Key Insights

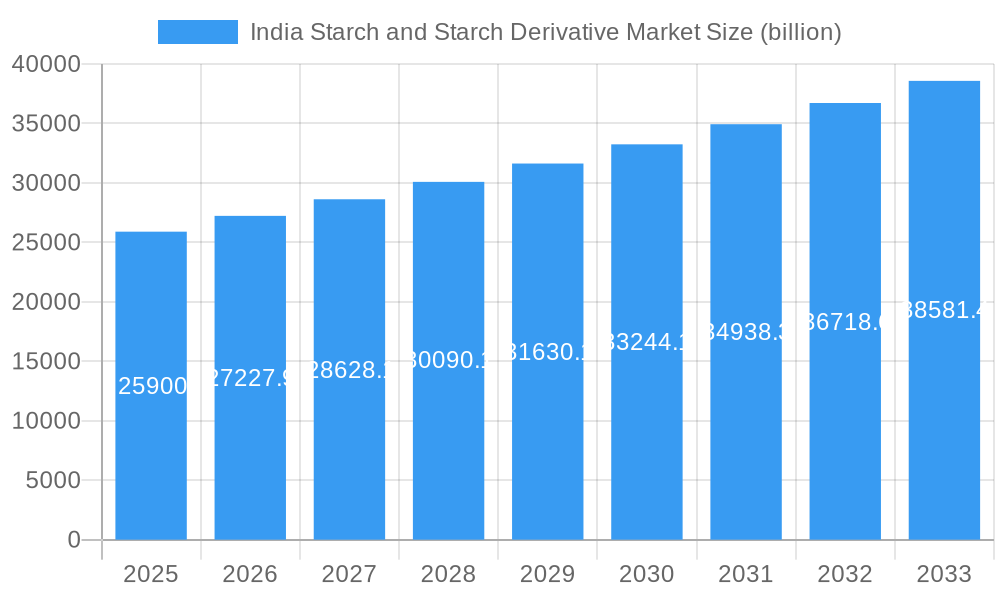

The Indian Starch and Starch Derivative Market is poised for significant expansion, projecting a robust market size of USD 25.9 billion in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.1% anticipated throughout the forecast period of 2025-2033. The market's dynamism is fueled by a confluence of escalating demand from the food and beverage sector, driven by changing consumer preferences towards processed and convenience foods, as well as a rising population. Furthermore, the increasing application of starch derivatives in the animal feed industry, owing to their role in improving digestibility and nutritional value, contributes substantially to market growth. Emerging applications in the pharmaceutical industry for excipients and binders, and the paper industry for coating and sizing, also present considerable opportunities.

India Starch and Starch Derivative Market Market Size (In Billion)

The market's trajectory is also influenced by advancements in processing technologies, leading to the development of novel starch derivatives with tailored functionalities. Modified starch, in particular, is expected to witness substantial uptake due to its versatility in providing improved texture, stability, and shelf-life to food products. Glucose syrups and maltodextrins remain dominant segments, catering to a wide array of confectionery, dairy, and bakery applications. While the abundance of readily available raw materials like corn and wheat provides a strong foundation, the market also sees the increasing utilization of cassava and other alternative sources, enhancing supply chain resilience. The competitive landscape features a mix of established global players and domestic manufacturers, all vying for market share through product innovation and strategic expansions, indicating a vibrant and evolving market environment.

India Starch and Starch Derivative Market Company Market Share

India Starch and Starch Derivative Market: A Comprehensive Analysis (2019-2033)

This in-depth report offers a comprehensive analysis of the India starch and starch derivative market, encompassing historical trends, current dynamics, and future projections. Leveraging high-traffic keywords such as "India starch market," "starch derivatives India," "food and beverage ingredients India," "pharmaceutical excipients India," and "bioethanol India," this report is meticulously crafted to maximize search engine visibility and engage industry professionals. We delve into the intricate parent and child market structures, providing invaluable insights for stakeholders seeking to understand the evolving landscape of this dynamic sector. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

India Starch and Starch Derivative Market Market Dynamics & Structure

The India starch and starch derivative market exhibits a moderately concentrated structure, with key players like Cargill Inc. and Archer Daniels Midland Company holding significant sway, alongside prominent domestic manufacturers such as Gayatri Bio Organics Limited and Sukhjit Starch & Chemicals Ltd. Technological innovation is a primary driver, with ongoing advancements in enzymatic hydrolysis and modification techniques enhancing product functionality and expanding applications across diverse sectors. Regulatory frameworks, particularly those governing food safety and pharmaceutical quality, play a crucial role in shaping market entry and product development. The threat of competitive product substitutes, such as synthetic sweeteners and alternative thickening agents, necessitates continuous innovation and cost-efficiency from starch derivative manufacturers. End-user demographics are increasingly focused on health and wellness, driving demand for natural and functional ingredients. Mergers and acquisition (M&A) trends, while not yet at a fever pitch, are expected to intensify as larger players seek to consolidate market share and acquire specialized technologies. For instance, the market witnessed approximately 2-3 significant M&A deals in the historical period (2019-2024), indicating a growing strategic interest. Innovation barriers are primarily linked to the capital-intensive nature of advanced processing technologies and the need for stringent quality control in food and pharmaceutical applications.

India Starch and Starch Derivative Market Growth Trends & Insights

The India starch and starch derivative market is poised for robust growth, projected to reach an estimated $XX billion in 2025, with a significant Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including the burgeoning Indian population, rising disposable incomes, and a growing preference for processed and convenience foods. The increasing demand for natural and plant-based ingredients across various industries, from food and beverage to pharmaceuticals and cosmetics, is a pivotal trend. Technological advancements, such as the development of novel modified starches with tailored functionalities for specific applications like improved texture, stability, and shelf-life, are accelerating adoption rates. Furthermore, evolving consumer behavior, characterized by a greater emphasis on health consciousness and the demand for clean-label products, is steering manufacturers towards developing starch derivatives that offer perceived health benefits and are derived from sustainable sources. The food and beverage sector, a primary consumer of starch derivatives, is witnessing a surge in demand for ingredients that enhance mouthfeel, act as thickeners, and serve as stabilizers in a wide array of products, including dairy, confectionery, and baked goods. The pharmaceutical industry's reliance on starch derivatives as excipients for tablet binding, disintegration, and controlled drug release further underpins market expansion. Similarly, the feed industry is increasingly incorporating starch derivatives for improved animal nutrition and palatability. The bioethanol segment is also a notable growth area, driven by government initiatives to promote renewable energy sources and reduce reliance on fossil fuels. The penetration of these derivatives is expanding beyond traditional applications into newer frontiers like biodegradable plastics and industrial adhesives, showcasing the market's inherent versatility. The market size evolution will be marked by a steady upward trajectory, driven by consistent demand and ongoing innovation.

Dominant Regions, Countries, or Segments in India Starch and Starch Derivative Market

Within the expansive India starch and starch derivative market, the Food and Beverage application segment stands as the undisputed leader, projecting a dominant market share of approximately XX% by 2025. This segment's supremacy is propelled by several interconnected factors, including India's vast and growing population, a rapidly urbanizing demographic, and an ever-increasing demand for processed foods, snacks, and beverages. Economic policies that support the food processing industry, coupled with significant investments in manufacturing infrastructure, further bolster this segment's growth. The proliferation of quick-service restaurants, the rise of modern retail, and the enduring popularity of traditional Indian snacks and sweets, all of which heavily rely on starch derivatives for texture, stability, and shelf-life, contribute significantly to this dominance.

From a Type perspective, Modified Starch is emerging as a key growth driver, expected to capture a substantial market share due to its versatile functional properties and adaptability to diverse applications. Its ability to be tailored for specific textures, viscosities, and stability under various processing conditions makes it indispensable in food, paper, and pharmaceutical industries.

Geographically, the Western Indian states, particularly Maharashtra and Gujarat, are leading the charge in consumption and production due to their well-established industrial base, robust agricultural output, and significant presence of food processing and pharmaceutical manufacturing units. These regions benefit from favorable economic policies, efficient logistics networks, and access to key raw materials like corn and wheat.

In terms of Source, Corn is anticipated to maintain its dominant position, owing to its widespread cultivation, high starch content, and cost-effectiveness. However, the demand for Wheat and Cassava is also projected to witness steady growth, driven by regional availability and specific functional requirements in certain applications. The demand for "Other Sources," which may include tapioca and potato starch, is also on an upward trajectory, reflecting diversification efforts and specialized applications. The overall growth potential in these dominant segments is substantial, driven by continued economic development, evolving consumer preferences, and supportive industrial policies.

India Starch and Starch Derivative Market Product Landscape

The India starch and starch derivative market is characterized by a dynamic product landscape driven by innovation and application-specific demands. Modified starches, offering enhanced viscosity, stability, and texture, are at the forefront, catering to diverse needs in food processing, from dairy products to baked goods and convenience meals. Glucose syrups and maltodextrins continue to be vital in confectionery and beverage industries for sweetness, body, and bulking. Cyclodextrins are gaining traction in the pharmaceutical sector for their drug delivery and solubility enhancement properties. Hydrolysates are finding niche applications in specialized food formulations and animal feed. The performance metrics of these products are constantly being refined, focusing on improved functionality, cost-effectiveness, and adherence to clean-label trends. Unique selling propositions often revolve around specific functional attributes like freeze-thaw stability, acid resistance, and improved emulsification, alongside the growing emphasis on natural sourcing and sustainable production.

Key Drivers, Barriers & Challenges in India Starch and Starch Derivative Market

Key Drivers:

- Growing Food & Beverage Industry: The expanding processed food and beverage sector in India, fueled by population growth and changing lifestyles, is a primary driver.

- Increasing Demand for Natural Ingredients: Consumer preference for natural, clean-label ingredients is boosting the demand for starch derivatives.

- Pharmaceutical & Healthcare Growth: The burgeoning pharmaceutical industry's reliance on starch derivatives as excipients for drug formulation is a significant growth catalyst.

- Government Initiatives: Support for biofuel production and the food processing sector through various government policies acts as a key driver.

- Technological Advancements: Innovations in starch modification and processing enhance product functionality and expand application areas.

Barriers & Challenges:

- Volatility in Raw Material Prices: Fluctuations in the prices of corn, wheat, and other agricultural inputs can impact production costs and profitability, with potential impacts of up to XX% on profit margins.

- Intense Competition: The market faces significant competition from both domestic and international players, leading to price pressures.

- Regulatory Compliance: Adhering to stringent food safety and quality standards, especially for pharmaceutical applications, poses a challenge.

- Supply Chain Disruptions: Dependence on agricultural produce makes the supply chain vulnerable to climate change and logistical issues.

- Capital Investment: The need for significant capital investment in advanced processing technology can be a barrier for new entrants.

Emerging Opportunities in India Starch and Starch Derivative Market

Emerging opportunities lie in the development of high-performance, functionalized starch derivatives tailored for specialized applications in areas like nutraceuticals and functional foods. The increasing consumer awareness regarding health and wellness presents a significant avenue for starch derivatives that offer prebiotic benefits or act as delivery systems for active ingredients. Furthermore, the growing demand for sustainable and biodegradable materials opens doors for starch-based bioplastics and packaging solutions. Untapped markets in the cosmetics sector, particularly for natural thickeners and emulsifiers, and the expanding animal feed industry requiring specialized nutritional ingredients also represent substantial growth potential. The development of novel starch modification techniques leveraging biotechnology can unlock unique properties and applications, driving innovation and market expansion.

Growth Accelerators in the India Starch and Starch Derivative Market Industry

Several catalysts are accelerating the long-term growth of the India starch and starch derivative market. Technological breakthroughs in enzymatic modification and cross-linking are enabling the creation of starch derivatives with superior functionalities, such as enhanced heat stability and acid resistance, expanding their applicability in challenging food processing environments. Strategic partnerships between raw material suppliers, starch manufacturers, and end-product formulators are fostering collaborative innovation and ensuring a consistent supply chain. Furthermore, market expansion strategies focusing on untapped rural markets for processed foods and the increasing export potential for specialized starch derivatives are acting as significant growth accelerators. The government's continued focus on promoting domestic manufacturing and reducing import dependence will also play a crucial role in accelerating industry growth.

Key Players Shaping the India Starch and Starch Derivative Market Market

- Gayatri Bio Organics Limited

- Sukhjit Starch & Chemicals Ltd

- Archer Daniels Midland Company

- AUDYOGIK VIKAS NIGAM LTD (Tirupati Starch & Chemicals Ltd)

- Universal Starch Chem Allied Ltd

- Gujarat Ambuja Exports Limited

- Gulshan Polyols Ltd

- Sahyadri Starch & Industries Pvt Limited

- Tate & Lyle PLC

- Cargill Inc.

Notable Milestones in India Starch and Starch Derivative Market Sector

- 2019: Increased investment in R&D for enzyme-modified starches by leading manufacturers.

- 2020: Significant surge in demand for starch derivatives for food preservation and shelf-life extension during the pandemic.

- 2021: Launch of new modified starch variants for improved texture and mouthfeel in dairy and bakery products.

- 2022: Growing adoption of cassava-based starch derivatives in specific food applications.

- 2023: Focus on sustainable sourcing and production processes gaining momentum.

- Early 2024: Expansion of production capacities by key players to meet growing domestic and export demand.

In-Depth India Starch and Starch Derivative Market Market Outlook

The India starch and starch derivative market is poised for sustained and robust growth, driven by a confluence of favorable factors. The persistent increase in demand from the food and beverage sector, coupled with the expanding applications in pharmaceuticals and bioethanol production, will continue to be the primary growth accelerators. Emerging opportunities in nutraceuticals, functional foods, and biodegradable materials offer significant untapped potential. Strategic investments in technological advancements, product innovation, and capacity expansion by key players will further fuel this growth trajectory. The market's outlook remains exceptionally strong, indicating a promising future for stakeholders across the value chain.

India Starch and Starch Derivative Market Segmentation

-

1. Type

- 1.1. Maltodextrin

- 1.2. Cyclodextrin

- 1.3. Glucose Syrups

- 1.4. Hydrolysates

- 1.5. Modified Starch

- 1.6. Other Types

-

2. Source

- 2.1. Corn

- 2.2. Wheat

- 2.3. Cassava

- 2.4. Other Sources

-

3. Application

- 3.1. Food and Beverage

- 3.2. Feed

- 3.3. Paper Industry

- 3.4. Pharmaceutical Industry

- 3.5. Bioethanol

- 3.6. Cosmetics

- 3.7. Other Applications

India Starch and Starch Derivative Market Segmentation By Geography

- 1. India

India Starch and Starch Derivative Market Regional Market Share

Geographic Coverage of India Starch and Starch Derivative Market

India Starch and Starch Derivative Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Processed Food Products; Technological Advancements Supporting Market Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Cost of Production Due to Rise in Energy and Labor Cost

- 3.4. Market Trends

- 3.4.1. Presence of Raw Materials In Abundance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Starch and Starch Derivative Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Maltodextrin

- 5.1.2. Cyclodextrin

- 5.1.3. Glucose Syrups

- 5.1.4. Hydrolysates

- 5.1.5. Modified Starch

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Corn

- 5.2.2. Wheat

- 5.2.3. Cassava

- 5.2.4. Other Sources

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Feed

- 5.3.3. Paper Industry

- 5.3.4. Pharmaceutical Industry

- 5.3.5. Bioethanol

- 5.3.6. Cosmetics

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gayatri Bio Organics Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sukhjit Starch & Chemicals Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AUDYOGIK VIKAS NIGAM LTD (Tirupati Starch & Chemicals Ltd )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Starch Chem Allied Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gujarat Ambuja Exports Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulshan Polyols Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sahyadri Starch & Industries Pvt Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tate & Lyle PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc.

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gayatri Bio Organics Limited

List of Figures

- Figure 1: India Starch and Starch Derivative Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Starch and Starch Derivative Market Share (%) by Company 2025

List of Tables

- Table 1: India Starch and Starch Derivative Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Starch and Starch Derivative Market Volume k Tons Forecast, by Type 2020 & 2033

- Table 3: India Starch and Starch Derivative Market Revenue billion Forecast, by Source 2020 & 2033

- Table 4: India Starch and Starch Derivative Market Volume k Tons Forecast, by Source 2020 & 2033

- Table 5: India Starch and Starch Derivative Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Starch and Starch Derivative Market Volume k Tons Forecast, by Application 2020 & 2033

- Table 7: India Starch and Starch Derivative Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: India Starch and Starch Derivative Market Volume k Tons Forecast, by Region 2020 & 2033

- Table 9: India Starch and Starch Derivative Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: India Starch and Starch Derivative Market Volume k Tons Forecast, by Type 2020 & 2033

- Table 11: India Starch and Starch Derivative Market Revenue billion Forecast, by Source 2020 & 2033

- Table 12: India Starch and Starch Derivative Market Volume k Tons Forecast, by Source 2020 & 2033

- Table 13: India Starch and Starch Derivative Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: India Starch and Starch Derivative Market Volume k Tons Forecast, by Application 2020 & 2033

- Table 15: India Starch and Starch Derivative Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India Starch and Starch Derivative Market Volume k Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Starch and Starch Derivative Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the India Starch and Starch Derivative Market?

Key companies in the market include Gayatri Bio Organics Limited, Sukhjit Starch & Chemicals Ltd, Archer Daniels Midland Company, AUDYOGIK VIKAS NIGAM LTD (Tirupati Starch & Chemicals Ltd ), Universal Starch Chem Allied Ltd, Gujarat Ambuja Exports Limited*List Not Exhaustive, Gulshan Polyols Ltd, Sahyadri Starch & Industries Pvt Limited, Tate & Lyle PLC, Cargill Inc..

3. What are the main segments of the India Starch and Starch Derivative Market?

The market segments include Type, Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Processed Food Products; Technological Advancements Supporting Market Growth.

6. What are the notable trends driving market growth?

Presence of Raw Materials In Abundance.

7. Are there any restraints impacting market growth?

Increasing Cost of Production Due to Rise in Energy and Labor Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Starch and Starch Derivative Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Starch and Starch Derivative Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Starch and Starch Derivative Market?

To stay informed about further developments, trends, and reports in the India Starch and Starch Derivative Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence