Key Insights

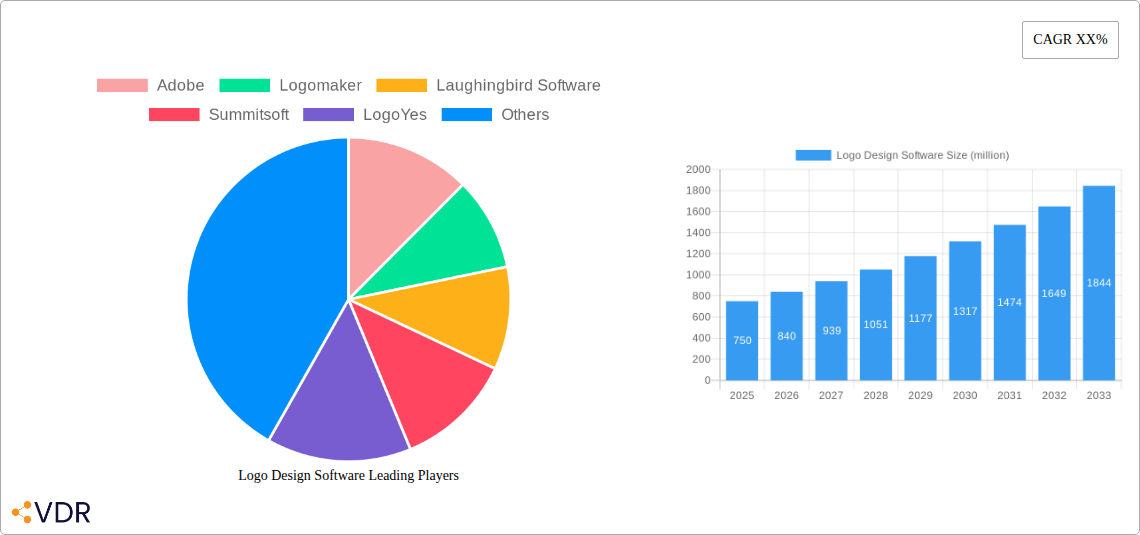

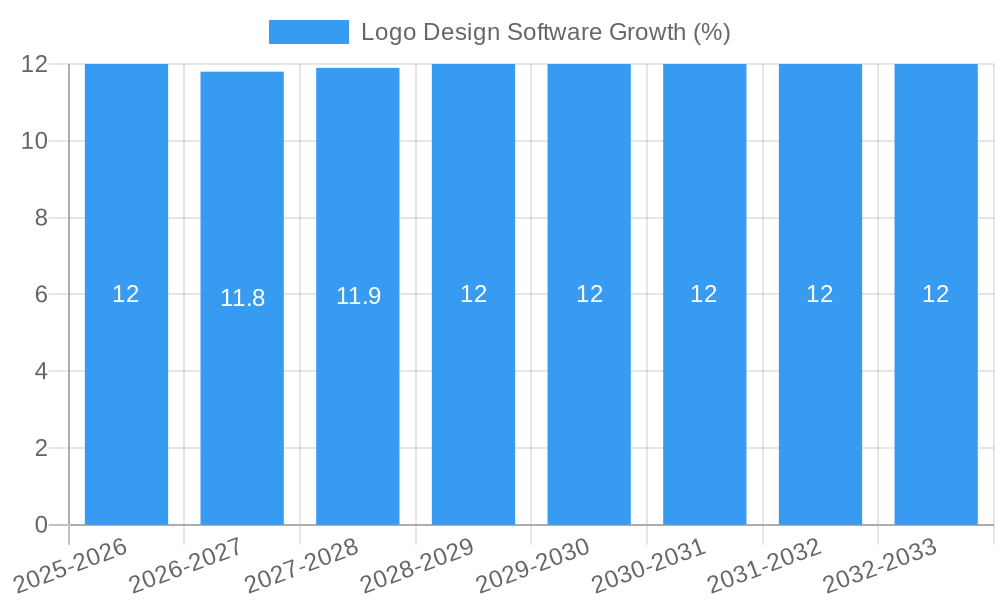

The global Logo Design Software market is poised for significant expansion, projected to reach an estimated market size of approximately $750 million in 2025. This growth is fueled by a burgeoning Compound Annual Growth Rate (CAGR) of around 12%, indicating robust and sustained demand for intuitive and accessible logo creation tools. The increasing need for consistent brand identity across digital and physical touchpoints, especially among small businesses and startups, acts as a primary driver. The proliferation of online businesses and the growing emphasis on personal branding further necessitate professional logo designs, making these software solutions indispensable. The market’s value is denominated in millions, reflecting the substantial economic activity generated by this sector.

Several key trends are shaping the logo design software landscape. The shift towards cloud-based solutions is paramount, offering flexibility, scalability, and collaborative features that appeal to a wide user base, from individual freelancers to large enterprises. Conversely, on-premises solutions continue to hold ground for organizations with stringent data security requirements or existing IT infrastructure. The market is segmented by application, with small businesses representing a significant portion due to their need for affordable and user-friendly design tools, followed by midsize and large enterprises that often seek more advanced customization and integration capabilities. Restraints, such as the increasing competition from free online logo makers and the perceived complexity of some professional-grade software, are being mitigated by continuous innovation in user experience and feature sets, ensuring the market remains dynamic and responsive to evolving user demands.

Report Description: Global Logo Design Software Market Analysis (2019-2033)

Unlock unparalleled insights into the burgeoning Logo Design Software market. This comprehensive report delves into the intricate dynamics, growth trajectories, and competitive landscape of the global logo design software industry. Covering a historical period from 2019 to 2024 and extending to a robust forecast period of 2025–2033, with a base and estimated year of 2025, this analysis is indispensable for strategists, investors, and technology providers seeking to capitalize on this rapidly evolving sector.

The report segments the market by application (Small Business, Midsize Enterprise, Large Enterprise, Other) and type (Cloud-based, On-premises), providing granular analysis for targeted decision-making. We explore the influence of leading companies like Adobe, Logomaker, Laughingbird Software, Summitsoft, LogoYes, Sothink, Designhill, Canva, LogoJoy, Squarespace, Graphicsprings, and Logaster, offering a clear view of market concentration and competitive strategies.

Key Highlights:

- Market Size: Projected to reach a significant valuation by 2033, driven by increasing demand for branding solutions across all business segments.

- CAGR: Detailed compound annual growth rate projections for the forecast period.

- Industry Developments: Analysis of key trends shaping the future of logo creation.

- Regional Dominance: Identification of high-growth regions and countries.

- Technological Innovations: Focus on AI-driven design, cloud adoption, and user-friendly interfaces.

This report is your definitive guide to understanding and navigating the future of logo design software.

Logo Design Software Market Dynamics & Structure

The global logo design software market exhibits a moderate to high concentration, with a few dominant players like Adobe and Canva holding significant market share. However, the landscape is increasingly fragmented with the rise of specialized, user-friendly platforms catering to specific niches and budget ranges. Technological innovation acts as a primary driver, with advancements in artificial intelligence (AI) for automated logo generation, intuitive drag-and-drop interfaces, and cloud-based accessibility revolutionizing the user experience. Regulatory frameworks, while less stringent than in some software sectors, primarily revolve around intellectual property rights and data privacy, influencing how user-generated content is managed. Competitive product substitutes are abundant, ranging from professional graphic design suites to freelance marketplaces and even manual design processes, posing a constant challenge to software providers. End-user demographics are diverse, encompassing freelance designers, small business owners, marketing teams, and large enterprises, each with distinct needs and purchasing power. Mergers and acquisitions (M&A) trends are moderate, often involving smaller innovative startups being acquired by larger entities to gain access to new technologies or customer bases. The market is characterized by a healthy balance between established giants and agile challengers.

- Market Concentration: Dominated by key players but with increasing fragmentation from niche providers.

- Technological Innovation Drivers: AI-powered design, cloud accessibility, intuitive UI/UX, and vector graphics capabilities.

- Regulatory Frameworks: Primarily focused on intellectual property and data privacy compliance.

- Competitive Product Substitutes: Freelance platforms, traditional design tools, and DIY design approaches.

- End-User Demographics: Diverse, including SMBs, freelancers, startups, and enterprise marketing departments.

- M&A Trends: Moderate activity, with acquisitions focused on technology and market access.

Logo Design Software Growth Trends & Insights

The logo design software market is poised for substantial growth, driven by an escalating global demand for professional and distinctive brand identities across all business sizes. The market size evolution is directly correlated with the proliferation of small and medium-sized enterprises (SMEs) worldwide, as well as the growing emphasis on personal branding and digital presence for freelancers and entrepreneurs. The historical period (2019–2024) witnessed a significant uplift in adoption rates, particularly for cloud-based solutions, as businesses embraced remote work and digital transformation initiatives. This trend is expected to accelerate, with the forecast period of 2025–2033 projected to see robust expansion. Technological disruptions, such as the integration of AI and machine learning algorithms, are revolutionizing the design process, enabling faster, more cost-effective, and highly personalized logo creation. These advancements are democratizing design, making professional-grade tools accessible to individuals and businesses with limited design expertise or budgets.

Consumer behavior shifts are playing a pivotal role. There's a growing preference for intuitive, on-demand design solutions that offer speed and flexibility without compromising on quality. Users are increasingly seeking platforms that provide comprehensive branding packages, extending beyond logo creation to include brand style guides and marketing collateral templates. Market penetration for cloud-based logo design software is projected to reach over 75% by 2033, driven by lower initial costs, seamless updates, and enhanced collaboration features. The estimated year of 2025 is set to mark a significant inflection point, with increased investment in AI-driven features and personalization capabilities. For instance, AI-powered suggestion engines that analyze brand keywords and industry trends to generate relevant logo concepts are becoming a standard offering. Furthermore, the rise of the gig economy and the burgeoning creator economy are fueling demand from individual professionals and influencers who require distinct visual identities. The CAGR for the logo design software market is projected to be in the range of 12-15% during the forecast period, indicating a healthy and sustained growth trajectory. The increasing digitalization of businesses across emerging economies also presents a significant opportunity for market expansion.

The impact of affordable, subscription-based models is also a key growth accelerator, allowing small businesses to access high-quality design tools without significant upfront capital expenditure. This accessibility is a powerful driver for adoption. Moreover, the integration of logo design software with broader marketing and website building platforms is creating synergistic growth opportunities, offering users a holistic solution for their business needs. The shift from complex professional software to user-friendly, template-driven platforms further broadens the addressable market.

Dominant Regions, Countries, or Segments in Logo Design Software

The Small Business segment is unequivocally the dominant force driving growth in the global logo design software market. This segment's expansive size and continuous influx of new ventures worldwide fuel an insatiable demand for cost-effective, user-friendly, and efficient branding solutions. Small businesses, often operating with limited budgets and in-house design expertise, rely heavily on specialized logo design software to establish their brand identity from inception. The Cloud-based type of logo design software is the prevailing model within this segment, offering unparalleled accessibility, scalability, and affordability. Its subscription-based nature aligns perfectly with the financial models of startups and small enterprises.

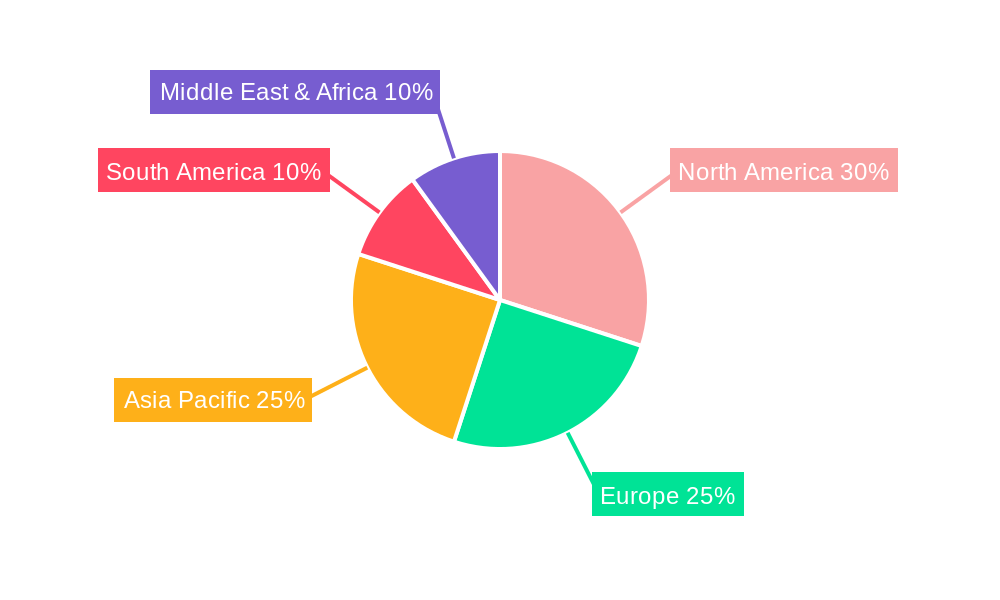

North America, particularly the United States, is the leading region in terms of market share and adoption rates. This dominance is attributed to a mature entrepreneurial ecosystem, a high prevalence of small businesses, advanced technological infrastructure, and a strong cultural emphasis on branding and digital presence. The region benefits from robust economic policies that support small business growth and a high level of digital literacy among consumers and business owners.

Key Drivers for Small Business Dominance:

- Entrepreneurial Boom: A consistent and growing number of new business formations globally.

- Cost-Effectiveness: Logo design software offers a significantly cheaper alternative to hiring professional designers.

- Ease of Use: Intuitive interfaces cater to users with no prior design experience.

- Speed and Efficiency: Enables quick creation of professional-looking logos.

- Scalability: Cloud-based solutions can adapt to growing business needs.

Dominance Factors in North America:

- Strong SME Ecosystem: A large base of active and aspiring small businesses.

- Technological Adoption: High receptiveness to cloud-based and AI-powered solutions.

- Investment in Branding: A cultural understanding of the importance of a strong brand identity.

- Supportive Economic Policies: Government initiatives promoting entrepreneurship and small business development.

- Digital Infrastructure: Widespread internet access and high digital literacy.

The Midsize Enterprise segment is also a significant contributor to market growth, exhibiting a consistent demand for professional branding that aligns with expanding business operations. These enterprises often require more sophisticated customization options and integration capabilities, which leading software providers are increasingly offering. The Cloud-based type is also highly preferred here due to its collaborative features and seamless updates, allowing multiple teams to work on branding initiatives efficiently.

Logo Design Software Product Landscape

The product landscape of logo design software is characterized by continuous innovation, focusing on democratizing design and enhancing user experience. Key product innovations include AI-powered logo generators that suggest design elements based on user inputs like industry, style preferences, and keywords. Cloud-based platforms dominate, offering features like collaborative design, template libraries, vector file exports, and brand asset management. Performance metrics are increasingly judged by the speed of design generation, the quality and uniqueness of output, and the intuitiveness of the user interface. Unique selling propositions revolve around affordability, ease of use for non-designers, and the breadth of customization options available within a template-driven framework. Technological advancements are pushing towards more sophisticated algorithms for intelligent design suggestions and seamless integration with other marketing and business tools.

Key Drivers, Barriers & Challenges in Logo Design Software

The logo design software market is propelled by several key drivers. Technological advancements, particularly in AI and machine learning, enable more sophisticated and personalized logo generation. The growing number of startups and small businesses globally creates a constant demand for affordable and accessible branding solutions. Increased digitalization across industries necessitates strong visual identities. Furthermore, the demand for personal branding among freelancers and influencers is a significant catalyst.

However, the market faces several barriers and challenges. Intense competition from a wide array of providers, including free online tools and professional design services, puts pressure on pricing and differentiation. Perception of limited originality from template-based software can be a restraint for some discerning clients. Intellectual property concerns and the need for robust copyright protection for AI-generated designs present regulatory hurdles. Supply chain issues are less of a direct concern for software, but the reliance on cloud infrastructure and ongoing maintenance costs are factors. The challenge lies in balancing ease of use with the depth of creative control and ensuring that AI-generated designs are truly unique and legally sound.

Emerging Opportunities in Logo Design Software

Emerging opportunities in the logo design software sector lie in the further integration of advanced AI capabilities, moving beyond simple suggestions to truly intelligent design partners. Hyper-personalization through user data analysis and brand archetypes presents a significant untapped market. The expansion of white-labeling solutions for agencies and larger enterprises seeking to offer branded design tools to their clients is another lucrative avenue. Furthermore, the growing demand for sustainable and ethical branding offers an opportunity for software to incorporate these principles into their design suggestions and marketing. The integration with emerging AR/VR platforms for logo visualization and branding experiences also represents a future growth area.

Growth Accelerators in the Logo Design Software Industry

The logo design software industry's long-term growth is significantly accelerated by breakthroughs in generative AI, enabling more sophisticated and unique design outputs. Strategic partnerships between software providers and marketing platforms, e-commerce solutions, and business registration services create synergistic growth and expanded customer reach. The increasing adoption of subscription-based models continues to lower the barrier to entry for businesses of all sizes, driving widespread accessibility. Furthermore, market expansion into emerging economies with a burgeoning entrepreneurial spirit offers substantial untapped potential, fueled by increasing internet penetration and a growing need for professional branding.

Key Players Shaping the Logo Design Software Market

- Adobe

- Logomaker

- Laughingbird Software

- Summitsoft

- LogoYes

- Sothink

- Designhill

- Canva

- LogoJoy

- Squarespace

- Graphicsprings

- Logaster

Notable Milestones in Logo Design Software Sector

- 2019: Increased adoption of AI-powered suggestion engines in logo generators.

- 2020: Surge in demand due to the global shift towards remote work and digital business presence.

- 2021: Expansion of cloud-based features including real-time collaboration.

- 2022: Introduction of more advanced vector editing capabilities within user-friendly interfaces.

- 2023: Enhanced integration with broader marketing and branding suites.

- 2024: Significant advancements in AI for generating unique and contextually relevant logo designs.

In-Depth Logo Design Software Market Outlook

The future of the logo design software market is exceptionally promising, driven by continued innovation and expanding market reach. The primary growth accelerator will be the sophistication of AI in design, leading to highly personalized and context-aware logo creation. Strategic alliances with business formation platforms and digital marketing agencies will broaden user acquisition channels. The pervasive adoption of affordable, flexible subscription models will continue to democratize professional branding. Furthermore, the market is set to benefit from the untapped potential in emerging economies, where the entrepreneurial spirit is high, and the need for digital brand presence is rapidly growing. These factors collectively position the logo design software market for sustained and accelerated growth in the coming years.

Logo Design Software Segmentation

-

1. Application

- 1.1. Small Business

- 1.2. Midsize Enterprise

- 1.3. Large Enterprise

- 1.4. Other

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premises

Logo Design Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logo Design Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Business

- 5.1.2. Midsize Enterprise

- 5.1.3. Large Enterprise

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small Business

- 6.1.2. Midsize Enterprise

- 6.1.3. Large Enterprise

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small Business

- 7.1.2. Midsize Enterprise

- 7.1.3. Large Enterprise

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small Business

- 8.1.2. Midsize Enterprise

- 8.1.3. Large Enterprise

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small Business

- 9.1.2. Midsize Enterprise

- 9.1.3. Large Enterprise

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Logo Design Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small Business

- 10.1.2. Midsize Enterprise

- 10.1.3. Large Enterprise

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adobe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Logomaker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Laughingbird Software

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Summitsoft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LogoYes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sothink

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Designhill

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Canva

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LogoJoy

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Squarespace

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Graphicsprings

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Logaster

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Adobe

List of Figures

- Figure 1: Global Logo Design Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Logo Design Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Logo Design Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Logo Design Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Logo Design Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Logo Design Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Logo Design Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Logo Design Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Logo Design Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Logo Design Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Logo Design Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Logo Design Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Logo Design Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Logo Design Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Logo Design Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Logo Design Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Logo Design Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Logo Design Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Logo Design Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Logo Design Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Logo Design Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Logo Design Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Logo Design Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Logo Design Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Logo Design Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Logo Design Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Logo Design Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Logo Design Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Logo Design Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Logo Design Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Logo Design Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Logo Design Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Logo Design Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Logo Design Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Logo Design Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Logo Design Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Logo Design Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Logo Design Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Logo Design Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Logo Design Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Logo Design Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logo Design Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Logo Design Software?

Key companies in the market include Adobe, Logomaker, Laughingbird Software, Summitsoft, LogoYes, Sothink, Designhill, Canva, LogoJoy, Squarespace, Graphicsprings, Logaster.

3. What are the main segments of the Logo Design Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logo Design Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logo Design Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logo Design Software?

To stay informed about further developments, trends, and reports in the Logo Design Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence