Key Insights

The North American self-adhesive label market is poised for significant expansion, projected to reach $53.1 billion by 2025, with a robust CAGR of 5.47% through 2033. This growth is propelled by escalating demand across key sectors including food & beverage, pharmaceutical, and personal care, where effective product identification and branding are paramount. Technological advancements, particularly in sustainable and eco-friendly label materials, alongside increased automation in labeling processes, are further stimulating market penetration. Hot melt adhesives continue to dominate, though emulsion acrylic and solvent-based alternatives are gaining traction for specialized applications. Plastic remains the preferred face material due to its inherent versatility and cost efficiency.

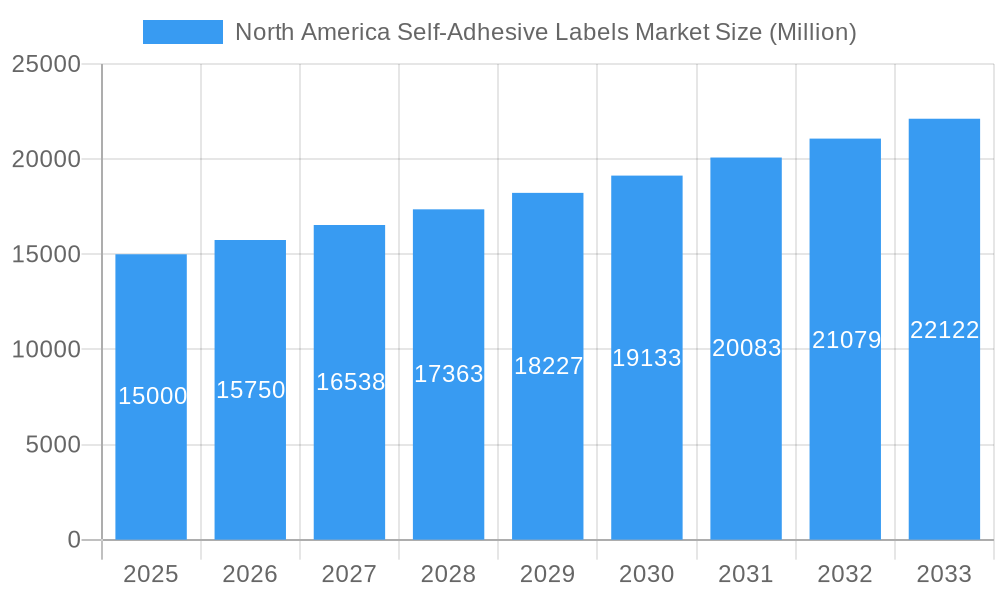

North America Self-Adhesive Labels Market Market Size (In Billion)

Despite positive growth prospects, the market confronts challenges such as volatile raw material costs and stringent regulatory landscapes concerning material composition and sustainability. Intense competition from established global players and emerging regional specialists characterizes the landscape. The United States leads the market share, supported by its extensive manufacturing and consumer base, with Canada and Mexico contributing smaller but significant portions. Future growth trajectories will be heavily influenced by material innovation, application automation, and the increasing demand for sustainable and compliant labeling solutions. The ongoing surge in e-commerce is anticipated to further amplify the need for product labeling.

North America Self-Adhesive Labels Market Company Market Share

North America Self-Adhesive Labels Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America self-adhesive labels market, encompassing its dynamics, growth trends, dominant segments, and key players. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this study offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers key segments like Food & Beverage, Pharmaceutical, and Logistics labels, analyzing various adhesive types (Hot Melt, Emulsion Acrylic, Solvent) and face materials (Paper, Plastic). The market size is presented in million units.

North America Self-Adhesive Labels Market Dynamics & Structure

The North American self-adhesive labels market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, particularly in sustainable and specialized label materials, is a key driver. Stringent regulatory frameworks concerning food safety and labeling regulations influence market dynamics. Competitive pressures arise from substitute products like printed tapes and digital printing technologies. End-user demographics, particularly the growing e-commerce sector and increased demand for personalized products, strongly influence market growth. The market also experiences a moderate level of mergers and acquisitions (M&A) activity.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Driven by advancements in materials science (e.g., eco-friendly adhesives), printing technologies (e.g., digital printing), and label design software.

- Regulatory Framework: Stringent regulations regarding food safety, pharmaceutical labeling, and environmental compliance significantly impact market dynamics.

- Competitive Substitutes: Printed tapes and alternative labeling methods pose competitive threats.

- End-User Demographics: Growth in e-commerce and the demand for personalized products boost label demand.

- M&A Activity: An average of xx M&A deals per year during the historical period, indicating a moderate level of consolidation. Innovation barriers include high R&D costs and the need for specialized expertise.

North America Self-Adhesive Labels Market Growth Trends & Insights

The North America self-adhesive labels market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to the expansion of e-commerce, increased demand for packaged goods, and technological advancements in label production. The adoption rate of self-adhesive labels across various end-use sectors has increased significantly, driven by their convenience and cost-effectiveness. Technological disruptions, such as the rise of digital printing, have enhanced customization and reduced production time. Consumer behavior shifts toward personalized products and eco-friendly packaging further fuel market expansion. The forecast period (2025-2033) anticipates continued growth, projected at a CAGR of xx%, driven by emerging trends like sustainable packaging solutions and the increasing demand for specialized labels in sectors such as pharmaceuticals and logistics. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in North America Self-Adhesive Labels Market

The United States dominates the North American self-adhesive labels market, owing to its large and diversified economy. Within the application segments, the Food and Beverage sector holds the largest market share, driven by high demand for packaged food and beverages. The Pharmaceutical segment is a significant growth contributor due to stringent regulatory requirements and the need for tamper-evident labels. Hot Melt adhesives maintain a dominant market share due to their cost-effectiveness and wide applicability, while paper remains the most widely used face material.

- Key Drivers in the US: Strong consumer spending, robust e-commerce sector, and advanced manufacturing capabilities.

- Food & Beverage Segment Dominance: Driven by increased packaged food and beverage consumption, coupled with the need for detailed labeling and branding.

- Pharmaceutical Segment Growth: Fueled by stricter regulations and rising demand for tamper-evident labels and detailed product information.

- Hot Melt Adhesive Preference: Cost-effectiveness and suitability for diverse applications drive its popularity.

- Paper as Primary Face Material: Cost-effectiveness and versatility make paper the preferred material for many applications.

North America Self-Adhesive Labels Market Product Landscape

The self-adhesive labels market offers a wide array of products, categorized by adhesive type, face material, and application. Recent innovations focus on sustainable materials, enhanced durability, and improved printing capabilities. Unique selling propositions include enhanced tamper-evidence, improved adhesion properties, and eco-friendly compositions. Technological advancements encompass digital printing technologies that enable on-demand label production, customization, and variable data printing capabilities.

Key Drivers, Barriers & Challenges in North America Self-Adhesive Labels Market

Key Drivers:

- Growing e-commerce sector driving demand for labels.

- Increasing demand for customized and personalized packaging.

- Stringent regulations requiring detailed product labeling.

- Technological advancements leading to improved label quality and efficiency.

Key Challenges:

- Fluctuations in raw material prices impacting production costs.

- Intense competition among established and emerging players.

- Environmental concerns requiring adoption of sustainable materials.

- Supply chain disruptions affecting timely delivery of labels. These disruptions, estimated to have cost the market xx million units in lost sales in 2024, highlight a key challenge.

Emerging Opportunities in North America Self-Adhesive Labels Market

- Growing demand for sustainable and eco-friendly labels.

- Increasing use of labels in the healthcare and logistics sectors.

- Expansion of digital printing capabilities for enhanced customization.

- Development of smart labels with integrated sensors and tracking capabilities.

Growth Accelerators in the North America Self-Adhesive Labels Market Industry

Technological breakthroughs in materials science, particularly in developing sustainable and high-performance adhesives, are key growth drivers. Strategic partnerships between label manufacturers and packaging companies are facilitating innovation and market penetration. Expanding into niche applications, such as specialized labels for medical devices and pharmaceuticals, offers significant growth opportunities.

Key Players Shaping the North America Self-Adhesive Labels Market Market

- THERMO DECOR INC

- LINTEC Corporation

- CCL Industries

- 3M

- Grupo Fortelite México

- Consolidated Label Co

- Multi-Color Corporation

- DuPont

- H B Fuller Company

- Avery Dennison Corporation

- Multi-Action

- Fuji Seal International Inc

- UPM

- *List Not Exhaustive

Notable Milestones in North America Self-Adhesive Labels Market Sector

- July 2022: Bain Capital Private Equity's joint ownership agreement with BC Partners for Fedrigoni signals increased investment in the self-adhesive label sector.

- February 2022: Avery Dennison's launch of EVE VEGAN-certified labels highlights the growing demand for sustainable and eco-friendly products.

In-Depth North America Self-Adhesive Labels Market Outlook

The North America self-adhesive labels market is poised for continued growth, driven by technological advancements, increasing demand from diverse sectors, and the adoption of sustainable practices. Strategic partnerships and market expansion into emerging segments will further accelerate this growth. The focus on sustainable and high-performance labels, coupled with technological innovations, presents significant opportunities for existing and new players in the market. The market is expected to reach xx million units by 2033.

North America Self-Adhesive Labels Market Segmentation

-

1. Adhesive Type

- 1.1. Hot Melt

- 1.2. Emulsion Acrylic

- 1.3. Solvent

-

2. Face Material

- 2.1. Paper

-

2.2. Plastic

- 2.2.1. Polypropylene

- 2.2.2. Polyester

- 2.2.3. Vinyl

- 2.2.4. Other Plastics

-

3. Application

- 3.1. Food and Beverage

- 3.2. Pharmaceutical

- 3.3. Logistics and Transport

- 3.4. Personal Care

- 3.5. Consumer Durables

- 3.6. Other Applications

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Self-Adhesive Labels Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Self-Adhesive Labels Market Regional Market Share

Geographic Coverage of North America Self-Adhesive Labels Market

North America Self-Adhesive Labels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing E-Commerce Industry in the Region; Increasing Demand for Packed Goods from Food And Beverage Industries

- 3.3. Market Restrains

- 3.3.1. Associated Government Regulations; Volatility in raw material prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Food and Beverages Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Self-Adhesive Labels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 5.1.1. Hot Melt

- 5.1.2. Emulsion Acrylic

- 5.1.3. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Face Material

- 5.2.1. Paper

- 5.2.2. Plastic

- 5.2.2.1. Polypropylene

- 5.2.2.2. Polyester

- 5.2.2.3. Vinyl

- 5.2.2.4. Other Plastics

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Pharmaceutical

- 5.3.3. Logistics and Transport

- 5.3.4. Personal Care

- 5.3.5. Consumer Durables

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 6. United States North America Self-Adhesive Labels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 6.1.1. Hot Melt

- 6.1.2. Emulsion Acrylic

- 6.1.3. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Face Material

- 6.2.1. Paper

- 6.2.2. Plastic

- 6.2.2.1. Polypropylene

- 6.2.2.2. Polyester

- 6.2.2.3. Vinyl

- 6.2.2.4. Other Plastics

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverage

- 6.3.2. Pharmaceutical

- 6.3.3. Logistics and Transport

- 6.3.4. Personal Care

- 6.3.5. Consumer Durables

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 7. Canada North America Self-Adhesive Labels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 7.1.1. Hot Melt

- 7.1.2. Emulsion Acrylic

- 7.1.3. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Face Material

- 7.2.1. Paper

- 7.2.2. Plastic

- 7.2.2.1. Polypropylene

- 7.2.2.2. Polyester

- 7.2.2.3. Vinyl

- 7.2.2.4. Other Plastics

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverage

- 7.3.2. Pharmaceutical

- 7.3.3. Logistics and Transport

- 7.3.4. Personal Care

- 7.3.5. Consumer Durables

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 8. Mexico North America Self-Adhesive Labels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 8.1.1. Hot Melt

- 8.1.2. Emulsion Acrylic

- 8.1.3. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Face Material

- 8.2.1. Paper

- 8.2.2. Plastic

- 8.2.2.1. Polypropylene

- 8.2.2.2. Polyester

- 8.2.2.3. Vinyl

- 8.2.2.4. Other Plastics

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverage

- 8.3.2. Pharmaceutical

- 8.3.3. Logistics and Transport

- 8.3.4. Personal Care

- 8.3.5. Consumer Durables

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Adhesive Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 THERMO DECOR INC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 LINTEC Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CCL Industries

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 3M

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Grupo Fortelite México

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Consolidated Label Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Multi-Color Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 DuPont

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 H B Fuller Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Avery Dennison Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Multi-Action

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Fuji Seal International Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 UPM*List Not Exhaustive

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 THERMO DECOR INC

List of Figures

- Figure 1: North America Self-Adhesive Labels Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Self-Adhesive Labels Market Share (%) by Company 2025

List of Tables

- Table 1: North America Self-Adhesive Labels Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 2: North America Self-Adhesive Labels Market Revenue billion Forecast, by Face Material 2020 & 2033

- Table 3: North America Self-Adhesive Labels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Self-Adhesive Labels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Self-Adhesive Labels Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Self-Adhesive Labels Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 7: North America Self-Adhesive Labels Market Revenue billion Forecast, by Face Material 2020 & 2033

- Table 8: North America Self-Adhesive Labels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: North America Self-Adhesive Labels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Self-Adhesive Labels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Self-Adhesive Labels Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 12: North America Self-Adhesive Labels Market Revenue billion Forecast, by Face Material 2020 & 2033

- Table 13: North America Self-Adhesive Labels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: North America Self-Adhesive Labels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Self-Adhesive Labels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Self-Adhesive Labels Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 17: North America Self-Adhesive Labels Market Revenue billion Forecast, by Face Material 2020 & 2033

- Table 18: North America Self-Adhesive Labels Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: North America Self-Adhesive Labels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Self-Adhesive Labels Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Self-Adhesive Labels Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the North America Self-Adhesive Labels Market?

Key companies in the market include THERMO DECOR INC, LINTEC Corporation, CCL Industries, 3M, Grupo Fortelite México, Consolidated Label Co, Multi-Color Corporation, DuPont, H B Fuller Company, Avery Dennison Corporation, Multi-Action, Fuji Seal International Inc, UPM*List Not Exhaustive.

3. What are the main segments of the North America Self-Adhesive Labels Market?

The market segments include Adhesive Type, Face Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing E-Commerce Industry in the Region; Increasing Demand for Packed Goods from Food And Beverage Industries.

6. What are the notable trends driving market growth?

Increasing Demand from Food and Beverages Industry.

7. Are there any restraints impacting market growth?

Associated Government Regulations; Volatility in raw material prices.

8. Can you provide examples of recent developments in the market?

July 2022: Bain Capital Private Equity, a United States-based private investment firm, signed definitive documents with BC Partners to enter into a joint ownership agreement for Fedrigoni, which produces self-adhesive labels and fiber-based packaging products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Self-Adhesive Labels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Self-Adhesive Labels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Self-Adhesive Labels Market?

To stay informed about further developments, trends, and reports in the North America Self-Adhesive Labels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence