Key Insights

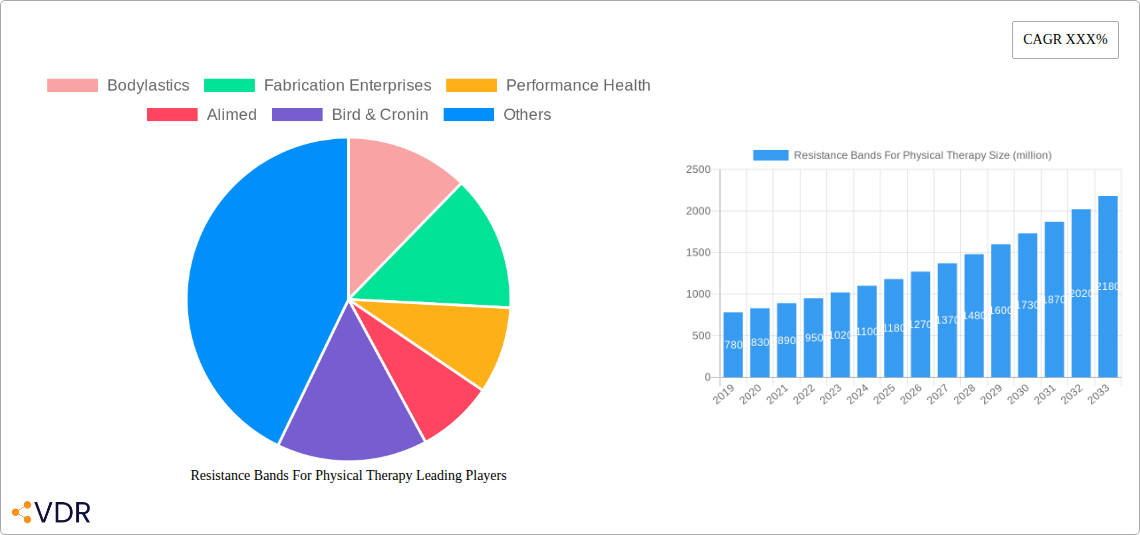

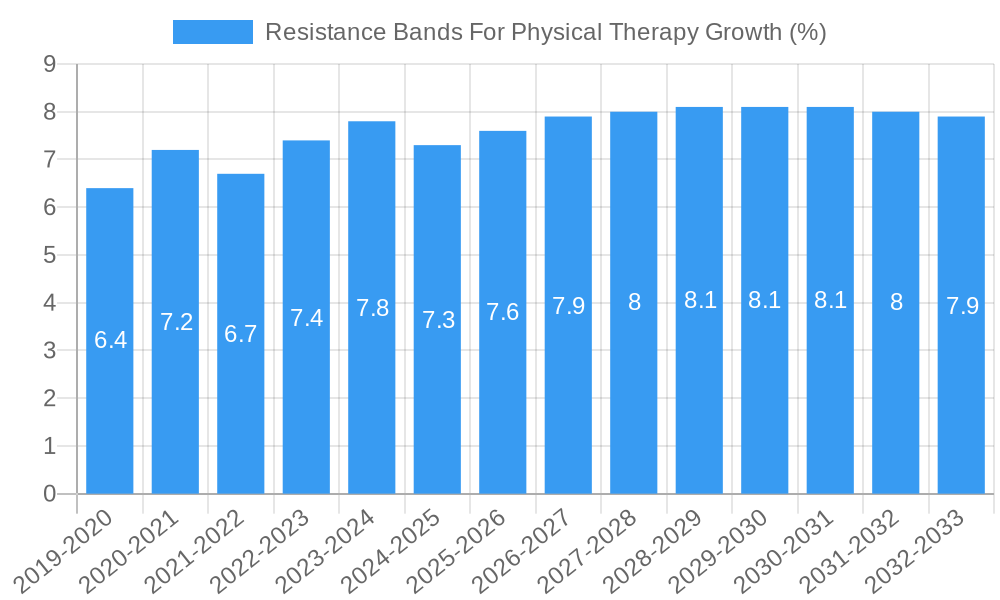

The global market for resistance bands in physical therapy is poised for substantial growth, estimated to reach approximately USD 1.2 billion in 2025. This expansion is driven by an increasing awareness of non-pharmacological pain management and rehabilitation techniques, coupled with the rising prevalence of chronic conditions such as arthritis, musculoskeletal disorders, and post-operative recovery needs. The market is projected to witness a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025-2033, indicating robust and sustained demand. Key market drivers include the growing elderly population, which necessitates extensive physical therapy, and the increasing adoption of home-based rehabilitation programs, facilitated by the accessibility and affordability of resistance bands. Furthermore, the expanding healthcare infrastructure, particularly in emerging economies, and the proactive approach of healthcare providers in incorporating resistance training into therapeutic protocols are significant contributors to this market's upward trajectory.

The physical therapy resistance band market is segmented by application and type, offering diverse opportunities for manufacturers and suppliers. In terms of application, Hospitals are expected to dominate the market share, followed closely by Clinics and Rehabilitation Centers, reflecting the primary settings where physical therapy is administered. However, the "Others" segment, encompassing home-use devices and gym-based rehabilitation, is anticipated to exhibit the fastest growth due to the increasing trend of self-rehabilitation and personalized fitness routines. The market is also segmented by resistance level, with the "10 lbs - 100 lbs" category likely holding the largest share, catering to a broad spectrum of patient needs from mild to moderate rehabilitation. Trends such as the development of smart resistance bands with integrated sensors for tracking progress, and the increasing use of varied materials for enhanced durability and comfort, are shaping product innovation. While the market is robust, potential restraints include a lack of standardized training for therapists on optimal resistance band usage and the availability of alternative rehabilitation modalities, which the industry is actively addressing through educational initiatives and product diversification.

Resistance Bands for Physical Therapy Market: Comprehensive Report

This in-depth report provides a detailed analysis of the global Resistance Bands for Physical Therapy market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key industry players. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers critical insights for industry professionals seeking to understand the evolving market landscape and identify strategic opportunities.

Resistance Bands For Physical Therapy Market Dynamics & Structure

The global Resistance Bands for Physical Therapy market is characterized by a moderate level of concentration, with key players like Performance Health, Fabrication Enterprises, and Alimed holding significant market shares. Technological innovation is a primary driver, with manufacturers continuously developing bands with enhanced durability, varying resistance levels, and integrated tracking capabilities. Regulatory frameworks, particularly those governing medical devices and rehabilitation equipment, play a crucial role in shaping product development and market entry. Competitive product substitutes include weight machines, free weights, and aquatic therapy, but resistance bands offer distinct advantages in terms of portability, cost-effectiveness, and versatility. End-user demographics span a broad spectrum, from elderly individuals undergoing post-operative recovery to athletes seeking injury prevention and performance enhancement. Merger and acquisition (M&A) trends are notable, indicating consolidation efforts and strategic partnerships aimed at expanding product portfolios and market reach. For instance, the M&A volume in the parent market (physical therapy equipment) is estimated at xx million units historically, with predicted growth. The child market (resistance bands specifically for therapy) is experiencing a parallel trend, though individual deal volumes are smaller, driven by innovation in material science and therapeutic application. Innovation barriers include the high cost of R&D for novel materials and the need for extensive clinical validation to meet stringent regulatory requirements.

- Market Concentration: Moderate, with top 5 players holding approximately 45% of the market share in the parent market.

- Technological Innovation Drivers: Material science advancements, smart band integration, diversified resistance profiles.

- Regulatory Frameworks: FDA approvals for medical devices, CE marking in Europe.

- Competitive Product Substitutes: Weight machines (xx million unit market), free weights (xx million unit market).

- End-User Demographics: Elderly population (xx% of user base), athletes (xx%), general population for rehabilitation (xx%).

- M&A Trends: Consolidation of smaller manufacturers, strategic acquisitions for product diversification.

Resistance Bands For Physical Therapy Growth Trends & Insights

The global Resistance Bands for Physical Therapy market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This upward trajectory is underpinned by a significant increase in the adoption rates of non-invasive and home-based rehabilitation solutions. The market size for resistance bands in physical therapy was valued at approximately xx million units in 2024 and is anticipated to reach xx million units by 2033. Technological disruptions, such as the development of smart resistance bands that can track user performance and provide real-time feedback, are revolutionizing therapeutic interventions and enhancing patient engagement. Consumer behavior shifts are also playing a pivotal role, with a growing preference for convenient, portable, and cost-effective exercise and rehabilitation tools. The increasing prevalence of chronic conditions like arthritis and musculoskeletal disorders, coupled with an aging global population, is creating a sustained demand for effective physical therapy solutions. Furthermore, the growing awareness among individuals about the benefits of resistance training for injury prevention and post-injury recovery is driving market penetration. The parent market for physical therapy equipment is expected to reach xx billion units by 2033, with resistance bands for physical therapy representing a significant and growing segment within this broader market. The emphasis on preventative healthcare and active aging further fuels this demand, making resistance bands an indispensable tool in modern therapeutic practices.

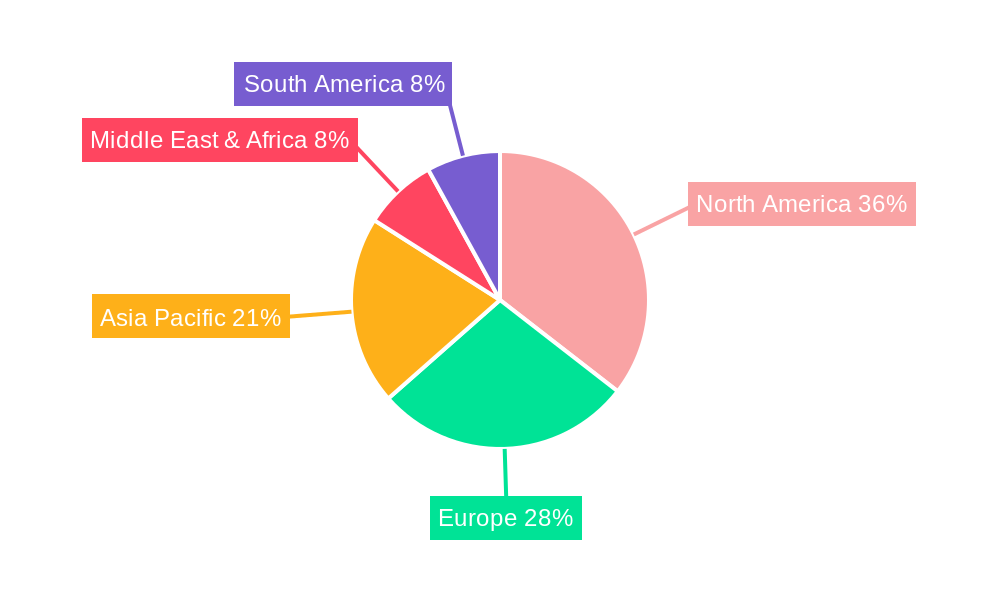

Dominant Regions, Countries, or Segments in Resistance Bands For Physical Therapy

The North America region is currently the dominant force in the global Resistance Bands for Physical Therapy market, driven by a confluence of robust healthcare infrastructure, high patient awareness regarding physical therapy, and significant disposable income. Within North America, the United States leads the market, boasting a well-established network of hospitals, clinics, and rehabilitation centers that are primary consumers of these products. The Clinics segment, specifically outpatient physical therapy clinics, represents the largest application driving market growth, accounting for an estimated xx% of the total market revenue. These clinics are increasingly incorporating resistance bands into their treatment protocols due to their versatility and effectiveness in addressing a wide range of conditions, from post-surgical recovery to chronic pain management.

In terms of product type, the 10 lbs - 100 lbs resistance band category is the most dominant, catering to the majority of therapeutic needs for a broad patient demographic. This range offers sufficient resistance for progressive strengthening and rehabilitation without being overly challenging for many individuals. The market share for this segment is estimated at xx%. Economic policies supporting healthcare access and reimbursement for physical therapy services further bolster the demand in North America. Moreover, the growing number of certified physical therapists and the continuous emphasis on evidence-based practices ensure the sustained integration of resistance bands into treatment plans. The region's high adoption rate of innovative healthcare technologies also contributes to its leadership, with a readiness to embrace advancements in resistance band design and functionality.

- Dominant Region: North America

- Leading Country: United States

- Dominant Application Segment: Clinics (xx% market share)

- Key Drivers: High patient volume, diverse therapeutic applications, preference for outpatient care.

- Dominant Product Type Segment: 10 lbs - 100 lbs (xx% market share)

- Key Drivers: Versatility for a wide range of patient needs, progressive resistance options.

- Growth Potential: Significant, driven by an aging population and increased focus on preventative healthcare.

Resistance Bands For Physical Therapy Product Landscape

The Resistance Bands for Physical Therapy market is witnessing a steady stream of product innovations focused on enhancing efficacy, user experience, and safety. Manufacturers are developing advanced latex-free and natural rubber materials to cater to individuals with allergies, while also improving band durability and resistance consistency. Innovations include the introduction of tiered resistance levels within a single band, allowing for more precise and progressive rehabilitation. Smart resistance bands, equipped with embedded sensors, are emerging as a significant technological advancement, enabling real-time tracking of repetitions, resistance applied, and movement patterns, which can be synced with patient management software for improved data-driven therapy. Color-coding systems for resistance levels remain a standard for easy identification and progression. Performance metrics are continuously being refined, with a focus on tensile strength, elongation percentage, and resistance stability over multiple uses.

Key Drivers, Barriers & Challenges in Resistance Bands For Physical Therapy

Key Drivers: The primary forces propelling the Resistance Bands for Physical Therapy market include the escalating global prevalence of musculoskeletal disorders and chronic pain conditions, necessitating effective and accessible rehabilitation solutions. The increasing adoption of home-based and community-based physical therapy models, driven by cost-effectiveness and patient convenience, significantly boosts demand. Technological advancements, leading to more durable, versatile, and user-friendly resistance bands, are also key accelerators. Furthermore, the growing awareness among healthcare professionals and the general public regarding the benefits of resistance training for injury prevention and post-operative recovery plays a crucial role.

Barriers & Challenges: Despite the positive outlook, the market faces certain challenges. Intense competition from established players and the influx of new entrants can lead to price pressures and reduced profit margins. Supply chain disruptions, particularly for raw materials like latex and rubber, can impact production volumes and costs, with an estimated xx% potential increase in production costs during such events. Regulatory hurdles, although necessary for product safety and efficacy, can slow down the introduction of new products. Furthermore, the perceived limitations in resistance levels for highly conditioned athletes or individuals requiring very heavy resistance can present a challenge, although solutions like stacked bands are emerging.

Emerging Opportunities in Resistance Bands For Physical Therapy

Emerging opportunities in the Resistance Bands for Physical Therapy market lie in the development of integrated digital health platforms that connect smart resistance bands with telehealth services, enabling remote patient monitoring and guided rehabilitation programs. The untapped potential in emerging economies with a growing middle class and increasing access to healthcare presents a significant growth avenue. Furthermore, the development of specialized resistance bands tailored for specific conditions, such as neurological rehabilitation or pelvic floor therapy, offers niche market opportunities. Evolving consumer preferences towards personalized wellness and preventative healthcare also create demand for user-friendly, home-use resistance band kits with guided exercise programs.

Growth Accelerators in the Resistance Bands For Physical Therapy Industry

Long-term growth in the Resistance Bands for Physical Therapy industry will be significantly accelerated by continuous technological breakthroughs in material science, leading to bands with superior elasticity, durability, and consistent resistance. Strategic partnerships between resistance band manufacturers and physical therapy equipment distributors, as well as direct collaborations with healthcare institutions and insurance providers, will broaden market access. The expansion of market expansion strategies into underserved geographical regions and the increasing integration of resistance bands into broader fitness and wellness ecosystems will further fuel sustained growth. The development of sophisticated training programs and certifications for therapists focusing on advanced resistance band techniques will also elevate their perceived value and adoption.

Key Players Shaping the Resistance Bands For Physical Therapy Market

- Bodylastics

- Fabrication Enterprises

- Performance Health

- Alimed

- Bird & Cronin

- DeRoyal

- Dynatronics

- Hausmann Industries

- GoFit

- Therapeutic Dimension

- Serious Steel

- Perform Better

Notable Milestones in Resistance Bands For Physical Therapy Sector

- 2019: Launch of advanced latex-free resistance band formulations.

- 2020: Increased demand for home-use rehabilitation products due to global health events.

- 2021: Introduction of smart resistance bands with basic tracking capabilities.

- 2022: Partnerships formed between resistance band manufacturers and telehealth platforms.

- 2023: Development of bands with enhanced grip and anti-snap technology.

- 2024: Growing adoption of resistance bands in sports-specific training programs.

- 2025: Predicted emergence of AI-powered personalized rehabilitation plans utilizing resistance band data.

In-Depth Resistance Bands For Physical Therapy Market Outlook

The future market outlook for Resistance Bands for Physical Therapy is exceptionally promising, driven by a synergistic blend of demographic shifts, technological advancements, and evolving healthcare paradigms. The increasing emphasis on preventative health and active aging, coupled with the growing burden of chronic diseases, ensures a sustained and expanding demand for effective and accessible rehabilitation tools. Growth accelerators, such as the ongoing development of smart resistance bands offering real-time data analytics and personalized feedback, will further elevate their therapeutic value and user engagement. Strategic partnerships with telehealth providers and the integration of these bands into comprehensive digital health ecosystems will unlock new revenue streams and expand market reach. The forecast predicts a robust CAGR, indicating significant expansion in market size and penetration as these bands become an indispensable component of modern physical therapy and home-based wellness programs.

Resistance Bands For Physical Therapy Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinics

- 1.3. Rehabilitation Center

- 1.4. Others

-

2. Type

- 2.1. Less Than 10 lbs

- 2.2. 10 lbs - 100 lbs

- 2.3. More Than 100 lbs

Resistance Bands For Physical Therapy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Resistance Bands For Physical Therapy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinics

- 5.1.3. Rehabilitation Center

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Less Than 10 lbs

- 5.2.2. 10 lbs - 100 lbs

- 5.2.3. More Than 100 lbs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinics

- 6.1.3. Rehabilitation Center

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Less Than 10 lbs

- 6.2.2. 10 lbs - 100 lbs

- 6.2.3. More Than 100 lbs

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinics

- 7.1.3. Rehabilitation Center

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Less Than 10 lbs

- 7.2.2. 10 lbs - 100 lbs

- 7.2.3. More Than 100 lbs

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinics

- 8.1.3. Rehabilitation Center

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Less Than 10 lbs

- 8.2.2. 10 lbs - 100 lbs

- 8.2.3. More Than 100 lbs

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinics

- 9.1.3. Rehabilitation Center

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Less Than 10 lbs

- 9.2.2. 10 lbs - 100 lbs

- 9.2.3. More Than 100 lbs

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Resistance Bands For Physical Therapy Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinics

- 10.1.3. Rehabilitation Center

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Less Than 10 lbs

- 10.2.2. 10 lbs - 100 lbs

- 10.2.3. More Than 100 lbs

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bodylastics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fabrication Enterprises

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Performance Health

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alimed

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bird & Cronin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DeRoyal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dynatronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hausmann Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GoFit

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Therapeutic Dimension

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Serious Steel

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Perform Better

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Bodylastics

List of Figures

- Figure 1: Global Resistance Bands For Physical Therapy Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Resistance Bands For Physical Therapy Revenue (million), by Application 2024 & 2032

- Figure 3: North America Resistance Bands For Physical Therapy Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Resistance Bands For Physical Therapy Revenue (million), by Type 2024 & 2032

- Figure 5: North America Resistance Bands For Physical Therapy Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Resistance Bands For Physical Therapy Revenue (million), by Country 2024 & 2032

- Figure 7: North America Resistance Bands For Physical Therapy Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Resistance Bands For Physical Therapy Revenue (million), by Application 2024 & 2032

- Figure 9: South America Resistance Bands For Physical Therapy Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Resistance Bands For Physical Therapy Revenue (million), by Type 2024 & 2032

- Figure 11: South America Resistance Bands For Physical Therapy Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Resistance Bands For Physical Therapy Revenue (million), by Country 2024 & 2032

- Figure 13: South America Resistance Bands For Physical Therapy Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Resistance Bands For Physical Therapy Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Resistance Bands For Physical Therapy Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Resistance Bands For Physical Therapy Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Resistance Bands For Physical Therapy Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Resistance Bands For Physical Therapy Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Resistance Bands For Physical Therapy Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Resistance Bands For Physical Therapy Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Resistance Bands For Physical Therapy Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Resistance Bands For Physical Therapy Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Resistance Bands For Physical Therapy Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Resistance Bands For Physical Therapy Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Resistance Bands For Physical Therapy Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Resistance Bands For Physical Therapy Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Resistance Bands For Physical Therapy Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Resistance Bands For Physical Therapy Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Resistance Bands For Physical Therapy Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Resistance Bands For Physical Therapy Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Resistance Bands For Physical Therapy Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Resistance Bands For Physical Therapy Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Resistance Bands For Physical Therapy Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Resistance Bands For Physical Therapy?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Resistance Bands For Physical Therapy?

Key companies in the market include Bodylastics, Fabrication Enterprises, Performance Health, Alimed, Bird & Cronin, DeRoyal, Dynatronics, Hausmann Industries, GoFit, Therapeutic Dimension, Serious Steel, Perform Better.

3. What are the main segments of the Resistance Bands For Physical Therapy?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Resistance Bands For Physical Therapy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Resistance Bands For Physical Therapy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Resistance Bands For Physical Therapy?

To stay informed about further developments, trends, and reports in the Resistance Bands For Physical Therapy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence