Key Insights

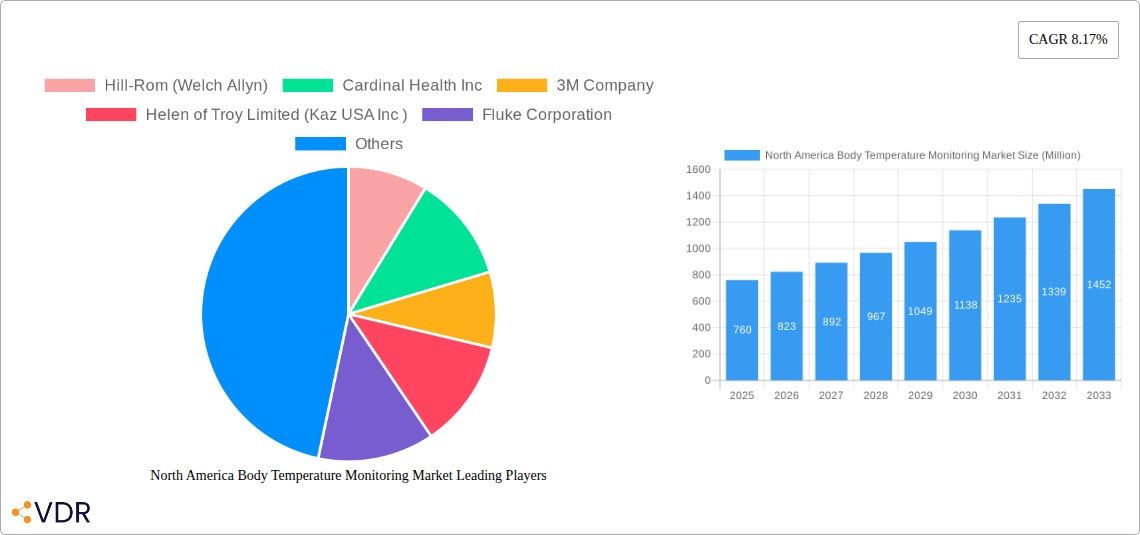

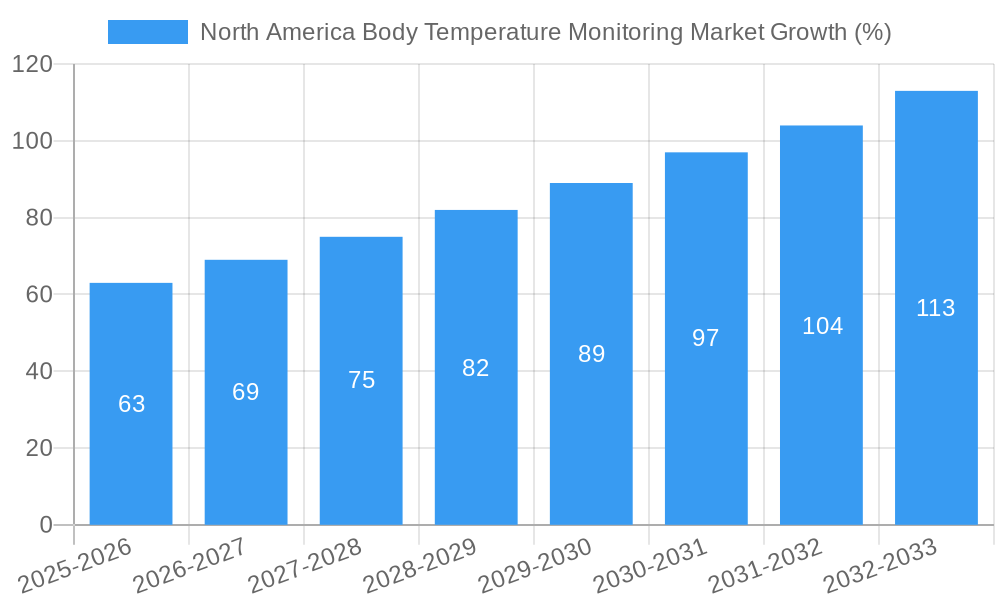

The North American body temperature monitoring market, valued at $0.76 billion in 2025, is projected to experience robust growth, driven by a rising elderly population, increasing prevalence of chronic diseases requiring close temperature monitoring, and technological advancements in thermometer design. The market's Compound Annual Growth Rate (CAGR) of 8.17% from 2025 to 2033 indicates a significant expansion, with substantial opportunities for market players. Non-contact thermometers are gaining popularity due to their ease of use and reduced risk of cross-contamination, particularly in healthcare settings. The segment is further fueled by the increasing adoption of smart thermometers with data logging and connectivity features, enabling remote patient monitoring and improved healthcare efficiency. Hospitals and clinics remain the largest end-users, although the home-use segment is steadily expanding, reflecting the growing emphasis on self-care and telehealth solutions. This growth is supported by increased consumer awareness of accurate temperature monitoring's importance in preventing and managing illnesses. However, the market faces potential restraints such as stringent regulatory approvals for new technologies and the potential for pricing pressure due to increasing competition among established and emerging players. The United States, as the largest economy in North America, constitutes a significant portion of the market share, followed by Canada and Mexico.

The market segmentation reveals valuable insights into specific growth areas. The non-contact thermometer segment is likely to show faster growth compared to contact thermometers due to increased hygiene concerns. Within applications, ear thermometers might demonstrate strong growth due to their ease of use, especially for children. Although the provided data lacks specific segment values, it is reasonable to assume that hospitals and clinics currently hold the largest market share within the end-user segment, but the home-use segment exhibits the highest growth potential considering the rising adoption of telehealth and home-based healthcare practices. This necessitates a strategic focus on developing user-friendly, affordable, and technologically advanced thermometers tailored to both professional and consumer needs. Future market success will hinge on innovation, strategic partnerships, and a strong focus on user experience.

North America Body Temperature Monitoring Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the North America body temperature monitoring market, providing crucial insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, growth trends, and key players, this report covers the period from 2019 to 2033, with 2025 as the base year and a forecast extending to 2033. The market is segmented by product (contact and non-contact thermometers), application (oral cavity, rectum, ear, other), and end-user (hospitals, clinics, homes). The report's value is presented in million units.

North America Body Temperature Monitoring Market Dynamics & Structure

The North America body temperature monitoring market is characterized by a moderately consolidated structure, with several major players holding significant market share. Technological innovation, particularly in non-contact thermometers and smart devices, is a key driver. Stringent regulatory frameworks, primarily overseen by the FDA, influence product development and market access. Competitive pressures exist from substitute products, such as wearable health trackers offering temperature monitoring capabilities. The end-user demographic is diverse, ranging from healthcare facilities to individual consumers. M&A activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, resulting in a xx% market share shift among the top 5 players.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% of market share in 2024.

- Technological Innovation: Driven by advancements in sensor technology, wireless connectivity, and data analytics.

- Regulatory Landscape: Stringent FDA regulations impacting product approvals and market entry.

- Competitive Substitutes: Wearable health trackers and smart home devices offering temperature monitoring.

- End-User Demographics: Hospitals, clinics, and homes constitute major end-user segments, with increasing adoption in home settings.

- M&A Trends: Moderate activity in recent years, with xx deals recorded between 2019 and 2024.

North America Body Temperature Monitoring Market Growth Trends & Insights

The North America body temperature monitoring market has experienced consistent growth over the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing healthcare expenditure, rising prevalence of infectious diseases, and growing consumer awareness regarding personal health. Technological disruptions, such as the introduction of smart thermometers with connected features, have accelerated market adoption. Shifting consumer preferences towards convenient and accurate temperature monitoring solutions are also driving market expansion. Market penetration for non-contact thermometers is increasing significantly, driven by their ease of use and hygiene advantages. The market is expected to maintain robust growth during the forecast period (2025-2033), reaching xx million units by 2033, with a projected CAGR of xx%.

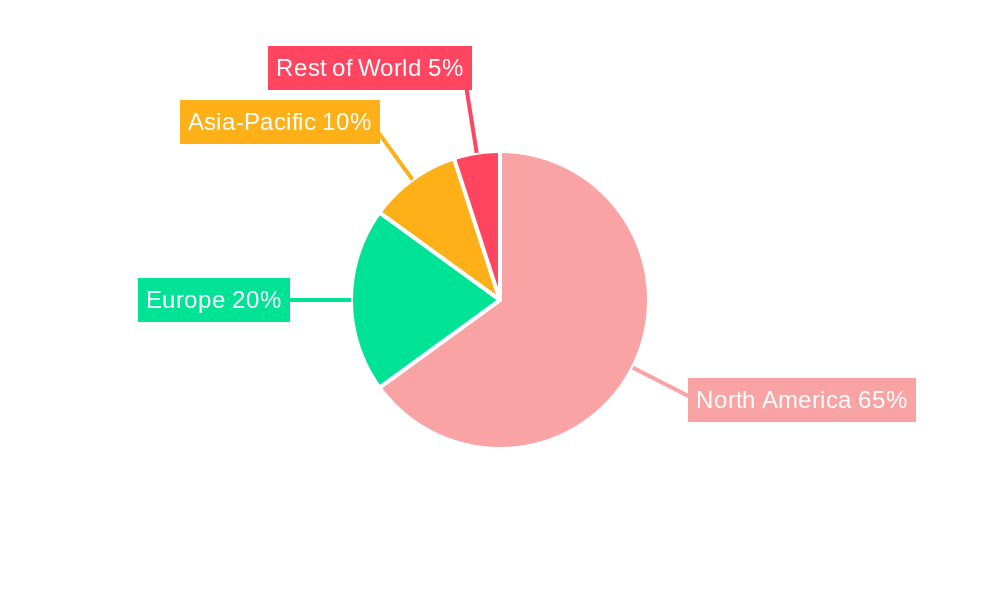

Dominant Regions, Countries, or Segments in North America Body Temperature Monitoring Market

The United States dominates the North America body temperature monitoring market, accounting for approximately xx% of the total market value in 2024. This dominance is primarily attributed to robust healthcare infrastructure, higher healthcare expenditure, and greater awareness of health monitoring technologies. Among product segments, non-contact thermometers are experiencing faster growth compared to contact thermometers, driven by their ease of use and reduced risk of cross-contamination. In terms of applications, oral cavity and ear remain the most prevalent methods. Hospitals and clinics account for a significant share of the market. However, the home segment shows significant growth potential fueled by the increasing accessibility and affordability of at-home health monitoring devices.

- Key Drivers in the US: Advanced healthcare infrastructure, high healthcare spending, and higher consumer awareness.

- Non-contact Thermometer Growth: Driven by convenience, hygiene, and accuracy.

- Hospital and Clinic Dominance: High volume of patients and demand for reliable temperature monitoring.

- Home Segment Potential: Driven by increasing affordability and convenience of at-home testing.

North America Body Temperature Monitoring Market Product Landscape

The market offers a range of contact and non-contact thermometers with diverse features. Contact thermometers, including oral, rectal, and axillary types, remain essential, offering accurate measurements at relatively lower costs. Non-contact thermometers, using infrared technology, provide touchless and convenient measurement, appealing to both healthcare professionals and consumers. Technological advancements include improved accuracy, faster readings, connectivity to mobile devices, and data logging capabilities. Unique selling propositions include features like fever alerts, age-specific measurement modes, and easy-to-read displays.

Key Drivers, Barriers & Challenges in North America Body Temperature Monitoring Market

Key Drivers:

- Increasing prevalence of infectious diseases requiring rapid temperature screening.

- Growing consumer awareness and self-monitoring of health.

- Technological advancements leading to greater accuracy and convenience.

- Increasing demand for remote patient monitoring solutions.

Challenges and Restraints:

- High initial investment costs for advanced technology thermometers, hindering widespread adoption, particularly in lower-income communities.

- Potential accuracy issues with certain non-contact thermometers, requiring proper usage and calibration.

- Regulatory hurdles and stringent approval processes for new product launches.

- Competitive pressures from established and emerging players in the market.

Emerging Opportunities in North America Body Temperature Monitoring Market

- Expansion into untapped markets, such as long-term care facilities and veterinary clinics.

- Integration of temperature monitoring with other telehealth solutions.

- Development of advanced features like continuous temperature monitoring and predictive analytics.

- Focus on user-friendly interfaces and improved data management capabilities.

Growth Accelerators in the North America Body Temperature Monitoring Market Industry

Strategic partnerships between technology companies and healthcare providers are accelerating market growth. Technological breakthroughs, particularly in AI-powered diagnostics and improved sensor accuracy, are creating opportunities for more precise and efficient temperature monitoring. Expansion into new market segments, such as home care and telemedicine, holds significant potential.

Key Players Shaping the North America Body Temperature Monitoring Market Market

- Hill-Rom (Welch Allyn)

- Cardinal Health Inc

- 3M Company

- Helen of Troy Limited (Kaz USA Inc)

- Fluke Corporation

- Spacelabs Healthcare Inc

- A&D Medical

- Easywell Biomedicals

- DeltaTrak Inc

- American Diagnostic Corporation

Notable Milestones in North America Body Temperature Monitoring Market Sector

- April 2022: TaiDoc Technology Corporation received 510(k) clearance from the FDA for its Clever Forehead Thermometer and Clever Medical Forehead Thermometer (Model TD-1241). This expanded the availability of FDA-approved non-contact thermometers.

- January 2023: Guangzhou Berrcom Medical Device Co., Ltd. received 510(k) clearance from the FDA for its Digital Thermometer, Models DT007 and DT008. This introduced additional competition in the digital thermometer market.

In-Depth North America Body Temperature Monitoring Market Outlook

The North America body temperature monitoring market is poised for continued growth, driven by advancements in technology, increasing healthcare spending, and evolving consumer preferences. Strategic partnerships and market expansions into untapped segments will further accelerate market growth. Opportunities exist for companies to develop innovative products with improved accuracy, connectivity, and user-friendly interfaces. The long-term outlook is positive, suggesting significant growth potential for companies operating in this dynamic market.

North America Body Temperature Monitoring Market Segmentation

-

1. Product

-

1.1. Contact

- 1.1.1. Digital Thermometers

- 1.1.2. Infrared Ear Thermometers

- 1.1.3. IR Temporal Artery Thermometers

- 1.1.4. Mercury Thermometers

- 1.1.5. Disposable Thermometers

- 1.1.6. Other Contact Products

-

1.2. Non-contact

- 1.2.1. Non-contact Infrared Thermometers

- 1.2.2. Thermal Scanners

-

1.1. Contact

-

2. Application

- 2.1. Oral Cavity

- 2.2. Rectum

- 2.3. Ear

- 2.4. Other Applications

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Homes

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Body Temperature Monitoring Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Body Temperature Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise of Infectious Conditions Such as Influenza

- 3.2.2 RSV

- 3.2.3 and Others; Increasing Pediatric Population; Increasing Demand for Disposable Thermometers and Digital Thermometer

- 3.3. Market Restrains

- 3.3.1. Issues Associated With Thermometers

- 3.4. Market Trends

- 3.4.1. Oral Cavity Segment is Expected to Witness Significant Growth in the North America Body Temperature Monitoring Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Contact

- 5.1.1.1. Digital Thermometers

- 5.1.1.2. Infrared Ear Thermometers

- 5.1.1.3. IR Temporal Artery Thermometers

- 5.1.1.4. Mercury Thermometers

- 5.1.1.5. Disposable Thermometers

- 5.1.1.6. Other Contact Products

- 5.1.2. Non-contact

- 5.1.2.1. Non-contact Infrared Thermometers

- 5.1.2.2. Thermal Scanners

- 5.1.1. Contact

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oral Cavity

- 5.2.2. Rectum

- 5.2.3. Ear

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Homes

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Contact

- 6.1.1.1. Digital Thermometers

- 6.1.1.2. Infrared Ear Thermometers

- 6.1.1.3. IR Temporal Artery Thermometers

- 6.1.1.4. Mercury Thermometers

- 6.1.1.5. Disposable Thermometers

- 6.1.1.6. Other Contact Products

- 6.1.2. Non-contact

- 6.1.2.1. Non-contact Infrared Thermometers

- 6.1.2.2. Thermal Scanners

- 6.1.1. Contact

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oral Cavity

- 6.2.2. Rectum

- 6.2.3. Ear

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Homes

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Contact

- 7.1.1.1. Digital Thermometers

- 7.1.1.2. Infrared Ear Thermometers

- 7.1.1.3. IR Temporal Artery Thermometers

- 7.1.1.4. Mercury Thermometers

- 7.1.1.5. Disposable Thermometers

- 7.1.1.6. Other Contact Products

- 7.1.2. Non-contact

- 7.1.2.1. Non-contact Infrared Thermometers

- 7.1.2.2. Thermal Scanners

- 7.1.1. Contact

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oral Cavity

- 7.2.2. Rectum

- 7.2.3. Ear

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Homes

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Contact

- 8.1.1.1. Digital Thermometers

- 8.1.1.2. Infrared Ear Thermometers

- 8.1.1.3. IR Temporal Artery Thermometers

- 8.1.1.4. Mercury Thermometers

- 8.1.1.5. Disposable Thermometers

- 8.1.1.6. Other Contact Products

- 8.1.2. Non-contact

- 8.1.2.1. Non-contact Infrared Thermometers

- 8.1.2.2. Thermal Scanners

- 8.1.1. Contact

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oral Cavity

- 8.2.2. Rectum

- 8.2.3. Ear

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Homes

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Body Temperature Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Hill-Rom (Welch Allyn)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cardinal Health Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 3M Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Helen of Troy Limited (Kaz USA Inc )

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fluke Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Spacelabs Healthcare Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 A&D Medical

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Easywell Biomedicals

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DeltaTrak Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 American Diagnostic Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hill-Rom (Welch Allyn)

List of Figures

- Figure 1: North America Body Temperature Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Body Temperature Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: North America Body Temperature Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Body Temperature Monitoring Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Body Temperature Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Body Temperature Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: North America Body Temperature Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Body Temperature Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Body Temperature Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Body Temperature Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Body Temperature Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Body Temperature Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Body Temperature Monitoring Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Body Temperature Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Body Temperature Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: North America Body Temperature Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Body Temperature Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Body Temperature Monitoring Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: North America Body Temperature Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: North America Body Temperature Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 19: North America Body Temperature Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: North America Body Temperature Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: North America Body Temperature Monitoring Market Revenue Million Forecast, by Product 2019 & 2032

- Table 22: North America Body Temperature Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: North America Body Temperature Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 24: North America Body Temperature Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: North America Body Temperature Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Body Temperature Monitoring Market?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the North America Body Temperature Monitoring Market?

Key companies in the market include Hill-Rom (Welch Allyn), Cardinal Health Inc, 3M Company, Helen of Troy Limited (Kaz USA Inc ), Fluke Corporation, Spacelabs Healthcare Inc, A&D Medical, Easywell Biomedicals, DeltaTrak Inc, American Diagnostic Corporation.

3. What are the main segments of the North America Body Temperature Monitoring Market?

The market segments include Product, Application, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Infectious Conditions Such as Influenza. RSV. and Others; Increasing Pediatric Population; Increasing Demand for Disposable Thermometers and Digital Thermometer.

6. What are the notable trends driving market growth?

Oral Cavity Segment is Expected to Witness Significant Growth in the North America Body Temperature Monitoring Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Issues Associated With Thermometers.

8. Can you provide examples of recent developments in the market?

January 2023: Guangzhou Berrcom Medical Device Co., Ltd. received 510 (K) clearance from the United States Food Drug Administration (FDA) approval for its Digital Thermometer, Model: DT007, DT008.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Body Temperature Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Body Temperature Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Body Temperature Monitoring Market?

To stay informed about further developments, trends, and reports in the North America Body Temperature Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence