Key Insights

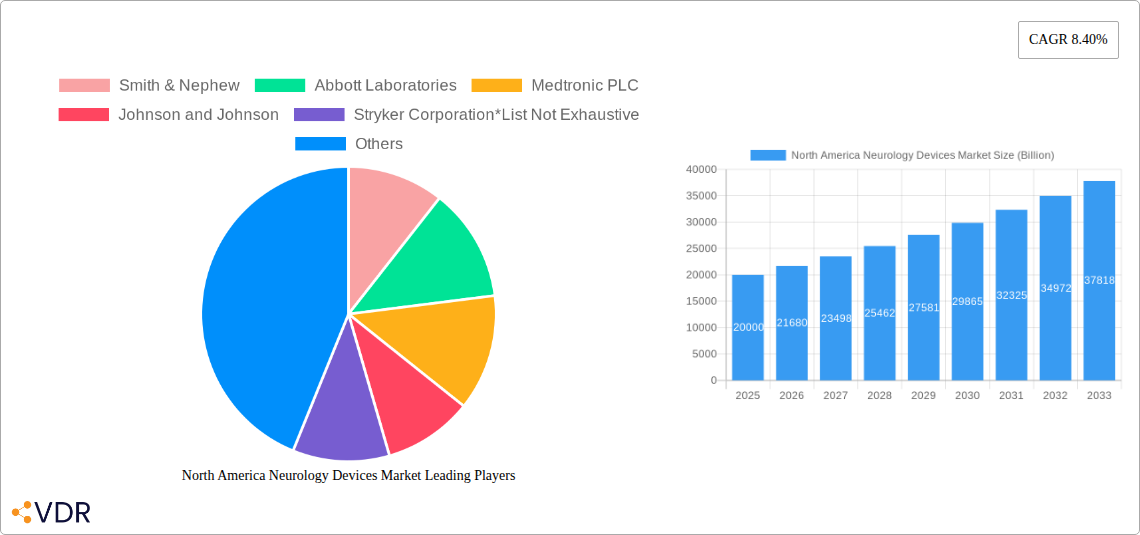

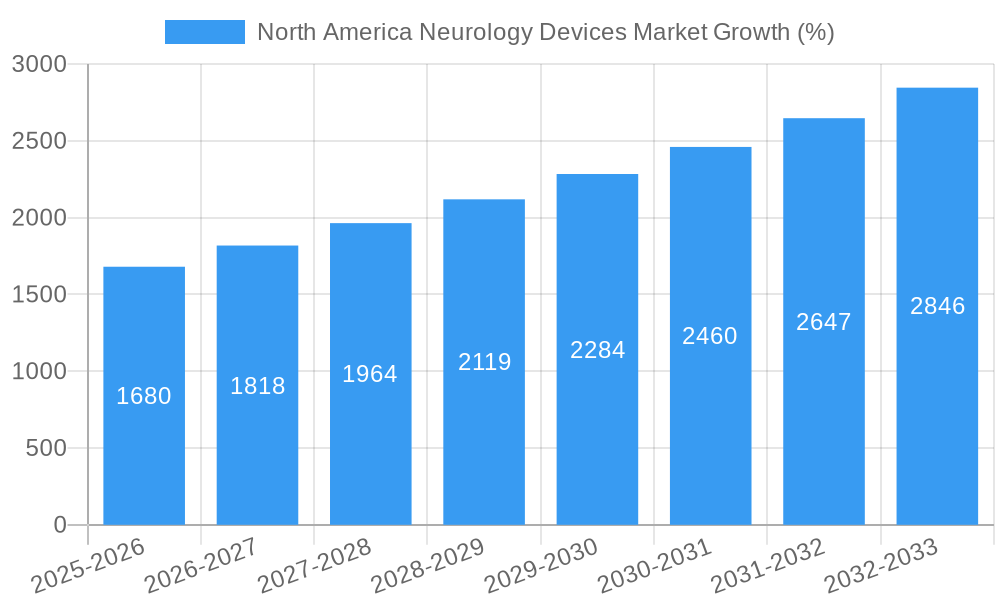

The North American neurology devices market is experiencing robust growth, driven by an aging population, increasing prevalence of neurological disorders like stroke, Alzheimer's disease, and Parkinson's disease, and advancements in minimally invasive surgical techniques. The market, valued at approximately $XX billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 8.40% from 2025 to 2033, reaching an estimated value of approximately $YY billion by 2033 (calculated based on a constant 8.40% CAGR). Key segments driving this growth include neurosurgery devices (particularly support devices and neurostimulation devices) and cerebrospinal fluid management devices. The rising adoption of advanced technologies like neuro-navigation systems, improved imaging techniques, and robotic-assisted surgery is further fueling market expansion. Competition among established players such as Medtronic, Johnson & Johnson, and Abbott Laboratories, as well as emerging companies, is intensifying, leading to continuous innovation and the introduction of more sophisticated and effective devices.

While the market presents significant opportunities, challenges remain. High costs associated with advanced neurology devices can restrict accessibility, particularly in regions with limited healthcare infrastructure. Furthermore, stringent regulatory requirements and the complex nature of clinical trials for new neurology devices can pose hurdles to market entry. Despite these constraints, the long-term outlook for the North American neurology devices market remains positive, fueled by continuous technological advancements, increased awareness of neurological disorders, and supportive government initiatives aimed at improving healthcare access. The increasing prevalence of chronic neurological conditions in the aging population will be a key driver of growth through 2033, ensuring a continued demand for innovative neurology devices. Strategic partnerships between device manufacturers and healthcare providers are also likely to play a key role in market expansion and improved patient outcomes.

North America Neurology Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America Neurology Devices market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by device type (Support Devices: Neurosurgery Devices; Other Neurosurgery Devices: Neurostimulation Devices; Other Neurosurgery Devices: Other Devices; Cerebrospinal Fluid Management Devices; Interventional Neurology Devices) offering a granular understanding of market performance across various segments. The total market value is projected to reach xx Billion by 2033.

North America Neurology Devices Market Market Dynamics & Structure

The North America neurology devices market is characterized by a moderately concentrated landscape, with key players such as Smith & Nephew, Abbott Laboratories, Medtronic PLC, Johnson & Johnson, and Stryker Corporation holding significant market share. Technological innovation, particularly in minimally invasive procedures and advanced imaging, is a primary growth driver. Stringent regulatory frameworks, including FDA approvals, pose significant challenges, impacting market entry and product lifecycle. The market also witnesses competitive pressures from substitute therapies and the emergence of innovative devices. The aging population and rising prevalence of neurological disorders are key demographic factors driving demand. Mergers and acquisitions (M&A) activity within the sector has been moderate, with a total of xx deals recorded between 2019 and 2024, resulting in a market concentration of approximately xx%.

- High Market Concentration: Top 5 players account for xx% of the market share.

- Technological Innovation: Advancements in neurostimulation, minimally invasive surgery, and AI-driven diagnostics are driving growth.

- Regulatory Hurdles: FDA approvals and stringent regulations create barriers to entry.

- Competitive Substitutes: Alternative therapies and emerging technologies pose competitive threats.

- Aging Population: The increasing elderly population fuels demand for neurology devices.

- M&A Activity: xx M&A deals recorded from 2019-2024, influencing market consolidation.

North America Neurology Devices Market Growth Trends & Insights

The North America neurology devices market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to an aging population, rising prevalence of neurological disorders (e.g., stroke, Parkinson's disease, epilepsy), and increased healthcare expenditure. Technological advancements, such as the development of sophisticated neurostimulation devices and minimally invasive surgical tools, have further fueled market expansion. The adoption rate of advanced neurology devices is increasing, particularly in major metropolitan areas with advanced healthcare infrastructure. Consumer behavior is shifting towards minimally invasive procedures due to reduced recovery times and improved patient outcomes. The market is expected to witness robust growth during the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors like continuous technological innovation and increasing government initiatives to improve neurological healthcare access. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

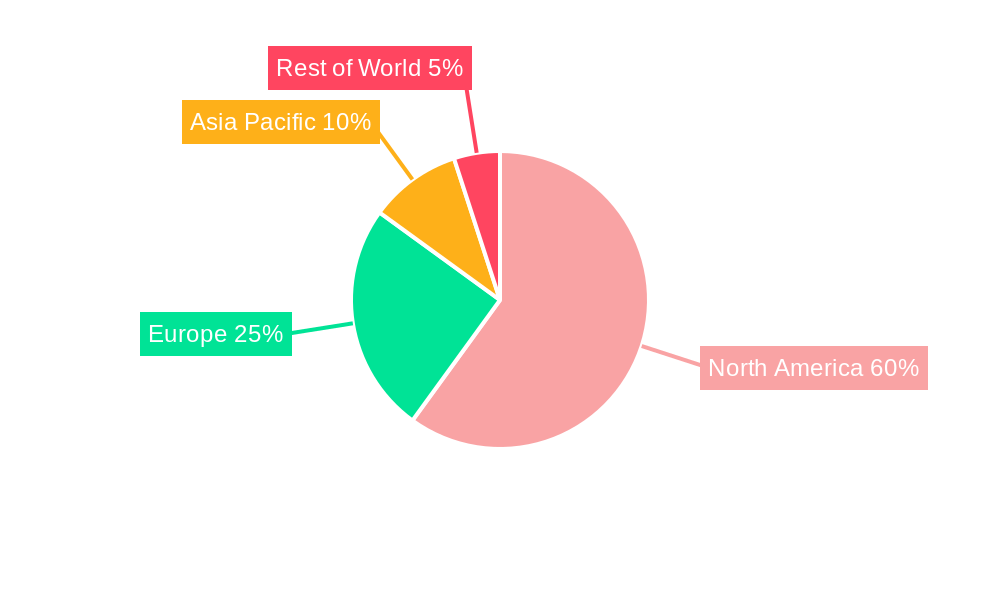

Dominant Regions, Countries, or Segments in North America Neurology Devices Market

The United States represents the dominant region within the North America neurology devices market, accounting for approximately xx% of the total market value. This dominance stems from factors like high healthcare expenditure, advanced medical infrastructure, a large aging population, and a high prevalence of neurological disorders. Canada also contributes significantly, driven by similar factors but at a comparatively smaller scale. Within the segment breakdown, Neurostimulation devices currently hold the largest market share, owing to the rising prevalence of chronic pain and neurological disorders requiring such intervention. The Interventional Neurology Devices segment is witnessing significant growth, driven by technological advancements in minimally invasive procedures.

- United States: High healthcare expenditure, advanced medical infrastructure, and large aging population drive market dominance.

- Canada: Significant contribution driven by similar factors as the U.S. but at a smaller scale.

- Neurostimulation Devices: Largest market segment due to the increasing prevalence of chronic pain and related neurological disorders.

- Interventional Neurology Devices: Rapid growth driven by advancements in minimally invasive procedures.

North America Neurology Devices Market Product Landscape

The North America neurology devices market showcases a diverse range of products, including advanced neurostimulation implants with improved targeting and personalized therapies, minimally invasive surgical tools for precise procedures, and sophisticated cerebrospinal fluid management systems. These devices are characterized by enhanced performance metrics such as improved precision, reduced invasiveness, and shortened recovery times. Key innovations focus on integrating advanced imaging techniques, AI-driven diagnostics, and closed-loop systems for personalized and optimized treatment. Unique selling propositions often involve smaller device sizes, improved biocompatibility, and better patient outcomes.

Key Drivers, Barriers & Challenges in North America Neurology Devices Market

Key Drivers: The aging population, increased prevalence of neurological disorders, technological advancements (e.g., minimally invasive surgeries, AI-driven diagnostics), rising healthcare expenditure, and favorable government initiatives are key drivers of market growth.

Challenges & Restraints: High device costs, stringent regulatory pathways (FDA approvals), potential reimbursement challenges, and the emergence of competing therapies limit market expansion. Supply chain disruptions, particularly during the post-pandemic period, led to shortages and impacted market growth by approximately xx%.

Emerging Opportunities in North America Neurology Devices Market

Untapped markets in rural areas and underserved communities represent significant growth opportunities. The increasing adoption of telehealth and remote patient monitoring presents a promising avenue for expanding market reach. Technological advancements such as AI-powered diagnostic tools, personalized medicine approaches, and the development of novel biomaterials offer significant opportunities for innovation.

Growth Accelerators in the North America Neurology Devices Market Industry

Technological breakthroughs in minimally invasive surgery, advanced imaging techniques, and AI-driven diagnostics are accelerating market growth. Strategic partnerships between device manufacturers, healthcare providers, and research institutions foster innovation and market expansion. Government initiatives aimed at improving neurological care and promoting the adoption of advanced technologies are further stimulating growth.

Key Players Shaping the North America Neurology Devices Market Market

- Smith & Nephew

- Abbott Laboratories

- Medtronic PLC

- Johnson & Johnson

- Stryker Corporation

- MicroPort Scientific Corporation

- Boston Scientific Corporation

- Nihon Kohden Corporation

- B Braun SE

- Penumbra Inc

Notable Milestones in North America Neurology Devices Market Sector

- October 2022: Medtronic launched the Neurovascular Co-Lab Platform, accelerating innovation in stroke care and treatment.

- April 2022: Abbott launched an upgraded version of its NeuroSphere myPath app, enhancing patient monitoring capabilities for neurostimulation devices.

In-Depth North America Neurology Devices Market Market Outlook

The North America neurology devices market is poised for sustained growth, driven by technological advancements, a growing elderly population, and increased awareness of neurological disorders. Strategic partnerships, focused R&D, and expansion into underserved markets will be key to unlocking future market potential. The market’s future is bright, with opportunities for companies to capitalize on innovative products and expand their market share through strategic initiatives.

North America Neurology Devices Market Segmentation

-

1. Device

- 1.1. Cerebrospinal Fluid Management Devices

-

1.2. Interventional Neurology Devices

- 1.2.1. Interventional/Surgical Simulators

- 1.2.2. Neurothrombectomy Devices

- 1.2.3. Carotid Artery Stents

- 1.2.4. Embolic Coils

- 1.2.5. Support Devices

-

1.3. Neurosurgery Devices

- 1.3.1. Neuroendoscopes

- 1.3.2. Stereotactic Systems

- 1.3.3. Aneurysm Clips

- 1.3.4. Other Neurosurgery Devices

-

1.4. Neurostimulation Devices

- 1.4.1. Spinal Cord Stimulation Devices

- 1.4.2. Deep Brain Stimulation Devices

- 1.4.3. Sacral Nerve Stimulation Devices

- 1.4.4. Other Neurostimulation Devices

- 1.5. Other Devices

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Neurology Devices Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Neurology Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Aging Population and Increase in Incidence of Neurological Disorders; Huge Investments by Private Players in Neurology Devices; Increase in R&D in the Field of Neurotherapies

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment; Stringent FDA Validation and Guidelines for New Devices

- 3.4. Market Trends

- 3.4.1. Cerebrospinal Fluid Management Devices is Expected to Witness High Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Cerebrospinal Fluid Management Devices

- 5.1.2. Interventional Neurology Devices

- 5.1.2.1. Interventional/Surgical Simulators

- 5.1.2.2. Neurothrombectomy Devices

- 5.1.2.3. Carotid Artery Stents

- 5.1.2.4. Embolic Coils

- 5.1.2.5. Support Devices

- 5.1.3. Neurosurgery Devices

- 5.1.3.1. Neuroendoscopes

- 5.1.3.2. Stereotactic Systems

- 5.1.3.3. Aneurysm Clips

- 5.1.3.4. Other Neurosurgery Devices

- 5.1.4. Neurostimulation Devices

- 5.1.4.1. Spinal Cord Stimulation Devices

- 5.1.4.2. Deep Brain Stimulation Devices

- 5.1.4.3. Sacral Nerve Stimulation Devices

- 5.1.4.4. Other Neurostimulation Devices

- 5.1.5. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. United States North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Cerebrospinal Fluid Management Devices

- 6.1.2. Interventional Neurology Devices

- 6.1.2.1. Interventional/Surgical Simulators

- 6.1.2.2. Neurothrombectomy Devices

- 6.1.2.3. Carotid Artery Stents

- 6.1.2.4. Embolic Coils

- 6.1.2.5. Support Devices

- 6.1.3. Neurosurgery Devices

- 6.1.3.1. Neuroendoscopes

- 6.1.3.2. Stereotactic Systems

- 6.1.3.3. Aneurysm Clips

- 6.1.3.4. Other Neurosurgery Devices

- 6.1.4. Neurostimulation Devices

- 6.1.4.1. Spinal Cord Stimulation Devices

- 6.1.4.2. Deep Brain Stimulation Devices

- 6.1.4.3. Sacral Nerve Stimulation Devices

- 6.1.4.4. Other Neurostimulation Devices

- 6.1.5. Other Devices

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Canada North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Cerebrospinal Fluid Management Devices

- 7.1.2. Interventional Neurology Devices

- 7.1.2.1. Interventional/Surgical Simulators

- 7.1.2.2. Neurothrombectomy Devices

- 7.1.2.3. Carotid Artery Stents

- 7.1.2.4. Embolic Coils

- 7.1.2.5. Support Devices

- 7.1.3. Neurosurgery Devices

- 7.1.3.1. Neuroendoscopes

- 7.1.3.2. Stereotactic Systems

- 7.1.3.3. Aneurysm Clips

- 7.1.3.4. Other Neurosurgery Devices

- 7.1.4. Neurostimulation Devices

- 7.1.4.1. Spinal Cord Stimulation Devices

- 7.1.4.2. Deep Brain Stimulation Devices

- 7.1.4.3. Sacral Nerve Stimulation Devices

- 7.1.4.4. Other Neurostimulation Devices

- 7.1.5. Other Devices

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Mexico North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Cerebrospinal Fluid Management Devices

- 8.1.2. Interventional Neurology Devices

- 8.1.2.1. Interventional/Surgical Simulators

- 8.1.2.2. Neurothrombectomy Devices

- 8.1.2.3. Carotid Artery Stents

- 8.1.2.4. Embolic Coils

- 8.1.2.5. Support Devices

- 8.1.3. Neurosurgery Devices

- 8.1.3.1. Neuroendoscopes

- 8.1.3.2. Stereotactic Systems

- 8.1.3.3. Aneurysm Clips

- 8.1.3.4. Other Neurosurgery Devices

- 8.1.4. Neurostimulation Devices

- 8.1.4.1. Spinal Cord Stimulation Devices

- 8.1.4.2. Deep Brain Stimulation Devices

- 8.1.4.3. Sacral Nerve Stimulation Devices

- 8.1.4.4. Other Neurostimulation Devices

- 8.1.5. Other Devices

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. United States North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Neurology Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Smith & Nephew

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Abbott Laboratories

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Medtronic PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Johnson and Johnson

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Stryker Corporation*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MicroPort Scientific Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Boston Scientific Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nihon Kohden Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 B Braun SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Penumbra Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Smith & Nephew

List of Figures

- Figure 1: North America Neurology Devices Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: North America Neurology Devices Market Share (%) by Company 2024

List of Tables

- Table 1: North America Neurology Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: North America Neurology Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Neurology Devices Market Revenue Billion Forecast, by Device 2019 & 2032

- Table 4: North America Neurology Devices Market Volume K Units Forecast, by Device 2019 & 2032

- Table 5: North America Neurology Devices Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 6: North America Neurology Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 7: North America Neurology Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 8: North America Neurology Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: North America Neurology Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 10: North America Neurology Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: United States North America Neurology Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: United States North America Neurology Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Neurology Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Neurology Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Neurology Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Neurology Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: North America Neurology Devices Market Revenue Billion Forecast, by Device 2019 & 2032

- Table 18: North America Neurology Devices Market Volume K Units Forecast, by Device 2019 & 2032

- Table 19: North America Neurology Devices Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 20: North America Neurology Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 21: North America Neurology Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 22: North America Neurology Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 23: North America Neurology Devices Market Revenue Billion Forecast, by Device 2019 & 2032

- Table 24: North America Neurology Devices Market Volume K Units Forecast, by Device 2019 & 2032

- Table 25: North America Neurology Devices Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 26: North America Neurology Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 27: North America Neurology Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 28: North America Neurology Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 29: North America Neurology Devices Market Revenue Billion Forecast, by Device 2019 & 2032

- Table 30: North America Neurology Devices Market Volume K Units Forecast, by Device 2019 & 2032

- Table 31: North America Neurology Devices Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 32: North America Neurology Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 33: North America Neurology Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 34: North America Neurology Devices Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Neurology Devices Market?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the North America Neurology Devices Market?

Key companies in the market include Smith & Nephew, Abbott Laboratories, Medtronic PLC, Johnson and Johnson, Stryker Corporation*List Not Exhaustive, MicroPort Scientific Corporation, Boston Scientific Corporation, Nihon Kohden Corporation, B Braun SE, Penumbra Inc.

3. What are the main segments of the North America Neurology Devices Market?

The market segments include Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Aging Population and Increase in Incidence of Neurological Disorders; Huge Investments by Private Players in Neurology Devices; Increase in R&D in the Field of Neurotherapies.

6. What are the notable trends driving market growth?

Cerebrospinal Fluid Management Devices is Expected to Witness High Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment; Stringent FDA Validation and Guidelines for New Devices.

8. Can you provide examples of recent developments in the market?

October 2022: Medtronic launched the Neurovascular Co-Lab Platform for accelerating innovation in stroke care and treatment to drive collaboration and connections to help bring neurovascular innovations to life.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Neurology Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Neurology Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Neurology Devices Market?

To stay informed about further developments, trends, and reports in the North America Neurology Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence