Key Insights

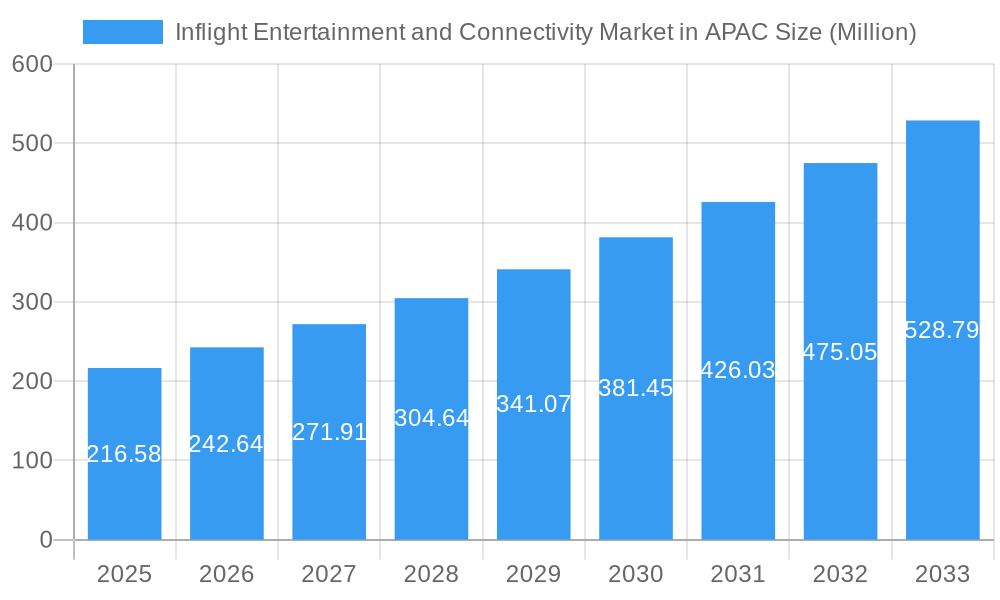

The Inflight Entertainment and Connectivity (IFEC) market in the Asia Pacific (APAC) region is poised for substantial growth, projected to reach an estimated USD 216.58 million with a compelling Compound Annual Growth Rate (CAGR) of 12.02% over the forecast period of 2025-2033. This robust expansion is primarily fueled by a confluence of factors. Increasing disposable incomes across key APAC nations like China, India, and South Korea are driving a surge in air travel demand, particularly for premium cabins. Airlines are strategically investing in enhanced IFEC systems to differentiate their offerings and cater to the evolving passenger expectations for seamless entertainment and connectivity during flights. This includes the adoption of advanced hardware solutions, rich content libraries, and high-speed satellite connectivity, all contributing to a more engaging and productive travel experience. Furthermore, the growing aviation infrastructure and the continuous influx of new aircraft orders within the region are creating ample opportunities for IFEC system integration.

Inflight Entertainment and Connectivity Market in APAC Market Size (In Million)

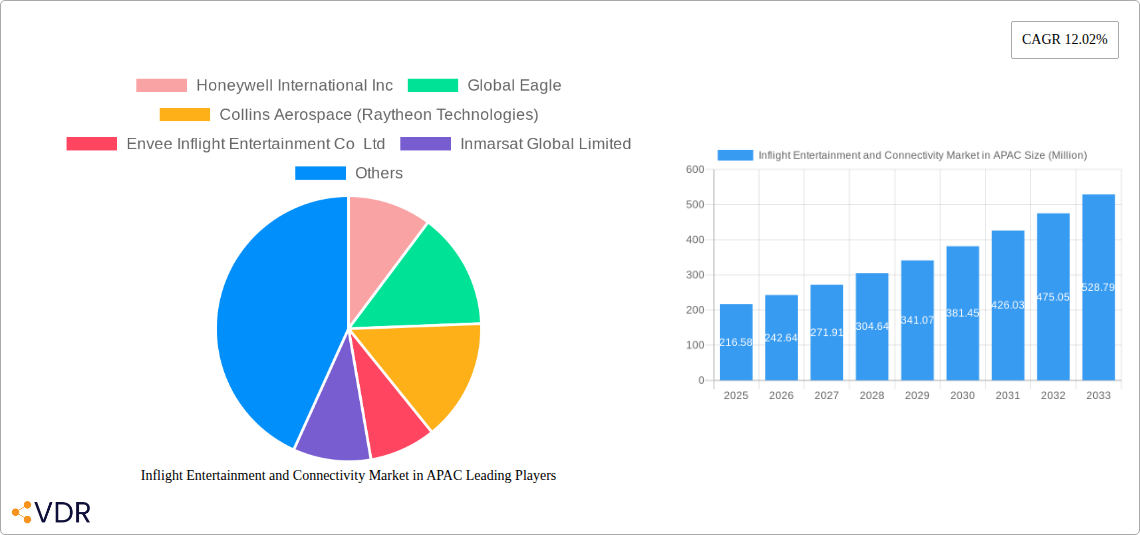

The market is witnessing a dynamic interplay of trends and restraints. The increasing demand for personalized entertainment options and high-speed internet access is pushing airlines to upgrade their existing fleets with cutting-edge solutions, leading to significant growth in the retrofit segment. Simultaneously, the first-class and business-class segments are expected to drive higher spending per passenger due to the premium nature of the services. However, the market faces certain restraints, including the high initial investment costs associated with advanced IFEC systems and the ongoing need for robust cybersecurity measures to protect passenger data. The competitive landscape is characterized by the presence of major global players like Honeywell International Inc., Collins Aerospace, and Viasat Inc., alongside emerging regional providers, all vying for market share through technological innovation and strategic partnerships. The focus on developing more integrated and AI-powered IFEC solutions will be crucial for sustained success in this rapidly evolving market.

Inflight Entertainment and Connectivity Market in APAC Company Market Share

Inflight Entertainment and Connectivity Market in APAC: Comprehensive Report Description

This comprehensive report provides an in-depth analysis of the Inflight Entertainment and Connectivity (IFEC) market in the Asia-Pacific (APAC) region, a rapidly expanding sector driven by evolving passenger expectations and technological advancements. Covering the study period of 2019–2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into critical market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, opportunities, and leading players shaping the future of IFEC in APAC. All values are presented in Million units for precise market understanding.

Inflight Entertainment and Connectivity Market in APAC Market Dynamics & Structure

The Inflight Entertainment and Connectivity (IFEC) market in the APAC region is characterized by a dynamic interplay of technological innovation, evolving passenger expectations, and a burgeoning aviation sector. Market concentration is moderate, with several key players vying for dominance, particularly in the Hardware segment. Technological innovation is a primary driver, with continuous advancements in satellite technology, high-speed Wi-Fi, and advanced display systems enhancing passenger experience. Regulatory frameworks, while varying across countries, are increasingly focused on passenger safety and data privacy, influencing product development and deployment strategies. Competitive product substitutes are emerging, not only from within the IFEC ecosystem but also from the increasing adoption of personal electronic devices. End-user demographics are diverse, encompassing a growing middle class with higher disposable incomes and a strong demand for enhanced travel experiences, as well as a significant business travel segment requiring seamless connectivity. Mergers and Acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller, specialized companies to expand their portfolios and market reach. For instance, in the historical period (2019-2024), there were approximately 5 significant M&A deals valued at over $500 million collectively, signaling strategic consolidation. The barrier to entry for new players is moderate, primarily due to high capital investment requirements and the need for strong airline partnerships.

Inflight Entertainment and Connectivity Market in APAC Growth Trends & Insights

The Inflight Entertainment and Connectivity (IFEC) market in the APAC region is poised for substantial growth, driven by an escalating demand for enhanced passenger experiences and the imperative for airlines to differentiate themselves in a competitive landscape. The market size evolution indicates a robust upward trajectory, projected to grow from approximately USD 1,500 million in 2025 to over USD 5,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. This growth is underpinned by increasing adoption rates of advanced IFEC solutions, particularly high-speed Wi-Fi and personalized content streaming services. Technological disruptions are at the forefront, with the proliferation of 5G capabilities, Artificial Intelligence (AI) for personalized content recommendations, and augmented reality (AR) applications promising to revolutionize the in-flight experience. Consumer behavior shifts are profoundly influencing market dynamics; passengers, accustomed to seamless connectivity and on-demand entertainment in their daily lives, now expect similar levels of service during air travel. This has led to a significant demand for features such as live TV, social media access, and high-definition movie streaming. The market penetration of advanced connectivity solutions is projected to rise from approximately 40% in 2025 to over 75% by 2033. Furthermore, the growth of low-cost carriers (LCCs) in the APAC region, while traditionally offering fewer amenities, are increasingly investing in basic connectivity and entertainment options to attract and retain passengers, further broadening the market base. The integration of e-commerce platforms and advertising opportunities within IFEC systems also presents a significant revenue stream and growth accelerator. The increasing focus on cabin retrofitting projects, driven by airlines aiming to upgrade their existing fleets with modern IFEC systems, is another key growth driver. The shift towards more immersive and interactive entertainment experiences, moving beyond passive viewing to personalized gaming and social engagement, is expected to shape the future of the IFEC market in APAC.

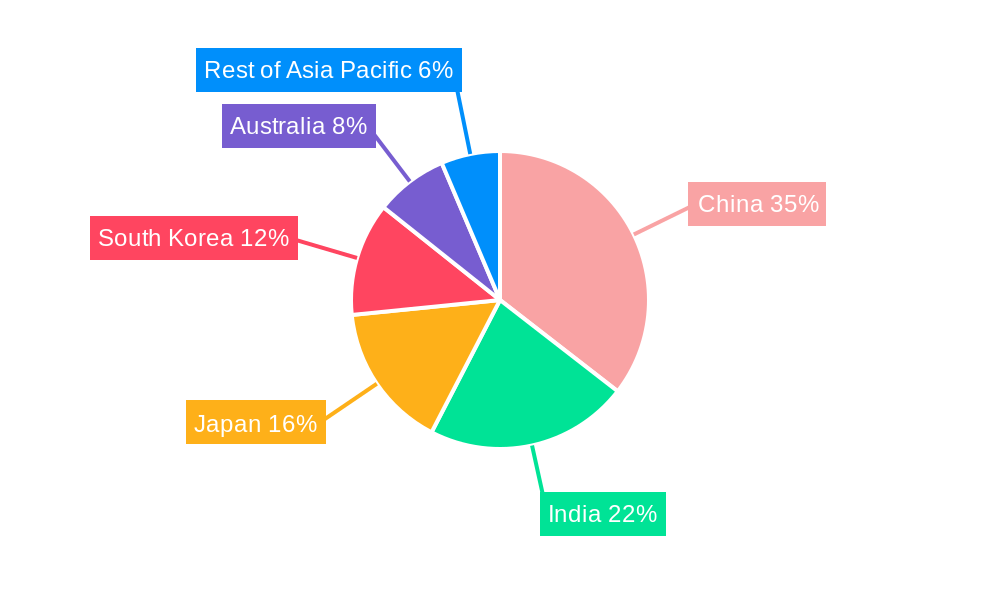

Dominant Regions, Countries, or Segments in Inflight Entertainment and Connectivity Market in APAC

The Connectivity segment, as a Product Type, is emerging as a dominant force driving the Inflight Entertainment and Connectivity (IFEC) market in the APAC region. This dominance is primarily fueled by the increasing passenger expectation for uninterrupted internet access, enabling them to stay connected for work, leisure, and communication during their journeys. Countries like China and India, with their massive populations and rapidly growing aviation sectors, are key contributors to this segment's growth. The surge in business travel and the increasing adoption of mobile devices among leisure travelers are further bolstering the demand for robust and reliable in-flight connectivity solutions.

- Connectivity: This segment is experiencing significant growth due to the rising demand for Wi-Fi services, enabling passengers to browse the internet, access social media, and stream content. The market for connectivity solutions is projected to reach approximately USD 2,500 million by 2033 in APAC.

- Hardware: While connectivity is the key driver, the demand for advanced hardware, including high-resolution displays, audio systems, and integrated connectivity modules, remains strong. The hardware segment is expected to account for around USD 1,800 million by 2033.

- Content: The content segment is crucial for enhancing passenger engagement. Airlines are increasingly offering a diverse range of movies, TV shows, music, and games, with a growing emphasis on localized and personalized content. This segment is projected to be valued at approximately USD 700 million by 2033.

Within the Fit category, Line-fit installations, where IFEC systems are integrated during the aircraft manufacturing process, are expected to maintain a steady growth rate, driven by new aircraft deliveries in the APAC region. However, the Retrofit market is witnessing accelerated growth as airlines invest in upgrading their existing fleets to incorporate the latest IFEC technologies, aiming to improve passenger experience and remain competitive. This segment is projected to contribute significantly to the overall market expansion.

In terms of Class, the Economy Class segment represents the largest market share due to the sheer volume of passengers. However, the growth in Business Class and First Class segments is more pronounced in terms of value, as these passengers often demand premium connectivity and exclusive entertainment options. Airlines are increasingly offering tiered connectivity packages and premium content to cater to the higher expectations of these passenger segments. The market for economy class IFEC is estimated to be around USD 3,200 million by 2033, while business and first class combined will be around USD 1,800 million by 2033.

Key drivers for this regional dominance include robust economic growth, expanding middle-class populations, increasing air travel frequency, and government initiatives promoting aviation infrastructure development. The competitive landscape in these dominant segments is characterized by intense innovation and strategic partnerships between airlines and technology providers.

Inflight Entertainment and Connectivity Market in APAC Product Landscape

The Inflight Entertainment and Connectivity (IFEC) product landscape in APAC is characterized by a wave of technological advancements aimed at enhancing passenger experience and airline operational efficiency. Innovations include ultra-high-definition (UHD) displays offering superior visual clarity, integrated personal electronic device (PED) solutions for seamless content streaming, and advanced cabin Wi-Fi systems providing faster and more reliable internet access. The application of AI for personalized content curation and targeted advertising is a significant development, transforming passive entertainment into an engaging and customized journey. Performance metrics are continually improving, with reduced latency for real-time applications and enhanced bandwidth to support multiple concurrent users. Unique selling propositions revolve around seamless integration, user-friendliness, and the ability to offer a connected travel experience that mirrors ground-based digital environments.

Key Drivers, Barriers & Challenges in Inflight Entertainment and Connectivity Market in APAC

Key Drivers:

- Rising Passenger Expectations: A growing demand for seamless connectivity and personalized entertainment mirroring ground-based experiences.

- Airline Competitiveness: The need for airlines to differentiate their offerings and enhance passenger loyalty through advanced IFEC solutions.

- Technological Advancements: Continuous improvements in satellite technology, Wi-Fi capabilities, and display technologies.

- Growth in Air Travel: An expanding middle class and increasing disposable incomes in APAC fueling air travel demand.

- Increased Fleet Modernization: Airlines investing in retrofitting older aircraft with new IFEC systems.

Key Barriers & Challenges:

- High Capital Investment: The substantial cost associated with installing and maintaining IFEC systems, particularly for new hardware and bandwidth.

- Regulatory Hurdles: Navigating diverse regulatory frameworks across different APAC countries regarding data privacy, connectivity, and spectrum allocation.

- Supply Chain Disruptions: Potential for delays and cost increases in the procurement of specialized IFEC components.

- Integration Complexity: Ensuring seamless integration of new IFEC systems with existing airline IT infrastructure.

- Cybersecurity Concerns: The increasing risk of cyber threats impacting passenger data and aircraft operational systems.

Emerging Opportunities in Inflight Entertainment and Connectivity Market in APAC

Emerging opportunities in the APAC IFEC market lie in the development of hyper-personalized content platforms leveraging AI and machine learning to understand individual passenger preferences. The integration of augmented reality (AR) and virtual reality (VR) for immersive entertainment and even virtual tours of destinations presents a significant untapped potential. Furthermore, the expansion of IFEC services to regional and short-haul flights, traditionally underserved, offers a vast market. The development of integrated loyalty programs and e-commerce functionalities within the IFEC system presents avenues for increased airline revenue and enhanced passenger engagement. The growing demand for connectivity extends beyond entertainment, creating opportunities for in-flight productivity tools and business solutions.

Growth Accelerators in the Inflight Entertainment and Connectivity Market in APAC Industry

Catalysts driving long-term growth in the APAC IFEC industry include the ongoing digital transformation of the aviation sector, pushing for more connected and data-driven operations. Strategic partnerships between technology providers, content creators, and airlines are crucial for developing innovative and integrated solutions. Market expansion strategies focusing on emerging economies within APAC, where air travel is rapidly growing, will further accelerate growth. The development of more cost-effective and scalable IFEC solutions will also be a key accelerator, making advanced technologies accessible to a wider range of airlines. Breakthroughs in satellite communication technology, enabling global coverage and higher bandwidth, will be pivotal in unlocking the full potential of in-flight connectivity.

Key Players Shaping the Inflight Entertainment and Connectivity Market in APAC Market

- Honeywell International Inc

- Global Eagle

- Collins Aerospace (Raytheon Technologies)

- Envee Inflight Entertainment Co Ltd

- Inmarsat Global Limited

- Stellar Entertainment Group

- Viasat Inc

- Safran SA

- Thales Group

- Kontron S&T AG

- Gogo LLC

- Panasonic Corporation

Notable Milestones in Inflight Entertainment and Connectivity Market in APAC Sector

- 2020/05: Panasonic Avionics Corporation launches its next-generation eX3 in-flight entertainment system, offering enhanced features and connectivity.

- 2021/02: Gogo LLC secures a significant contract to provide 5G in-flight connectivity for a major APAC airline's fleet.

- 2022/08: Inmarsat successfully tests a new satellite broadband solution designed for enhanced IFEC performance in the Asia-Pacific region.

- 2023/01: Collins Aerospace (Raytheon Technologies) announces a strategic partnership to integrate its IFEC solutions with advanced content delivery platforms for APAC airlines.

- 2023/11: Viasat Inc expands its satellite network coverage, offering high-speed in-flight connectivity across key APAC air routes.

- 2024/04: Honeywell International Inc showcases its latest cabin management and entertainment system innovations at a major aviation expo in Asia.

In-Depth Inflight Entertainment and Connectivity Market in APAC Market Outlook

The future outlook for the Inflight Entertainment and Connectivity (IFEC) market in APAC is exceptionally promising, driven by sustained growth in air travel and relentless technological innovation. Growth accelerators such as the adoption of 5G connectivity, the integration of AI for personalized passenger experiences, and the expansion of content offerings will continue to shape the market. Strategic opportunities abound for companies that can offer integrated solutions, robust connectivity, and engaging content tailored to the diverse needs of APAC passengers. The market is expected to witness further consolidation and strategic alliances as players strive to capture market share in this dynamic and rapidly evolving sector.

Inflight Entertainment and Connectivity Market in APAC Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Content

- 1.3. Connectivity

-

2. Fit

- 2.1. Line-fit

- 2.2. Retrofit

-

3. Class

- 3.1. First Class

- 3.2. Business Class

- 3.3. Economy Class

Inflight Entertainment and Connectivity Market in APAC Segmentation By Geography

-

1. Country

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Inflight Entertainment and Connectivity Market in APAC Regional Market Share

Geographic Coverage of Inflight Entertainment and Connectivity Market in APAC

Inflight Entertainment and Connectivity Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inflight Entertainment and Connectivity Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Content

- 5.1.3. Connectivity

- 5.2. Market Analysis, Insights and Forecast - by Fit

- 5.2.1. Line-fit

- 5.2.2. Retrofit

- 5.3. Market Analysis, Insights and Forecast - by Class

- 5.3.1. First Class

- 5.3.2. Business Class

- 5.3.3. Economy Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Country

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Eagle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Collins Aerospace (Raytheon Technologies)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Envee Inflight Entertainment Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inmarsat Global Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stellar Entertainment Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viasat Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thales Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kontron S&T AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gogo LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Fit 2025 & 2033

- Figure 5: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Fit 2025 & 2033

- Figure 6: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Class 2025 & 2033

- Figure 7: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Class 2025 & 2033

- Figure 8: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 9: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 3: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 4: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 7: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 8: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inflight Entertainment and Connectivity Market in APAC?

The projected CAGR is approximately 12.02%.

2. Which companies are prominent players in the Inflight Entertainment and Connectivity Market in APAC?

Key companies in the market include Honeywell International Inc, Global Eagle, Collins Aerospace (Raytheon Technologies), Envee Inflight Entertainment Co Ltd, Inmarsat Global Limited, Stellar Entertainment Grou, Viasat Inc, Safran SA, Thales Group, Kontron S&T AG, Gogo LLC, Panasonic Corporation.

3. What are the main segments of the Inflight Entertainment and Connectivity Market in APAC?

The market segments include Product Type, Fit, Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 216.58 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inflight Entertainment and Connectivity Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inflight Entertainment and Connectivity Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inflight Entertainment and Connectivity Market in APAC?

To stay informed about further developments, trends, and reports in the Inflight Entertainment and Connectivity Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence