Key Insights

The South Korea Automotive OEM Coatings Market is projected to experience substantial growth. Forecasts indicate a market size of $16.12 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 4.3%. This expansion is driven by South Korea's advanced automotive manufacturing sector, a global leader in passenger and commercial vehicle production. Key growth factors include the rising demand for coatings offering enhanced durability, superior aesthetics, and improved environmental performance. The industry's focus on lighter, more fuel-efficient vehicles necessitates the adoption of innovative coating technologies that are compatible with new materials. Moreover, stringent environmental regulations are accelerating the shift towards eco-friendly coatings, such as water-borne and solvent-borne formulations with reduced VOC emissions, alongside the increasing adoption of efficient and sustainable electrocoat and powder coating technologies.

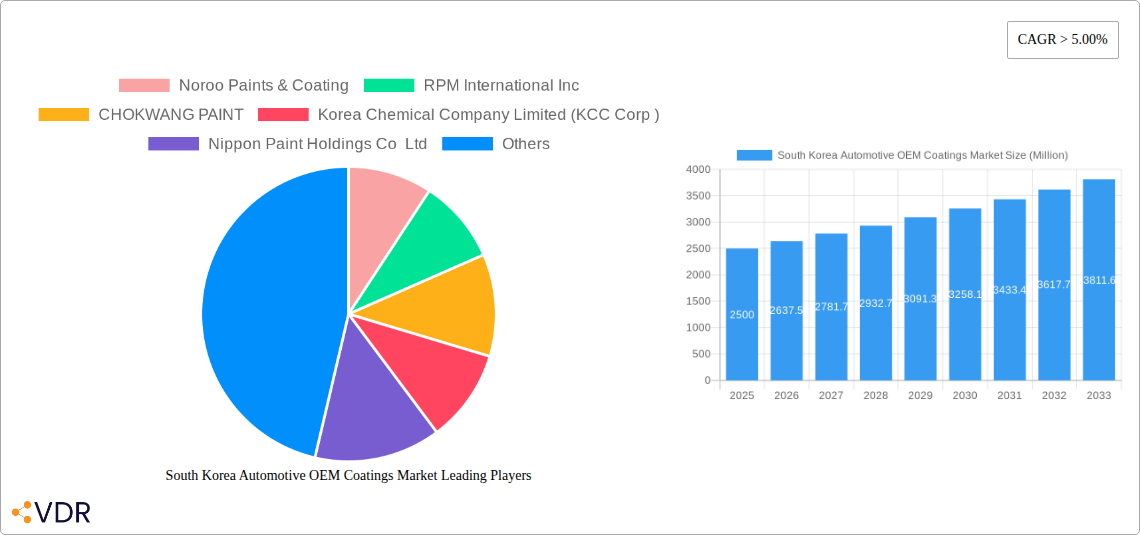

South Korea Automotive OEM Coatings Market Market Size (In Billion)

The market is segmented by resin type, with Epoxy and Polyurethane resins being prominent due to their exceptional protective qualities and versatility. The multi-layer coating system, comprising E-Coat, Primer, Base Coat, and Clear Coat, is critical for achieving optimal finish and protection. Technological advancements are significantly favoring sustainable solutions, with water-borne and solvent-borne coatings currently dominating applications, while electrocoat and powder coatings are gaining momentum. Passenger vehicles constitute the largest application segment, followed by commercial vehicles and the ACE (Automotive, Construction, and Electronics) sector. Leading manufacturers such as Nippon Paint Holdings, BASF SE, and PPG Industries are actively investing in R&D to meet the evolving demand for high-performance and environmentally conscious automotive coatings in South Korea.

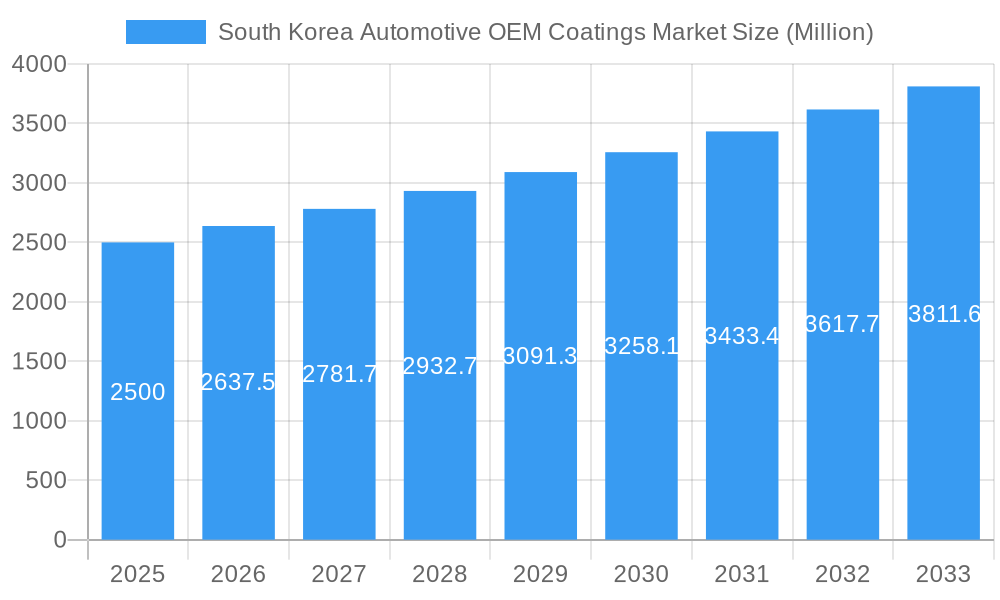

South Korea Automotive OEM Coatings Market Company Market Share

This comprehensive report offers an in-depth analysis of the South Korea Automotive OEM Coatings Market, detailing its dynamics, growth trends, and future outlook. It provides a granular breakdown of market segments including Resin (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Other Resins), Layer (E-Coat, Primer, Base Coat, Clear Coat), Technology (Water-Borne, Solvent-Borne, Electrocoat, Powder Coatings), and Application (Passenger Vehicles, Commercial Vehicles, ACE). This report is an essential resource for stakeholders aiming to leverage opportunities within this crucial industry. Covering the Base Year of 2024 and extending through a Forecast Period of 2025–2033, it delivers precise projections and historical insights from 2019–2024. All quantitative data is presented in billions.

South Korea Automotive OEM Coatings Market Market Dynamics & Structure

The South Korea Automotive OEM Coatings Market exhibits a moderately concentrated structure, with a few dominant players holding significant market shares, while a dynamic landscape of smaller, specialized firms contributes to innovation and competition. Technological advancements, particularly in the realm of sustainable and high-performance coatings, are key drivers of market evolution. Stringent environmental regulations and growing consumer demand for eco-friendly solutions are pushing OEMs towards the adoption of Water-Borne and Powder Coatings. The competitive product substitute landscape is characterized by ongoing research into novel resin chemistries and application techniques that enhance durability, aesthetic appeal, and cost-efficiency. End-user demographics, influenced by increasing disposable incomes and a preference for premium vehicles, are indirectly shaping the demand for advanced OEM coatings. Mergers and acquisitions (M&A) trends, though less frequent in recent years, remain a strategic lever for market consolidation and portfolio expansion. For instance, the last five years have seen approximately 2-3 significant M&A activities focused on acquiring specialized technological capabilities or expanding regional reach. Barriers to entry include high initial investment costs for R&D and manufacturing, and the need to secure stringent OEM approvals.

- Market Concentration: Dominated by a mix of global chemical giants and strong local players.

- Technological Innovation Drivers: Focus on sustainability, performance enhancement (durability, scratch resistance), and smart coatings.

- Regulatory Frameworks: Increasingly stringent VOC emission standards and environmental impact assessments.

- Competitive Product Substitutes: Advancements in UV-curable coatings and bio-based resins.

- End-User Demographics: Growing demand for personalized aesthetics and advanced protective features in vehicles.

- M&A Trends: Strategic acquisitions focused on technology acquisition and market share expansion.

South Korea Automotive OEM Coatings Market Growth Trends & Insights

The South Korea Automotive OEM Coatings Market is poised for robust growth, fueled by a confluence of factors including sustained demand for new vehicles, technological advancements, and evolving consumer preferences. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033, reflecting a significant expansion from its current valuation. Adoption rates of advanced coating technologies, such as Water-Borne and Powder Coatings, are accelerating as manufacturers prioritize environmental compliance and operational efficiency. Technological disruptions, including the integration of self-healing and color-changing functionalities into coatings, are set to redefine product offerings and create new market segments. Consumer behavior shifts towards a greater emphasis on vehicle aesthetics, longevity, and sustainable choices are directly influencing OEM coating specifications. The penetration of electric vehicles (EVs) is also a key growth influencer, demanding specialized coatings for battery protection, thermal management, and unique visual finishes. The market penetration of advanced coatings is expected to reach XX% by 2030.

Dominant Regions, Countries, or Segments in South Korea Automotive OEM Coatings Market

Within the South Korea Automotive OEM Coatings Market, the Passenger Vehicles segment is the primary driver of growth, accounting for an estimated XX% of the market share in 2025. This dominance is underpinned by the country's strong automotive manufacturing base and consistently high consumer demand for personal transportation. The Clear Coat layer is also a dominant segment, crucial for providing aesthetic appeal, UV protection, and scratch resistance, representing approximately XX% of the market value. In terms of technology, Water-Borne coatings are increasingly favored due to their lower volatile organic compound (VOC) emissions, capturing a growing market share and estimated to reach XX% by 2030. Regionally, the Gyeonggi Province, home to major automotive manufacturing hubs and R&D centers, leads in coating consumption. Economic policies supporting the automotive sector and infrastructure development for advanced manufacturing further bolster this dominance.

- Application Dominance: Passenger Vehicles (XX% market share in 2025) – driven by robust domestic demand and export volumes.

- Layer Dominance: Clear Coat (XX% market share in 2025) – essential for aesthetic appeal and protection.

- Technology Dominance: Water-Borne Coatings (projected XX% market share by 2030) – driven by environmental regulations and OEM sustainability goals.

- Regional Strength: Gyeonggi Province – concentration of automotive manufacturing facilities and R&D.

- Key Drivers: Government incentives for automotive exports, continuous OEM innovation in vehicle design, and rising consumer expectations for vehicle durability and appearance.

South Korea Automotive OEM Coatings Market Product Landscape

The South Korea Automotive OEM Coatings Market is characterized by a dynamic product landscape focused on delivering enhanced performance, superior aesthetics, and environmental sustainability. Manufacturers are continuously innovating with advanced formulations that offer superior scratch resistance, UV protection, and corrosion prevention. New developments include low-VOC Water-Borne coatings with improved drying times and durability, as well as specialty coatings designed for the unique requirements of electric vehicles, such as thermal management and battery pack protection. The aesthetic appeal is further enhanced through the development of novel color effects, matte finishes, and customized textures, catering to evolving consumer preferences for vehicle personalization. Unique selling propositions often revolve around patented resin technologies that offer a balance of performance, cost-effectiveness, and eco-friendliness.

Key Drivers, Barriers & Challenges in South Korea Automotive OEM Coatings Market

Key Drivers: The South Korea Automotive OEM Coatings Market is propelled by sustained demand for passenger and commercial vehicles, driven by both domestic consumption and significant export volumes. Continuous technological innovation by OEMs, focusing on vehicle performance, aesthetics, and lightweighting, directly translates into demand for advanced coating solutions. Stringent environmental regulations promoting the use of low-VOC and sustainable coatings, such as Water-Borne and Powder Coatings, act as powerful adoption catalysts. The growing electric vehicle (EV) market also presents a significant growth avenue, necessitating specialized coatings.

Barriers & Challenges: High capital investment for R&D and manufacturing facilities poses a significant barrier to entry for new players. Securing OEM approvals is a lengthy and complex process, requiring extensive testing and validation. Fluctuations in raw material prices, particularly for key resins and pigments, can impact profit margins and supply chain stability. Intense competition among established global and local players leads to price pressures and necessitates continuous innovation to maintain market share. Supply chain disruptions, exacerbated by geopolitical events, can affect the availability and cost of critical raw materials.

Emerging Opportunities in South Korea Automotive OEM Coatings Market

Emerging opportunities in the South Korea Automotive OEM Coatings Market lie in the expanding electric vehicle (EV) sector, which requires specialized coatings for thermal management, battery protection, and unique aesthetic finishes. The growing demand for advanced driver-assistance systems (ADAS) is creating opportunities for functional coatings that integrate sensors or improve radar/lidar transparency. Furthermore, the trend towards vehicle personalization and customization presents a niche market for specialty and effect coatings. The increasing focus on circular economy principles is also driving interest in recyclable and bio-based coating solutions, offering a significant avenue for innovation and market differentiation.

Growth Accelerators in the South Korea Automotive OEM Coatings Market Industry

The growth accelerators for the South Korea Automotive OEM Coatings Market are primarily driven by continuous technological breakthroughs in coating formulations, leading to enhanced performance, durability, and environmental compliance. Strategic partnerships between coating manufacturers and automotive OEMs are crucial for co-developing innovative solutions tailored to new vehicle architectures and material applications, particularly for EVs and autonomous vehicles. Market expansion strategies, including the development of localized production facilities and targeted sales channels, will further fuel long-term growth. Investment in R&D for sustainable coating technologies, such as advanced Water-Borne and Powder Coatings, will remain a key catalyst for capturing market share and meeting evolving regulatory demands.

Key Players Shaping the South Korea Automotive OEM Coatings Market Market

- Noroo Paints & Coating

- RPM International Inc

- CHOKWANG PAINT

- Korea Chemical Company Limited (KCC Corp)

- Nippon Paint Holdings Co Ltd

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- Samhwa Paint Industrial Co

- PPG Industries

- Covestro AG

- Kansai Paint Co Ltd

Notable Milestones in South Korea Automotive OEM Coatings Market Sector

- 2019: Launch of novel eco-friendly Water-Borne basecoat systems by major players, focusing on reduced VOC emissions.

- 2020: Increased R&D investment in advanced protective coatings for electric vehicle battery packs and components.

- 2021: Introduction of new digital color matching tools to enhance OEM customization capabilities.

- 2022: Strategic collaborations to develop coatings with enhanced self-healing properties.

- 2023: Major players focus on expanding production capacity for sustainable coating solutions to meet growing demand.

- 2024: Significant advancements in Powder Coatings technology for automotive applications, offering improved efficiency and performance.

In-Depth South Korea Automotive OEM Coatings Market Market Outlook

The future outlook for the South Korea Automotive OEM Coatings Market is exceptionally promising, driven by sustained demand from the automotive sector and a strong push towards sustainable and high-performance solutions. Growth accelerators include the continued evolution of electric vehicle technology, necessitating specialized and innovative coatings. Strategic partnerships between global and local players will foster the development of cutting-edge functionalities and expand market reach. The focus on circular economy principles will also unlock new opportunities in recyclable and bio-based coating materials. Continuous technological advancements in Water-Borne and Powder Coatings, coupled with increasingly stringent environmental regulations, will solidify their market dominance, ensuring sustained growth and market leadership in the coming years.

South Korea Automotive OEM Coatings Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resins

-

2. Layer

- 2.1. E-Coat

- 2.2. Pirmer

- 2.3. Base Coat

- 2.4. Clear Coat

-

3. Technology

- 3.1. Water-Borne

- 3.2. Solvent-Borne

- 3.3. Electrocoat

- 3.4. Powder Coatings

-

4. Application

- 4.1. Passenger Vehicles

- 4.2. Commercial Vehicles

- 4.3. ACE

South Korea Automotive OEM Coatings Market Segmentation By Geography

- 1. South Korea

South Korea Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of South Korea Automotive OEM Coatings Market

South Korea Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies

- 3.4. Market Trends

- 3.4.1. Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Layer

- 5.2.1. E-Coat

- 5.2.2. Pirmer

- 5.2.3. Base Coat

- 5.2.4. Clear Coat

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-Borne

- 5.3.2. Solvent-Borne

- 5.3.3. Electrocoat

- 5.3.4. Powder Coatings

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Passenger Vehicles

- 5.4.2. Commercial Vehicles

- 5.4.3. ACE

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Noroo Paints & Coating

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPM International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHOKWANG PAINT

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korea Chemical Company Limited (KCC Corp )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Axalta Coating Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samhwa Paint Industrial Co*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covestro AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Paint Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Noroo Paints & Coating

List of Figures

- Figure 1: South Korea Automotive OEM Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 2: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2020 & 2033

- Table 3: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Layer 2020 & 2033

- Table 4: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2020 & 2033

- Table 5: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 7: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2020 & 2033

- Table 9: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2020 & 2033

- Table 11: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 12: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2020 & 2033

- Table 13: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Layer 2020 & 2033

- Table 14: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2020 & 2033

- Table 15: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 17: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2020 & 2033

- Table 19: South Korea Automotive OEM Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive OEM Coatings Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the South Korea Automotive OEM Coatings Market?

Key companies in the market include Noroo Paints & Coating, RPM International Inc, CHOKWANG PAINT, Korea Chemical Company Limited (KCC Corp ), Nippon Paint Holdings Co Ltd, BASF SE, Axalta Coating Systems, Akzo Nobel N V, Samhwa Paint Industrial Co*List Not Exhaustive, PPG Industries, Covestro AG, Kansai Paint Co Ltd.

3. What are the main segments of the South Korea Automotive OEM Coatings Market?

The market segments include Resin, Layer, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market.

7. Are there any restraints impacting market growth?

Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence