Key Insights

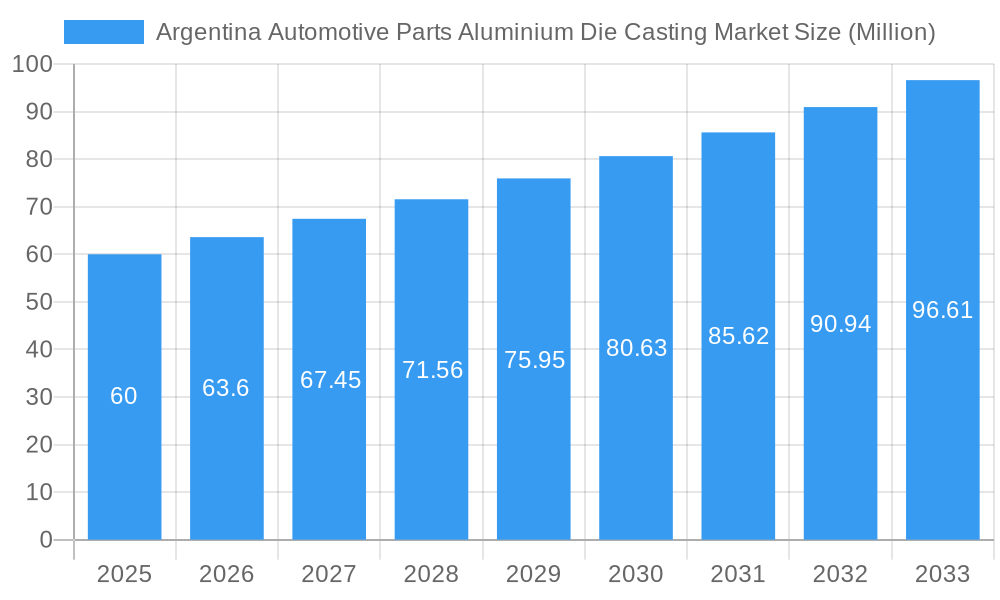

The Argentina Automotive Parts Aluminium Die Casting Market is projected to experience robust expansion, driven by the increasing demand for lightweight vehicles and the growth of the national automotive sector. The market is anticipated to reach a size of $85.92 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.2% from 2025 to 2033. Key growth catalysts include the rising adoption of advanced automotive technologies, such as electric and hybrid vehicles, which require high-performance, lightweight components. Aluminum die casting's superior strength-to-weight ratio, corrosion resistance, and design flexibility make it the preferred material for engine parts, body panels, and transmission components. The market is segmented by production process (pressure, vacuum, squeeze, semi-solid die casting) and application (body parts, engine parts, transmission components, others), highlighting the diverse manufacturing and end-use applications within Argentina's automotive industry.

Argentina Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

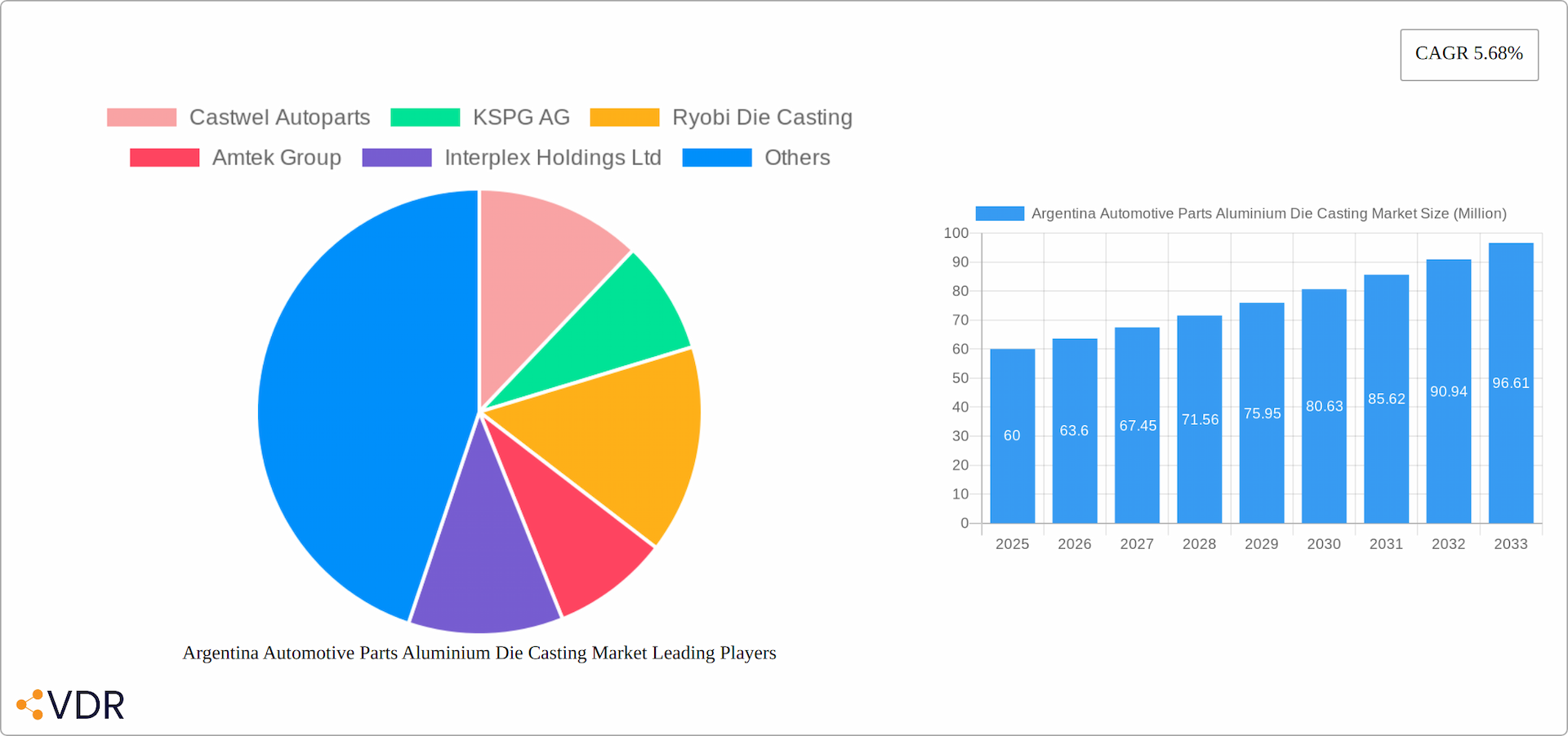

Leading market contributors include Castwel Autoparts, KSPG AG, and Nemak, whose production capacity and technological innovation significantly influence market dynamics. The competitive environment features a blend of established international companies and local manufacturers. Future growth is expected to be propelled by advancements in die casting technology, increased automation in manufacturing, and government initiatives supporting sustainable automotive production. The automotive industry's ongoing focus on lightweighting will further accelerate demand for aluminum die casting components in Argentina, ensuring sustained market growth throughout the forecast period (2025-2033).

Argentina Automotive Parts Aluminium Die Casting Market Company Market Share

Argentina Automotive Parts Aluminum Die Casting Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Argentina automotive parts aluminum die casting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 (Base Year: 2025, Estimated Year: 2025). The market is segmented by production process type (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting) and application type (Body Parts, Engine Parts, Transmission Components, Others). Key players analyzed include Castwel Autoparts, KSPG AG, Ryobi Die Casting, Amtek Group, Interplex Holdings Ltd, Nemak, ALCOA Inc, Buvo Castings (EU), Dynamic Technologies Ltd, and Gibbs Die Casting Group (List Not Exhaustive). The report projects a market valued at XX Million units by 2033.

Argentina Automotive Parts Aluminium Die Casting Market Market Dynamics & Structure

The Argentina automotive parts aluminum die casting market is characterized by a moderately concentrated landscape, featuring a blend of established, large-scale manufacturers and agile, specialized smaller firms. This dynamic environment is significantly shaped by continuous technological innovation, particularly in the development of advanced aluminum alloys that offer superior strength-to-weight ratios and improved performance characteristics. Furthermore, advancements in die-casting machine capabilities, including automation and precision control, are crucial for meeting evolving automotive industry demands. The regulatory framework, with its increasing focus on emissions standards and sustainable material sourcing, plays a pivotal role in influencing production methodologies and material choices. The market's competitive edge is constantly being redefined by the emergence of viable substitutes, such as components manufactured using other metal casting techniques and increasingly sophisticated plastic alternatives. The primary demand driver remains the automotive production volumes within Argentina and the overarching global trend towards lightweight vehicles to enhance fuel efficiency and reduce environmental impact. While mergers and acquisitions (M&A) have been observed to be relatively subdued in recent years, with a limited number of significant transactions, the top 5 players are estimated to have commanded approximately XX% of the market share in 2024, indicating a degree of consolidation among key entities.

- Market Concentration: Moderately concentrated, with the top 5 players estimated to hold approximately XX% market share in 2024.

- Technological Innovation: A strong emphasis on developing lightweight aluminum alloys, implementing advanced automation in casting processes, and achieving high precision casting for intricate parts.

- Regulatory Landscape: Stringent emissions standards and evolving regulations concerning the responsible sourcing of materials are significant influences on manufacturing practices.

- Competitive Substitutes: The market faces competition from alternative solutions such as plastic components and other metal casting methods.

- End-User Demographics: The market's trajectory is intrinsically linked to automotive production volumes and the growing consumer and regulatory demand for fuel-efficient, lightweight vehicles.

- M&A Activity: M&A activity has been relatively low in recent years, with approximately xx significant deals recorded between 2019 and 2024, suggesting organic growth and strategic alliances as primary expansion strategies for many players.

Argentina Automotive Parts Aluminium Die Casting Market Growth Trends & Insights

The Argentina automotive parts aluminum die casting market experienced a CAGR of XX% during the historical period (2019-2024) and is projected to grow at a CAGR of XX% during the forecast period (2025-2033), reaching XX million units by 2033. This growth is fueled by increasing automotive production, the rising adoption of aluminum die casting in automotive applications due to its lightweight properties, and ongoing technological advancements leading to improved casting quality and efficiency. Consumer preference for fuel-efficient vehicles further bolsters market demand. Technological disruptions, such as the introduction of larger die-casting machines and improved alloy formulations, are accelerating growth. Shifts in consumer behavior towards higher quality and more sustainable vehicles also impact the market positively. The market penetration rate is projected to reach XX% by 2033.

Dominant Regions, Countries, or Segments in Argentina Automotive Parts Aluminium Die Casting Market

While data on regional breakdown within Argentina is limited, the automotive industry's concentration around major urban centers suggests these areas likely dominate the aluminum die casting market. Within the segments, Pressure Die Casting currently holds the largest market share (XX%), driven by its cost-effectiveness and suitability for high-volume production. The Body Parts segment demonstrates the highest growth potential (XX%), fueled by demand for lightweight car bodies.

- Key Drivers: Growth in automotive production, government incentives for local manufacturing, and increasing demand for lightweight vehicles.

- Dominant Segment: Pressure Die Casting (XX% market share in 2024) and Body Parts application (XX% market share in 2024).

- Growth Potential: Body Parts segment showcases the highest growth potential (XX% CAGR projected).

Argentina Automotive Parts Aluminium Die Casting Market Product Landscape

The Argentina automotive parts aluminum die casting market offers a comprehensive portfolio of meticulously engineered products designed to meet the exacting requirements of various automotive applications. Recent advancements have seen the introduction of novel aluminum alloys that boast exceptional strength-to-weight ratios, contributing directly to vehicle lightweighting initiatives, alongside improved surface finishes that enhance aesthetic appeal and durability. The relentless pursuit of technological excellence is evident in the adoption of precision casting techniques, which are instrumental in minimizing casting defects, ensuring unparalleled dimensional accuracy, and delivering superior product consistency. The unique selling propositions that distinguish market participants often revolve around delivering cost-effective solutions without compromising on quality, enabling the creation of lightweight yet robust vehicle components that contribute to enhanced performance and fuel efficiency.

Key Drivers, Barriers & Challenges in Argentina Automotive Parts Aluminium Die Casting Market

Key Drivers: The escalating demand for lightweight vehicles, driven by the imperative for improved fuel efficiency and reduced environmental impact, stands as a paramount driver for the Argentina automotive parts aluminum die casting market. Complementing this, continuous technological advancements in both die casting processes and the development of advanced aluminum alloys are instrumental in enabling the production of more sophisticated and efficient components. Furthermore, supportive government incentives and forward-thinking policies aimed at bolstering domestic automotive manufacturing play a crucial role in fostering market expansion and investment.

Key Challenges: The inherent volatility of raw material prices, particularly for aluminum, presents a significant and persistent challenge for manufacturers, impacting cost predictability and profit margins. The intricacies of global supply chains can lead to disruptions, affecting production schedules and timely delivery of finished parts. Increasingly stringent environmental regulations necessitate substantial investments in advanced emission control technologies and sustainable manufacturing practices, adding to operational costs. Moreover, the competitive pressure exerted by established foreign manufacturers with economies of scale and potentially lower production costs can pose a considerable threat to domestic players.

Emerging Opportunities in Argentina Automotive Parts Aluminium Die Casting Market

Emerging opportunities lie in the growing adoption of electric vehicles (EVs) and the demand for high-performance aluminum alloys in their components. The potential for increased local production driven by government support presents a significant opportunity. Exploring niche applications within the automotive industry could also unlock new market segments.

Growth Accelerators in the Argentina Automotive Parts Aluminium Die Casting Market Industry

The long-term growth trajectory of the Argentina automotive parts aluminum die casting market is poised to be significantly propelled by ongoing technological advancements that promise to elevate productivity and optimize efficiency within the die casting processes. The cultivation of strategic partnerships and collaborative ventures between die casting specialists and automotive manufacturers will be pivotal in fortifying supply chains, ensuring greater reliability, and fostering innovation. Crucially, the continued implementation of robust government policies that champion and support the domestic automotive industry will serve as a vital catalyst, creating a more conducive environment for market expansion and investment.

Key Players Shaping the Argentina Automotive Parts Aluminium Die Casting Market Market

- Castwel Autoparts

- KSPG AG

- Ryobi Die Casting

- Amtek Group

- Interplex Holdings Ltd

- Nemak

- ALCOA Inc

- Buvo Castings (EU)

- Dynamic Technologies Ltd

- Gibbs Die Casting Group

Notable Milestones in Argentina Automotive Parts Aluminium Die Casting Market Sector

- January 2023: Pace Industries' USD 2.8 million investment signals expansion in North American die-casting capacity, indirectly influencing the global supply chain and potentially impacting Argentina's access to advanced technology.

- September 2022: Alcoa's advancements in aluminum alloys enhance material performance, potentially increasing the adoption of higher-quality aluminum in Argentinan automotive parts.

- March 2022: Ningbo Tuopu Group's production of a large die-cast part showcases technological advancements and potential for similar large-scale production in Argentina.

In-Depth Argentina Automotive Parts Aluminium Die Casting Market Market Outlook

The Argentina automotive parts aluminum die casting market is projected to experience robust long-term growth, underpinned by several converging factors. The intensifying global and domestic demand for lightweight vehicles, crucial for enhancing fuel efficiency and meeting environmental mandates, will continue to be a primary impetus. Coupled with this, sustained technological advancements in die casting techniques and the continuous evolution of high-performance aluminum alloys will enable the production of increasingly sophisticated and lighter components. The prospect of proactive government support, through incentives and favorable policies, further strengthens the outlook for the market. Strategic investments in cutting-edge technologies, alongside the forging of strong, collaborative partnerships, will be indispensable for players aiming to thrive and achieve success in this dynamic sector. Consequently, the market presents significant opportunities for both established domestic entities and international players seeking to capitalize on the burgeoning demand for high-quality, cost-effective, and innovative aluminum die-cast automotive parts within Argentina and potentially beyond.

Argentina Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Parts

- 2.2. Engine Parts

- 2.3. Transmission Components

- 2.4. Others

Argentina Automotive Parts Aluminium Die Casting Market Segmentation By Geography

- 1. Argentina

Argentina Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of Argentina Automotive Parts Aluminium Die Casting Market

Argentina Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Concern For Fuel Efficiency and Emissions Standards

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Passenger Vehicle Sales Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Parts

- 5.2.2. Engine Parts

- 5.2.3. Transmission Components

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Castwel Autoparts

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KSPG AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ryobi Die Casting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amtek Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALCOA Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Buvo Castings (EU)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dynamic Technologies Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gibbs Die Casting Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Castwel Autoparts

List of Figures

- Figure 1: Argentina Automotive Parts Aluminium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Argentina Automotive Parts Aluminium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Argentina Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Argentina Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Castwel Autoparts, KSPG AG, Ryobi Die Casting, Amtek Group, Interplex Holdings Ltd, Nemak, ALCOA Inc, Buvo Castings (EU), Dynamic Technologies Ltd, Gibbs Die Casting Group*List Not Exhaustive.

3. What are the main segments of the Argentina Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Concern For Fuel Efficiency and Emissions Standards.

6. What are the notable trends driving market growth?

Passenger Vehicle Sales Driving Growth.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

January 2023: North American die-cast manufacturer Pace Industries announced a USD 2.8 million investment in its Jackson facility in Madison County, indicating an expansion of its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the Argentina Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence