Key Insights

The Asia-Pacific e-commerce apparel market is poised for significant expansion, driven by increasing internet and smartphone penetration, rising disposable incomes, and a growing consumer preference for convenient online shopping. The market, valued at $779.3 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.15% between 2025 and 2033. Key growth catalysts include urbanization, widespread adoption of digital payments, and the influence of online fashion personalities and personalized shopping experiences. Market segmentation covers product types (formal, casual, sportswear, nightwear, and others), end-users (men, women, and children), and platform types (third-party retailers and company websites). While established brands like Adidas, Inditex, and Nike maintain a strong presence, emerging brands and e-commerce-native businesses are gaining traction through targeted strategies and niche offerings. Growth is especially pronounced in major economies such as China, India, and Japan, reflecting their large digital consumer bases. Nevertheless, challenges such as product authenticity concerns, logistical complexities, and the necessity for robust cybersecurity remain. The market’s upward trajectory is sustained, contingent on businesses adapting to evolving consumer demands, optimizing supply chains, and delivering seamless omnichannel retail experiences.

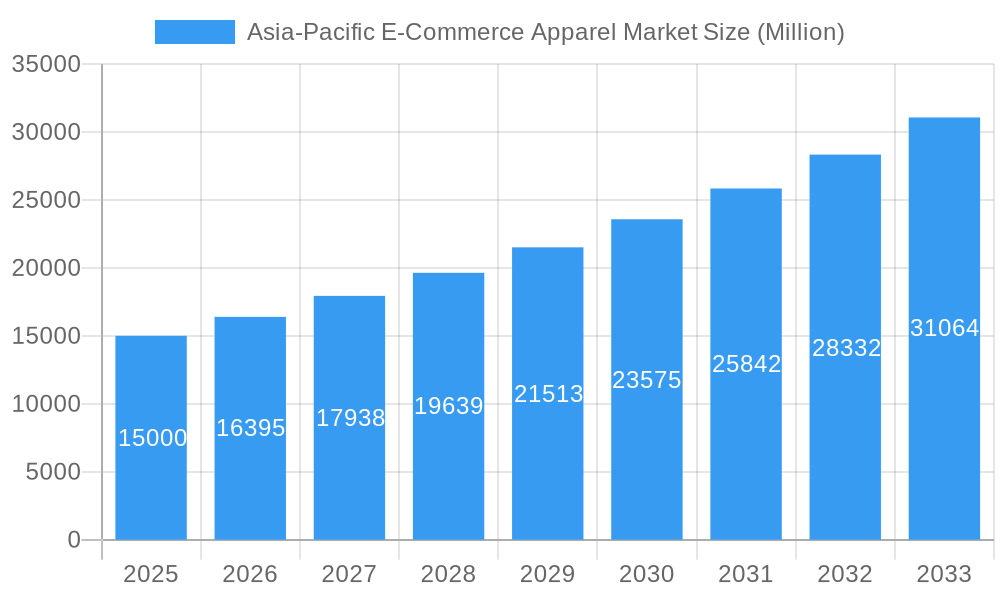

Asia-Pacific E-Commerce Apparel Market Market Size (In Billion)

The forecast period (2025-2033) offers substantial opportunities for companies that utilize data analytics for personalized offerings, invest in innovative technologies like augmented reality (AR) and virtual try-ons, and prioritize sustainability and ethical sourcing to attract environmentally conscious consumers. Meeting the increasing demand for personalized fashion recommendations and ensuring smooth returns and exchanges will be critical for success. Competition is expected to intensify, particularly from fast-fashion and value-apparel players. Effective strategies will encompass efficient inventory management, strong logistics capabilities, and compelling digital marketing campaigns tailored to the diverse Asia-Pacific consumer demographic. Adapting to mobile shopping trends and offering multilingual support will further distinguish leading businesses in this dynamic market.

Asia-Pacific E-Commerce Apparel Market Company Market Share

Asia-Pacific E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific e-commerce apparel market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from 2019-2024 (Historical Period), with a base year of 2025 and a forecast period extending to 2033 (Study Period: 2019-2033; Forecast Period: 2025-2033). The market is segmented by product type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), end-user (Men, Women, Kids/Children), and platform type (Third-Party Retailer, Company's Own Website). Key players analyzed include Adidas AG, Inditex, Aditya Birla Group, Arvind Lifestyle Brands Limited, V Ventures (Italian Colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitton, and Nike Inc. This report is an essential resource for businesses, investors, and industry professionals seeking to understand and capitalize on the opportunities within this rapidly evolving market. The total market value is predicted to reach xx Million units by 2033.

Asia-Pacific E-Commerce Apparel Market Market Dynamics & Structure

The Asia-Pacific e-commerce apparel market is characterized by high growth potential, fueled by increasing internet penetration, smartphone adoption, and a burgeoning middle class with rising disposable incomes. Market concentration is relatively fragmented, with both large multinational corporations and smaller domestic brands competing for market share. Technological innovation, particularly in areas such as mobile commerce, personalized recommendations, and augmented reality (AR) fitting tools, are reshaping the competitive landscape.

- Market Concentration: Moderately fragmented, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Strong driver, with investments in AI-powered personalization and virtual try-on experiences.

- Regulatory Frameworks: Vary across countries, impacting data privacy, cross-border e-commerce, and consumer protection.

- Competitive Product Substitutes: Fast fashion brands present significant competition, along with secondhand clothing platforms and locally produced apparel.

- End-User Demographics: Young adults (18-35) are the primary target, with growing demand from older demographics and increasing focus on specialized sizes and styles.

- M&A Trends: Consolidation is anticipated, with larger players acquiring smaller brands to expand product portfolios and geographic reach. An estimated xx M&A deals occurred in the Asia-Pacific region between 2019 and 2024.

Asia-Pacific E-Commerce Apparel Market Growth Trends & Insights

The Asia-Pacific e-commerce apparel market has witnessed dynamic expansion, with a robust CAGR of [Insert Specific CAGR]% observed between 2019 and 2024. This surge is largely fueled by escalating disposable incomes across the region, widespread internet and smartphone adoption, and a definitive shift in consumer behavior towards the unparalleled convenience of online apparel shopping. Looking ahead, the market is projected to sustain this upward momentum, with an anticipated CAGR of [Insert Specific CAGR]% forecasted for the period of 2025-2033. The landscape is further energized by disruptive technological innovations such as the burgeoning social commerce sector and the immersive integration of live-streaming shopping experiences, both acting as powerful catalysts for market expansion and deeper consumer engagement. Contemporary consumers are increasingly prioritizing personalized shopping journeys, demanding greater customization options and highly efficient, hassle-free returns processes. Market penetration is expected to reach an impressive [Insert Specific Percentage]% by 2033, underscoring the region's digital retail dominance.

Dominant Regions, Countries, or Segments in Asia-Pacific E-Commerce Apparel Market

China and India are the dominant markets within the Asia-Pacific region, accounting for a combined xx% of the total market value in 2025. The Casual Wear segment holds the largest market share due to its versatility and affordability, followed closely by Sportswear. Women's apparel segment accounts for a significant majority of the market. Third-Party Retailers currently dominate the platform type, although Company's Own Website is demonstrating strong growth.

- Key Drivers in China: Robust e-commerce infrastructure, high internet penetration, and a preference for online shopping among younger demographics.

- Key Drivers in India: Rapid growth of the middle class, increasing smartphone usage, and government initiatives supporting digital commerce.

- Casual Wear Dominance: High demand due to affordability, versatility, and suitability for various occasions.

- Women's Apparel Market Share: Higher spending on apparel by women compared to men.

- Third-Party Retailer dominance: Established networks, broader reach, and established trust with consumers.

Asia-Pacific E-Commerce Apparel Market Product Landscape

Product innovation is a key driver in this market. Brands are constantly introducing new styles, materials, and technologies to attract customers. The use of sustainable and ethically sourced materials is also becoming more prevalent, responding to growing consumer awareness. Key innovations include improved online fitting tools, personalized recommendations based on AI and data analytics, and seamless omnichannel experiences.

Key Drivers, Barriers & Challenges in Asia-Pacific E-Commerce Apparel Market

Key Drivers: The market's ascent is propelled by a confluence of factors including rising disposable incomes, escalating internet and mobile penetration rates, a strong consumer preference for the convenience offered by online shopping, continuous technological advancements in e-commerce platforms, and supportive government initiatives fostering digital commerce growth.

Key Challenges: Despite the promising outlook, the market grapples with intense competition from both established and nascent brands, the persistent issue of counterfeit goods, susceptibility to supply chain disruptions, the challenge of ensuring consistent and reliable delivery experiences, and ongoing concerns surrounding data privacy and security. Notably, supply chain inefficiencies are estimated to have impacted sales by approximately [Insert Specific Percentage]% in 2022.

Emerging Opportunities in Asia-Pacific E-Commerce Apparel Market

Significant growth potential lies within the largely untapped markets of Southeast Asia. Furthermore, the industry is ripe for innovation in delivering highly personalized consumer experiences. Enhancing product discoverability through advanced AI-powered search functionalities and sophisticated recommendation engines presents a key avenue. The integration of Augmented Reality (AR) and Virtual Reality (VR) technologies promises to revolutionize online fitting and visualization, creating more immersive and engaging shopping journeys. The growing global imperative for sustainability and ethical sourcing is also shaping consumer choices and opening up lucrative avenues for brands aligned with these values.

Growth Accelerators in the Asia-Pacific E-Commerce Apparel Market Industry

The relentless pace of technological advancements, the formation of strategic alliances between fashion brands and leading e-commerce platforms, successful expansion into previously underserved markets, and increased investment in targeted marketing campaigns and robust customer engagement initiatives are the primary growth accelerators propelling the long-term expansion of this dynamic industry.

Key Players Shaping the Asia-Pacific E-Commerce Apparel Market Market

- Adidas AG

- Industria de Diseño Textil S A (Inditex)

- Aditya Birla Group

- Arvind Lifestyle Brands Limited

- V Ventures (Italian Colony)

- Forever 21 Inc

- PVH Corp

- Raymond Group

- Hennes & Mauritz AB

- Fast Retailing Co Ltd

- BIBA Fashion Limited

- LVMH Moët Hennessy Louis Vuitton

- Nike Inc

Notable Milestones in Asia-Pacific E-Commerce Apparel Market Sector

- February 2023: Forever 21 relaunches in Japan as an upscale brand, focusing on localized designs and online sales.

- March 2023: Italian Colony launches its online store in India, offering affordable Italian fashion.

- March 2023: UNIQLO collaborates with Attack on Titan, launching a new line of t-shirts with custom packaging.

- May 2023: Alessandro Vittore announces plans to launch in the Indian market.

In-Depth Asia-Pacific E-Commerce Apparel Market Market Outlook

The Asia-Pacific e-commerce apparel market is firmly positioned for continued, substantial growth in the coming years. The trajectory outlined in this report highlights strategic imperatives for brands to prioritize personalization, embrace sustainable practices, and develop seamless omnichannel retail experiences. Leveraging cutting-edge technological advancements will be crucial for elevating the customer shopping journey. The market is expected to exhibit remarkable expansion, presenting compelling opportunities for both established industry leaders and agile new entrants aiming to capture market share in this vibrant and evolving digital retail landscape.

Asia-Pacific E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

Asia-Pacific E-Commerce Apparel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Asia-Pacific E-Commerce Apparel Market

Asia-Pacific E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Brick-and-Mortar Retail

- 3.4. Market Trends

- 3.4.1. Strong Growth of Fashion Marketplaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industria de Diseño Textil S A (Inditex)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aditya Birla Group's

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arvind Lifestyle Brands Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 V Ventures (Italian colony)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Forever 21 Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVH Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raymond Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hennes & Mauritz AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fast Retailing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BIBA Fashion Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LVMH Moët Hennessy Louis Vuitto

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nike Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Asia-Pacific E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 9: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 19: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-Commerce Apparel Market?

The projected CAGR is approximately 9.15%.

2. Which companies are prominent players in the Asia-Pacific E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Industria de Diseño Textil S A (Inditex), Aditya Birla Group's, Arvind Lifestyle Brands Limited, V Ventures (Italian colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitto, Nike Inc.

3. What are the main segments of the Asia-Pacific E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 779.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media.

6. What are the notable trends driving market growth?

Strong Growth of Fashion Marketplaces.

7. Are there any restraints impacting market growth?

Competition from Traditional Brick-and-Mortar Retail.

8. Can you provide examples of recent developments in the market?

May 2023: Alessandro Vittore, a United Kingdom-based clothing company, announced its plans to launch the brand in Indian Market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence