Key Insights

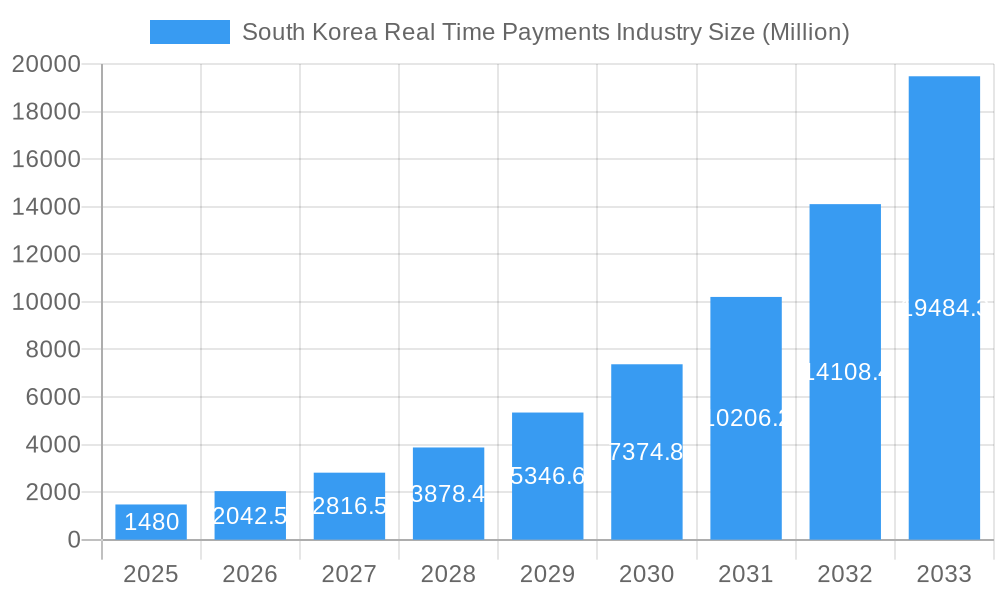

The South Korean real-time payments (RTP) market is experiencing explosive growth, projected to reach \$1.48 billion in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 37.91% from 2025 to 2033. This surge is driven by several key factors. The increasing adoption of smartphones and mobile wallets, coupled with a digitally savvy population, fuels the preference for fast, convenient transactions. Government initiatives promoting digital financial inclusion and a robust fintech ecosystem further accelerate market expansion. The prevalence of e-commerce and the rising popularity of peer-to-peer (P2P) payments, exemplified by platforms like KakaoPay and Toss, are significant contributors. Furthermore, businesses are increasingly integrating RTP solutions into their operations for streamlined payment processing, boosting the P2B segment. Competition among established players like VISA and Mastercard, alongside innovative fintech startups, fosters innovation and drives down transaction costs, benefiting both consumers and businesses.

South Korea Real Time Payments Industry Market Size (In Billion)

Looking ahead, the South Korean RTP market is poised for continued dominance in the region. The ongoing integration of RTP systems with existing financial infrastructure, the potential for further regulatory streamlining, and the continuous development of advanced payment technologies like blockchain-based solutions will only amplify growth. While challenges such as security concerns and the need for financial literacy programs exist, the overall market outlook remains overwhelmingly positive, promising substantial expansion over the forecast period. The market's success hinges on maintaining the balance between innovation, security, and regulatory oversight to ensure its sustainable growth trajectory.

South Korea Real Time Payments Industry Company Market Share

South Korea Real Time Payments Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Korea real-time payments industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking to understand this rapidly evolving market. The report segments the market by payment type (P2P, P2B) and analyzes the performance of key players including VISA Inc, Fiserv Inc, KakaoPay (Kakao Corp), EMQ, Naver-Pay (Naver Corporation), Toss (Viva Republica Inc), American Express Company, Mastercard Inc, ACI Worldwide Inc, and PayCo (NHN Corp). The report’s detailed analysis and precise data will empower businesses to make informed decisions and gain a competitive edge. Market size is presented in millions of units.

South Korea Real Time Payments Industry Market Dynamics & Structure

The South Korean real-time payments market is characterized by high growth potential driven by technological advancements, supportive regulatory frameworks, and increasing consumer adoption of digital payment methods. Market concentration is moderate, with a few dominant players and a number of smaller, niche players. Technological innovation, particularly in mobile payment solutions and open banking APIs, is a key driver. The regulatory environment is generally supportive of innovation, although ongoing regulatory adjustments impact market participants. The prevalence of mobile devices and high internet penetration contribute to the widespread adoption of real-time payment systems.

- Market Concentration: Moderate, with xx% market share held by the top 3 players in 2025.

- Technological Innovation: Driven by advancements in mobile payments, AI, and blockchain technology.

- Regulatory Framework: Supportive, with ongoing adjustments to accommodate the rapid pace of technological change.

- Competitive Product Substitutes: Traditional banking transactions pose some competition.

- End-User Demographics: High mobile and internet penetration fuels adoption amongst young and tech-savvy demographics.

- M&A Trends: xx M&A deals recorded between 2019-2024, indicating a consolidation trend within the market. xx further deals are predicted in the forecast period.

South Korea Real Time Payments Industry Growth Trends & Insights

The South Korean real-time payments market experienced robust growth during the historical period (2019-2024). The market size reached xx million in 2024, exhibiting a CAGR of xx% during this period. The adoption rate of real-time payment systems continues to surge, driven by factors such as increasing smartphone penetration, the rising popularity of e-commerce, and government initiatives to promote digital payments. Technological advancements like improved mobile payment applications and enhanced security measures are further accelerating market growth. Consumer behavior is shifting towards preference for speed, convenience and security in payments, leading to the preference for real-time payment options. The forecast period (2025-2033) projects continued robust growth, with the market size estimated to reach xx million in 2033, representing a CAGR of xx%.

Dominant Regions, Countries, or Segments in South Korea Real Time Payments Industry

The South Korean real-time payments market is largely concentrated within the country itself. The P2P segment currently dominates, representing xx% of the market in 2025, driven by the widespread adoption of mobile payment apps and social media integration. The P2B segment is also exhibiting strong growth, with increased online transactions and the expansion of e-commerce.

- Key Drivers for P2P Dominance: High smartphone penetration, user-friendly mobile apps, and social media integration.

- Key Drivers for P2B Growth: Expansion of e-commerce, increasing online shopping activities and rising government focus on digital economy.

- Market Share: P2P holds xx% market share in 2025. P2B holds xx% market share in 2025.

- Growth Potential: Both segments show strong growth potential, with P2B expected to experience faster growth than P2P in the forecast period.

South Korea Real Time Payments Industry Product Landscape

The South Korean real-time payments landscape is characterized by a diverse range of products, including mobile payment apps, online banking platforms, and specialized real-time payment gateways. These products offer varying features such as peer-to-peer (P2P) transfers, business-to-consumer (B2C) payments, and international remittances. Key innovations focus on enhanced security measures like biometric authentication and advanced fraud detection systems. Several platforms integrate loyalty programs and rewards systems to enhance user engagement.

Key Drivers, Barriers & Challenges in South Korea Real Time Payments Industry

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing e-commerce and digital transactions.

- Government initiatives promoting digital payments.

- Technological advancements in mobile payment solutions.

Key Challenges & Restraints:

- Security concerns related to data breaches and fraud.

- Regulatory hurdles and compliance requirements.

- Competition from established players and new entrants.

- Interoperability issues between different payment systems. The impact of these issues on market growth is estimated at xx million in lost revenue annually.

Emerging Opportunities in South Korea Real Time Payments Industry

- Expansion into untapped markets: Reaching underserved segments with tailored solutions.

- Innovation in payment solutions: Developing new applications such as micro-payments and blockchain integration.

- Cross-border payments: Facilitating seamless international transactions.

- Open banking initiatives: Leveraging APIs for greater integration and innovation.

Growth Accelerators in the South Korea Real Time Payments Industry

Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), will play a crucial role in driving future growth. Strategic partnerships between fintech companies and traditional financial institutions can also fuel market expansion. Furthermore, the increasing adoption of open banking APIs and the development of innovative payment solutions will unlock new opportunities.

Key Players Shaping the South Korea Real Time Payments Market

- VISA Inc

- Fiserv Inc

- KakaoPay (Kakao Corp)

- EMQ

- Naver-Pay (Naver Corporation)

- Toss (Viva Republica Inc)

- American Express Company

- Mastercard Inc

- ACI Worldwide Inc

- PayCo (NHN Corp)

Notable Milestones in South Korea Real Time Payments Industry Sector

- November 2023: Visa announces expansion of Real Time Visa Account Updater (VAU) to Asia Pacific, enhancing merchant and customer experience.

- July 2023: Fiserv launches integration with the Federal Reserve’s FedNow instant payments system, boosting interest in pay-by-bank options.

In-Depth South Korea Real Time Payments Industry Market Outlook

The South Korean real-time payments market is poised for significant growth in the coming years, driven by sustained technological advancements, increased consumer adoption of digital payments, and supportive regulatory frameworks. Strategic partnerships, innovative product development, and expansion into new market segments will be critical for success in this dynamic industry. The long-term outlook is highly positive, with significant opportunities for both established players and new entrants.

South Korea Real Time Payments Industry Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

South Korea Real Time Payments Industry Segmentation By Geography

- 1. South Korea

South Korea Real Time Payments Industry Regional Market Share

Geographic Coverage of South Korea Real Time Payments Industry

South Korea Real Time Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 37.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments

- 3.3. Market Restrains

- 3.3.1. Growing Cyber Threats in the region

- 3.4. Market Trends

- 3.4.1. Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Real Time Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VISA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fiserv Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KakaoPay (Kakao Corp )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EMQ

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Naver-Pay (Naver Corporation)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toss (Viva Republica Inc )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American Express Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACI Worldwide Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PayCo (NHN Corp )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 VISA Inc

List of Figures

- Figure 1: South Korea Real Time Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Real Time Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 2: South Korea Real Time Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: South Korea Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 4: South Korea Real Time Payments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Real Time Payments Industry?

The projected CAGR is approximately 37.91%.

2. Which companies are prominent players in the South Korea Real Time Payments Industry?

Key companies in the market include VISA Inc, Fiserv Inc, KakaoPay (Kakao Corp ), EMQ, Naver-Pay (Naver Corporation), Toss (Viva Republica Inc ), American Express Company*List Not Exhaustive, Mastercard Inc, ACI Worldwide Inc, PayCo (NHN Corp ).

3. What are the main segments of the South Korea Real Time Payments Industry?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments.

6. What are the notable trends driving market growth?

Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Growing Cyber Threats in the region.

8. Can you provide examples of recent developments in the market?

November 2023 - Visa, has announced the expansion of Real Time Visa Account Updater (VAU) to selected markets in Asia Pacific, streamlining the payment experience for merchants and customers by providing cardholders with a single credential for life. With the introduction of the service in Asia Pacific, consumers and merchants in the region will have access to Real Time VAU across subscription services such as ride-hailing, food delivery and monthly utility payments, amongst others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Real Time Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Real Time Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Real Time Payments Industry?

To stay informed about further developments, trends, and reports in the South Korea Real Time Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence