Key Insights

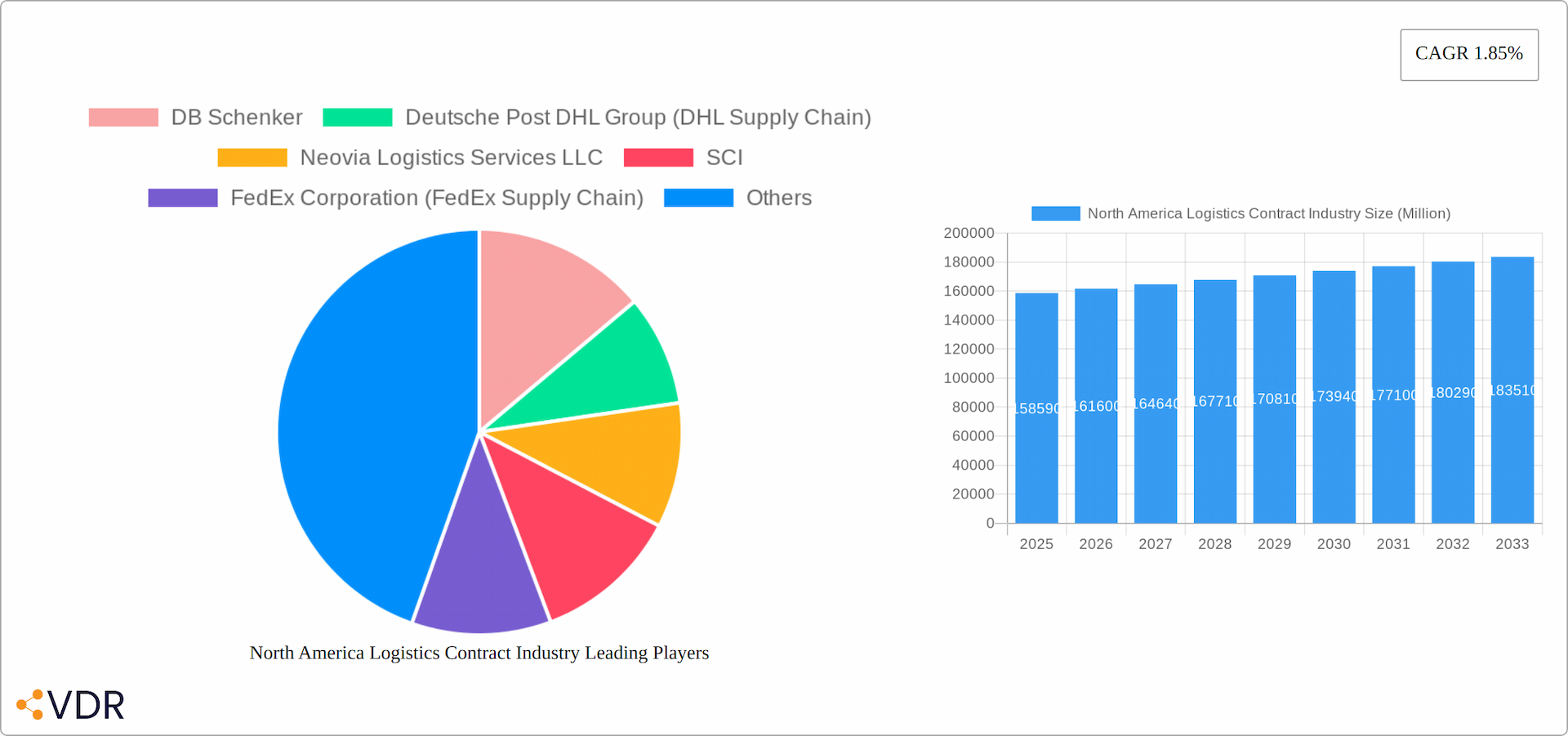

The North American logistics contract industry, valued at $158.59 billion in 2025, is projected to experience steady growth, driven by the increasing demand for efficient supply chain management across diverse sectors. The industry's Compound Annual Growth Rate (CAGR) of 1.85% from 2025 to 2033 reflects a predictable, albeit moderate, expansion. Key drivers include the burgeoning e-commerce sector fueling last-mile delivery needs, the rise of omnichannel retail strategies demanding greater supply chain agility, and the increasing adoption of advanced technologies like automation and AI for improved efficiency and cost reduction. Growth is further supported by the expansion of manufacturing and automotive industries, particularly in the United States and Mexico, contributing to higher volumes of goods requiring transportation and logistics solutions. However, factors like fluctuating fuel prices, driver shortages, and geopolitical uncertainties act as potential restraints, impacting profitability and overall market growth. The market is segmented by type (insourced vs. outsourced), end-user (manufacturing, automotive, consumer goods, high-tech, healthcare, and others), and geography (United States, Canada, and Mexico). The dominance of large players like DHL, FedEx, UPS, and others indicates a competitive landscape with significant barriers to entry for smaller firms.

North America Logistics Contract Industry Market Size (In Billion)

The segmentation analysis reveals that outsourced logistics services represent a significant portion of the market due to cost-effectiveness and access to specialized expertise. Within end-users, manufacturing and automotive sectors are major contributors to demand, followed by consumer goods and retail, as e-commerce continues its exponential growth. The United States holds the largest market share within North America, given its large economy and well-established infrastructure. However, Canada and Mexico are also witnessing considerable growth, driven by increased manufacturing activity and cross-border trade. Looking ahead, the industry's future trajectory hinges on successfully navigating challenges related to sustainability, evolving consumer expectations, and technological advancements in areas like autonomous vehicles and drone delivery. This will require continuous investment in technology, skilled workforce development, and strategic partnerships across the supply chain.

North America Logistics Contract Industry Company Market Share

North America Logistics Contract Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America logistics contract industry, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking a clear understanding of this dynamic sector.

Keywords: North America Logistics Contract Industry, Contract Logistics, 3PL, 4PL, Logistics Outsourcing, Supply Chain Management, Warehouse Management, Transportation Management, Manufacturing Logistics, Retail Logistics, Healthcare Logistics, DHL Supply Chain, FedEx Supply Chain, UPS Supply Chain Solutions, DB Schenker, United States Logistics, Canada Logistics, Mexico Logistics, Market Size, Market Share, Growth Trends, CAGR, M&A, Technological Innovation.

North America Logistics Contract Industry Market Dynamics & Structure

The North American contract logistics market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market size in 2025 is estimated at xx Million, expected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, particularly in automation and data analytics, are key drivers of innovation. However, regulatory complexities and the need for substantial capital investment pose barriers to entry for smaller firms.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Adoption of AI, robotics, and IoT is transforming warehouse operations and transportation efficiency.

- Regulatory Framework: Compliance with evolving safety, security, and environmental regulations adds operational complexities.

- Competitive Product Substitutes: The rise of e-commerce and direct-to-consumer models is creating increased competition.

- End-User Demographics: The manufacturing, healthcare, and retail sectors are major end-users of contract logistics services.

- M&A Trends: Consolidation through mergers and acquisitions is expected to continue, driving further market concentration. The number of M&A deals in the period 2019-2024 was approximately xx.

North America Logistics Contract Industry Growth Trends & Insights

The North American contract logistics market has experienced robust growth over the past years, fueled by the expansion of e-commerce, globalization of supply chains, and increasing demand for efficient logistics solutions. The market size expanded from xx Million in 2019 to xx Million in 2024. This positive trajectory is expected to continue, driven by factors such as:

- E-commerce Boom: The rapid growth of online retail is boosting demand for last-mile delivery and warehousing services.

- Supply Chain Optimization: Companies are increasingly outsourcing logistics functions to enhance efficiency and reduce costs.

- Technological Advancements: Automation, AI, and big data analytics are improving the speed, accuracy, and cost-effectiveness of logistics operations.

- Shifting Consumer Behavior: Consumers are demanding faster and more convenient delivery options, putting pressure on logistics providers to innovate.

- Market Penetration: The penetration of contract logistics services is expected to increase further, particularly in the smaller and medium-sized business sector.

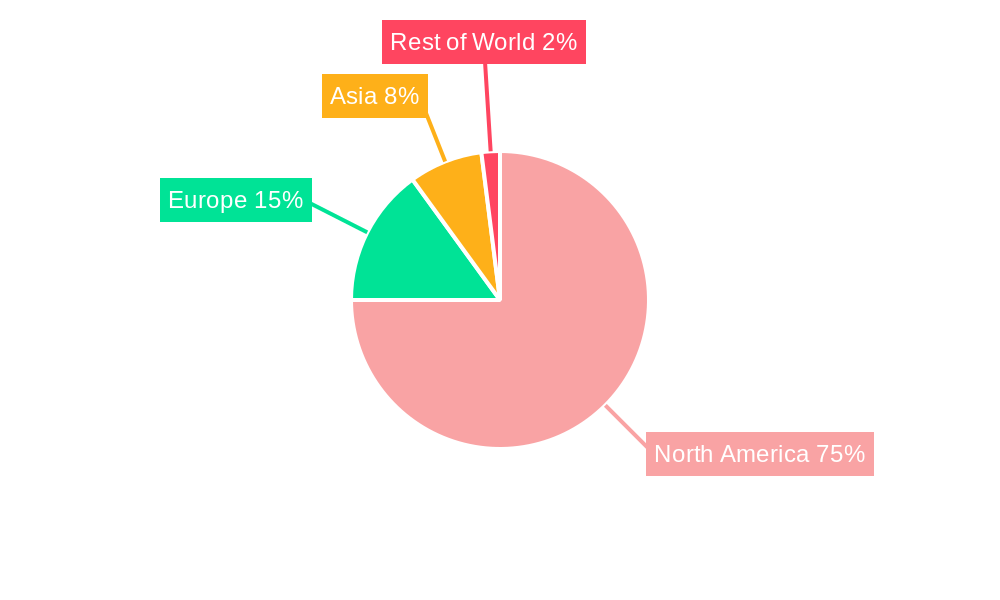

Dominant Regions, Countries, or Segments in North America Logistics Contract Industry

The United States holds the dominant position in the North American contract logistics market, commanding approximately [Insert Updated Percentage]% of the total market value in 2025 (or latest available year). This leadership stems from its expansive and diversified economy, sophisticated infrastructure network, and the robust growth of its e-commerce sector. Canada and Mexico are also experiencing substantial growth, fueled by increased foreign direct investment and the expansion of their manufacturing sectors. The market is further segmented by specialized services, such as temperature-controlled logistics and last-mile delivery, which are experiencing particularly rapid growth.

By Service Type: The Outsourced segment maintains a larger market share ([Insert Updated Percentage]%) compared to the Insourced segment ([Insert Updated Percentage]% ), reflecting a prevailing preference for leveraging external logistics expertise and scalability. This trend is driven by companies focusing on their core competencies and seeking efficient solutions for complex supply chain operations.

By End User: The Manufacturing & Automotive and Consumer Goods & Retail sectors represent the largest market segments, followed by High-Tech, Healthcare & Pharmaceuticals, and others. The Healthcare and Pharmaceuticals sector demonstrates particularly robust growth, driven by the increasing demand for specialized temperature-controlled logistics and stringent regulatory compliance.

- United States: The strong US economy, extensive infrastructure, high e-commerce penetration, and diverse industrial base solidify its market leadership.

- Canada: Growth is propelled by expanding manufacturing and e-commerce sectors, as well as investments in logistics infrastructure.

- Mexico: Its strategic proximity to the US market, cost-competitive labor, and a developing manufacturing base make it an increasingly attractive location for logistics providers, particularly for near-shoring and reshoring initiatives.

- Manufacturing & Automotive: High demand for efficient and reliable supply chain management solutions, particularly for just-in-time manufacturing and global supply chains.

- Consumer Goods & Retail: The explosive growth of e-commerce continues to fuel demand for rapid and reliable last-mile delivery services, demanding flexible and scalable logistics solutions.

- Healthcare & Pharmaceuticals: The sector faces stringent regulatory compliance, requiring specialized temperature-controlled logistics and robust track-and-trace capabilities to ensure product integrity and patient safety.

North America Logistics Contract Industry Product Landscape

The North American contract logistics market provides a comprehensive range of services, encompassing warehousing, transportation management, freight forwarding, order fulfillment, and integrated supply chain management solutions. Recent innovations emphasize the adoption of automation technologies (e.g., robotics, automated guided vehicles, AI-powered sorting), advanced data analytics (predictive modeling for inventory optimization, real-time visibility platforms), and sustainable practices (green logistics initiatives, reducing carbon footprint). These advancements are enhancing operational efficiency, supply chain transparency, and overall resilience, allowing businesses to better adapt to market fluctuations and disruptions. Key differentiators for providers include specialized industry expertise, technological proficiency, and a commitment to sustainable practices. The use of blockchain technology for increased transparency and security is also gaining traction.

Key Drivers, Barriers & Challenges in North America Logistics Contract Industry

Key Drivers:

- Increased demand for efficient and cost-effective logistics solutions

- Growth of e-commerce and omnichannel retailing

- Technological advancements such as AI, automation, and IoT

- Globalization and expansion of international trade

- Government initiatives to improve infrastructure and supply chain efficiency.

Challenges & Restraints:

- Labor shortages and rising labor costs

- Supply chain disruptions and volatility

- Increasing fuel prices and transportation costs

- Stringent regulatory compliance requirements

- Intense competition and market consolidation. The impact of increased competition is estimated to reduce profit margins by approximately xx% by 2033.

Emerging Opportunities in North America Logistics Contract Industry

- Expansion of Last-Mile Delivery Solutions: Increasing demand for faster, more flexible, and cost-effective last-mile delivery options, including same-day and on-demand services.

- Growth of Cold Chain Logistics: Rising demand for temperature-controlled transportation and warehousing to support the pharmaceutical, food, and other temperature-sensitive goods industries.

- Increased Adoption of Sustainable and Green Logistics Solutions: Growing regulatory pressures and consumer preferences are driving the adoption of environmentally friendly logistics practices, including alternative fuels, optimized routing, and carbon offsetting.

- Growing Demand for Integrated Logistics Solutions: Businesses are increasingly seeking comprehensive, end-to-end solutions that streamline their entire supply chain, from procurement to delivery.

- Opportunities in Emerging Markets within North America: Growth in less developed regions of North America offers potential for expansion and development of robust logistics networks.

- E-commerce Fulfillment Growth: The persistent rise of e-commerce requires efficient, scalable, and robust fulfillment solutions to meet increasing customer expectations.

Growth Accelerators in the North America Logistics Contract Industry Industry

Technological breakthroughs, especially in automation and artificial intelligence, are significant growth catalysts. Strategic partnerships between logistics providers and technology companies are creating innovative solutions that enhance efficiency and visibility. Furthermore, expansion into new markets and service offerings, coupled with a focus on sustainability, is expected to drive long-term growth.

Key Players Shaping the North America Logistics Contract Industry Market

- DB Schenker

- Deutsche Post DHL Group (DHL Supply Chain)

- Neovia Logistics Services LLC

- SCI

- FedEx Corporation (FedEx Supply Chain)

- United Parcel Service Inc (UPS Supply Chain Solutions)

- Schnedier National

- 3 Other Companies (Key Information/Overview)

- Yusen Logistics Co Ltd

- Penske Logistics Inc

- Kuehne + Nagel International AG

- CEVA Logistics

- PiVAL International

- TIBA

- XPO Logistics Inc

- Americold

- Hellmann Worldwide Logistics GmbH & Co KG

- Geodis

- J B Hunt Transport Services Inc

- Ryder System Inc

Notable Milestones in North America Logistics Contract Industry Sector

- June 2022: DHL Supply Chain surpasses 100 million units picked using LocusBots in North American facilities.

- February 2022: DHL Supply Chain invests USD 400 million to expand its pharmaceutical and medical device distribution network by 27%, adding nearly 3 million square feet.

In-Depth North America Logistics Contract Industry Market Outlook

The North American contract logistics market is poised for sustained growth, driven by technological innovation, strategic partnerships, and expanding e-commerce. The market's future potential is significant, with opportunities for growth in specialized services, sustainable practices, and new technologies. Strategic acquisitions and partnerships will continue to shape the competitive landscape, and providers focusing on efficiency, resilience, and customer-centric solutions will gain a competitive edge.

North America Logistics Contract Industry Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

North America Logistics Contract Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Logistics Contract Industry Regional Market Share

Geographic Coverage of North America Logistics Contract Industry

North America Logistics Contract Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increased Outsourcing of Services4.; Increasing Demand For Contract Logistics In Italy

- 3.2.2 France

- 3.2.3 And Poland4.; Growth Of Ecommerce Sector Across Europe

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Competition In The European Contract Logistics Market

- 3.4. Market Trends

- 3.4.1. Growing E-commerce in the Region Driving the Contract Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Logistics Contract Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deutsche Post DHL Group (DHL Supply Chain)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neovia Logistics Services LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SCI

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corporation (FedEx Supply Chain)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 United Parcel Service Inc (UPS Supply Chain Solutions)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schnedier National*6 3 Other Companies (Key Information/Overview)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yusen Logistics Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Penske Logistics Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kuehne + Nagel International AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CEVA Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PiVAL International

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TIBA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 XPO Logistics Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Americold

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Hellmann Worldwide Logistics GmbH & Co KG

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Geodis

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 J B Hunt Transport Services Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Ryder System Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: North America Logistics Contract Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Logistics Contract Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Logistics Contract Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Logistics Contract Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Logistics Contract Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Logistics Contract Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Logistics Contract Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: North America Logistics Contract Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Logistics Contract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Logistics Contract Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Logistics Contract Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Logistics Contract Industry?

The projected CAGR is approximately 1.85%.

2. Which companies are prominent players in the North America Logistics Contract Industry?

Key companies in the market include DB Schenker, Deutsche Post DHL Group (DHL Supply Chain), Neovia Logistics Services LLC, SCI, FedEx Corporation (FedEx Supply Chain), United Parcel Service Inc (UPS Supply Chain Solutions), Schnedier National*6 3 Other Companies (Key Information/Overview), Yusen Logistics Co Ltd, Penske Logistics Inc, Kuehne + Nagel International AG, CEVA Logistics, PiVAL International, TIBA, XPO Logistics Inc, Americold, Hellmann Worldwide Logistics GmbH & Co KG, Geodis, J B Hunt Transport Services Inc, Ryder System Inc.

3. What are the main segments of the North America Logistics Contract Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 158.59 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Outsourcing of Services4.; Increasing Demand For Contract Logistics In Italy. France. And Poland4.; Growth Of Ecommerce Sector Across Europe.

6. What are the notable trends driving market growth?

Growing E-commerce in the Region Driving the Contract Logistics Market.

7. Are there any restraints impacting market growth?

4.; Increasing Competition In The European Contract Logistics Market.

8. Can you provide examples of recent developments in the market?

Jun 2022: DHL Supply Chain, in contract logistics in the Americas and a division of Deutsche Post DHL Group, revealed that LocusBots from Locus Robotics had selected more than 100 million units in its North American facilities. The achievement was made at the DHL facility in Hanover Township, Pennsylvania, while completing orders for a significant clothes retailer. The facility where the milestone was reached is one of over a dozen DHL locations in North America that employ more than 2,000 LocusBots-more than any other contract logistics provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Logistics Contract Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Logistics Contract Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Logistics Contract Industry?

To stay informed about further developments, trends, and reports in the North America Logistics Contract Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence