Key Insights

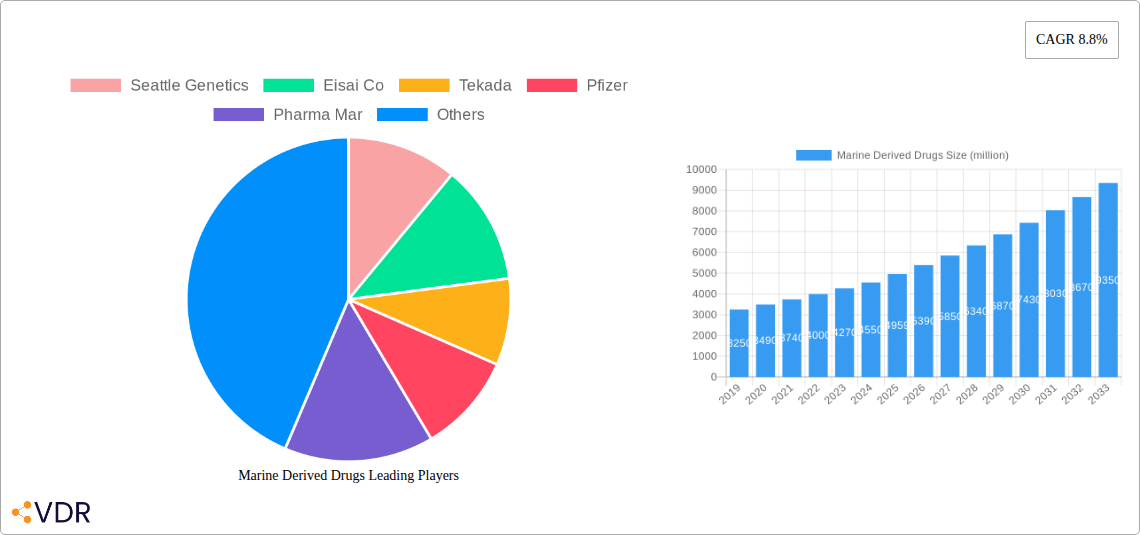

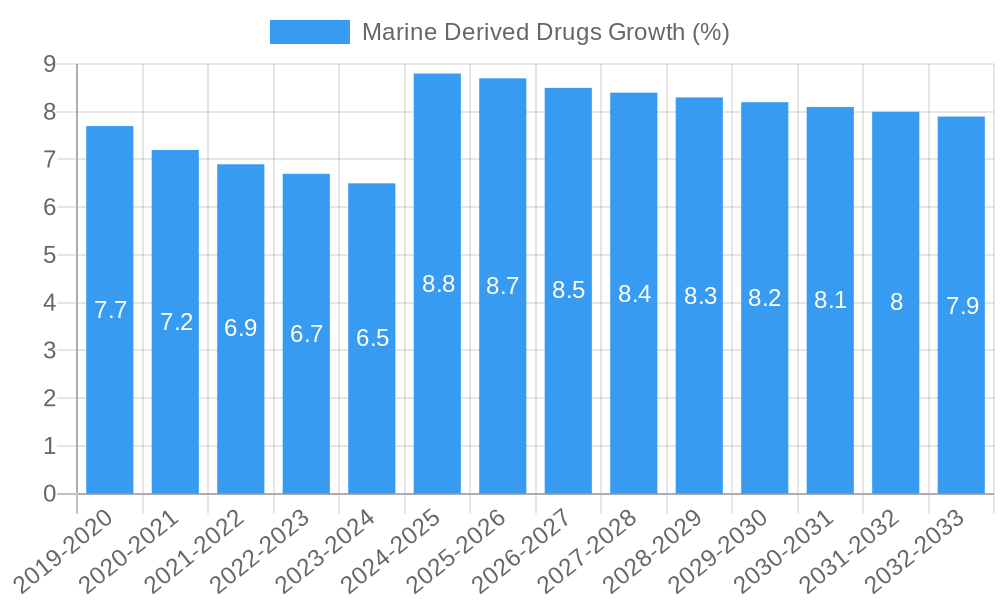

The global marine-derived drugs market is projected to experience robust growth, reaching an estimated USD 4959 million by 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 8.8% through 2033. This significant expansion is fueled by the immense biodiversity of marine organisms, which serve as a rich source of novel therapeutic compounds with unique pharmacological properties. The rising prevalence of chronic diseases, particularly cancer and cardiovascular conditions, is a primary driver, increasing the demand for innovative treatment options. Marine organisms like sponges, mollusks, and tunicates have yielded groundbreaking drugs that are revolutionizing treatment protocols. Key applications are dominated by antitumor drugs, followed by anti-cardiovascular drugs, underscoring the critical role of marine bio-resources in addressing unmet medical needs in these therapeutic areas. The continuous discovery and development of new drug candidates from these unexplored ecosystems promise to sustain market momentum.

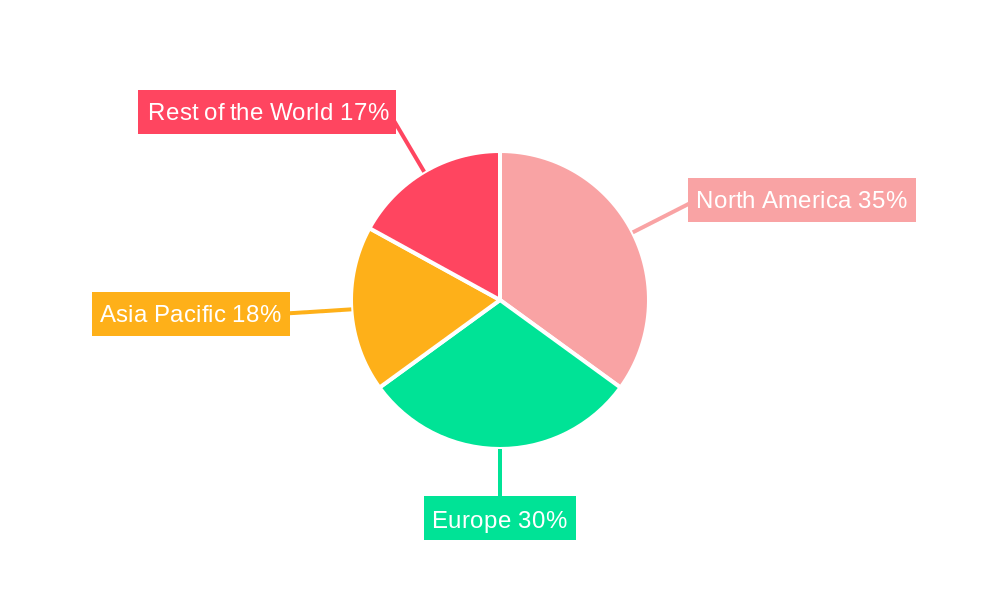

The market's expansion is further propelled by advancements in marine biotechnology and drug discovery techniques, enabling more efficient extraction, identification, and synthesis of active compounds. Pharmaceutical giants and specialized biotech firms are actively investing in research and development, forging collaborations to explore marine environments for untapped therapeutic potential. While the market exhibits strong growth, certain restraints may influence its trajectory. These include the challenges associated with deep-sea exploration, the high cost of drug development and clinical trials, and stringent regulatory hurdles. Nevertheless, the immense therapeutic potential of marine-derived compounds, coupled with increasing global healthcare expenditure and a growing awareness of natural product-based medicines, are expected to outweigh these challenges, ensuring a dynamic and promising future for the marine-derived drugs market. The North America and Europe regions are expected to lead the market, driven by significant R&D investments and established healthcare infrastructure, with Asia Pacific showing promising growth due to increasing investments and a burgeoning research landscape.

Marine Derived Drugs Market: Unlocking the Ocean's Pharmaceutical Potential

Report Description:

Dive into the vast and unexplored pharmaceutical frontier with the "Marine Derived Drugs Market" report. This comprehensive analysis delves into the burgeoning sector of medicines derived from marine organisms, exploring its immense potential in treating a wide array of diseases. With a focus on high-traffic keywords like "marine pharmaceuticals," "biotechnology," "drug discovery," and "natural product therapeutics," this report is meticulously crafted for industry professionals, researchers, and investors seeking to capitalize on the next wave of medical innovation. We dissect the parent and child market structures, providing granular insights into the specialized segments driving growth. This report offers a definitive roadmap to understanding the current landscape, future trajectory, and critical investment opportunities within the marine derived drugs industry.

Marine Derived Drugs Market Dynamics & Structure

The marine derived drugs market is characterized by a dynamic interplay of scientific innovation, stringent regulatory frameworks, and significant investment in research and development. While currently exhibiting a moderately concentrated landscape, driven by leading pharmaceutical companies and specialized biotechs, the potential for new entrants and groundbreaking discoveries remains high. Technological advancements in deep-sea exploration, genetic sequencing, and synthetic biology are acting as key innovation drivers, accelerating the identification and development of novel marine compounds. Regulatory hurdles, particularly the rigorous approval processes for new drugs, and the complexities of sustainable sourcing present significant barriers. Competitive product substitutes, primarily from terrestrial natural products and synthetic drugs, exert pressure, but the unique efficacy profiles of marine-derived compounds offer distinct advantages. End-user demographics are broad, encompassing patients with oncology, cardiovascular, and neurological conditions, with a growing interest in treatments for rare diseases. Mergers and acquisitions (M&A) are a notable trend, as larger pharmaceutical players seek to integrate promising marine biotech capabilities and product pipelines. For instance, an estimated 30-40 M&A deals are anticipated within the historical period (2019-2024), with deal values potentially reaching hundreds of millions. The market concentration is estimated to be around 60% held by the top 5 companies.

- Market Concentration: Moderately concentrated, with key players investing heavily in R&D and pipeline expansion.

- Technological Innovation Drivers: Advances in genomics, drug discovery platforms, and sustainable cultivation techniques.

- Regulatory Frameworks: Complex and lengthy approval processes, requiring substantial investment and time.

- Competitive Product Substitutes: Established terrestrial natural products and synthetic drugs, necessitating unique therapeutic advantages.

- End-User Demographics: Patients with unmet needs in oncology, cardiovascular diseases, infectious diseases, and neurological disorders.

- M&A Trends: Increasing consolidation as companies seek to acquire promising pipelines and technological expertise.

Marine Derived Drugs Growth Trends & Insights

The marine derived drugs market is poised for substantial growth, driven by the untapped therapeutic potential of the ocean's biodiversity. The market size, projected to reach $12,500 million in 2025, is expected to experience a robust Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period of 2025–2033. This significant expansion is fueled by a confluence of factors including escalating prevalence of chronic diseases, a global push for natural and sustainable therapeutic solutions, and ongoing breakthroughs in marine biotechnology. Adoption rates for marine-derived drugs are steadily increasing as clinical trial data validates their efficacy and safety profiles, particularly in the challenging field of oncology where compounds like Eribulin mesylate have demonstrated remarkable success. Technological disruptions, such as advancements in high-throughput screening and combinatorial chemistry applied to marine natural products, are revolutionizing the drug discovery process, reducing time-to-market and increasing the success rate of identifying viable drug candidates. Furthermore, a growing consumer preference for naturally derived medicines, coupled with increasing awareness of the unique pharmacological properties of marine organisms, is creating a favorable market environment.

The historical period (2019–2024) witnessed steady growth, with the market size evolving from approximately $6,000 million in 2019 to an estimated $10,500 million by 2024. This growth was underpinned by early-stage clinical successes and strategic investments in R&D. The base year, 2025, stands as a pivotal point, with an estimated market value of $12,500 million, setting the stage for accelerated expansion. Market penetration for specific marine-derived drugs, especially in niche therapeutic areas, is expected to deepen significantly as more compounds transition from preclinical to clinical and ultimately to commercial stages. The impact of these drugs on patient outcomes, particularly in areas like cancer and infectious diseases where resistance to existing therapies is a major concern, is driving investor confidence and research focus. The shift towards personalized medicine also presents an opportunity for marine-derived compounds, many of which possess highly specific mechanisms of action. The increasing understanding of marine ecosystems and the associated microbial communities further expands the potential for novel drug discovery. The ongoing exploration of deep-sea hydrothermal vents and polar regions, for example, continues to reveal organisms with unique biochemical capabilities, promising a rich pipeline for future drug development. Consumer behavior shifts towards seeking treatments with potentially fewer side effects and a stronger emphasis on sustainable sourcing are also contributing to the positive market outlook. The industry is moving towards collaborative research models, involving academic institutions, biotechnology firms, and large pharmaceutical companies, to pool resources and expertise, thereby accelerating the development and commercialization of marine-derived therapeutics.

Dominant Regions, Countries, or Segments in Marine Derived Drugs

The global marine derived drugs market is witnessing a dominant surge driven by the Antitumor Drugs segment, which is projected to command a significant market share of approximately 45% in 2025. This dominance is propelled by the relentless pursuit of novel cancer therapies, where marine organisms have historically proven to be a rich source of potent cytotoxic agents. Compounds derived from sponges and tunicates, in particular, have yielded groundbreaking anticancer drugs, such as Eribulin mesylate (Halaven®) and Trabectedin (Yondelis®), which have revolutionized the treatment of various solid tumors. The application of marine-derived drugs in oncology is further bolstered by their unique mechanisms of action, often targeting cellular processes that are difficult to inhibit with conventional synthetic drugs, thereby offering new hope for patients with refractory or metastatic cancers. The market for antitumor drugs within this sector is estimated to be $5,625 million in 2025.

Beyond oncology, the Anti-Cardiovascular Drugs segment is emerging as a significant growth area, projected to capture around 20% of the market in 2025, with an estimated value of $2,500 million. Marine sources are being explored for compounds with anticoagulant, antiplatelet, and cholesterol-lowering properties, addressing the global burden of cardiovascular diseases. The "Others" application segment, encompassing anti-infective, anti-inflammatory, and neurological drugs, also contributes substantially, expected to account for 35% of the market in 2025, valued at $4,375 million, highlighting the broad therapeutic potential of marine-derived compounds.

Geographically, North America is anticipated to lead the market in 2025, driven by strong research and development infrastructure, significant investment in biotechnology, and a robust regulatory environment conducive to drug innovation. The presence of leading pharmaceutical companies and academic institutions in the United States and Canada, coupled with a high prevalence of target diseases like cancer and cardiovascular disorders, positions North America as a key market. The region's market share is estimated at 35%, equating to $4,375 million in 2025. Europe follows closely, with a market share of 30% ($3,750 million), fueled by advancements in marine biotechnology and a growing demand for natural pharmaceuticals. Asia Pacific, with its rapidly expanding healthcare sector and increasing R&D capabilities, is expected to witness the fastest growth, projected at a CAGR of 17% over the forecast period.

Within the Type segmentation, Sponges are projected to be a leading source of marine-derived drugs, contributing an estimated 30% to the market in 2025 ($3,750 million). Their complex chemical structures and diverse secondary metabolites have yielded a wealth of pharmacologically active compounds. Tunicates are also highly significant, expected to hold a 25% market share ($3,125 million), known for producing potent anticancer agents. Fish and Mollusks contribute 15% ($1,875 million) and 10% ($1,250 million) respectively, while the "Others" category, including marine microorganisms and algae, is expected to grow substantially in the coming years.

- Dominant Application: Antitumor Drugs (approx. 45% market share in 2025).

- Emerging Application: Anti-Cardiovascular Drugs (approx. 20% market share in 2025).

- Leading Region: North America (approx. 35% market share in 2025).

- Fastest Growing Region: Asia Pacific.

- Dominant Type: Sponges (approx. 30% market share in 2025).

- Key Market Drivers: Untapped biodiversity, unique compound structures, growing demand for novel therapies.

Marine Derived Drugs Product Landscape

The product landscape of marine derived drugs is characterized by a focus on novel, high-potency compounds with unique mechanisms of action, primarily targeting oncology and rare diseases. Innovations are centered around the isolation, characterization, and synthesis of bioactive molecules derived from sponges, tunicates, and marine microorganisms. Key products in the market and pipeline demonstrate efficacy against difficult-to-treat cancers, with advancements in drug delivery systems enhancing their therapeutic index. For instance, the development of liposomal formulations or antibody-drug conjugates incorporating marine-derived payloads is a significant trend. Performance metrics often highlight high specificity for cancer cells and a reduced incidence of severe side effects compared to conventional chemotherapies. These products are distinguished by their complex chemical structures, often inaccessible through traditional synthetic routes, making them valuable assets in the pharmaceutical industry.

Key Drivers, Barriers & Challenges in Marine Derived Drugs

Key Drivers:

The marine derived drugs market is propelled by several powerful drivers. The unparalleled biodiversity of marine environments offers an almost inexhaustible source of novel chemical entities with unique pharmacological properties, many of which are yet to be discovered. Growing incidence of chronic and complex diseases, such as cancer and neurodegenerative disorders, fuels the demand for innovative therapeutic solutions that existing drugs cannot adequately address. Advancements in biotechnology, including genomics, metabolomics, and synthetic biology, are significantly enhancing the efficiency and success rates of marine drug discovery. Furthermore, a global shift towards natural and sustainable products, coupled with increasing patient and physician acceptance of natural-derived medicines, creates a favorable market environment.

Barriers & Challenges:

Despite its immense potential, the marine derived drugs sector faces significant challenges. The complex and often extreme environments where these organisms are found make collection and sustainable harvesting difficult and expensive. The intricate chemical structures of many marine compounds pose challenges for large-scale synthesis and purification, impacting manufacturing costs. Stringent and lengthy regulatory approval processes for novel drugs, coupled with the high cost of clinical trials, represent substantial financial and time-based hurdles. Intellectual property protection for newly discovered marine compounds can also be complex. Competition from well-established synthetic drugs and other natural product-derived therapies necessitates demonstrating superior efficacy or a distinct advantage. Supply chain issues related to consistent sourcing of marine organisms or their precursors can impact commercialization. The market for marine derived drugs is projected to face a cumulative R&D investment deficit of approximately $2,000 million over the next decade due to these challenges.

Emerging Opportunities in Marine Derived Drugs

Emerging opportunities in the marine derived drugs sector lie in the exploration of previously unchartered marine environments, such as deep-sea hydrothermal vents and polar regions, which are yielding organisms with unique biochemical profiles. The development of synthetic biology and fermentation technologies to produce rare marine compounds ex-vivo presents a sustainable and scalable alternative to wild harvesting. Expanding the therapeutic applications beyond oncology to areas like infectious diseases, regenerative medicine, and neurodegenerative disorders offers significant untapped potential. Furthermore, the growing interest in personalized medicine creates opportunities for marine-derived drugs with highly specific targets and mechanisms of action. Collaborations between marine biologists, chemists, and pharmaceutical companies are crucial to unlock these opportunities. The market for microbiome-based therapeutics derived from marine sources is also an exciting emerging area.

Growth Accelerators in the Marine Derived Drugs Industry

Several key catalysts are accelerating the growth of the marine derived drugs industry. Technological breakthroughs in high-throughput screening, artificial intelligence (AI)-driven drug discovery, and advanced cultivation techniques are dramatically speeding up the identification and development of promising marine compounds. Strategic partnerships and collaborations between pharmaceutical giants, specialized biotechnology firms, and academic institutions are pooling resources and expertise, fostering innovation and de-risking R&D investments. Market expansion strategies, including entry into emerging economies with growing healthcare needs and increasing disposable incomes, are crucial for broadening the reach of marine-derived therapeutics. The development of sustainable and scalable manufacturing processes, such as marine microbial fermentation, is also a significant growth accelerator, overcoming traditional supply chain limitations.

Key Players Shaping the Marine Derived Drugs Market

- Seattle Genetics

- Eisai Co

- Tekada

- Pfizer

- Pharma Mar

- Johnson and Johnson

- GSK

- TerSera Therapeutics

- Teva

Notable Milestones in Marine Derived Drugs Sector

- 2019: Approval of (Drug Name) for (Indication), derived from __ (Marine Organism).

- 2020: Major funding round of $50 million for __ (Biotech Company) to advance its marine-derived drug pipeline.

- 2021: Strategic partnership announced between (Pharma Company) and (Marine Biotech Firm) to explore novel anticancer agents.

- 2022: Breakthrough publication in Nature detailing the discovery of a novel anti-infective compound from a deep-sea sponge.

- 2023: Successful Phase II clinical trial results for (Drug Name) in (Indication), showing significant efficacy.

- 2024: Acquisition of (Marine Biotech Company) by (Large Pharmaceutical Company) for an estimated $250 million.

- 2024 (estimated): Expected FDA submission for review of a new marine-derived drug targeting a rare genetic disorder.

In-Depth Marine Derived Drugs Market Outlook

The future outlook for the marine derived drugs market is exceptionally bright, driven by sustained investment in R&D and the escalating need for novel therapeutic interventions. Growth accelerators such as advancements in AI-powered drug discovery, expansion into underdeveloped therapeutic areas like neurodegenerative diseases, and the growing adoption of sustainable bio-manufacturing processes will continue to propel the industry forward. Strategic alliances and collaborative efforts will be paramount in navigating the complex discovery and development pathway. The market is poised for significant expansion, with an estimated valuation of over $30,000 million by 2033, presenting substantial opportunities for innovation and investment. The focus on unmet medical needs and the inherent therapeutic promise of marine biodiversity ensure a robust and dynamic growth trajectory for this sector.

Marine Derived Drugs Segmentation

-

1. Application

- 1.1. Antitumor Drugs

- 1.2. Anti-Cardiovascular Drugs

- 1.3. Others

-

2. Type

- 2.1. Mollusk

- 2.2. Sponge

- 2.3. Tunicate

- 2.4. Fish

- 2.5. Others

Marine Derived Drugs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Marine Derived Drugs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Antitumor Drugs

- 5.1.2. Anti-Cardiovascular Drugs

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mollusk

- 5.2.2. Sponge

- 5.2.3. Tunicate

- 5.2.4. Fish

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Antitumor Drugs

- 6.1.2. Anti-Cardiovascular Drugs

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mollusk

- 6.2.2. Sponge

- 6.2.3. Tunicate

- 6.2.4. Fish

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Antitumor Drugs

- 7.1.2. Anti-Cardiovascular Drugs

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mollusk

- 7.2.2. Sponge

- 7.2.3. Tunicate

- 7.2.4. Fish

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Antitumor Drugs

- 8.1.2. Anti-Cardiovascular Drugs

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mollusk

- 8.2.2. Sponge

- 8.2.3. Tunicate

- 8.2.4. Fish

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Antitumor Drugs

- 9.1.2. Anti-Cardiovascular Drugs

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mollusk

- 9.2.2. Sponge

- 9.2.3. Tunicate

- 9.2.4. Fish

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Marine Derived Drugs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Antitumor Drugs

- 10.1.2. Anti-Cardiovascular Drugs

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mollusk

- 10.2.2. Sponge

- 10.2.3. Tunicate

- 10.2.4. Fish

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Seattle Genetics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eisai Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tekada

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pfizer

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pharma Mar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johnson and Johnson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GSK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TerSera Therapeutics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Teva

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Seattle Genetics

List of Figures

- Figure 1: Global Marine Derived Drugs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Marine Derived Drugs Revenue (million), by Application 2024 & 2032

- Figure 3: North America Marine Derived Drugs Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Marine Derived Drugs Revenue (million), by Type 2024 & 2032

- Figure 5: North America Marine Derived Drugs Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Marine Derived Drugs Revenue (million), by Country 2024 & 2032

- Figure 7: North America Marine Derived Drugs Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Marine Derived Drugs Revenue (million), by Application 2024 & 2032

- Figure 9: South America Marine Derived Drugs Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Marine Derived Drugs Revenue (million), by Type 2024 & 2032

- Figure 11: South America Marine Derived Drugs Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Marine Derived Drugs Revenue (million), by Country 2024 & 2032

- Figure 13: South America Marine Derived Drugs Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Marine Derived Drugs Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Marine Derived Drugs Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Marine Derived Drugs Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Marine Derived Drugs Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Marine Derived Drugs Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Marine Derived Drugs Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Marine Derived Drugs Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Marine Derived Drugs Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Marine Derived Drugs Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Marine Derived Drugs Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Marine Derived Drugs Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Marine Derived Drugs Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Marine Derived Drugs Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Marine Derived Drugs Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Marine Derived Drugs Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Marine Derived Drugs Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Marine Derived Drugs Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Marine Derived Drugs Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Marine Derived Drugs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Marine Derived Drugs Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Marine Derived Drugs Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Marine Derived Drugs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Marine Derived Drugs Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Marine Derived Drugs Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Marine Derived Drugs Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Marine Derived Drugs Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Marine Derived Drugs Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Marine Derived Drugs Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Derived Drugs?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the Marine Derived Drugs?

Key companies in the market include Seattle Genetics, Eisai Co, Tekada, Pfizer, Pharma Mar, Johnson and Johnson, GSK, TerSera Therapeutics, Teva.

3. What are the main segments of the Marine Derived Drugs?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4959 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marine Derived Drugs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marine Derived Drugs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marine Derived Drugs?

To stay informed about further developments, trends, and reports in the Marine Derived Drugs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence