Key Insights

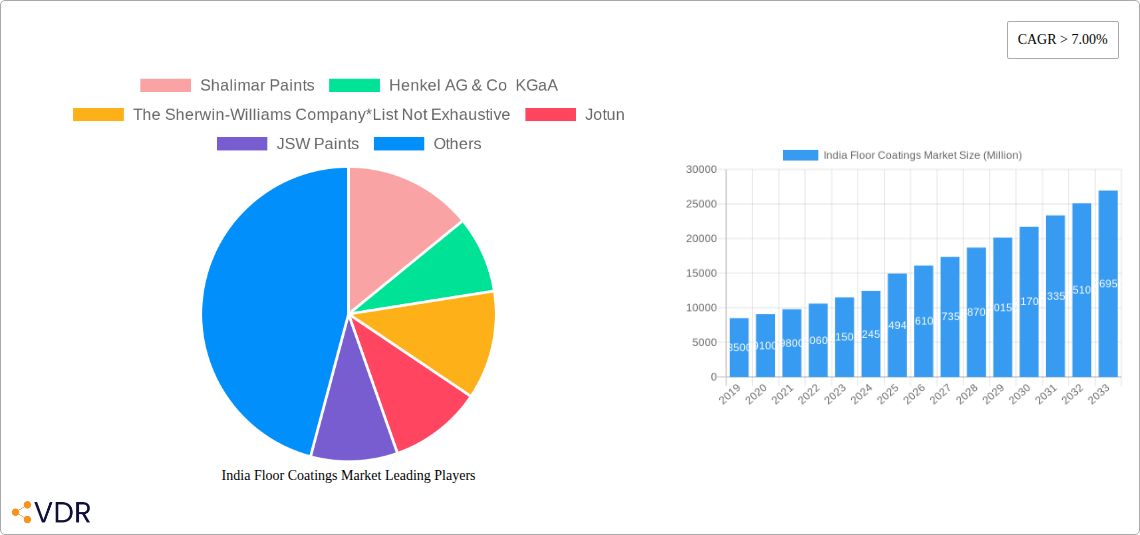

The India Floor Coatings Market is projected for robust growth, with an estimated market size of 14,940 Million in 2025. This expansion is driven by a projected Compound Annual Growth Rate (CAGR) exceeding 7.00% throughout the forecast period of 2025-2033. Key market drivers include the burgeoning construction sector, both residential and commercial, fueled by urbanization and rising disposable incomes. Increasing awareness of the aesthetic and protective benefits of advanced floor coatings, such as epoxy and polyaspartics, is further stimulating demand. The industrial segment, requiring durable and chemical-resistant coatings for manufacturing facilities and warehouses, also presents a significant growth avenue. Furthermore, the trend towards sustainable and low-VOC (Volatile Organic Compound) coatings is gaining traction, pushing manufacturers to innovate and offer eco-friendly solutions. This evolving consumer preference and regulatory landscape will continue to shape product development and market strategies.

India Floor Coatings Market Market Size (In Billion)

The market is segmented across various product types, including epoxy, polyaspartics, acrylic, and polyurethane coatings, each catering to specific application needs and performance requirements. While concrete remains a dominant floor material, the use of coatings on wood and other specialized flooring surfaces is also on the rise. The residential sector, driven by home renovation and new construction projects, is a significant contributor, alongside the commercial segment encompassing retail spaces, offices, and hospitality. The industrial sector's demand for high-performance coatings for factories, automotive workshops, and pharmaceutical facilities underscores the versatility and critical role of floor coatings in modern infrastructure. Leading companies such as Asian Paints, Akzo Nobel N.V., PPG Industries, and Sika AG are actively investing in research and development to introduce innovative products and expand their market presence within India, contributing to the market's dynamic growth trajectory.

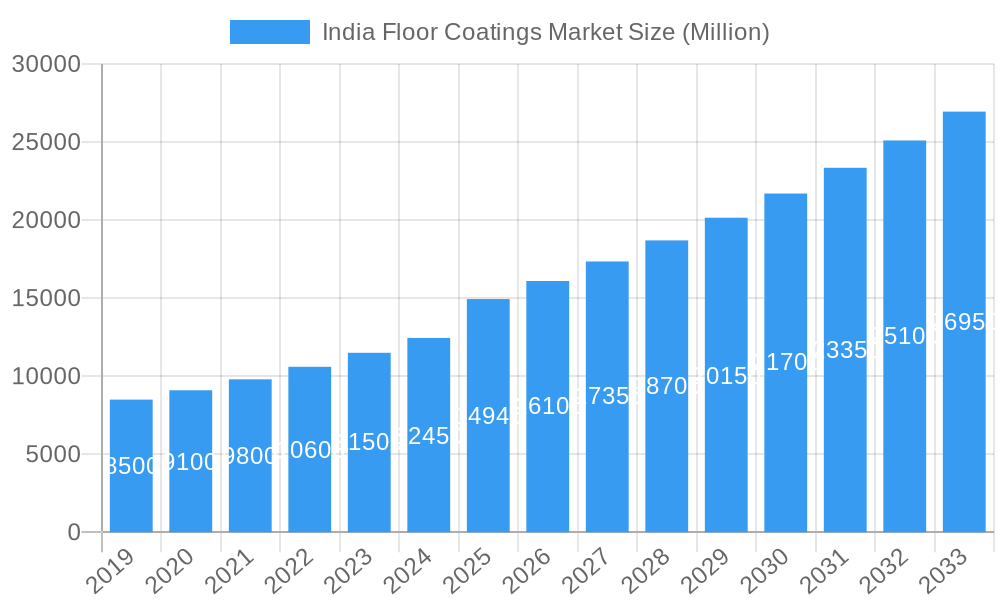

India Floor Coatings Market Company Market Share

India Floor Coatings Market Report: Unveiling Growth Drivers, Segment Dominance, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the India floor coatings market, a rapidly expanding sector driven by robust construction activity, industrial growth, and increasing aesthetic demands. Explore the intricate market dynamics, identify dominant regions and segments, and gain insights into the strategies of key players shaping the future of epoxy floor coatings in India, polyaspartic floor coatings India, acrylic floor coatings market India, and polyurethane floor coatings India. This report is essential for manufacturers, suppliers, investors, and stakeholders seeking to capitalize on the immense opportunities within this dynamic market.

India Floor Coatings Market Market Dynamics & Structure

The India floor coatings market is characterized by a moderately concentrated structure, with a few leading players holding significant market share. Technological innovation is a key driver, with continuous advancements in product formulations leading to enhanced durability, aesthetic appeal, and environmental sustainability. Regulatory frameworks, particularly those pertaining to VOC emissions and safety standards, are evolving and influencing product development. Competitive product substitutes, ranging from traditional paints to advanced resinous systems, present a dynamic landscape. End-user demographics are diverse, encompassing residential, commercial, and industrial sectors, each with unique requirements and purchasing behaviors. Mergers and acquisitions (M&A) are observed as key players seek to expand their product portfolios and geographical reach. For instance, the Indian floor coatings industry has witnessed strategic consolidations aimed at enhancing market penetration and product innovation.

- Market Concentration: Dominated by a mix of domestic and international players, with a trend towards consolidation for greater market leverage.

- Technological Innovation: Focus on developing eco-friendly, low-VOC, and high-performance coatings for diverse applications.

- Regulatory Frameworks: Increasing stringency around environmental impact and product safety is shaping manufacturing processes and material choices.

- Competitive Landscape: Intense competition from established brands and emerging players offering specialized solutions.

- End-user Demographics: A growing middle class in residential, expanding commercial infrastructure, and a robust industrial sector are key demand drivers.

- M&A Trends: Strategic acquisitions and partnerships to gain market share, access new technologies, and expand distribution networks.

India Floor Coatings Market Growth Trends & Insights

The India floor coatings market is projected for substantial growth, driven by a confluence of economic, demographic, and technological factors. The market size has witnessed a consistent upward trajectory, fueled by increasing disposable incomes and a growing awareness of the benefits offered by modern floor coating solutions. Adoption rates for advanced coatings like epoxy and polyaspartics are accelerating, particularly in industrial and commercial settings, owing to their superior durability, chemical resistance, and aesthetic versatility. Technological disruptions, such as the development of faster curing times, improved UV resistance, and self-cleaning properties, are revolutionizing the industry. Consumer behavior is shifting towards prioritizing long-term value, aesthetics, and ease of maintenance, leading to a greater demand for high-quality floor coatings. The growth of the residential construction sector and the expansion of commercial spaces like malls, offices, and healthcare facilities are directly translating into increased demand for protective and decorative floor finishes. Furthermore, the government's focus on infrastructure development and manufacturing initiatives is creating a fertile ground for industrial floor coatings. The CAGR of the India floor coatings market is expected to remain robust, reflecting sustained demand across all key segments.

Dominant Regions, Countries, or Segments in India Floor Coatings Market

The India floor coatings market exhibits regional dominance influenced by industrial activity, urbanization, and infrastructure development. Western India, encompassing states like Maharashtra and Gujarat, emerges as a dominant region due to its strong industrial base, presence of manufacturing hubs, and significant urban centers with high construction activity. The commercial and industrial segments are particularly strong in this region, driving demand for advanced epoxy floor coatings and polyurethane floor coatings.

- Western India:

- Key Driver: High concentration of manufacturing industries (automotive, pharmaceuticals, chemical) requiring durable and resistant floor solutions.

- Market Share: Significant portion of the industrial floor coatings market in India.

- Growth Potential: Continuous industrial expansion and a growing demand for aesthetically pleasing and functional commercial spaces.

- Sub-segments: Epoxy and Polyurethane coatings are highly sought after for their performance characteristics in this region.

The Product Type segment is led by Epoxy floor coatings. Their widespread use in industrial applications like warehouses, manufacturing units, and chemical plants, owing to their excellent chemical resistance, durability, and seamless finish, makes them a dominant force. Concrete floor coatings within the Floor Material segment are also highly prevalent, serving as a robust base for various coating applications across all end-user industries. The Industrial end-user industry segment stands out as the primary driver of market growth, owing to the critical need for protective, high-performance flooring solutions in manufacturing facilities, food processing plants, and logistics centers.

Product Type Dominance (Epoxy):

- Applications: Industrial manufacturing, warehouses, pharmaceutical facilities, food & beverage processing, garages.

- Performance: High chemical resistance, abrasion resistance, durability, and easy maintenance.

- Market Penetration: Widely adopted due to proven performance and versatility.

Floor Material Dominance (Concrete):

- Application: Foundation for a vast majority of industrial, commercial, and residential floors.

- Properties: Strength, durability, and cost-effectiveness as a base material.

- Coating Compatibility: Excellent adhesion with various coating types, including epoxy, polyurethane, and acrylic.

End-user Industry Dominance (Industrial):

- Needs: Safety, hygiene, chemical resistance, heavy load-bearing capacity, impact resistance.

- Growth Factors: Government initiatives promoting manufacturing, expansion of logistics and warehousing, stringent safety regulations.

- Sub-segments: Automotive, chemical, pharmaceutical, food & beverage, electronics manufacturing.

India Floor Coatings Market Product Landscape

The India floor coatings market boasts a diverse product landscape characterized by continuous innovation. Epoxy coatings remain a cornerstone, offering exceptional durability, chemical resistance, and aesthetic versatility for industrial and commercial applications. Polyaspartic coatings are gaining traction due to their rapid curing times, UV stability, and superior scratch resistance, making them ideal for high-traffic areas. Acrylic coatings provide a cost-effective and quick-drying solution, particularly for residential and light commercial use. Polyurethane coatings offer a balance of flexibility, abrasion resistance, and UV stability, suitable for various environments. Innovations are focused on developing low-VOC, water-based formulations, and coatings with enhanced antimicrobial properties and self-healing capabilities, catering to evolving environmental consciousness and functional demands.

Key Drivers, Barriers & Challenges in India Floor Coatings Market

Key Drivers:

- Robust Construction and Infrastructure Development: Significant government investment in infrastructure projects, including industrial parks, logistics hubs, and urban development, fuels demand for durable and protective flooring.

- Growing Industrial Sector: Expansion of manufacturing industries, including automotive, pharmaceuticals, and food processing, necessitates high-performance floor coatings for safety, hygiene, and efficiency.

- Increasing Disposable Incomes and Urbanization: A rising middle class in urban centers drives demand for aesthetically pleasing and durable flooring solutions in residential and commercial spaces.

- Technological Advancements: Development of innovative, eco-friendly, and high-performance coatings with enhanced properties like faster curing times and improved durability.

Barriers & Challenges:

- Price Sensitivity: A segment of the market remains price-sensitive, opting for lower-cost, less durable alternatives.

- Skilled Labor Shortage: The application of advanced floor coatings often requires specialized skills, leading to challenges in finding qualified applicators.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials can impact manufacturing costs and product pricing.

- Awareness and Education: Limited awareness among some end-users about the long-term benefits and technical advantages of modern floor coatings.

- Competition from Traditional Flooring: Established traditional flooring materials like tiles and marble continue to pose competition.

Emerging Opportunities in India Floor Coatings Market

Emerging opportunities in the India floor coatings market lie in the growing demand for sustainable and eco-friendly solutions. The development and promotion of low-VOC and water-based floor coatings present a significant avenue for growth, aligning with increasing environmental regulations and consumer preferences. Furthermore, the expansion of the healthcare and pharmaceutical sectors is creating a niche for specialized antimicrobial and sterile floor coatings. The untapped potential in the renovation and retrofitting market for existing commercial and industrial facilities offers a substantial growth segment. The increasing adoption of smart building technologies is also opening doors for floor coatings with integrated functionalities like heating or sensing capabilities.

Growth Accelerators in the India Floor Coatings Market Industry

Several catalysts are accelerating the growth of the India floor coatings market. Technological breakthroughs in resin chemistry are enabling the development of coatings with superior performance attributes such as enhanced chemical resistance, faster cure times, and improved aesthetics, directly impacting application efficiency and end-user satisfaction. Strategic partnerships between raw material suppliers and coating manufacturers are fostering innovation and cost optimization. Market expansion strategies by leading players, including the establishment of new manufacturing facilities and strengthening of distribution networks, are crucial for reaching a wider customer base. The increasing focus on DIY (Do-It-Yourself) friendly floor coating solutions is also contributing to market expansion by empowering a broader range of users.

Key Players Shaping the India Floor Coatings Market Market

- Shalimar Paints

- Henkel AG & Co KGaA

- The Sherwin-Williams Company

- Jotun

- JSW Paints

- Sheenlac Paints Ltd

- HMG Paints Limited

- Mapei

- Nippon Paint Holdings Co Ltd

- BASF SE

- Indigo Paints Ltd

- Kansai Nerolac Paints Limited

- Akzo Nobel N V

- Sto SE & Co KGaA

- Sika AG

- PPG Industries

- Asian Paints

Notable Milestones in India Floor Coatings Market Sector

- October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 million to add capacity by 40,000 lakh liter at its plant in Amritsar, Punjab.

In-Depth India Floor Coatings Market Market Outlook

The future outlook for the India floor coatings market is exceptionally promising, driven by sustained economic growth and an ever-increasing demand for high-performance, aesthetically pleasing, and sustainable flooring solutions. The market is poised for continuous expansion as investments in infrastructure, manufacturing, and urbanization gain momentum. Key growth accelerators include ongoing technological advancements leading to more durable, eco-friendly, and specialized coatings, alongside strategic initiatives by leading companies to expand their product portfolios and market reach. Emerging opportunities in sectors like healthcare and the renovation market, coupled with a growing consumer preference for long-term value and sophisticated finishes, will further fuel market penetration. The India floor coatings market is set to witness significant opportunities for innovation and strategic expansion.

India Floor Coatings Market Segmentation

-

1. Product Type

- 1.1. Epoxy

- 1.2. Polyaspartics

- 1.3. Acrylic

- 1.4. Polyurethane

- 1.5. Other Product Types

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-user Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

India Floor Coatings Market Segmentation By Geography

- 1. India

India Floor Coatings Market Regional Market Share

Geographic Coverage of India Floor Coatings Market

India Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India

- 3.3. Market Restrains

- 3.3.1. Harmful Environmental Impact of Conventional Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Floor Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartics

- 5.1.3. Acrylic

- 5.1.4. Polyurethane

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shalimar Paints

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henkel AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSW Paints

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheenlac Paints Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HMG Paints Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mapei

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paint Holdings Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indigo Paints Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Nerolac Paints Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Akzo Nobel N V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sto SE & Co KGaA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sika AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 PPG Industries

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Asian Paints

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Shalimar Paints

List of Figures

- Figure 1: India Floor Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Floor Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 4: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 5: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: India Floor Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Floor Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 12: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 13: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: India Floor Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Floor Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Floor Coatings Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the India Floor Coatings Market?

Key companies in the market include Shalimar Paints, Henkel AG & Co KGaA, The Sherwin-Williams Company*List Not Exhaustive, Jotun, JSW Paints, Sheenlac Paints Ltd, HMG Paints Limited, Mapei, Nippon Paint Holdings Co Ltd, BASF SE, Indigo Paints Ltd, Kansai Nerolac Paints Limited, Akzo Nobel N V, Sto SE & Co KGaA, Sika AG, PPG Industries, Asian Paints.

3. What are the main segments of the India Floor Coatings Market?

The market segments include Product Type, Floor Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14940 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India.

6. What are the notable trends driving market growth?

Increasing Construction Activities in India.

7. Are there any restraints impacting market growth?

Harmful Environmental Impact of Conventional Coatings.

8. Can you provide examples of recent developments in the market?

October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 million to add capacity by 40,000 lakh liter at its plant in Amritsar, Punjab.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Floor Coatings Market?

To stay informed about further developments, trends, and reports in the India Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence