Key Insights

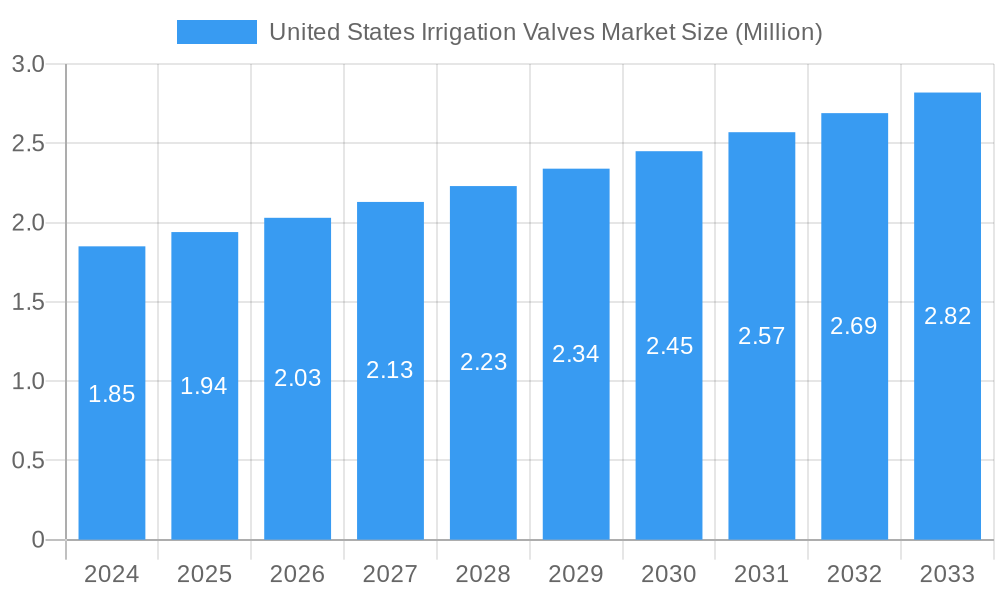

The United States irrigation valves market is poised for robust growth, projected to reach $1.85 million in 2024, with an estimated Compound Annual Growth Rate (CAGR) of 4.8% from 2025 to 2033. This expansion is primarily driven by the increasing adoption of advanced irrigation technologies in agriculture to enhance water efficiency and crop yields. Growing concerns over water scarcity, coupled with government initiatives promoting sustainable farming practices, are significantly boosting demand for sophisticated irrigation valve solutions. The agricultural sector, a key consumer, is embracing smart irrigation systems that integrate automatic valves, leading to reduced water wastage and optimized resource management. Furthermore, the non-agricultural sector, including landscaping, golf courses, and public parks, is also witnessing a rise in demand for automated and efficient irrigation systems, contributing to the overall market growth. The market is characterized by technological advancements in valve materials and designs, focusing on durability, leak-proof performance, and smart connectivity.

United States Irrigation Valves Market Market Size (In Million)

The market's growth trajectory is further supported by innovative trends such as the integration of IoT and AI in irrigation valve control, enabling remote monitoring and data-driven decision-making. Companies are investing in research and development to offer smart valves that can adapt to varying weather conditions and soil moisture levels, thereby optimizing water distribution. However, certain factors may present challenges. High initial investment costs for advanced irrigation systems can be a restraint for some farmers, particularly smallholders. Additionally, the availability of cheaper, less sophisticated alternatives and the need for skilled labor for installation and maintenance of automated systems could pose limitations. Despite these challenges, the persistent need for water conservation and the drive towards precision agriculture in the United States are expected to propel the market forward, with significant contributions from metal and plastic valves, and a strong preference for ball and butterfly valve types in various agricultural and non-agricultural applications.

United States Irrigation Valves Market Company Market Share

United States Irrigation Valves Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report provides an in-depth analysis of the United States irrigation valves market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and a detailed player overview. With a study period from 2019 to 2033, this research offers critical insights for industry stakeholders, investors, and manufacturers looking to navigate this evolving sector. The analysis delves into segments including Metal Valves, Plastic Valves, Ball Valves, Butterfly Valves, Globe Valves, Automatic Valves, Agricultural Applications, and Non-agricultural applications, presenting all values in million units.

United States Irrigation Valves Market Market Dynamics & Structure

The United States irrigation valves market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Technological innovation remains a primary driver, with manufacturers continuously developing smarter, more efficient, and automated valve solutions. Regulatory frameworks, particularly those pertaining to water conservation and agricultural subsidies, play a crucial role in shaping market demand. The competitive landscape features a mix of established global giants and emerging domestic players, each vying for market dominance through product differentiation and strategic partnerships.

- Technological Innovation: Focus on IoT integration, remote control capabilities, and water-efficient technologies for precise irrigation.

- Regulatory Impact: Stringent water usage regulations and government incentives for sustainable agriculture drive demand for advanced irrigation valves.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in alternative irrigation methods indirectly influence valve market dynamics.

- End-User Demographics: A growing awareness among agricultural and landscaping professionals regarding water scarcity and the benefits of smart irrigation is boosting adoption.

- M&A Trends: Consolidation is evident as companies seek to expand their product portfolios, enhance their technological capabilities, and broaden their market reach. For instance, the merger of A.R.I., Dorot, and OCV to form Aquestia signifies a strategic move to strengthen market presence and offerings.

United States Irrigation Valves Market Growth Trends & Insights

The United States irrigation valves market is poised for robust growth, driven by escalating demand for water-efficient agricultural practices and the increasing adoption of smart technologies across various applications. The market size is projected to expand significantly, fueled by a growing emphasis on precision agriculture, where optimized water delivery is paramount for crop yield and resource management. Adoption rates for advanced irrigation valves, especially automatic and smart variants, are on an upward trajectory as end-users recognize their long-term cost savings and environmental benefits.

Technological disruptions, such as the integration of sensors, AI-powered analytics, and cloud-based control systems, are transforming the irrigation valve landscape, enabling unprecedented levels of control and efficiency. Consumer behavior shifts are also playing a pivotal role, with farmers and landscape managers increasingly prioritizing sustainable and data-driven solutions. The forecast CAGR is estimated at 6.8% for the period 2025-2033. Market penetration for smart irrigation valves is expected to reach 55% by 2033, up from an estimated 30% in 2025. The estimated market size for 2025 stands at $1,850 million units, with projections reaching $3,175 million units by 2033. This growth is underpinned by the increasing need to optimize water usage in agriculture, a sector that remains the largest consumer of irrigation solutions. Furthermore, the non-agricultural sector, including landscaping and industrial applications, is witnessing steady growth, driven by aesthetic preferences and regulatory compliance.

Dominant Regions, Countries, or Segments in United States Irrigation Valves Market

The Agricultural Applications segment stands out as the dominant force driving growth within the United States irrigation valves market. This dominance is largely attributable to the vast expanse of agricultural land across the nation, coupled with the increasing imperative for water conservation due to climate change and regulatory pressures. The economic importance of agriculture, coupled with government initiatives promoting modern farming techniques, further bolsters the demand for advanced irrigation valves.

- Leading Segment: Agricultural Applications.

- Key Drivers:

- Water Scarcity: Growing concerns over water availability are compelling farmers to adopt efficient irrigation systems.

- Government Incentives: Federal and state programs offer subsidies and grants for adopting water-saving technologies.

- Technological Advancements: Precision irrigation techniques, such as drip and micro-irrigation, rely heavily on sophisticated valve systems for optimal water delivery.

- Crop Yield Optimization: Efficient irrigation directly correlates with improved crop health and increased yields, offering significant economic benefits to farmers.

- Regulatory Compliance: Stricter regulations on water usage are pushing the agricultural sector towards more controlled and monitored irrigation.

- Key Drivers:

- Dominant Regions: The Western United States is a key region due to its arid and semi-arid climate, making water management a critical concern for its extensive agricultural operations. States like California, Arizona, and Washington are major consumers of irrigation valves.

- Dominant Valve Type: Automatic Valves are experiencing significant growth within agricultural applications due to their ability to automate irrigation schedules, respond to environmental conditions, and minimize manual labor.

- Dominant Material Type: While both metal and plastic valves are utilized, plastic valves are gaining traction in agricultural settings due to their corrosion resistance, lighter weight, and often lower cost, especially for large-scale installations.

United States Irrigation Valves Market Product Landscape

The product landscape of the United States irrigation valves market is characterized by continuous innovation focused on enhancing efficiency, automation, and connectivity. Manufacturers are introducing smart valves that integrate IoT capabilities, allowing for remote monitoring, control, and data-driven irrigation scheduling. These advancements aim to optimize water usage, reduce operational costs, and improve crop yields. Ball valves and automatic valves are particularly prevalent, catering to diverse agricultural and non-agricultural needs. Performance metrics such as flow rate control, pressure regulation, and durability in various environmental conditions are key selling propositions.

Key Drivers, Barriers & Challenges in United States Irrigation Valves Market

The United States irrigation valves market is propelled by several key drivers including the increasing necessity for water conservation in agriculture and landscaping, government initiatives promoting efficient water management, and technological advancements in smart irrigation systems. The growing adoption of precision agriculture, which relies on automated and controlled water delivery, further fuels market expansion.

- Key Drivers:

- Water scarcity and drought conditions.

- Government incentives and regulations for water-efficient technologies.

- Advancements in smart irrigation and IoT integration.

- Demand for increased crop yields and optimized resource utilization.

- Growth in the landscaping and turf management sectors.

Key challenges and restraints include the initial high cost of advanced smart irrigation valves, which can be a barrier for small-scale farmers and businesses. Supply chain disruptions and the fluctuating prices of raw materials also pose significant challenges. Furthermore, the need for skilled labor to install and maintain complex automated systems can limit adoption in certain regions.

- Key Challenges & Restraints:

- High initial investment cost for advanced systems.

- Lack of awareness and technical expertise among some end-users.

- Supply chain vulnerabilities and raw material price volatility.

- Harsh environmental conditions impacting valve longevity.

- Competition from established, lower-cost conventional irrigation methods.

Emerging Opportunities in United States Irrigation Valves Market

Emerging opportunities in the United States irrigation valves market lie in the integration of Artificial Intelligence (AI) and machine learning for predictive irrigation management, offering unparalleled efficiency and resource optimization. The expansion of smart irrigation solutions into urban landscaping, public parks, and sports fields presents a significant untapped market. Furthermore, developing modular and customizable valve systems tailored for specific crop types and regional water conditions can unlock new market segments. The increasing focus on water reuse and recycling in industrial and agricultural applications also opens avenues for specialized valve solutions.

Growth Accelerators in the United States Irrigation Valves Market Industry

Long-term growth in the United States irrigation valves market will be significantly accelerated by continued technological breakthroughs, particularly in the realm of sensor technology and data analytics for real-time irrigation adjustments. Strategic partnerships between valve manufacturers, agricultural technology providers, and water management agencies will foster innovation and broaden market reach. The expansion of smart city initiatives and sustainable urban development projects will also drive demand for intelligent irrigation valve systems in non-agricultural applications. Market expansion into emerging agricultural regions and the development of cost-effective solutions for a wider range of users will further solidify growth.

Key Players Shaping the United States Irrigation Valves Market Market

- Netafim USA

- GF Piping Systems

- The Toro Company

- Erdmann Corporation

- Anything Flows LLC

- BERMAD CS Ltd

- ACE PUMP CORPORATION

- Dorot

- TVI

- Raven Industries Inc

Notable Milestones in United States Irrigation Valves Market Sector

- May 2022: Netafim U.S.A. expanded its manufacturing presence in the United States, with its innovative FlexNet piping solution being manufactured in Fresno, California, aiming for more efficient delivery and custom configurations across the Americas.

- January 2022: Netafim U.S.A. partnered with Bayer to create the Precise Defense program, enabling targeted delivery of crop protection products directly to the root zone, thereby reducing water usage in almond tree irrigation.

- July 2021: A.R.I. and Dorot, specialists in automatic hydraulic control valves, merged with OCV to form Aquestia. This consolidation created a leading producer of water and fluid transmission system protection products, expanding service areas across waterworks, agriculture, wastewater, and industrial applications.

In-Depth United States Irrigation Valves Market Market Outlook

The United States irrigation valves market outlook is exceptionally positive, driven by the indispensable need for water efficiency and the rapid advancement of smart agricultural technologies. Growth accelerators such as the integration of AI for predictive irrigation and the expansion of smart city projects will continue to fuel demand across both agricultural and non-agricultural sectors. Strategic alliances and the development of user-friendly, cost-effective solutions will be crucial for capitalizing on the vast market potential. The industry is poised for sustained expansion as stakeholders increasingly prioritize sustainable water management and embrace innovative irrigation solutions.

United States Irrigation Valves Market Segmentation

-

1. Material Type

- 1.1. Metal Valves

- 1.2. Plastic Valves

-

2. Valve Type

- 2.1. Ball Valve

- 2.2. Butterfly Valve

- 2.3. Globe Valve

- 2.4. Automatic Valves

-

3. Application

- 3.1. Agricultural Applications

- 3.2. Non-agricultural applications

United States Irrigation Valves Market Segmentation By Geography

- 1. United States

United States Irrigation Valves Market Regional Market Share

Geographic Coverage of United States Irrigation Valves Market

United States Irrigation Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects

- 3.3. Market Restrains

- 3.3.1. Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge

- 3.4. Market Trends

- 3.4.1. Plastic Valves to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Irrigation Valves Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metal Valves

- 5.1.2. Plastic Valves

- 5.2. Market Analysis, Insights and Forecast - by Valve Type

- 5.2.1. Ball Valve

- 5.2.2. Butterfly Valve

- 5.2.3. Globe Valve

- 5.2.4. Automatic Valves

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Agricultural Applications

- 5.3.2. Non-agricultural applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Netafim USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GF Piping Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Toro Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Erdmann Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anything Flows LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BERMAD CS Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACE PUMP CORPORATION

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dorot

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TVI

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Raven Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Netafim USA

List of Figures

- Figure 1: United States Irrigation Valves Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Irrigation Valves Market Share (%) by Company 2025

List of Tables

- Table 1: United States Irrigation Valves Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 3: United States Irrigation Valves Market Revenue undefined Forecast, by Valve Type 2020 & 2033

- Table 4: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2020 & 2033

- Table 5: United States Irrigation Valves Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Irrigation Valves Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: United States Irrigation Valves Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Irrigation Valves Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 10: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 11: United States Irrigation Valves Market Revenue undefined Forecast, by Valve Type 2020 & 2033

- Table 12: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2020 & 2033

- Table 13: United States Irrigation Valves Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: United States Irrigation Valves Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United States Irrigation Valves Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Irrigation Valves Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Irrigation Valves Market?

Key companies in the market include Netafim USA, GF Piping Systems, The Toro Company, Erdmann Corporation, Anything Flows LLC, BERMAD CS Ltd, ACE PUMP CORPORATION, Dorot, TVI, Raven Industries Inc.

3. What are the main segments of the United States Irrigation Valves Market?

The market segments include Material Type, Valve Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects.

6. What are the notable trends driving market growth?

Plastic Valves to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge.

8. Can you provide examples of recent developments in the market?

May 2022 - Netafim U.S.A., a subsidiary of Netafim Ltd., and the provider of precision irrigation solutions such as irrigation valves, sprinklers, etc., expanded its manufacturing presence in the United States. FlexNet, the company's innovative, high-performance, flexible, lightweight piping solution for above- and below-ground drip irrigation systems, would be manufacturing its products in Fresno, California. Netafim has invested in local manufacturing to produce and deliver FlexNet to customers across the Americas more efficiently and provide growers with more custom configuration options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Irrigation Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Irrigation Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Irrigation Valves Market?

To stay informed about further developments, trends, and reports in the United States Irrigation Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence