Key Insights

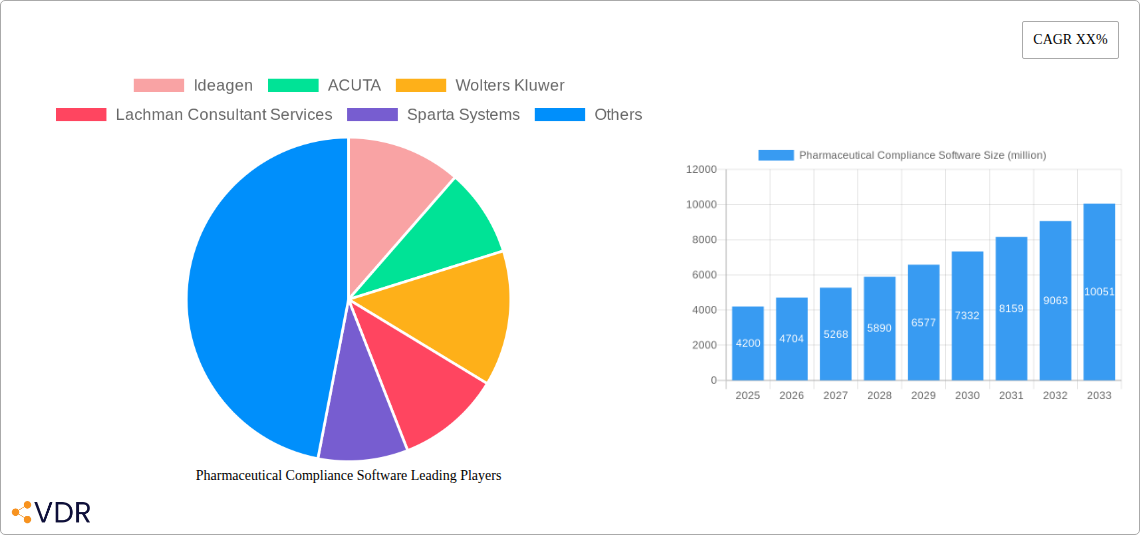

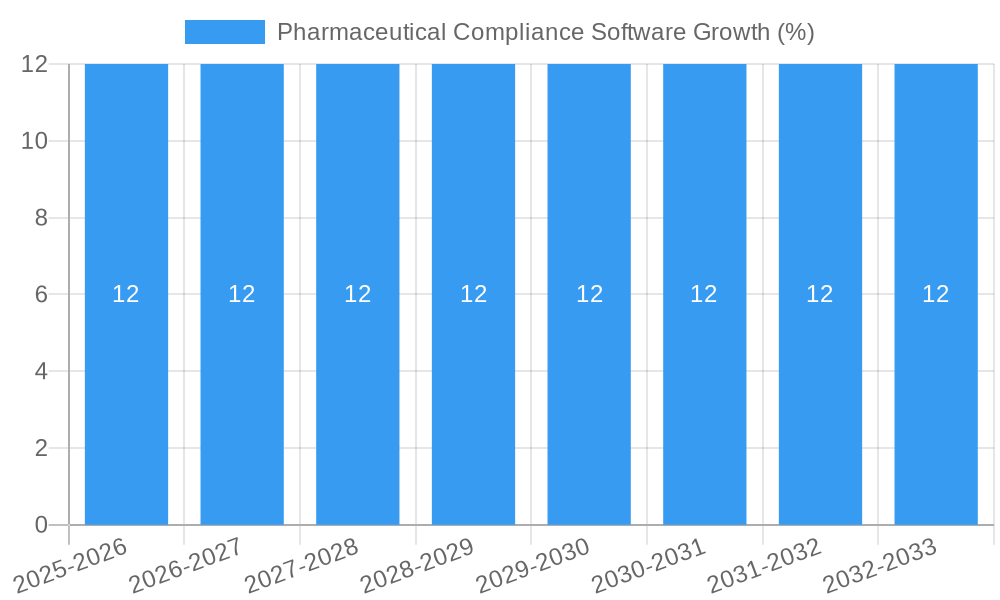

The global Pharmaceutical Compliance Software market is poised for significant expansion, with an estimated market size of approximately USD 4,200 million in 2025. This growth is projected to accelerate at a Compound Annual Growth Rate (CAGR) of around 12% during the forecast period of 2025-2033. This robust expansion is primarily fueled by the escalating complexity of regulatory landscapes worldwide, including stringent Good Manufacturing Practices (GMP), Good Laboratory Practices (GLP), and Good Clinical Practices (GCP) mandates. Pharmaceutical companies are increasingly investing in compliance software to streamline validation processes, enhance data integrity, and ensure adherence to evolving international and regional regulations. Furthermore, the growing emphasis on patient safety and drug efficacy necessitates meticulous documentation and quality control, making robust compliance solutions indispensable. The market's dynamism is also driven by technological advancements, with a notable shift towards cloud-based solutions offering greater scalability, accessibility, and cost-efficiency compared to traditional on-premise systems.

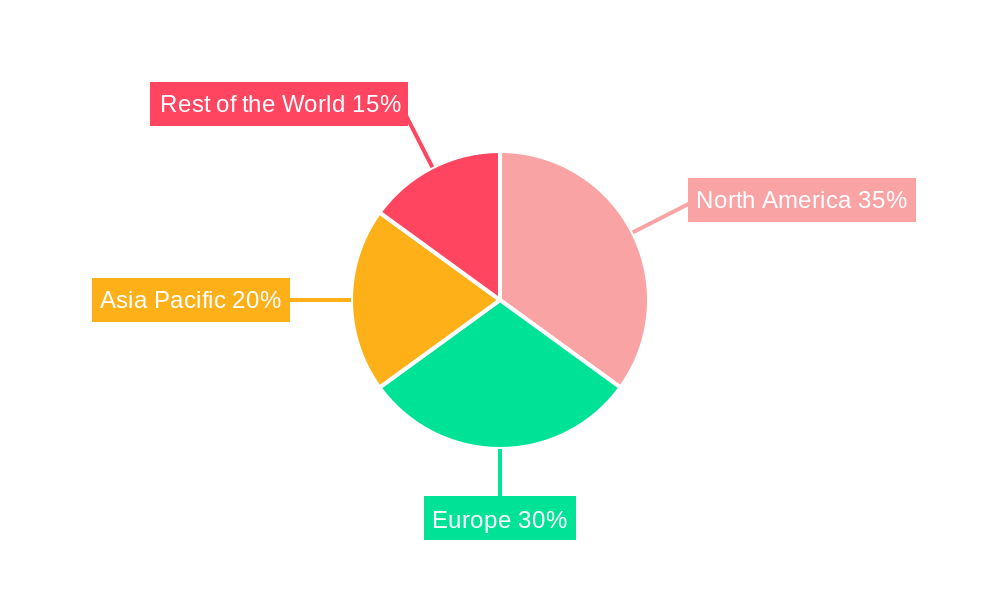

The market is segmented by application into Product Information Management and Pharmaceutical Electronic Registration, both of which are critical for maintaining product lifecycle integrity and regulatory filings. The primary types of software available are Cloud-Based Pharmaceutical Compliance Software and On-Premise Pharmaceutical Compliance Software, with cloud solutions gaining substantial traction due to their flexibility and lower upfront investment. Key players such as Ideagen, Wolters Kluwer, Sparta Systems, and MasterControl are at the forefront, offering comprehensive suites of tools designed to address a wide array of compliance challenges. Geographically, North America and Europe currently represent the largest markets, owing to well-established pharmaceutical industries and strict regulatory frameworks. However, the Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth due to increasing pharmaceutical manufacturing activities and a growing awareness of compliance standards. The market, while experiencing strong growth, faces restraints such as the high initial implementation costs for some enterprise-level solutions and the challenge of integrating new software with legacy systems.

Here's the SEO-optimized report description for Pharmaceutical Compliance Software, incorporating all your requirements:

Report Title: Global Pharmaceutical Compliance Software Market: Growth, Trends, and Forecast 2025-2033

Report Description:

Dive deep into the critical pharmaceutical compliance software market with this comprehensive report, designed to empower industry professionals and stakeholders. Our analysis spans from 2019–2033, with a robust focus on the base year 2025 and the forecast period 2025–2033. We meticulously examine the evolving landscape of cloud-based pharmaceutical compliance software and on-premise pharmaceutical compliance software, crucial for navigating stringent global regulations and ensuring product integrity. This report offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, emerging opportunities, and the strategic moves of leading companies like Ideagen, ACUTA, Wolters Kluwer, Lachman Consultant Services, Sparta Systems, Intagras, LogicManager, LogicGate, Bwise, Qordata, Qualsys, Axway, Med-Script, QUMAS, and MasterControl. Understand the competitive ecosystem, including the impact of Product Information Management and Pharmaceutical Electronic Registration applications. With quantitative data, including market share percentages and M&A volumes, and qualitative analysis, this report is an essential resource for understanding the present and future trajectory of the pharmaceutical compliance software industry.

Pharmaceutical Compliance Software Market Dynamics & Structure

The pharmaceutical compliance software market is characterized by a moderate concentration, with a few key players holding significant market share while a growing number of specialized vendors cater to niche requirements. Technological innovation is primarily driven by the increasing complexity of global regulatory frameworks, the demand for real-time data analytics, and the integration of AI and machine learning for predictive compliance. Regulatory frameworks, such as FDA's 21 CFR Part 11, EMA's Annex 11, and GxP guidelines, act as both drivers and constraints, pushing for advanced software solutions while dictating strict validation and security protocols. Competitive product substitutes are emerging in the form of integrated enterprise resource planning (ERP) systems with compliance modules, though specialized pharmaceutical compliance software retains a distinct advantage in depth and breadth of functionality. End-user demographics are shifting towards smaller and mid-sized pharmaceutical companies seeking scalable and cost-effective compliance solutions, alongside large enterprises requiring robust, enterprise-grade platforms. Mergers and acquisition (M&A) trends are notable, with larger players acquiring innovative startups to expand their product portfolios and market reach. The global pharmaceutical compliance software market saw approximately 15 M&A deals in the historical period 2019-2024, with an estimated market share of key players around 60%. The cost of implementing and validating these systems can be a barrier, alongside the continuous need for employee training and adaptation to evolving software.

- Market Concentration: Moderate, with top 5 players holding ~55% of the market share.

- Technological Innovation Drivers: AI/ML integration, real-time data analytics, IoT device integration, blockchain for data integrity.

- Regulatory Frameworks: FDA 21 CFR Part 11, EMA Annex 11, GxP, ICH guidelines.

- Competitive Product Substitutes: ERP systems with compliance modules, manual processes augmented by generic document management.

- End-User Demographics: Large pharmaceutical corporations, biotechnology firms, contract research organizations (CROs), contract manufacturing organizations (CMOs), emerging biotech startups.

- M&A Trends: Consolidation among vendors, acquisition of niche technology providers, strategic alliances for expanded offerings.

- Innovation Barriers: High validation costs, lengthy implementation cycles, data security concerns, resistance to change within organizations.

Pharmaceutical Compliance Software Growth Trends & Insights

The pharmaceutical compliance software market is poised for significant expansion, driven by an escalating need for robust regulatory adherence and operational efficiency within the pharmaceutical and life sciences industries. Market size evolution indicates a consistent upward trajectory, projected to grow from an estimated USD 3,500 million in the base year 2025 to USD 7,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 9.5%. This growth is fueled by increasing scrutiny from regulatory bodies worldwide, compelling pharmaceutical companies to invest in sophisticated software solutions that automate compliance processes, minimize human error, and ensure data integrity across the entire product lifecycle. Adoption rates of digital compliance solutions are accelerating, particularly among small and medium-sized enterprises (SMEs) that are increasingly recognizing the long-term cost savings and risk mitigation benefits of adopting these technologies over manual or fragmented approaches. The shift towards cloud-based solutions is a major trend, offering scalability, accessibility, and reduced IT infrastructure costs, thus lowering the barrier to entry for many organizations. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for advanced risk assessment, predictive analytics, and automated document review, are enhancing the value proposition of pharmaceutical compliance software. These advancements enable proactive identification of potential compliance issues, thereby preventing costly deviations and recalls. Consumer behavior shifts are also playing a role; as the demand for safe and effective pharmaceuticals rises globally, so does the expectation for transparency and accountability from manufacturers, pushing companies to adopt more stringent compliance measures facilitated by advanced software. The increasing complexity of drug development, coupled with the globalization of pharmaceutical supply chains, further necessitates integrated and comprehensive compliance management systems. For instance, the need to manage electronic batch records (EBRs), streamline electronic submission processes, and maintain audit trails for all activities is paramount. Market penetration is expected to deepen across all segments, with a notable surge in adoption within emerging economies that are rapidly strengthening their regulatory oversight. The market penetration for cloud-based solutions is anticipated to reach 70% by 2033, significantly outpacing on-premise solutions. This sustained growth reflects the indispensable role of technology in ensuring patient safety and maintaining public trust in the pharmaceutical sector. The overall market value in the historical period 2019-2024 experienced a growth of around 55% from USD 2,000 million to USD 3,100 million.

Dominant Regions, Countries, or Segments in Pharmaceutical Compliance Software

The global pharmaceutical compliance software market exhibits distinct regional and segment dominance, driven by a confluence of regulatory stringency, market maturity, and technological adoption. North America, particularly the United States, currently leads the market, primarily due to its robust regulatory framework enforced by the Food and Drug Administration (FDA), a highly developed pharmaceutical industry, and a strong appetite for technological innovation. The US market alone is estimated to contribute approximately 35% of the global market revenue in 2025. Key drivers in this region include the extensive presence of large pharmaceutical companies and contract research organizations (CROs) that require sophisticated solutions for managing complex regulatory requirements across product development, manufacturing, and post-market surveillance.

Within the Applications segment, Product Information Management (PIM) and Pharmaceutical Electronic Registration are experiencing substantial growth, with PIM solutions being pivotal for managing vast amounts of product data, ensuring accuracy, and facilitating faster regulatory submissions. Pharmaceutical Electronic Registration is critical for streamlining the submission and approval processes with regulatory agencies, a key area where North America's mature market and stringent oversight create high demand for efficient software. The combined market share of these two applications is estimated to be around 60% of the total application segment in 2025.

Geographically, Europe follows North America in market size, driven by the European Medicines Agency (EMA) and stringent Good Manufacturing Practice (GMP) and Good Clinical Practice (GCP) guidelines across its member states. Countries like Germany, the United Kingdom, and Switzerland are significant contributors due to their established pharmaceutical hubs and advanced regulatory ecosystems. The cloud-based pharmaceutical compliance software segment is a dominant type, projected to account for over 65% of the total market share by 2025. This dominance is attributed to the scalability, flexibility, and cost-effectiveness offered by cloud solutions, which are particularly attractive to pharmaceutical companies aiming to optimize their IT investments and enhance collaboration across global operations. The growing emphasis on digital transformation and the increasing adoption of Software-as-a-Service (SaaS) models further propel the growth of cloud-based solutions.

Asia-Pacific is emerging as a high-growth region, fueled by the expanding pharmaceutical manufacturing base in countries like China and India, coupled with a gradual strengthening of their regulatory landscapes. While on-premise solutions still hold a considerable share in some markets due to data security concerns or legacy infrastructure, the trend is unmistakably towards cloud adoption. The market penetration for cloud-based solutions in the Asia-Pacific region is expected to rise from 40% in 2025 to 60% by 2033. Factors such as government initiatives to promote digital health and an increasing number of local pharmaceutical companies aiming for international market access are significant growth catalysts.

- Dominant Region: North America (particularly the USA)

- Key Countries: United States, Germany, United Kingdom, China, India

- Dominant Application Segment: Product Information Management (PIM) and Pharmaceutical Electronic Registration

- Dominant Type: Cloud-Based Pharmaceutical Compliance Software

- Growth Potential in Emerging Markets: Asia-Pacific

- Market Share of Cloud-Based Software (2025): ~65%

- Market Share of PIM & Electronic Registration (2025): ~60% of application segment

Pharmaceutical Compliance Software Product Landscape

The pharmaceutical compliance software product landscape is characterized by advanced, integrated platforms designed to address the multifaceted regulatory demands of the industry. Innovations focus on enhancing data integrity, automating complex workflows, and providing robust audit trails for all compliance-related activities. Key product features include electronic document management systems (EDMS), CAPA (Corrective and Preventive Actions) management, deviation management, audit management, and training management modules. Unique selling propositions often lie in seamless integration capabilities with existing enterprise resource planning (ERP) and laboratory information management systems (LIMS). Technological advancements are pushing towards AI-powered analytics for predictive compliance, blockchain for immutable data logging, and enhanced cybersecurity features to protect sensitive pharmaceutical data. Performance metrics emphasized by vendors include reduced audit findings, faster submission cycles, and improved overall compliance posture. The market is witnessing a rise in modular solutions that allow companies to select and customize functionalities based on their specific needs, offering greater flexibility and cost-effectiveness.

Key Drivers, Barriers & Challenges in Pharmaceutical Compliance Software

Key Drivers:

The pharmaceutical compliance software market is propelled by several critical factors. The escalating stringency of global regulatory requirements, such as FDA's 21 CFR Part 11 and EMA's Annex 11, necessitates sophisticated software to ensure adherence and avoid hefty penalties. The increasing complexity of pharmaceutical R&D and manufacturing processes, coupled with the globalization of supply chains, demands integrated solutions for comprehensive oversight. Furthermore, the growing emphasis on patient safety and data integrity drives the adoption of technologies that minimize human error and provide auditable records. The push for digital transformation within the pharmaceutical industry, including the adoption of Industry 4.0 principles, also acts as a significant catalyst.

Barriers & Challenges:

Despite robust growth drivers, the market faces significant barriers and challenges. The high cost of implementation, validation, and ongoing maintenance of compliance software can be prohibitive, especially for smaller enterprises. Navigating evolving regulatory landscapes requires constant software updates and retraining of personnel, adding to operational complexity. Data security and privacy concerns remain paramount, with companies hesitant to adopt cloud solutions without stringent guarantees. Supply chain disruptions can impact the availability of hardware components for on-premise solutions and the overall implementation timelines. Competitive pressures from established players and emerging technologies also pose challenges, requiring continuous innovation and adaptation. The estimated cost of compliance failures, leading to product recalls or regulatory fines, can range from hundreds of thousands to millions of dollars, underscoring the importance of effective software solutions despite implementation hurdles.

Emerging Opportunities in Pharmaceutical Compliance Software

Emerging opportunities in the pharmaceutical compliance software market are abundant, driven by new technological integrations and evolving industry needs. The increasing adoption of AI and machine learning presents a significant opportunity for developing predictive compliance solutions that can identify potential issues before they arise, significantly reducing risk. The growing focus on data integrity and traceability within the pharmaceutical supply chain opens avenues for blockchain-based compliance solutions, offering immutable records and enhanced transparency. Furthermore, the rise of personalized medicine and advanced therapies creates a demand for specialized compliance software capable of managing the unique complexities associated with these novel treatment modalities. Untapped markets in developing economies, where regulatory frameworks are maturing, also offer substantial growth potential as local pharmaceutical companies invest in compliance infrastructure. The development of integrated platforms that span across various compliance areas, from R&D to post-market surveillance, represents a key opportunity for vendors to offer comprehensive, end-to-end solutions.

Growth Accelerators in the Pharmaceutical Compliance Software Industry

Several growth accelerators are fueling the long-term expansion of the pharmaceutical compliance software industry. Technological breakthroughs, such as advancements in cloud computing, AI, and IoT, are enabling the development of more sophisticated, scalable, and cost-effective compliance solutions. Strategic partnerships between software vendors, pharmaceutical companies, and regulatory bodies are crucial for co-developing and testing new compliance technologies, ensuring their relevance and efficacy. Market expansion strategies, including geographical diversification into emerging economies and the development of tailored solutions for specific therapeutic areas or company sizes, are also key accelerators. Furthermore, the increasing regulatory pressure to adopt digital solutions for GxP compliance and electronic record-keeping is a constant accelerator. Investments in research and development by leading players to offer cutting-edge features like real-time risk assessment and automated quality control further drive sustained growth. The trend towards embracing digital twins for process simulation and compliance validation also represents a significant accelerator.

Key Players Shaping the Pharmaceutical Compliance Software Market

- Ideagen

- ACUTA

- Wolters Kluwer

- Lachman Consultant Services

- Sparta Systems

- Intagras

- LogicManager

- LogicGate

- Bwise

- Qordata

- Qualsys

- Axway

- Med-Script

- QUMAS

- MasterControl

Notable Milestones in Pharmaceutical Compliance Software Sector

- 2019 October: MasterControl launches its cloud-based quality management system, enhancing accessibility for pharmaceutical companies.

- 2020 March: Sparta Systems (now part of Honeywell) introduces new AI-driven modules for risk-based compliance management.

- 2020 September: Ideagen acquires Compli, a move strengthening its presence in the pharmaceutical regulatory compliance space.

- 2021 February: Wolters Kluwer enhances its regulatory intelligence platform with advanced AI capabilities for pharmacovigilance.

- 2021 July: Qualsys announces significant updates to its QMS software, focusing on enhanced data integrity and audit trails.

- 2022 April: LogicGate releases its GRC platform with specialized modules for pharmaceutical compliance.

- 2022 November: Axway's acquisition of Syncplicity aims to bolster its secure content collaboration for regulated industries.

- 2023 January: Qordata expands its pharmaceutical analytics offerings with new compliance reporting features.

- 2023 June: Lachman Consultant Services partners with a leading cloud provider to offer enhanced SaaS compliance solutions.

- 2024 March: Intagras launches a new module for electronic batch record (EBR) management, addressing critical manufacturing compliance needs.

In-Depth Pharmaceutical Compliance Software Market Outlook

The pharmaceutical compliance software market is set for robust and sustained growth, driven by an unyielding demand for regulatory adherence and operational excellence. Growth accelerators such as the ongoing digital transformation in the life sciences sector, the relentless evolution of global regulatory frameworks, and advancements in artificial intelligence will continue to shape the market. The increasing preference for cloud-based solutions will provide a significant boost, offering scalability and accessibility. Strategic partnerships and vendor-led innovation in areas like predictive analytics and blockchain will further enhance the value proposition of these software solutions. Future market potential lies in addressing the compliance needs of emerging therapeutic areas and expanding penetration in rapidly developing markets. Vendors that can offer integrated, intelligent, and user-friendly platforms that simplify complex regulatory environments will be best positioned for success in this dynamic and critical industry segment.

Pharmaceutical Compliance Software Segmentation

-

1. Application

- 1.1. Product Information Management

- 1.2. Pharmaceutical Electronic Registration

-

2. Types

- 2.1. Cloud-Based Pharmaceutical Compliance Software

- 2.2. On-Premise Pharmaceutical Compliance Software

Pharmaceutical Compliance Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Compliance Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Product Information Management

- 5.1.2. Pharmaceutical Electronic Registration

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-Based Pharmaceutical Compliance Software

- 5.2.2. On-Premise Pharmaceutical Compliance Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Product Information Management

- 6.1.2. Pharmaceutical Electronic Registration

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-Based Pharmaceutical Compliance Software

- 6.2.2. On-Premise Pharmaceutical Compliance Software

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Product Information Management

- 7.1.2. Pharmaceutical Electronic Registration

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-Based Pharmaceutical Compliance Software

- 7.2.2. On-Premise Pharmaceutical Compliance Software

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Product Information Management

- 8.1.2. Pharmaceutical Electronic Registration

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-Based Pharmaceutical Compliance Software

- 8.2.2. On-Premise Pharmaceutical Compliance Software

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Product Information Management

- 9.1.2. Pharmaceutical Electronic Registration

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-Based Pharmaceutical Compliance Software

- 9.2.2. On-Premise Pharmaceutical Compliance Software

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pharmaceutical Compliance Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Product Information Management

- 10.1.2. Pharmaceutical Electronic Registration

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-Based Pharmaceutical Compliance Software

- 10.2.2. On-Premise Pharmaceutical Compliance Software

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ideagen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACUTA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wolters Kluwer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lachman Consultant Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sparta Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intagras

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LogicManager

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LogicGate

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bwise

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qordata

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Qualsys

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Axway

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Med-Script

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 QUMAS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MasterControl

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ideagen

List of Figures

- Figure 1: Global Pharmaceutical Compliance Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Compliance Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pharmaceutical Compliance Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pharmaceutical Compliance Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Pharmaceutical Compliance Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Pharmaceutical Compliance Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pharmaceutical Compliance Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pharmaceutical Compliance Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pharmaceutical Compliance Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pharmaceutical Compliance Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Pharmaceutical Compliance Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Pharmaceutical Compliance Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pharmaceutical Compliance Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pharmaceutical Compliance Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pharmaceutical Compliance Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pharmaceutical Compliance Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Pharmaceutical Compliance Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Pharmaceutical Compliance Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical Compliance Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pharmaceutical Compliance Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pharmaceutical Compliance Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Compliance Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Compliance Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Compliance Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Compliance Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical Compliance Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical Compliance Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Compliance Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Compliance Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Compliance Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Compliance Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Compliance Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Pharmaceutical Compliance Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Pharmaceutical Compliance Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Pharmaceutical Compliance Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Pharmaceutical Compliance Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Pharmaceutical Compliance Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pharmaceutical Compliance Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Compliance Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Pharmaceutical Compliance Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pharmaceutical Compliance Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Compliance Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Pharmaceutical Compliance Software?

Key companies in the market include Ideagen, ACUTA, Wolters Kluwer, Lachman Consultant Services, Sparta Systems, Intagras, LogicManager, LogicGate, Bwise, Qordata, Qualsys, Axway, Med-Script, QUMAS, MasterControl.

3. What are the main segments of the Pharmaceutical Compliance Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Compliance Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Compliance Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Compliance Software?

To stay informed about further developments, trends, and reports in the Pharmaceutical Compliance Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence