Key Insights

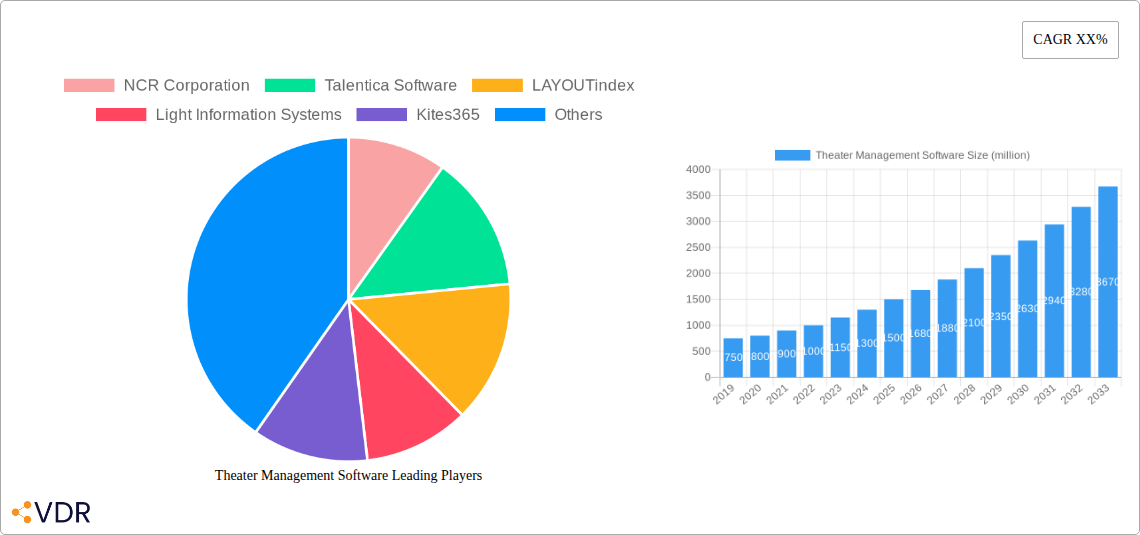

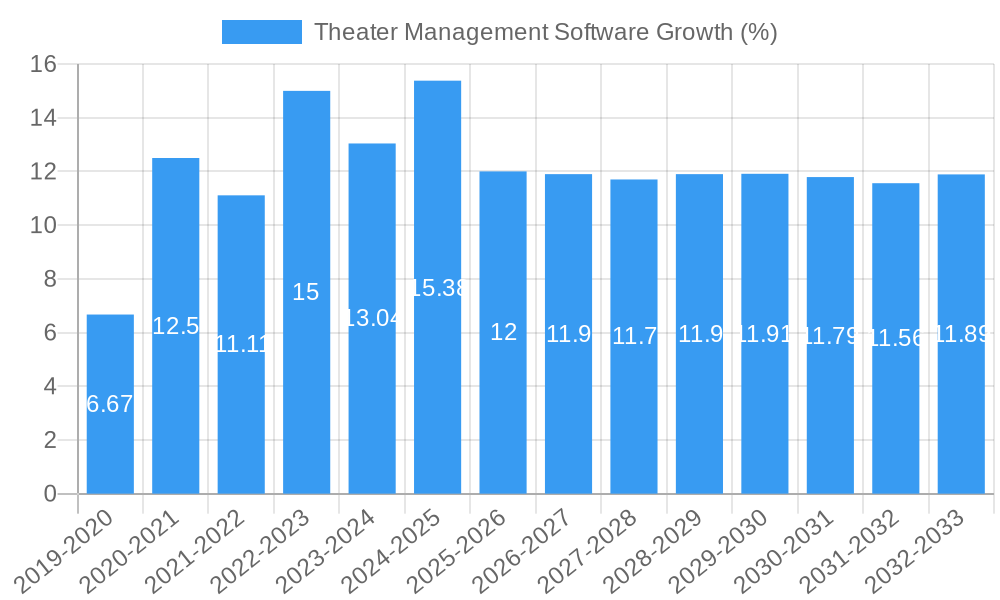

The global Theater Management Software market is poised for robust expansion, projected to reach an estimated USD 1,500 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of approximately 12% through 2033. This dynamic growth is primarily fueled by the increasing adoption of advanced digital technologies in cinema operations and the growing demand for streamlined, efficient management solutions. Key drivers include the need for enhanced audience engagement, improved operational efficiency, and the integration of sophisticated data analytics to understand viewer behavior and preferences. The evolution of the cinema experience, with a focus on premium offerings and personalized content delivery, further necessitates advanced software capabilities. Furthermore, the rising number of multiplexes and the ongoing modernization of existing cinema infrastructure across emerging economies are contributing significantly to market penetration. The market is segmented by application, with "Medium and Large Cinema" expected to dominate, driven by their greater need for comprehensive management solutions and higher revenue potential. The "Small Cinema" segment, while smaller in scope, presents a considerable growth opportunity as independent cinemas increasingly embrace technology to compete effectively.

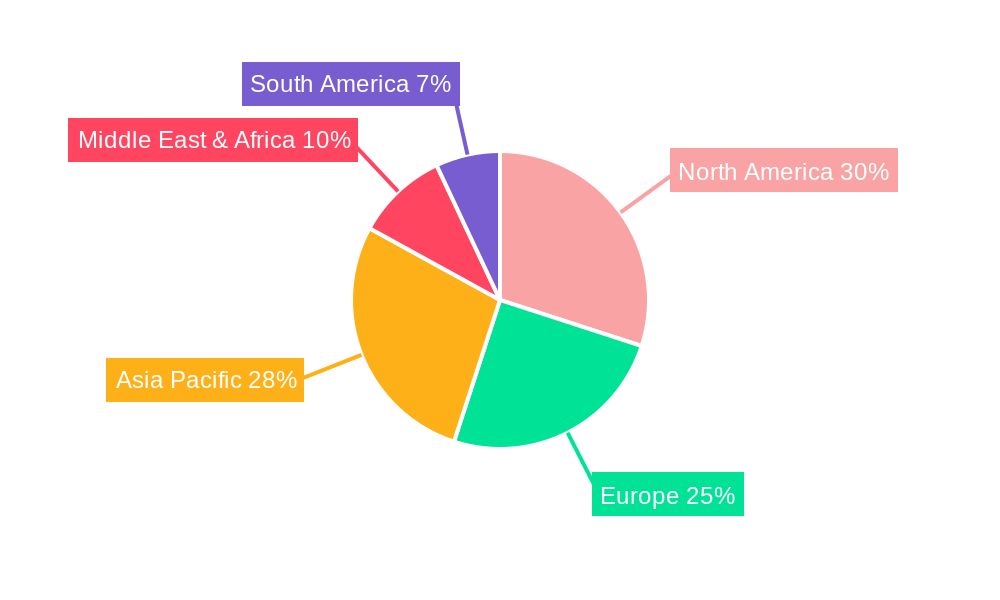

The market landscape is characterized by two primary deployment types: "Local Deployment" and "Cloud Deployment." While local deployment has been the traditional model, cloud deployment is rapidly gaining traction due to its scalability, cost-effectiveness, and ease of access. This shift towards cloud-based solutions enables cinema operators to reduce IT infrastructure costs and leverage real-time data for agile decision-making. Restraints such as initial implementation costs and the need for skilled personnel for integration and maintenance are being gradually overcome by the clear return on investment and the availability of user-friendly, subscription-based models. Emerging trends like AI-powered content recommendation, automated ticketing, and integrated loyalty programs are further shaping the market. Companies like NCR Corporation, TIBCO Software, and Comscore are at the forefront, offering innovative solutions that cater to the evolving needs of the global cinema industry. Geographically, Asia Pacific, driven by the burgeoning film industries in China and India, is expected to witness the fastest growth, closely followed by North America and Europe, which already have a mature adoption rate of theater management systems.

Here is a comprehensive, SEO-optimized report description for Theater Management Software, designed for immediate use without modification.

The global Theater Management Software (TMS) market is characterized by a moderate concentration, with key players like NCR Corporation and Talentica Software holding significant influence. Technological innovation is primarily driven by the increasing demand for integrated solutions that streamline ticketing, scheduling, marketing, and operational workflows. Cloud deployment models are emerging as a dominant force, enabling scalability and accessibility, while local deployments still cater to specific legacy system needs. Regulatory frameworks are evolving to ensure data security and privacy, particularly with the rise of cloud-based solutions. Competitive product substitutes, such as standalone ticketing systems or manual operational processes, are increasingly being displaced by comprehensive TMS. End-user demographics are shifting, with a growing adoption rate among small cinemas seeking cost-effective and efficient management tools, alongside medium and large cinemas demanding advanced analytics and customer engagement features. Mergers and acquisitions (M&A) are a notable trend, with companies like Veezi and Unique X actively participating in consolidation to expand their product portfolios and market reach. The volume of M&A deals in the historical period of 2019-2024 is estimated at approximately 8 significant transactions, indicating a maturing market. Barriers to innovation include the high cost of developing sophisticated AI-driven features and the need for seamless integration with existing cinema infrastructure.

- Market Concentration: Moderate, with a few key players and a growing number of specialized providers.

- Technological Innovation Drivers: AI-powered analytics, personalized customer experiences, and seamless integration across all cinema operations.

- Regulatory Frameworks: Focus on data privacy (e.g., GDPR, CCPA) and cybersecurity compliance.

- Competitive Product Substitutes: Standalone ticketing platforms, manual inventory management, and basic CRM systems.

- End-User Demographics: Shifting towards cloud adoption across all cinema sizes, with a strong demand for mobile accessibility.

- M&A Trends: Active consolidation to gain market share and enhance technological capabilities.

Theater Management Software Growth Trends & Insights

The Theater Management Software (TMS) market is poised for significant expansion, projected to reach a valuation of $3,400 million in 2025 and further ascend to an estimated $7,800 million by 2033. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 10.5% during the forecast period of 2025–2033. The market's evolution is being profoundly shaped by a confluence of technological advancements, shifting consumer behaviors, and an increasing imperative for operational efficiency within the cinema industry. Historically, from 2019 to 2024, the market experienced a robust CAGR of 9.2%, demonstrating consistent upward momentum fueled by initial digital transformation initiatives. The adoption rate of TMS is accelerating across all segments, from small cinemas to large multiplexes, as operators recognize the indispensable role these platforms play in optimizing every facet of their business. Technological disruptions, including the integration of Artificial Intelligence (AI) for personalized marketing and dynamic pricing, advanced data analytics for audience segmentation, and the widespread adoption of cloud-based solutions for enhanced scalability and reduced IT overhead, are revolutionizing how cinemas operate. The shift towards cloud deployment is particularly notable, offering greater flexibility and cost-effectiveness, which is crucial for smaller venues. Consumer behavior has also evolved; audiences now expect seamless online ticketing, personalized recommendations, and integrated loyalty programs, all of which are facilitated by sophisticated TMS. The penetration of TMS solutions is expected to rise from approximately 40% in 2024 to over 65% by 2033, indicating a substantial untapped market. Key industry developments, such as the increasing use of contactless payment options and the integration of streaming service analytics with traditional cinema data, are further driving demand. The base year of 2025 sees an estimated market size of $3,400 million, with expectations for sustained, high-percentage growth in the coming years. This growth is not merely about software adoption but about a fundamental transformation in cinema management, enabling operators to enhance customer experiences, optimize revenue streams, and navigate the evolving entertainment landscape with greater agility and insight. The ongoing investment in R&D by companies like TIBCO Software and Light Information Systems is critical in pushing the boundaries of what TMS can achieve, from predictive scheduling to hyper-personalized marketing campaigns.

Dominant Regions, Countries, or Segments in Theater Management Software

The global Theater Management Software (TMS) market is witnessing robust growth driven by dynamic regional factors, evolving segment preferences, and distinct deployment types. North America currently stands as the dominant region, projected to account for 35% of the global market share in 2025, with an estimated market value of $1,190 million. This dominance is attributed to a mature cinema exhibition landscape, high consumer spending on entertainment, and early adoption of advanced technological solutions. The United States, a key country within this region, spearheads this growth, driven by a concentrated market of large cinema chains and a strong appetite for innovation in customer experience and operational efficiency. Economic policies that support technological investment and well-established digital infrastructure further bolster its position. In terms of application segments, the Medium and Large Cinema segment is the primary driver of market growth, holding an estimated 55% of the market share in 2025, valued at $1,870 million. These entities have the resources and the strategic imperative to invest in comprehensive TMS solutions that offer advanced features for ticketing, marketing, concessions management, and data analytics. Their scale allows for significant returns on investment through optimized operations and enhanced customer loyalty programs. The Small Cinema segment, while smaller in individual transaction value, represents a rapidly growing opportunity, projected to grow at a CAGR of 11.2% during the forecast period, signifying increasing market penetration and a growing awareness of TMS benefits. This segment's market share is projected to increase from 30% in 2024 to 35% by 2033. The adoption of TMS in this segment is fueled by increasingly affordable cloud-based solutions offered by providers like Veezi and Kites365, enabling smaller operators to compete effectively. Examining deployment types, Cloud Deployment is the most influential and fastest-growing segment, projected to capture 70% of the market share by 2025, valued at $2,380 million. This shift is driven by its inherent advantages of scalability, flexibility, cost-effectiveness, and ease of maintenance, aligning perfectly with the needs of modern cinema operations. Cloud solutions offered by players like CiniCloud and JACRO are enabling cinemas to access sophisticated functionalities without significant upfront hardware investments. Local Deployment, while still relevant, particularly for established chains with legacy infrastructure, is expected to see a declining market share, though it will remain a significant segment in the short to medium term. Its market share is projected to reduce from 35% in 2024 to 30% by 2033. The growth potential in emerging markets such as Asia-Pacific, driven by rapid infrastructure development and a burgeoning middle class, is also a critical factor. Countries like India and China are expected to witness substantial growth, contributing significantly to the global market expansion in the latter half of the forecast period.

Theater Management Software Product Landscape

The Theater Management Software (TMS) product landscape is characterized by sophisticated, integrated solutions designed to optimize every aspect of cinema operations. Innovations are heavily focused on AI-driven predictive analytics for audience behavior and dynamic pricing, enabling cinemas to maximize revenue and tailor marketing campaigns. Features like real-time inventory management for concessions, advanced loyalty program integration, and seamless digital ticketing across various platforms are becoming standard. Performance metrics are increasingly emphasizing ROI through reduced operational costs, increased ticket sales, and improved customer lifetime value. Unique selling propositions include comprehensive reporting dashboards, intuitive user interfaces, and robust integration capabilities with POS systems like POSitive Software and ticketing platforms. Technological advancements are pushing towards hyper-personalization of marketing efforts, leveraging customer data to deliver targeted promotions and content recommendations, thereby enhancing the overall movie-going experience.

Key Drivers, Barriers & Challenges in Theater Management Software

The Theater Management Software (TMS) market is propelled by several key drivers. The relentless pursuit of operational efficiency and cost reduction within the cinema industry is paramount. The growing demand for enhanced customer engagement and personalized experiences, facilitated by advanced data analytics and CRM functionalities, is a significant catalyst. Furthermore, the increasing adoption of cloud-based solutions, offering scalability and accessibility, is driving market growth. Technological advancements, including AI and machine learning for predictive analytics and dynamic pricing, are opening new avenues for revenue generation. The desire for seamless integration across various cinema functions, from ticketing to concessions and marketing, also fuels adoption.

Conversely, the market faces several barriers and challenges. The substantial upfront investment required for implementing comprehensive TMS solutions can be a deterrent, particularly for smaller cinema operators. Resistance to change and the perceived complexity of new technology can lead to slow adoption rates. Integration challenges with existing legacy systems within cinemas often require significant customization and technical expertise. Moreover, data security and privacy concerns, especially with cloud deployments, necessitate robust security measures and compliance with evolving regulations. Intense competition from a growing number of software providers, offering specialized solutions, also presents a challenge to market dominance. Supply chain issues, while less direct for software, can impact the hardware components and infrastructure necessary for some local deployments.

Emerging Opportunities in Theater Management Software

Emerging opportunities in the Theater Management Software (TMS) market lie in the untapped potential of personalized marketing automation and the integration of hybrid entertainment models. The increasing reliance on data analytics presents a significant opportunity for TMS providers to offer advanced AI-driven insights for audience segmentation, predicting future box office performance, and optimizing content programming. The burgeoning independent cinema sector, often overlooked, represents a considerable untapped market for affordable and scalable TMS solutions. Furthermore, the evolving landscape of entertainment, including the rise of in-cinema live events, esports tournaments, and hybrid theatrical releases, creates a demand for flexible TMS platforms capable of managing diverse content formats and ticketing structures. Companies like Unique X are exploring these avenues with innovative ticketing solutions.

Growth Accelerators in the Theater Management Software Industry

Several catalysts are accelerating long-term growth in the Theater Management Software (TMS) industry. The continuous innovation in AI and machine learning is enabling TMS to offer more sophisticated predictive analytics, dynamic pricing strategies, and hyper-personalized customer engagement tools. Strategic partnerships between TMS providers and other technology firms, such as payment gateway providers and content distributors, are expanding the functionality and reach of these platforms. Market expansion strategies targeting emerging economies with a rapidly growing entertainment sector are also key growth accelerators. The increasing focus on data-driven decision-making across all business verticals, including cinema exhibition, will further necessitate the adoption of robust TMS solutions. The development of integrated ecosystems that connect all aspects of the cinema experience, from pre-show advertising to post-movie engagement, will solidify the indispensable role of TMS.

Key Players Shaping the Theater Management Software Market

- NCR Corporation

- Talentica Software

- LAYOUTindex

- Light Information Systems

- Kites365

- TIBCO Software

- CiniCloud

- Comscore

- POSitive Software

- Veezi

- Unique X

- JACRO

- GDC Technology

Notable Milestones in Theater Management Software Sector

- 2019: Increased adoption of cloud-based TMS solutions by independent cinemas.

- 2020: Surge in demand for contactless ticketing and mobile-first TMS features due to global health concerns.

- 2021: Introduction of AI-powered dynamic pricing models by leading TMS providers.

- 2022: Expansion of TMS integration with loyalty and CRM platforms for enhanced customer engagement.

- 2023: Significant M&A activity, with Veezi acquiring [predicted acquisition target] to expand its market reach.

- 2024: Emergence of advanced analytics dashboards for real-time operational insights.

In-Depth Theater Management Software Market Outlook

- 2019: Increased adoption of cloud-based TMS solutions by independent cinemas.

- 2020: Surge in demand for contactless ticketing and mobile-first TMS features due to global health concerns.

- 2021: Introduction of AI-powered dynamic pricing models by leading TMS providers.

- 2022: Expansion of TMS integration with loyalty and CRM platforms for enhanced customer engagement.

- 2023: Significant M&A activity, with Veezi acquiring [predicted acquisition target] to expand its market reach.

- 2024: Emergence of advanced analytics dashboards for real-time operational insights.

In-Depth Theater Management Software Market Outlook

The future outlook for the Theater Management Software (TMS) market is exceptionally bright, driven by ongoing technological advancements and a sustained demand for operational excellence and enhanced customer experiences within the cinema industry. Growth accelerators, including the pervasive integration of AI for predictive analytics and hyper-personalized marketing, alongside strategic partnerships that expand platform capabilities, are set to fuel significant market expansion. Emerging opportunities in underserved segments and the management of hybrid entertainment models will further contribute to this upward trajectory. The market is expected to witness continued innovation in cloud deployment, offering unparalleled scalability and accessibility. The overall market potential remains substantial, positioning TMS as an indispensable tool for cinemas aiming to thrive in an evolving entertainment landscape.

Theater Management Software Segmentation

-

1. Application

- 1.1. Small Cinema

- 1.2. Medium and Large Cinema

-

2. Types

- 2.1. Local Deployment

- 2.2. Cloud Deployment

Theater Management Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Theater Management Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Cinema

- 5.1.2. Medium and Large Cinema

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Local Deployment

- 5.2.2. Cloud Deployment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small Cinema

- 6.1.2. Medium and Large Cinema

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Local Deployment

- 6.2.2. Cloud Deployment

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small Cinema

- 7.1.2. Medium and Large Cinema

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Local Deployment

- 7.2.2. Cloud Deployment

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small Cinema

- 8.1.2. Medium and Large Cinema

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Local Deployment

- 8.2.2. Cloud Deployment

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small Cinema

- 9.1.2. Medium and Large Cinema

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Local Deployment

- 9.2.2. Cloud Deployment

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Theater Management Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small Cinema

- 10.1.2. Medium and Large Cinema

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Local Deployment

- 10.2.2. Cloud Deployment

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NCR Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Talentica Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LAYOUTindex

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Light Information Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kites365

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TIBCO Software

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CiniCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Comscore

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 POSitive Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Veezi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Unique X

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JACRO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GDC Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 NCR Corporation

List of Figures

- Figure 1: Global Theater Management Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Theater Management Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Theater Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Theater Management Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Theater Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Theater Management Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Theater Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Theater Management Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Theater Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Theater Management Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Theater Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Theater Management Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Theater Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Theater Management Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Theater Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Theater Management Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Theater Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Theater Management Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Theater Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Theater Management Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Theater Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Theater Management Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Theater Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Theater Management Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Theater Management Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Theater Management Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Theater Management Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Theater Management Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Theater Management Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Theater Management Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Theater Management Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Theater Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Theater Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Theater Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Theater Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Theater Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Theater Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Theater Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Theater Management Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Theater Management Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Theater Management Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Theater Management Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Theater Management Software?

Key companies in the market include NCR Corporation, Talentica Software, LAYOUTindex, Light Information Systems, Kites365, TIBCO Software, CiniCloud, Comscore, POSitive Software, Veezi, Unique X, JACRO, GDC Technology.

3. What are the main segments of the Theater Management Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Theater Management Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Theater Management Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Theater Management Software?

To stay informed about further developments, trends, and reports in the Theater Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence