Key Insights

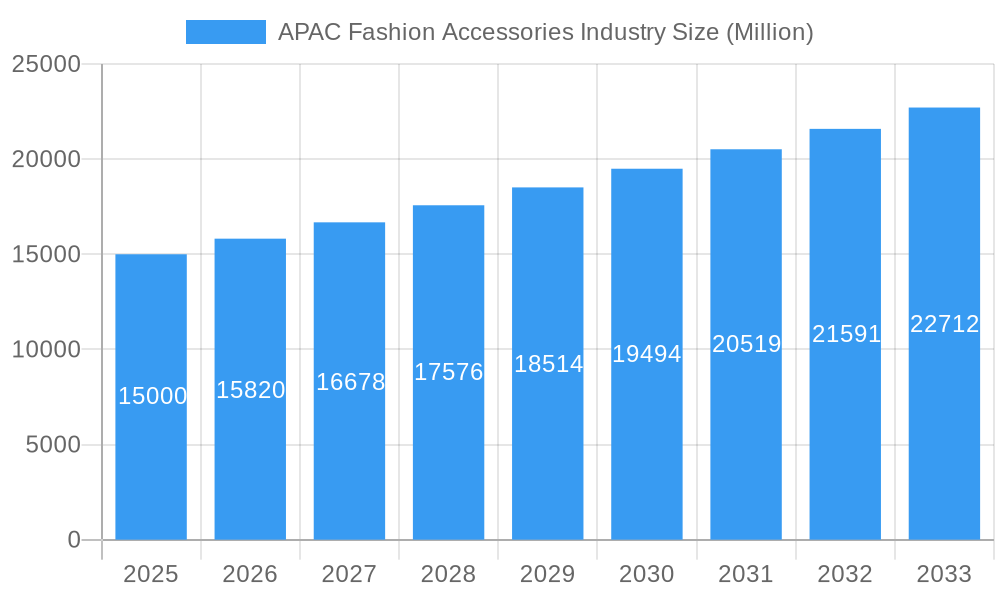

The Asia-Pacific (APAC) fashion accessories market is forecast for substantial expansion, projected to reach $741.24 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.31% from 2025 to 2033. Key growth drivers include increasing disposable incomes among the rising middle classes in China and India, alongside the convenience and accessibility offered by the growing online retail sector. Evolving fashion trends, amplified by social media and celebrity influence, continuously fuel demand for new accessories. Footwear and apparel currently lead market segmentation, followed by handbags, wallets, watches, and other accessories. A competitive landscape features both established international brands and burgeoning domestic players. Potential challenges include volatile raw material costs and regional economic uncertainties. Online retail is expected to be the fastest-growing segment due to high internet and mobile penetration in APAC. Diverse cultural preferences across the region necessitate tailored product offerings to cater to specific consumer demands.

APAC Fashion Accessories Industry Market Size (In Billion)

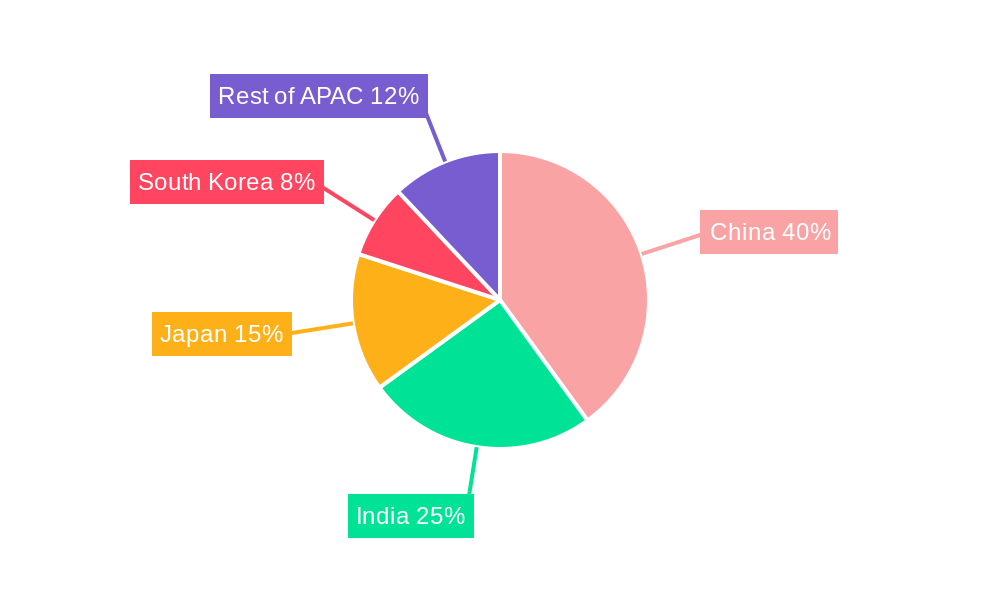

China and India are pivotal to APAC market dynamics due to their large populations and expanding consumer bases. Navigating regional variations in consumer preferences, purchasing power, and distribution networks is essential for market success. Intense competition between global and local brands requires robust branding, innovative product design, strategic marketing, and efficient supply chain management for a competitive advantage. Future growth will be propelled by the rising demand for sustainable and ethically produced accessories, reflecting increased consumer consciousness towards environmental and social responsibility.

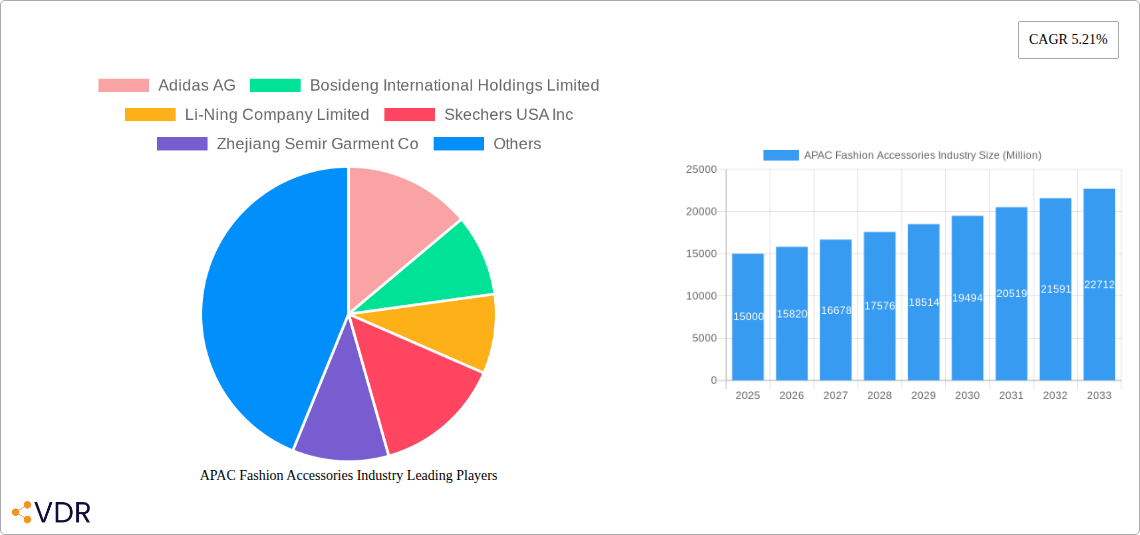

APAC Fashion Accessories Industry Company Market Share

APAC Fashion Accessories Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) fashion accessories industry, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The report leverages robust data and expert analysis to present a clear picture of current market trends and future growth prospects, segmented by end-user (men, women, kids/children, unisex), distribution channel (offline and online retail), and product type (footwear, apparel, wallets, handbags, watches, and other products). The report's detailed market sizing, competitive analysis, and future projections make it an indispensable resource for understanding and capitalizing on opportunities within the APAC fashion accessories market. The base year is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

APAC Fashion Accessories Industry Market Dynamics & Structure

The APAC fashion accessories market presents a dynamic and multifaceted landscape, characterized by the co-existence of globally recognized powerhouses and a vibrant ecosystem of emerging local enterprises. Market concentration exhibits considerable variation across different product categories and geographical territories. For instance, the footwear segment demonstrates high concentration, with dominant international brands such as Nike Inc. and Adidas AG commanding substantial market share (estimated at **XX%** and **XX%** respectively by 2025). Conversely, segments like handcrafted accessories are notably more fragmented, offering space for niche players. Key growth accelerators include technological innovation, with a particular emphasis on the expansion of e-commerce capabilities and the burgeoning demand for personalized product design. Navigating the market requires a keen understanding of the influence exerted by regulatory frameworks governing product safety and intellectual property rights. The competitive arena is further shaped by the presence of readily available product substitutes, ranging from budget-friendly alternatives to desirable vintage pieces, posing a continuous challenge for premium offerings. End-user demographics are undergoing a significant transformation, driven by a burgeoning middle class across the region and a pronounced shift in consumer preferences towards sustainable and ethically produced fashion. Mergers and acquisitions (M&A) activity has been observed at a moderate pace in recent years, with **XX** notable deals recorded between 2019 and 2024. These transactions have predominantly focused on strategies aimed at broadening market penetration and incorporating cutting-edge technologies.

- Market Concentration: High concentration observed in the footwear segment, while handcrafted accessories display a more fragmented market structure.

- Technological Innovation: E-commerce penetration, advanced personalized design solutions, and the adoption of sustainable materials are identified as pivotal drivers of market evolution.

- Regulatory Framework: Stringent product safety standards and robust intellectual property rights frameworks significantly influence operational strategies and market entry.

- Competitive Substitutes: The availability of affordable fashion alternatives and the enduring appeal of vintage items present a consistent competitive pressure, particularly for higher-priced segments.

- End-User Demographics: The expanding middle-class population and evolving consumer consciousness regarding ethical and sustainable fashion are actively shaping demand patterns.

- M&A Trends: A total of **XX** M&A deals were executed between 2019 and 2024, primarily targeting market expansion initiatives and the integration of novel technological advancements.

APAC Fashion Accessories Industry Growth Trends & Insights

The APAC fashion accessories market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including rising disposable incomes, increasing urbanization, and the growing influence of social media and celebrity endorsements on consumer purchasing decisions. The market penetration of online retail channels has accelerated, impacting both established and emerging players. Technological disruptions, particularly in areas like 3D printing and augmented reality (AR) for virtual try-ons, are reshaping the industry. Consumer behavior shifts, towards more conscious and sustainable choices, are impacting demand for eco-friendly materials and ethical brands. The forecast period (2025-2033) projects continued expansion, albeit at a slightly moderated CAGR of xx%, driven by further market penetration in developing economies and the ongoing evolution of consumer preferences. This growth will be further influenced by factors like evolving fashion trends, the impact of global economic conditions and geopolitical events. The market size is predicted to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in APAC Fashion Accessories Industry

China and India remain the dominant markets within the APAC region, accounting for a combined xx% of the total market size in 2025. High population density, rising middle-class disposable incomes, and the growing popularity of online shopping contribute to their dominance. The women's segment consistently outperforms other end-user categories, driven by increasing female participation in the workforce and evolving fashion trends. Offline retail remains the most significant distribution channel, accounting for approximately xx% of total sales in 2025, although online retail is experiencing rapid growth, particularly in urban centers. Footwear dominates the product type segment, accounting for xx% of the market.

- Key Drivers in China & India: Large populations, rising disposable incomes, strong online retail growth.

- Women's Segment Dominance: Increased female workforce participation, evolving fashion trends.

- Offline Retail Channel Strength: Although online channels are rapidly expanding.

- Footwear Market Leadership: Largest product segment by volume.

APAP Fashion Accessories Industry Product Landscape

The APAP fashion accessories market displays a diverse product landscape, ranging from traditional leather goods to cutting-edge smartwatches. Technological advancements are evident in the incorporation of smart materials, sustainable production techniques, and the integration of wearable technology into accessories. Unique selling propositions frequently center on craftsmanship, design exclusivity, brand heritage, and technological functionality. Performance metrics such as durability, comfort, and functionality play a key role in consumer purchasing decisions.

Key Drivers, Barriers & Challenges in APAC Fashion Accessories Industry

Key Drivers:

- Rising disposable incomes in emerging economies.

- Growing influence of social media and e-commerce.

- Increasing demand for personalized and sustainable products.

Key Challenges and Restraints:

- Intense competition from both international and domestic brands.

- Fluctuations in raw material costs and supply chain disruptions (impacting profitability by an estimated xx% in 2024).

- Stringent regulatory requirements and counterfeiting concerns.

Emerging Opportunities in APAP Fashion Accessories Industry

- Untapped Markets: Expanding into less developed regions within APAC.

- Innovative Applications: Integrating wearable technology and smart materials.

- Evolving Consumer Preferences: Catering to increasing demands for sustainability and ethical sourcing.

Growth Accelerators in the APAC Fashion Accessories Industry

Technological breakthroughs in materials science and manufacturing processes are poised to drive significant growth. Strategic partnerships between brands and technology companies are also fostering innovation and enhancing market reach. Expansion into new markets, particularly in Southeast Asia, and a focus on catering to evolving consumer preferences, such as sustainable and personalized products, will further accelerate market growth.

Key Players Shaping the APAC Fashion Accessories Industry Market

- Adidas AG

- Bosideng International Holdings Limited

- Li-Ning Company Limited

- Skechers USA Inc

- Zhejiang Semir Garment Co

- Aditya Birla Group

- Puma SE

- Fossil Group Inc

- Nike Inc

- Uniqlo Co Ltd

- List Not Exhaustive

Notable Milestones in APAC Fashion Accessories Industry Sector

- May 2021: Senreve established its inaugural pop-up store in Singapore, underscoring the escalating interest and demand for luxury fashion accessories within the region.

- December 2021: Roger Dubuis inaugurated its first flagship store in Australia, signifying a strategic expansion and enhanced presence within the premium luxury watch segment.

- September 2022: The re-entry of Forever 21 and American Eagle Outfitters into the Japanese market highlights a resurgence of prominent international fashion brands and underscores the critical role of e-commerce in reaching Japanese consumers.

In-Depth APAC Fashion Accessories Industry Market Outlook

The fashion accessories market within the APAC region is projected for robust and sustained growth, propelled by a synergistic combination of increasing disposable incomes, rapid technological advancements, and a perceptible evolution in consumer tastes and values. Significant strategic opportunities await brands that can adeptly harness the power of digital platforms, deliver uniquely personalized customer experiences, and embed sustainable and ethical practices throughout their entire value chain. Further expansion into previously untapped or underserved markets across the vast APAC territories, coupled with the formation of strategic alliances to amplify brand visibility and broaden product distribution networks, represents substantial avenues for market participants to explore. The long-term market outlook remains decidedly positive, with expectations of consistent and steady growth anticipated throughout the forecast period. This optimistic trajectory is firmly rooted in the region's inherently dynamic economic landscape and the perpetually evolving and influential world of global fashion.

APAC Fashion Accessories Industry Segmentation

-

1. Product Type

- 1.1. Footwear

- 1.2. Apparel

- 1.3. Wallets

- 1.4. Handbags

- 1.5. Watches

- 1.6. Other Products

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

- 2.4. Unisex

-

3. Distibution Channel

- 3.1. Offline Retail Channel

- 3.2. Online Retail Channel

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

APAC Fashion Accessories Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Fashion Accessories Industry Regional Market Share

Geographic Coverage of APAC Fashion Accessories Industry

APAC Fashion Accessories Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Growing Preference for Luxury Fashion Accessories is Pushing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Footwear

- 5.1.2. Apparel

- 5.1.3. Wallets

- 5.1.4. Handbags

- 5.1.5. Watches

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.2.4. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Offline Retail Channel

- 5.3.2. Online Retail Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Footwear

- 6.1.2. Apparel

- 6.1.3. Wallets

- 6.1.4. Handbags

- 6.1.5. Watches

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.2.4. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Offline Retail Channel

- 6.3.2. Online Retail Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Footwear

- 7.1.2. Apparel

- 7.1.3. Wallets

- 7.1.4. Handbags

- 7.1.5. Watches

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.2.4. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Offline Retail Channel

- 7.3.2. Online Retail Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Footwear

- 8.1.2. Apparel

- 8.1.3. Wallets

- 8.1.4. Handbags

- 8.1.5. Watches

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.2.4. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Offline Retail Channel

- 8.3.2. Online Retail Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Footwear

- 9.1.2. Apparel

- 9.1.3. Wallets

- 9.1.4. Handbags

- 9.1.5. Watches

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.2.4. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Offline Retail Channel

- 9.3.2. Online Retail Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Footwear

- 10.1.2. Apparel

- 10.1.3. Wallets

- 10.1.4. Handbags

- 10.1.5. Watches

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids/Children

- 10.2.4. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. Offline Retail Channel

- 10.3.2. Online Retail Channel

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adidas AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosideng International Holdings Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Li-Ning Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skechers USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhejiang Semir Garment Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aditya Birla Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puma SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fossil Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nike Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Uniqlo Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adidas AG

List of Figures

- Figure 1: Global APAC Fashion Accessories Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: China APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: China APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: China APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 7: China APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 8: China APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: China APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: China APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Japan APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Japan APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Japan APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Japan APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Japan APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 17: Japan APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 18: Japan APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 19: Japan APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Japan APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Japan APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: India APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 23: India APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: India APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 25: India APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: India APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 27: India APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 28: India APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 29: India APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: India APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: India APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Australia APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Australia APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: Australia APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Australia APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 37: Australia APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 38: Australia APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Australia APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Australia APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Australia APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 9: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 14: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 24: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 29: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Fashion Accessories Industry?

The projected CAGR is approximately 6.31%.

2. Which companies are prominent players in the APAC Fashion Accessories Industry?

Key companies in the market include Adidas AG, Bosideng International Holdings Limited, Li-Ning Company Limited, Skechers USA Inc, Zhejiang Semir Garment Co, Aditya Birla Group, Puma SE, Fossil Group Inc, Nike Inc, Uniqlo Co Ltd*List Not Exhaustive.

3. What are the main segments of the APAC Fashion Accessories Industry?

The market segments include Product Type, End User, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 741.24 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Growing Preference for Luxury Fashion Accessories is Pushing the Market.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

September 2022: Forever 21 and American Eagle Outfitters Inc. announced their comeback to the Japanese market after leaving in 2019. Forever has stated that it will begin e-commerce sales and launch a physical store in February 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Fashion Accessories Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Fashion Accessories Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Fashion Accessories Industry?

To stay informed about further developments, trends, and reports in the APAC Fashion Accessories Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence