Key Insights

The global Testing, Inspection, and Certification (TIC) market within the consumer goods and retail sector is poised for significant expansion. Driven by escalating consumer demand for product safety and quality, stringent regulatory mandates, and the proliferation of e-commerce, the market is projected to reach $417.76 billion by 2025, with a compound annual growth rate (CAGR) of 3.6% from 2025 to 2033. Key growth drivers include heightened consumer awareness regarding product safety and sustainability, compelling manufacturers to prioritize rigorous testing and certification for enhanced brand trust. Furthermore, evolving global regulations necessitate strict adherence through comprehensive TIC services. The burgeoning e-commerce landscape also amplifies the need for robust quality control across supply chains, thereby increasing reliance on outsourced TIC solutions. The increasing product and supply chain complexity further necessitates specialized testing expertise, favoring established TIC providers. The testing and inspection services segment currently leads the market, with certification services also anticipating substantial growth. Outsourcing of TIC functions is the predominant sourcing model, enabling businesses to concentrate on core competencies while leveraging external expertise for quality assurance.

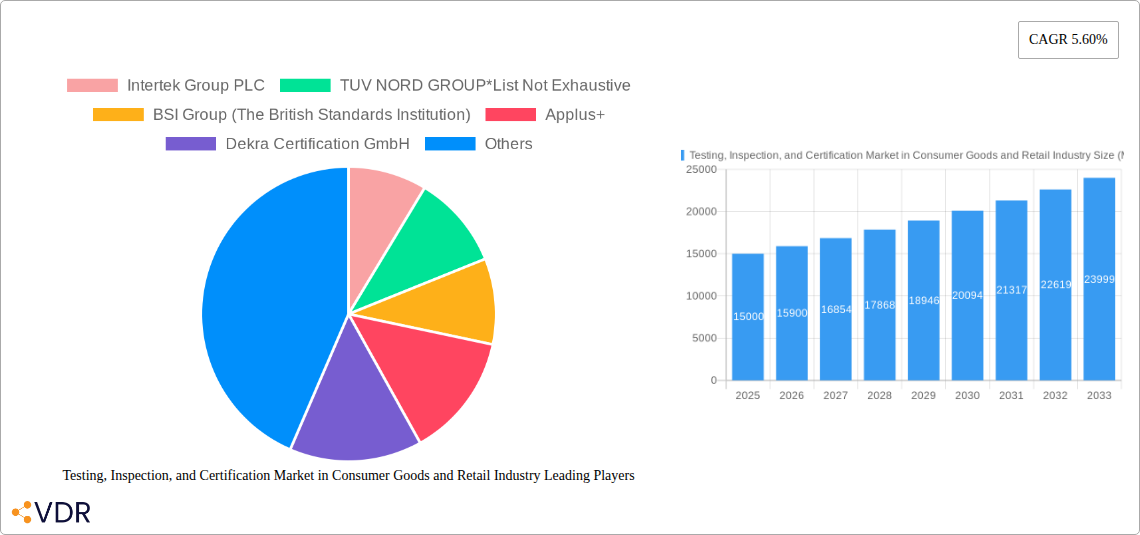

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Market Size (In Billion)

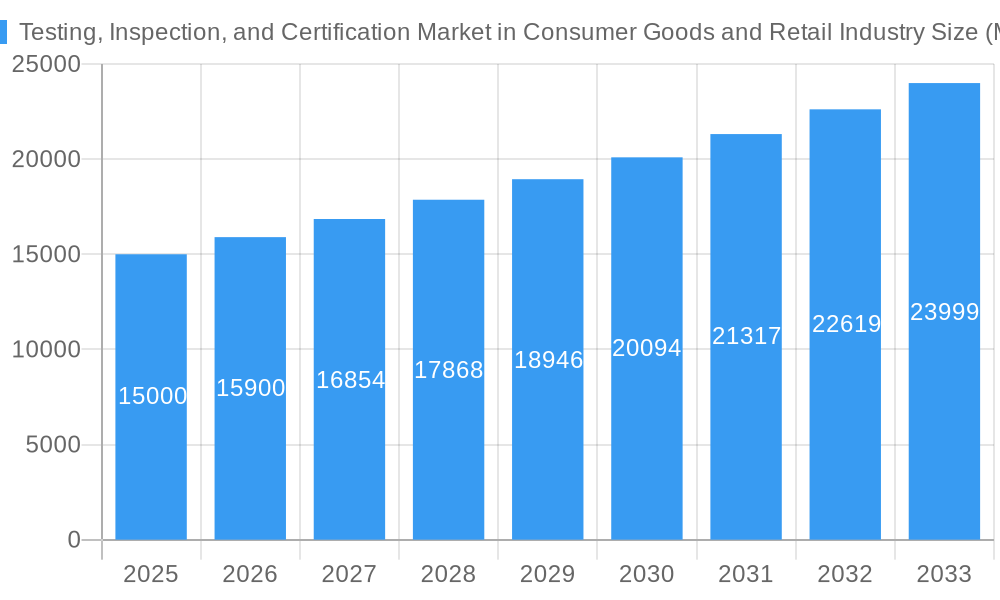

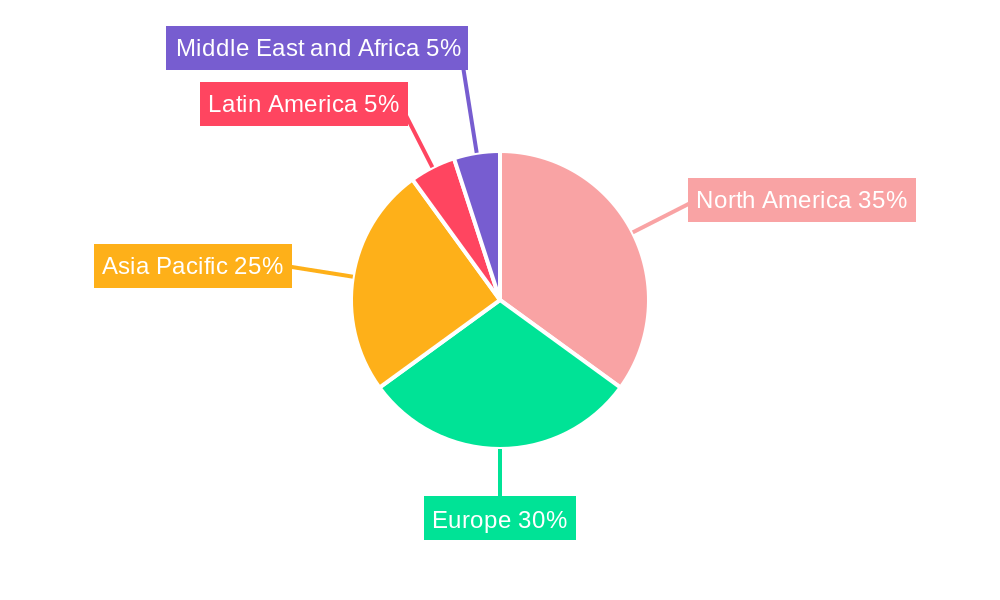

Geographically, North America and Europe currently lead the TIC market, supported by well-established regulatory frameworks and robust industry infrastructure. However, emerging economies in the Asia-Pacific region, notably China and India, represent high-growth opportunities owing to expanding manufacturing capabilities and rising consumer expenditure. The competitive environment features major multinational corporations such as Intertek, TÜV NORD, BSI, Applus+, Dekra, SGS, Bureau Veritas, UL, ALS, Eurofins, and TÜV SÜD, actively pursuing market share through strategic acquisitions, technological innovations, and global expansion. Market challenges include price competition from emerging entities and the continuous investment required in advanced testing technologies and skilled personnel to address evolving industry demands. The market's trajectory indicates a positive outlook for TIC providers adept at navigating the dynamic consumer goods and retail landscape.

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Company Market Share

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Testing, Inspection, and Certification (TIC) market within the consumer goods and retail industry, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional dominance, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report uses 2025 as its base year and provides forecasts until 2033. Market values are presented in million units.

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Market Dynamics & Structure

The global TIC market within the consumer goods and retail sector is characterized by a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as economies of scale, global reach, and technological capabilities. The industry is witnessing continuous technological innovation, driven by the need for faster, more accurate, and cost-effective testing solutions. Automation, AI, and advanced analytical techniques are transforming testing methodologies.

Regulatory frameworks, including product safety standards and compliance requirements (e.g., RoHS, REACH), play a crucial role in shaping market demand. These regulations drive the need for rigorous testing and certification services. The market also faces pressure from competitive product substitutes, especially in specific niches, but the overall demand for independent verification remains strong. End-user demographics are evolving, with increasing consumer awareness of product quality and safety, leading to greater reliance on TIC services. The industry has also seen a moderate number of M&A activities in recent years, with larger companies acquiring smaller firms to expand their service offerings and geographic reach.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong drivers include automation, AI, and advanced analytics.

- Regulatory Frameworks: Compliance needs (e.g., RoHS, REACH) significantly impact market growth.

- M&A Activity: xx deals recorded between 2019 and 2024, with an average deal value of xx million.

- Innovation Barriers: High initial investment costs for advanced technologies, lack of skilled workforce.

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Growth Trends & Insights

The Testing, Inspection, and Certification (TIC) market within the consumer goods and retail industry has demonstrated remarkable resilience and consistent growth throughout the historical period spanning 2019 to 2024. This sustained upward trajectory is primarily propelled by several interconnected factors. Firstly, escalating consumer demand for products that are not only safe and compliant but also of exceptional quality remains a cornerstone driver. Secondly, the ever-evolving and increasingly stringent regulatory landscape across global markets necessitates robust TIC services to ensure adherence. Thirdly, the globalization of supply chains, while offering operational efficiencies, also introduces greater complexity and risk, thereby amplifying the need for comprehensive assurance. Looking ahead, the market is poised for continued and accelerated expansion during the forecast period of 2025-2033. Analysts project a significant Compound Annual Growth Rate (CAGR) of approximately xx%. This anticipated growth will be further fueled by the accelerating adoption of cutting-edge technological advancements, a substantial rise in e-commerce penetration, and the inherent complexities associated with modern product manufacturing processes and intricate supply chain networks. The uptake of TIC services is witnessing a steady ascent across a diverse array of industry segments, underscoring a growing organizational and consumer awareness regarding the paramount importance of quality assurance and proactive risk mitigation strategies. The industry is also experiencing transformative disruption, largely driven by technological innovations that are not only enhancing operational efficiency and driving cost savings but also paving the way for the development of novel and advanced testing capabilities. Furthermore, evolving consumer preferences, particularly a heightened emphasis on sustainability, ethical sourcing, and product transparency, are significantly shaping the demand for specific types of TIC services, creating new specialized market niches. It is projected that the overall market penetration of TIC services will witness an impressive increase of approximately xx% by the year 2033, a trend directly attributable to heightened consumer vigilance and more rigorous regulatory oversight from governing bodies worldwide.

Dominant Regions, Countries, or Segments in Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry

Currently, the Testing, Inspection, and Certification (TIC) market within the consumer goods and retail sector is prominently led by North America and Europe. These regions benefit from well-established and robust regulatory frameworks, a strong consumer spending culture, and the concentration of major global TIC service providers. However, the Asia-Pacific region is emerging as a powerhouse of growth, driven by rapid industrialization, a burgeoning manufacturing base, and a significant increase in disposable incomes, leading to a greater demand for quality-assured products.

Analysis by Service Type:

- Testing and Inspection Services: This segment commands a substantial market share, estimated at xx%, significantly outweighing certification services. This dominance is attributed to the extensive and multifaceted testing requirements that span the entire product lifecycle, from raw material evaluation to finished product assessment.

- Certification Services: While currently smaller in share, this segment is experiencing robust growth at a CAGR of xx%. The surge is a direct response to the escalating demand for verifiable compliance with international standards, as well as the increasing importance placed on brand reputation and consumer trust, which are often bolstered by recognized certifications.

Analysis by Sourcing Type:

- Outsourced Services: This segment holds the lion's share of the market, with approximately xx% market share. The preference for outsourcing stems from its cost-effectiveness, access to specialized and cutting-edge expertise that may not be available in-house, and the inherent scalability it offers to businesses, allowing them to adapt to fluctuating demands.

- In-house Services: Predominantly utilized by large corporations with substantial existing infrastructure and dedicated internal testing capabilities, this segment represents a smaller portion of the overall market. While still relevant, its growth is generally less dynamic compared to the outsourced segment.

Key Drivers of Growth in Dominant Regions:

- North America: Characterized by exceptionally stringent regulatory standards, a highly informed and aware consumer base, and a mature, well-established market infrastructure.

- Europe: Similar to North America, with an added and increasing emphasis on sustainable production practices and ethically sourced materials, influencing product development and testing needs.

- Asia-Pacific: Experiencing accelerated growth due to rapid industrialization, a continuously expanding manufacturing sector catering to global demand, and rising consumer purchasing power and aspirations.

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Product Landscape

The TIC market offers a diverse range of services, tailored to the specific needs of various consumer goods and retail sectors. These services include physical and chemical testing, safety assessments, compliance audits, and certification programs. Recent innovations involve the integration of advanced technologies, such as AI and machine learning, to enhance testing efficiency, accuracy, and cost-effectiveness. Unique selling propositions include specialized expertise in specific product categories (e.g., textiles, electronics), quick turnaround times, and comprehensive reporting capabilities. These advancements are transforming the industry and creating new opportunities for specialized services and customized solutions.

Key Drivers, Barriers & Challenges in Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry

Key Drivers:

Stringent regulatory requirements, growing consumer demand for quality and safety, globalization of supply chains, and advancements in testing technologies are the primary drivers of market growth. For example, the increasing demand for sustainable products fuels the need for eco-friendly certification, expanding the market for specialized testing services.

Key Challenges and Restraints:

High operational costs, complexities of managing global supply chains, intense competition from established players, and the need to keep up with rapidly evolving technologies present challenges. The need for skilled personnel poses a significant barrier. Regulatory uncertainties and variations across different regions also impose challenges, leading to increased compliance costs and potential market fragmentation.

Emerging Opportunities in Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry

The landscape of opportunities within the TIC market for consumer goods and retail is evolving rapidly. A significant area of growth lies within the expanding e-commerce sector, which necessitates agile, efficient, and highly scalable testing and authentication solutions to maintain consumer trust and product integrity across diverse online platforms. The burgeoning global emphasis on sustainability and ethical sourcing presents lucrative niche opportunities for specialized certifications and testing services that verify environmental claims, fair labor practices, and responsible material procurement. Furthermore, the integration of blockchain technology is emerging as a transformative trend, offering unparalleled transparency and tamper-proof capabilities for product certifications and supply chain traceability. Finally, the development and implementation of advanced analytics and AI-powered testing solutions are poised to revolutionize the industry, offering predictive insights, enhanced accuracy, and significant cost efficiencies, thereby unlocking substantial growth potential.

Growth Accelerators in the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Industry

The long-term growth trajectory of the TIC market in the consumer goods and retail industry will be significantly propelled by several key accelerators. Foremost among these are technological breakthroughs, particularly in the realms of automation, artificial intelligence (AI), and the Internet of Things (IoT), which promise to revolutionize testing methodologies, improve efficiency, and expand the scope of services. Strategic efforts to expand into new and emerging markets, especially developing economies with growing middle classes and increasing regulatory maturity, will unlock substantial new revenue streams. The formation of strategic partnerships and collaborations will be crucial for TIC providers to broaden their service portfolios, gain access to new technologies, and enhance their global reach. Furthermore, the adoption of innovative business models, such as subscription-based services and integrated digital platforms, will cater to evolving client needs and improve accessibility. Finally, proactive government initiatives and policy frameworks that promote and enforce high-quality and safety standards across the consumer goods and retail sectors will continue to act as significant catalysts for market growth.

Key Players Shaping the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Market

Notable Milestones in Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Sector

- July 2022: SGS, a global leader in TIC services, significantly bolstered its capabilities in the UK's textile and fashion industry by inaugurating a new ISO/IEC 17025 accredited laboratory in Leicester. This strategic expansion is designed to meet the growing demand for soft lines testing and substantially increase testing capacity in a key European hub for apparel and textiles.

- February 2022: Applus+ Laboratories achieved a notable accreditation for conducting Visa's VCARS XT 2.0 contactless terminal testing. This accreditation enhances Applus+'s position and capabilities in the rapidly evolving fintech and payment technology sector, enabling them to provide essential testing services for next-generation payment devices.

In-Depth Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Market Outlook

The future of the TIC market in the consumer goods and retail industry is bright, fueled by continued technological advancements, evolving regulatory landscapes, and increasing consumer expectations. Strategic opportunities exist in leveraging data analytics to offer predictive maintenance and risk mitigation services, expanding into emerging markets with growing consumer bases, and forming partnerships to offer integrated solutions. The focus on sustainability, ethical sourcing, and digitalization will shape the industry’s future trajectory.

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-house

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry

Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mass Customization and Shorter Product Life Cycles; Technological Evolution

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Package Testing

- 3.4. Market Trends

- 3.4.1. Certification Service to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-house

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-house

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-house

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-house

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-house

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-house

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TUV NORD GROUP*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BSI Group (The British Standards Institution)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Applus+

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dekra Certification GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SGS SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bureau Veritas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UL LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ALS Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurofins Scientific SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TUV SUD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 11: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 12: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 17: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 18: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 23: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 24: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Sourcing Type 2025 & 2033

- Figure 29: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 30: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 18: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 24: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 25: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 27: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Sourcing Type 2020 & 2033

- Table 28: Global Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry?

Key companies in the market include Intertek Group PLC, TUV NORD GROUP*List Not Exhaustive, BSI Group (The British Standards Institution), Applus+, Dekra Certification GmbH, SGS SA, Bureau Veritas, UL LLC, ALS Limited, Eurofins Scientific SE, TUV SUD.

3. What are the main segments of the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry?

The market segments include Service Type, Sourcing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Mass Customization and Shorter Product Life Cycles; Technological Evolution.

6. What are the notable trends driving market growth?

Certification Service to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Costs Associated with Package Testing.

8. Can you provide examples of recent developments in the market?

July 2022: SGS recently expanded its operations in Leicester, United Kingdom, opening a new ISO/IEC 17025 accredited laboratory dedicated to soft lines testing. Situated near the second-largest textile and fashion manufacturing business concentration in the United Kingdom, the new laboratory increases capacity and capabilities for the full range of apparel, household textiles, accessories, and raw materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market in Consumer Goods and Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence