Key Insights

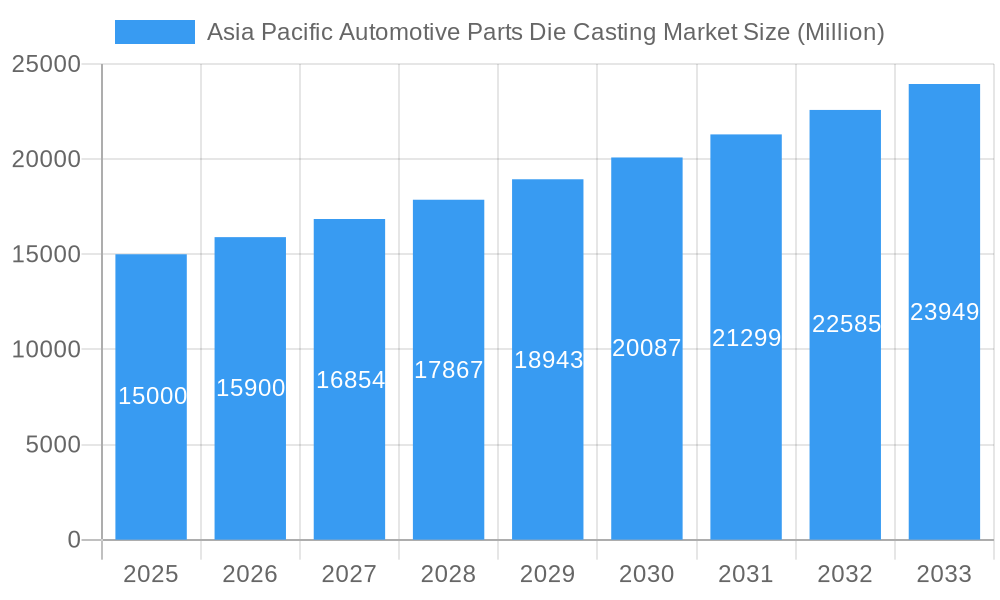

The Asia Pacific automotive parts die casting market is projected for substantial expansion, driven by the region's thriving automotive sector, particularly in China and India. With a projected Compound Annual Growth Rate (CAGR) of 6%, the market is expected to reach a size of 18.37 billion by the base year of 2025. Key growth drivers include escalating vehicle production, the increasing demand for lightweight components to enhance fuel efficiency, and the adoption of advanced die casting techniques such as pressure and semi-solid die casting. Aluminum continues to be the preferred raw material due to its inherent lightweight and corrosion-resistant attributes, though magnesium and zinc are gaining importance for specialized applications. The market is segmented by application (body assembly, engine parts, transmission parts), production process (pressure, vacuum, squeeze, semi-solid die casting), and raw material (aluminum, zinc, magnesium). China commands a leading market share, attributed to its extensive automotive manufacturing capabilities, followed by India and other emerging economies. However, rising labor costs and stringent environmental regulations in select nations present market growth challenges. Prominent market participants, including SYX Die Casting and Gibbs Die Casting Group, are prioritizing technological innovation, strategic alliances, and geographic expansion to secure their competitive positions. The proliferation of electric vehicles (EVs) is a significant market influencer, boosting demand for specialized die cast components for battery systems and electric motors.

Asia Pacific Automotive Parts Die Casting Market Market Size (In Billion)

The forecast period from 2025-2033 offers considerable growth prospects for stakeholders in the Asia Pacific automotive parts die casting market. In-depth market segmentation reveals that the body assembly segment currently holds the largest market share, succeeded by engine and transmission parts. The growing emphasis on high-precision die castings is a direct consequence of advancements in automotive design and engineering, necessitating investment in cutting-edge technologies and workforce development. While pressure die casting remains the dominant production method, semi-solid die casting is anticipated to gain traction due to its superior material properties and defect reduction capabilities. The competitive landscape is characterized by a blend of global corporations and regional enterprises, fostering a dynamic environment of price competition, technological innovation, and customer service. Sustained market growth will depend on the industry's adaptability to evolving regulatory frameworks, supply chain complexities, and shifting consumer preferences.

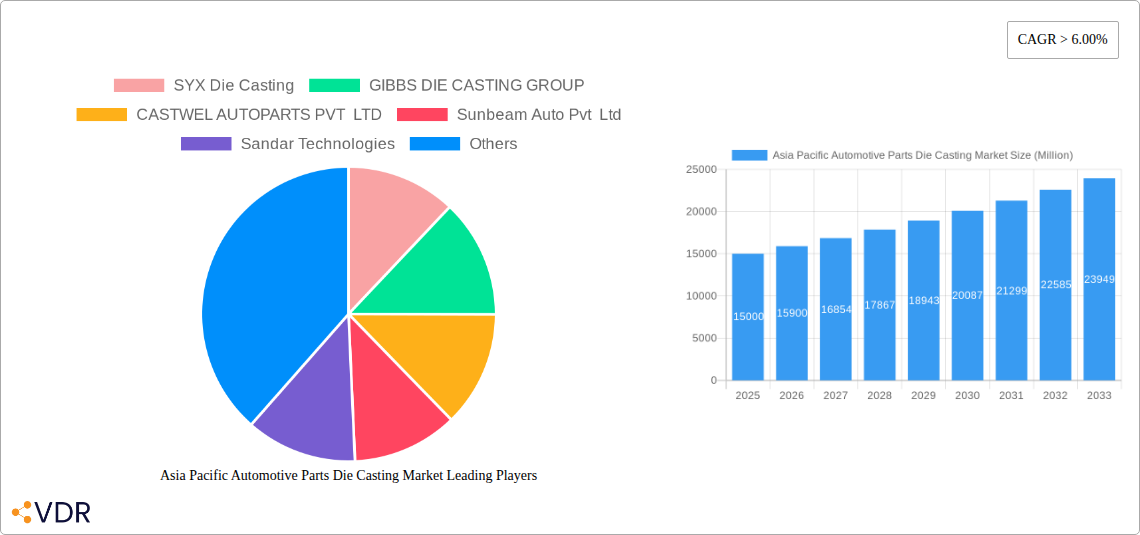

Asia Pacific Automotive Parts Die Casting Market Company Market Share

Asia Pacific Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific automotive parts die casting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by application type (body assembly, engine parts, transmission parts, others), country (China, India, Japan, South Korea, Rest of Asia-Pacific), production process type (pressure die casting, vacuum die casting, squeeze die casting, semi-solid die casting), and raw material (aluminum, zinc, magnesium, others). Key players analyzed include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, and Dynacast Inc. The report's total market size in 2025 is estimated at xx Million units.

Asia Pacific Automotive Parts Die Casting Market Dynamics & Structure

The Asia Pacific automotive parts die casting market exhibits a moderately consolidated structure, with a few large players commanding significant market share. Technological innovation, particularly in lightweighting materials and advanced casting techniques, is a major driver. Stringent emission regulations and fuel efficiency standards are shaping demand for lighter vehicle components, boosting the adoption of die casting. Furthermore, mergers and acquisitions (M&A) are reshaping the competitive landscape, with larger companies seeking to expand their geographical reach and product portfolios. The market is also influenced by the availability of raw materials, fluctuating prices, and government policies related to manufacturing and environmental protection.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: Focus on lightweighting materials (e.g., aluminum alloys) and high-pressure die casting.

- Regulatory Framework: Stringent emission and fuel efficiency norms driving demand for lighter parts.

- M&A Activity: xx M&A deals recorded in the last 5 years, primarily focused on consolidation and expansion.

- Competitive Substitutes: Forging, plastic injection molding.

- Innovation Barriers: High capital investment costs for advanced equipment, skilled labor shortage.

Asia Pacific Automotive Parts Die Casting Market Growth Trends & Insights

The Asia Pacific automotive parts die casting market has witnessed substantial growth over the historical period (2019-2024), driven primarily by the booming automotive industry in the region, particularly in China and India. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This growth trajectory is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, reaching an estimated xx Million units by 2033. Factors like increasing vehicle production, rising disposable incomes, and the adoption of advanced driver-assistance systems (ADAS) are fueling demand. Technological disruptions, such as the rise of electric vehicles (EVs) and the increasing adoption of lightweight materials, present both opportunities and challenges. Changing consumer preferences toward fuel-efficient vehicles are also impacting the market. Market penetration of die-cast components in various vehicle segments is also steadily increasing.

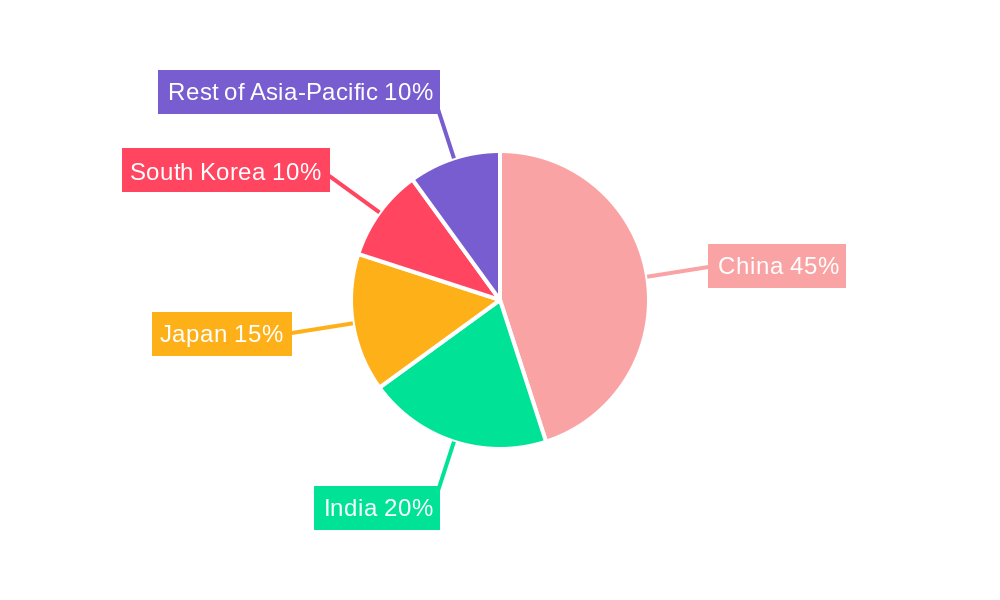

Dominant Regions, Countries, or Segments in Asia Pacific Automotive Parts Die Casting Market

China dominates the Asia Pacific automotive parts die casting market, accounting for xx% of the total market share in 2025, followed by India at xx% and Japan at xx%. This dominance is attributed to factors such as large-scale automotive manufacturing, a well-established supply chain, and favorable government policies promoting automotive production. The engine parts segment holds the largest market share within application types, followed by body assembly and transmission parts. Pressure die casting remains the most prevalent production process, due to its cost-effectiveness and versatility. Aluminum is the most widely used raw material, owing to its lightweight properties and good castability.

- Key Drivers (China): Large automotive manufacturing base, robust domestic demand, supportive government policies.

- Key Drivers (India): Growing automotive industry, increasing vehicle sales, cost-competitive labor.

- Key Drivers (Engine Parts Segment): Increasing complexity of engine designs, demand for lightweight components.

- Key Drivers (Pressure Die Casting): Cost-effectiveness, high production rates, versatility.

- Key Drivers (Aluminum): Lightweight properties, high strength-to-weight ratio, good castability.

Asia Pacific Automotive Parts Die Casting Market Product Landscape

The market offers a wide range of die-cast automotive parts, encompassing components for engines, transmissions, chassis, and body assemblies. Product innovations are primarily focused on improving part strength, reducing weight, and enhancing surface finish. Advanced casting technologies like high-pressure die casting and semi-solid die casting are gaining traction. Unique selling propositions center on improved durability, enhanced precision, and reduced manufacturing costs. Technological advancements include the use of advanced alloys, surface treatments, and simulation software for optimized design.

Key Drivers, Barriers & Challenges in Asia Pacific Automotive Parts Die Casting Market

Key Drivers: Growing automotive production, increasing demand for lightweight vehicles, technological advancements in die casting processes, favorable government policies.

Challenges: Fluctuating raw material prices, intense competition, skilled labor shortages, environmental regulations, supply chain disruptions. For instance, the COVID-19 pandemic highlighted the vulnerability of global supply chains, impacting the availability of raw materials and causing production delays. This disruption resulted in a xx% decrease in production during the peak of the pandemic.

Emerging Opportunities in Asia Pacific Automotive Parts Die Casting Market

Emerging opportunities lie in the increasing adoption of electric vehicles, the growth of the lightweighting trend, and the development of advanced casting technologies. Untapped markets exist in Southeast Asia, where the automotive industry is rapidly expanding. Innovative applications include the use of die casting in battery housings and other EV components. Evolving consumer preferences for environmentally friendly vehicles create opportunities for manufacturers to develop sustainable die casting solutions.

Growth Accelerators in the Asia Pacific Automotive Parts Die Casting Market Industry

Long-term growth will be accelerated by technological breakthroughs in die casting processes, enabling the production of even lighter and stronger components. Strategic partnerships between die casters and automotive manufacturers will facilitate the development and adoption of innovative solutions. Market expansion strategies, focusing on emerging markets in Southeast Asia and beyond, will unlock significant growth potential.

Key Players Shaping the Asia Pacific Automotive Parts Die Casting Market Market

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Notable Milestones in Asia Pacific Automotive Parts Die Casting Market Sector

- 2020: Increased adoption of aluminum alloys due to lightweighting initiatives.

- 2022: Several major M&A deals reshaping the competitive landscape.

- 2023: Launch of several new high-pressure die casting facilities.

- 2024: Introduction of new environmental regulations impacting material choices.

In-Depth Asia Pacific Automotive Parts Die Casting Market Outlook

The Asia Pacific automotive parts die casting market is poised for continued growth driven by several factors, including technological innovation, expansion into new markets, and the increasing demand for lightweight vehicles. Strategic partnerships and investments in research and development will further drive market expansion. Companies that can adapt to evolving consumer preferences and technological advancements will be best positioned to capitalize on the significant opportunities available in this dynamic market.

Asia Pacific Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Others

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Others

-

4. Countries

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Automotive Parts Die Casting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Asia Pacific Automotive Parts Die Casting Market

Asia Pacific Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Aluminium is Expected to Grow With Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Countries

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Asia Pacific Automotive Parts Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 3: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 5: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 7: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 8: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 10: Asia Pacific Automotive Parts Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Automotive Parts Die Casting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Automotive Parts Die Casting Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Asia Pacific Automotive Parts Die Casting Market?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Asia Pacific Automotive Parts Die Casting Market?

The market segments include Production Process Type, Raw Material, Application Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Aluminium is Expected to Grow With Highest CAGR.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence