Key Insights

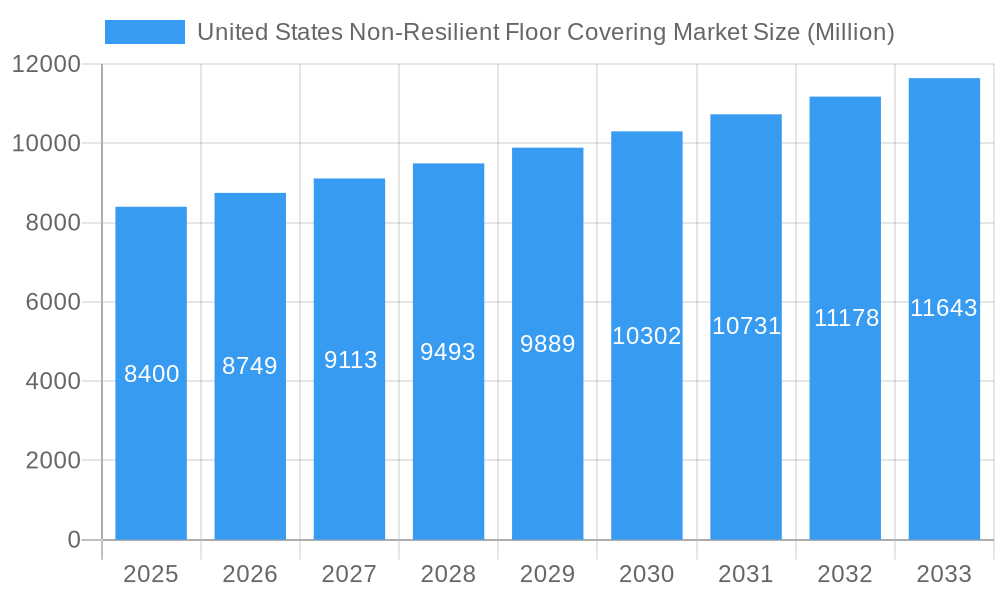

The United States non-resilient floor covering market, valued at approximately $8.4 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of aesthetically pleasing and durable flooring options in both residential and commercial sectors fuels market expansion. Specifically, the demand for ceramic, stone, and wood-look tile flooring is on the rise, reflecting consumer preferences for sophisticated designs and low-maintenance surfaces. Furthermore, the construction boom in both new residential buildings and commercial spaces, including retail outlets and hospitality facilities, provides significant growth opportunities. Online distribution channels are also contributing to market expansion, offering consumers wider choices and convenient purchasing experiences. However, price fluctuations in raw materials and potential economic downturns represent potential restraints on market growth. The market segmentation by product type (ceramic, stone, laminate, wood, and others), end-user (residential and commercial), and distribution channel (online and offline) allows for a nuanced understanding of market dynamics and consumer preferences. This detailed segmentation facilitates strategic planning and targeted marketing initiatives for businesses operating in this sector.

United States Non-Resilient Floor Covering Market Market Size (In Billion)

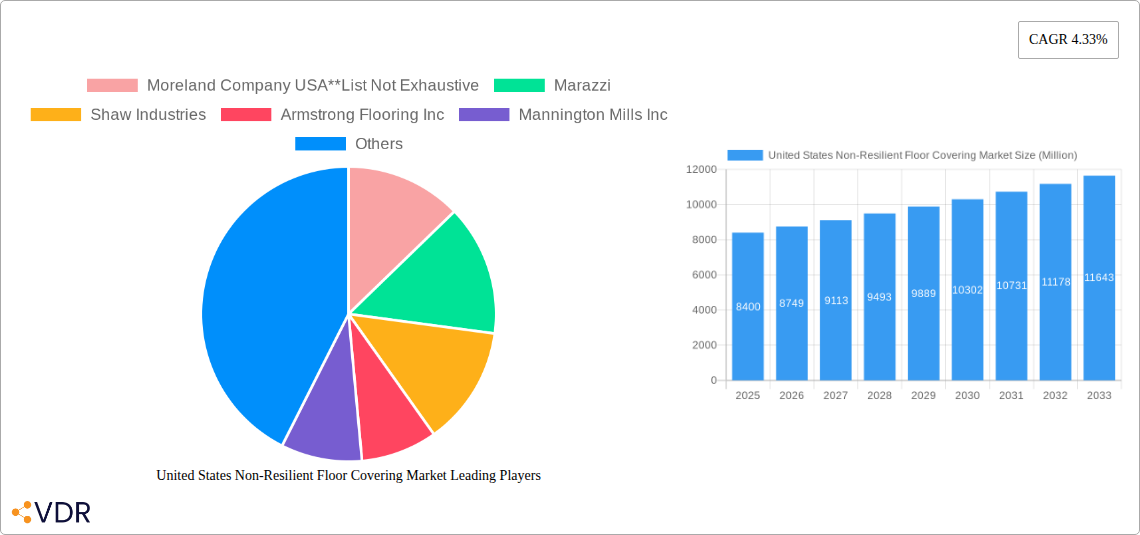

The competitive landscape of the US non-resilient floor covering market is marked by established players such as Mohawk Industries, Shaw Industries, and Armstrong Flooring, alongside regional and specialized companies. These companies are actively engaged in product innovation, focusing on enhanced durability, improved aesthetics, and eco-friendly manufacturing processes. The market's future trajectory will likely depend on consumer preferences, technological advancements in flooring materials, and the overall economic climate. Strategic partnerships, mergers, and acquisitions are expected to continue shaping the competitive landscape and driving further consolidation in the industry. Further, government regulations concerning building codes and sustainable construction practices will influence product development and market demand.

United States Non-Resilient Floor Covering Market Company Market Share

United States Non-Resilient Floor Covering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Non-Resilient Floor Covering market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). The market is segmented by product type (Ceramic Tiles Flooring, Stone Tiles Flooring, Laminate Tiles Flooring, Wood Tiles Flooring, Other Product Types), end-user (Residential, Commercial), and distribution channel (Online, Offline). The report offers valuable insights for manufacturers, distributors, investors, and industry professionals seeking to navigate this dynamic market. The market is projected to reach xx Million units by 2033.

United States Non-Resilient Floor Covering Market Market Dynamics & Structure

The United States non-resilient floor covering market exhibits a moderately consolidated structure, with several key players holding significant market share. Technological innovation, particularly in material science and manufacturing processes, is a crucial driver, while regulatory frameworks concerning sustainability and building codes play a vital role. Competition from resilient flooring options (vinyl, linoleum) and the increasing popularity of alternative flooring materials represents a key challenge. Demographic shifts, including changing housing preferences and commercial construction trends, significantly influence market demand. M&A activity has been moderate in recent years, with larger companies seeking to expand their product portfolios and market reach.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on sustainable materials, improved durability, and design aesthetics.

- Regulatory Landscape: Building codes and environmental regulations influence material choices and manufacturing processes.

- Competitive Substitutes: Resilient flooring (vinyl, linoleum) and other flooring materials (carpet, bamboo).

- End-User Demographics: Shifting preferences towards eco-friendly and durable flooring solutions.

- M&A Activity: Moderate level of consolidation, driven by strategic expansion and product diversification. xx major M&A deals in the past 5 years.

United States Non-Resilient Floor Covering Market Growth Trends & Insights

The US non-resilient floor covering market experienced steady growth between 2019 and 2024, driven by factors such as increasing construction activity, renovations, and rising consumer disposable income. However, the market faced temporary disruptions due to the COVID-19 pandemic and supply chain challenges. Technological advancements, particularly in sustainable and high-performance materials, are expected to fuel future growth. Consumer preferences are shifting towards aesthetically pleasing and environmentally friendly options, influencing product development and marketing strategies. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates in various segments are expected to increase, driven by factors such as rising disposable incomes and construction activity. Detailed market sizing and segmentation analysis are presented in the full report.

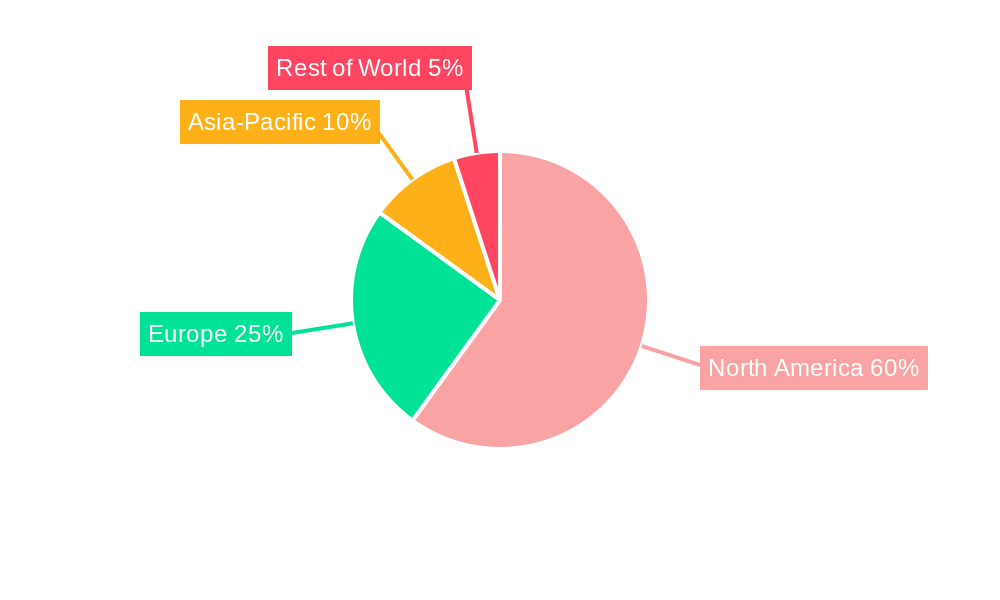

Dominant Regions, Countries, or Segments in United States Non-Resilient Floor Covering Market

The market is geographically dispersed, with significant demand across various regions of the United States. However, the South and West regions show higher growth rates, due to strong residential and commercial construction activities. Within product types, Ceramic Tiles Flooring and Laminate Tiles Flooring maintain the largest market share, driven by their affordability and versatility. The residential sector dominates the end-user segment, while online distribution channels show significant growth potential.

- Leading Region: South and West regions demonstrate the highest growth rates.

- Key Drivers (South & West): Strong residential construction, commercial development, and favorable economic conditions.

- Dominant Product Types: Ceramic Tiles Flooring and Laminate Tiles Flooring hold the largest market share.

- Dominant End-User: Residential sector accounts for the major portion of market demand.

- Distribution Channel Trends: Online channels are experiencing rapid growth, but offline channels continue to dominate.

United States Non-Resilient Floor Covering Market Product Landscape

The non-resilient floor covering market offers a diverse range of products, with ongoing innovations in material composition, design, and installation methods. Manufacturers are focusing on developing sustainable, durable, and aesthetically appealing products to meet evolving consumer preferences. Key features include improved scratch resistance, water resistance, and ease of maintenance. Technological advancements are driven by the need for eco-friendly materials and efficient manufacturing processes.

Key Drivers, Barriers & Challenges in United States Non-Resilient Floor Covering Market

Key Drivers:

- Increasing construction activity, both residential and commercial.

- Growing demand for aesthetically pleasing and durable flooring solutions.

- Technological advancements leading to improved product performance and sustainability.

Key Challenges:

- Fluctuations in raw material prices impacting production costs.

- Intense competition from substitute flooring materials.

- Supply chain disruptions impacting product availability and pricing. (Estimated impact: xx% reduction in supply during Q1 2023).

Emerging Opportunities in United States Non-Resilient Floor Covering Market

- Growing demand for sustainable and eco-friendly flooring options.

- Increasing adoption of large-format tiles in commercial spaces.

- Expanding applications in specialized settings (e.g., healthcare, hospitality).

- Customization and personalization of flooring solutions based on individual preferences.

Growth Accelerators in the United States Non-Resilient Floor Covering Market Industry

Strategic partnerships focused on technological innovation and supply chain optimization are key growth catalysts. The development of advanced manufacturing technologies and the utilization of sustainable materials enhance profitability and environmental responsibility. Expansion into new markets and product diversification strategies further drive market growth.

Key Players Shaping the United States Non-Resilient Floor Covering Market Market

- Moreland Company USA

- Marazzi

- Shaw Industries

- Armstrong Flooring Inc

- Mannington Mills Inc

- FloorMuffler

- Kronotex USA

- Florida Tile Inc

- Mohawk Industries Inc

- Bruce flooring

Notable Milestones in United States Non-Resilient Floor Covering Market Sector

- April 2023: Shaw Industries Group, Inc. partnered with Encina Development Group for waste material recycling, potentially impacting sustainability and cost reduction. (USD 2.72 million annual waste material supply).

- August 2022: AHF's leaseback deal with Broadstone Net Lease signifies a significant financial transaction and potential market restructuring. (USD 5 million annual lease payment).

In-Depth United States Non-Resilient Floor Covering Market Market Outlook

The US non-resilient floor covering market is poised for sustained growth, driven by robust construction activity, consumer demand for high-quality flooring, and ongoing technological innovation. Strategic partnerships, sustainable material adoption, and market expansion initiatives will shape the future of the industry. The market presents significant opportunities for established players and new entrants alike.

United States Non-Resilient Floor Covering Market Segmentation

-

1. Product Type

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Other Product Types

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

United States Non-Resilient Floor Covering Market Segmentation By Geography

- 1. United States

United States Non-Resilient Floor Covering Market Regional Market Share

Geographic Coverage of United States Non-Resilient Floor Covering Market

United States Non-Resilient Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth of Construction Sector is Driving the United States Non-Resilient Flooring Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Non-Resilient Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Moreland Company USA**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marazzi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shaw Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Armstrong Flooring Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mannington Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FloorMuffler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kronotex USA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Florida Tile Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mohawk Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bruce flooring

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Moreland Company USA**List Not Exhaustive

List of Figures

- Figure 1: United States Non-Resilient Floor Covering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Non-Resilient Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 7: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States Non-Resilient Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Non-Resilient Floor Covering Market?

The projected CAGR is approximately 4.33%.

2. Which companies are prominent players in the United States Non-Resilient Floor Covering Market?

Key companies in the market include Moreland Company USA**List Not Exhaustive, Marazzi, Shaw Industries, Armstrong Flooring Inc, Mannington Mills Inc, FloorMuffler, Kronotex USA, Florida Tile Inc, Mohawk Industries Inc, Bruce flooring.

3. What are the main segments of the United States Non-Resilient Floor Covering Market?

The market segments include Product Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Growth of Construction Sector is Driving the United States Non-Resilient Flooring Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices.

8. Can you provide examples of recent developments in the market?

April 2023: Encina Development Group, a producer of ISCC+ circular chemicals from end-of-life plastics, announced a new recycling partnership with Shaw Industries Group, Inc., a global flooring manufacturer. Under the agreement, Shaw will provide Encina with more than USD 2.72 million of waste materials from its carpet manufacturing processes annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Non-Resilient Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Non-Resilient Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Non-Resilient Floor Covering Market?

To stay informed about further developments, trends, and reports in the United States Non-Resilient Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence