Key Insights

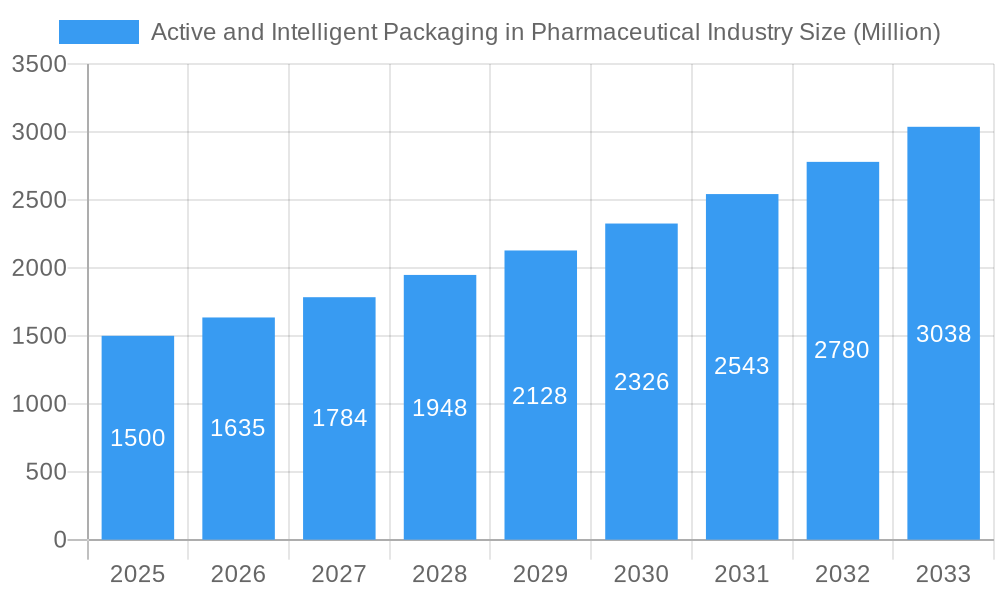

The pharmaceutical active and intelligent packaging market is poised for significant expansion, driven by escalating demands for superior product safety, extended shelf life, and enhanced supply chain transparency. The market, valued at $12.48 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 10.13%. This growth trajectory is underpinned by several critical drivers. Paramount among these are stringent regulatory mandates for drug safety and efficacy, compelling pharmaceutical firms to adopt sophisticated packaging solutions that guarantee product integrity and deter counterfeiting. Furthermore, the increasing volume of temperature-sensitive pharmaceuticals, including biologics and vaccines, necessitates intelligent packaging integrated with time-temperature indicators (TTIs) and sensors to maintain optimal storage conditions across the supply chain. The growing imperative for tamper-evident packaging also enhances patient safety and fosters consumer confidence, thereby stimulating market growth. Active packaging technologies, such as oxygen scavengers, moisture absorbers, and antimicrobial agents, are crucial for extending the viability of sensitive medications. Concurrently, intelligent packaging innovations like RFID and NFC tags offer real-time tracking and monitoring, optimizing supply chain management and preventing product diversion.

Active and Intelligent Packaging in Pharmaceutical Industry Market Size (In Billion)

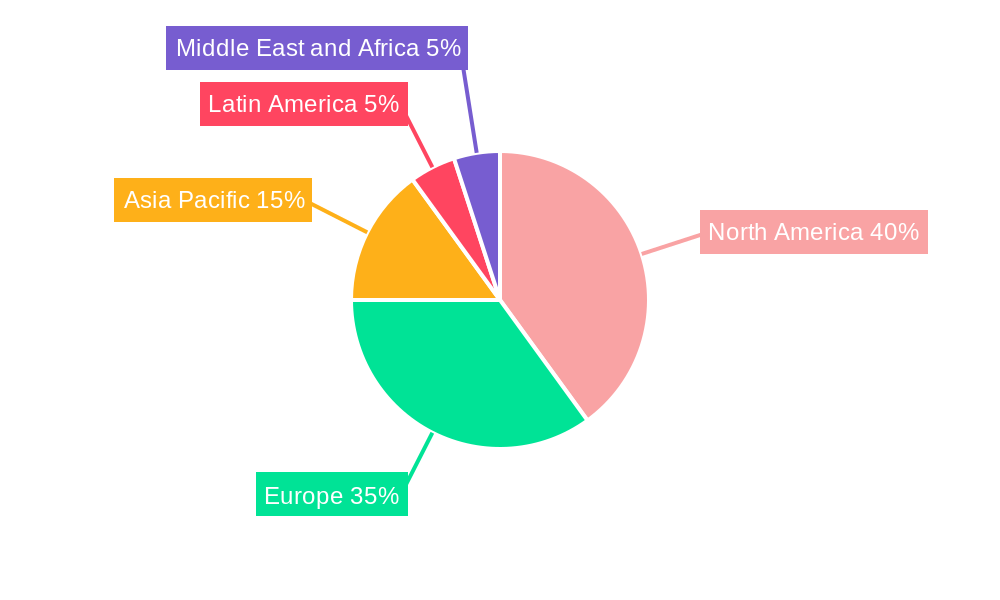

Significant regional disparities characterize the market landscape. North America and Europe currently dominate market share, attributed to robust regulatory environments and a high concentration of pharmaceutical enterprises. However, the Asia-Pacific region is expected to experience substantial growth, propelled by increasing healthcare expenditures and expanding pharmaceutical manufacturing in key economies like China and India. The competitive arena features a blend of established packaging manufacturers and specialized technology providers. Companies are strategically investing in research and development to introduce groundbreaking solutions and broaden their product offerings, aligning with the evolving requirements of the pharmaceutical sector. Strategic collaborations and mergers & acquisitions are also anticipated to influence market dynamics in the coming years. The ongoing development of more advanced and cost-effective solutions is set to further accelerate market expansion throughout the forecast period.

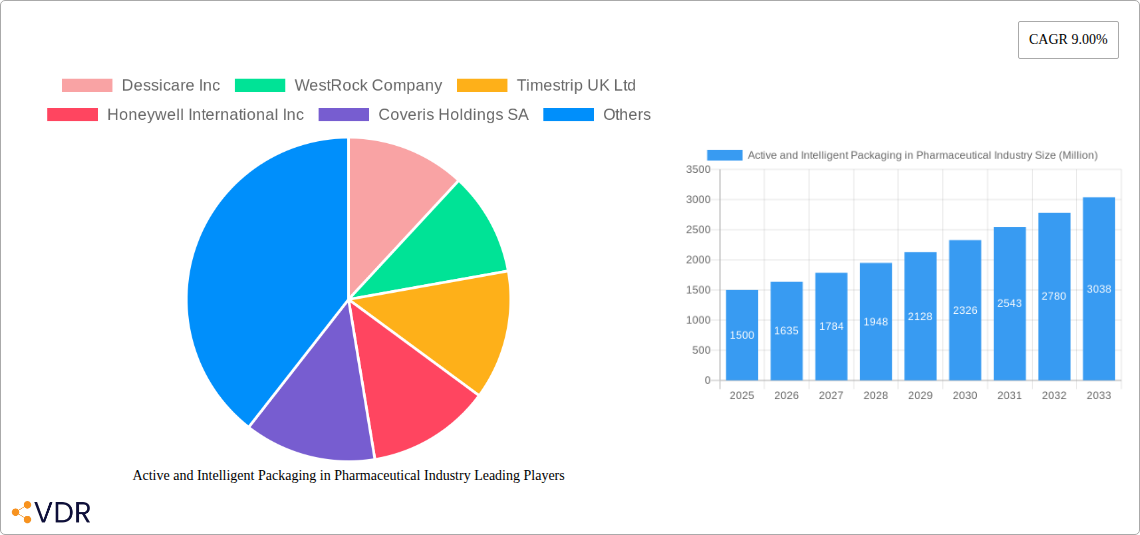

Active and Intelligent Packaging in Pharmaceutical Industry Company Market Share

Active and Intelligent Packaging in Pharmaceutical Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Active and Intelligent Packaging market within the pharmaceutical industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive market research and data analysis to deliver a holistic understanding of this dynamic sector. The total market size in 2025 is estimated at xx Million units.

Active and Intelligent Packaging in Pharmaceutical Industry Market Dynamics & Structure

This section delves into the intricate structure of the Active and Intelligent Packaging market within the pharmaceutical industry. We analyze market concentration, revealing a moderately consolidated landscape with key players holding significant market share. For example, Amcor Ltd and Sealed Air Corporation collectively hold an estimated xx% market share in 2025. Technological innovation is a crucial driver, with continuous advancements in sensor technology, material science, and printing techniques shaping the market. Stringent regulatory frameworks, particularly concerning material safety and efficacy, significantly influence market dynamics. Competitive product substitutes, such as traditional packaging materials, pose a challenge, while the increasing demand for enhanced product protection and traceability drives market growth.

- Market Concentration: Moderately consolidated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on improved sensor accuracy, miniaturization, and sustainable materials.

- Regulatory Framework: Stringent FDA and EMA regulations influence material selection and labeling.

- Competitive Substitutes: Traditional packaging materials present a significant competitive threat.

- End-User Demographics: Pharmaceutical companies of all sizes, focusing on both prescription and OTC drugs.

- M&A Trends: A moderate level of M&A activity is observed, with xx major deals recorded between 2019-2024.

Active and Intelligent Packaging in Pharmaceutical Industry Growth Trends & Insights

The Active and Intelligent Packaging market in the pharmaceutical sector is experiencing robust growth, driven by increasing demand for enhanced product safety, extended shelf life, and improved supply chain visibility. The market size is projected to expand at a CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx Million units by 2033. This growth is fueled by the rising adoption of intelligent packaging solutions, particularly RFID and time-temperature indicators (TTIs), enabling real-time monitoring and improved traceability. Technological disruptions, such as the integration of IoT sensors and blockchain technology, are further accelerating market growth. Consumer behavior shifts towards greater demand for personalized medicine and convenient packaging solutions also contribute to market expansion.

Market penetration of intelligent packaging solutions is currently at xx% in 2025 and is expected to reach xx% by 2033. The adoption of active packaging solutions, driven by the need for extended shelf life and enhanced product preservation, also shows strong growth trends.

Dominant Regions, Countries, or Segments in Active and Intelligent Packaging in Pharmaceutical Industry

North America currently holds the largest market share in the Active and Intelligent Packaging market for the pharmaceutical industry, followed by Europe. The dominance of these regions is attributed to strong regulatory frameworks, advanced healthcare infrastructure, and a high concentration of pharmaceutical companies. However, Asia-Pacific is projected to witness the fastest growth during the forecast period, driven by increasing healthcare expenditure, expanding pharmaceutical manufacturing, and rising consumer awareness of product quality and safety.

Key Drivers:

- North America: Strong regulatory frameworks, advanced healthcare infrastructure, high pharmaceutical R&D investment.

- Europe: Large pharmaceutical industry presence, robust regulatory compliance, high consumer awareness.

- Asia-Pacific: Rapid economic growth, increasing healthcare expenditure, expanding pharmaceutical manufacturing.

Segment Dominance:

- Active Packaging: Oxygen scavengers and moisture absorbers currently dominate, while antimicrobial packaging shows strong growth potential.

- Intelligent Packaging: Time-Temperature Indicators (TTIs) and RFID/NFC tags are leading segments, with increasing adoption of advanced sensor technologies.

Active and Intelligent Packaging in Pharmaceutical Industry Product Landscape

The Active and Intelligent Packaging market showcases a diverse range of products, with continuous innovation focused on improving performance and functionality. Oxygen scavengers, for example, are evolving towards more efficient and sustainable materials, while intelligent packaging solutions are integrating advanced sensors for enhanced data collection and real-time monitoring capabilities. Unique selling propositions often center around improved shelf-life extension, enhanced product security, and improved supply chain visibility. Key technological advancements include the integration of nano-materials, bio-based materials, and advanced sensor technologies, improving overall performance and sustainability.

Key Drivers, Barriers & Challenges in Active and Intelligent Packaging in Pharmaceutical Industry

Key Drivers:

- Enhanced Product Protection: Extending shelf life and maintaining product quality.

- Improved Supply Chain Visibility: Real-time tracking and monitoring of pharmaceuticals.

- Regulatory Compliance: Meeting stringent regulatory requirements for safety and efficacy.

- Growing Demand for Traceability: Combating counterfeiting and ensuring product authenticity.

Key Challenges & Restraints:

- High Initial Investment Costs: Implementing advanced packaging solutions requires significant upfront investment.

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary approvals can be time-consuming and costly.

- Supply Chain Disruptions: Global supply chain instability can impact the availability of raw materials and packaging components.

- Limited Consumer Awareness: Lack of widespread understanding of the benefits of active and intelligent packaging limits adoption.

Emerging Opportunities in Active and Intelligent Packaging in Pharmaceutical Industry

The Active and Intelligent Packaging market presents numerous emerging opportunities. The integration of smart packaging with digital health platforms holds significant potential, enabling personalized medication management and improved patient compliance. Untapped markets in developing economies offer substantial growth potential, driven by rising healthcare awareness and growing demand for quality pharmaceuticals. Furthermore, the development of more sustainable and eco-friendly packaging materials is attracting significant interest, creating opportunities for environmentally conscious manufacturers.

Growth Accelerators in the Active and Intelligent Packaging in Pharmaceutical Industry Industry

Long-term growth in the Active and Intelligent Packaging market is fueled by technological breakthroughs, particularly in sensor miniaturization and the development of sophisticated data analytics platforms. Strategic partnerships between packaging manufacturers, pharmaceutical companies, and technology providers are driving innovation and accelerating market penetration. Furthermore, the expansion into new markets, particularly in developing countries, presents significant opportunities for growth and market expansion.

Key Players Shaping the Active and Intelligent Packaging in Pharmaceutical Industry Market

- Dessicare Inc

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Coveris Holdings SA

- Sonoco Products Company

- Landec Corporation

- Ball Corporation

- Crown Holdings Inc

- Bemis Company Inc

- BASF SE

- CCL Industries Inc

- Graphic Packaging

- Sealed Air Corporation

- Amcor Ltd

(List Not Exhaustive)

Notable Milestones in Active and Intelligent Packaging in Pharmaceutical Industry Sector

- 2020: Amcor launches a new range of recyclable active packaging solutions for pharmaceuticals.

- 2021: Sealed Air introduces a temperature-indicating label for improved cold chain management.

- 2022: Several key players announce strategic partnerships to accelerate the development of innovative packaging solutions.

- 2023: Increased regulatory focus on sustainable packaging solutions drives innovation in eco-friendly materials.

- 2024: Significant investments are made in advanced sensor technologies for enhanced real-time monitoring.

In-Depth Active and Intelligent Packaging in Pharmaceutical Industry Market Outlook

The future of the Active and Intelligent Packaging market in the pharmaceutical industry is bright. Continuous technological advancements, coupled with the growing demand for enhanced product security, traceability, and sustainability, will drive significant market expansion. Strategic partnerships and collaborations will further fuel innovation and market penetration. The focus on data-driven solutions, combined with the integration of smart packaging with digital health platforms, will reshape the industry landscape and unlock new opportunities for market growth. The market is poised for a period of sustained growth, fueled by strong demand and technological innovation.

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation

-

1. Active Packaging

- 1.1. Oxygen Scavengers

- 1.2. Microwave Susceptors

- 1.3. Odor Absorbers/Emitters

- 1.4. Moisture/ Humidity Absorbers

- 1.5. Anti-microbial Packaging

- 1.6. Others A

-

2. Intelligent Packaging

- 2.1. Coding and Marking

- 2.2. Sensors

- 2.3. RFID & NFC

- 2.4. Other Intelligent Packaging

Active and Intelligent Packaging in Pharmaceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Intelligent Packaging in Pharmaceutical Industry Regional Market Share

Geographic Coverage of Active and Intelligent Packaging in Pharmaceutical Industry

Active and Intelligent Packaging in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancements in Pharmaceutical Packaging Industry

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 5.1.1. Oxygen Scavengers

- 5.1.2. Microwave Susceptors

- 5.1.3. Odor Absorbers/Emitters

- 5.1.4. Moisture/ Humidity Absorbers

- 5.1.5. Anti-microbial Packaging

- 5.1.6. Others A

- 5.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 5.2.1. Coding and Marking

- 5.2.2. Sensors

- 5.2.3. RFID & NFC

- 5.2.4. Other Intelligent Packaging

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6. North America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 6.1.1. Oxygen Scavengers

- 6.1.2. Microwave Susceptors

- 6.1.3. Odor Absorbers/Emitters

- 6.1.4. Moisture/ Humidity Absorbers

- 6.1.5. Anti-microbial Packaging

- 6.1.6. Others A

- 6.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 6.2.1. Coding and Marking

- 6.2.2. Sensors

- 6.2.3. RFID & NFC

- 6.2.4. Other Intelligent Packaging

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7. Europe Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 7.1.1. Oxygen Scavengers

- 7.1.2. Microwave Susceptors

- 7.1.3. Odor Absorbers/Emitters

- 7.1.4. Moisture/ Humidity Absorbers

- 7.1.5. Anti-microbial Packaging

- 7.1.6. Others A

- 7.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 7.2.1. Coding and Marking

- 7.2.2. Sensors

- 7.2.3. RFID & NFC

- 7.2.4. Other Intelligent Packaging

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8. Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 8.1.1. Oxygen Scavengers

- 8.1.2. Microwave Susceptors

- 8.1.3. Odor Absorbers/Emitters

- 8.1.4. Moisture/ Humidity Absorbers

- 8.1.5. Anti-microbial Packaging

- 8.1.6. Others A

- 8.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 8.2.1. Coding and Marking

- 8.2.2. Sensors

- 8.2.3. RFID & NFC

- 8.2.4. Other Intelligent Packaging

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9. Latin America Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 9.1.1. Oxygen Scavengers

- 9.1.2. Microwave Susceptors

- 9.1.3. Odor Absorbers/Emitters

- 9.1.4. Moisture/ Humidity Absorbers

- 9.1.5. Anti-microbial Packaging

- 9.1.6. Others A

- 9.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 9.2.1. Coding and Marking

- 9.2.2. Sensors

- 9.2.3. RFID & NFC

- 9.2.4. Other Intelligent Packaging

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10. Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 10.1.1. Oxygen Scavengers

- 10.1.2. Microwave Susceptors

- 10.1.3. Odor Absorbers/Emitters

- 10.1.4. Moisture/ Humidity Absorbers

- 10.1.5. Anti-microbial Packaging

- 10.1.6. Others A

- 10.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 10.2.1. Coding and Marking

- 10.2.2. Sensors

- 10.2.3. RFID & NFC

- 10.2.4. Other Intelligent Packaging

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dessicare Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WestRock Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Timestrip UK Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coveris Holdings SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sonoco Products Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Landec Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ball Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Crown Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bemis Company Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CCL Industries Inc *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Graphic Packaging

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sealed Air Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Amcor Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Dessicare Inc

List of Figures

- Figure 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 3: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 4: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 5: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 6: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 9: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 10: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 11: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 12: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 15: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 16: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 17: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 18: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 21: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 22: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 23: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 24: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Active Packaging 2025 & 2033

- Figure 27: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Active Packaging 2025 & 2033

- Figure 28: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Intelligent Packaging 2025 & 2033

- Figure 29: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 30: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Active and Intelligent Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 2: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 3: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 5: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 6: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 10: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 11: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 17: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 18: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Active and Intelligent Packaging in Pharmaceutical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 24: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 25: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Active Packaging 2020 & 2033

- Table 27: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Intelligent Packaging 2020 & 2033

- Table 28: Global Active and Intelligent Packaging in Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Intelligent Packaging in Pharmaceutical Industry?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Active and Intelligent Packaging in Pharmaceutical Industry?

Key companies in the market include Dessicare Inc, WestRock Company, Timestrip UK Ltd, Honeywell International Inc, Coveris Holdings SA, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, CCL Industries Inc *List Not Exhaustive, Graphic Packaging, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Active and Intelligent Packaging in Pharmaceutical Industry?

The market segments include Active Packaging, Intelligent Packaging .

4. Can you provide details about the market size?

The market size is estimated to be USD 12.48 billion as of 2022.

5. What are some drivers contributing to market growth?

; Advancements in Pharmaceutical Packaging Industry.

6. What are the notable trends driving market growth?

RFID & NFC Holds an Important Position in the Active & Intelligent Packaging in Pharmaceutical Market.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Intelligent Packaging in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Intelligent Packaging in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Intelligent Packaging in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Active and Intelligent Packaging in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence