Key Insights

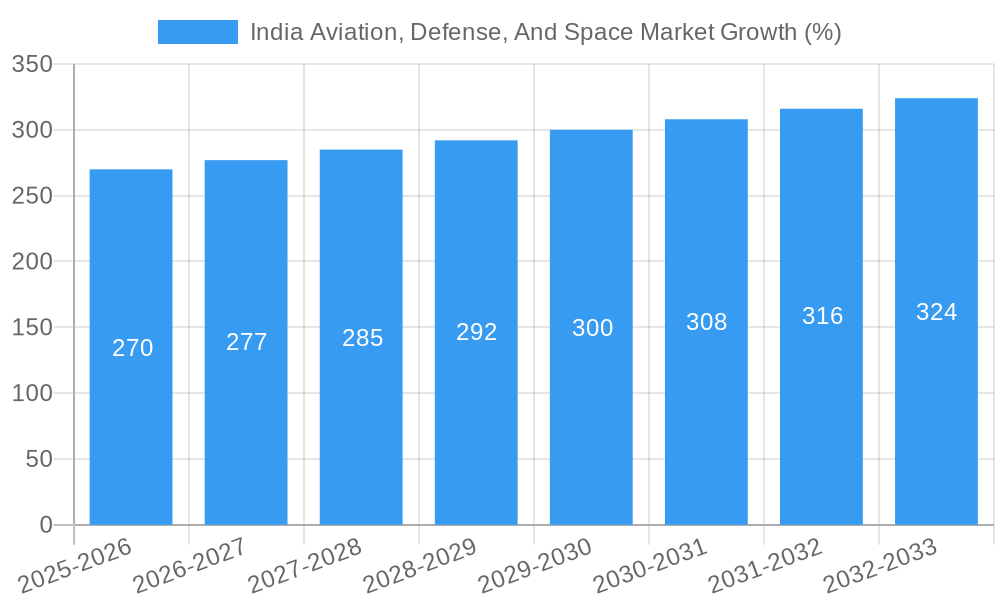

The India Aviation, Defense, and Space market, valued at ₹10.34 billion (approximately US$1.25 billion assuming a ₹82.72 to USD exchange rate in 2025) in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 2.59% from 2025 to 2033. This growth is fueled by increasing government spending on defense modernization, a burgeoning civil aviation sector responding to rising passenger demand, and the nation's ambitious space exploration programs. Key segments contributing to this growth include the Air Force (with significant investment in combat and non-combat aircraft, UAVs, and munitions), the Army (focused on armored vehicles, helicopters, and weapon systems), and the Navy (with modernization efforts for naval vessels and aircraft). The burgeoning private sector participation, particularly from conglomerates like Tata Sons, Adani Group, and Mahindra & Mahindra, further contributes to market dynamism. While challenges such as technological dependence on foreign suppliers and fluctuating global energy prices exist, the overall market outlook remains positive, indicating a significant opportunity for domestic and international players alike. Specific growth drivers include the government’s “Make in India” initiative stimulating domestic manufacturing and technological advancements in areas like UAV technology and satellite communications.

The market segmentation reveals a significant contribution from the defense sector, particularly the Air Force and Army, which consistently invest in modernizing their fleets and weapon systems. The civil aviation segment is predicted to show robust growth based on the increasing demand for air travel. The space segment, while smaller in terms of current revenue, possesses significant long-term growth potential fueled by increasing investment in both governmental and private space exploration ventures. Regional analysis suggests that growth will likely be distributed proportionally across the North, South, East, and West regions of India, with possibly slightly higher concentration in regions with significant industrial and defense bases. The competitive landscape is characterized by a mix of large public sector undertakings (PSUs) like HAL and BEL, private sector companies, and international players vying for market share. This diverse ecosystem contributes to both intense competition and collaborative opportunities.

India Aviation, Defense, & Space Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic India Aviation, Defense, and Space market, encompassing its structure, growth trends, key players, and future outlook. From the parent market of defense and aerospace to the child markets of air force, army, navy, space, and civil aviation, this report offers invaluable insights for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in million units.

India Aviation, Defense, And Space Market Market Dynamics & Structure

The Indian Aviation, Defense, and Space market is characterized by a complex interplay of factors impacting its structure and dynamics. Market concentration is moderate, with a few large players like HAL and BEL dominating certain segments, while smaller specialized firms like Mistral Solutions cater to niche areas. Technological innovation is a key driver, particularly in areas like UAVs, satellite technology, and advanced weaponry. The regulatory framework, while evolving, plays a significant role in shaping market access and investment decisions. The increasing preference for domestically produced equipment is a strong trend. Substitutes exist, but their effectiveness varies by segment. The end-user demographics are diverse, encompassing government agencies, private companies, and individual consumers. M&A activity is moderate but expected to increase with privatization initiatives.

- Market Concentration: Moderate, with a few large players and numerous smaller specialized firms.

- Technological Innovation: Strong driver, particularly in UAVs, satellite technology, and advanced weaponry.

- Regulatory Framework: Evolving, influencing market access and investment. Emphasis on "Make in India" initiative.

- Competitive Product Substitutes: Exist, but effectiveness varies by segment.

- End-User Demographics: Government agencies, private companies, individual consumers.

- M&A Trends: Moderate activity expected to increase. Estimated xx M&A deals in the forecast period.

India Aviation, Defense, And Space Market Growth Trends & Insights

The Indian Aviation, Defense, and Space market exhibits robust growth, fueled by increasing defense spending, modernization initiatives, and a burgeoning civil aviation sector. The market witnessed significant expansion during the historical period (2019-2024), exceeding xx million units. The CAGR for the forecast period (2025-2033) is projected at xx%, driven by factors like increased demand for advanced weaponry, modernization of aging fleets across all segments, and the expansion of space exploration programs. Technological disruptions, such as the rise of UAVs and AI-integrated systems, further propel market growth. Shifting consumer preferences towards more sophisticated and technologically advanced systems are also noticeable, reflected in the government's emphasis on indigenous technologies. Market penetration in certain segments, like commercial aviation, remains high but further growth is expected in advanced defense and space technologies. The adoption rate of newer technologies shows a consistently upward trend. Air India's recent order of Boeing aircraft exemplifies the growth in the commercial aviation segment.

Dominant Regions, Countries, or Segments in India Aviation, Defense, And Space Market

The Indian Aviation, Defense, and Space market demonstrates diverse growth across its segments and regions. While precise market share data is proprietary, several factors point to the dominance of certain areas. The defense segment, particularly the Air Force and Army, is a significant growth driver due to ongoing modernization efforts. The Southern and Western regions of India are key manufacturing and deployment hubs. The space segment is characterized by significant government investment, focusing on indigenous satellite technology and launch capabilities. The civil aviation segment is experiencing strong growth driven by rising passenger numbers and expanding airline operations.

- Key Drivers:

- Increased Defense Spending: Government commitment to modernizing armed forces.

- Infrastructure Development: Investment in airports, aerospace facilities, and spaceports.

- Economic Growth: Supports increased demand for both defense and commercial aviation services.

- Government Policies: "Make in India" initiative promotes domestic manufacturing.

- Dominant Segments: Air Force (Combat Aircraft), Army (Armored Vehicles), and Civil Aviation (Commercial Aircraft) show the most robust growth potential. These segments are expected to represent xx% of the market by 2033.

India Aviation, Defense, And Space Market Product Landscape

The Indian Aviation, Defense, and Space market showcases a diverse product landscape characterized by constant innovation. Advanced UAVs, fifth-generation fighter jets, indigenous satellite launch vehicles, and next-generation commercial aircraft represent technological advancements. These products offer unique selling propositions like enhanced surveillance capabilities, improved maneuverability, increased payload capacity, and reduced operational costs. Emphasis is placed on integrating advanced technologies like AI, machine learning, and advanced materials to enhance product performance and operational efficiency.

Key Drivers, Barriers & Challenges in India Aviation, Defense, And Space Market

Key Drivers:

- Increased government spending on defense modernization.

- Growing demand for advanced technologies in aerospace and defense.

- Expansion of the civil aviation sector and increased air travel.

- Emphasis on indigenous technology development ("Make in India" initiative).

Key Challenges and Restraints:

- Complex regulatory environment and bureaucratic hurdles.

- Dependence on foreign technology for certain advanced systems.

- Supply chain disruptions and logistical challenges.

- Intense competition from both domestic and international players. This competition results in approximately xx million units lost annually due to pricing pressures.

Emerging Opportunities in India Aviation, Defense, And Space Market

- Growing demand for UAVs for both military and civilian applications.

- Expansion of private sector participation in the space industry.

- Development of indigenous space launch capabilities.

- Increased focus on cybersecurity in the aerospace and defense sectors.

- Growth of the MRO (Maintenance, Repair, and Overhaul) market.

Growth Accelerators in the India Aviation, Defense, And Space Market Industry

Long-term growth is fueled by continuous technological advancements, strategic partnerships between domestic and international players, and expansion into new markets. Government initiatives focused on indigenous technology and domestic manufacturing are crucial catalysts. The development of a robust aerospace ecosystem will further drive market expansion.

Key Players Shaping the India Aviation, Defense, And Space Market Market

- ISR

- Larsen & Toubro Limited

- Indian Ordnance Factories

- Mistral Solutions Pvt Ltd

- Tata Sons Private Limited

- Goa Shipyard Limited

- Kalyani Steels Ltd (KSL)

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Mahindra & Mahindra Limited

- Adani Group

- Bharat Electronics Limited (BEL)

Notable Milestones in India Aviation, Defense, And Space Market Sector

- December 2023: Indian government approves defense acquisition projects worth USD 2.67 million, including 97 Tejas light combat aircraft and 156 Prachand combat helicopters; 98% of procurement sourced domestically.

- February 2023: Air India orders 190 Boeing 737 MAX aircraft, with options for 50 more, boosting the commercial aviation segment.

In-Depth India Aviation, Defense, And Space Market Market Outlook

The Indian Aviation, Defense, and Space market holds immense potential for future growth. Continued government investment, technological advancements, and a growing private sector participation will drive market expansion. Strategic partnerships, both domestic and international, will play a crucial role in unlocking this potential. The focus on indigenous technology and the "Make in India" initiative will further strengthen the market's position on the global stage. The market is poised for sustained growth, with significant opportunities for both established and emerging players.

India Aviation, Defense, And Space Market Segmentation

-

1. Air Force

- 1.1. Combat a

- 1.2. Weapons and Munitions

- 1.3. MRO

-

2. Army

- 2.1. Armored Vehicles, Helicopters, and UAVs

- 2.2. Weapons and Munitions

- 2.3. MRO

-

3. Navy

- 3.1. Naval Ve

- 3.2. Weapons and Munitions

- 3.3. MRO

-

4. Space

- 4.1. Satellite

- 4.2. Launch Vehicles and Rovers

-

5. Civil Aviation

- 5.1. Commercial Aircraft

- 5.2. Business Jet

- 5.3. MRO

India Aviation, Defense, And Space Market Segmentation By Geography

- 1. India

India Aviation, Defense, And Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 5.1.1. Combat a

- 5.1.2. Weapons and Munitions

- 5.1.3. MRO

- 5.2. Market Analysis, Insights and Forecast - by Army

- 5.2.1. Armored Vehicles, Helicopters, and UAVs

- 5.2.2. Weapons and Munitions

- 5.2.3. MRO

- 5.3. Market Analysis, Insights and Forecast - by Navy

- 5.3.1. Naval Ve

- 5.3.2. Weapons and Munitions

- 5.3.3. MRO

- 5.4. Market Analysis, Insights and Forecast - by Space

- 5.4.1. Satellite

- 5.4.2. Launch Vehicles and Rovers

- 5.5. Market Analysis, Insights and Forecast - by Civil Aviation

- 5.5.1. Commercial Aircraft

- 5.5.2. Business Jet

- 5.5.3. MRO

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Air Force

- 6. North India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Aviation, Defense, And Space Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ISR

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Larsen & Toubro Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Indian Ordnance Factories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mistral Solutions Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tata Sons Private Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Goa Shipyard Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kalyani Steels Ltd (KSL)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hindustan Aeronautics Limited (HAL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hinduja Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mahindra & Mahindra Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Adani Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Bharat Electronics Limited (BEL)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ISR

List of Figures

- Figure 1: India Aviation, Defense, And Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Aviation, Defense, And Space Market Share (%) by Company 2024

List of Tables

- Table 1: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 3: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 4: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 5: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 6: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 7: India Aviation, Defense, And Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India Aviation, Defense, And Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Aviation, Defense, And Space Market Revenue Million Forecast, by Air Force 2019 & 2032

- Table 14: India Aviation, Defense, And Space Market Revenue Million Forecast, by Army 2019 & 2032

- Table 15: India Aviation, Defense, And Space Market Revenue Million Forecast, by Navy 2019 & 2032

- Table 16: India Aviation, Defense, And Space Market Revenue Million Forecast, by Space 2019 & 2032

- Table 17: India Aviation, Defense, And Space Market Revenue Million Forecast, by Civil Aviation 2019 & 2032

- Table 18: India Aviation, Defense, And Space Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation, Defense, And Space Market?

The projected CAGR is approximately 2.59%.

2. Which companies are prominent players in the India Aviation, Defense, And Space Market?

Key companies in the market include ISR, Larsen & Toubro Limited, Indian Ordnance Factories, Mistral Solutions Pvt Ltd, Tata Sons Private Limited, Goa Shipyard Limited, Kalyani Steels Ltd (KSL), Hindustan Aeronautics Limited (HAL), Hinduja Group, Mahindra & Mahindra Limited, Adani Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Aviation, Defense, And Space Market?

The market segments include Air Force, Army, Navy, Space, Civil Aviation.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.34 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Civil Aviation Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: The Indian government announced that they have accorded initial approval for defense acquisition projects worth USD 2.67 million. The project will include the acquisition of 97 Tejas light combat aircraft and 156 Prachand combat helicopters. Moreover, 98% of the total procurement will be sourced from domestic industries, thereby giving a significant boost to the Indian defense industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation, Defense, And Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation, Defense, And Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation, Defense, And Space Market?

To stay informed about further developments, trends, and reports in the India Aviation, Defense, And Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence