Key Insights

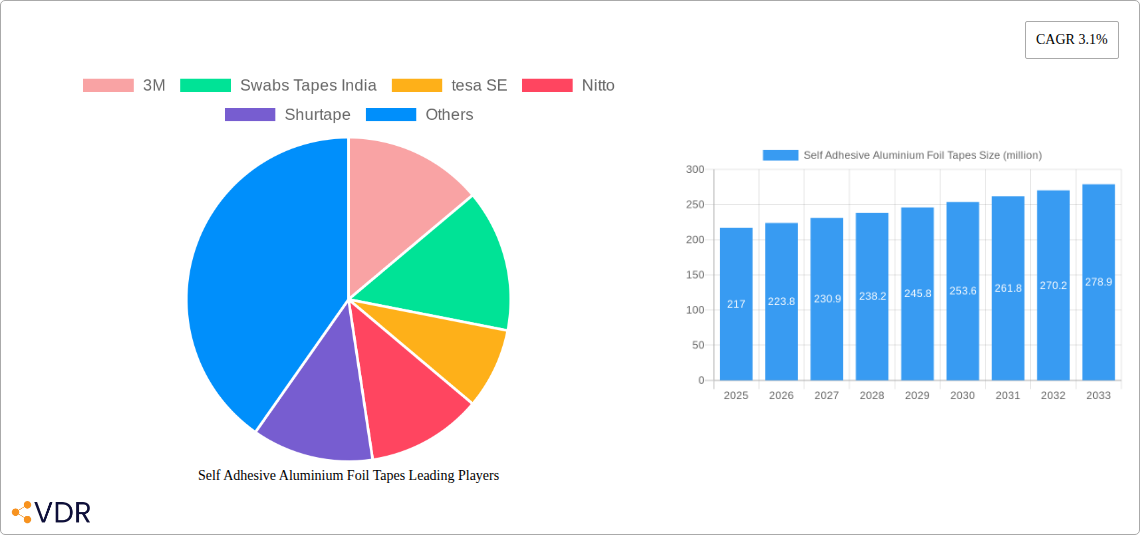

The global market for Self-Adhesive Aluminium Foil Tapes is poised for steady expansion, driven by the unique properties of these tapes that offer excellent thermal insulation, moisture resistance, and reflectivity. The market is estimated to reach USD 217 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 3.1% over the forecast period of 2025-2033. A significant driver for this growth is the burgeoning electronics industry, where these tapes are crucial for shielding sensitive components and dissipating heat in devices ranging from consumer electronics to advanced computing hardware. Furthermore, the construction sector is increasingly adopting these tapes for HVAC systems, insulation applications, and sealing joints, contributing to their widespread use.

Self Adhesive Aluminium Foil Tapes Market Size (In Million)

The automobile industry also presents a substantial growth avenue, with self-adhesive aluminium foil tapes being employed for thermal management in engine compartments, exhaust systems, and battery enclosures in both conventional and electric vehicles. Emerging applications in renewable energy, particularly in solar panel manufacturing and wind turbine blade repair, are also expected to fuel market demand. While the market is robust, restraints such as the availability of alternative sealing and insulation materials and price volatility of raw materials could pose challenges. However, continuous innovation in adhesive technologies and product development, focusing on enhanced durability and specialized functionalities, will likely offset these concerns, ensuring sustained market growth. Key players like 3M, tesa SE, and Nitto are at the forefront of this innovation, introducing advanced solutions to meet evolving industry needs.

Self Adhesive Aluminium Foil Tapes Company Market Share

Self Adhesive Aluminium Foil Tapes Market Report: Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Self Adhesive Aluminium Foil Tapes market, a critical component across diverse industrial applications. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights for stakeholders. Leveraging high-traffic keywords such as aluminium foil tape, self-adhesive tape, industrial tape, HVAC tape, electronics tape, automotive tape, and construction tape, this report maximizes search engine visibility and engages industry professionals, including those in the parent market of adhesives and sealants and the child market of specialty tapes.

Self Adhesive Aluminium Foil Tapes Market Dynamics & Structure

The Self Adhesive Aluminium Foil Tapes market exhibits a moderately concentrated structure, with key players like 3M, tesa SE, and Nitto holding significant shares. Technological innovation is a primary driver, with advancements in adhesive formulations and backing materials enhancing performance and expanding application possibilities. Regulatory frameworks, particularly concerning environmental standards and product safety, are increasingly influencing manufacturing processes and material choices. Competitive product substitutes, while present in some niche areas, struggle to match the unique thermal conductivity, reflectivity, and sealing properties of aluminium foil tapes. End-user demographics reveal a growing demand from the electronics industry, construction industry, and automobile industry, driven by miniaturization, energy efficiency requirements, and lightweighting trends, respectively. Mergers and acquisitions (M&A) activity, while not overtly dominant, contributes to market consolidation and strategic expansion. For instance, a predicted 5 M&A deals in the historical period (2019-2024) aimed at acquiring specialized manufacturing capabilities or expanding geographical reach. Innovation barriers include the capital-intensive nature of R&D for advanced adhesive technologies and the need to meet stringent performance specifications for critical applications.

- Market Concentration: Moderately concentrated, with a few major global players.

- Technological Innovation: Driven by adhesive science and material engineering.

- Regulatory Frameworks: Influencing material compliance and sustainability.

- Competitive Substitutes: Limited in core performance aspects.

- End-User Demographics: Growing demand from electronics, construction, and automotive sectors.

- M&A Trends: Strategic acquisitions for capability enhancement, with an estimated 5 deals in the historical period.

- Innovation Barriers: High R&D costs, stringent performance requirements.

Self Adhesive Aluminium Foil Tapes Growth Trends & Insights

The Self Adhesive Aluminium Foil Tapes market is poised for robust growth, driven by escalating demand across key industrial sectors. The global market size is projected to expand significantly from an estimated $1,200 million in 2025 to $1,850 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 5.5%. Adoption rates are steadily increasing as industries recognize the multifaceted benefits of these tapes, including thermal management, electromagnetic shielding, sealing, and insulation. Technological disruptions, such as the development of high-temperature resistant and environmentally friendly adhesive formulations, are further propelling market penetration. Consumer behavior shifts towards energy-efficient solutions and product longevity are directly impacting the demand for high-performance tapes in applications ranging from HVAC systems to electronic device assembly. The market penetration for specialty aluminium foil tapes is predicted to reach 75% in the automotive sector by 2030, up from 60% in 2024. Market insights indicate a growing preference for tapes with enhanced conformability and adhesion to irregular surfaces, catering to the intricate designs of modern electronic components and automotive interiors. The increasing focus on reducing operational costs through effective insulation and sealing solutions across commercial and residential construction projects is also a significant growth catalyst. The integration of these tapes in renewable energy infrastructure, such as solar panel installation and wind turbine maintenance, further contributes to their expanding application landscape.

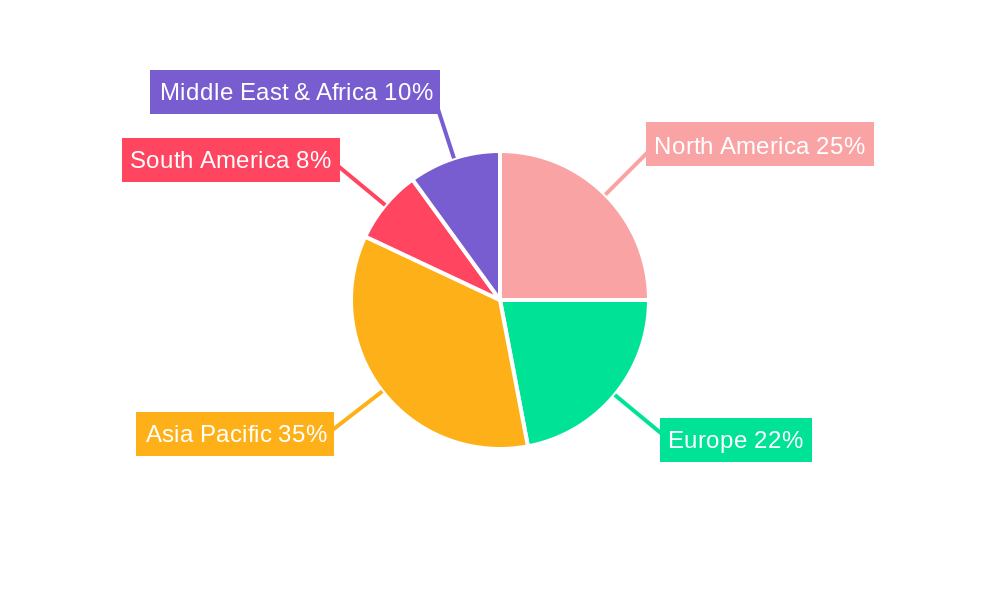

Dominant Regions, Countries, or Segments in Self Adhesive Aluminium Foil Tapes

The Electronics Industry segment stands out as a dominant force in driving the Self Adhesive Aluminium Foil Tapes market growth, projected to account for approximately 35% of the global market share by 2025. This dominance is fueled by the insatiable demand for miniaturization and thermal management in electronic devices, from smartphones and laptops to complex industrial control systems. The 0.1mm-0.15mm thickness category is particularly significant within this segment, offering an optimal balance of performance and conformability for intricate electronic assemblies. Geographically, Asia-Pacific is the leading region, expected to contribute over 40% of the global market revenue in 2025. This leadership is attributed to the region's status as a global manufacturing hub for electronics, automotive components, and construction materials, coupled with favorable economic policies and substantial investments in infrastructure development. Countries like China, South Korea, and Japan are at the forefront of this regional dominance, benefiting from a robust supply chain and a high concentration of end-user industries. The Construction Industry is the second-largest segment, with an estimated market share of 25% by 2025, driven by increasing demand for energy-efficient building solutions and improved HVAC system sealing. The Automobile Industry follows, with a projected market share of 20%, spurred by the trend towards lightweighting and advanced thermal management in electric vehicles and internal combustion engine vehicles.

- Dominant Segment (Application): Electronics Industry (approx. 35% market share in 2025).

- Key Drivers: Miniaturization, thermal management, electromagnetic shielding.

- Growth Potential: High, driven by constant innovation in consumer electronics and industrial automation.

- Dominant Segment (Type): 0.1mm-0.15mm thickness (significant within electronics and automotive).

- Key Attributes: Versatile performance, good conformability.

- Dominant Region: Asia-Pacific (over 40% market share in 2025).

- Key Countries: China, South Korea, Japan.

- Dominance Factors: Manufacturing hub, strong end-user industry presence, infrastructure investment.

- Other Significant Segments: Construction Industry (approx. 25%), Automobile Industry (approx. 20%).

Self Adhesive Aluminium Foil Tapes Product Landscape

The Self Adhesive Aluminium Foil Tapes product landscape is characterized by continuous innovation aimed at enhancing performance and expanding application versatility. Manufacturers are developing tapes with superior thermal conductivity, excellent reflectivity, and improved adhesion to a wide range of substrates. Key product innovations include high-temperature resistant formulations capable of withstanding extreme operational environments in industries like aerospace and industrial manufacturing. Furthermore, advancements in backing materials and adhesive technologies are leading to tapes with enhanced conformability, allowing for easier application on irregular surfaces commonly found in complex electronic assemblies and automotive components. Unique selling propositions often revolve around specific performance metrics such as flame retardancy, UV resistance, and long-term durability. For instance, a new generation of HVAC aluminium foil tapes offers improved moisture barrier properties, contributing to increased energy efficiency and system longevity.

Key Drivers, Barriers & Challenges in Self Adhesive Aluminium Foil Tapes

The Self Adhesive Aluminium Foil Tapes market is propelled by several key drivers. Technological advancements in adhesive formulations, enabling higher temperature resistance and stronger adhesion, are significant. The growing emphasis on energy efficiency and thermal management across industries, particularly in HVAC systems, electronics, and automotive, is a primary growth factor. The increasing adoption of these tapes in renewable energy installations and specialized industrial applications also contributes to market expansion.

- Key Drivers:

- Technological advancements in adhesives and backing materials.

- Growing demand for energy efficiency and thermal management.

- Expansion in electronics, automotive, and construction sectors.

- Increased use in renewable energy and industrial applications.

Conversely, the market faces several barriers and challenges. The relatively higher cost compared to conventional tapes can be a restraint for price-sensitive applications. Supply chain disruptions, particularly for raw materials like aluminium and specialized adhesives, can impact availability and pricing. Stringent regulatory requirements regarding environmental impact and material safety can necessitate costly product reformulation and compliance efforts. Furthermore, intense competition from alternative sealing and insulation materials, though often with performance compromises, presents a continuous challenge.

- Key Barriers & Challenges:

- Higher cost compared to conventional tapes.

- Supply chain volatility and raw material price fluctuations.

- Stringent environmental and safety regulations.

- Competition from alternative materials.

- Need for specialized application expertise in certain industries.

Emerging Opportunities in Self Adhesive Aluminium Foil Tapes

Emerging opportunities in the Self Adhesive Aluminium Foil Tapes market lie in several key areas. The growing adoption of electric vehicles (EVs) presents a significant opportunity, as these vehicles require advanced thermal management and electromagnetic shielding solutions where aluminium foil tapes are crucial. The expansion of 5G infrastructure and data centers will also drive demand for high-performance shielding and thermal tapes. Furthermore, untapped markets in emerging economies, coupled with increasing industrialization, offer substantial growth potential. Innovative applications in niche sectors such as aerospace, medical devices, and advanced manufacturing are also anticipated to open new avenues for growth.

Growth Accelerators in the Self Adhesive Aluminium Foil Tapes Industry

Several factors are acting as growth accelerators for the Self Adhesive Aluminium Foil Tapes industry. Continued research and development leading to lighter, stronger, and more sustainable tape formulations will fuel adoption. Strategic partnerships between tape manufacturers and key end-users, such as automotive OEMs and electronics giants, will accelerate product integration and market penetration. Market expansion strategies focusing on developing regions and targeting new applications will unlock significant growth potential. The increasing global focus on energy conservation and the development of smart buildings and cities will further accelerate the demand for effective insulation and sealing solutions provided by aluminium foil tapes.

Key Players Shaping the Self Adhesive Aluminium Foil Tapes Market

The global Self Adhesive Aluminium Foil Tapes market is shaped by a dynamic landscape of key industry players, each contributing through innovation, market reach, and strategic initiatives. These companies are instrumental in defining product standards, driving technological advancements, and catering to the diverse needs of various industrial sectors.

- 3M

- Swabs Tapes India

- tesa SE

- Nitto

- Shurtape

- Can-Do National Tape

- Intertape Polymer

- Cantech

- Saint-Gobain

- Nichiban Brand

- PPI Adhesive Products

- Scapa Group

- Adhesive Specialties

- Strouse

Notable Milestones in Self Adhesive Aluminium Foil Tapes Sector

The Self Adhesive Aluminium Foil Tapes sector has witnessed several pivotal milestones that have shaped its growth trajectory and market dynamics. These developments reflect continuous innovation, strategic expansions, and the evolving needs of various industries.

- 2019: Launch of ultra-thin (.05mm) aluminium foil tapes with enhanced conductivity for advanced electronics.

- 2020: Introduction of high-temperature resistant tapes (up to 300°C) for aerospace and automotive applications.

- 2021: Major manufacturers invest in sustainable adhesive technologies, aiming for eco-friendly product lines.

- 2022: Increased adoption of aluminium foil tapes in renewable energy infrastructure, such as solar panel installations.

- 2023: Development of specialized tapes with improved electromagnetic interference (EMI) shielding capabilities for 5G applications.

- 2024: Significant increase in M&A activities as larger players acquire specialized tape manufacturers to expand their product portfolios and market reach.

In-Depth Self Adhesive Aluminium Foil Tapes Market Outlook

The future outlook for the Self Adhesive Aluminium Foil Tapes market remains exceptionally positive, driven by persistent technological advancements and expanding application horizons. Growth accelerators such as the burgeoning electric vehicle sector, the ongoing expansion of 5G networks, and the global push for energy-efficient infrastructure will continue to fuel demand. Strategic partnerships and the exploration of untapped markets in developing economies are expected to further enhance market penetration. The industry is well-positioned to capitalize on these trends, offering advanced solutions that meet the stringent performance requirements of modern manufacturing and infrastructure projects, ensuring a robust and sustained growth trajectory for the foreseeable future.

Self Adhesive Aluminium Foil Tapes Segmentation

-

1. Application

- 1.1. Electronics Industry

- 1.2. Construction Industry

- 1.3. Automobile Industry

- 1.4. Other

-

2. Types

- 2.1. 0.05mm-0.08mm

- 2.2. 0.1mm-0.15mm

- 2.3. Other

Self Adhesive Aluminium Foil Tapes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Self Adhesive Aluminium Foil Tapes Regional Market Share

Geographic Coverage of Self Adhesive Aluminium Foil Tapes

Self Adhesive Aluminium Foil Tapes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electronics Industry

- 5.1.2. Construction Industry

- 5.1.3. Automobile Industry

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 0.05mm-0.08mm

- 5.2.2. 0.1mm-0.15mm

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electronics Industry

- 6.1.2. Construction Industry

- 6.1.3. Automobile Industry

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 0.05mm-0.08mm

- 6.2.2. 0.1mm-0.15mm

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electronics Industry

- 7.1.2. Construction Industry

- 7.1.3. Automobile Industry

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 0.05mm-0.08mm

- 7.2.2. 0.1mm-0.15mm

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electronics Industry

- 8.1.2. Construction Industry

- 8.1.3. Automobile Industry

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 0.05mm-0.08mm

- 8.2.2. 0.1mm-0.15mm

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electronics Industry

- 9.1.2. Construction Industry

- 9.1.3. Automobile Industry

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 0.05mm-0.08mm

- 9.2.2. 0.1mm-0.15mm

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Self Adhesive Aluminium Foil Tapes Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electronics Industry

- 10.1.2. Construction Industry

- 10.1.3. Automobile Industry

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 0.05mm-0.08mm

- 10.2.2. 0.1mm-0.15mm

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swabs Tapes India

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 tesa SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nitto

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shurtape

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Can-Do National Tape

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intertape Polymer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cantech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saint-Gobain

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nichiban Brand

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PPI Adhesive Products

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Scapa Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Adhesive Specialties

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Strouse

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Self Adhesive Aluminium Foil Tapes Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Self Adhesive Aluminium Foil Tapes Revenue (million), by Application 2025 & 2033

- Figure 3: North America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Self Adhesive Aluminium Foil Tapes Revenue (million), by Types 2025 & 2033

- Figure 5: North America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Self Adhesive Aluminium Foil Tapes Revenue (million), by Country 2025 & 2033

- Figure 7: North America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Self Adhesive Aluminium Foil Tapes Revenue (million), by Application 2025 & 2033

- Figure 9: South America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Self Adhesive Aluminium Foil Tapes Revenue (million), by Types 2025 & 2033

- Figure 11: South America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Self Adhesive Aluminium Foil Tapes Revenue (million), by Country 2025 & 2033

- Figure 13: South America Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Self Adhesive Aluminium Foil Tapes Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Self Adhesive Aluminium Foil Tapes Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Self Adhesive Aluminium Foil Tapes Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Self Adhesive Aluminium Foil Tapes Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Self Adhesive Aluminium Foil Tapes Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self Adhesive Aluminium Foil Tapes?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Self Adhesive Aluminium Foil Tapes?

Key companies in the market include 3M, Swabs Tapes India, tesa SE, Nitto, Shurtape, Can-Do National Tape, Intertape Polymer, Cantech, Saint-Gobain, Nichiban Brand, PPI Adhesive Products, Scapa Group, Adhesive Specialties, Strouse.

3. What are the main segments of the Self Adhesive Aluminium Foil Tapes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 217 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self Adhesive Aluminium Foil Tapes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self Adhesive Aluminium Foil Tapes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self Adhesive Aluminium Foil Tapes?

To stay informed about further developments, trends, and reports in the Self Adhesive Aluminium Foil Tapes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence