Key Insights

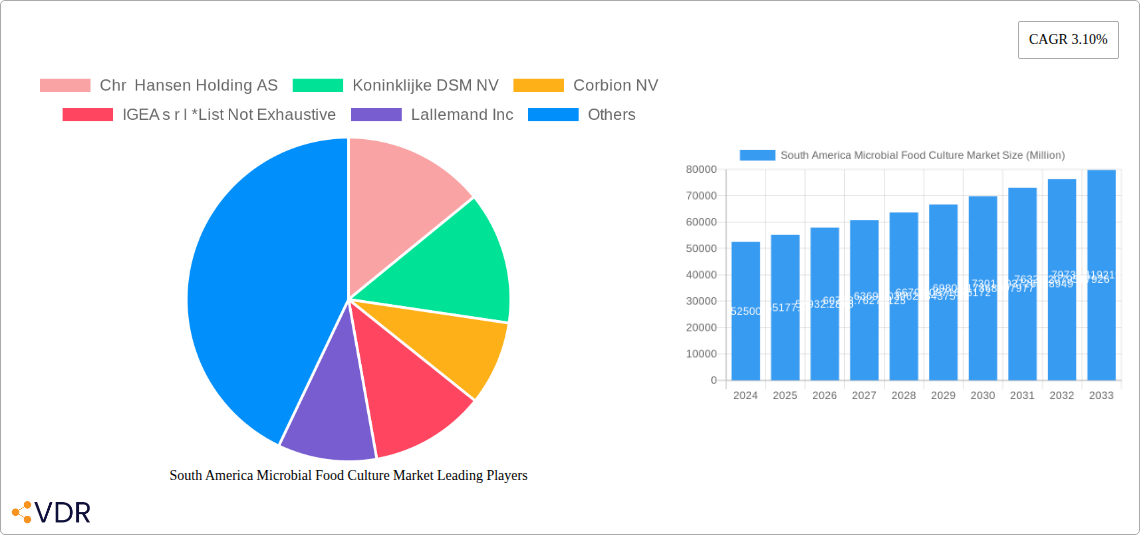

The South America Microbial Food Culture Market is poised for significant expansion, projected to reach an estimated USD 52.5 billion in 2024, with a robust Compound Annual Growth Rate (CAGR) of 5.1% expected through 2033. This substantial growth is underpinned by several key drivers. Increasing consumer demand for naturally preserved and health-enhancing food products is a primary catalyst, propelling the adoption of starter, adjunct, and aroma cultures in dairy, bakery, and confectionery applications. Furthermore, the rising awareness of the health benefits associated with probiotics is fueling their integration into a wider array of food and beverage items, including fermented dairy, functional beverages, and even baked goods. The trend towards clean-label products and the desire for enhanced taste and texture in food formulations are also significant contributors to market expansion. Innovations in microbial strain development, offering improved performance and specificity, are further bolstering market penetration.

South America Microbial Food Culture Market Market Size (In Billion)

Despite the promising outlook, certain restraints could influence the market's trajectory. Fluctuations in raw material prices and stringent regulatory frameworks for food additives and microbial ingredients in different South American nations could pose challenges. However, the vast and diverse agricultural landscape of the region, coupled with the growing sophistication of its food processing industry, presents ample opportunities. The bakery and confectionery segment is expected to witness substantial growth, driven by a preference for traditional and innovative baked goods. Similarly, the dairy sector, a cornerstone of South American diets, will continue to be a major consumer of microbial cultures for yogurt, cheese, and other fermented products. The fruits and vegetables, and beverage segments are also demonstrating increasing adoption, reflecting a broader shift towards healthier and more diversified food consumption patterns across countries like Brazil, Argentina, and Colombia.

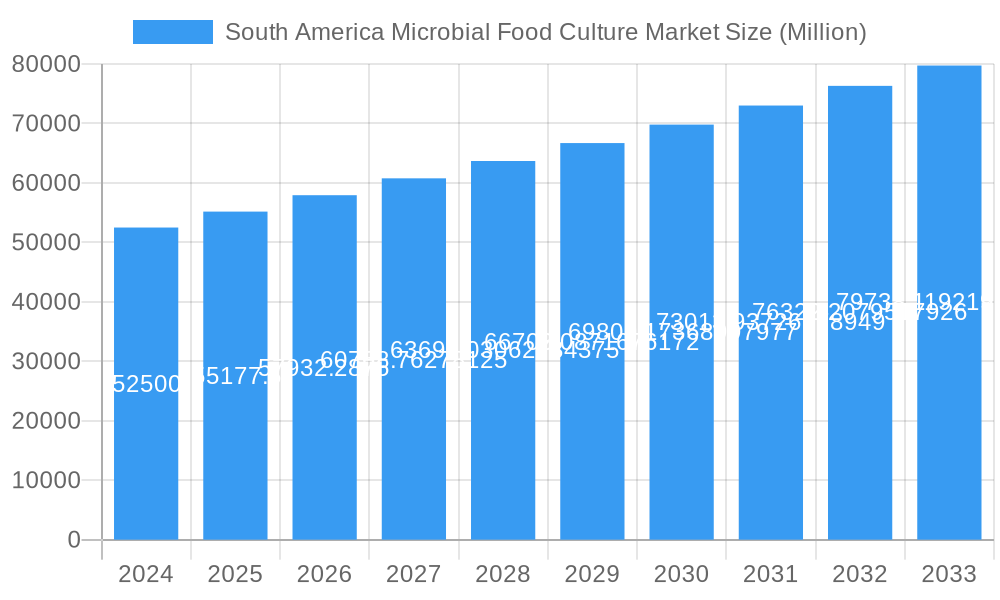

South America Microbial Food Culture Market Company Market Share

South America Microbial Food Culture Market: A Comprehensive Analysis of Growth, Trends, and Opportunities (2019–2033)

This in-depth report provides a detailed examination of the South America Microbial Food Culture Market, a critical sector within the food ingredient and biotechnology landscape. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this analysis delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the competitive strategies of leading players. With a projected market size of $2.5 billion by 2025 and an estimated growth to $4.2 billion by 2033, this market is poised for significant expansion driven by increasing consumer demand for natural food ingredients, fermented products, and health-enhancing functional foods.

South America Microbial Food Culture Market Market Dynamics & Structure

The South America Microbial Food Culture Market is characterized by a moderately concentrated structure, with key global players holding significant market share, alongside a growing number of regional and specialized manufacturers. Technological innovation is a primary driver, fueled by advancements in microbial strain selection, fermentation processes, and genetic engineering, leading to improved culture performance and novel applications in food production. Regulatory frameworks, while evolving, are increasingly focusing on food safety, labeling transparency, and the recognition of microbial cultures for their beneficial properties, particularly probiotics. Competitive product substitutes, such as chemical preservatives and artificial flavorings, are present but are facing increasing consumer preference for natural alternatives. End-user demographics are shifting towards a more health-conscious and ingredient-aware consumer base, driving demand for microbial cultures that offer functional benefits. Mergers and acquisitions (M&A) trends are observed, as larger companies seek to expand their product portfolios, geographic reach, and technological capabilities, further consolidating the market.

- Market Concentration: Dominated by a few multinational corporations with strong R&D capabilities and established distribution networks.

- Technological Innovation Drivers: Focus on developing robust, high-performing microbial strains with enhanced shelf-life, specific flavor profiles, and improved probiotic efficacy.

- Regulatory Frameworks: Increasing emphasis on GRAS (Generally Recognized As Safe) status for new strains and clear labeling of microbial ingredients.

- Competitive Product Substitutes: Traditional preservatives and synthetic additives are being challenged by the rising popularity of natural, fermented food products.

- End-User Demographics: Growing demand from health-conscious consumers seeking functional foods, fermented dairy products, and plant-based alternatives.

- M&A Trends: Strategic acquisitions by key players to gain market share, acquire new technologies, and diversify product offerings.

South America Microbial Food Culture Market Growth Trends & Insights

The South America Microbial Food Culture Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033. This expansion is underpinned by a confluence of evolving consumer preferences and significant advancements in food technology. The increasing consumer awareness regarding the health benefits associated with fermented foods, such as improved gut health, enhanced nutrient absorption, and immune system support, is a paramount driver. This has led to a substantial surge in demand for probiotic cultures in various food applications, from yogurts and kefirs to supplements and specialized beverages. Furthermore, the burgeoning interest in artisanal and naturally preserved foods is fueling the adoption of starter and adjunct cultures that impart unique flavors, textures, and aromas to products like cheeses, baked goods, and cured meats.

Technological disruptions are playing a pivotal role in shaping market trajectory. Innovations in downstream processing, strain optimization, and precision fermentation techniques are leading to the development of more efficient, cost-effective, and tailored microbial solutions. This includes the creation of cultures with extended shelf-lives, improved performance under varying processing conditions, and the ability to produce specific bioactive compounds. The rise of plant-based diets has also opened new avenues for microbial cultures, with ongoing research into their application in developing innovative dairy alternatives, meat substitutes, and fermented plant-based yogurts and cheeses that mimic the taste and texture of traditional products. Market penetration is deepening across diverse end-user industries, with significant growth anticipated in the dairy sector, followed by bakery, confectionery, and the rapidly expanding functional beverage market. Consumer behavior shifts towards seeking natural ingredients and transparent labeling further propel the market, as microbial cultures are perceived as natural and beneficial additives. The overall market size is expected to witness a healthy increase, reflecting the growing integration of these specialized ingredients into everyday food products.

Dominant Regions, Countries, or Segments in South America Microbial Food Culture Market

Within the South America Microbial Food Culture Market, the Dairy segment stands out as the most dominant end-industry, accounting for an estimated 45% of the market share in 2025. This dominance is driven by the region's rich tradition of dairy consumption and the widespread popularity of fermented dairy products such as yogurt, cheese, kefir, and artisanal dairy specialties. Consumers in South America have a deeply ingrained preference for the taste, texture, and perceived health benefits offered by these cultured dairy items. The robust demand for probiotic-enriched yogurts and the continuous innovation in cheese production, leveraging specific starter and adjunct cultures for unique flavor profiles, solidify the dairy sector's leading position.

Brazil and Argentina are identified as the leading countries in this segment, benefiting from large domestic markets, well-established dairy processing industries, and a growing consumer base actively seeking health-promoting food options. Economic policies supporting agricultural development and food manufacturing, coupled with investments in research and development for dairy cultures, further bolster their market leadership.

Among the product types, Starter Cultures represent the largest category, holding an estimated 50% of the market share. These cultures are indispensable for the initial fermentation process in a wide array of food products, particularly in dairy and bakery. Their ability to control fermentation speed, influence flavor development, and ensure product consistency makes them fundamental to food manufacturing. The increasing demand for a diverse range of cheeses, yogurts, and fermented meat products directly translates into sustained demand for high-quality starter cultures.

- Dominant End-Industry: Dairy, accounting for an estimated 45% market share, driven by high consumption of yogurts, cheeses, and fermented milk products.

- Leading Countries: Brazil and Argentina, with their substantial dairy production, consumption, and advanced food processing capabilities.

- Dominant Product Type: Starter Cultures, representing approximately 50% of the market, essential for controlled fermentation in dairy, bakery, and meat products.

- Key Growth Drivers:

- Economic Policies: Favorable government support for the food processing industry and agricultural sectors.

- Consumer Preferences: Strong cultural inclination towards fermented foods and growing demand for natural, healthy ingredients.

- Infrastructure: Well-developed logistics and cold chain infrastructure supporting the distribution of perishable food cultures.

- Innovation in Dairy: Continuous development of novel dairy products and artisanal cheese varieties requiring specialized cultures.

South America Microbial Food Culture Market Product Landscape

The product landscape of the South America Microbial Food Culture Market is characterized by a continuous stream of innovations aimed at enhancing product performance, expanding applications, and meeting evolving consumer demands. Key developments include the introduction of highly robust starter cultures with improved acid production rates and flavor profiles, enabling faster and more efficient fermentation in dairy and bakery products. Adjunct and aroma cultures are seeing increased utilization for developing complex and unique taste notes in artisanal cheeses and fermented meats, differentiating products in a competitive market. The probiotics segment is witnessing significant growth with the development of strains offering specific health benefits, such as improved gut health, immune support, and even mood enhancement, leading to their integration into a wider array of functional foods and beverages beyond traditional dairy. Companies are also focusing on developing cultures that are resistant to processing stresses, ensuring viability and efficacy throughout the food production chain.

Key Drivers, Barriers & Challenges in South America Microbial Food Culture Market

Key Drivers:

- Growing Health and Wellness Trends: Increasing consumer focus on natural ingredients, probiotics, and the health benefits of fermented foods is a significant market propellant.

- Demand for Natural and Clean Label Products: Consumers are actively seeking alternatives to artificial preservatives and additives, driving the adoption of microbial cultures.

- Expansion of Processed Food Industry: Growth in the dairy, bakery, and confectionery sectors, coupled with the rise of convenience foods, fuels demand for food cultures.

- Technological Advancements: Ongoing research and development in strain selection, fermentation technology, and culture optimization are leading to innovative and improved product offerings.

Barriers & Challenges:

- Supply Chain Complexity and Cold Chain Requirements: Maintaining the viability and efficacy of live microbial cultures throughout the supply chain presents logistical challenges.

- Regulatory Hurdles and Approval Processes: Navigating varied national regulations for food ingredients and the approval process for new microbial strains can be time-consuming and costly.

- Price Sensitivity and Competition: The market faces competition from established players and potential price pressures, especially in commodity food segments.

- Consumer Education and Awareness: Ensuring widespread consumer understanding of the benefits and applications of various microbial cultures requires ongoing educational efforts.

- Microbial Contamination Risks: Ensuring the purity and consistent performance of cultures to prevent unwanted microbial growth in food products is a critical operational challenge.

Emerging Opportunities in South America Microbial Food Culture Market

Emerging opportunities in the South America Microbial Food Culture Market lie in the expanding functional food and beverage sector, particularly in the development of plant-based fermented products. As consumer demand for vegan and vegetarian options grows, microbial cultures play a crucial role in replicating the taste, texture, and fermentation characteristics of traditional dairy products in plant-based alternatives like yogurts, cheeses, and milks. Furthermore, the untapped potential in developing novel probiotic strains targeting specific health outcomes beyond general gut health, such as immune modulation or cognitive function, presents a significant avenue for growth. The increasing interest in personalized nutrition also opens doors for customized microbial solutions tailored to individual dietary needs and health goals. The burgeoning market for fermented ingredients in non-traditional food categories like snacks and beverages also offers considerable growth potential.

Growth Accelerators in the South America Microbial Food Culture Market Industry

Several catalysts are accelerating long-term growth in the South America Microbial Food Culture Market. Technological breakthroughs in genetic engineering and synthetic biology are enabling the development of more specialized and high-performing microbial strains with tailored functionalities, such as enhanced production of specific enzymes or flavor compounds. Strategic partnerships between culture manufacturers, food processors, and research institutions are fostering innovation and accelerating product development cycles. Market expansion strategies, including the penetration into emerging economies within South America and the development of niche product lines for specific dietary requirements (e.g., allergen-free cultures), are further driving growth. The growing emphasis on sustainability within the food industry also presents an opportunity for microbial cultures that can contribute to reducing food waste and improving resource efficiency in food production.

Key Players Shaping the South America Microbial Food Culture Market Market

- Chr Hansen Holding AS

- Koninklijke DSM NV

- Corbion NV

- IGEA s r l

- Lallemand Inc

Notable Milestones in South America Microbial Food Culture Market Sector

- 2022: Chr Hansen Holding AS launches a new range of probiotic strains specifically for the South American market, targeting gut health and immunity.

- 2021: Koninklijke DSM NV announces significant investment in R&D for plant-based fermentation solutions, expanding its offerings for the growing vegan food sector.

- 2020: Corbion NV acquires a South American biotech firm, enhancing its local production capabilities and distribution network for food cultures.

- 2019: Lallemand Inc receives regulatory approval for a novel starter culture that enhances flavor complexity in artisanal cheeses across several South American countries.

In-Depth South America Microbial Food Culture Market Market Outlook

The future of the South America Microbial Food Culture Market is exceptionally promising, driven by the sustained momentum of health and wellness trends, a growing preference for natural ingredients, and continuous technological innovation. The market's trajectory is expected to be characterized by increasing demand for functional foods, personalized nutrition solutions, and plant-based alternatives, all of which rely heavily on advanced microbial cultures. Strategic investments in research and development, coupled with potential consolidation through mergers and acquisitions, will further shape the competitive landscape. The integration of digital technologies in fermentation processes and supply chain management will also play a crucial role in optimizing efficiency and ensuring product quality. Overall, the market is poised for significant expansion, presenting substantial opportunities for stakeholders to capitalize on evolving consumer needs and food industry advancements.

South America Microbial Food Culture Market Segmentation

-

1. Type

- 1.1. Starter Cultures

- 1.2. Adjunct and Aroma Cultures

- 1.3. Probiotics

-

2. End-Industry

- 2.1. Bakery and Confectionery

- 2.2. Dairy

- 2.3. Fruits and Vegetables

- 2.4. Beverages

- 2.5. Other End-user Industries

South America Microbial Food Culture Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Microbial Food Culture Market Regional Market Share

Geographic Coverage of South America Microbial Food Culture Market

South America Microbial Food Culture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Starter Culture in Food & Beverage Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Microbial Food Culture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Starter Cultures

- 5.1.2. Adjunct and Aroma Cultures

- 5.1.3. Probiotics

- 5.2. Market Analysis, Insights and Forecast - by End-Industry

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy

- 5.2.3. Fruits and Vegetables

- 5.2.4. Beverages

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chr Hansen Holding AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koninklijke DSM NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corbion NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IGEA s r l *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lallemand Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Chr Hansen Holding AS

List of Figures

- Figure 1: South America Microbial Food Culture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Microbial Food Culture Market Share (%) by Company 2025

List of Tables

- Table 1: South America Microbial Food Culture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Microbial Food Culture Market Revenue undefined Forecast, by End-Industry 2020 & 2033

- Table 3: South America Microbial Food Culture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: South America Microbial Food Culture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: South America Microbial Food Culture Market Revenue undefined Forecast, by End-Industry 2020 & 2033

- Table 6: South America Microbial Food Culture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Microbial Food Culture Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Microbial Food Culture Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the South America Microbial Food Culture Market?

Key companies in the market include Chr Hansen Holding AS, Koninklijke DSM NV, Corbion NV, IGEA s r l *List Not Exhaustive, Lallemand Inc.

3. What are the main segments of the South America Microbial Food Culture Market?

The market segments include Type, End-Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Starter Culture in Food & Beverage Industries.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Microbial Food Culture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Microbial Food Culture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Microbial Food Culture Market?

To stay informed about further developments, trends, and reports in the South America Microbial Food Culture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence