersible Pump

- 10.1.2. Openwell Submersible Pump

- 10.1.3. Non-clog Submersible Pump

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. Truck

- 10.2.2. Electric

- 10.2.3. Hydraulic

- 10.2.4. Other Drive Types

- 10.3. Market Analysis, Insights and Forecast - by Head

- 10.3.1. Below 50 m

- 10.3.2. Between 50 m to 100 m

- 10.3.3. Above 100 m

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Water and Wastewater

- 10.4.2. Oil and Gas Industry

- 10.4.3. Mining and Construction Industry

- 10.4.4. Other End Users

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. India

- 10.5.3. Japan

- 10.5.4. South Korea

- 10.5.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Falcon Pumps Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weir Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atlas Copco AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baker Hughes Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Havells India Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crompton Greaves Consumer Electricals Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sulzer AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shimge Pump Industry Group Co Ltd *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Falcon Pumps Pvt Ltd

List of Figures

- Figure 1: Asia Pacific Submersible Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Submersible Pump Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 4: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 5: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 6: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 7: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 9: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 16: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 17: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 18: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 19: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 21: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 28: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 29: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 30: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 31: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 33: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 40: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 41: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 42: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 43: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 45: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 51: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 52: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 53: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 54: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 55: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 56: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 57: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 59: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 63: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 64: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 65: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Head 2020 & 2033

- Table 66: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Head 2020 & 2033

- Table 67: Asia Pacific Submersible Pump Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 69: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 71: Asia Pacific Submersible Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Asia Pacific Submersible Pump Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Submersible Pump Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Asia Pacific Submersible Pump Market?

Key companies in the market include Falcon Pumps Pvt Ltd, Flowserve Corporation, Weir Group PLC, Atlas Copco AB, Baker Hughes Co, Havells India Ltd, Halliburton Co, Crompton Greaves Consumer Electricals Limited, Sulzer AG, Schlumberger Limited, Shimge Pump Industry Group Co Ltd *List Not Exhaustive.

3. What are the main segments of the Asia Pacific Submersible Pump Market?

The market segments include Type, Drive Type, Head, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2023, The Uttar Pradesh Government announced its goal to install more than 30,000 solar PV irrigation pumps under the PM KUSUM Yojana, allocating a budget of USD 52 million for FY 2023-24. The government officials stated the significant initiative aims to provide farmers in 75 districts of the state with eco-friendly and sustainable energy solutions. The implementation of this initiative falls under the purview of the Uttar Pradesh New and Renewable Energy Agency (UPNEDA), which will oversee the installation of clean energy-based irrigation systems through surface and submersible pump setups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Submersible Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Submersible Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Submersible Pump Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Submersible Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence