Key Insights

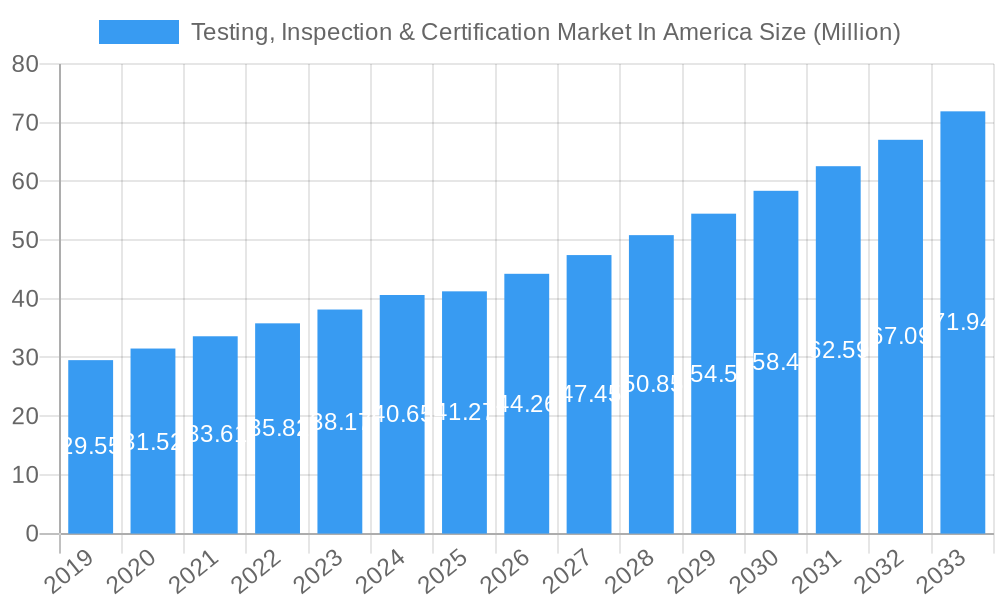

The Testing, Inspection, and Certification (TIC) market in America is poised for robust expansion, projecting a market size of $41.27 million by 2025 with an impressive CAGR of 7.32% through 2033. This growth is primarily fueled by increasingly stringent regulatory landscapes across diverse industries, a growing emphasis on product quality and safety, and the escalating demand for reliable assurance in complex supply chains. The automotive sector, driven by advancements in electric vehicles and autonomous driving technologies, alongside the burgeoning renewable energy sector and the continuous need for infrastructure development, are significant contributors to this upward trajectory. Furthermore, the rising consumer awareness regarding the safety and sustainability of products, particularly within the Consumer Products and Retail segment, acts as a powerful catalyst for enhanced TIC services. The digital transformation wave also plays a crucial role, necessitating specialized testing for connected devices, cybersecurity, and data integrity across all end-user industries.

Testing, Inspection & Certification Market In America Market Size (In Million)

Key drivers of this market include the ever-evolving global regulatory frameworks, the need to mitigate risks associated with product recalls and safety incidents, and the drive for operational efficiency and compliance. The increasing outsourcing of TIC services by manufacturers and service providers, seeking specialized expertise and cost-effectiveness, further bolsters market growth. Emerging trends such as the integration of AI and IoT in testing methodologies, the rise of sustainable and green TIC services, and the expansion of digital certification platforms are shaping the future of the industry. While the market demonstrates strong growth, potential restraints such as high initial investment for advanced testing equipment and a shortage of skilled professionals in niche areas require strategic attention from market participants. The competitive landscape is characterized by a mix of large global players and specialized regional providers, all vying to capitalize on the expanding opportunities across North America and beyond.

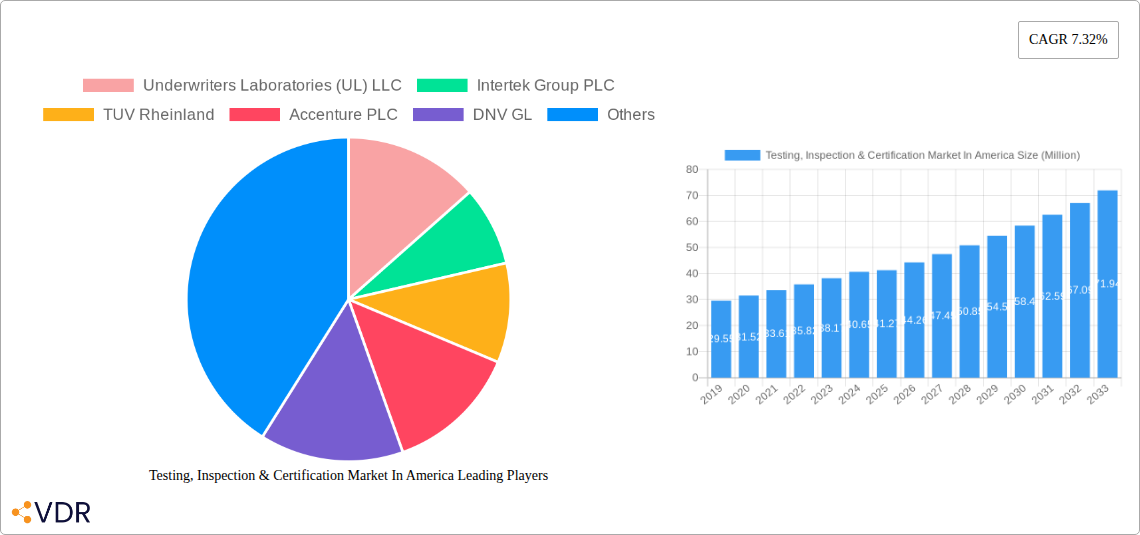

Testing, Inspection & Certification Market In America Company Market Share

Unlock the Future of American Business: The Comprehensive Testing, Inspection, & Certification Market Report (2019-2033)

Gain an unparalleled understanding of the dynamic Testing, Inspection, and Certification (TIC) market across America. This in-depth report, covering the historical period of 2019-2024 and forecasting through 2033 with a base year of 2025, delivers critical insights into market size evolution, growth drivers, competitive landscapes, and emerging opportunities. Explore the intricate parent and child market structures, with all values presented in millions. For professionals in quality assurance, regulatory compliance, product development, supply chain management, and strategic planning, this report is your essential guide to navigating the evolving demands of American industries. Discover how testing services, inspection services, and certification services are shaping sectors from consumer products and retail to energy, automotive, and infrastructure.

Testing, Inspection & Certification Market In America Market Dynamics & Structure

The American Testing, Inspection, and Certification (TIC) market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share, yet ample room for specialized and emerging firms. Technological innovation is a paramount driver, fueled by increasing demand for advanced testing methodologies, digital solutions like IoT integration, and AI-powered analytics to enhance efficiency and accuracy. Stringent regulatory frameworks, both federal and state, mandate compliance across numerous industries, creating a perpetual need for independent verification and validation. Competitive product substitutes, while present in the form of in-house testing capabilities, are often outweighed by the perceived objectivity, expertise, and risk mitigation offered by third-party TIC providers. End-user demographics are shifting, with a growing emphasis on sustainability, ethical sourcing, and consumer safety driving demand for specialized TIC services. Mergers and acquisitions (M&A) trends indicate strategic consolidation, with larger entities acquiring niche players to expand service portfolios and geographic reach. For instance, the recent flurry of M&A activity in the cybersecurity TIC sector underscores its growing importance. Barriers to innovation include the high cost of sophisticated laboratory equipment and the need for specialized, accredited personnel.

- Market Concentration: Moderately concentrated with key players like SGS SA, Bureau Veritas SA, and Intertek Group PLC holding substantial market influence.

- Technological Drivers: Adoption of AI for predictive maintenance, IoT for real-time monitoring, and advanced materials testing are crucial.

- Regulatory Landscape: Federal regulations (e.g., FDA, EPA, CPSC) and state-specific mandates significantly influence demand.

- M&A Trends: Strategic acquisitions to broaden service offerings in sectors like cybersecurity and sustainable materials testing.

Testing, Inspection & Certification Market In America Growth Trends & Insights

The American Testing, Inspection, and Certification (TIC) market is poised for robust growth, driven by an escalating commitment to quality, safety, and compliance across all industrial sectors. The market size is projected to expand significantly from approximately $XX million in 2024 to an estimated $XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around XX%. This upward trajectory is underpinned by increasing consumer awareness and demand for safe, reliable products, compelling manufacturers to invest more heavily in rigorous testing and certification processes. Furthermore, the growing complexity of global supply chains necessitates comprehensive inspection and verification at various points to ensure product integrity and ethical sourcing. Technological advancements are acting as significant disruptors and enablers; the integration of digital technologies, such as the Internet of Things (IoT) for real-time monitoring and Artificial Intelligence (AI) for advanced data analysis and predictive quality control, is revolutionizing the efficiency and scope of TIC services. These innovations not only enhance the accuracy and speed of testing but also open new avenues for value-added services.

Consumer behavior shifts are playing a pivotal role, with a discernible rise in the preference for sustainably produced and ethically manufactured goods. This has propelled the demand for certifications related to environmental standards, social accountability, and fair labor practices. For example, the consumer products and retail sector is witnessing increased scrutiny, driving demand for comprehensive safety and quality testing. Similarly, the energy and power sector, with its ongoing transition towards renewable sources and the imperative for grid modernization, requires extensive inspection and certification of new technologies and infrastructure to ensure safety and reliability. The automotive industry, embracing electric vehicles (EVs) and autonomous driving technologies, faces new safety and performance standards that necessitate specialized TIC. The building infrastructure/construction sector, driven by a need for resilient and sustainable structures, also contributes significantly to market growth through its demand for materials testing, structural integrity checks, and compliance certifications. The oil and gas industry, despite market fluctuations, continues to rely on stringent inspection and testing for safety and environmental compliance. The adoption rates for advanced TIC solutions are accelerating, as businesses recognize that proactive compliance and quality assurance are not just regulatory necessities but crucial elements for brand reputation and competitive advantage. Market penetration is deep across established industries, but there is significant untapped potential in emerging sectors and for niche, specialized TIC services that cater to evolving global standards and technological advancements.

Dominant Regions, Countries, or Segments in Testing, Inspection & Certification Market In America

The Testing, Inspection, and Certification (TIC) market in America is experiencing dynamic growth, with specific regions, countries, and industry segments taking the lead. Among the service types, Testing and Inspection Service commands a dominant share, driven by the sheer volume of product development, manufacturing, and infrastructure projects across the continent. This segment’s dominance is fueled by the continuous need for quality control, safety verification, and performance validation of a vast array of goods and services.

Within the end-user industries, Consumer Products and Retail stands out as a primary growth engine and a segment with substantial market share. This is directly attributable to the immense consumer base in America, coupled with increasingly stringent consumer protection laws and heightened consumer awareness regarding product safety, quality, and ethical sourcing. Companies in this sector are under constant pressure to meet evolving standards for everything from electronics and apparel to food and toys, making comprehensive testing and inspection non-negotiable.

The Energy and Power sector is another significant contributor to the market's dominance, especially in light of the global transition towards sustainable energy sources and the ongoing need for secure and reliable energy infrastructure. The burgeoning renewable energy market, including solar, wind, and battery storage technologies, requires extensive testing and certification to ensure performance, safety, and grid integration. Furthermore, the traditional oil and gas industry, despite its cyclical nature, continues to demand rigorous inspection and certification services for asset integrity, environmental compliance, and operational safety.

The Building Infrastructure/Construction segment also holds considerable weight. As America focuses on modernizing its aging infrastructure and developing new urban centers, there is a sustained demand for materials testing, structural integrity assessments, and compliance certifications for building codes and environmental standards. Economic policies aimed at infrastructure development, such as government stimulus packages and public-private partnerships, directly accelerate growth in this segment.

Key drivers behind the dominance of these segments include:

- Robust Regulatory Frameworks: Strong governmental oversight and evolving compliance requirements create a persistent demand for TIC services.

- Economic Policies: Government investments in infrastructure, renewable energy, and manufacturing incentivize extensive testing and certification.

- Consumer Demand: Heightened consumer awareness regarding safety, sustainability, and product efficacy propels demand for certified products and services.

- Technological Advancements: The introduction of new technologies in industries like automotive (EVs, autonomous driving) and energy necessitates specialized testing and certification.

- Market Share and Growth Potential: The sheer size of the consumer market and the critical nature of safety and performance in energy and infrastructure ensure sustained high market share and substantial growth potential for these dominant segments.

Testing, Inspection & Certification Market In America Product Landscape

The Testing, Inspection, and Certification (TIC) market in America is characterized by a sophisticated product and service landscape, driven by technological innovation and evolving industry demands. Key product innovations include advanced analytical instrumentation for material characterization, non-destructive testing (NDT) equipment for infrastructure integrity, and digital platforms offering remote monitoring and data management for inspection processes. Applications span across virtually every industry, from ensuring the safety and efficacy of pharmaceuticals and food products to verifying the performance and durability of automotive components and aerospace systems. Performance metrics are increasingly focused on speed, accuracy, cost-effectiveness, and the ability to provide actionable insights. Unique selling propositions often lie in specialized accreditations, global network reach, and the integration of cutting-edge technologies like AI and IoT for predictive quality assurance.

Key Drivers, Barriers & Challenges in Testing, Inspection & Certification Market In America

Key Drivers: The American Testing, Inspection, and Certification (TIC) market is propelled by several critical factors. Foremost among these is the ever-evolving and increasingly stringent global regulatory landscape, demanding rigorous compliance for products and services entering domestic and international markets. This is complemented by rising consumer awareness and demand for product safety, quality, and sustainability, compelling businesses to invest in independent verification. Technological advancements, particularly in areas like AI, IoT, and advanced materials science, create new testing needs and opportunities for more efficient and comprehensive TIC solutions. Economic policies, such as infrastructure spending and support for green technologies, also directly stimulate demand for TIC services within specific sectors.

Barriers & Challenges: Despite robust growth, the market faces significant challenges. The high cost of acquiring and maintaining sophisticated testing equipment and obtaining necessary accreditations can act as a barrier, particularly for smaller TIC providers. A shortage of skilled and certified personnel is another critical constraint, impacting the capacity and expertise available to meet demand. Intense competition among established players and the emergence of new, specialized service providers can lead to price pressures. Furthermore, navigating the complex and often fragmented regulatory environment across different states and industries requires significant expertise and resources. Supply chain disruptions can also impact the availability of testing equipment and consumables, indirectly affecting service delivery timelines.

Emerging Opportunities in Testing, Inspection & Certification Market In America

Emerging opportunities in the American TIC market are abundant, particularly in the realm of sustainability and digital transformation. The growing demand for Environmental, Social, and Governance (ESG) certifications presents a significant avenue for growth, encompassing areas like carbon footprint verification, ethical sourcing audits, and circular economy assessments. The proliferation of the Internet of Things (IoT) devices and smart technologies creates a new frontier for cybersecurity testing and certification, ensuring the security and reliability of connected systems. Furthermore, advancements in biotechnology and personalized medicine are driving a need for specialized testing and certification services in the healthcare sector. The increasing adoption of AI and machine learning by businesses also opens doors for TIC providers to offer AI validation and ethical AI certification services, ensuring the integrity and fairness of these powerful tools.

Growth Accelerators in the Testing, Inspection & Certification Market In America Industry

Several key catalysts are accelerating long-term growth within the American TIC industry. Technological breakthroughs, such as the development of miniaturized sensors for remote monitoring and the application of blockchain for secure data provenance, are enhancing the capabilities and efficiency of TIC services. Strategic partnerships between TIC providers and technology companies are fostering innovation and enabling the development of integrated solutions that offer enhanced value to clients. Market expansion strategies, including geographical diversification and the acquisition of niche service providers, are allowing companies to broaden their reach and expertise. The increasing global interconnectedness of supply chains also necessitates a greater reliance on independent TIC services to ensure consistent quality and compliance across borders, further solidifying the industry's growth trajectory.

Key Players Shaping the Testing, Inspection & Certification Market In America Market

- Underwriters Laboratories (UL) LLC

- Intertek Group PLC

- TUV Rheinland

- Accenture PLC

- DNV GL

- Societe Generale De Surveillance SA (SGS SA)

- Applus Services SA

- Hartford Steam Boiler Inspection and Insurance Company (Munich Re)

- SYSTRA S

- MISTRAS Group Inc

- SecureWorks Corp

- Booz Allen Hamilton Holding Corporation

- KPMG International Limited

- Element Materials Technology Group Limited

- RICARDO PLC

- DEKRA SE

- Optiv Security Inc

- Kiwa NV

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- TUV Nord

- Battelle Memorial Institute

- TUV SUD

Notable Milestones in Testing, Inspection & Certification Market In America Sector

- November 2023: Intertek announced the launch of iCare in Türkiye, one of its most successful markets. iCare is a cutting-edge digital portal offering textile manufacturers a comprehensive solution for seamlessly managing and monitoring their testing processes. With iCare, manufacturers will have the ability to effortlessly oversee and control their projects, transforming their quality and assurance processes.

- October 2023: SGS announced a joint venture partnership with Eezytrace, an innovative software platform that provides data-driven risk management and facilitates digitalizing the self-check process in the food industry. SGS is committed to supporting operators in improving food safety management worldwide through its position as the world’s leading provider of testing, inspection, and certification services. A new benchmark of excellence and effectiveness in food services and retail is set up through its collaboration with Eezytrace.

In-Depth Testing, Inspection & Certification Market In America Market Outlook

The future of the American Testing, Inspection, and Certification (TIC) market is exceptionally promising, driven by a confluence of factors that underscore its indispensable role in modern commerce. Growth accelerators will continue to be fueled by the persistent demand for regulatory compliance, the escalating consumer focus on product safety and sustainability, and the transformative impact of digital technologies. Strategic partnerships between TIC providers and industry leaders will unlock new service offerings and enhance market penetration. As industries increasingly adopt advanced technologies like AI and IoT, the need for specialized testing and certification in areas such as cybersecurity and data integrity will surge. Furthermore, the global push towards a circular economy and decarbonization will create substantial opportunities for TIC services related to environmental impact assessment and green certifications. The market outlook suggests a sustained period of growth, innovation, and strategic expansion, solidifying the TIC sector's position as a critical enabler of trust and progress in the American economy.

Testing, Inspection & Certification Market In America Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. End-user Industry

- 2.1. Consumer Products and Retail

- 2.2. Energy and Power

- 2.3. Automotive

- 2.4. Oil and Gas

- 2.5. Mining

- 2.6. Agriculture/Food

- 2.7. Chemical

- 2.8. Building Infrastructure/Construction

- 2.9. Industri

- 2.10. Transportation (Aerospace and Rail)

- 2.11. Other End-user Industries

Testing, Inspection & Certification Market In America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

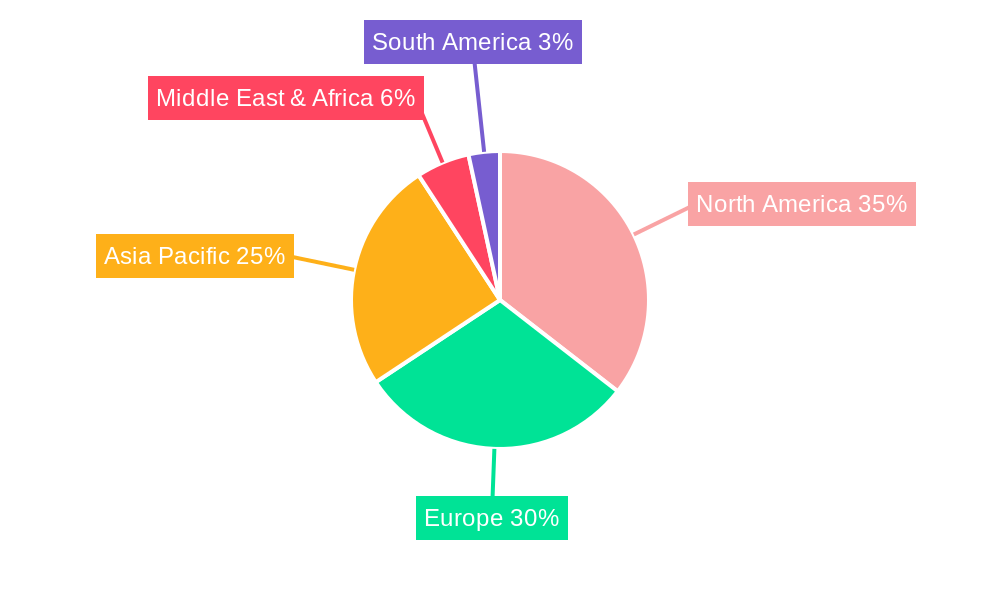

Testing, Inspection & Certification Market In America Regional Market Share

Geographic Coverage of Testing, Inspection & Certification Market In America

Testing, Inspection & Certification Market In America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Consumer Products and Retail Segment Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Products and Retail

- 5.2.2. Energy and Power

- 5.2.3. Automotive

- 5.2.4. Oil and Gas

- 5.2.5. Mining

- 5.2.6. Agriculture/Food

- 5.2.7. Chemical

- 5.2.8. Building Infrastructure/Construction

- 5.2.9. Industri

- 5.2.10. Transportation (Aerospace and Rail)

- 5.2.11. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Consumer Products and Retail

- 6.2.2. Energy and Power

- 6.2.3. Automotive

- 6.2.4. Oil and Gas

- 6.2.5. Mining

- 6.2.6. Agriculture/Food

- 6.2.7. Chemical

- 6.2.8. Building Infrastructure/Construction

- 6.2.9. Industri

- 6.2.10. Transportation (Aerospace and Rail)

- 6.2.11. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Consumer Products and Retail

- 7.2.2. Energy and Power

- 7.2.3. Automotive

- 7.2.4. Oil and Gas

- 7.2.5. Mining

- 7.2.6. Agriculture/Food

- 7.2.7. Chemical

- 7.2.8. Building Infrastructure/Construction

- 7.2.9. Industri

- 7.2.10. Transportation (Aerospace and Rail)

- 7.2.11. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Consumer Products and Retail

- 8.2.2. Energy and Power

- 8.2.3. Automotive

- 8.2.4. Oil and Gas

- 8.2.5. Mining

- 8.2.6. Agriculture/Food

- 8.2.7. Chemical

- 8.2.8. Building Infrastructure/Construction

- 8.2.9. Industri

- 8.2.10. Transportation (Aerospace and Rail)

- 8.2.11. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Consumer Products and Retail

- 9.2.2. Energy and Power

- 9.2.3. Automotive

- 9.2.4. Oil and Gas

- 9.2.5. Mining

- 9.2.6. Agriculture/Food

- 9.2.7. Chemical

- 9.2.8. Building Infrastructure/Construction

- 9.2.9. Industri

- 9.2.10. Transportation (Aerospace and Rail)

- 9.2.11. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Testing, Inspection & Certification Market In America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Consumer Products and Retail

- 10.2.2. Energy and Power

- 10.2.3. Automotive

- 10.2.4. Oil and Gas

- 10.2.5. Mining

- 10.2.6. Agriculture/Food

- 10.2.7. Chemical

- 10.2.8. Building Infrastructure/Construction

- 10.2.9. Industri

- 10.2.10. Transportation (Aerospace and Rail)

- 10.2.11. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Underwriters Laboratories (UL) LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intertek Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TUV Rheinland

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accenture PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DNV GL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Societe Generale De Surveillance SA (SGS SA)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Applus Services SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hartford Steam Boiler Inspection and Insurance Company (Munich Re)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SYSTRA S

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MISTRAS Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SecureWorks Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Booz Allen Hamilton Holding Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KPMG International Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Element Materials Technology Group Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 RICARDO PLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DEKRA SE

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Optiv Security Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Kiwa NV

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 ALS Limited

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Bureau Veritas SA

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Eurofins Scientific SE

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 TUV Nord

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Battelle Memorial Institute

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 TUV SUD

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Underwriters Laboratories (UL) LLC

List of Figures

- Figure 1: Global Testing, Inspection & Certification Market In America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection & Certification Market In America Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection & Certification Market In America Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection & Certification Market In America Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Testing, Inspection & Certification Market In America Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Testing, Inspection & Certification Market In America Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Testing, Inspection & Certification Market In America Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Testing, Inspection & Certification Market In America Revenue (Million), by Service Type 2025 & 2033

- Figure 9: South America Testing, Inspection & Certification Market In America Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: South America Testing, Inspection & Certification Market In America Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: South America Testing, Inspection & Certification Market In America Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America Testing, Inspection & Certification Market In America Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Testing, Inspection & Certification Market In America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Testing, Inspection & Certification Market In America Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe Testing, Inspection & Certification Market In America Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe Testing, Inspection & Certification Market In America Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Testing, Inspection & Certification Market In America Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Testing, Inspection & Certification Market In America Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Testing, Inspection & Certification Market In America Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Testing, Inspection & Certification Market In America Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Middle East & Africa Testing, Inspection & Certification Market In America Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Middle East & Africa Testing, Inspection & Certification Market In America Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa Testing, Inspection & Certification Market In America Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa Testing, Inspection & Certification Market In America Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Testing, Inspection & Certification Market In America Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Testing, Inspection & Certification Market In America Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Asia Pacific Testing, Inspection & Certification Market In America Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Asia Pacific Testing, Inspection & Certification Market In America Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Testing, Inspection & Certification Market In America Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Testing, Inspection & Certification Market In America Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Testing, Inspection & Certification Market In America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Testing, Inspection & Certification Market In America Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Testing, Inspection & Certification Market In America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection & Certification Market In America?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Testing, Inspection & Certification Market In America?

Key companies in the market include Underwriters Laboratories (UL) LLC, Intertek Group PLC, TUV Rheinland, Accenture PLC, DNV GL, Societe Generale De Surveillance SA (SGS SA), Applus Services SA, Hartford Steam Boiler Inspection and Insurance Company (Munich Re), SYSTRA S, MISTRAS Group Inc, SecureWorks Corp, Booz Allen Hamilton Holding Corporation, KPMG International Limited, Element Materials Technology Group Limited, RICARDO PLC, DEKRA SE, Optiv Security Inc, Kiwa NV, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, TUV Nord, Battelle Memorial Institute, TUV SUD.

3. What are the main segments of the Testing, Inspection & Certification Market In America?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations and Mandates to Ensure Product Safety and Environmental Protection.

6. What are the notable trends driving market growth?

Consumer Products and Retail Segment Holds Major Market Share.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

November 2023 - Intertek announced the launch of iCare in Türkiye, one of its most successful markets. iCare is a cutting-edge digital portal offering textile manufacturers a comprehensive solution for seamlessly managing and monitoring their testing processes. With iCare, manufacturers will have the ability to effortlessly oversee and control their projects, transforming their quality and assurance processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection & Certification Market In America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection & Certification Market In America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection & Certification Market In America?

To stay informed about further developments, trends, and reports in the Testing, Inspection & Certification Market In America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence