Key Insights

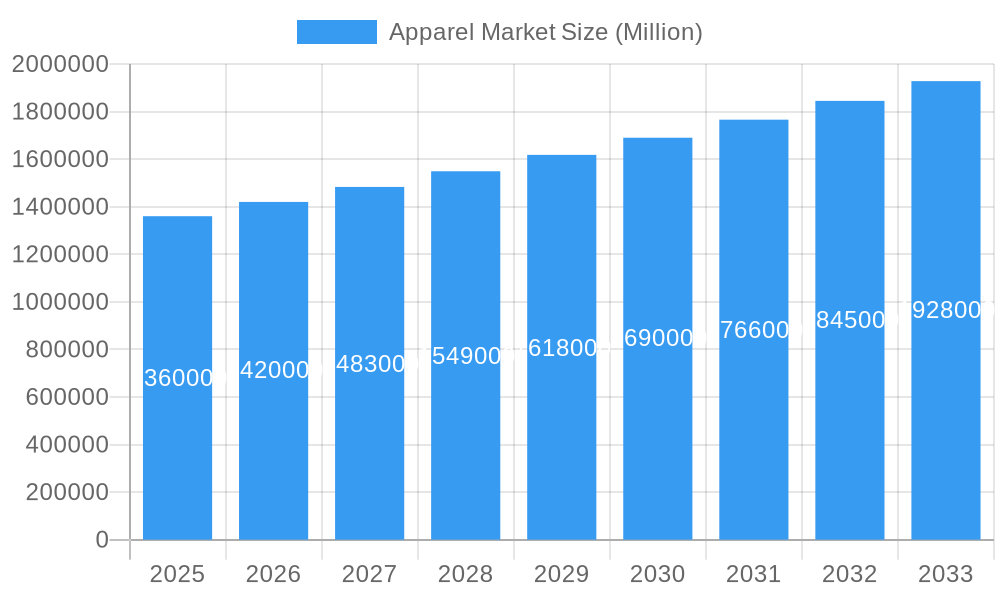

The global apparel market, valued at $1.36 trillion in 2025, is projected to experience robust growth, driven by several key factors. The rising disposable incomes in developing economies, coupled with increasing urbanization and a shift towards a more fashion-conscious consumer base, are significantly boosting demand. E-commerce platforms have revolutionized the apparel industry, providing unparalleled access to diverse styles and brands, further fueling market expansion. The market is segmented by end-user (men, women, children) and type (formal wear, casual wear, sportswear, nightwear, other), with casual wear currently dominating due to its versatility and everyday use. Growth within the sportswear segment is particularly strong, driven by the increasing popularity of fitness activities and athleisure trends. Sustainability concerns are also influencing consumer choices, with demand for ethically sourced and eco-friendly apparel increasing. While the market faces challenges such as fluctuating raw material prices and global economic uncertainties, innovation in fabrics, technology, and supply chain management is mitigating these risks. Competitive pressures from fast-fashion brands and the rise of direct-to-consumer models are shaping the market landscape, necessitating constant adaptation and innovation for established players.

Apparel Market Market Size (In Million)

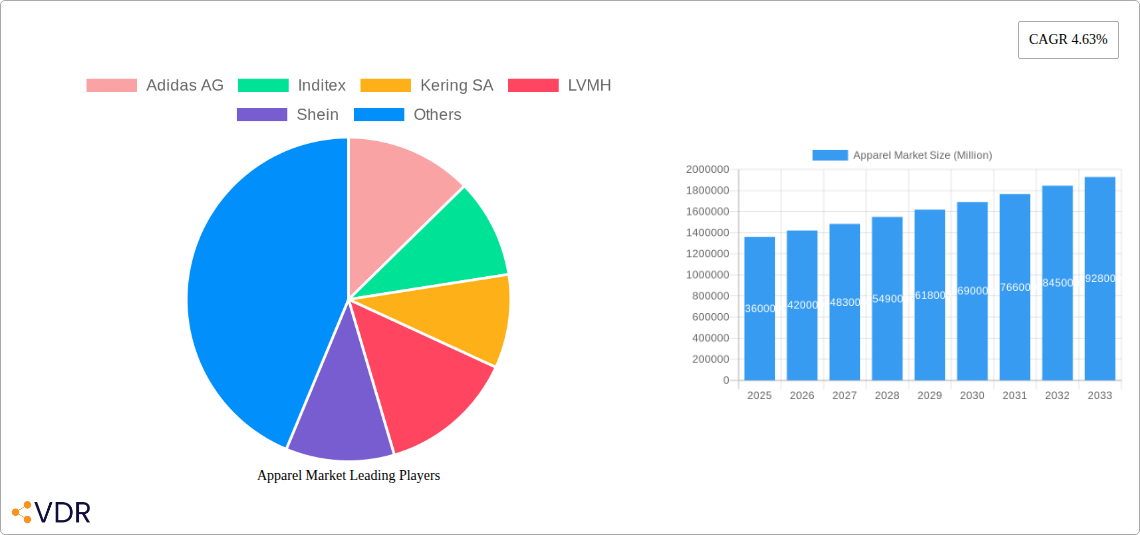

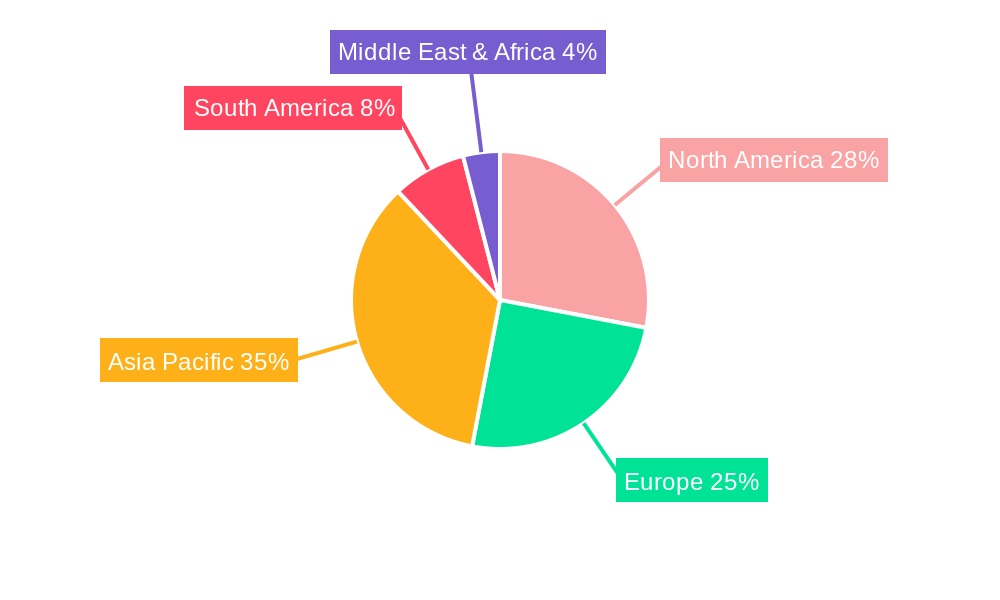

The regional distribution of the apparel market reflects varying levels of economic development and consumer preferences. North America and Europe currently hold significant market share, driven by high purchasing power and established fashion industries. However, the Asia-Pacific region is projected to witness the fastest growth, fueled by rapidly expanding middle classes in countries like China and India. The increasing penetration of online retail and the rise of local brands are further contributing to this growth. South America and the Middle East & Africa are also expected to show notable growth, albeit at a slower pace, as these regions increasingly participate in global fashion trends. The competitive landscape is fiercely contested, with established giants like Adidas, Nike, Inditex, and LVMH vying for market share alongside emerging players such as Shein and local brands. The future of the apparel market will be shaped by ongoing technological advancements, evolving consumer preferences, and the imperative for sustainable practices.

Apparel Market Company Market Share

Apparel Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global apparel market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes parent markets (apparel) and child markets (men's, women's, children's apparel; formal, casual, sportswear, etc.) to deliver granular insights.

Apparel Market Dynamics & Structure

The global apparel market, valued at xx million units in 2024, is characterized by a moderately concentrated structure with key players like Adidas AG, Inditex, Kering SA, LVMH, Shein, PVH Corp, Aditya Birla Group, H&M Hennes & Mauritz AB, Puma, Nike Inc, and Reliance Retail holding significant market shares. Market concentration is influenced by factors including brand recognition, global reach, and economies of scale.

- Market Concentration: The top 10 players hold approximately xx% of the global market share in 2024.

- Technological Innovation: Advancements in fabric technology (e.g., sustainable materials, smart fabrics), manufacturing processes (e.g., 3D printing, automation), and e-commerce platforms drive market growth. However, high initial investment costs present a barrier to entry for smaller players.

- Regulatory Frameworks: Regulations concerning labor practices, environmental sustainability, and product safety significantly impact market dynamics. Compliance costs can be substantial, particularly for businesses operating in multiple jurisdictions.

- Competitive Product Substitutes: The market faces competition from substitute products like secondhand clothing and rental services. These alternatives challenge traditional business models and influence consumer behavior.

- End-User Demographics: Shifting demographics, particularly in developing economies, are key growth drivers. Increased disposable incomes and evolving fashion preferences influence demand across various apparel segments.

- M&A Trends: The apparel industry witnesses frequent mergers and acquisitions, primarily driven by expansion strategies, technology integration, and brand portfolio diversification. The number of M&A deals averaged xx per year between 2019 and 2024, with a total value of xx million units.

Apparel Market Growth Trends & Insights

The global apparel market exhibited a CAGR of xx% during the historical period (2019-2024), driven by increasing consumer spending, the rise of e-commerce, and the growing popularity of fast fashion. The market is expected to continue its growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by several factors including:

- E-commerce Penetration: The rapid expansion of online retail channels has significantly broadened market reach and increased accessibility.

- Changing Consumer Preferences: Consumers are increasingly demanding sustainable and ethically produced apparel, driving innovation in sustainable materials and manufacturing processes.

- Technological Disruptions: The integration of technology in the apparel industry, including personalized shopping experiences and virtual try-ons, enhance customer engagement and drive sales.

- Market Segmentation: The growth is spread across various segments, including sportswear, casual wear, and formal wear, with variations based on regional trends and consumer preferences. The increasing demand for athleisure and sustainable fashion segments are driving market expansion.

Dominant Regions, Countries, or Segments in Apparel Market

The North American and European regions currently dominate the global apparel market, accounting for approximately xx% of the total market share in 2024. However, the Asia-Pacific region is witnessing rapid growth, fueled by rising disposable incomes and a burgeoning middle class.

Key Drivers:

- Economic growth: Rising disposable incomes in developing economies are significantly boosting apparel consumption.

- Favorable demographics: A growing young population in developing regions fuels demand for trendy apparel.

- Evolving fashion trends: The growing influence of social media and fashion influencers drives rapid adoption of new styles and trends.

Segment Dominance: The casual wear segment is the largest, holding approximately xx% of the market share in 2024, owing to its versatility and broad appeal across demographics. The women's apparel segment represents the largest end-user category.

Country Dominance: The USA and China are the dominant apparel markets globally, based on consumption volume and manufacturing capacity. India is rapidly emerging as a significant player in both consumption and production.

Apparel Market Product Landscape

The apparel market is a vibrant and multifaceted ecosystem, encompassing everything from essential everyday wear to avant-garde haute couture. This broad spectrum caters to an incredibly diverse array of consumer needs, styles, and lifestyle choices. Innovation is the constant engine driving this sector forward, propelled by cutting-edge advancements in textile science, sophisticated design software, and highly efficient manufacturing processes. Today's discerning consumers are increasingly drawn to unique selling propositions such as the incorporation of eco-friendly and recycled materials, the integration of smart technology for enhanced functionality (like adaptive temperature regulation or biometric tracking), and the growing demand for personalized customization that allows individuals to express their unique identity. Key performance indicators for success within this landscape include exceptional durability, unparalleled comfort, and compelling aesthetic appeal that resonates with target demographics.

Key Drivers, Barriers & Challenges in Apparel Market

Key Drivers:

- Rising disposable incomes: Increased purchasing power in developing economies fuels market growth.

- Technological advancements: Innovations in fabrics, designs, and manufacturing processes enhance product quality and appeal.

- E-commerce boom: Online retail channels expand market reach and increase accessibility.

Key Challenges:

- Supply chain disruptions: Global supply chain vulnerabilities, particularly during the pandemic, exposed market fragility and led to increased production costs.

- Regulatory compliance: Meeting stringent regulations concerning labor practices, environmental sustainability, and product safety increases operational costs.

- Intense competition: The presence of numerous established players and emerging brands creates fierce competition, impacting profit margins. The market share of established players is under pressure from fast fashion brands and direct-to-consumer models.

Emerging Opportunities in Apparel Market

- Sustainable and ethical apparel: Growing consumer demand for environmentally friendly and ethically produced garments creates significant opportunities for brands committed to sustainability.

- Personalization and customization: The ability to offer bespoke apparel options catering to individual needs and preferences increases customer loyalty.

- Technological integration: The use of augmented reality (AR) and virtual reality (VR) in online shopping enhances customer experience.

- Athleisure wear: The blending of athletic and casual wear segments fuels growth in this expanding category.

Growth Accelerators in the Apparel Market Industry

The future trajectory of the apparel market is set to be significantly shaped by a confluence of powerful growth accelerators. Foremost among these are revolutionary technological breakthroughs in the development and application of sustainable and bio-based materials, offering environmentally conscious alternatives. The relentless expansion and sophistication of e-commerce platforms continue to democratize access and drive sales globally. Strategic, synergistic partnerships between established brands and influential digital personalities are proving instrumental in expanding reach and fostering brand loyalty. Furthermore, the dynamic entry of innovative new players is injecting fresh perspectives and challenging conventional market norms. Crucially, the widespread adoption and integration of circular economy principles, emphasizing reuse, repair, and recycling, will be paramount in fostering long-term sustainability and substantially mitigating the industry's environmental footprint.

Key Players Shaping the Apparel Market Market

- Adidas AG

- Inditex

- Kering SA

- LVMH

- Shein

- PVH Corp

- Aditya Birla Group

- H&M Hennes & Mauritz Retail Pvt Ltd

- Hennes & Mauritz AB

- Puma

- Nike Inc

- Reliance Retail

Notable Milestones in Apparel Market Sector

- September 2023: H&M India expands its presence in Hyderabad, opening its third store in the city, reflecting the brand's commitment to the Indian market. This signifies the growing potential of the Indian apparel market.

- August 2023: Reliance Retail launches 'Yousta', a youth-oriented fashion brand, targeting a significant demographic segment, underscoring the importance of catering to evolving consumer preferences.

- May 2023: Adidas partners with Rich Mnisi to launch a Pride 2023 apparel collection, incorporating sustainable materials and collaborating with Better Cotton, highlighting the increasing importance of ethical and sustainable practices in the industry.

In-Depth Apparel Market Market Outlook

The apparel market is on a robust path toward sustained and significant growth, propelled by a deep understanding of evolving consumer desires, relentless technological innovation, and the ever-expanding reach of digital retail channels. Strategic opportunities abound for businesses that can effectively capitalize on the growing demand for sustainable and ethically produced apparel, as well as those offering highly personalized fashion solutions. The integration of advanced technologies is set to redefine the shopping experience, making it more immersive and convenient. Furthermore, tapping into the burgeoning potential of emerging markets in developing economies presents a substantial avenue for expansion. Ultimately, a steadfast commitment to sustainability, transparent and ethical sourcing practices, and continuous technological advancement will be the defining pillars of future success in this incredibly dynamic and competitive global market.

Apparel Market Segmentation

-

1. End User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Type

- 2.1. Formal Wear

- 2.2. Casual Wear

- 2.3. Sportswear

- 2.4. Nightwear

- 2.5. Other Types

Apparel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Apparel Market Regional Market Share

Geographic Coverage of Apparel Market

Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Marketing and Innovative Designs Driving the Market; Growing Demand for Apparel Personalization and Customization

- 3.3. Market Restrains

- 3.3.1. Competition from Local Brands with Affordable Pricing

- 3.4. Market Trends

- 3.4.1. E-Commerce Driving the Apparel Business

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Formal Wear

- 5.2.2. Casual Wear

- 5.2.3. Sportswear

- 5.2.4. Nightwear

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Formal Wear

- 6.2.2. Casual Wear

- 6.2.3. Sportswear

- 6.2.4. Nightwear

- 6.2.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Formal Wear

- 7.2.2. Casual Wear

- 7.2.3. Sportswear

- 7.2.4. Nightwear

- 7.2.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Formal Wear

- 8.2.2. Casual Wear

- 8.2.3. Sportswear

- 8.2.4. Nightwear

- 8.2.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Formal Wear

- 9.2.2. Casual Wear

- 9.2.3. Sportswear

- 9.2.4. Nightwear

- 9.2.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Apparel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Formal Wear

- 10.2.2. Casual Wear

- 10.2.3. Sportswear

- 10.2.4. Nightwear

- 10.2.5. Other Types

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Saudi Arabia Apparel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Men

- 11.1.2. Women

- 11.1.3. Children

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Formal Wear

- 11.2.2. Casual Wear

- 11.2.3. Sportswear

- 11.2.4. Nightwear

- 11.2.5. Other Types

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Adidas AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Inditex

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kering SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LVMH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Shein

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PVH Corp

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Aditya Birla Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 H&M Hennes & Mauritz Retail Pvt Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hennes & Mauritz AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Puma

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nike Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Reliance Retai

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Adidas AG

List of Figures

- Figure 1: Global Apparel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Apparel Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 5: North America Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 9: North America Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 16: Europe Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 17: Europe Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 19: Europe Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 21: Europe Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Asia Pacific Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 29: Asia Pacific Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Asia Pacific Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 33: Asia Pacific Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 40: South America Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 41: South America Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: South America Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 43: South America Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 44: South America Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 45: South America Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: South America Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 47: South America Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Middle East Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 53: Middle East Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Middle East Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Middle East Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Middle East Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 57: Middle East Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Middle East Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Middle East Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Saudi Arabia Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 64: Saudi Arabia Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 65: Saudi Arabia Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 66: Saudi Arabia Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 67: Saudi Arabia Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Saudi Arabia Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 69: Saudi Arabia Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Saudi Arabia Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Saudi Arabia Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Saudi Arabia Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 73: Saudi Arabia Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Saudi Arabia Apparel Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 3: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 5: Global Apparel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Apparel Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 9: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 23: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 25: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Russia Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Russia Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 43: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: China Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Japan Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: India Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 59: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 61: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Brazil Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Argentina Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Argentina Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 70: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 71: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 72: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 73: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 75: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 76: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 77: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 78: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 79: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 81: South Africa Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: South Africa Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Rest of Middle East Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Rest of Middle East Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Apparel Market?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Apparel Market?

Key companies in the market include Adidas AG, Inditex, Kering SA, LVMH, Shein, PVH Corp, Aditya Birla Group, H&M Hennes & Mauritz Retail Pvt Ltd, Hennes & Mauritz AB, Puma, Nike Inc, Reliance Retai.

3. What are the main segments of the Apparel Market?

The market segments include End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Marketing and Innovative Designs Driving the Market; Growing Demand for Apparel Personalization and Customization.

6. What are the notable trends driving market growth?

E-Commerce Driving the Apparel Business.

7. Are there any restraints impacting market growth?

Competition from Local Brands with Affordable Pricing.

8. Can you provide examples of recent developments in the market?

September 2023: H&M India revealed its expansion plans in Hyderabad by inaugurating its third store in the city. The company currently boasts 55 stores spread across 28 cities in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Apparel Market?

To stay informed about further developments, trends, and reports in the Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence