Key Insights

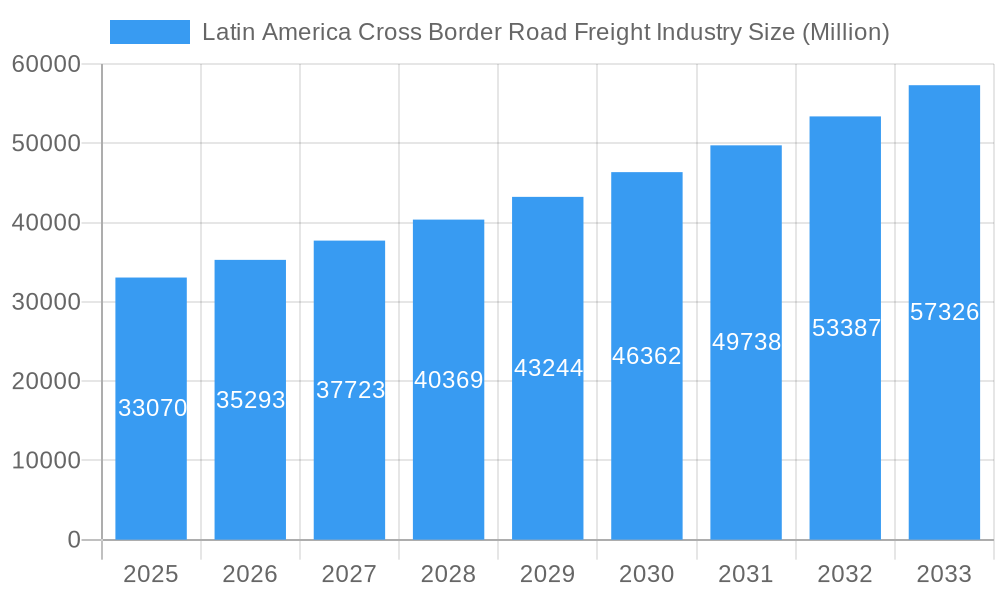

The Latin American cross-border road freight market, valued at $33.07 billion in 2025, is projected to experience robust growth, driven by increasing cross-border trade, expanding e-commerce, and the development of improved infrastructure in key regions like Brazil, Mexico, and Argentina. The Compound Annual Growth Rate (CAGR) of 6.57% from 2025 to 2033 indicates a significant expansion of this market, reaching an estimated value exceeding $60 billion by 2033. Key growth drivers include the rising demand for efficient logistics solutions across diverse sectors, particularly manufacturing, automotive, pharmaceuticals, and agricultural products. The increasing preference for just-in-time inventory management among businesses further fuels this growth. However, challenges such as fluctuating fuel prices, border complexities, and varying regulatory landscapes across different Latin American countries pose potential restraints on market expansion. The market is segmented by function (FTL, LTL, CEP) and end-user industry, offering opportunities for specialization and tailored logistics solutions. Major players like DHL, Ceva Logistics, and Kuehne + Nagel are actively competing in this dynamic market, investing in technological advancements and strategic partnerships to enhance their service offerings and market share.

Latin America Cross Border Road Freight Industry Market Size (In Billion)

The competitive landscape is characterized by both large multinational logistics providers and smaller regional players. This segmentation indicates diverse service offerings catering to the specific needs of various industries and cargo types. The ongoing infrastructure improvements, particularly in road networks and border crossing facilities, are expected to further enhance the efficiency and cost-effectiveness of cross-border road freight transportation in the region. Consequently, this will contribute to increased market penetration and sustained growth throughout the forecast period. Continued focus on improving security measures and customs procedures will also play a significant role in bolstering the market's future prospects. Companies are investing in technology such as route optimization software and real-time tracking systems to improve efficiency and reduce transportation costs. This technological advancement and the potential for further regulatory streamlining will be key factors influencing the market's trajectory in the coming years.

Latin America Cross Border Road Freight Industry Company Market Share

Latin America Cross Border Road Freight Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America cross-border road freight industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Latin American Logistics) and its child market (Cross-border Road Freight) providing granular data for informed strategies.

Latin America Cross Border Road Freight Industry Market Dynamics & Structure

This section analyzes the market structure, competition, and driving forces shaping the Latin American cross-border road freight landscape. The market is characterized by a mix of large multinational players and smaller regional operators. Market concentration is moderate, with the top 5 players holding an estimated xx% market share in 2025. Technological innovation, particularly in telematics and logistics software, is driving efficiency gains. Regulatory frameworks vary across countries, impacting operational costs and compliance. Competitive substitutes include rail and air freight, though road freight maintains a significant advantage for shorter distances and specific cargo types. End-user demographics are diverse, reflecting the varied economic activities across Latin America. M&A activity has been moderate in recent years, with approximately xx deals completed annually (2019-2024), driven primarily by expansion strategies and consolidation efforts.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Technological Innovation: Telematics, route optimization software, and digital freight marketplaces are key drivers.

- Regulatory Frameworks: Varying regulations across countries create complexities and compliance challenges.

- Competitive Substitutes: Rail and air freight offer alternatives, but road freight dominates for shorter distances.

- M&A Activity: Approximately xx deals annually (2019-2024), focused on expansion and consolidation.

- Innovation Barriers: High initial investment costs, integration challenges, and lack of skilled workforce.

Latin America Cross Border Road Freight Industry Growth Trends & Insights

The Latin American cross-border road freight market has experienced consistent growth over the historical period (2019-2024), driven by increasing trade volumes within the region and with other continents. The market size reached approximately XXX million units in 2024, and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching an estimated XXX million units by 2033. This growth is fueled by e-commerce expansion, improving infrastructure in certain corridors, and the increasing adoption of technology to improve efficiency and transparency in supply chains. Consumer behavior shifts towards faster delivery expectations and the demand for reliable cross-border logistics services are also contributing factors. Technological disruptions, such as the implementation of blockchain technology for enhanced security and traceability, are further shaping the market landscape. Market penetration of advanced logistics solutions remains relatively low, creating significant opportunities for growth.

Dominant Regions, Countries, or Segments in Latin America Cross Border Road Freight Industry

Mexico and Brazil are the dominant countries in the Latin American cross-border road freight market, accounting for approximately xx% and xx% of the total market volume, respectively, in 2025. Within the functional segments, Full Truck Load (FTL) dominates, representing xx% of the market share, followed by Less than Truck Load (LTL). The key end-user segments are Manufacturing and Automotive (xx%), Distributive Trade (xx%), and Chemicals (xx%), driven by robust industrial activity and growing consumer demand. Growth is primarily driven by:

- Mexico: Strong manufacturing base, proximity to the US market, and robust infrastructure in certain corridors.

- Brazil: Large domestic market, significant agricultural output, and growing industrial sector.

- FTL: Cost-effectiveness for large shipments.

- Manufacturing & Automotive: High volume of cross-border shipments of components and finished goods.

- Distributive Trade: Growing e-commerce driving demand for efficient last-mile delivery solutions.

- Chemicals: High demand for specialized transportation and handling.

Latin America Cross Border Road Freight Industry Product Landscape

Product innovations focus on enhancing efficiency, safety, and tracking capabilities. This includes advanced telematics systems for real-time monitoring, route optimization software, and temperature-controlled trucking for sensitive goods. The focus is on improved delivery times, reduced fuel consumption, and enhanced security features. Unique selling propositions include specialized handling for particular goods, integrated logistics platforms, and customizable solutions.

Key Drivers, Barriers & Challenges in Latin America Cross Border Road Freight Industry

Key Drivers:

- Increasing cross-border trade within Latin America and with other continents.

- Growth of e-commerce and demand for faster delivery.

- Investments in infrastructure improvements in key transportation corridors.

- Adoption of technology to improve efficiency and transparency.

Key Challenges:

- Infrastructure Deficiencies: Poor road conditions, particularly in certain regions, lead to higher transportation costs and delays. This results in approximately xx million units of lost cargo annually (estimated).

- Regulatory Hurdles: Inconsistent regulations across countries create complexities and compliance burdens.

- Security Concerns: Cargo theft and security risks remain significant concerns, impacting operational costs.

Emerging Opportunities in Latin America Cross Border Road Freight Industry

- Growth of e-commerce: Driving demand for efficient last-mile delivery solutions.

- Untapped markets: Expansion into less developed regions with potential for growth.

- Technological advancements: Adoption of automation, artificial intelligence, and blockchain technology.

- Sustainable logistics: Growing demand for eco-friendly transportation solutions.

Growth Accelerators in the Latin America Cross Border Road Freight Industry Industry

Long-term growth will be driven by continued infrastructure improvements, the adoption of innovative technologies, strategic partnerships between logistics providers and technology companies, and expansion into new markets. Further integration of regional trade blocs, and government support for improving logistics infrastructure will play a key role.

Key Players Shaping the Latin America Cross Border Road Freight Industry Market

- DHL

- Ceva Logistics

- Atlasmex

- XPO Logistics

- RML Transport Inc

- Kuehne Nagel

- Gefco Logistica

- CH Robinson Worldwide Inc

- Dibiagi Transporte Internacional

- FC Cargo

Notable Milestones in Latin America Cross Border Road Freight Industry Sector

- 2021: Implementation of new customs regulations in Mexico impacting cross-border shipments.

- 2022: Launch of a major digital freight marketplace in Brazil.

- 2023: Significant investment in infrastructure upgrades in the Andean region.

In-Depth Latin America Cross Border Road Freight Industry Market Outlook

The Latin American cross-border road freight market is poised for continued growth over the forecast period (2025-2033), driven by e-commerce expansion, infrastructure investments, and technological advancements. Strategic partnerships and a focus on sustainable logistics will be crucial for success. The market presents significant opportunities for both established players and new entrants. Expansion into untapped markets and specialization in niche segments will be key differentiators.

Latin America Cross Border Road Freight Industry Segmentation

-

1. Function

- 1.1. Full Truck Load (FTL)

- 1.2. Less than Truck Load (LTL)

- 1.3. Courier, Express, and Parcel (CEP)

-

2. End User

- 2.1. Chemicals

- 2.2. Agriculture, Fishing, and Forestry

- 2.3. Construction

- 2.4. Distributive Trade

- 2.5. Pharmaceutical and Healthcare

- 2.6. Manufacturing and Automotive

-

3. Geography

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Argentina

- 3.4. Chile

- 3.5. Colombia

- 3.6. Rest of Latin America

Latin America Cross Border Road Freight Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Chile

- 5. Colombia

- 6. Rest of Latin America

Latin America Cross Border Road Freight Industry Regional Market Share

Geographic Coverage of Latin America Cross Border Road Freight Industry

Latin America Cross Border Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Oil and Gas Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Full Truck Load (FTL)

- 5.1.2. Less than Truck Load (LTL)

- 5.1.3. Courier, Express, and Parcel (CEP)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Chemicals

- 5.2.2. Agriculture, Fishing, and Forestry

- 5.2.3. Construction

- 5.2.4. Distributive Trade

- 5.2.5. Pharmaceutical and Healthcare

- 5.2.6. Manufacturing and Automotive

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Argentina

- 5.3.4. Chile

- 5.3.5. Colombia

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Chile

- 5.4.5. Colombia

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Mexico Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Full Truck Load (FTL)

- 6.1.2. Less than Truck Load (LTL)

- 6.1.3. Courier, Express, and Parcel (CEP)

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Chemicals

- 6.2.2. Agriculture, Fishing, and Forestry

- 6.2.3. Construction

- 6.2.4. Distributive Trade

- 6.2.5. Pharmaceutical and Healthcare

- 6.2.6. Manufacturing and Automotive

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mexico

- 6.3.2. Brazil

- 6.3.3. Argentina

- 6.3.4. Chile

- 6.3.5. Colombia

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. Brazil Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Full Truck Load (FTL)

- 7.1.2. Less than Truck Load (LTL)

- 7.1.3. Courier, Express, and Parcel (CEP)

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Chemicals

- 7.2.2. Agriculture, Fishing, and Forestry

- 7.2.3. Construction

- 7.2.4. Distributive Trade

- 7.2.5. Pharmaceutical and Healthcare

- 7.2.6. Manufacturing and Automotive

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mexico

- 7.3.2. Brazil

- 7.3.3. Argentina

- 7.3.4. Chile

- 7.3.5. Colombia

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Argentina Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Full Truck Load (FTL)

- 8.1.2. Less than Truck Load (LTL)

- 8.1.3. Courier, Express, and Parcel (CEP)

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Chemicals

- 8.2.2. Agriculture, Fishing, and Forestry

- 8.2.3. Construction

- 8.2.4. Distributive Trade

- 8.2.5. Pharmaceutical and Healthcare

- 8.2.6. Manufacturing and Automotive

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mexico

- 8.3.2. Brazil

- 8.3.3. Argentina

- 8.3.4. Chile

- 8.3.5. Colombia

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Chile Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Full Truck Load (FTL)

- 9.1.2. Less than Truck Load (LTL)

- 9.1.3. Courier, Express, and Parcel (CEP)

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Chemicals

- 9.2.2. Agriculture, Fishing, and Forestry

- 9.2.3. Construction

- 9.2.4. Distributive Trade

- 9.2.5. Pharmaceutical and Healthcare

- 9.2.6. Manufacturing and Automotive

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Mexico

- 9.3.2. Brazil

- 9.3.3. Argentina

- 9.3.4. Chile

- 9.3.5. Colombia

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Colombia Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Full Truck Load (FTL)

- 10.1.2. Less than Truck Load (LTL)

- 10.1.3. Courier, Express, and Parcel (CEP)

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Chemicals

- 10.2.2. Agriculture, Fishing, and Forestry

- 10.2.3. Construction

- 10.2.4. Distributive Trade

- 10.2.5. Pharmaceutical and Healthcare

- 10.2.6. Manufacturing and Automotive

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Mexico

- 10.3.2. Brazil

- 10.3.3. Argentina

- 10.3.4. Chile

- 10.3.5. Colombia

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Rest of Latin America Latin America Cross Border Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Function

- 11.1.1. Full Truck Load (FTL)

- 11.1.2. Less than Truck Load (LTL)

- 11.1.3. Courier, Express, and Parcel (CEP)

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Chemicals

- 11.2.2. Agriculture, Fishing, and Forestry

- 11.2.3. Construction

- 11.2.4. Distributive Trade

- 11.2.5. Pharmaceutical and Healthcare

- 11.2.6. Manufacturing and Automotive

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Mexico

- 11.3.2. Brazil

- 11.3.3. Argentina

- 11.3.4. Chile

- 11.3.5. Colombia

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Function

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DHL

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ceva Logistics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Atlasmex

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 XPO Logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 RML Transport Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kuehne Nagel

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Gefco Logistica

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CH Robinson Worldwide Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Dibiagi Transporte Internacional**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FC Cargo

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 DHL

List of Figures

- Figure 1: Latin America Cross Border Road Freight Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Cross Border Road Freight Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 6: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 10: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 14: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 18: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 22: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 26: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Latin America Cross Border Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cross Border Road Freight Industry?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Latin America Cross Border Road Freight Industry?

Key companies in the market include DHL, Ceva Logistics, Atlasmex, XPO Logistics, RML Transport Inc, Kuehne Nagel, Gefco Logistica, CH Robinson Worldwide Inc, Dibiagi Transporte Internacional**List Not Exhaustive, FC Cargo.

3. What are the main segments of the Latin America Cross Border Road Freight Industry?

The market segments include Function, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.07 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Increasing Demand from the Oil and Gas Industry.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cross Border Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cross Border Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cross Border Road Freight Industry?

To stay informed about further developments, trends, and reports in the Latin America Cross Border Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence