**

Tech Titans on Track for $4 Trillion Market Cap Summer: Ives Predicts Meteoric Rise for Big Tech

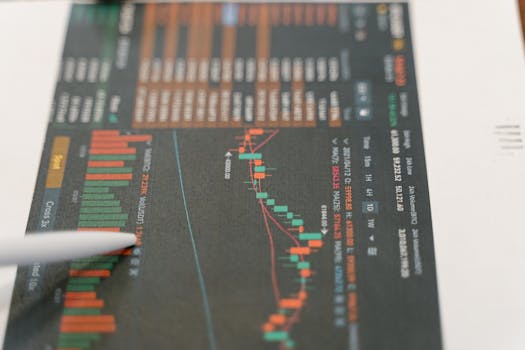

The tech sector is buzzing with anticipation, fueled by a bold prediction from prominent Wedbush Securities analyst Dan Ives. Ives forecasts a summer of unprecedented growth for leading technology giants, potentially pushing their combined market capitalization to a staggering $4 trillion. This projection highlights the remarkable resilience and continued expansion of these companies, despite ongoing economic uncertainties and regulatory scrutiny. The prediction is based on a confluence of factors, including strong AI adoption, robust cloud computing growth, and surprisingly resilient consumer spending.

The $4 Trillion Summer: A Deep Dive into Ives' Prediction

Ives' forecast isn't based on mere speculation. He points to several key drivers contributing to this anticipated surge in market valuations:

Artificial Intelligence (AI) Revolution: The AI boom is undeniably reshaping the technological landscape. Companies like Microsoft, Google, and Amazon are at the forefront of this revolution, integrating AI capabilities into their existing products and developing entirely new AI-powered services. This rapid AI adoption is expected to significantly boost revenues and investor confidence, leading to higher stock valuations. The ongoing race to develop and implement cutting-edge AI technologies is creating a significant competitive advantage for these giants. Keywords such as "Generative AI," "Large Language Models (LLMs)," and "AI investments" are central to understanding this growth trajectory.

Cloud Computing Dominance Continues: The cloud computing market remains a significant engine of growth for major tech companies. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) continue to dominate this space, providing essential infrastructure and services to businesses worldwide. The growing adoption of cloud services across various industries, coupled with the increasing complexity and scalability demands of businesses, ensures sustained growth in this sector.

Resilient Consumer Spending: Despite concerns about inflation and a potential recession, consumer spending on tech products and services has remained remarkably resilient. This suggests a fundamental demand for these offerings, further supporting the bullish outlook on tech valuations. The continued consumer interest in smartphones, wearables, and streaming services contributes significantly to the overall health of the tech sector.

Strategic Acquisitions and Partnerships: Many tech giants are aggressively pursuing strategic acquisitions and partnerships to expand their market reach and bolster their product offerings. These moves solidify their competitive positions and further drive investor confidence, contributing to the predicted market cap surge.

Key Players in the $4 Trillion Forecast:

Microsoft (MSFT): Microsoft's strategic partnership with OpenAI and the integration of AI into its flagship products, like Bing and Office 365, are major catalysts for its growth. The company’s strong position in cloud computing with Azure also fuels the expectation of continued market dominance.

Apple (AAPL): Apple's consistent innovation and strong brand loyalty continue to drive sales of its iPhones, Macs, and wearables. The company's services segment is also showing robust growth, contributing significantly to its overall valuation. Apple’s upcoming product releases and rumored expansion into new markets are likely to further enhance investor sentiment.

Google (GOOGL): Google's dominance in search, advertising, and cloud computing, combined with its aggressive investments in AI, positions it for significant growth. The company's continued innovation across various platforms and services makes it a key player in this market cap prediction.

Amazon (AMZN): Amazon's robust e-commerce business, combined with the growth of AWS, ensures its continued position as a tech giant. Amazon's expansion into new areas such as advertising and healthcare contributes to the diversity of its revenue streams and fuels investor optimism.

Challenges and Potential Headwinds:

While the outlook is bullish, it's important to acknowledge potential challenges:

Regulatory Scrutiny: Increased regulatory scrutiny of Big Tech companies, particularly regarding antitrust concerns and data privacy, could pose a headwind to their growth. Ongoing investigations and potential fines could impact their profitability and investor confidence.

Geopolitical Uncertainty: Global geopolitical events and economic instability can impact the tech sector's performance. Supply chain disruptions and shifts in global trade patterns could affect the availability and cost of components, potentially hindering growth.

Inflation and Interest Rates: Persistent inflation and rising interest rates could dampen consumer spending and investment, impacting the growth trajectory of tech companies.

Competition: Intense competition from smaller, more agile companies and emerging technologies could challenge the dominance of established tech giants.

Navigating the Uncertainties:

Despite these potential headwinds, Ives' prediction reflects a strong underlying belief in the long-term growth potential of these tech giants. Their continuous innovation, aggressive investment in emerging technologies like AI, and dominance in crucial sectors like cloud computing position them favorably for sustained growth. The ability of these companies to adapt to changing market conditions and navigate regulatory challenges will ultimately determine how closely they approach the predicted $4 trillion market cap.

Conclusion:

Dan Ives' prediction of a $4 trillion summer for leading tech companies is a bold statement, but it's grounded in the strong performance and growth potential of these tech giants. While challenges exist, their dominance in key technological sectors, coupled with their investments in transformative technologies like AI, suggests a promising future. The coming months will be crucial in determining whether this ambitious forecast comes to fruition, but the potential for significant growth in the tech sector remains undeniable. Investors and analysts alike will be closely monitoring these companies' performance to gauge the accuracy of this exciting projection.