Key Insights

The Middle East and Africa (MEA) Aircraft Maintenance, Repair, and Overhaul (MRO) market is projected for significant expansion, driven by escalating air travel, fleet growth, and increasing demand for specialized aviation services across commercial and defense sectors. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.46%. This robust growth is underpinned by substantial investments in aviation infrastructure, a burgeoning middle class fueling air travel, and government initiatives aimed at enhancing regional connectivity. Key market segments include airframe MRO, engine MRO, and component/modification MRO, with commercial aviation currently leading, though military and general aviation segments present considerable growth potential.

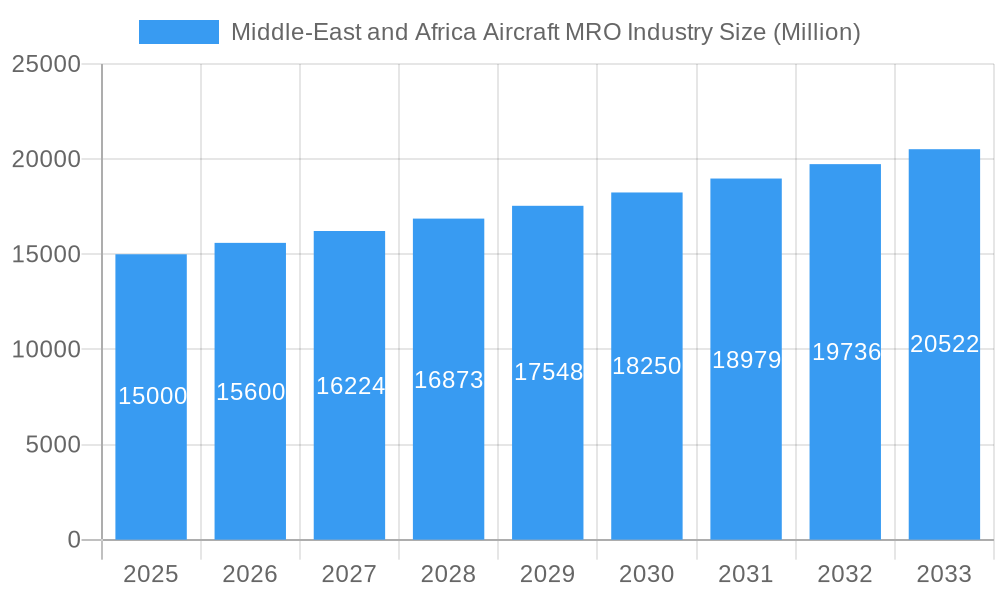

Middle-East and Africa Aircraft MRO Industry Market Size (In Billion)

Leading industry players are strategically expanding their capabilities and global presence to capitalize on this burgeoning market. Despite favorable growth prospects, the market faces challenges including volatile fuel prices, regional economic instability, and the critical need for skilled workforce development to meet the escalating demand for specialized MRO expertise. The African region, in particular, shows immense promise, with countries experiencing substantial growth in air travel and associated MRO requirements, stimulating investment in advanced facilities and technology.

Middle-East and Africa Aircraft MRO Industry Company Market Share

Further analysis indicates substantial market expansion for the MEA Aircraft MRO sector during the forecast period of 2025-2033. The region's extensive network of established airlines and a rising number of low-cost carriers contribute to this positive outlook. While commercial MRO services represent a significant concentration, opportunities for growth are evident in the military and general aviation sectors, supported by government defense investments and the increasing prevalence of private jets. Companies are employing strategic partnerships, acquisitions, and technological advancements to bolster efficiency and service offerings, addressing workforce constraints and fostering industry sustainability. The market size is estimated at $3.72 billion in 2025, with projections extending to 2033.

Middle East & Africa Aircraft MRO Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa Aircraft Maintenance, Repair, and Overhaul (MRO) industry, offering crucial insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It analyzes market dynamics, growth trends, dominant segments, key players, and future opportunities across various MRO types and end-users within the region. The report utilizes data to provide precise market sizing, forecasts, and key performance indicators (KPIs) in Million Units.

Middle-East and Africa Aircraft MRO Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Middle East and Africa Aircraft MRO industry. The market is characterized by a blend of established international players and regional operators, resulting in a moderately fragmented structure. Market concentration is expected to shift slightly towards larger players through mergers and acquisitions (M&A) activity.

- Market Concentration: Moderately fragmented, with a combined market share of the top 5 players estimated at 45% in 2025.

- Technological Innovation: Driven by the adoption of advanced technologies like digital twin technology, predictive maintenance, and AI-powered diagnostics. However, high initial investment costs present a barrier for smaller operators.

- Regulatory Frameworks: Vary across countries but are generally geared towards ensuring safety and airworthiness standards, aligning with international best practices like those set by EASA and FAA. Inconsistencies can create challenges for cross-border operations.

- Competitive Product Substitutes: Limited, with the core service remaining essential for aircraft operation. Competition primarily focuses on service quality, turnaround time, and pricing.

- End-User Demographics: Predominantly driven by commercial airlines, followed by military and general aviation sectors. Growth is anticipated across all segments, influenced by factors such as increasing air travel demand and fleet modernization.

- M&A Trends: A rising number of strategic acquisitions are expected in the forecast period, driven by the need for expanded service offerings, geographical reach, and technological capabilities. The volume of M&A deals is projected to reach xx deals annually by 2033.

Middle-East and Africa Aircraft MRO Industry Growth Trends & Insights

The Middle East and Africa Aircraft MRO market exhibits robust growth prospects driven by the expansion of airline fleets, increasing air passenger traffic, and government investments in aviation infrastructure. The historical period (2019-2024) saw moderate growth, impacted by the COVID-19 pandemic. However, the market is expected to experience significant recovery and expansion during the forecast period (2025-2033).

The market size is projected to expand at a CAGR of xx% from 2025 to 2033, reaching a value of xx million by 2033. This growth is fueled by the rising demand for both airframe and engine MRO services, particularly from the rapidly expanding commercial aviation sector in the region. Technological disruptions, such as the implementation of digital solutions and predictive maintenance, are contributing to efficiency gains and cost reductions. Changing consumer behavior, including a preference for enhanced travel experiences, indirectly drives the demand for better aircraft maintenance and reliability.

Dominant Regions, Countries, or Segments in Middle-East and Africa Aircraft MRO Industry

The Middle East region, particularly the UAE and Saudi Arabia, dominates the market due to the presence of major airline hubs and substantial government investments in aviation infrastructure. Within MRO types, Airframe MRO holds the largest market share, followed by Engine MRO and Component and Modifications MRO. The Commercial segment is the largest end-user, fuelled by the expansion of major airlines.

- Key Drivers:

- UAE & Saudi Arabia: Large airline fleets, strong government support for aviation infrastructure, and strategic location.

- Commercial Aviation: Expansion of major airlines, increased passenger traffic, and fleet modernization programs.

- Airframe MRO: High demand driven by regular maintenance and repair needs of large aircraft fleets.

- Dominance Factors:

- Market Share: The Middle East commands over 60% of the overall MEA MRO market.

- Growth Potential: High growth potential driven by the ongoing expansion of the aviation sector.

Middle-East and Africa Aircraft MRO Industry Product Landscape

The product landscape is characterized by a diverse range of MRO services, including airframe maintenance, engine overhaul, component repair, and line maintenance. Innovations focus on improving efficiency, reducing downtime, and leveraging data analytics for predictive maintenance. The implementation of digital technologies like augmented reality (AR) and virtual reality (VR) is gaining traction for training and maintenance purposes. Key selling propositions include faster turnaround times, cost-effectiveness, and enhanced safety standards.

Key Drivers, Barriers & Challenges in Middle-East and Africa Aircraft MRO Industry

Key Drivers:

- Increasing air travel demand in the region.

- Government investments in aviation infrastructure.

- Fleet modernization programs by airlines.

- Technological advancements in MRO techniques.

Key Challenges:

- Skilled labor shortages.

- High infrastructure costs.

- Competition from established international players.

- Regulatory complexities across different countries. This leads to an estimated xx million loss annually due to delays in regulatory approvals.

Emerging Opportunities in Middle-East and Africa Aircraft MRO Industry

- Growing demand for specialized MRO services for newer aircraft types.

- Expansion of MRO services into smaller airports and regional hubs.

- Increased adoption of digital technologies for remote diagnostics and predictive maintenance.

- Growth in the general aviation sector.

Growth Accelerators in the Middle-East and Africa Aircraft MRO Industry Industry

Long-term growth will be significantly propelled by technological advancements in predictive maintenance, AI-powered diagnostics, and digital twin technologies. Strategic partnerships between MRO providers and airlines will enhance service integration and efficiency. Expanding into untapped markets in Africa, along with government initiatives promoting regional aviation, will further accelerate growth.

Key Players Shaping the Middle-East and Africa Aircraft MRO Industry Market

- Ethiopian Airlines

- Turkish Technic

- Raytheon Technologies Corporation

- South African Airways Technical (SAAT)

- Joramco

- AMMROC

- Egyptair Maintenance & Engineering

- Safran SA

- Etihad Airways Engineering LLC

- Air France Industries KLM Engineering & Maintenance

- Sanad Aerotech

- Lufthansa Technik AG

- General Electric Company

- Emirates Engineering

- Saudia Aerospace Engineering Industries

Notable Milestones in Middle-East and Africa Aircraft MRO Industry Sector

- 2020: Several MRO providers implemented digital transformation initiatives to enhance operational efficiency.

- 2022: A significant M&A deal involving two major regional players consolidated market share in the Middle East.

- 2023: Several new partnerships were formed between MRO providers and technology companies to integrate advanced solutions.

In-Depth Middle-East and Africa Aircraft MRO Industry Market Outlook

The Middle East and Africa Aircraft MRO market presents significant growth potential, driven by increasing air travel demand, fleet expansion, and ongoing technological advancements. Strategic investments in infrastructure, coupled with favorable regulatory environments, will further enhance market expansion. Opportunities abound for MRO providers to leverage digital solutions, strategic partnerships, and expansion into under-served markets to capitalize on this growth trajectory.

Middle-East and Africa Aircraft MRO Industry Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component and Modifications MRO

- 1.4. Line Maintenance

-

2. End-User

- 2.1. Commercial

- 2.2. Military

- 2.3. General Aviation

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Turkey

- 3.1.4. South Africa

- 3.1.5. Egypt

- 3.1.6. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Aircraft MRO Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Turkey

- 1.4. South Africa

- 1.5. Egypt

- 1.6. Rest of Middle East and Africa

Middle-East and Africa Aircraft MRO Industry Regional Market Share

Geographic Coverage of Middle-East and Africa Aircraft MRO Industry

Middle-East and Africa Aircraft MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine MRO Segment Held the Largest Market Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Aircraft MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component and Modifications MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Military

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Turkey

- 5.3.1.4. South Africa

- 5.3.1.5. Egypt

- 5.3.1.6. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turkish Technic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raytheon Technologies Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Joramco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AMMROC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Etihad Airways Engineering LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air France Industries KLM Engineering & Maintenanc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanad Aerotech

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 General Electric Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emirates Engineering

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Saudia Aerospace Engineering Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle-East and Africa Aircraft MRO Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Aircraft MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Turkey Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Egypt Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Middle East and Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Aircraft MRO Industry?

The projected CAGR is approximately 14.46%.

2. Which companies are prominent players in the Middle-East and Africa Aircraft MRO Industry?

Key companies in the market include Ethiopian Airlines, Turkish Technic, Raytheon Technologies Corporation, South African Airways Technical (SAAT), Joramco, AMMROC, Egyptair Maintenance & Engineering, Safran SA, Etihad Airways Engineering LLC, Air France Industries KLM Engineering & Maintenanc, Sanad Aerotech, Lufthansa Technik AG, General Electric Company, Emirates Engineering, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle-East and Africa Aircraft MRO Industry?

The market segments include MRO Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.72 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine MRO Segment Held the Largest Market Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Aircraft MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Aircraft MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Aircraft MRO Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Aircraft MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence