Key Insights

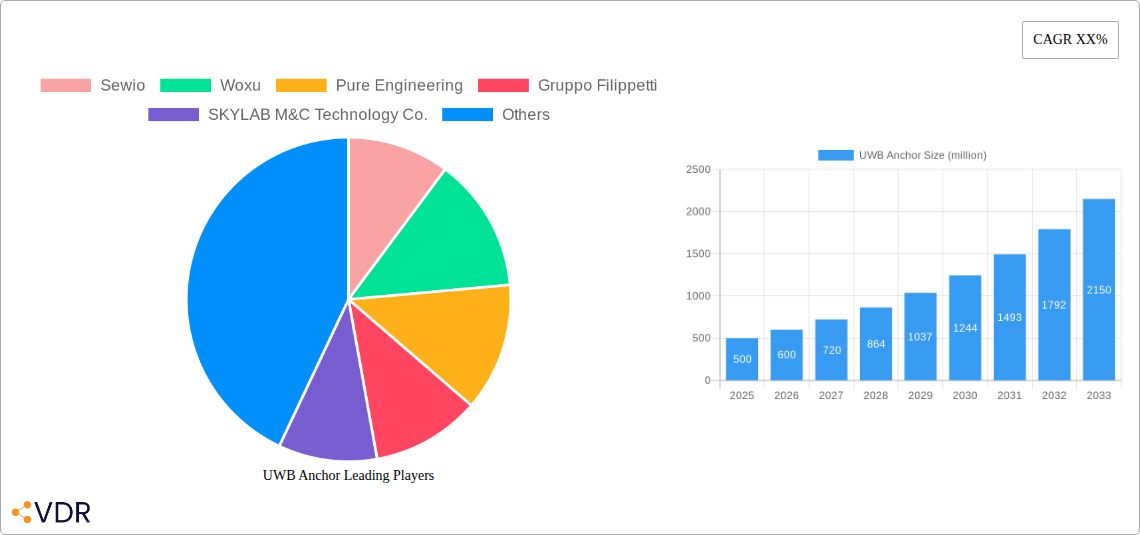

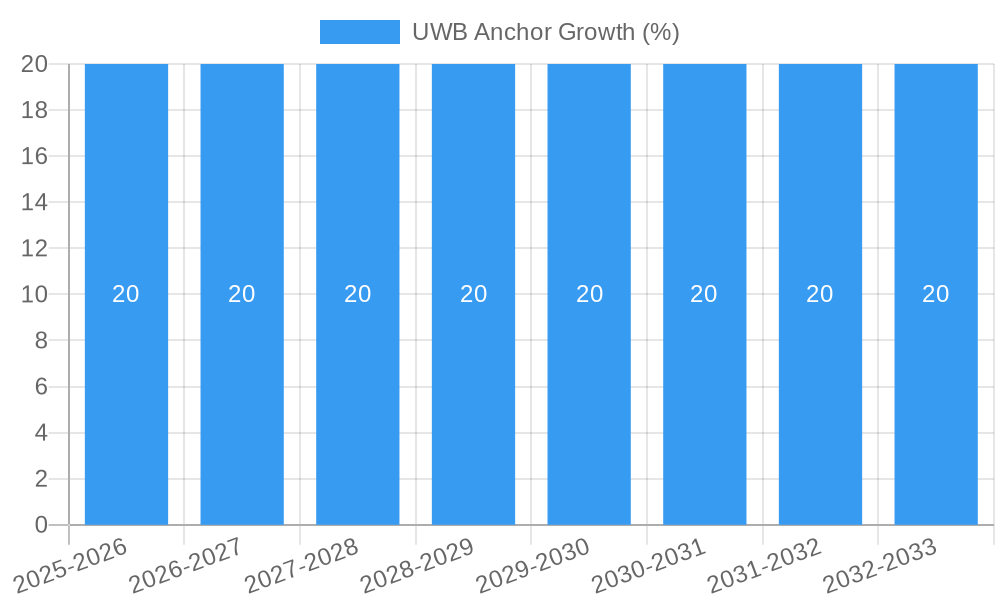

The Ultra-Wideband (UWB) Anchor market is poised for significant expansion, driven by the increasing demand for precise indoor and outdoor positioning solutions across a multitude of industries. With an estimated market size of approximately $500 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 20% through 2033. This growth is primarily fueled by the escalating adoption of UWB technology in industrial automation for asset tracking, worker safety, and real-time location systems (RTLS). The medical sector is also a key contributor, leveraging UWB for patient monitoring and equipment location, while the logistics industry benefits from enhanced inventory management and supply chain visibility. Emerging applications in smart cities and augmented reality further underscore the market's dynamic trajectory.

The market's expansion is further propelled by advancements in UWB technology, offering superior accuracy, lower power consumption, and enhanced security compared to traditional positioning methods. Key drivers include the growing need for real-time data analytics, the proliferation of IoT devices requiring precise localization, and the development of sophisticated UWB anchor systems. While the market enjoys strong growth, certain restraints such as the initial high cost of implementation for some applications and the need for greater standardization across different UWB chipsets may present challenges. However, ongoing research and development, coupled with increasing economies of scale, are expected to mitigate these limitations, solidifying the UWB anchor market's upward momentum in the coming years.

Here is a comprehensive, SEO-optimized report description for the UWB Anchor market, designed for maximum visibility and reader engagement, with all values presented in millions of units.

Title: UWB Anchor Market: Navigating the Future of Precision Location with Industry-Leading Insights & Forecasts (2019-2033)

Report Description:

Unlock unparalleled insights into the dynamic Ultra-Wideband (UWB) Anchor market. This in-depth report delves into the intricate landscape of UWB technology, forecasting its exponential growth and transformative impact across diverse sectors. With a detailed analysis spanning the Study Period (2019–2033), Base Year (2025), Estimated Year (2025), and Forecast Period (2025–2033), this report is your definitive guide to understanding market evolution, key players, and emerging opportunities.

The UWB Anchor market is witnessing a paradigm shift, driven by the escalating demand for hyper-accurate indoor and outdoor positioning solutions. This report meticulously analyzes market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. We provide quantitative insights, including market share percentages and M&A deal volumes, alongside qualitative factors that shape innovation barriers. From the burgeoning Industry and Medical segments to the critical Logistics and Food applications, and the expansive Others category, alongside Indoor Positioning and Outdoor Positioning types, our analysis covers the entire spectrum.

Leveraging advanced analytical models, this report delivers a comprehensive understanding of UWB Anchor market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Specific metrics like CAGR and market penetration are meticulously detailed, offering actionable intelligence for strategic decision-making. Identify the dominant regions, countries, and segments driving market growth, supported by analyses of economic policies, infrastructure development, and significant market share.

Explore the cutting-edge UWB Anchor Product Landscape, detailing product innovations, diverse applications, and crucial performance metrics. Understand the unique selling propositions and technological advancements that are redefining precision location. This report also critically examines the Key Drivers, Barriers & Challenges shaping the UWB Anchor industry. Identify technological, economic, and policy-driven factors propelling the market, while also addressing supply chain issues, regulatory hurdles, and competitive pressures with quantifiable impacts.

Discover Emerging Opportunities within untapped markets, innovative applications, and evolving consumer preferences. Uncover the catalysts driving long-term growth, including technological breakthroughs, strategic partnerships, and market expansion strategies that will shape the Growth Accelerators in the UWB Anchor Industry. Get an in-depth view of the Key Players Shaping the UWB Anchor Market and their strategic moves, alongside Notable Milestones in the UWB Anchor Sector that have defined its trajectory. This report culminates in an In-Depth UWB Anchor Market Outlook, summarizing future potential and strategic opportunities to guide your business decisions.

This report is essential for: Technology providers, solution integrators, investors, research & development teams, procurement managers, and strategic planners seeking to capitalize on the UWB Anchor market's immense potential.

UWB Anchor Market Dynamics & Structure

The UWB Anchor market is characterized by a moderately concentrated structure, with a few prominent players leading technological advancements and market adoption, alongside a growing number of niche innovators. Key drivers of innovation stem from the inherent capabilities of UWB technology, offering superior accuracy, low power consumption, and high data rates compared to traditional localization technologies. Regulatory frameworks are evolving, particularly concerning spectrum allocation and device certifications, influencing market entry and product development. Competitive product substitutes include Bluetooth Low Energy (BLE) beacons, Wi-Fi triangulation, and RFID, though UWB generally offers a distinct advantage in precision and reliability for demanding applications. End-user demographics are increasingly sophisticated, with a strong demand for real-time, centimeter-level accuracy in industrial automation, asset tracking, and immersive experiences. Mergers and acquisitions (M&A) are on the rise as larger technology firms seek to integrate UWB capabilities into their broader ecosystems, alongside strategic partnerships aimed at expanding application reach. For instance, the number of M&A deals in the broader location-based services sector has seen a 15% year-over-year increase, with a significant portion targeting UWB technology firms. Innovation barriers include the complexity of UWB chip integration and the need for specialized expertise in system design and deployment, which currently limits widespread adoption in some consumer-facing segments.

- Market Concentration: Moderate, with a mix of established players and emerging startups.

- Technological Innovation Drivers: High accuracy, low power, robust performance in challenging environments, secure data transmission.

- Regulatory Frameworks: Evolving spectrum regulations, certification requirements impacting device deployment.

- Competitive Product Substitutes: BLE, Wi-Fi, RFID; UWB offers superior precision.

- End-User Demographics: Demand for real-time, high-accuracy location data across industrial, medical, and logistics sectors.

- M&A Trends: Increasing consolidation as larger players acquire UWB expertise; strategic alliances for ecosystem expansion.

- Innovation Barriers: Chip integration complexity, specialized system design knowledge required.

UWB Anchor Growth Trends & Insights

The UWB Anchor market is poised for substantial growth, driven by an insatiable demand for precision location technologies across a multitude of applications. The market size, estimated at $1,200 million in the base year of 2025, is projected to ascend to $4,500 million by the end of the forecast period in 2033, signifying a robust Compound Annual Growth Rate (CAGR) of approximately 15.2%. This impressive expansion is fueled by increasing adoption rates in industrial settings for asset tracking, real-time location systems (RTLS), and machinery monitoring, where downtime and efficiency are paramount. The medical sector is rapidly embracing UWB for patient tracking, equipment management, and precise surgical guidance, leveraging its non-ionizing nature and high accuracy. Furthermore, the logistics industry is capitalizing on UWB for warehouse automation, supply chain visibility, and intelligent inventory management, expecting to contribute 25% to market revenue growth in the coming years.

Technological disruptions, such as the integration of UWB into smartphones and other consumer electronics, are further democratizing access to this powerful technology, paving the way for new consumer-facing applications and services. This has led to a significant shift in consumer behavior, with growing expectations for seamless and context-aware location-based experiences, from indoor navigation in large venues to enhanced augmented reality (AR) and virtual reality (VR) applications. The market penetration of UWB anchors is expected to surge from 8% in 2025 to an impressive 22% by 2033, particularly within industrial IoT (IIoT) deployments. This growth is also supported by the increasing availability of affordable UWB chipsets and development kits, lowering the barrier to entry for system integrators and application developers. The ability of UWB to provide centimeter-level accuracy, even in complex, RF-challenging environments, distinguishes it from other indoor positioning technologies, making it the preferred choice for mission-critical applications. Moreover, advancements in UWB-based safety systems, such as proximity detection and collision avoidance in heavy machinery and robotics, are becoming a significant growth driver. The broader ecosystem, including software platforms and data analytics, is also maturing, enabling more sophisticated use cases and driving further market adoption. The evolution from basic tracking to intelligent positioning services, powered by AI and machine learning, will be a key theme in the coming years.

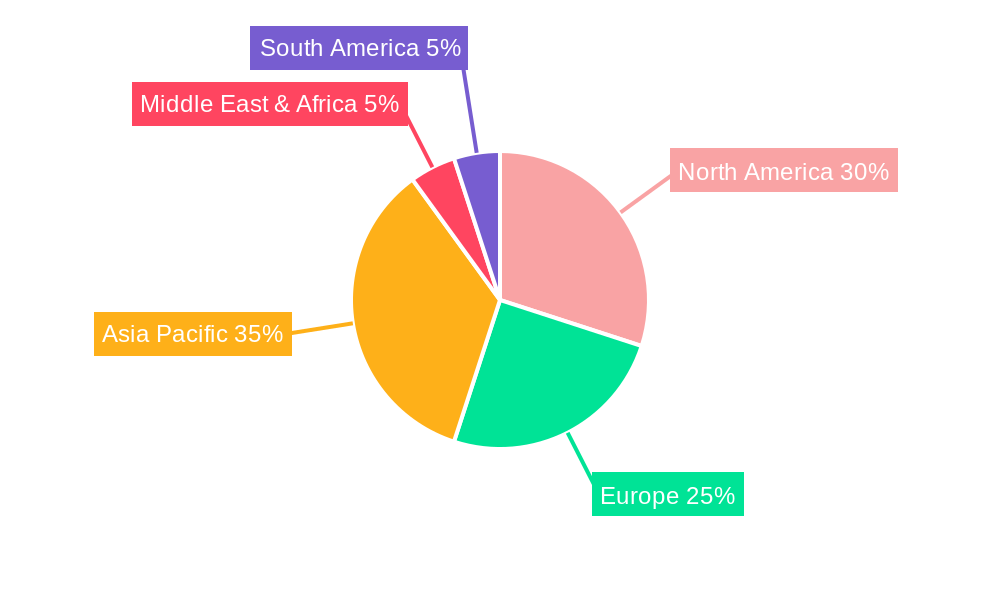

Dominant Regions, Countries, or Segments in UWB Anchor

The Industry segment, particularly within the Indoor Positioning type, is emerging as the dominant force driving growth in the global UWB Anchor market. This dominance is underpinned by the industrial sector's profound need for hyper-accurate, real-time location data to optimize operations, enhance safety, and improve efficiency. Key drivers include the accelerating adoption of Industry 4.0 initiatives, the rise of smart factories, and the increasing demand for sophisticated asset tracking and management solutions. North America, led by the United States, and Europe, particularly Germany and the United Kingdom, are spearheading this adoption due to their advanced manufacturing sectors and robust investment in industrial automation.

- Industry Segment Dominance: This segment accounts for an estimated 40% of the total UWB Anchor market revenue in 2025 and is projected to maintain its lead, growing at a CAGR of 16% over the forecast period.

- Key Drivers:

- Industry 4.0 & IIoT Adoption: Increased investment in smart manufacturing, automation, and connected industrial environments.

- Asset Tracking & Management: Need for precise location of tools, equipment, and materials in large industrial facilities.

- Worker Safety: Implementation of proximity sensing and location-based safety alerts for personnel in hazardous environments.

- Process Optimization: Real-time data for streamlining production workflows, reducing downtime, and improving quality control.

- Key Drivers:

- Indoor Positioning Type Leadership: Indoor positioning applications are expected to represent 70% of the UWB Anchor market share within the Industry segment.

- Dominance Factors:

- Challenging RF Environments: UWB's superior performance in multi-path environments common in industrial settings (e.g., warehouses, factories).

- High Accuracy Requirements: Centimeter-level precision essential for automated guided vehicles (AGVs), robotic arms, and precision assembly.

- Infrastructure Deployment: Increasing availability of UWB anchor infrastructure in new and retrofitted industrial facilities.

- Dominance Factors:

- Geographical Influence (Focusing on leading countries within dominant regions):

- United States: Significant investment in industrial automation, defense, and advanced manufacturing, driving strong demand for UWB solutions. Market share estimated at 28% in 2025.

- Germany: A powerhouse in industrial manufacturing and automotive, with substantial adoption of RTLS for supply chain and production line optimization. Market share estimated at 15% in 2025.

- China: Rapid industrial growth and government initiatives for smart manufacturing are fueling a substantial increase in UWB adoption. Market share projected to grow from 12% in 2025 to 18% by 2033.

The synergy between the demanding requirements of the Industry segment and the precision offered by Indoor Positioning applications, supported by strategic investments in leading economies, firmly establishes this combination as the primary growth engine for the UWB Anchor market.

UWB Anchor Product Landscape

The UWB Anchor product landscape is characterized by continuous innovation focused on miniaturization, enhanced performance, and broader integration capabilities. Manufacturers are developing UWB anchors with improved power efficiency, enabling longer operational lifespans in battery-powered deployments. Product innovations include anchors with wider signal bandwidths for greater accuracy and data throughput, as well as anchors designed for specific environmental conditions, such as high-temperature or rugged industrial settings. Key applications span real-time location systems (RTLS) for asset and personnel tracking, precision proximity sensing for safety and automation, and high-fidelity indoor navigation. Performance metrics such as ranging accuracy (typically within 10-30 cm), update rates (up to 500 Hz), and maximum range (up to 100 meters in open spaces) are critical differentiators. Unique selling propositions often revolve around ease of deployment, compatibility with existing infrastructure, and robust security features to protect location data. Technological advancements include the development of UWB modules that integrate seamlessly with other wireless technologies, facilitating hybrid positioning solutions.

Key Drivers, Barriers & Challenges in UWB Anchor

The UWB Anchor market is propelled by several key drivers. The escalating demand for centimeter-level accuracy in industrial automation, logistics, and asset tracking is paramount. The growing adoption of Industry 4.0 and the Internet of Things (IoT) creates fertile ground for UWB's superior performance in complex environments. Furthermore, the increasing integration of UWB technology into smartphones and consumer electronics is expanding its accessibility and paving the way for new applications. The development of more compact, energy-efficient, and cost-effective UWB chipsets and modules is also a significant growth accelerator.

Key Drivers:

- Precision Location Demand: Critical for RTLS, AGVs, and safety systems.

- Industry 4.0 & IoT: Driving adoption in smart manufacturing and connected logistics.

- Smartphone Integration: Expanding consumer use cases and market reach.

- Technological Advancements: Miniaturization, power efficiency, and cost reduction in chipsets.

Conversely, the market faces significant barriers and challenges. The relatively higher cost of UWB anchors and implementation compared to technologies like BLE can hinder widespread adoption, especially for smaller businesses or cost-sensitive applications. The ecosystem, while growing, still requires further development in terms of standardized software platforms and interoperability between different vendor solutions. Regulatory hurdles, particularly concerning spectrum licensing and interference, can also pose challenges in certain regions. Supply chain disruptions for key components and the need for specialized technical expertise for installation and maintenance remain ongoing concerns. Competitive pressures from established, lower-cost technologies necessitate continuous innovation and value proposition refinement.

Key Barriers & Challenges:

- Cost: Higher initial investment compared to alternative technologies.

- Ecosystem Development: Need for greater standardization and interoperability.

- Regulatory Hurdles: Spectrum allocation and interference management.

- Supply Chain & Expertise: Component availability and skilled labor for deployment.

- Competitive Landscape: Pressure from established and emerging location technologies.

Emerging Opportunities in UWB Anchor

Emerging opportunities in the UWB Anchor market lie in the burgeoning fields of extended reality (XR), including augmented reality (AR) and virtual reality (VR), where precise spatial tracking is essential for immersive experiences. The healthcare sector presents significant untapped potential for UWB in advanced patient monitoring, surgical robotics, and smart hospital management systems, offering enhanced safety and efficiency. Furthermore, the automotive industry's interest in UWB for keyless entry, vehicle-to-vehicle (V2V) communication, and autonomous driving safety features opens up substantial new avenues. The development of smart city infrastructure, with applications in intelligent traffic management, public safety, and location-based services, is another promising frontier. As UWB technology matures and costs decrease, opportunities will also arise in retail for enhanced customer analytics and personalized experiences, and in smart home applications for context-aware automation.

Growth Accelerators in the UWB Anchor Industry

Several factors are poised to accelerate the growth of the UWB Anchor industry. The increasing standardization of UWB protocols by organizations like the IEEE, along with the formation of industry alliances such as the FiRa Consortium, will foster greater interoperability and drive wider adoption. Strategic partnerships between UWB chip manufacturers, device makers, and application developers are crucial for creating integrated solutions and expanding market reach. Government initiatives and investments in smart infrastructure and digital transformation further catalyze demand. The continuous refinement of UWB technology, leading to smaller form factors, lower power consumption, and reduced costs, will make it a more attractive proposition for a broader range of applications and industries. Expansion into emerging markets with growing industrial and technological capabilities will also contribute significantly to long-term growth.

Key Players Shaping the UWB Anchor Market

- Sewio

- Woxu

- Pure Engineering

- Gruppo Filippetti

- SKYLAB M&C Technology Co.,Ltd

- Chang Ying Techology Co.,Ltd.

- Pozyx

- INSITU

- RedPoint

- Decawave

Notable Milestones in UWB Anchor Sector

- 2019: Launch of next-generation UWB chipsets offering improved power efficiency and range by key semiconductor manufacturers.

- 2020: Increased adoption of UWB for asset tracking in healthcare and industrial settings, driven by the need for precise inventory management.

- 2021: Formation of the FiRa Consortium to promote UWB interoperability and drive its adoption in consumer electronics and automotive sectors.

- 2022: Significant advancements in UWB-enabled safety systems, including proximity detection for industrial machinery and vehicles.

- 2023: Growing integration of UWB into smartphones, leading to new use cases in AR, VR, and contactless interactions.

- 2024: Emergence of specialized UWB solutions for precise indoor navigation in large venues like airports and stadiums.

- Early 2025: Anticipated release of more affordable UWB anchor modules, lowering the barrier to entry for small and medium-sized enterprises.

In-Depth UWB Anchor Market Outlook

The UWB Anchor market is set for a period of sustained and significant expansion, driven by an ever-increasing need for precise location intelligence. The ongoing digital transformation across industries, coupled with advancements in AI and IoT, will continue to fuel the demand for UWB's superior accuracy and reliability. The integration of UWB into mainstream consumer devices will unlock vast new market potential and drive widespread consumer awareness. Strategic collaborations, technological innovation in chip design and system integration, and supportive regulatory environments will act as critical growth accelerators. The market's outlook is exceptionally bright, offering substantial opportunities for both established players and agile innovators to capitalize on the UWB revolution.

UWB Anchor Segmentation

-

1. Application

- 1.1. Industry

- 1.2. Medical

- 1.3. Logistics

- 1.4. Food

- 1.5. Others

-

2. Types

- 2.1. Indoor Positioning

- 2.2. Outdoor Positioning

UWB Anchor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UWB Anchor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industry

- 5.1.2. Medical

- 5.1.3. Logistics

- 5.1.4. Food

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Indoor Positioning

- 5.2.2. Outdoor Positioning

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industry

- 6.1.2. Medical

- 6.1.3. Logistics

- 6.1.4. Food

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Indoor Positioning

- 6.2.2. Outdoor Positioning

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industry

- 7.1.2. Medical

- 7.1.3. Logistics

- 7.1.4. Food

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Indoor Positioning

- 7.2.2. Outdoor Positioning

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industry

- 8.1.2. Medical

- 8.1.3. Logistics

- 8.1.4. Food

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Indoor Positioning

- 8.2.2. Outdoor Positioning

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industry

- 9.1.2. Medical

- 9.1.3. Logistics

- 9.1.4. Food

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Indoor Positioning

- 9.2.2. Outdoor Positioning

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific UWB Anchor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industry

- 10.1.2. Medical

- 10.1.3. Logistics

- 10.1.4. Food

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Indoor Positioning

- 10.2.2. Outdoor Positioning

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sewio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Woxu

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pure Engineering

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gruppo Filippetti

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SKYLAB M&C Technology Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chang Ying Techology Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pozyx

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 INSITU

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 RedPoint

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Decawav

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Sewio

List of Figures

- Figure 1: Global UWB Anchor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global UWB Anchor Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America UWB Anchor Revenue (million), by Application 2024 & 2032

- Figure 4: North America UWB Anchor Volume (K), by Application 2024 & 2032

- Figure 5: North America UWB Anchor Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America UWB Anchor Volume Share (%), by Application 2024 & 2032

- Figure 7: North America UWB Anchor Revenue (million), by Types 2024 & 2032

- Figure 8: North America UWB Anchor Volume (K), by Types 2024 & 2032

- Figure 9: North America UWB Anchor Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America UWB Anchor Volume Share (%), by Types 2024 & 2032

- Figure 11: North America UWB Anchor Revenue (million), by Country 2024 & 2032

- Figure 12: North America UWB Anchor Volume (K), by Country 2024 & 2032

- Figure 13: North America UWB Anchor Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America UWB Anchor Volume Share (%), by Country 2024 & 2032

- Figure 15: South America UWB Anchor Revenue (million), by Application 2024 & 2032

- Figure 16: South America UWB Anchor Volume (K), by Application 2024 & 2032

- Figure 17: South America UWB Anchor Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America UWB Anchor Volume Share (%), by Application 2024 & 2032

- Figure 19: South America UWB Anchor Revenue (million), by Types 2024 & 2032

- Figure 20: South America UWB Anchor Volume (K), by Types 2024 & 2032

- Figure 21: South America UWB Anchor Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America UWB Anchor Volume Share (%), by Types 2024 & 2032

- Figure 23: South America UWB Anchor Revenue (million), by Country 2024 & 2032

- Figure 24: South America UWB Anchor Volume (K), by Country 2024 & 2032

- Figure 25: South America UWB Anchor Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America UWB Anchor Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe UWB Anchor Revenue (million), by Application 2024 & 2032

- Figure 28: Europe UWB Anchor Volume (K), by Application 2024 & 2032

- Figure 29: Europe UWB Anchor Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe UWB Anchor Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe UWB Anchor Revenue (million), by Types 2024 & 2032

- Figure 32: Europe UWB Anchor Volume (K), by Types 2024 & 2032

- Figure 33: Europe UWB Anchor Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe UWB Anchor Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe UWB Anchor Revenue (million), by Country 2024 & 2032

- Figure 36: Europe UWB Anchor Volume (K), by Country 2024 & 2032

- Figure 37: Europe UWB Anchor Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe UWB Anchor Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa UWB Anchor Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa UWB Anchor Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa UWB Anchor Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa UWB Anchor Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa UWB Anchor Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa UWB Anchor Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa UWB Anchor Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa UWB Anchor Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa UWB Anchor Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa UWB Anchor Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa UWB Anchor Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa UWB Anchor Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific UWB Anchor Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific UWB Anchor Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific UWB Anchor Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific UWB Anchor Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific UWB Anchor Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific UWB Anchor Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific UWB Anchor Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific UWB Anchor Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific UWB Anchor Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific UWB Anchor Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific UWB Anchor Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific UWB Anchor Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UWB Anchor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global UWB Anchor Volume K Forecast, by Region 2019 & 2032

- Table 3: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 5: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 7: Global UWB Anchor Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global UWB Anchor Volume K Forecast, by Region 2019 & 2032

- Table 9: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 11: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 13: Global UWB Anchor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global UWB Anchor Volume K Forecast, by Country 2019 & 2032

- Table 15: United States UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 23: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 25: Global UWB Anchor Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global UWB Anchor Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 35: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 37: Global UWB Anchor Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global UWB Anchor Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 59: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 61: Global UWB Anchor Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global UWB Anchor Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global UWB Anchor Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global UWB Anchor Volume K Forecast, by Application 2019 & 2032

- Table 77: Global UWB Anchor Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global UWB Anchor Volume K Forecast, by Types 2019 & 2032

- Table 79: Global UWB Anchor Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global UWB Anchor Volume K Forecast, by Country 2019 & 2032

- Table 81: China UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific UWB Anchor Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific UWB Anchor Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UWB Anchor?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the UWB Anchor?

Key companies in the market include Sewio, Woxu, Pure Engineering, Gruppo Filippetti, SKYLAB M&C Technology Co., Ltd, Chang Ying Techology Co., Ltd., Pozyx, INSITU, RedPoint, Decawav.

3. What are the main segments of the UWB Anchor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UWB Anchor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UWB Anchor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UWB Anchor?

To stay informed about further developments, trends, and reports in the UWB Anchor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence