Key Insights

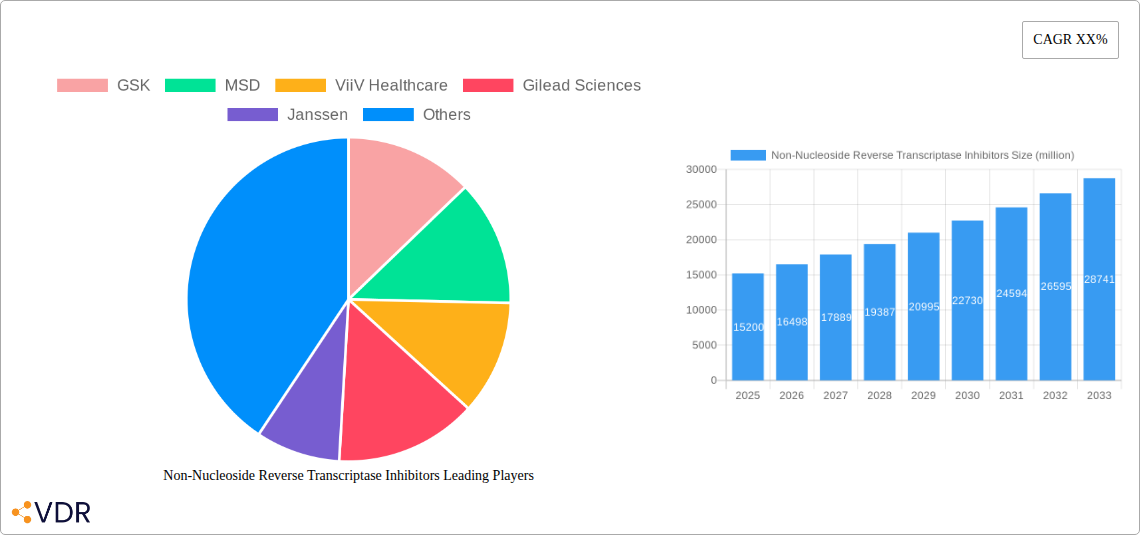

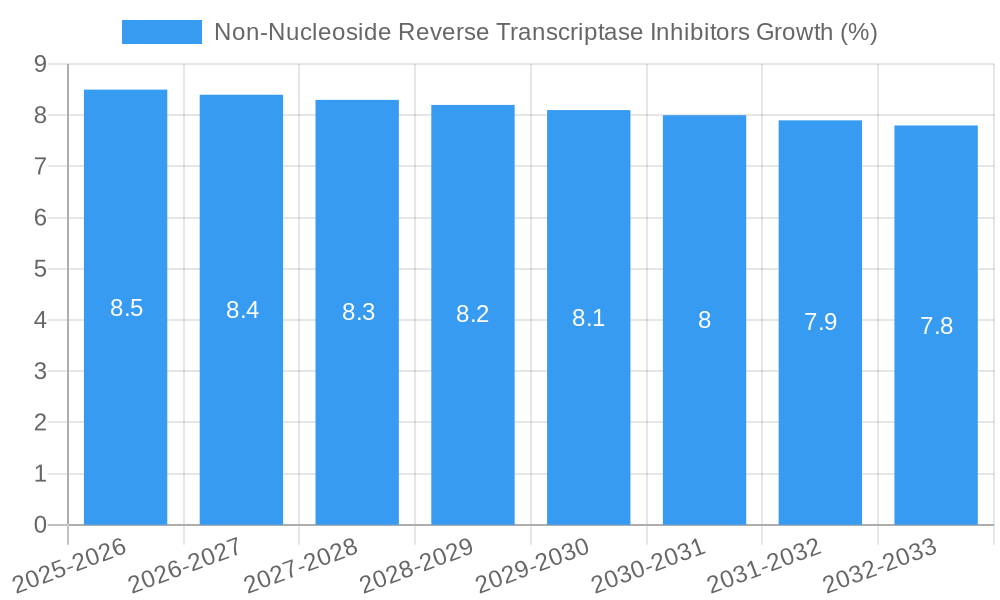

The global Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market is poised for robust expansion, projected to reach an estimated value of $15,200 million by 2025, with a Compound Annual Growth Rate (CAGR) of 8.5% expected throughout the forecast period of 2025-2033. This significant growth is primarily driven by the escalating prevalence of HIV/AIDS globally, coupled with continuous advancements in antiretroviral therapy (ART) that enhance treatment efficacy and patient adherence. NNRTIs represent a cornerstone in combination ART regimens due to their favorable side-effect profiles and cost-effectiveness, making them accessible to a wider patient population, particularly in low- and middle-income countries. The increasing demand for oral formulations, driven by convenience and patient preference, alongside the established use of injections for specific patient groups, will shape the market's segmentation. Furthermore, supportive government initiatives and increased healthcare expenditure aimed at combating infectious diseases are crucial catalysts for market expansion.

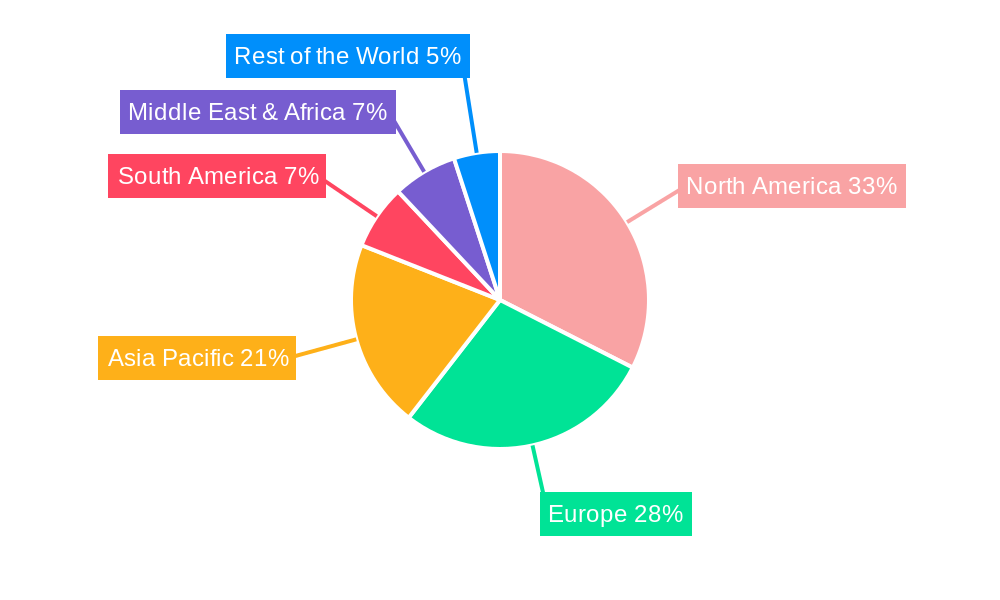

The market landscape is characterized by intense competition and strategic collaborations among leading pharmaceutical giants such as GSK, MSD, ViiV Healthcare, and Gilead Sciences, alongside a growing presence of generic manufacturers like Cipla and Mylan Laboratories. These companies are actively engaged in research and development to introduce next-generation NNRTIs with improved resistance profiles and reduced drug interactions. Geographically, North America and Europe currently dominate the market, owing to well-established healthcare infrastructures and high disease awareness. However, the Asia Pacific region is expected to exhibit the highest growth rate, fueled by a large patient pool, increasing access to ART, and a growing focus on generic drug manufacturing. Restraints such as the development of drug resistance in certain viral strains and the emergence of newer drug classes may temper growth, but the fundamental role of NNRTIs in HIV treatment ensures their continued relevance and market expansion.

Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) Market Research Report 2024-2033

This comprehensive market research report provides an in-depth analysis of the Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market. It covers historical data from 2019–2024 and forecasts the market's trajectory from 2025–2033, with a base year of 2025. The report leverages extensive data to offer critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and leading market players. This report is essential for pharmaceutical companies, healthcare providers, investors, and researchers seeking to understand and capitalize on the evolving NNRTI market.

Non-Nucleoside Reverse Transcriptase Inhibitors Market Dynamics & Structure

The Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market exhibits a dynamic landscape characterized by moderate to high concentration, with several key global pharmaceutical giants holding significant market share. Technological innovation remains a primary driver, fueled by ongoing research and development efforts to discover more potent, safer, and convenient NNRTI formulations, particularly in the fight against HIV/AIDS. The stringent regulatory frameworks established by agencies like the FDA and EMA, while posing development hurdles, also ensure product quality and efficacy, fostering trust among healthcare professionals and patients. Competitive product substitutes, including nucleoside reverse transcriptase inhibitors (NRTIs) and integrase strand transfer inhibitors (INSTIs), continually challenge NNRTI dominance, necessitating continuous innovation and differentiation. End-user demographics, primarily driven by the prevalence of HIV/AIDS and an aging global population, significantly influence market demand. Mergers and acquisitions (M&A) trends are moderately active, as larger companies seek to expand their portfolios and consolidate market positions through strategic acquisitions of innovative smaller firms or complementary product lines.

- Market Concentration: Dominated by a few large pharmaceutical companies, with a notable presence of specialized generic manufacturers.

- Technological Innovation Drivers: Focus on enhanced viral suppression, reduced side effects, simplified dosing regimens, and combating drug resistance.

- Regulatory Frameworks: Strict approval processes for new NNRTIs and generics, ensuring safety and efficacy standards.

- Competitive Product Substitutes: Ongoing competition from NRTIs, INSTIs, and other antiretroviral classes.

- End-User Demographics: Driven by HIV/AIDS patient populations, including new diagnoses and individuals requiring lifelong treatment.

- M&A Trends: Strategic acquisitions and partnerships aimed at portfolio expansion and market consolidation.

Non-Nucleoside Reverse Transcriptase Inhibitors Growth Trends & Insights

The Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market has demonstrated robust growth over the historical period (2019–2024) and is projected to continue its upward trajectory throughout the forecast period (2025–2033). This sustained growth is propelled by a confluence of factors including the persistent global burden of HIV/AIDS, advancements in antiretroviral therapy (ART) leading to improved patient outcomes and longevity, and the increasing adoption of fixed-dose combination therapies that enhance patient adherence. The market size evolution has been characterized by a steady increase, with the base year 2025 projected to see a market size of approximately XX million units, reaching an estimated XX million units by the estimated year 2025. The forecast period (2025–2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately XX%, underscoring the market's strong expansion potential.

Adoption rates of NNRTIs remain high, particularly in resource-limited settings where they often form a cornerstone of first-line ART regimens due to their efficacy and relatively lower cost compared to some newer drug classes. Technological disruptions have primarily focused on developing NNRTIs with improved pharmacokinetic profiles, reduced drug-drug interaction potential, and improved safety margins, thereby mitigating long-term side effects. For instance, the development of long-acting injectable NNRTIs has been a significant advancement, offering a promising alternative for patients struggling with daily oral adherence. Consumer behavior shifts are also playing a crucial role, with increasing patient awareness about treatment options and a greater demand for personalized medicine and convenient dosing schedules influencing prescribing patterns. The integration of NNRTIs into highly active antiretroviral therapy (HAART) regimens has revolutionized HIV management, transforming a once-fatal disease into a manageable chronic condition. This has led to a sustained demand for effective and accessible antiretroviral drugs. Furthermore, the increasing emphasis on preventative strategies like pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP), where NNRTIs play a vital role in certain regimens, contributes to the overall market expansion. The market penetration of NNRTIs is high in developed economies but shows significant growth potential in emerging markets as healthcare infrastructure improves and access to treatment expands. The ongoing research into novel NNRTIs that can overcome existing resistance patterns is also a key driver of future growth and market dynamism.

Dominant Regions, Countries, or Segments in Non-Nucleoside Reverse Transcriptase Inhibitors

The Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market's dominance is primarily driven by the Application: Hospital segment, closely followed by the Application: Clinic segment. The overarching demand for effective HIV/AIDS treatment and management within these healthcare settings propels their leading position.

Dominant Application Segment: Hospital

- Market Share: Hospitals account for a substantial majority of NNRTI consumption, estimated at around XX% in 2025.

- Key Drivers:

- Prevalence of HIV/AIDS: Hospitals are central to the diagnosis, treatment initiation, and long-term management of HIV/AIDS patients, who are prescribed NNRTIs as part of combination therapies.

- Inpatient and Outpatient Care: The comprehensive care provided in hospitals, encompassing both acute care for opportunistic infections and chronic disease management, necessitates a consistent supply of antiretroviral medications.

- Specialized HIV/AIDS Centers: Dedicated HIV/AIDS treatment centers within hospitals are major consumers of NNRTIs, often utilizing them in complex regimens.

- Access to Specialists: Hospitals offer access to infectious disease specialists and pharmacists who are crucial in tailoring and managing NNRTI therapies.

- Reimbursement Policies: Favorable reimbursement policies for HIV/AIDS treatment in hospital settings further support their dominance.

Significant Application Segment: Clinic

- Market Share: Clinics, including specialized infectious disease clinics and primary care facilities, represent the second-largest segment, estimated at XX% in 2025.

- Key Drivers:

- Outpatient Management: Clinics are pivotal for ongoing outpatient management of HIV-positive individuals, routine check-ups, and prescription refills for NNRTIs.

- Early Diagnosis and Treatment Initiation: Many clinics are on the front lines of early HIV detection, leading to prompt initiation of NNRTI-based ART.

- Community-Based Healthcare: The expansion of community-based clinics in both urban and rural areas increases access to NNRTI treatment.

- Cost-Effectiveness: For stable patients, clinics offer a more cost-effective alternative to hospital-based care for managing their condition.

Emerging Application Segment: Others

- Market Share: This segment, encompassing pharmacies, retail outlets, and direct-to-patient distribution channels, holds a smaller but growing share, estimated at XX% in 2025.

- Key Drivers:

- Patient Convenience: Pharmacies play a crucial role in dispensing NNRTI prescriptions, offering convenience for patients.

- Generic Drug Accessibility: The availability of generic NNRTIs through retail channels increases affordability and accessibility.

Dominant Type Segment: Oral

- Market Share: Oral formulations of NNRTIs represent the vast majority of the market, estimated at XX% in 2025.

- Key Drivers:

- Patient Adherence: Oral medications are generally preferred by patients for their ease of administration and integration into daily routines.

- Established Treatment Protocols: The long history and established efficacy of oral NNRTIs in ART regimens solidify their dominance.

- Cost-Effectiveness: Oral formulations are typically more cost-effective to manufacture and distribute.

Emerging Type Segment: Injection

- Market Share: Injectable NNRTIs, while currently a smaller segment at XX% in 2025, are experiencing significant growth.

- Key Drivers:

- Improved Adherence: Long-acting injectable NNRTIs offer a significant advantage for patients struggling with daily oral adherence, reducing the risk of treatment interruption and viral rebound.

- Patient Preference: For some patients, the convenience of less frequent injections (e.g., monthly or quarterly) is a major benefit.

- Technological Advancements: Ongoing research and development are leading to more sophisticated and patient-friendly injectable formulations.

The growth in the Hospital and Clinic application segments, coupled with the established dominance of Oral NNRTIs and the burgeoning potential of Injection formulations, paints a clear picture of the market's current and future landscape.

Non-Nucleoside Reverse Transcriptase Inhibitors Product Landscape

The Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) product landscape is characterized by continuous innovation aimed at enhancing therapeutic efficacy, improving patient safety profiles, and overcoming drug resistance. Key advancements include the development of novel NNRTIs with improved pharmacokinetic properties, allowing for reduced dosing frequency and fewer drug-drug interactions. Furthermore, the integration of NNRTIs into single-tablet, fixed-dose combination therapies has significantly improved patient adherence and simplified treatment regimens. Emerging long-acting injectable formulations represent a paradigm shift, offering a compelling alternative for patients who struggle with daily oral medications. These products demonstrate unique selling propositions through extended drug release, improved patient convenience, and potential for reduced viral load rebound due to consistent drug levels.

Key Drivers, Barriers & Challenges in Non-Nucleoside Reverse Transcriptase Inhibitors

Key Drivers:

- Persistent HIV/AIDS Burden: The ongoing global prevalence of HIV/AIDS remains the primary driver for NNRTI demand, necessitating continuous access to effective antiretroviral therapies.

- Advancements in ART: Continuous improvements in the efficacy and tolerability of combination antiretroviral therapies, often including NNRTIs, lead to better patient outcomes and longer lifespans, sustaining demand.

- Development of Fixed-Dose Combinations: Single-tablet regimens incorporating NNRTIs enhance patient adherence and simplify treatment management, boosting market adoption.

- Emergence of Long-Acting Injectables: Innovative long-acting injectable NNRTIs offer improved convenience and adherence, addressing a key patient need and opening new market avenues.

- Growing Healthcare Infrastructure in Emerging Markets: Expansion of healthcare access and infrastructure in developing economies leads to increased diagnosis and treatment of HIV, driving NNRTI consumption.

Barriers & Challenges:

- Drug Resistance: The emergence of HIV strains resistant to NNRTIs poses a significant challenge, necessitating the development of next-generation inhibitors and alternative drug classes.

- Drug-Drug Interactions: Certain NNRTIs can interact with other medications, complicating treatment regimens and requiring careful monitoring.

- Side Effect Profiles: While improving, some NNRTIs can still be associated with adverse effects, impacting patient tolerance and adherence.

- High Development Costs: The research and development of new NNRTIs are expensive and time-consuming, with a high failure rate in clinical trials.

- Competition from Other Drug Classes: The continuous development of more potent and novel antiretroviral agents, such as integrase inhibitors, presents strong competition to NNRTIs.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as evidenced by recent events, can impact the availability and affordability of essential NNRTI medications.

- Regulatory Hurdles: Stringent regulatory approval processes for new drug entities and generics can delay market entry and increase development costs.

Emerging Opportunities in Non-Nucleoside Reverse Transcriptase Inhibitors

Emerging opportunities in the Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) sector lie in the development of novel drug candidates with broader resistance profiles and reduced side effects. The increasing focus on long-acting injectable formulations presents a significant growth avenue, offering improved patient convenience and adherence. Furthermore, exploring the potential of NNRTIs in combination with newer antiretroviral classes could unlock synergistic therapeutic benefits. Untapped markets in regions with a high prevalence of HIV/AIDS but limited access to advanced treatment also represent substantial growth potential. The evolving consumer preferences towards personalized medicine and simplified treatment regimens are also creating opportunities for innovative delivery systems and combination therapies.

Growth Accelerators in the Non-Nucleoside Reverse Transcriptase Inhibitors Industry

Several key catalysts are accelerating long-term growth in the Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) industry. Technological breakthroughs in drug discovery and formulation are leading to the development of more effective and patient-friendly NNRTIs, including advanced long-acting injectables that enhance adherence. Strategic partnerships between pharmaceutical giants and smaller biotech firms are fostering innovation and accelerating the pipeline of next-generation NNRTIs. Market expansion strategies, particularly focusing on increasing access to affordable generic NNRTIs in low- and middle-income countries, are crucial growth drivers. The growing understanding of HIV pathogenesis and the development of novel therapeutic targets also create opportunities for the strategic positioning and application of NNRTIs within evolving treatment paradigms.

Key Players Shaping the Non-Nucleoside Reverse Transcriptase Inhibitors Market

- GSK

- MSD

- ViiV Healthcare

- Gilead Sciences

- Janssen

- Smart Pharma

- LUPIN PHARMS

- Cipla

- Mylan Laboratories

- kohlpharma GmbH

- Apotex

- Boehringer Ingelheim

- Micro Labs

- MacLeods Pharmaceuticals

- Aurobindo Pharma

- HETERO LABS

- Orifarm GmbH

- Laurus Generics

- Sandoz

- Qilu Pharmaceutical

- Aidea Pharmaceutical

- Brilliant Pharmaceutical

Notable Milestones in Non-Nucleoside Reverse Transcriptase Inhibitors Sector

- 2019: Launch of new fixed-dose combination pills integrating NNRTIs for simplified HIV treatment.

- 2020: Advancements in research for NNRTIs with improved resistance profiles against emerging HIV strains.

- 2021: Significant progress in the clinical development of long-acting injectable NNRTIs.

- 2022: Approval of novel NNRTI formulations offering enhanced pharmacokinetic properties.

- 2023: Increased global accessibility initiatives for generic NNRTIs in underserved regions.

- 2024: Continued clinical trials for next-generation NNRTIs with reduced side effects and improved tolerability.

In-Depth Non-Nucleoside Reverse Transcriptase Inhibitors Market Outlook

The future outlook for the Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) market is exceptionally positive, driven by robust growth accelerators. The increasing sophistication of long-acting injectable formulations promises to revolutionize patient adherence and treatment efficacy, representing a significant market expansion opportunity. Strategic collaborations between leading pharmaceutical companies and emerging biotechnology firms will continue to fuel innovation, bringing novel NNRTIs with superior resistance profiles and enhanced safety to the forefront. Furthermore, the sustained global commitment to HIV/AIDS treatment and prevention, coupled with expanding healthcare infrastructure in developing nations, will ensure a consistent and growing demand for accessible and effective NNRTI therapies. The market is poised for continued evolution, with a focus on patient-centric solutions and overcoming therapeutic challenges.

Non-Nucleoside Reverse Transcriptase Inhibitors Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. Oral

- 2.2. Injection

Non-Nucleoside Reverse Transcriptase Inhibitors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Non-Nucleoside Reverse Transcriptase Inhibitors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Oral

- 5.2.2. Injection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Oral

- 6.2.2. Injection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Oral

- 7.2.2. Injection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Oral

- 8.2.2. Injection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Oral

- 9.2.2. Injection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Oral

- 10.2.2. Injection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GSK

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MSD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ViiV Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gilead Sciences

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Janssen

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smart Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LUPIN PHARMS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mylan Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 kohlpharma GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apotex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Boehringer Ingelheim

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Micro Labs

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MacLeods Pharmaceuticals

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aurobindo Pharma

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 HETERO LABS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Orifarm GmbH

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Laurus Generics

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Sandoz

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Qilu Pharmaceutical

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Aidea Pharmaceutical

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Brilliant Pharmaceutical

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 GSK

List of Figures

- Figure 1: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Application 2024 & 2032

- Figure 3: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Types 2024 & 2032

- Figure 5: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Country 2024 & 2032

- Figure 7: North America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Application 2024 & 2032

- Figure 9: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Types 2024 & 2032

- Figure 11: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Country 2024 & 2032

- Figure 13: South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Non-Nucleoside Reverse Transcriptase Inhibitors Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Non-Nucleoside Reverse Transcriptase Inhibitors Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Nucleoside Reverse Transcriptase Inhibitors?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Non-Nucleoside Reverse Transcriptase Inhibitors?

Key companies in the market include GSK, MSD, ViiV Healthcare, Gilead Sciences, Janssen, Smart Pharma, LUPIN PHARMS, Cipla, Mylan Laboratories, kohlpharma GmbH, Apotex, Boehringer Ingelheim, Micro Labs, MacLeods Pharmaceuticals, Aurobindo Pharma, HETERO LABS, Orifarm GmbH, Laurus Generics, Sandoz, Qilu Pharmaceutical, Aidea Pharmaceutical, Brilliant Pharmaceutical.

3. What are the main segments of the Non-Nucleoside Reverse Transcriptase Inhibitors?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Nucleoside Reverse Transcriptase Inhibitors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Nucleoside Reverse Transcriptase Inhibitors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Nucleoside Reverse Transcriptase Inhibitors?

To stay informed about further developments, trends, and reports in the Non-Nucleoside Reverse Transcriptase Inhibitors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence