Key Insights

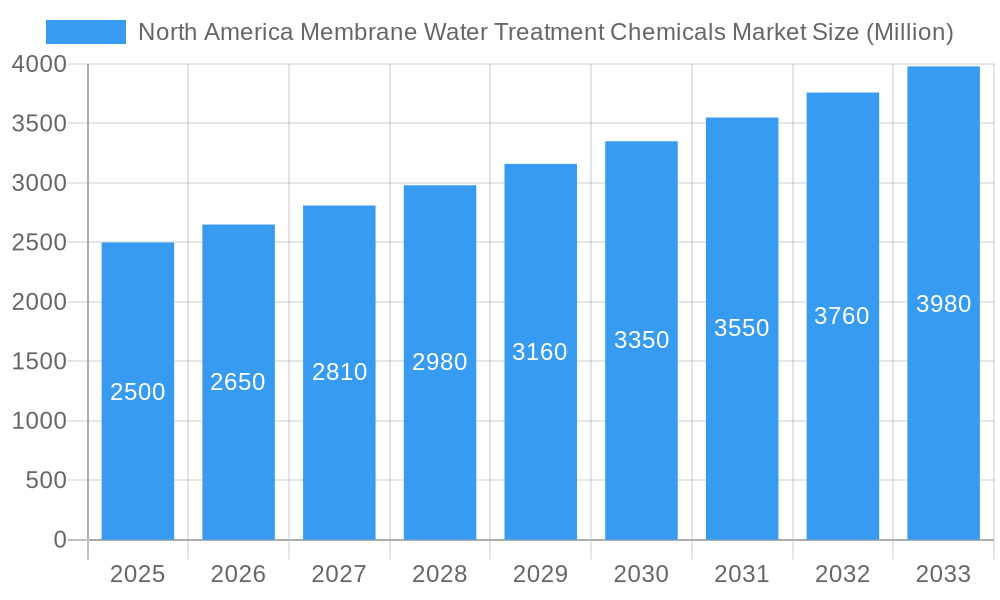

The North America membrane water treatment chemicals market is projected for significant expansion, driven by escalating demand for high-purity water across industries such as food & beverage, healthcare, and municipal water treatment. With a projected compound annual growth rate (CAGR) of 6.1%, the market is set to reach approximately $2.4 billion by 2025. This growth is underpinned by stringent water quality regulations and heightened awareness of water scarcity. Market segmentation includes pre-treatment chemicals, biological controllers, and other chemical types, with pre-treatment solutions leading due to their role in optimizing membrane performance. The food & beverage, healthcare, and municipal sectors are key end-users, emphasizing the critical need for water purity. Technological innovations in membrane systems and the development of eco-friendly chemicals are further accelerating market growth, although fluctuating raw material costs and regulatory shifts may present challenges.

North America Membrane Water Treatment Chemicals Market Market Size (In Billion)

Continued market expansion is anticipated through 2033. North America dominates the market due to its advanced infrastructure and robust regulatory environment. Leading companies are actively engaged in R&D to introduce innovative solutions. Emerging opportunities lie in the adoption of advanced oxidation processes (AOPs) and membrane bioreactors (MBRs). The trend towards sustainable and cost-effective solutions is increasing the adoption of biological controllers and environmentally friendly chemicals. Intensifying competition is expected to drive product innovation and efficiency, benefiting consumers and the environment.

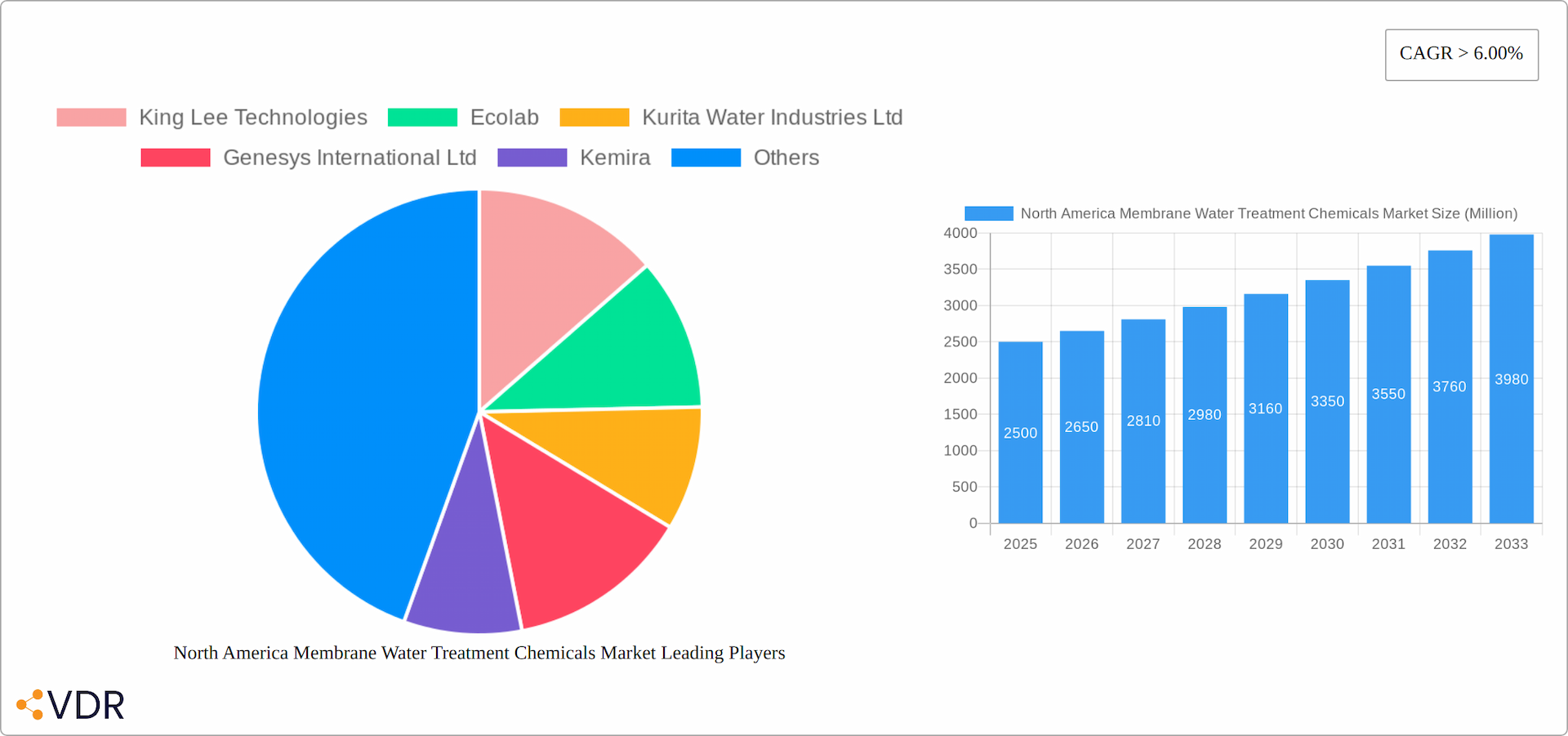

North America Membrane Water Treatment Chemicals Market Company Market Share

North America Membrane Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America membrane water treatment chemicals market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The market is segmented by chemical type (pre-treatment, biological controllers, other chemical types) and end-user industry (food & beverage processing, healthcare, municipal, chemicals, power, other end-user industries). The total market size in 2025 is estimated at $XX million and is projected to reach $XX million by 2033. Key players analyzed include King Lee Technologies, Ecolab, Kurita Water Industries Ltd, Genesys International Ltd, Kemira, Dow, Danaher (ChemTreat Inc), Solenis, Suez, Veolia, American Water Chemicals Inc, Italmatch Chemicals S.p.A, and Toray.

North America Membrane Water Treatment Chemicals Market Dynamics & Structure

The North American membrane water treatment chemicals market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, driven by the need for enhanced efficiency and sustainability, is a key driver. Stringent environmental regulations and increasing water scarcity are further propelling market growth. However, high initial investment costs and the availability of substitute technologies present challenges. The market witnesses frequent mergers and acquisitions (M&A) activity, reflecting the consolidation trend.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on developing environmentally friendly, high-performance chemicals.

- Regulatory Framework: Stringent regulations on wastewater discharge are driving demand.

- Competitive Substitutes: Reverse osmosis and other membrane technologies offer some level of substitution.

- End-User Demographics: Municipal and industrial segments are the major consumers.

- M&A Trends: Consolidation is expected to continue, with larger companies acquiring smaller specialized firms. An estimated xx M&A deals occurred between 2019 and 2024.

North America Membrane Water Treatment Chemicals Market Growth Trends & Insights

The North America membrane water treatment chemicals market demonstrated robust growth during the historical period (2019-2024), achieving a Compound Annual Growth Rate (CAGR) of approximately 6.5%. This upward trajectory was propelled by a confluence of factors, including intensified industrialization across sectors like manufacturing and energy, increasing urbanization leading to higher demand for treated water, and progressively stringent environmental regulations mandating cleaner water discharge and usage. Furthermore, a growing societal awareness of water scarcity issues and the vital role of efficient water management has significantly contributed to market expansion.

Looking ahead, the market is poised for continued expansion throughout the forecast period (2025-2033). This sustained growth will be fueled by the escalating demand from a diverse range of end-user industries, with a particular emphasis on municipal water treatment facilities and various industrial applications, including power generation, petrochemicals, and food & beverage production. Significant investments in upgrading and expanding water infrastructure, coupled with the adoption of advanced membrane technologies, are key drivers. Technological advancements are not only focused on improving membrane performance but also on the development of more sustainable, biodegradable, and eco-friendly chemical formulations. Consumer preferences are demonstrably shifting towards environmentally responsible water treatment solutions, creating a strong demand for high-performance chemicals that minimize environmental impact. The market penetration for advanced chemical types, such as specialized antiscalants and biocides, is projected to rise from an estimated 40% in 2025 to approximately 60% by 2033, reflecting the increasing adoption of sophisticated treatment methodologies.

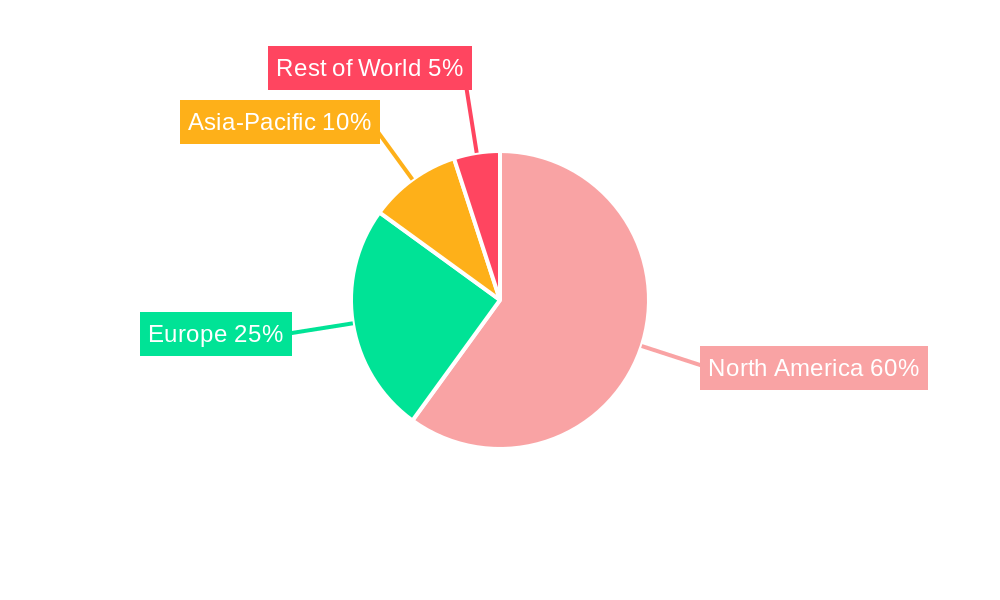

Dominant Regions, Countries, or Segments in North America Membrane Water Treatment Chemicals Market

The United States stands as the dominant force within the North American membrane water treatment chemicals market, commanding the largest market share. This leadership is attributed to its extensive and diverse industrial base, which inherently requires substantial water treatment processes, and its robust framework of stringent environmental regulations that compel adherence to high water quality standards. Furthermore, significant government investment in modernizing and expanding water infrastructure plays a crucial role in sustaining this dominance.

Within the chemical types segment, pre-treatment chemicals continue to hold a significant market position. These chemicals are indispensable for safeguarding membrane integrity and prolonging their operational lifespan by preventing fouling, scaling, and biofouling. Their critical role in optimizing membrane performance makes them a foundational component of most membrane water treatment systems.

The municipal sector represents a substantial end-user segment, driven by the continuous need to provide safe and potable water to large populations and to treat wastewater effectively. Following closely, the food & beverage processing industry is another key consumer of membrane water treatment chemicals, utilizing these solutions for product purification, ingredient water treatment, and wastewater management.

- Key Drivers (United States): A highly developed industrial landscape, exceptionally stringent environmental protection laws, and considerable governmental funding allocated to water infrastructure development and upgrades.

- Key Drivers (Pre-treatment Chemicals): Their essential function in protecting membranes from damage, thereby extending their service life and reducing replacement costs.

- Key Drivers (Municipal Sector): The sheer scale of operations in municipal water treatment plants necessitates the consistent and substantial use of various water treatment chemicals.

- Growth Potential: Significant untapped growth potential is identified within the "other end-user industries" segment. This is propelled by the increasing industrial activity in emerging sectors and a heightened global and regional emphasis on environmental stewardship and water conservation initiatives.

North America Membrane Water Treatment Chemicals Market Product Landscape

The market offers a wide range of products, including pre-treatment chemicals for cleaning and scaling prevention, biocides for controlling microbial growth, and other specialized chemicals for enhancing membrane performance. Recent innovations focus on developing eco-friendly, high-performance chemicals with improved efficiency and reduced environmental impact. Key selling propositions include enhanced membrane life, reduced operating costs, and compliance with stringent environmental regulations.

Key Drivers, Barriers & Challenges in North America Membrane Water Treatment Chemicals Market

Key Drivers:

- Increasing demand from municipal and industrial sectors.

- Stringent environmental regulations.

- Technological advancements leading to higher efficiency and sustainability.

- Growing awareness of water scarcity.

Challenges:

- High initial investment costs.

- Fluctuations in raw material prices.

- Competition from substitute technologies.

- Supply chain disruptions. (estimated xx% impact on market growth in 2024)

Emerging Opportunities in North America Membrane Water Treatment Chemicals Market

- Growing demand for sustainable and eco-friendly chemicals.

- Expansion into emerging end-user industries.

- Development of advanced membrane cleaning and preservation technologies.

- Increased adoption of smart water management solutions.

Growth Accelerators in the North America Membrane Water Treatment Chemicals Market Industry

The long-term growth trajectory of the North America membrane water treatment chemicals market will be significantly shaped by continuous technological advancements in membrane technology itself. Innovations leading to higher efficiency, greater durability, and broader applicability of membranes will inherently drive the demand for compatible and advanced chemical solutions. Strategic partnerships and collaborations between leading chemical manufacturers and established water treatment solution providers are expected to accelerate product development and market penetration. Furthermore, the strategic expansion into new geographic sub-regions and under-served end-user segments within North America presents substantial growth opportunities. The market will also be invigorated by supportive government incentives and evolving regulations that actively promote sustainable water management practices, resource recovery, and the circular economy, thereby creating a favorable environment for innovative and environmentally conscious chemical solutions.

Key Players Shaping the North America Membrane Water Treatment Chemicals Market Market

The North America Membrane Water Treatment Chemicals Market is characterized by the presence of several key players who are actively involved in innovation, product development, and strategic market expansion. These companies are instrumental in shaping the market landscape through their comprehensive product portfolios and commitment to sustainable water management solutions.

- King Lee Technologies

- Ecolab

- Kurita Water Industries Ltd

- Genesys International Ltd

- Kemira

- Dow

- Danaher (ChemTreat Inc)

- Solenis

- Suez

- Veolia

- American Water Chemicals Inc

- Italmatch Chemicals S.p.A

- Toray

Notable Milestones in North America Membrane Water Treatment Chemicals Market Sector

- 2021 (Q3): Ecolab launched a new line of sustainable membrane cleaning chemicals.

- 2022 (Q1): Kurita Water Industries Ltd acquired a smaller specialty chemical manufacturer.

- 2023 (Q2): New EPA regulations impacting chemical usage in water treatment came into effect.

In-Depth North America Membrane Water Treatment Chemicals Market Outlook

The North America membrane water treatment chemicals market is poised for significant growth over the forecast period. Technological advancements, coupled with increasing environmental concerns and government regulations, will drive demand for high-performance, sustainable chemicals. Strategic partnerships and market expansion into new segments offer lucrative opportunities for market players. The market's future potential is significant, presenting various strategic opportunities for companies to capitalize on the growing demand for efficient and sustainable water treatment solutions.

North America Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Types

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of North America Membrane Water Treatment Chemicals Market

North America Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Freshwater; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; High Capital Cost; Other Restraints

- 3.4. Market Trends

- 3.4.1. Food & Beverage Industry to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. United States North America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Canada North America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Mexico North America Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 King Lee Technologies

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ecolab

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kurita Water Industries Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Genesys International Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kemira

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dow

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Danaher (ChemTreat Inc )

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Solenis

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Suez

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Veolia

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 American Water Chemicals Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Italmatch Chemicals S p A

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Toray

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 King Lee Technologies

List of Figures

- Figure 1: North America Membrane Water Treatment Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Membrane Water Treatment Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 2: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 3: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 10: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 11: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 13: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 18: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 19: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 26: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 27: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Membrane Water Treatment Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the North America Membrane Water Treatment Chemicals Market?

Key companies in the market include King Lee Technologies, Ecolab, Kurita Water Industries Ltd, Genesys International Ltd, Kemira, Dow, Danaher (ChemTreat Inc ), Solenis, Suez, Veolia, American Water Chemicals Inc, Italmatch Chemicals S p A, Toray.

3. What are the main segments of the North America Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Freshwater; Other Drivers.

6. What are the notable trends driving market growth?

Food & Beverage Industry to dominate the Market.

7. Are there any restraints impacting market growth?

; High Capital Cost; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the North America Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence