Key Insights

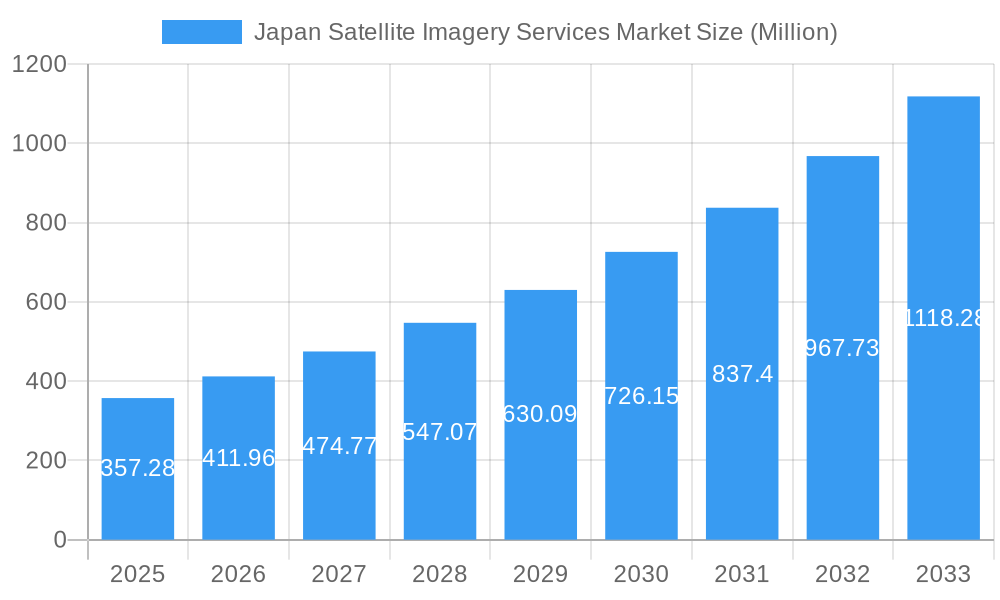

The Japan Satellite Imagery Services Market is experiencing robust expansion, projected to reach 357.28 million by 2025. This growth is fueled by a CAGR of 15.25%, indicating a dynamic and rapidly evolving sector. Key drivers include the increasing adoption of geospatial data for informed decision-making across various industries, from natural resource management and conservation to sophisticated surveillance and security operations. The government sector, a significant end-user, is leveraging satellite imagery for critical functions like disaster management and infrastructure planning. Furthermore, advancements in satellite technology, leading to higher resolution imagery and faster data delivery, are propelling market adoption. The construction and transportation sectors are increasingly relying on satellite data for site analysis, progress monitoring, and route optimization, contributing to the market's upward trajectory.

Japan Satellite Imagery Services Market Market Size (In Million)

The market is further shaped by emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) for automated image analysis and pattern recognition, enhancing the value derived from satellite data. The military and defense sector continues to be a major consumer, utilizing imagery for intelligence gathering and strategic planning. Simultaneously, the forestry and agriculture sectors are witnessing a surge in the use of satellite imagery for precision farming, crop health monitoring, and sustainable land management practices. While the market presents substantial opportunities, potential restraints could include the high initial investment costs associated with advanced satellite technology and the need for skilled professionals to interpret complex geospatial data. However, the continuous innovation and increasing affordability of satellite-derived insights are expected to mitigate these challenges, ensuring sustained growth in the coming years.

Japan Satellite Imagery Services Market Company Market Share

Japan Satellite Imagery Services Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a meticulous analysis of the Japan Satellite Imagery Services Market, a rapidly evolving sector driven by advancements in space technology and an increasing demand for geospatial data across diverse industries. We delve into the intricate market dynamics, growth trends, regional dominance, product landscape, and key players shaping this critical market. The study encompasses a comprehensive historical analysis from 2019-2024, a detailed base year analysis for 2025, and an extensive forecast period from 2025-2033. Gain critical insights into market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, all presented with quantitative metrics and qualitative assessments. Discover the dominant segments, key drivers, emerging opportunities, and growth accelerators poised to define the future of satellite imagery services in Japan.

Japan Satellite Imagery Services Market Market Dynamics & Structure

The Japan Satellite Imagery Services Market exhibits a moderately concentrated structure, with key players like Airbus SE, Maxar Technologies, and the Japan Aerospace Exploration Agency (JAXA) holding significant influence. Technological innovation serves as a primary driver, fueled by continuous advancements in sensor technology, data processing capabilities, and Artificial Intelligence (AI) for image analysis. This innovation is crucial for enhancing resolution, spectral capabilities, and real-time data delivery. Regulatory frameworks, primarily overseen by agencies like the Ministry of Internal Affairs and Communications (MIC) and the Ministry of Economy, Trade and Industry (METI), govern data dissemination and commercial satellite operations, ensuring security and national interests are met. While there are no direct competitive product substitutes that fully replicate the unique, wide-area coverage and persistent monitoring capabilities of satellite imagery, advancements in drone technology and ground-based sensing present complementary solutions in specific niche applications. End-user demographics are expanding, with strong adoption from government agencies for Surveillance and Security and Disaster Management, alongside growing interest from sectors like Construction, Forestry and Agriculture, and Transportation and Logistics. Merger and acquisition (M&A) trends are relatively nascent but are expected to increase as smaller technology providers seek consolidation to offer comprehensive solutions and larger players aim to expand their service portfolios and geographical reach. The market concentration, estimated to be around 60% for the top five players, is influenced by the high capital investment required for satellite infrastructure.

- Market Concentration: Moderately concentrated with top players holding a significant share.

- Technological Innovation: Driven by sensor advancements, AI in analytics, and improved data processing.

- Regulatory Frameworks: Governed by MIC and METI, focusing on data security and commercial operations.

- Competitive Landscape: Primarily driven by satellite capabilities, with drones and ground sensors as complementary.

- End-User Demographics: Expanding beyond government to commercial sectors like construction and agriculture.

- M&A Trends: Nascent but expected to grow for portfolio expansion and consolidation.

Japan Satellite Imagery Services Market Growth Trends & Insights

The Japan Satellite Imagery Services Market is poised for robust growth, driven by a confluence of technological advancements, increasing data demands, and evolving end-user needs. The market size is projected to grow from an estimated USD 1,800 Million in 2025 to USD 3,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is underpinned by the escalating adoption of satellite imagery for a myriad of applications, including precision agriculture, urban planning, environmental monitoring, and national security. The increasing availability of high-resolution and multispectral imagery, coupled with sophisticated analytical tools, is democratizing access to valuable geospatial intelligence, thereby accelerating market penetration. Technological disruptions, such as the development of small satellite constellations, artificial intelligence-powered data analytics, and cloud-based platforms, are further enhancing the efficiency, affordability, and accessibility of satellite imagery services. These innovations are enabling faster data processing, more insightful analysis, and the creation of novel applications that were previously unfeasible. Consumer behavior shifts are evident, with a growing demand for actionable insights rather than raw data. Businesses and governments are increasingly seeking integrated solutions that can provide real-time monitoring, predictive analytics, and decision-support tools derived from satellite data. The "New Space" revolution, characterized by private sector innovation and reduced launch costs, is also playing a pivotal role in stimulating market growth. This trend is fostering greater competition and driving down service costs, making satellite imagery services more attractive to a wider range of end-users. The historical period from 2019-2024 saw steady growth, driven by initial government investments and increasing awareness of satellite data benefits. The base year 2025 marks a significant inflection point, with accelerated adoption across various industries.

Dominant Regions, Countries, or Segments in Japan Satellite Imagery Services Market

Within the Japan Satellite Imagery Services Market, the Government end-user segment stands out as the dominant force, accounting for an estimated 40% of the total market share in 2025. This dominance is driven by critical government needs in Surveillance and Security, Disaster Management, and Intelligence. Japan's strategic geographical location and its susceptibility to natural disasters like earthquakes and typhoons necessitate robust monitoring and response capabilities, for which satellite imagery is indispensable. The Ministry of Defense and various national security agencies heavily rely on satellite data for reconnaissance, border patrol, and threat assessment. Similarly, agencies like the Cabinet Office and the Fire and Disaster Management Agency utilize satellite imagery for disaster preparedness, real-time damage assessment, and effective resource allocation during emergencies. Furthermore, the Japanese government's commitment to national infrastructure development and environmental protection fuels the demand for geospatial data in areas like urban planning, land use mapping, and resource management.

The Application: Geospatial Data Acquisition and Mapping segment is also a significant contributor, intrinsically linked to government and commercial needs. This segment provides the foundational data that enables other applications. The Intelligence application, while sensitive, also represents a substantial market driven by national security requirements.

Key Drivers of Dominance:

- National Security Imperatives: Persistent need for real-time monitoring and threat assessment.

- Disaster Preparedness and Response: Critical for a nation prone to natural calamities.

- Infrastructure Development: Government-led projects in urban planning and transportation.

- Environmental Monitoring: Policies focused on climate change mitigation and resource conservation.

- Technological Advancement: Government investment in space programs and R&D.

The Government segment's growth potential remains high, fueled by evolving geopolitical landscapes and an increasing emphasis on data-driven decision-making. While other segments like Transportation and Logistics and Forestry and Agriculture are exhibiting strong growth, their current market share is considerably smaller compared to the foundational role of government utilization. The synergy between the Government end-user and the Geospatial Data Acquisition and Mapping application segment creates a powerful market dynamic, ensuring sustained demand for satellite imagery services.

Japan Satellite Imagery Services Market Product Landscape

The product landscape of the Japan Satellite Imagery Services Market is characterized by a diverse range of offerings focused on delivering high-quality, actionable geospatial data. Innovations are centered on enhancing spatial resolution, spectral accuracy, and temporal revisit rates of satellite imagery. Companies are increasingly offering integrated solutions that combine raw imagery with advanced analytics, AI-powered interpretation, and cloud-based platforms for seamless data access and processing. Unique selling propositions often lie in the ability to provide specific data types, such as high-resolution optical imagery, radar data for all-weather imaging, or thermal imagery for monitoring heat signatures. Technological advancements are leading to the development of smaller, more agile satellites capable of rapid deployment and tasking, thereby improving the responsiveness of services. Furthermore, the integration of machine learning algorithms allows for automated object detection, change analysis, and predictive modeling, significantly enhancing the value proposition of satellite imagery services. The performance metrics that are crucial for end-users include accuracy, timeliness, coverage area, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Japan Satellite Imagery Services Market

Key Drivers:

The Japan Satellite Imagery Services Market is propelled by several key drivers. Technological advancements in satellite sensors and data processing are continuously improving the quality and accessibility of imagery. The growing emphasis on National Security and Defense fuels demand for surveillance and intelligence applications. Furthermore, Japan's vulnerability to Natural Disasters drives the need for effective disaster management solutions. Increasing government initiatives and investments in space technology and infrastructure also play a crucial role. The expansion of commercial applications in sectors like Agriculture, Construction, and Environmental Monitoring further bolsters market growth.

Barriers & Challenges:

Despite the promising growth, the market faces several barriers and challenges. The high initial investment required for satellite infrastructure and data acquisition is a significant hurdle. Regulatory complexities and data security concerns can also impede market expansion. Competition from alternative technologies, such as drones for localized mapping, presents a challenge, although they often serve complementary roles. Supply chain issues related to satellite component manufacturing and launch services can lead to delays and increased costs. Furthermore, the lack of skilled professionals in data analysis and interpretation can limit the effective utilization of satellite imagery. The market faces a potential challenge of data saturation without robust analytical capabilities to extract meaningful insights.

Emerging Opportunities in Japan Satellite Imagery Services Market

Emerging opportunities in the Japan Satellite Imagery Services Market are abundant, driven by innovation and evolving societal needs. The increasing demand for precision agriculture presents a significant opportunity for satellite imagery to optimize crop yields and resource management. The development of smart cities and infrastructure projects requires detailed geospatial data for planning, monitoring, and management. Furthermore, the growing awareness of climate change and the need for environmental monitoring are creating demand for services related to deforestation tracking, pollution assessment, and natural resource management. The integration of satellite imagery with Internet of Things (IoT) devices and AI offers new avenues for real-time monitoring and predictive analytics across various sectors. The expansion of the New Space economy is also fostering opportunities for smaller, more agile companies to offer specialized services and innovative applications, catering to niche market demands.

Growth Accelerators in the Japan Satellite Imagery Services Market Industry

Several factors are acting as significant growth accelerators for the Japan Satellite Imagery Services Market. Technological breakthroughs in sensor technology, miniaturization of satellites, and advancements in AI-driven data analytics are continuously enhancing the capabilities and reducing the costs of satellite imagery services. Strategic partnerships and collaborations between satellite operators, data providers, and end-users are fostering innovation and creating integrated solutions that address specific industry needs. For instance, collaborations aimed at developing new algorithms for specific applications, like infrastructure monitoring or maritime surveillance, are driving market expansion. Government support and investment in space programs and the promotion of space-based industries also play a crucial role in accelerating growth. Furthermore, the increasing adoption of satellite imagery for commercial purposes beyond traditional defense and security applications, such as in insurance, finance, and urban planning, is opening up new revenue streams and driving market penetration.

Key Players Shaping the Japan Satellite Imagery Services Market Market

- L3Harris Technologies Inc

- Airbus SE

- Japan Aerospace Exploration Agency (JAXA)

- Maxar Technologies

- New Japan Radio Co Ltd

- NTT Data Corporation

- Remote Sensing Technology Center of Japan (RESTEC)

- Kokusai Kogyo Co Ltd

- PASCO Corporation

- Mitsubishi Electric

Notable Milestones in Japan Satellite Imagery Services Market Sector

- January 2023: Axelspace announced an agreement with New Space Intelligence, a Japanese satellite imagery analysis service provider. This partnership aims to promote the expansion of satellite data utilization by developing new applications using satellite imagery.

- November 2022: Japan Space Imaging Corporation signed an agreement with Satellite Vu to launch a unique constellation of satellites delivering the highest resolution thermal data from space. This provides customers and partners with preferred access to Satellite Vu's imagery, products, and services.

In-Depth Japan Satellite Imagery Services Market Market Outlook

The Japan Satellite Imagery Services Market is characterized by a strong outlook for sustained growth, driven by ongoing technological advancements and an expanding array of applications. Key growth accelerators include the relentless pursuit of higher resolution and more frequent revisit times in satellite imagery, coupled with the increasing sophistication of AI and machine learning for data interpretation and insight generation. Strategic partnerships, such as the one between Axelspace and New Space Intelligence, are crucial for unlocking new use cases and broadening the adoption of satellite data. The focus on disaster management, national security, and infrastructure development within Japan will continue to be significant demand drivers. Furthermore, the growing commercial interest in areas like precision agriculture and environmental monitoring presents substantial untapped potential. The market is set to witness increased integration of satellite data with other data sources, leading to more comprehensive and actionable solutions, solidifying its position as an indispensable tool for decision-making across industries.

Japan Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Other End-Users

Japan Satellite Imagery Services Market Segmentation By Geography

- 1. Japan

Japan Satellite Imagery Services Market Regional Market Share

Geographic Coverage of Japan Satellite Imagery Services Market

Japan Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Infrastructural Development in Japan; Increasing Requirement for Mapping and Navigation System

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Infrastructural Development in Japan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Japan Aerospace Exploration Agency (JAXA)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maxar Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 New Japan Radio Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NTT Data Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remote Sensing Technology Center of Japan (RESTEC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kokusai Kogyo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PASCO Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Japan Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Satellite Imagery Services Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Japan Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Japan Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Japan Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Japan Satellite Imagery Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Satellite Imagery Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Japan Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Japan Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Japan Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Japan Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Japan Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Satellite Imagery Services Market?

The projected CAGR is approximately 15.25%.

2. Which companies are prominent players in the Japan Satellite Imagery Services Market?

Key companies in the market include L3Harris Technologies Inc, Airbus SE, Japan Aerospace Exploration Agency (JAXA), Maxar Technologies, New Japan Radio Co Ltd, NTT Data Corporation, Remote Sensing Technology Center of Japan (RESTEC), Kokusai Kogyo Co Ltd, PASCO Corporation, Mitsubishi Electric.

3. What are the main segments of the Japan Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 357.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Infrastructural Development in Japan; Increasing Requirement for Mapping and Navigation System.

6. What are the notable trends driving market growth?

Infrastructural Development in Japan.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

January 2023: Axelspace announced that the company signed an agreement with New Space Intelligence which is a Japanese satellite imagery analysis service provider company. With this partnership, both companies will work together to promote the expansion of satellite data utilization by developing new applications using satellite imagery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the Japan Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence