Key Insights

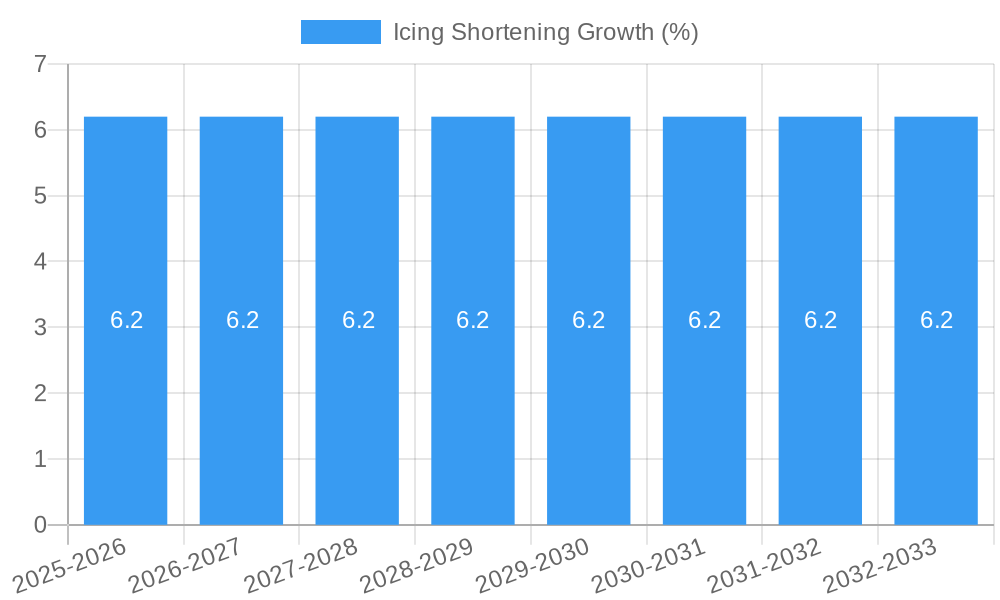

The global Icing Shortening market is poised for significant expansion, projected to reach an estimated $1,500 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.2% expected throughout the forecast period of 2025-2033. This growth is primarily fueled by escalating consumer demand for bakery products, a segment that extensively utilizes icing shortening for texture, stability, and aesthetic appeal. The increasing popularity of cakes, biscuits, and pastries, both in home baking and commercial establishments, directly translates into higher consumption of icing shortening. Furthermore, advancements in food technology are leading to the development of specialized icing shortening formulations that cater to evolving dietary preferences, such as reduced-fat or plant-based options, further broadening the market's reach. Innovations in product quality and shelf-life are also contributing to sustained market interest.

Key market dynamics driving this growth include the rising disposable incomes in emerging economies, leading to increased expenditure on premium bakery items. Moreover, the strong influence of social media and online culinary trends showcasing beautifully decorated baked goods encourages home bakers and small businesses to invest in high-quality ingredients like icing shortening. While the market demonstrates strong potential, certain restraints could influence its trajectory. Volatility in the prices of raw materials, particularly vegetable oils and animal fats, can impact manufacturing costs and, consequently, market pricing. Additionally, growing consumer awareness and preference for healthier alternatives, including natural sweeteners and less processed ingredients, may pose a challenge to traditional icing shortening products. However, the industry's adaptability, with companies focusing on developing healthier and more sustainable icing shortening solutions, is expected to mitigate these challenges and ensure continued market vitality. The market is segmented by application into Bread, Cake, Biscuits, and Others, with Cakes and Biscuits expected to dominate due to their widespread consumption. By type, the market is bifurcated into Animal Fat Icing Shortening and Plant Based Fat Icing Shortening, with plant-based options gaining considerable traction.

Sure, here's a compelling, SEO-optimized report description for Icing Shortening, designed to maximize search engine visibility and engage industry professionals.

This comprehensive report provides an in-depth analysis of the global icing shortening market, offering critical insights into its dynamics, growth trajectories, and future outlook. Spanning a study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report meticulously examines historical trends, current market conditions, and projected growth for the forecast period of 2025–2033. It delves into the intricate structure of the market, exploring parent and child market dynamics to offer a holistic understanding of this essential bakery ingredient.

Icing Shortening Market Dynamics & Structure

The global icing shortening market is characterized by moderate concentration, with key players like ADM, Bunge, Par-Way Tryson, Amoretti, Brolite Products, Pakmaya, Barry Callebaut, and others vying for market share. Technological innovation, particularly in developing plant-based alternatives and improved functionalities, is a significant driver. Regulatory frameworks surrounding food safety and ingredient labeling are also shaping market strategies. Competitive product substitutes, such as butter and margarines, present ongoing challenges, necessitating continuous product differentiation and value proposition enhancement. End-user demographics, increasingly favoring healthier and sustainably sourced ingredients, are influencing product development and marketing efforts. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion, with an estimated XX M&A deal volumes recorded historically.

- Market Concentration: Moderate, with consolidation opportunities.

- Technological Innovation: Focus on plant-based fats and functional properties.

- Regulatory Frameworks: Stringent food safety and labeling compliance.

- Competitive Substitutes: Butter, margarine, and other fat sources.

- End-User Demographics: Growing demand for healthier and sustainable options.

- M&A Trends: Strategic tool for growth and market access.

Icing Shortening Growth Trends & Insights

The global icing shortening market is poised for robust expansion, driven by escalating demand for baked goods worldwide and evolving consumer preferences. The market size evolution is projected to witness a significant upward trajectory throughout the forecast period. Adoption rates for specialized icing shortenings are increasing, particularly in emerging economies with a growing middle class and a burgeoning foodservice sector. Technological disruptions, including advancements in fat crystallization and emulsification, are enabling the development of shortenings with enhanced performance characteristics, such as improved aeration, texture, and shelf-life, contributing to an estimated CAGR of XX% over the forecast period. Consumer behavior shifts, marked by a greater interest in artisanal baking and convenience products, further fuel market growth. The increasing awareness of the role of fats in food formulation, coupled with the demand for clean-label ingredients, is compelling manufacturers to innovate. The penetration of plant-based icing shortenings is particularly noteworthy, driven by health and environmental concerns. The overall market penetration is expected to reach XX% by 2033.

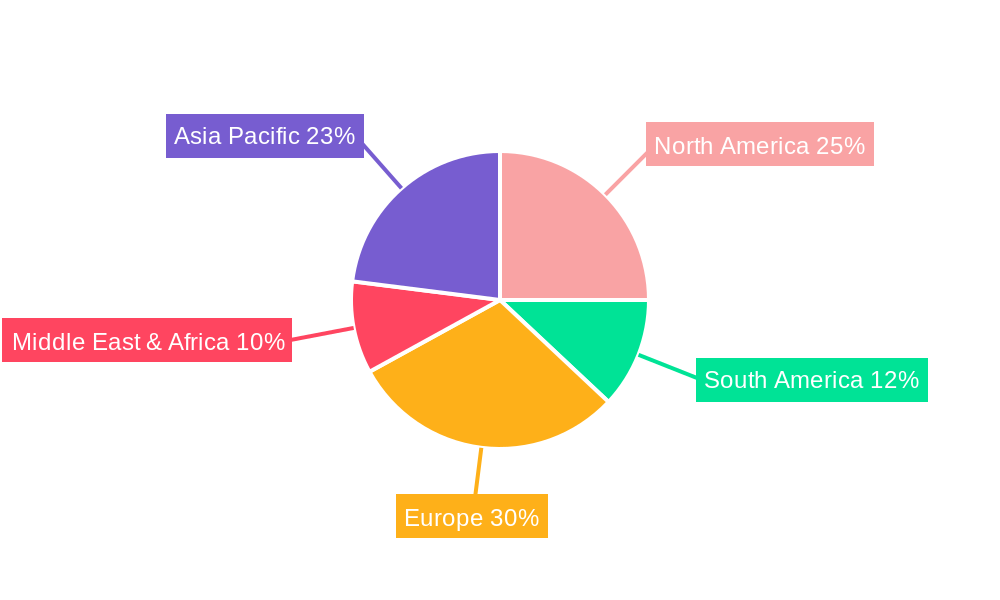

Dominant Regions, Countries, or Segments in Icing Shortening

The Application segment of Cakes stands out as a dominant force in the global icing shortening market, driven by the perennial popularity of cakes across diverse cultural celebrations and everyday indulgence. North America, particularly the United States, emerges as a leading region due to its mature bakery industry, high disposable incomes, and established consumer demand for a wide array of baked goods. The Type of Plant Based Fat Icing Shortening is experiencing exceptional growth, outpacing its animal fat counterpart due to rising health consciousness and dietary trends favoring plant-derived ingredients.

- Dominant Application Segment: Cakes

- High demand for decorative frostings and fillings.

- Integral to celebratory occasions and the foodservice industry.

- Continuous innovation in cake formulations supporting specialized shortenings.

- Leading Region: North America

- Strong presence of major bakery manufacturers and retail chains.

- High per capita consumption of bakery products.

- Advancements in food technology and consumer acceptance of new product formulations.

- Economic policies supporting the food processing industry.

- Fastest Growing Type: Plant Based Fat Icing Shortening

- Growing consumer preference for vegan, vegetarian, and cholesterol-free options.

- Environmental sustainability concerns influencing ingredient choices.

- Technological advancements enhancing performance to rival animal-based counterparts.

- Regulatory push towards healthier food options.

Icing Shortening Product Landscape

The icing shortening product landscape is dynamic, with manufacturers focusing on innovations that enhance texture, stability, and ease of use in various bakery applications. Key product developments include high-ratio shortenings for superior crumb structure in cakes, no-hydrogenated options for healthier profiles, and specialized blends for specific functional benefits like improved aeration and gloss in icings. Performance metrics such as melting point, plasticity, and oxidative stability are critical differentiators, with advancements enabling longer shelf life and consistent results for bakers. Unique selling propositions often revolve around clean-label formulations, allergen-free properties, and the incorporation of natural ingredients. Technological advancements in emulsification and fat structure modification are enabling the creation of premium icing shortenings that meet evolving consumer demands for both taste and health.

Key Drivers, Barriers & Challenges in Icing Shortening

Key Drivers: The icing shortening market is propelled by the growing global demand for bakery products, especially in emerging economies, and the consistent innovation in food technology that allows for improved product functionality and texture. The increasing popularity of plant-based diets and the demand for healthier alternatives are significant drivers for plant-based icing shortenings. Furthermore, the expansion of the foodservice industry, including bakeries, cafes, and restaurants, creates sustained demand.

Key Barriers & Challenges: Supply chain volatility, particularly for key raw materials like vegetable oils, poses a significant challenge, impacting pricing and availability. Regulatory hurdles related to food safety standards and ingredient labeling can also create compliance complexities for manufacturers. Intense competitive pressure from established players and the threat of substitute products, such as butter and margarine, necessitate continuous product development and aggressive market strategies. The fluctuating costs of raw materials and energy further add to the financial strain on businesses. The estimated impact of these challenges on market growth is significant, potentially reducing the CAGR by XX%.

Emerging Opportunities in Icing Shortening

Emerging opportunities in the icing shortening industry lie in the continued development of innovative, functional, and health-conscious products. The demand for clean-label and non-GMO shortenings is on the rise, presenting a significant avenue for growth. Untapped markets in developing regions with a growing middle class and an increasing appetite for Western-style bakery products offer substantial expansion potential. Furthermore, the exploration of novel plant-based fat sources and advanced processing techniques can lead to shortenings with superior nutritional profiles and performance characteristics. Opportunities also exist in catering to specific dietary needs, such as low-fat, low-sugar, or allergen-free icing shortenings, to capture niche market segments.

Growth Accelerators in the Icing Shortening Industry

Growth accelerators in the icing shortening industry are primarily driven by advancements in food science and technology, leading to the development of high-performance, cost-effective, and healthier shortening options. The increasing consumer awareness and preference for plant-based ingredients are acting as a major catalyst for the expansion of this segment. Strategic partnerships between ingredient suppliers and bakery manufacturers are crucial for co-creating innovative solutions and expanding market reach. Furthermore, the growing trend of home baking and the demand for readily available, high-quality baking ingredients also contribute to market acceleration. Strategic market expansion into regions with nascent bakery industries presents significant long-term growth opportunities.

Key Players Shaping the Icing Shortening Market

- ADM

- Bunge

- Par-Way Tryson

- Amoretti

- Brolite Products

- Pakmaya

- Barry Callebaut

Notable Milestones in Icing Shortening Sector

- 2019: Launch of novel no-hydrogenated vegetable shortenings by major players, catering to health-conscious consumers.

- 2020: Increased R&D investment in plant-based fat alternatives due to growing vegan and vegetarian trends.

- 2021: Significant supply chain disruptions impacting key vegetable oil prices, leading to price adjustments.

- 2022: Emergence of specialized shortenings for gluten-free and keto-friendly baking applications.

- 2023: Increased M&A activity focused on acquiring companies with expertise in sustainable ingredient sourcing.

- 2024: Growing adoption of clean-label certifications for icing shortening products.

In-Depth Icing Shortening Market Outlook

- 2019: Launch of novel no-hydrogenated vegetable shortenings by major players, catering to health-conscious consumers.

- 2020: Increased R&D investment in plant-based fat alternatives due to growing vegan and vegetarian trends.

- 2021: Significant supply chain disruptions impacting key vegetable oil prices, leading to price adjustments.

- 2022: Emergence of specialized shortenings for gluten-free and keto-friendly baking applications.

- 2023: Increased M&A activity focused on acquiring companies with expertise in sustainable ingredient sourcing.

- 2024: Growing adoption of clean-label certifications for icing shortening products.

In-Depth Icing Shortening Market Outlook

The outlook for the global icing shortening market is exceptionally promising, driven by a confluence of enduring demand for bakery staples and dynamic innovation. Growth accelerators such as the escalating adoption of plant-based ingredients, coupled with continuous technological breakthroughs in fat functionality and formulation, will be instrumental. Strategic partnerships between raw material providers and bakery manufacturers will foster product differentiation and market penetration. The increasing urbanization and rising disposable incomes in emerging economies present vast untapped potential. As consumer preferences continue to evolve towards healthier, more sustainable, and convenient food options, the icing shortening market is well-positioned to capitalize on these trends, promising sustained growth and profitability.

Icing Shortening Segmentation

-

1. Application

- 1.1. Bread

- 1.2. Cake

- 1.3. Biscuits

- 1.4. Others

-

2. Type

- 2.1. Animal Fat Icing Shortening

- 2.2. Plant Based Fat Icing Shortening

Icing Shortening Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Icing Shortening REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bread

- 5.1.2. Cake

- 5.1.3. Biscuits

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Animal Fat Icing Shortening

- 5.2.2. Plant Based Fat Icing Shortening

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bread

- 6.1.2. Cake

- 6.1.3. Biscuits

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Animal Fat Icing Shortening

- 6.2.2. Plant Based Fat Icing Shortening

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bread

- 7.1.2. Cake

- 7.1.3. Biscuits

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Animal Fat Icing Shortening

- 7.2.2. Plant Based Fat Icing Shortening

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bread

- 8.1.2. Cake

- 8.1.3. Biscuits

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Animal Fat Icing Shortening

- 8.2.2. Plant Based Fat Icing Shortening

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bread

- 9.1.2. Cake

- 9.1.3. Biscuits

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Animal Fat Icing Shortening

- 9.2.2. Plant Based Fat Icing Shortening

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Icing Shortening Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bread

- 10.1.2. Cake

- 10.1.3. Biscuits

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Animal Fat Icing Shortening

- 10.2.2. Plant Based Fat Icing Shortening

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bunge

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Par-Way Tryson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amoretti

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brolite Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pakmaya

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barry Callebaut

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Icing Shortening Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Icing Shortening Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Icing Shortening Revenue (million), by Application 2024 & 2032

- Figure 4: North America Icing Shortening Volume (K), by Application 2024 & 2032

- Figure 5: North America Icing Shortening Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Icing Shortening Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Icing Shortening Revenue (million), by Type 2024 & 2032

- Figure 8: North America Icing Shortening Volume (K), by Type 2024 & 2032

- Figure 9: North America Icing Shortening Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Icing Shortening Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Icing Shortening Revenue (million), by Country 2024 & 2032

- Figure 12: North America Icing Shortening Volume (K), by Country 2024 & 2032

- Figure 13: North America Icing Shortening Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Icing Shortening Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Icing Shortening Revenue (million), by Application 2024 & 2032

- Figure 16: South America Icing Shortening Volume (K), by Application 2024 & 2032

- Figure 17: South America Icing Shortening Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Icing Shortening Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Icing Shortening Revenue (million), by Type 2024 & 2032

- Figure 20: South America Icing Shortening Volume (K), by Type 2024 & 2032

- Figure 21: South America Icing Shortening Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Icing Shortening Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Icing Shortening Revenue (million), by Country 2024 & 2032

- Figure 24: South America Icing Shortening Volume (K), by Country 2024 & 2032

- Figure 25: South America Icing Shortening Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Icing Shortening Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Icing Shortening Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Icing Shortening Volume (K), by Application 2024 & 2032

- Figure 29: Europe Icing Shortening Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Icing Shortening Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Icing Shortening Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Icing Shortening Volume (K), by Type 2024 & 2032

- Figure 33: Europe Icing Shortening Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Icing Shortening Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Icing Shortening Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Icing Shortening Volume (K), by Country 2024 & 2032

- Figure 37: Europe Icing Shortening Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Icing Shortening Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Icing Shortening Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Icing Shortening Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Icing Shortening Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Icing Shortening Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Icing Shortening Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Icing Shortening Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Icing Shortening Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Icing Shortening Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Icing Shortening Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Icing Shortening Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Icing Shortening Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Icing Shortening Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Icing Shortening Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Icing Shortening Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Icing Shortening Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Icing Shortening Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Icing Shortening Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Icing Shortening Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Icing Shortening Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Icing Shortening Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Icing Shortening Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Icing Shortening Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Icing Shortening Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Icing Shortening Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Icing Shortening Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Icing Shortening Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Icing Shortening Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Icing Shortening Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Icing Shortening Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Icing Shortening Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Icing Shortening Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Icing Shortening Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Icing Shortening Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Icing Shortening Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Icing Shortening Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Icing Shortening Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Icing Shortening Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Icing Shortening Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Icing Shortening Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Icing Shortening Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Icing Shortening Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Icing Shortening Volume K Forecast, by Country 2019 & 2032

- Table 81: China Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Icing Shortening Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Icing Shortening Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Icing Shortening?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Icing Shortening?

Key companies in the market include ADM, Bunge, Par-Way Tryson, Amoretti, Brolite Products, Pakmaya, Barry Callebaut.

3. What are the main segments of the Icing Shortening?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Icing Shortening," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Icing Shortening report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Icing Shortening?

To stay informed about further developments, trends, and reports in the Icing Shortening, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence