Key Insights

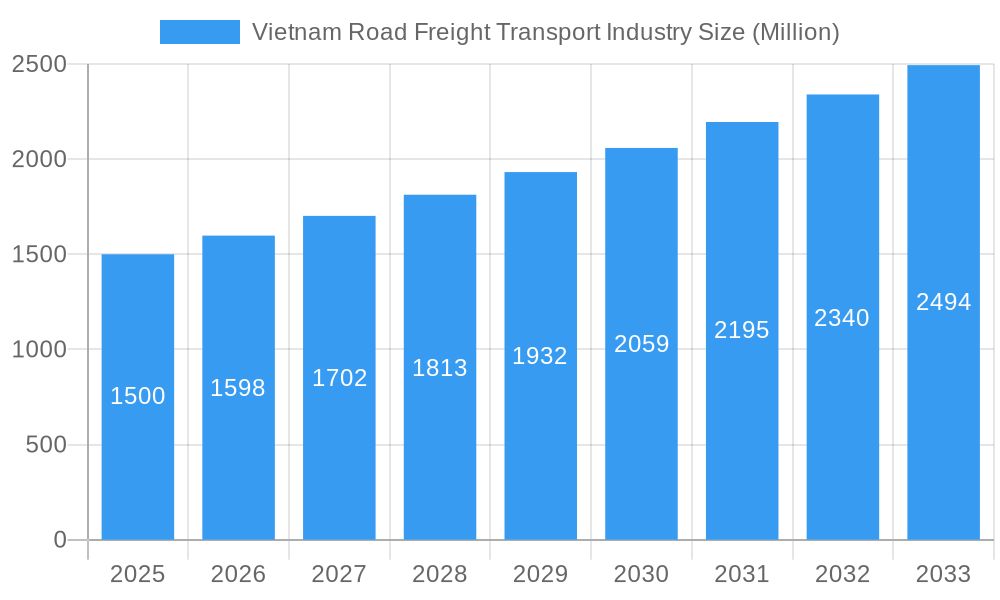

The Vietnam road freight transport industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.98% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, Vietnam's burgeoning manufacturing and e-commerce sectors are generating significant demand for efficient and reliable freight transportation. The expansion of industrial zones and infrastructure projects across the country, particularly improved highway networks, further supports this trend. Increased cross-border trade, especially within Southeast Asia, is also contributing significantly to the market's expansion. The rising adoption of temperature-controlled transportation for sensitive goods like agricultural products and pharmaceuticals represents another significant growth opportunity. While the industry faces challenges like fluctuating fuel prices and driver shortages, these are being offset by technological advancements, such as improved logistics management systems and the increasing use of GPS tracking, improving efficiency and transparency. The diversification of services, including the growing adoption of LTL and FTL solutions tailored to specific needs, further enhances market competitiveness and caters to a broader range of client requirements.

Vietnam Road Freight Transport Industry Market Size (In Billion)

The segmentation of the market reveals interesting dynamics. While the domestic market is currently larger, international road freight transport is witnessing faster growth driven by increased regional trade agreements. The full-truckload (FTL) segment remains dominant, but the less-than-truckload (LTL) segment is experiencing a surge due to the rise of e-commerce. The preference for containerized freight reflects ongoing efforts to standardize transport and improve supply chain efficiency. The industry caters to a diverse range of end-user industries, with manufacturing, agriculture, and wholesale/retail trade being the major contributors. While solid goods dominate the transported cargo, the temperature-controlled segment showcases the industry's growing capability to handle specialized goods. Competitive rivalry among major players like A.P. Moller-Maersk, DHL Group, and several domestic logistics providers ensures continuous innovation and service improvements. The forecast period of 2025-2033 offers promising prospects for sustained growth, driven by continued economic development and improved infrastructure within Vietnam.

Vietnam Road Freight Transport Industry Company Market Share

Vietnam Road Freight Transport Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Vietnam road freight transport industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for businesses, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. Parent markets include the broader Southeast Asian logistics market, and child markets include specific segments like LTL and FTL transportation within Vietnam.

Keywords: Vietnam road freight transport, logistics, trucking, transportation, FTL, LTL, containerized freight, non-containerized freight, long haul, short haul, supply chain, market analysis, market size, market share, industry growth, key players, Maersk, ViettelPost, Nippon Express, Gemadept, DHL, Vietnam logistics industry, Southeast Asia logistics, freight forwarding, domestic freight, international freight.

Vietnam Road Freight Transport Industry Market Dynamics & Structure

The Vietnamese road freight transport market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and smaller domestic players. Market concentration is expected to increase slightly by 2033 due to M&A activity and the expansion of larger players. Technological innovation, primarily driven by digitalization and automation, is transforming operations and improving efficiency. However, regulatory frameworks, including licensing and safety standards, present both opportunities and challenges. The industry faces competition from alternative modes of transportation, particularly rail and sea freight, especially for long-haul shipments. End-user demographics are shifting towards a greater reliance on e-commerce and faster delivery times, influencing demand for LTL services.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share in 2025, projected to increase to xx% by 2033.

- Technological Innovation: Increased adoption of GPS tracking, telematics, and route optimization software; emerging adoption of autonomous vehicles and drones remains limited but growing.

- Regulatory Framework: Government initiatives focused on infrastructure development and streamlining logistics regulations. xx new regulations expected in the next 5 years.

- Competitive Substitutes: Rail and sea freight for long-haul; Last-mile delivery services (e.g., motorbike couriers) for urban areas.

- M&A Trends: Increased consolidation predicted, with xx M&A deals expected between 2025 and 2033, driven by economies of scale and market expansion strategies.

- End-User Demographics: Growth in e-commerce fueling demand for faster and more reliable delivery services.

Vietnam Road Freight Transport Industry Growth Trends & Insights

The Vietnam road freight transport market experienced robust growth during the historical period (2019-2024), driven by a rapidly expanding economy, increasing industrialization, and rising e-commerce adoption. The market size, estimated at xx million USD in 2025, is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching xx million USD by 2033. This growth is propelled by technological advancements enhancing efficiency and reducing costs, coupled with a shift towards improved infrastructure. Consumer behavior increasingly favors faster and more reliable delivery, contributing to the growth of LTL and time-sensitive services. Penetration of technological solutions like GPS tracking is estimated at xx% in 2025, projected to reach xx% by 2033. However, challenges like driver shortages and fluctuating fuel prices could potentially impact growth trajectories.

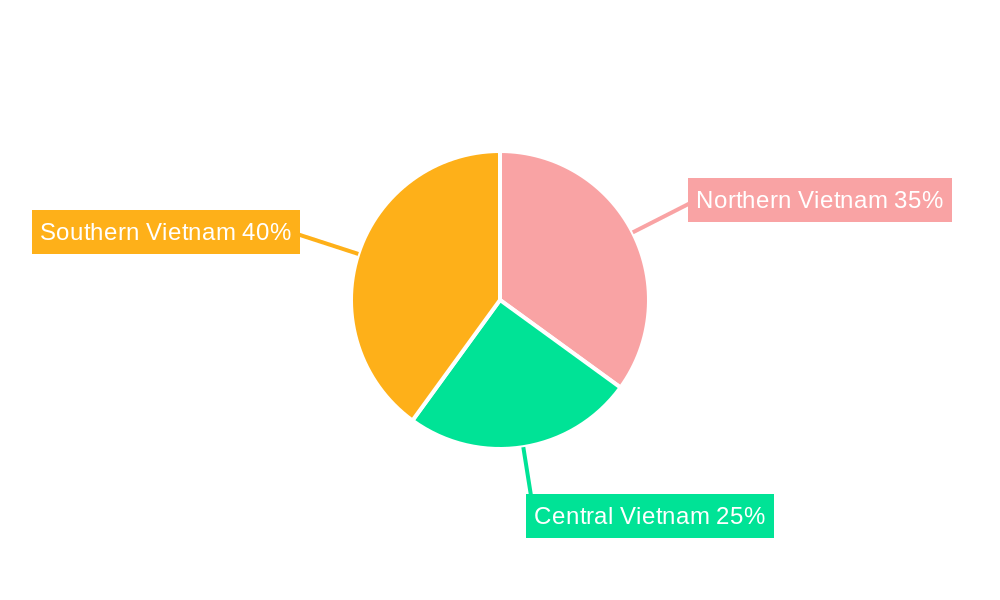

Dominant Regions, Countries, or Segments in Vietnam Road Freight Transport Industry

The Southern region of Vietnam dominates the road freight transport market, driven by a higher concentration of industrial zones, ports, and manufacturing facilities. International freight, particularly imports and exports through major ports like Ho Chi Minh City, shows strong growth. Full Truck Load (FTL) services hold a larger market share than Less than Truck Load (LTL), but LTL is experiencing faster growth due to the increasing dominance of e-commerce. Containerized freight remains the dominant mode for international shipments, reflecting the strong reliance on containerized shipping. The manufacturing, wholesale and retail trade sectors account for the largest share of transported goods.

- Key Growth Drivers:

- Rapid economic growth and industrialization.

- Expansion of e-commerce and related demand for LTL services.

- Government investments in infrastructure development (roads, highways).

- Increased foreign direct investment (FDI) in manufacturing and logistics.

- Dominant Segments:

- Region: Southern Vietnam

- Destination: International freight

- Truckload Specification: FTL

- Containerization: Containerized

- End-User Industry: Manufacturing, Wholesale and Retail Trade

Vietnam Road Freight Transport Industry Product Landscape

The product landscape is evolving with the integration of technology and enhanced service offerings. Companies are incorporating GPS tracking, route optimization software, and telematics systems to improve efficiency and transparency. Value-added services like warehousing, customs brokerage, and last-mile delivery are gaining traction. The focus is on providing customized solutions to meet specific customer needs, including temperature-controlled transportation for sensitive goods and specialized handling for oversized or hazardous materials. Competition is primarily driven by price, service quality, and reliability.

Key Drivers, Barriers & Challenges in Vietnam Road Freight Transport Industry

Key Drivers:

- Economic growth and industrial expansion fuel demand.

- Government infrastructure investments improve logistics efficiency.

- E-commerce boom increases demand for timely delivery.

- Technological advancements enhance efficiency and cost-effectiveness.

Key Challenges:

- Driver shortages and high driver turnover create operational difficulties.

- Congestion in major cities and inadequate road infrastructure in some regions.

- Fluctuating fuel prices increase operational costs.

- Stringent regulations related to safety and environmental standards, adding to costs. xx% of transporters faced compliance challenges in 2024, resulting in estimated xx million USD in fines and penalties.

Emerging Opportunities in Vietnam Road Freight Transport Industry

- Expansion into rural and underserved areas offers untapped market potential.

- Growth of e-commerce presents opportunities for last-mile delivery solutions.

- Adoption of innovative technologies such as AI and IoT can enhance operational efficiency and customer service.

- Development of sustainable and environmentally friendly transportation solutions addresses growing concerns.

Growth Accelerators in the Vietnam Road Freight Transport Industry

Continued economic growth, coupled with infrastructure improvements and government support for logistics development, will be key growth drivers. Technological advancements, including the increased adoption of digital platforms and automation, will enhance efficiency and reduce costs. Strategic partnerships between logistics providers and e-commerce platforms will further accelerate growth. Expansion into new markets and diversification of services will also play a significant role in shaping the future of the industry.

Key Players Shaping the Vietnam Road Freight Transport Industry Market

- A P Moller - Maersk (Maersk)

- ViettelPost

- Nippon Express Holdings (Nippon Express)

- Saigon Newport Corporation

- NYK (Nippon Yusen Kaisha) Line (NYK Line)

- ASG Corporation

- DHL Group (DHL)

- Nguyen Ngoc Logistics Corporation

- GEODIS (GEODIS)

- Gemadept

- Rhenus Group (Rhenus)

- Hop Nhat International Joint Stock Company

- VNT Logistic

- Macs Shipping Corporation

- MP Logistics

- Linfox Pty Ltd (Linfox)

- PetroVietnam Transport Corporation

- Kintetsu Group Holdings Co Ltd (Kintetsu Group)

- Vinatrans

- Indo Trans Logistics Corporation

- Transimex Corporation

- Bee Logistics Corporation

- U&I Logistics Corporation

- Bolloré Group (Bolloré)

- Aviation Logistics Corporation (ALS)

- Royal Cargo

- Expeditors International of Washington Inc (Expeditors)

- Viet Total Logistics Co Ltd

Notable Milestones in Vietnam Road Freight Transport Industry Sector

- July 2023: Nippon Express (Vietnam) opened its NX Yen Phong Logistics Center in Bac Ninh, expanding its warehousing and distribution capabilities in northern Vietnam.

- August 2023: GEODIS launched its expanded road network connecting Southeast Asia and China, offering multimodal transport solutions.

- August 2023: Viettel Post and KOIMA signed a strategic cooperation agreement to develop logistics infrastructure and promote cross-border commerce.

In-Depth Vietnam Road Freight Transport Industry Market Outlook

The Vietnam road freight transport market is poised for sustained growth over the forecast period, driven by strong economic fundamentals, infrastructure development, and the increasing adoption of technology. Opportunities exist in expanding into underserved regions, providing specialized services like temperature-controlled transport, and leveraging technology to enhance efficiency and customer experience. Strategic partnerships and M&A activity will continue to shape the market landscape, leading to greater consolidation and improved service offerings. The focus on sustainability and environmental responsibility will also play a significant role in shaping the future of the industry.

Vietnam Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Vietnam Road Freight Transport Industry Segmentation By Geography

- 1. Vietnam

Vietnam Road Freight Transport Industry Regional Market Share

Geographic Coverage of Vietnam Road Freight Transport Industry

Vietnam Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ViettelPost

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippon Express Holdings

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saigon Newport Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NYK (Nippon Yusen Kaisha) Line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ASG Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHL Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nguyen Ngoc Logistics Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEODIS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gemadept

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rhenus Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hop Nhat International Joint Stock Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VNT Logistic

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Macs Shipping Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MP Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Linfox Pty Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 PetroVietnam Transport Corporation

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Kintetsu Group Holdings Co Ltd

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Vinatrans

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Indo Trans Logistics Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Transimex Corporation

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Bee Logistics Corporation

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 U&I Logistics Corporation

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Bolloré Group

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Aviation Logistics Corporation (ALS)

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Royal Cargo

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Expeditors International of Washington Inc

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 Viet Total Logistics Co Ltd

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Vietnam Road Freight Transport Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Road Freight Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Destination 2020 & 2033

- Table 3: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Truckload Specification 2020 & 2033

- Table 4: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Containerization 2020 & 2033

- Table 5: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Distance 2020 & 2033

- Table 6: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Goods Configuration 2020 & 2033

- Table 7: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Temperature Control 2020 & 2033

- Table 8: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 9: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 10: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Destination 2020 & 2033

- Table 11: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Truckload Specification 2020 & 2033

- Table 12: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Containerization 2020 & 2033

- Table 13: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Distance 2020 & 2033

- Table 14: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Goods Configuration 2020 & 2033

- Table 15: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Temperature Control 2020 & 2033

- Table 16: Vietnam Road Freight Transport Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Road Freight Transport Industry?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Vietnam Road Freight Transport Industry?

Key companies in the market include A P Moller - Maersk, ViettelPost, Nippon Express Holdings, Saigon Newport Corporation, NYK (Nippon Yusen Kaisha) Line, ASG Corporation, DHL Group, Nguyen Ngoc Logistics Corporation, GEODIS, Gemadept, Rhenus Group, Hop Nhat International Joint Stock Company, VNT Logistic, Macs Shipping Corporation, MP Logistics, Linfox Pty Ltd, PetroVietnam Transport Corporation, Kintetsu Group Holdings Co Ltd, Vinatrans, Indo Trans Logistics Corporation, Transimex Corporation, Bee Logistics Corporation, U&I Logistics Corporation, Bolloré Group, Aviation Logistics Corporation (ALS), Royal Cargo, Expeditors International of Washington Inc, Viet Total Logistics Co Ltd.

3. What are the main segments of the Vietnam Road Freight Transport Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

August 2023: Viettel Post and KOIMA also signed a strategic cooperation agreement in the fields of logistics, investment, and trade. This initiative is aligned with Viettel Post's strategy to establish a national logistics infrastructure and promote cross-border commerce.August 2023: GEODIS has expanded its Road Network from Southeast Asia (SEA) to China providing secure day-definite, and environmentally friendly solutions connecting Singapore, Malaysia, Thailand, Vietnam, and China. GEODIS Road Network is integrated with major air and sea ports and offers multimodal options to meet customer needs. Road network has offically launched on August 2023.July 2023: Nippon Express (Vietnam) has opened its NX Yen Phong Logistics Center in the northern province of Bac Ninh. The warehouse will perform tasks such as inventory control, sorting, and packing of apparel and electrical/electronic equipment. It will also serve as a distribution center for Hanoi and other parts of northern Vietnam and provide bonded inventory management services for Export Processing Enterprises (EPEs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Vietnam Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence