Key Insights

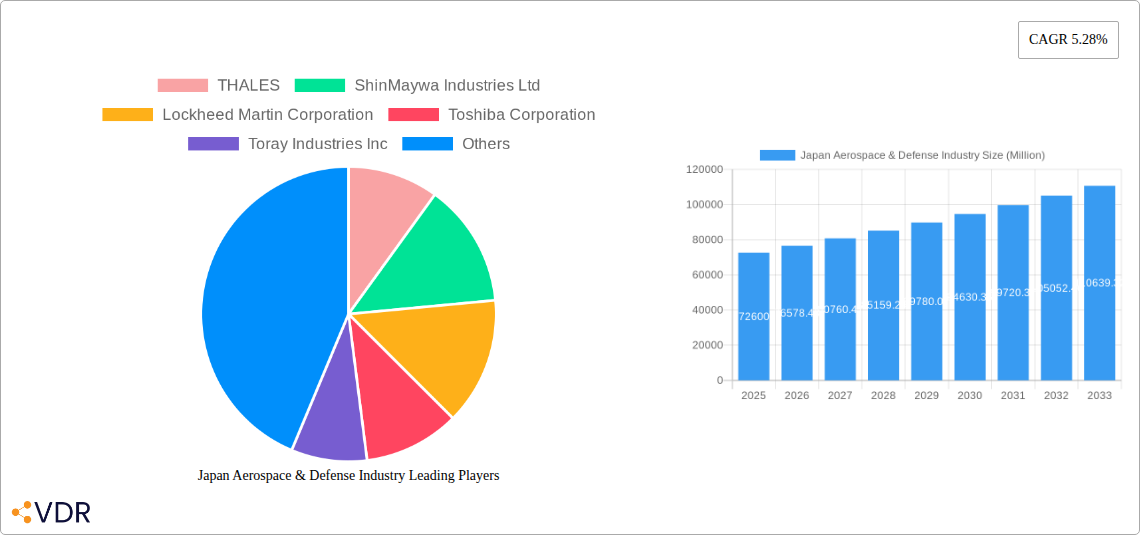

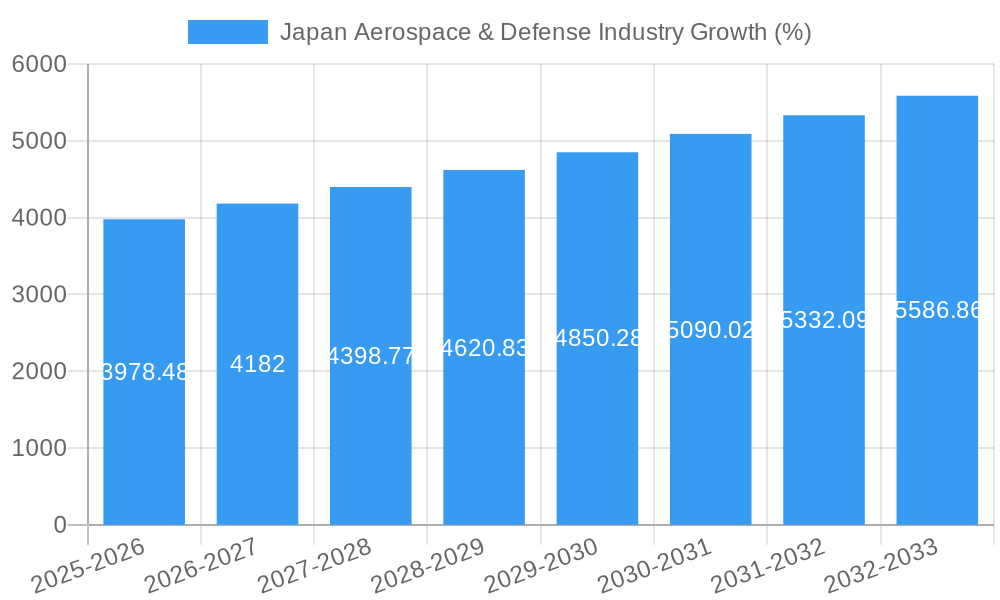

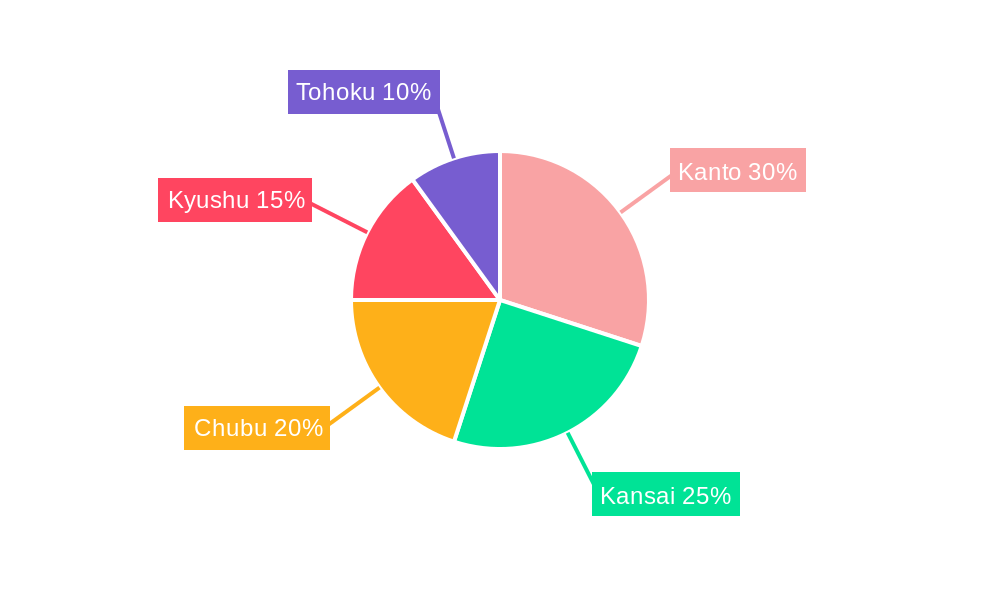

The Japan Aerospace & Defense Industry, valued at $72.60 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.28% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing geopolitical tensions in the Asia-Pacific region are driving significant investments in defense modernization and technological advancements. Secondly, Japan's commitment to enhancing its self-defense capabilities, including investments in advanced fighter jets, surveillance systems, and missile defense technologies, is a major catalyst for market growth. The government's focus on technological innovation within the aerospace sector further stimulates the industry. Finally, a burgeoning domestic space exploration program, encompassing satellite development and launch capabilities, contributes to the overall market expansion. The industry is segmented by sector (Aerospace, Defense), service type (Manufacturing, MRO – Maintenance, Repair, and Overhaul), and platform (Terrestrial, Aerial, Naval). Key players like Thales, Lockheed Martin, and Mitsubishi Heavy Industries are driving innovation and competition within these segments. The regional distribution of activity is concentrated across key areas of Japan, including Kanto, Kansai, Chubu, Kyushu, and Tohoku, each contributing uniquely to the overall market size.

The projected growth trajectory suggests a significant increase in market value by 2033. While specific regional breakdowns are not provided, a reasonable assumption is that growth will be fairly evenly distributed across the identified regions, reflecting the strategic importance of the aerospace and defense sectors throughout Japan. The dominance of major global players alongside significant domestic corporations underscores the industry's competitiveness and technological sophistication. However, challenges remain, including potential fluctuations in government spending and the need for sustained investment in research and development to maintain a competitive edge in the global aerospace and defense landscape. Further expansion is anticipated due to increased collaborations between Japanese and international companies for technological advancements.

Japan Aerospace & Defense Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Aerospace & Defense Industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year and estimated year. The analysis includes detailed segmentation by Sector (Aerospace, Defense), Service Type (Manufacturing, MRO), and Platform (Terrestrial, Aerial, Naval). Market values are presented in Million units.

Japan Aerospace & Defense Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the Japan Aerospace & Defense industry. The market is characterized by a relatively concentrated structure with a few major players holding significant market share. Technological innovation, particularly in areas such as unmanned aerial vehicles (UAVs) and advanced materials, is a key driver. Stringent regulatory frameworks and export controls influence market dynamics, while the rising adoption of commercial off-the-shelf (COTS) technologies presents both opportunities and challenges. Mergers and acquisitions (M&A) activity plays a crucial role in shaping the market landscape.

- Market Concentration: High, with top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Focus on UAVs, AI-powered systems, and lightweight composite materials. Barriers to innovation include high R&D costs and stringent certification processes.

- Regulatory Framework: Strict regulations governing defense exports and technology transfer impact market growth.

- Competitive Product Substitutes: Limited, due to the specialized nature of aerospace and defense products.

- End-User Demographics: Primarily government agencies (Ministry of Defence, etc.) and their affiliated entities.

- M&A Trends: Steady increase in M&A activity driven by consolidation and technological synergy, with xx deals recorded between 2019-2024, valued at approximately xx Million.

Japan Aerospace & Defense Industry Growth Trends & Insights

The Japan Aerospace & Defense industry has experienced steady growth over the historical period (2019-2024), driven by increasing defense budgets, modernization efforts, and technological advancements. This trend is expected to continue during the forecast period (2025-2033), albeit at a moderated pace due to macroeconomic factors and global uncertainties. The market is witnessing a shift towards technologically advanced systems, with a growing emphasis on cybersecurity and autonomous capabilities. Consumer behavior is largely shaped by government procurement policies and priorities.

- Market Size Evolution: The market size grew from xx Million in 2019 to xx Million in 2024, projecting to reach xx Million by 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% of potential market currently tapped.

- Technological Disruptions: Adoption of AI, robotics, and advanced materials is driving significant transformations.

Dominant Regions, Countries, or Segments in Japan Aerospace & Defense Industry

The Kanto region is currently the dominant region in Japan’s Aerospace & Defense industry, driven by its concentration of major players, advanced infrastructure, and robust government support. The Aerospace segment within the sector shows the highest growth potential, owing to increasing investments in civil aviation and space exploration. Within Service Types, Manufacturing holds a larger market share than MRO due to high government spending on new systems and platforms. Naval platforms are projected to see robust growth, fueled by increased naval modernization programs.

- Key Drivers (Kanto Region): Concentrated expertise, robust infrastructure, government investments, proximity to key players.

- Key Drivers (Aerospace Segment): Rising civil aviation demand, space exploration initiatives, technology advancements.

- Key Drivers (Manufacturing Service Type): Government procurement, new system developments, modernization programs.

- Key Drivers (Naval Platform): Increased naval modernization programs, regional security concerns.

- Market Share (Kanto): xx% in 2025

- Growth Potential (Aerospace): xx% CAGR (2025-2033)

Japan Aerospace & Defense Industry Product Landscape

The Japanese Aerospace & Defense industry boasts a diverse product portfolio, encompassing advanced aircraft, missiles, satellites, and related technologies. Recent innovations focus on incorporating AI, improved sensor technologies, and lightweight materials to enhance performance, efficiency, and survivability. Unique selling propositions often center around highly specialized engineering capabilities and long-standing partnerships with global leaders.

Key Drivers, Barriers & Challenges in Japan Aerospace & Defense Industry

Key Drivers: Increasing defense budgets, technological advancements in areas such as AI and UAVs, and growing regional security concerns are propelling market growth. Government initiatives supporting technological innovation and modernization further stimulate market expansion.

Key Challenges: High R&D costs, stringent regulatory frameworks, global supply chain disruptions, and intense competition from international players pose significant challenges. These factors can hinder market expansion and innovation. Supply chain disruptions have resulted in approximately xx Million in lost revenue in 2024.

Emerging Opportunities in Japan Aerospace & Defense Industry

Emerging opportunities include the growing demand for UAVs, the development of hypersonic technologies, and the increasing focus on space-based capabilities. Furthermore, strategic partnerships with international companies and expansion into niche markets hold significant potential for growth. The growing adoption of digital technologies for logistics and MRO also presents notable opportunities.

Growth Accelerators in the Japan Aerospace & Defense Industry

Technological advancements, strategic partnerships with international companies, and government initiatives promoting technological innovation act as key growth accelerators. Expansion into new markets, such as commercial space and advanced manufacturing, promises significant growth potential.

Key Players Shaping the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Japan Aerospace & Defense Industry Sector

- 2022 (Q3): Mitsubishi Heavy Industries announced a significant investment in advanced materials research for aerospace applications.

- 2021 (Q4): Joint venture formed between Kawasaki Heavy Industries and a foreign partner for UAV development.

- 2020 (Q1): New regulations introduced impacting the import of certain defense technologies.

In-Depth Japan Aerospace & Defense Industry Market Outlook

The Japan Aerospace & Defense industry is poised for continued growth, driven by ongoing modernization efforts, technological advancements, and the increasing focus on regional security. Strategic partnerships and investments in R&D will be crucial for success. The focus on advanced technologies, such as AI and hypersonic weapons, will shape the market's evolution in the coming years, presenting significant opportunities for players who can adapt to these changes.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kanto Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ShinMaywa Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toray Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Steel Works Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Komatsu Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mitsubishi Heavy Industries Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kanto Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kansai Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chubu Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kyushu Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tohoku Japan Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2019 & 2032

- Table 15: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence