Key Insights

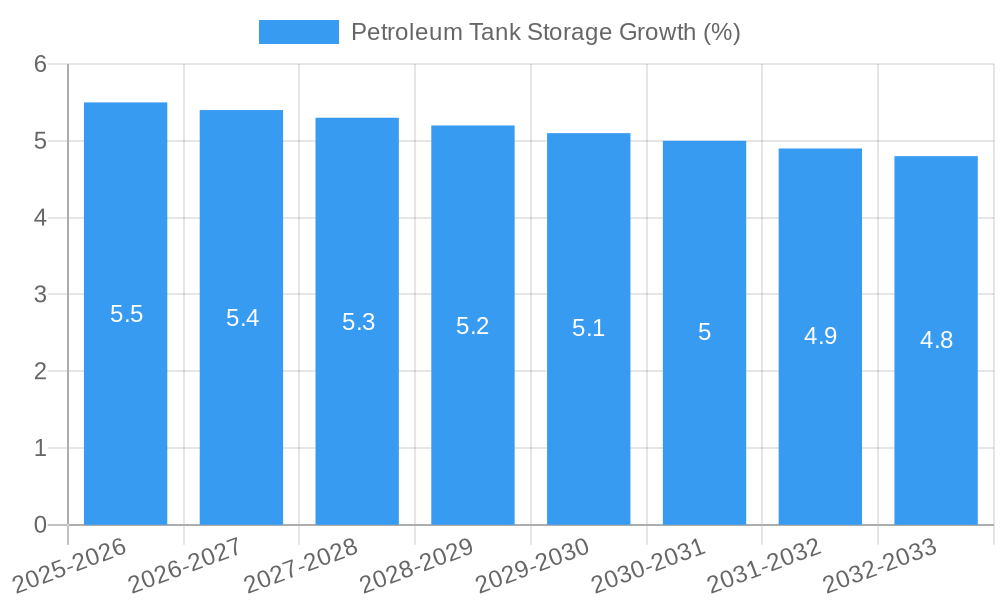

The global Petroleum Tank Storage market is experiencing robust expansion, projected to reach approximately USD 50,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 5.5% through 2033. This substantial growth is primarily fueled by the increasing global demand for refined oil products and crude oil, coupled with the strategic importance of efficient storage infrastructure to manage supply chain complexities and price volatility. The oil and chemical industries represent the dominant applications, with a significant portion of the market dedicated to refined oil storage, followed closely by crude oil storage. Factors such as the burgeoning energy needs of developing economies, the expansion of refining capacities, and the rise in strategic petroleum reserves are key drivers propelling this market forward. The continuous development of new oil fields and the increasing trade of petroleum products across continents necessitate expanded and modern storage facilities.

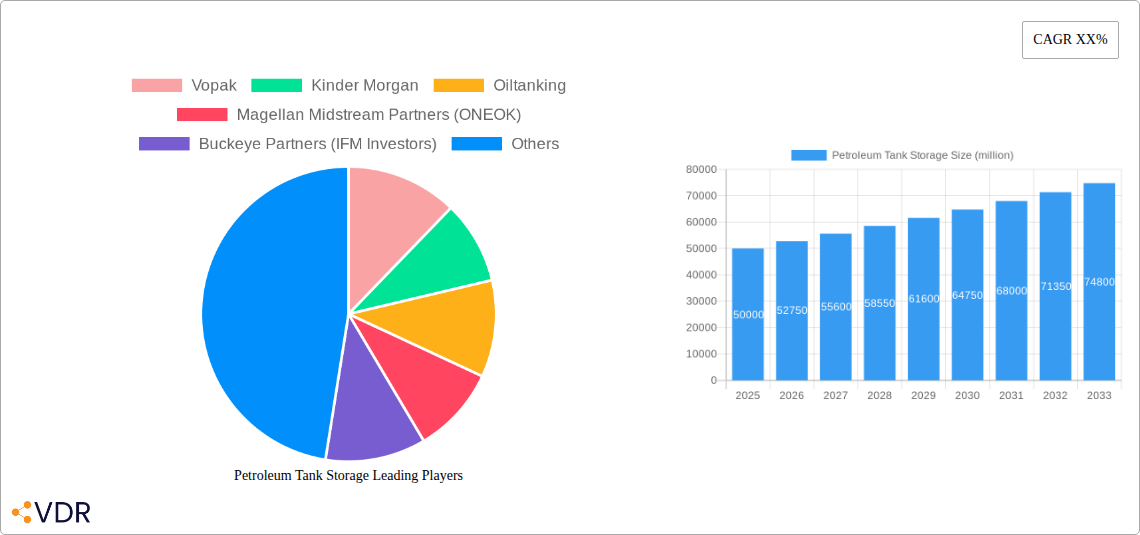

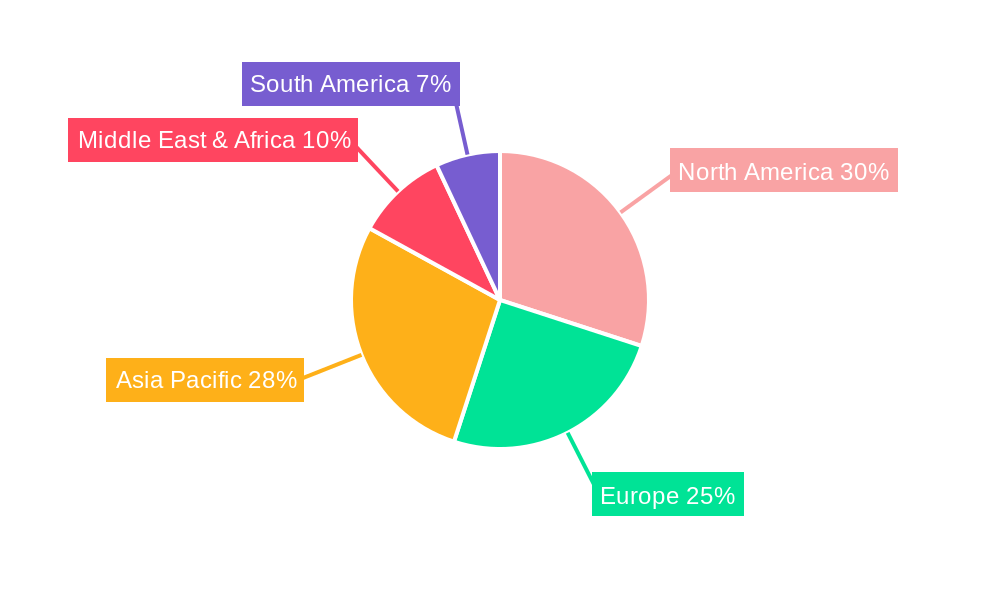

Despite the positive outlook, the market faces certain restraints, including stringent environmental regulations and the ongoing global shift towards renewable energy sources, which could impact long-term demand for fossil fuels. However, these challenges are being partially offset by significant investments in upgrading existing infrastructure to meet environmental standards and by the continued reliance on petroleum products for a considerable period. Technological advancements in tank monitoring, safety systems, and automation are also shaping the market, enhancing operational efficiency and reducing risks. Geographically, Asia Pacific is emerging as a high-growth region due to rapid industrialization and increasing energy consumption, while North America and Europe continue to hold substantial market shares owing to established infrastructure and significant refining and trading activities. The competitive landscape is characterized by the presence of large, established players like Vopak, Kinder Morgan, and Oiltanking, alongside national oil companies and regional operators, all vying for market dominance through strategic expansions, acquisitions, and technological innovation.

Here is a compelling, SEO-optimized report description for Petroleum Tank Storage, designed for maximum industry engagement and search visibility.

Report Title: Global Petroleum Tank Storage Market: Strategic Analysis, Growth Drivers, and Future Outlook (2019-2033)

Report Description:

Unlock unparalleled insights into the global Petroleum Tank Storage market with this comprehensive, data-driven report. Covering the Study Period of 2019–2033, with a Base Year of 2025 and a detailed Forecast Period of 2025–2033, this analysis delves into the intricate dynamics, growth trajectories, and strategic landscape of the petroleum and chemical storage sector. Essential for industry professionals, investors, and policymakers, this report provides a granular understanding of market concentration, technological innovation, regulatory frameworks, and competitive strategies. We explore parent and child markets, revealing critical trends in Refined Oil Storage, Crude Oil Storage, and other niche applications within the Oil Industry and Chemical Industry. Quantify market evolution with up-to-date metrics and leverage expert analysis to navigate challenges and capitalize on emerging opportunities in this vital sector.

Petroleum Tank Storage Market Dynamics & Structure

The global petroleum tank storage market exhibits a moderately concentrated structure, with key players dominating significant market shares. Vopak and Kinder Morgan lead the charge, followed closely by Oiltanking and Magellan Midstream Partners. Technological innovation is primarily driven by advancements in automation, digital monitoring systems, and enhanced safety protocols to meet stringent environmental regulations. Regulatory frameworks worldwide emphasize safety, environmental protection, and inventory management, influencing operational standards and investment decisions. Competitive product substitutes are limited due to the specialized nature of petroleum storage, but efficiency improvements in transportation and alternative energy storage solutions pose indirect competitive pressures. End-user demographics are dominated by national oil companies, independent refiners, and large chemical manufacturers. Mergers and acquisitions (M&A) activity remains a significant trend, with strategic consolidation aimed at expanding geographic reach and service offerings. For instance, the acquisition of Buckeye Partners by IFM Investors and Sunoco's acquisition of NuStar Energy highlight ongoing consolidation. The market's M&A deal volume is projected to remain robust, driven by the need for scale and operational efficiency. Innovation barriers include high capital investment requirements for new infrastructure and the complexity of integrating advanced technologies into existing legacy systems.

- Market Concentration: Dominated by a few key players, with Vopak and Kinder Morgan holding substantial market share.

- Technological Innovation Drivers: Automation, digital monitoring, and advanced safety systems.

- Regulatory Frameworks: Focus on safety, environmental compliance, and inventory management.

- Competitive Product Substitutes: Limited, but alternative energy storage and transportation efficiency present indirect competition.

- End-User Demographics: National oil companies, independent refiners, and chemical manufacturers.

- M&A Trends: Ongoing consolidation for geographic expansion and service enhancement.

- Examples: Buckeye Partners acquisition by IFM Investors, NuStar Energy acquisition by Sunoco.

- Projected M&A Deal Volume: Robust.

- Innovation Barriers: High capital investment and integration complexity.

Petroleum Tank Storage Growth Trends & Insights

The global petroleum tank storage market is poised for robust growth, driven by evolving energy demands and the critical role of storage in the Oil Industry and Chemical Industry. Over the Forecast Period of 2025–2033, the market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5%, expanding its market size from an estimated $85,000 million in 2025 to over $130,000 million by 2033. This growth is underpinned by increasing global consumption of refined oil products and the rising production of petrochemicals, necessitating expanded and modern storage infrastructure. Adoption rates for advanced tank management systems, including IoT sensors and AI-driven predictive maintenance, are accelerating, leading to improved operational efficiency and safety. Technological disruptions, such as the development of modular and eco-friendly storage solutions, are beginning to influence market trends, though traditional tank storage remains dominant. Consumer behavior shifts are also playing a role, with an increasing demand for transparency in supply chains and a greater emphasis on environmental, social, and governance (ESG) performance from storage providers. The Historical Period of 2019–2024 has laid a strong foundation, with consistent demand for both Crude Oil Storage and Refined Oil Storage. The Estimated Year of 2025 sees the market at a pivotal point, ready to leverage these trends. Market penetration of smart storage technologies is projected to reach 40% by 2033, enhancing asset utilization and reducing operational risks. The strategic importance of storage facilities in managing supply chain volatility, particularly in light of geopolitical events and fluctuating crude oil prices, will continue to fuel investment and expansion. Furthermore, the growing trend of regionalized refining and chemical production will necessitate localized storage solutions, contributing to market expansion in emerging economies. The integration of digitalization across the entire storage lifecycle, from booking to inventory management, is transforming how the industry operates, making it more agile and responsive to market demands. This evolution is critical for ensuring energy security and supporting economic development globally.

Dominant Regions, Countries, or Segments in Petroleum Tank Storage

The Oil Industry segment, particularly Refined Oil Storage, is the dominant force driving growth in the global petroleum tank storage market. This dominance stems from the sheer volume of refined products that require safe and efficient storage post-refining, before distribution to consumers. In the Forecast Period of 2025–2033, this segment is projected to account for over 60% of the total market revenue, valued at an estimated $78,000 million by 2033. The United States stands out as a leading country, primarily due to its vast refining capacity, extensive pipeline networks, and significant demand for refined products. Key drivers of this dominance include strong economic policies supporting the energy sector, substantial investment in infrastructure, and the presence of major players like Kinder Morgan and Magellan Midstream Partners. The Application of Oil Industry is further amplified by the consistent demand for various refined products, including gasoline, diesel, jet fuel, and heating oil. The Types of Refined Oil Storage are crucial for maintaining supply chain stability and meeting seasonal demands. North America, specifically the U.S., represents approximately 35% of the global market share due to its established infrastructure and robust consumption patterns. Asia-Pacific is emerging as a significant growth region, driven by rapid industrialization and increasing energy needs, with countries like China and India showing substantial expansion in their storage capacities. Crude Oil Storage also plays a vital role, acting as a buffer against supply disruptions and price volatility, holding an estimated market share of 30%. However, the logistical complexities and longer-term storage needs of crude oil position refined product storage as the more immediate and consistently high-volume segment. The Chemical Industry application, while growing, represents a smaller but specialized niche, focusing on the storage of various feedstocks and finished chemical products, holding an estimated 10% market share. Dominance factors include the geographical distribution of refining hubs, the proximity of storage facilities to major consumption centers, and government support for energy infrastructure development. The market share and growth potential within the Oil Industry segment are further bolstered by ongoing investments in upgrading existing facilities and constructing new terminals to accommodate larger vessel sizes and enhanced safety features. The strategic importance of these storage hubs for national energy security and economic stability solidifies their leading position.

- Dominant Segment: Oil Industry Application, specifically Refined Oil Storage.

- Market Share of Refined Oil Storage: Projected to exceed 60% by 2033.

- Leading Country: United States, due to extensive refining capacity and demand.

- Key Drivers in the U.S.: Favorable economic policies, infrastructure investment, major industry players.

- Regional Dominance: North America leads (approx. 35% market share), followed by Asia-Pacific's rapid growth.

- Crude Oil Storage Share: Approximately 30% of the market.

- Chemical Industry Share: Approximately 10% of the market, a specialized niche.

- Growth Potential Factors: Proximity to consumption centers, government support, infrastructure upgrades.

Petroleum Tank Storage Product Landscape

The petroleum tank storage product landscape is characterized by advancements in tank materials, safety features, and digital integration. Innovations focus on enhancing durability, reducing environmental impact, and improving operational efficiency. Products range from large-scale conventional steel tanks for crude oil and refined products to specialized tanks designed for chemicals with unique containment requirements. Key performance metrics include capacity, material integrity, resistance to corrosion, and leak detection capabilities. Unique selling propositions often revolve around compliance with stringent safety and environmental regulations, such as those mandated by API and EPA standards. Technological advancements are leading to the development of double-hulled tanks, advanced sealing mechanisms, and integrated fire suppression systems. Furthermore, the adoption of smart sensors for real-time monitoring of tank levels, temperature, and pressure is transforming product offerings, providing operators with unprecedented visibility and control over their assets.

Key Drivers, Barriers & Challenges in Petroleum Tank Storage

Key Drivers:

- Growing Global Energy Demand: Sustained consumption of refined products and chemicals fuels the need for storage.

- Supply Chain Volatility: Strategic storage is crucial for managing disruptions and price fluctuations in the oil and gas sector.

- Infrastructure Development: Investments in new refining capacity and expanding distribution networks necessitate more storage.

- Technological Advancements: Automation and digital monitoring enhance efficiency and safety, driving adoption.

- Regulatory Compliance: Increasingly stringent safety and environmental standards necessitate modern, compliant storage solutions.

Barriers & Challenges:

- High Capital Investment: Building and maintaining tank terminals requires substantial upfront capital.

- Environmental Regulations: Compliance with evolving environmental standards can be costly and complex.

- Permitting and Land Acquisition: Securing permits and suitable land for new facilities can be a lengthy and challenging process.

- Geopolitical Instability: Conflicts and trade disputes can disrupt supply chains and impact demand for storage.

- Competition and Oversupply: In certain regions, an oversupply of storage capacity can lead to price wars and reduced profitability.

- Supply Chain Issues: Disruptions in the supply of raw materials or equipment can impact construction timelines and costs.

Emerging Opportunities in Petroleum Tank Storage

Emerging opportunities in petroleum tank storage lie in the expansion of services beyond simple storage, the adoption of sustainable practices, and the utilization of new technologies. There is a growing demand for value-added services such as blending, heating, and specialized handling of various petroleum and chemical products. The push for decarbonization presents an opportunity for tank storage operators to diversify into storing alternative fuels like hydrogen or biofuels, leveraging existing infrastructure where feasible. Furthermore, the increasing focus on digitalization opens avenues for offering advanced data analytics and remote monitoring services to clients. Untapped markets in developing economies with expanding industrial bases represent significant growth potential. Evolving consumer preferences for transparency and ESG compliance are creating opportunities for companies that can demonstrate robust sustainability initiatives and secure ethical sourcing of stored products.

Growth Accelerators in the Petroleum Tank Storage Industry

Growth accelerators in the petroleum tank storage industry are primarily driven by strategic partnerships, technological breakthroughs, and market expansion initiatives. The increasing need for integrated logistics solutions is fostering partnerships between terminal operators, shipping companies, and pipeline providers. Technological breakthroughs, particularly in areas like advanced leak detection, predictive maintenance using AI, and automation of loading/unloading processes, are significantly improving operational efficiency and reducing costs, thereby accelerating investment. Market expansion strategies, including the development of new storage hubs in strategically important locations or in regions with growing demand, are crucial. The ongoing global energy transition, while presenting challenges, also creates opportunities for storage of emerging energy sources, thus acting as a long-term growth accelerator. Companies are also focusing on expanding their service portfolios to include more complex handling and processing capabilities, adding further value and driving revenue growth.

Key Players Shaping the Petroleum Tank Storage Market

- Vopak

- Kinder Morgan

- Oiltanking

- Magellan Midstream Partners

- Buckeye Partners

- NuStar Energy

- TransMontaigne Partners

- IMTT

- Enbridge Inc.

- Horizon Terminals Ltd.

- Exolum

- Marathon Petroleum Corp

- Puma Energy

- Eurotank Terminal Rotterdam

- Inter Terminals

- Zenith Energy

- SINOPEC

- CNPC

- CNOOC

- BP

- Chevron

- Shell

- Sinochem

Notable Milestones in Petroleum Tank Storage Sector

- 2019: Vopak announces significant investments in expanding capacity in key Asian markets.

- 2020: Kinder Morgan completes a major acquisition, consolidating its U.S. pipeline and terminal network.

- 2021: Oiltanking invests heavily in automation and digital solutions across its global terminals.

- 2022: Magellan Midstream Partners announces expansion projects for refined products terminals to meet growing demand.

- 2022: IFM Investors successfully acquires Buckeye Partners, signaling continued M&A activity.

- 2023: Sunoco completes the acquisition of NuStar Energy, further consolidating the U.S. market.

- 2023: Emerging players like Zenith Energy focus on expanding into underserved regions.

- 2024: Increased focus on ESG initiatives and sustainability reporting by major storage providers.

- 2024: Advancements in double-hulled tank technology gain wider adoption for enhanced safety.

In-Depth Petroleum Tank Storage Market Outlook

The in-depth petroleum tank storage market outlook points towards continued robust growth, propelled by an increasing global energy demand and the essential role of storage in managing supply chain complexities. Strategic opportunities abound in expanding service offerings to include value-added services like blending and specialized product handling, particularly for the Chemical Industry. The ongoing energy transition presents a significant avenue for growth through the storage of emerging fuels such as biofuels and potentially hydrogen. Technological advancements in automation and AI-driven predictive maintenance will continue to accelerate operational efficiencies and safety standards, making these solutions a key differentiator. Market expansion into high-growth regions and the development of integrated logistics solutions with partners will be critical for capitalizing on future market potential. Companies that can effectively navigate evolving regulatory landscapes and demonstrate strong ESG commitments will be best positioned for long-term success.

Petroleum Tank Storage Segmentation

-

1. Application

- 1.1. Oil Industry

- 1.2. Chemical Industry

- 1.3. Others

-

2. Types

- 2.1. Refined Oil Storage

- 2.2. Crude Oil Storage

- 2.3. Others

Petroleum Tank Storage Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Petroleum Tank Storage REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil Industry

- 5.1.2. Chemical Industry

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Refined Oil Storage

- 5.2.2. Crude Oil Storage

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil Industry

- 6.1.2. Chemical Industry

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Refined Oil Storage

- 6.2.2. Crude Oil Storage

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil Industry

- 7.1.2. Chemical Industry

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Refined Oil Storage

- 7.2.2. Crude Oil Storage

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil Industry

- 8.1.2. Chemical Industry

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Refined Oil Storage

- 8.2.2. Crude Oil Storage

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil Industry

- 9.1.2. Chemical Industry

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Refined Oil Storage

- 9.2.2. Crude Oil Storage

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Petroleum Tank Storage Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil Industry

- 10.1.2. Chemical Industry

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Refined Oil Storage

- 10.2.2. Crude Oil Storage

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Vopak

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kinder Morgan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oiltanking

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Magellan Midstream Partners (ONEOK)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Buckeye Partners (IFM Investors)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NuStar Energy (Sunoco)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TransMontaigne Partners

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IMTT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Enbridge Inc. (Pembina Pipeline Corporation)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Horizon Terminals Ltd. (ENOC Group)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Exolum

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Marathon Petroleum Corp

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Puma Energy

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Eurotank Terminal Rotterdam

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Inter Terminals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zenith Energy

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SINOPEC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 CNPC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 CNOOC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 BP

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Chevron

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Shell

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sinochem

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Vopak

List of Figures

- Figure 1: Global Petroleum Tank Storage Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Petroleum Tank Storage Revenue (million), by Application 2024 & 2032

- Figure 3: North America Petroleum Tank Storage Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Petroleum Tank Storage Revenue (million), by Types 2024 & 2032

- Figure 5: North America Petroleum Tank Storage Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Petroleum Tank Storage Revenue (million), by Country 2024 & 2032

- Figure 7: North America Petroleum Tank Storage Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Petroleum Tank Storage Revenue (million), by Application 2024 & 2032

- Figure 9: South America Petroleum Tank Storage Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Petroleum Tank Storage Revenue (million), by Types 2024 & 2032

- Figure 11: South America Petroleum Tank Storage Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Petroleum Tank Storage Revenue (million), by Country 2024 & 2032

- Figure 13: South America Petroleum Tank Storage Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Petroleum Tank Storage Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Petroleum Tank Storage Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Petroleum Tank Storage Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Petroleum Tank Storage Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Petroleum Tank Storage Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Petroleum Tank Storage Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Petroleum Tank Storage Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Petroleum Tank Storage Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Petroleum Tank Storage Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Petroleum Tank Storage Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Petroleum Tank Storage Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Petroleum Tank Storage Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Petroleum Tank Storage Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Petroleum Tank Storage Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Petroleum Tank Storage Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Petroleum Tank Storage Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Petroleum Tank Storage Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Petroleum Tank Storage Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Petroleum Tank Storage Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Petroleum Tank Storage Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Petroleum Tank Storage Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Petroleum Tank Storage Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Petroleum Tank Storage Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Petroleum Tank Storage Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Petroleum Tank Storage Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Petroleum Tank Storage Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Petroleum Tank Storage Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Petroleum Tank Storage Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Petroleum Tank Storage?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Petroleum Tank Storage?

Key companies in the market include Vopak, Kinder Morgan, Oiltanking, Magellan Midstream Partners (ONEOK), Buckeye Partners (IFM Investors), NuStar Energy (Sunoco), TransMontaigne Partners, IMTT, Enbridge Inc. (Pembina Pipeline Corporation), Horizon Terminals Ltd. (ENOC Group), Exolum, Marathon Petroleum Corp, Puma Energy, Eurotank Terminal Rotterdam, Inter Terminals, Zenith Energy, SINOPEC, CNPC, CNOOC, BP, Chevron, Shell, Sinochem.

3. What are the main segments of the Petroleum Tank Storage?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Petroleum Tank Storage," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Petroleum Tank Storage report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Petroleum Tank Storage?

To stay informed about further developments, trends, and reports in the Petroleum Tank Storage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence