Key Insights

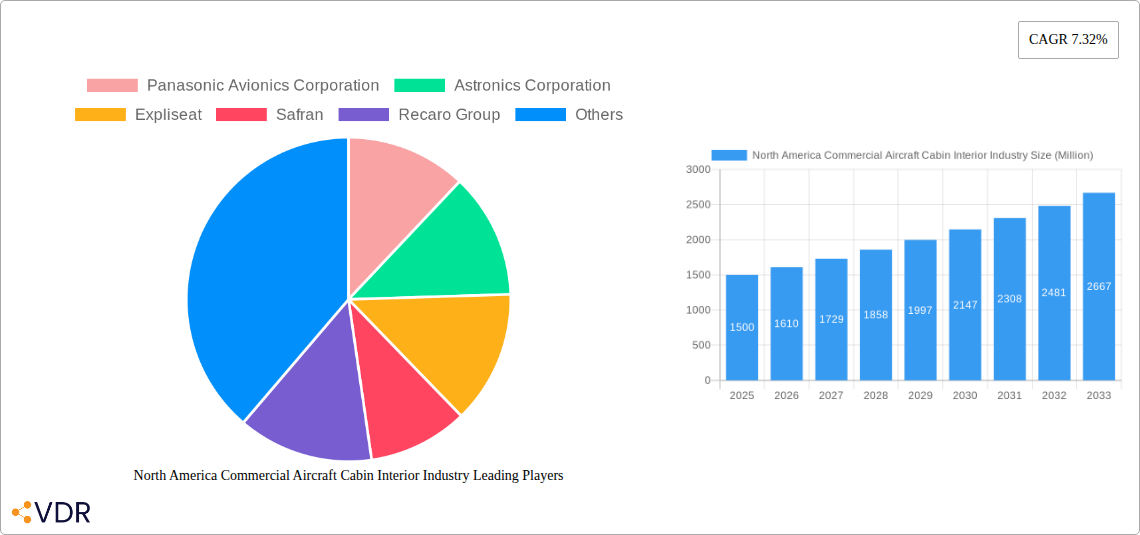

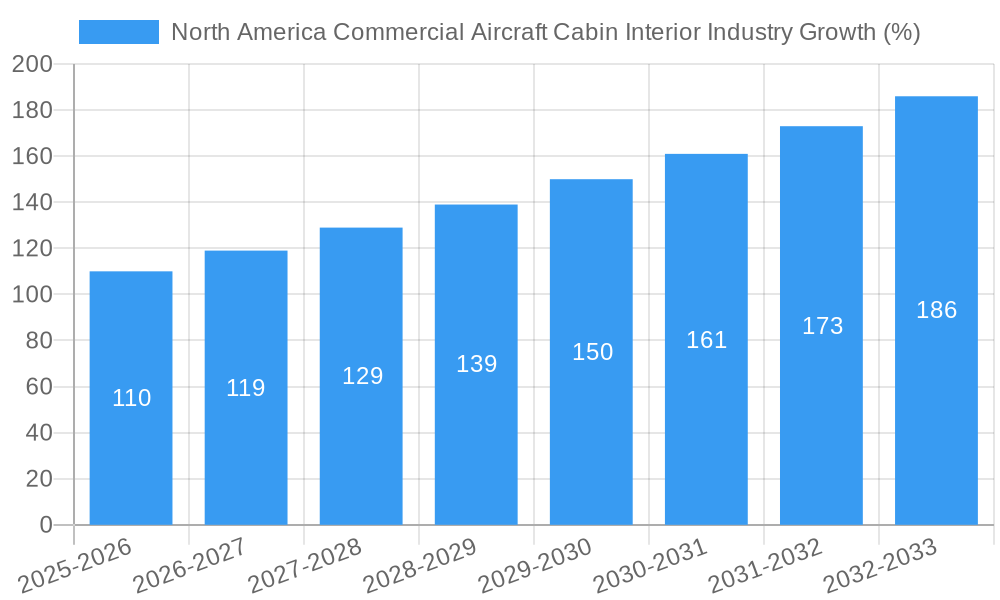

The North American commercial aircraft cabin interior market is experiencing robust growth, driven by increasing passenger traffic, a focus on enhanced passenger comfort and experience, and technological advancements in cabin design and in-flight entertainment. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 7.32% and a specified market size 'XX' million, the exact figure requires the missing value 'XX' to be supplied), is projected to expand significantly over the forecast period of 2025-2033. Key growth drivers include the rising demand for fuel-efficient narrow-body aircraft, the increasing preference for premium cabin classes, and the integration of advanced technologies such as improved in-flight entertainment systems and personalized lighting solutions. Major players like Boeing and Airbus are constantly innovating, pushing the boundaries of cabin design and passenger amenities, fueling this market's expansion. Specific segments such as in-flight entertainment systems and passenger seats are expected to exhibit faster growth due to technological advancements and rising consumer expectations.

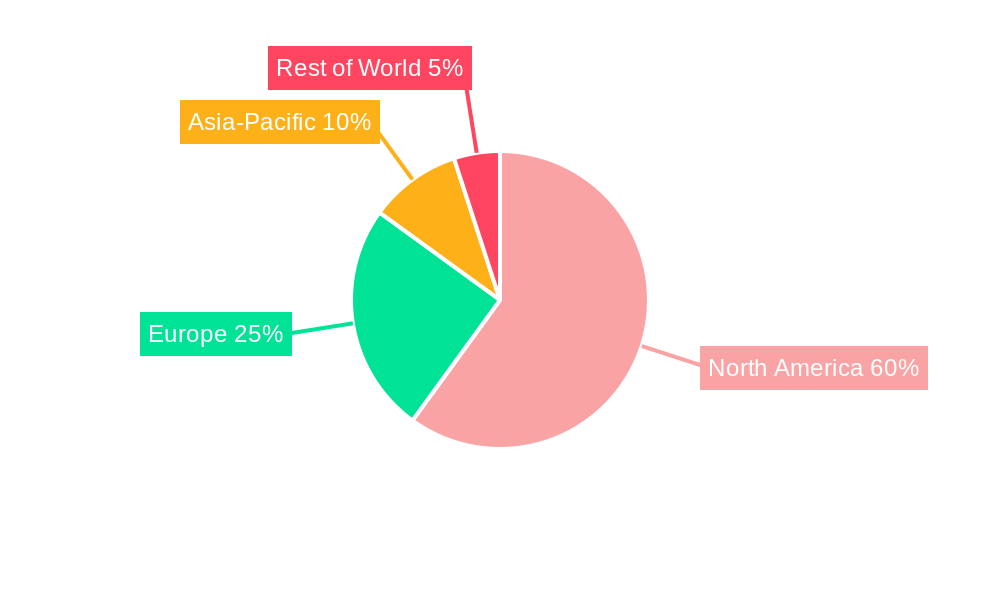

Despite the positive outlook, the market faces certain restraints. Supply chain disruptions, particularly concerning raw materials and component availability, and fluctuating fuel prices can impact manufacturing costs and overall market growth. Additionally, increasing regulatory compliance requirements for aircraft safety and environmental standards add to the operational challenges. However, the long-term growth trajectory remains positive due to the continued expansion of the aviation industry and the relentless pursuit of enhancing the passenger experience. The regional focus on North America, encompassing the US, Canada, and Mexico, highlights a significant market concentration due to a large air travel network and a strong presence of major aircraft manufacturers and suppliers within the region. The analysis of segments like Cabin Lights, Cabin Windows, Passenger Seats, and In-Flight Entertainment Systems, further broken down by aircraft type and cabin class, provides a granular understanding of this dynamic sector.

North America Commercial Aircraft Cabin Interior Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America commercial aircraft cabin interior market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand the market dynamics, growth trends, and future opportunities within this lucrative sector. The report covers key segments including passenger seats, cabin lighting, in-flight entertainment systems, and cabin windows across narrowbody and widebody aircraft for various cabin classes, spanning the United States, Canada, and the Rest of North America. The market value is presented in millions of units.

North America Commercial Aircraft Cabin Interior Industry Market Dynamics & Structure

The North American commercial aircraft cabin interior market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, driven by passenger demand for enhanced comfort and connectivity, is a major growth driver. Stringent safety regulations and evolving industry standards form a robust regulatory framework. Competition from substitute materials and technologies is present, but innovation in areas like lightweight materials and sustainable options is mitigating this challenge. The market is significantly influenced by airline fleet renewal and expansion plans, alongside evolving passenger demographics and preferences. Mergers and acquisitions (M&A) activity in the sector is moderate, with xx deals recorded in the historical period, primarily focused on strengthening technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on lightweight materials, advanced IFE systems (4K screens, high-fidelity audio), and sustainable cabin solutions.

- Regulatory Landscape: Stringent safety regulations from FAA (United States) and Transport Canada drive product development and quality.

- Competitive Substitutes: Emerging materials and technologies challenge traditional solutions, although premiumization trends favor high-quality offerings.

- End-User Demographics: Shifting passenger preferences towards enhanced comfort and connectivity influence product development.

- M&A Activity: xx deals recorded between 2019-2024, mainly focused on technology integration and market expansion.

North America Commercial Aircraft Cabin Interior Industry Growth Trends & Insights

The North American commercial aircraft cabin interior market experienced a compound annual growth rate (CAGR) of xx% during 2019-2024, reaching a market size of xx million in 2025. Driven by strong air passenger traffic growth (pre-pandemic levels and subsequent recovery) and an increasing focus on passenger experience, the market is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx million by 2033. Technological disruptions, including the integration of advanced IFE systems and the adoption of sustainable materials, are significantly influencing market growth. Consumer behavior is shifting towards higher expectations regarding comfort, connectivity, and personalized in-flight experiences. Market penetration of advanced IFE systems is expected to increase from xx% in 2025 to xx% by 2033. The adoption of lightweight materials is also gaining traction, driven by airlines' focus on fuel efficiency.

Dominant Regions, Countries, or Segments in North America Commercial Aircraft Cabin Interior Industry

The United States dominates the North American commercial aircraft cabin interior market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to its large commercial aviation fleet and the presence of major airlines and aircraft manufacturers. The narrowbody aircraft segment holds the largest share, driven by high demand for fuel-efficient aircraft for short- and medium-haul routes. The passenger seats segment is the largest product type, reflecting the importance of passenger comfort. Within cabin classes, economy and premium economy class holds the largest share, owing to higher passenger volumes.

- Key Drivers in the US Market: Strong airline industry, significant aircraft manufacturing presence, high disposable income among air travelers, robust infrastructure.

- Key Drivers in Canada: Growing domestic and international air travel, airline fleet modernization programs.

- Product Type: Passenger Seats (xx million in 2025), followed by In-Flight Entertainment Systems (xx million in 2025) and Cabin Lighting (xx million in 2025).

- Aircraft Type: Narrowbody (xx million in 2025) dominates due to higher volume of short-haul flights.

- Cabin Class: Economy and Premium Economy (xx million in 2025) maintains a large market share due to passenger volumes.

North America Commercial Aircraft Cabin Interior Industry Product Landscape

The North American commercial aircraft cabin interior market showcases a diverse product landscape, with continuous innovation in materials, design, and technology. Passenger seats are evolving towards enhanced comfort, ergonomics, and space optimization. IFE systems are integrating advanced features like 4K OLED screens, high-fidelity audio, and personalized content delivery. Cabin lighting is adopting energy-efficient LED technology and customizable mood lighting. Cabin windows are increasingly incorporating electrochromic technology for adjustable light transmission. Unique selling propositions include enhanced passenger comfort, improved fuel efficiency (lightweight materials), increased operational efficiency, and personalized in-flight experiences.

Key Drivers, Barriers & Challenges in North America Commercial Aircraft Cabin Interior Industry

Key Drivers:

- Growing air passenger traffic.

- Increasing focus on enhanced passenger experience.

- Technological advancements in materials, IFE systems, and lighting solutions.

- Airline fleet modernization and expansion.

Key Challenges:

- Supply chain disruptions impacting material availability and production timelines. (Impact: xx% increase in production costs in 2023)

- Fluctuations in fuel prices affecting airline profitability and investment in cabin upgrades.

- Intense competition among suppliers requiring continuous innovation and cost optimization.

- Stringent regulatory compliance demands, requiring significant investment in testing and certification.

Emerging Opportunities in North America Commercial Aircraft Cabin Interior Industry

- Increased demand for sustainable and eco-friendly cabin materials.

- Growing adoption of advanced passenger service technologies, including personalized entertainment and interactive systems.

- Expansion of premium economy and business class cabins.

- Opportunities in the retrofit market as older aircraft are upgraded.

Growth Accelerators in the North America Commercial Aircraft Cabin Interior Industry Industry

Technological advancements, such as the development of lighter, more durable, and sustainable materials, along with improved IFE systems, are driving long-term growth. Strategic partnerships between manufacturers and airlines are also accelerating innovation and market penetration. Expanding into untapped market segments, such as regional aircraft and business jets, presents further growth potential. Expansion into new technologies like personalized lighting and health-focused cabin designs are also major accelerators.

Key Players Shaping the North America Commercial Aircraft Cabin Interior Market

- Panasonic Avionics Corporation

- Astronics Corporation

- Expliseat

- Safran

- Recaro Group

- STG Aerospace

- Luminator Technology Group

- FACC AG

- Thompson Aero Seating

- Thales Group

- Diehl Aerospace GmbH

- SCHOTT Technical Glass Solutions GmbH

- GKN Aerospace Service Limited

- Jamco Corporation

- Adient Aerospace

- Collins Aerospace

Notable Milestones in North America Commercial Aircraft Cabin Interior Industry Sector

- June 2023: United Airlines selects Panasonic's Astrova system, featuring 4K OLED screens and programmable LED lighting.

- June 2023: Expliseat secures an order for over 2,000 TiSeat E2 units from Jazeera Airways.

- July 2023: Jamco Corporation installs its Venture reverse herringbone seats on KLM's B777 fleet.

In-Depth North America Commercial Aircraft Cabin Interior Industry Market Outlook

The North American commercial aircraft cabin interior market is poised for significant growth over the next decade, driven by the factors outlined above. Strategic investments in technological innovation, sustainable materials, and enhanced passenger experiences will be crucial for sustained success. The market will witness increased competition and consolidation as companies vie for market share. Opportunities exist in emerging technologies and new market segments. Airlines will continue to invest in upgrading their fleets to enhance the passenger experience and drive operational efficiency. This ultimately translates into a positive outlook for market growth, with significant opportunities for innovation and strategic partnerships.

North America Commercial Aircraft Cabin Interior Industry Segmentation

-

1. Product Type

- 1.1. Cabin Lights

- 1.2. Cabin Windows

- 1.3. In-Flight Entertainment System

- 1.4. Passenger Seats

- 1.5. Other Product Types

-

2. Aircraft Type

- 2.1. Narrowbody

- 2.2. Widebody

-

3. Cabin Class

- 3.1. Business and First Class

- 3.2. Economy and Premium Economy Class

North America Commercial Aircraft Cabin Interior Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Aircraft Cabin Interior Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cabin Lights

- 5.1.2. Cabin Windows

- 5.1.3. In-Flight Entertainment System

- 5.1.4. Passenger Seats

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Narrowbody

- 5.2.2. Widebody

- 5.3. Market Analysis, Insights and Forecast - by Cabin Class

- 5.3.1. Business and First Class

- 5.3.2. Economy and Premium Economy Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic Avionics Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Astronics Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Expliseat

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Safran

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Recaro Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STG Aerospace

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Luminator Technology Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FACC AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Thompson Aero Seatin

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Thales Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Diehl Aerospace GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SCHOTT Technical Glass Solutions GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 GKN Aerospace Service Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Jamco Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Adient Aerospace

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Collins Aerospace

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: North America Commercial Aircraft Cabin Interior Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Commercial Aircraft Cabin Interior Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 4: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Cabin Class 2019 & 2032

- Table 5: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 13: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Cabin Class 2019 & 2032

- Table 14: North America Commercial Aircraft Cabin Interior Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Commercial Aircraft Cabin Interior Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Aircraft Cabin Interior Industry?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the North America Commercial Aircraft Cabin Interior Industry?

Key companies in the market include Panasonic Avionics Corporation, Astronics Corporation, Expliseat, Safran, Recaro Group, STG Aerospace, Luminator Technology Group, FACC AG, Thompson Aero Seatin, Thales Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, GKN Aerospace Service Limited, Jamco Corporation, Adient Aerospace, Collins Aerospace.

3. What are the main segments of the North America Commercial Aircraft Cabin Interior Industry?

The market segments include Product Type, Aircraft Type, Cabin Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Jamco Corporation announced that through a collaboration with KLM Royal Dutch Airlines (KLM), its premium class seats, Venture reverse herringbone, were installed in the World Business Class (WBC) of KLM's B777 Fleet.June 2023: United will be the first US airline to offer Panasonic's Astrova system, giving customers exclusive features like 4K OLED screens, high fidelity audio, and programmable LED lighting, starting in 2025.June 2023: French designer and aircraft seat manufacturer Expliseat is expected to deliver more than 2,000 units of its latest TiSeat model named E2. This model will be installed on the aircraft of the expanding Kuwaiti airline Jazeera Airways, which uses the Airbus A320 and A321 models, providing additional comfort to its passengers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Aircraft Cabin Interior Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Aircraft Cabin Interior Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Aircraft Cabin Interior Industry?

To stay informed about further developments, trends, and reports in the North America Commercial Aircraft Cabin Interior Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence