Key Insights

The Canadian plant-based food and beverage market is poised for significant expansion, driven by increasing consumer demand for healthier, sustainable, and ethically sourced options. With a projected market size of $5.5 billion in 2025, the sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 10.21% through 2033. This upward trend is fueled by a growing number of consumers, particularly younger demographics, adopting plant-based diets due to concerns about animal welfare, environmental impact, and personal health. The rising incidence of lactose intolerance and other dietary sensitivities further accelerates the demand for dairy alternatives. Key product categories, including meat substitutes, plant-based milk (such as soy and almond), and non-dairy ice cream, are at the forefront of this growth, benefiting from continuous product innovation and enhanced accessibility.

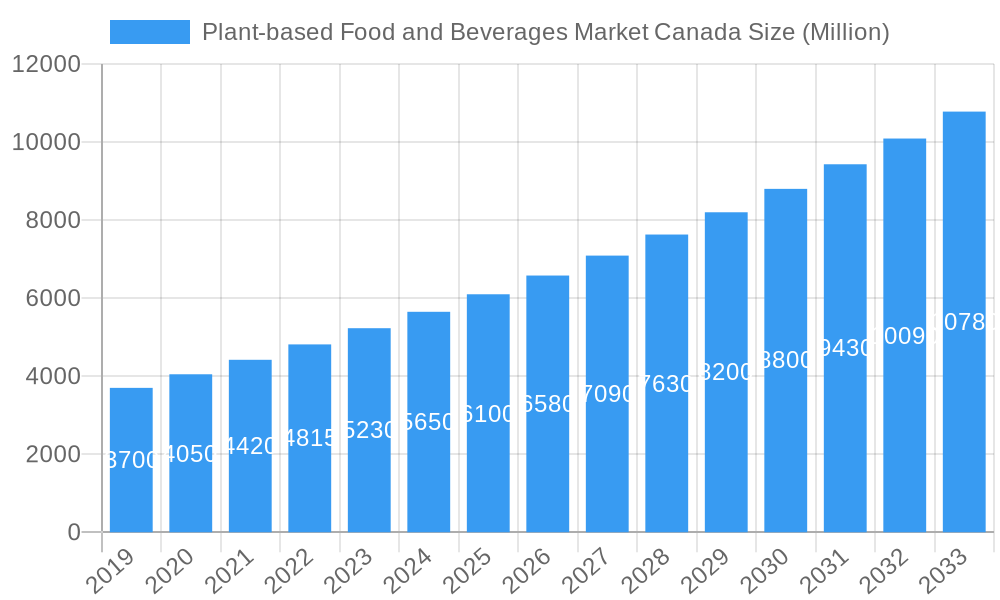

Plant-based Food and Beverages Market Canada Market Size (In Billion)

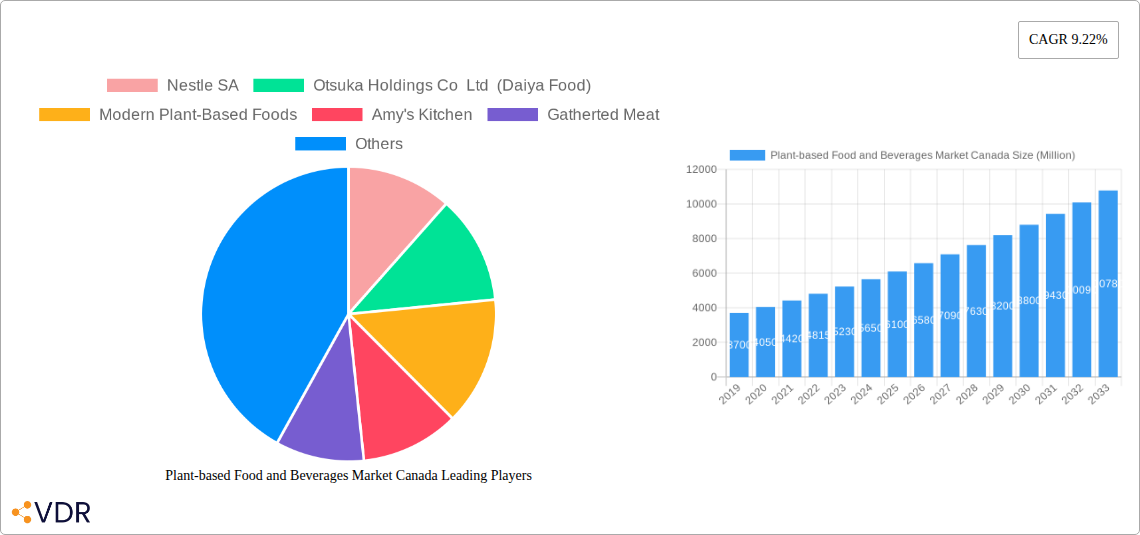

Market expansion is further facilitated by the growing influence of retail channels, with supermarkets and hypermarkets significantly increasing the availability of plant-based products. The e-commerce sector also plays a crucial role, offering consumers convenience and a broader product selection. Leading global corporations such as Nestle SA, Danone S.A., Beyond Meat, and Impossible Foods Inc., alongside innovative Canadian brands, are investing heavily in research, development, and marketing, stimulating competition and driving market advancements. While strong consumer interest and a favorable regulatory landscape support market growth, potential challenges include the price parity with conventional products and the ongoing need for consumer education regarding taste and texture. Nevertheless, advancements in food technology and a greater appreciation for plant-forward diets are effectively addressing these concerns.

Plant-based Food and Beverages Market Canada Company Market Share

Comprehensive Report: Plant-based Food and Beverages Market Canada (2019-2033)

This in-depth report offers a complete analysis of the Plant-based Food and Beverages Market in Canada, providing critical insights for industry stakeholders. Covering the historical period of 2019-2024, base year 2025, and a robust forecast period extending to 2033, this study meticulously examines market dynamics, growth trends, dominant segments, product landscape, key players, and emerging opportunities. With a focus on maximizing SEO visibility through high-traffic keywords, this report is an indispensable resource for manufacturers, suppliers, investors, and market strategists navigating the burgeoning Canadian plant-based sector. All values are presented in Million units for clarity.

Plant-based Food and Beverages Market Canada Market Dynamics & Structure

The Plant-based Food and Beverages Market in Canada is characterized by a dynamic and evolving landscape, driven by increasing consumer awareness of health, environmental sustainability, and ethical concerns. Market concentration is moderately fragmented, with both established food giants and agile startups vying for market share. Technological innovation is a significant driver, particularly in improving the taste, texture, and nutritional profile of plant-based products, making them more appealing substitutes for traditional animal-based options. Regulatory frameworks are gradually adapting to support the growth of this sector, with clear labeling standards and potential incentives for sustainable food production. Competitive product substitutes are abundant, ranging from traditional vegan staples to sophisticated meat and dairy alternatives. End-user demographics are diverse, encompassing health-conscious individuals, environmentally aware consumers, and those with dietary restrictions or allergies. Mergers and acquisitions (M&A) trends are on the rise as larger corporations seek to expand their plant-based portfolios and gain a competitive edge.

- Market Concentration: Moderately fragmented with key players and emerging innovators.

- Technological Innovation: Focus on enhancing taste, texture, and nutritional value of plant-based products.

- Regulatory Frameworks: Evolving to support clear labeling and sustainable practices.

- Competitive Product Substitutes: Wide array of plant-based meat, dairy, and other food alternatives.

- End-User Demographics: Broad appeal across health-conscious, environmentally aware, and diet-restricted consumers.

- M&A Trends: Increasing activity as major companies invest in or acquire plant-based brands.

Plant-based Food and Beverages Market Canada Growth Trends & Insights

The Canadian plant-based food and beverages market is experiencing robust growth, propelled by a confluence of societal shifts and evolving consumer preferences. The market size evolution is marked by a consistent upward trajectory, indicative of a maturing yet still rapidly expanding sector. Adoption rates for plant-based alternatives are accelerating across various product categories, moving beyond niche segments to mainstream consumer acceptance. Technological disruptions are playing a pivotal role, with advancements in ingredient sourcing, processing techniques, and product formulation leading to more palatable and versatile plant-based options. Consumer behavior shifts are profoundly influencing market dynamics; individuals are increasingly prioritizing health and wellness, actively seeking out plant-forward diets to manage chronic diseases, improve energy levels, and support overall well-being. Environmental consciousness is another major catalyst, with consumers gravitating towards foods that minimize their ecological footprint. The ethical treatment of animals is also a significant consideration for a growing segment of the population. These intertwined factors are driving a sustained increase in demand for plant-based products, from dairy alternatives and meat substitutes to a wider array of plant-based snacks and meals. The market penetration of plant-based options is expanding, with greater availability across all retail channels and increasing integration into foodservice. Industry-wide collaborations and innovations are further solidifying the market's growth, promising continued expansion and diversification in the coming years. For instance, the forecast period (2025-2033) is expected to witness a significant CAGR, reflecting sustained consumer interest and ongoing product development. The estimated market size for 2025 stands at $XXX Million, with projections indicating substantial growth by 2033. This growth is underpinned by continuous product innovation and strategic market penetration efforts by key industry players.

Dominant Regions, Countries, or Segments in Plant-based Food and Beverages Market Canada

Within the Canadian plant-based food and beverages market, Dairy Alternative Beverages consistently emerge as a dominant segment, driven by widespread consumer adoption and extensive product innovation. This category, encompassing Soy Milk, Almond Milk, and Other Dairy Alternative Beverages, commands a significant market share due to its versatility, health benefits, and increasing accessibility. The widespread availability of these beverages in Supermarkets/ Hypermarkets further solidifies their leading position, making them a convenient choice for a broad consumer base. Economic policies supporting sustainable agriculture and health initiatives promoting balanced diets have indirectly boosted the growth of dairy alternatives. The infrastructure for producing and distributing these beverages is well-established across Canada, facilitating broad market reach. The dominance of Dairy Alternative Beverages can also be attributed to their role as a gateway product for consumers exploring plant-based diets; many individuals begin by replacing cow's milk with plant-based alternatives, gradually expanding their consumption to other plant-based products. Furthermore, advancements in formulation have led to improved taste and texture, closely mimicking traditional dairy products, thus appealing to a wider demographic. The market share of this segment is estimated to be XX% of the total plant-based food and beverages market in Canada.

Beyond dairy alternatives, Meat Substitutes represent another highly significant segment, fueled by growing concerns about the environmental and ethical implications of conventional meat production. Within this segment, Textured Vegetable Protein (TVP) and Tofu are particularly popular due to their affordability and versatility, while newer innovations like plant-based burgers and sausages are gaining traction. Online Retail Channels are increasingly contributing to the growth of all plant-based segments, offering convenience and a wider selection to consumers, especially in urban centers. The market share of Meat Substitutes is estimated at XX%.

- Dominant Segment (Product Type): Dairy Alternative Beverages (Soy Milk, Almond Milk, Other Dairy Alternative Beverages).

- Key Drivers: Health benefits, versatility, improved taste and texture, gateway product for plant-based diets.

- Market Share (Estimated): XX%

- Dominant Distribution Channel: Supermarkets/ Hypermarkets.

- Key Drivers: Widespread accessibility, convenience, strong product placement for plant-based options.

- Significant Growing Segment (Product Type): Meat Substitutes (Textured Vegetable Protein, Tofu, Tempeh, Others).

- Key Drivers: Environmental concerns, ethical considerations, growing variety of innovative products.

- Market Share (Estimated): XX%

- Growing Distribution Channel: Online Retail Channels.

- Key Drivers: Convenience, wider product selection, accessibility in urban and rural areas.

Plant-based Food and Beverages Market Canada Product Landscape

The plant-based food and beverages market in Canada is characterized by a vibrant and ever-expanding product landscape, driven by continuous innovation and a keen understanding of consumer demands. Product innovations are focused on replicating the sensory experiences of traditional animal-based products while enhancing nutritional value and sustainability. Key applications range from everyday staples like plant-based milks and yogurts to sophisticated meat alternatives that mimic the taste and texture of beef, chicken, and seafood. Performance metrics are steadily improving, with many plant-based products now boasting comparable protein content and desirable cooking properties. Unique selling propositions often revolve around allergen-free formulations, organic ingredients, and reduced environmental impact. Technological advancements in plant protein extraction, flavor encapsulation, and texturization techniques are instrumental in this evolution.

Key Drivers, Barriers & Challenges in Plant-based Food and Beverages Market Canada

The growth of the plant-based food and beverages market in Canada is propelled by several key drivers, including a significant surge in consumer awareness regarding health and wellness, coupled with a growing concern for environmental sustainability and ethical animal welfare practices. Technological advancements in food science have led to the development of more palatable and diverse plant-based alternatives, effectively addressing previous taste and texture limitations. Government initiatives and a supportive regulatory environment encouraging sustainable food systems also act as accelerators.

However, the market faces several barriers and challenges. Supply chain complexities, particularly in sourcing high-quality, consistent plant-based ingredients, can impact production costs and availability. Regulatory hurdles related to labeling accuracy and standardized definitions for plant-based products can create confusion for consumers. Furthermore, competitive pricing pressures from conventional animal-based products and the need for substantial investment in research and development to keep pace with evolving consumer expectations pose significant challenges.

Emerging Opportunities in Plant-based Food and Beverages Market Canada

Emerging opportunities within the Canadian plant-based food and beverages market are abundant, driven by evolving consumer preferences and untapped market potential. There is a significant opportunity in developing premium plant-based products that cater to sophisticated palates, moving beyond basic substitutes to gourmet options. The foodservice sector presents a vast arena for expansion, with restaurants and cafes increasingly integrating plant-based dishes and beverages onto their menus to meet growing demand. Furthermore, innovation in alternative proteins, such as those derived from fungi (mycoprotein) and algae, offers exciting avenues for product development and differentiation. The "free-from" market, including gluten-free and soy-free plant-based options, continues to be a growing niche, catering to specific dietary needs.

Growth Accelerators in the Plant-based Food and Beverages Market Canada Industry

Several key catalysts are accelerating the long-term growth of the Canadian plant-based food and beverages industry. Technological breakthroughs in ingredient processing and product formulation are continuously enhancing the appeal and functionality of plant-based options, making them more accessible and desirable to a broader consumer base. Strategic partnerships between plant-based brands and established food manufacturers or retailers are facilitating wider distribution and increased market penetration. Market expansion strategies, including the development of new product categories and the exploration of international markets by Canadian companies, are also contributing to sustained growth. Investments in sustainable sourcing and production methods further bolster the industry's appeal.

Key Players Shaping the Plant-based Food and Beverages Market Canada Market

- Nestle SA

- Otsuka Holdings Co Ltd (Daiya Food)

- Modern Plant-Based Foods

- Amy's Kitchen

- Gatherted Meat

- Danone S A

- Beyond Meat

- Impossible Foods Inc

- Tonnies Holding Aps & Co KG

- The Meatless Farm Company

Notable Milestones in Plant-based Food and Beverages Market Canada Sector

- May 2022: Danone Canada launched a fresh-new dairy-free beverage called - Nextmil under its Silk Canada brand.

- August 2021: Beyond Meat announced its partnership with A&W Canada to launch plant-based chicken nuggets nationwide for a limited time.

- July 2020: HumanCo. holding company that promotes sustainability and healthy living announced the purchase of the majority shares of Coconut Bliss, a maker of organic plant-based ice cream.

In-Depth Plant-based Food and Beverages Market Canada Market Outlook

The future outlook for the Canadian plant-based food and beverages market is exceptionally bright, characterized by sustained growth and significant untapped potential. As consumer demand for healthier, more sustainable, and ethically produced food options continues to rise, the market is poised for further expansion. Strategic opportunities lie in continued product innovation, particularly in developing functional plant-based foods that offer specific health benefits. Partnerships across the value chain, from ingredient suppliers to retail and foodservice providers, will be crucial for market penetration and consumer engagement. Moreover, investments in research and development for novel plant-based proteins and ingredient technologies will drive future product differentiation and market leadership. The market's trajectory indicates a strong and enduring shift towards plant-based diets, presenting a dynamic landscape for all stakeholders.

Plant-based Food and Beverages Market Canada Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Textured Vegetable Protein

- 1.1.2. Tofu

- 1.1.3. Tempeh

- 1.1.4. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

- 1.6. Other Plant Based Products

-

1.1. Meat Substitutes

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convinience Sores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

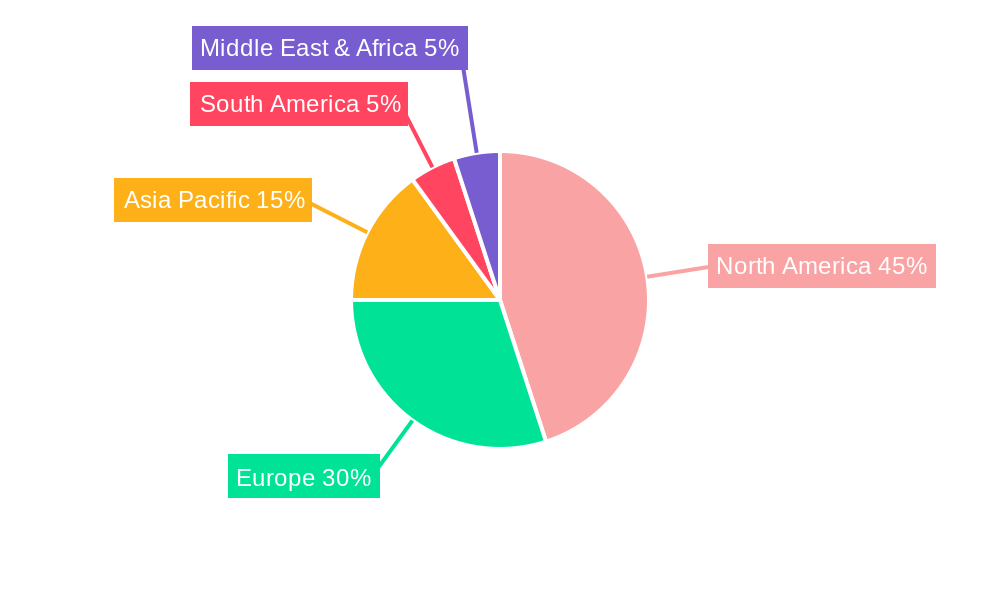

Plant-based Food and Beverages Market Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant-based Food and Beverages Market Canada Regional Market Share

Geographic Coverage of Plant-based Food and Beverages Market Canada

Plant-based Food and Beverages Market Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Benefits Associated with Vegan Diet

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Textured Vegetable Protein

- 5.1.1.2. Tofu

- 5.1.1.3. Tempeh

- 5.1.1.4. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.6. Other Plant Based Products

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convinience Sores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Meat Substitutes

- 6.1.1.1. Textured Vegetable Protein

- 6.1.1.2. Tofu

- 6.1.1.3. Tempeh

- 6.1.1.4. Others

- 6.1.2. Dairy Alternative Beverages

- 6.1.2.1. Soy Milk

- 6.1.2.2. Almond Milk

- 6.1.2.3. Other Dairy Alternative Beverages

- 6.1.3. Non-dairy Ice Cream

- 6.1.4. Non-dairy Cheese

- 6.1.5. Non-dairy Yogurt

- 6.1.6. Other Plant Based Products

- 6.1.1. Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convinience Sores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Meat Substitutes

- 7.1.1.1. Textured Vegetable Protein

- 7.1.1.2. Tofu

- 7.1.1.3. Tempeh

- 7.1.1.4. Others

- 7.1.2. Dairy Alternative Beverages

- 7.1.2.1. Soy Milk

- 7.1.2.2. Almond Milk

- 7.1.2.3. Other Dairy Alternative Beverages

- 7.1.3. Non-dairy Ice Cream

- 7.1.4. Non-dairy Cheese

- 7.1.5. Non-dairy Yogurt

- 7.1.6. Other Plant Based Products

- 7.1.1. Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convinience Sores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Meat Substitutes

- 8.1.1.1. Textured Vegetable Protein

- 8.1.1.2. Tofu

- 8.1.1.3. Tempeh

- 8.1.1.4. Others

- 8.1.2. Dairy Alternative Beverages

- 8.1.2.1. Soy Milk

- 8.1.2.2. Almond Milk

- 8.1.2.3. Other Dairy Alternative Beverages

- 8.1.3. Non-dairy Ice Cream

- 8.1.4. Non-dairy Cheese

- 8.1.5. Non-dairy Yogurt

- 8.1.6. Other Plant Based Products

- 8.1.1. Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convinience Sores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Meat Substitutes

- 9.1.1.1. Textured Vegetable Protein

- 9.1.1.2. Tofu

- 9.1.1.3. Tempeh

- 9.1.1.4. Others

- 9.1.2. Dairy Alternative Beverages

- 9.1.2.1. Soy Milk

- 9.1.2.2. Almond Milk

- 9.1.2.3. Other Dairy Alternative Beverages

- 9.1.3. Non-dairy Ice Cream

- 9.1.4. Non-dairy Cheese

- 9.1.5. Non-dairy Yogurt

- 9.1.6. Other Plant Based Products

- 9.1.1. Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convinience Sores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Meat Substitutes

- 10.1.1.1. Textured Vegetable Protein

- 10.1.1.2. Tofu

- 10.1.1.3. Tempeh

- 10.1.1.4. Others

- 10.1.2. Dairy Alternative Beverages

- 10.1.2.1. Soy Milk

- 10.1.2.2. Almond Milk

- 10.1.2.3. Other Dairy Alternative Beverages

- 10.1.3. Non-dairy Ice Cream

- 10.1.4. Non-dairy Cheese

- 10.1.5. Non-dairy Yogurt

- 10.1.6. Other Plant Based Products

- 10.1.1. Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Convinience Sores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Otsuka Holdings Co Ltd (Daiya Food)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Modern Plant-Based Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amy's Kitchen

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gatherted Meat

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beyond Meat

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Impossible Foods Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tonnies Holding Aps & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Meatless Farm Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Plant-based Food and Beverages Market Canada Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Plant-based Food and Beverages Market Canada Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Plant-based Food and Beverages Market Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Plant-based Food and Beverages Market Canada Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Plant-based Food and Beverages Market Canada Revenue (billion), by Product Type 2025 & 2033

- Figure 9: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Plant-based Food and Beverages Market Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Plant-based Food and Beverages Market Canada Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Plant-based Food and Beverages Market Canada Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Plant-based Food and Beverages Market Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Plant-based Food and Beverages Market Canada Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Plant-based Food and Beverages Market Canada Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Plant-based Food and Beverages Market Canada Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Food and Beverages Market Canada?

The projected CAGR is approximately 10.21%.

2. Which companies are prominent players in the Plant-based Food and Beverages Market Canada?

Key companies in the market include Nestle SA, Otsuka Holdings Co Ltd (Daiya Food), Modern Plant-Based Foods, Amy's Kitchen, Gatherted Meat, Danone S A, Beyond Meat, Impossible Foods Inc, Tonnies Holding Aps & Co KG, The Meatless Farm Company*List Not Exhaustive.

3. What are the main segments of the Plant-based Food and Beverages Market Canada?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods.

6. What are the notable trends driving market growth?

Increasing Awareness About Benefits Associated with Vegan Diet.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Danone Canada launched a fresh-new dairy-free beverage called - Nextmil under its Silk Canada brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Food and Beverages Market Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Food and Beverages Market Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Food and Beverages Market Canada?

To stay informed about further developments, trends, and reports in the Plant-based Food and Beverages Market Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence