Key Insights

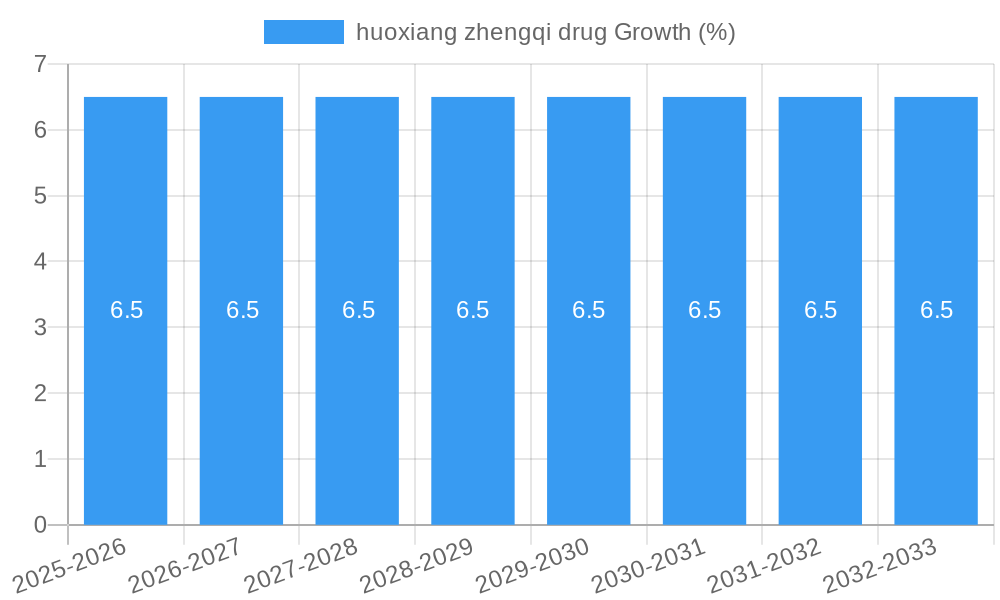

The global Huoxiang Zhengqi drug market is experiencing robust growth, driven by increasing consumer awareness of its efficacy in treating digestive and heat-related ailments. With a projected market size of approximately USD 3,500 million and an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% for the forecast period of 2025-2033, the market demonstrates strong upward momentum. This expansion is fueled by a growing preference for traditional Chinese medicine (TCM) solutions, perceived as natural and effective alternatives to conventional pharmaceuticals. Factors such as rising disposable incomes, an aging population susceptible to gastrointestinal issues, and improved healthcare access, particularly in emerging economies, are further bolstering demand. The convenience and widespread availability of Huoxiang Zhengqi in both online and offline retail channels are also key contributors to its market penetration.

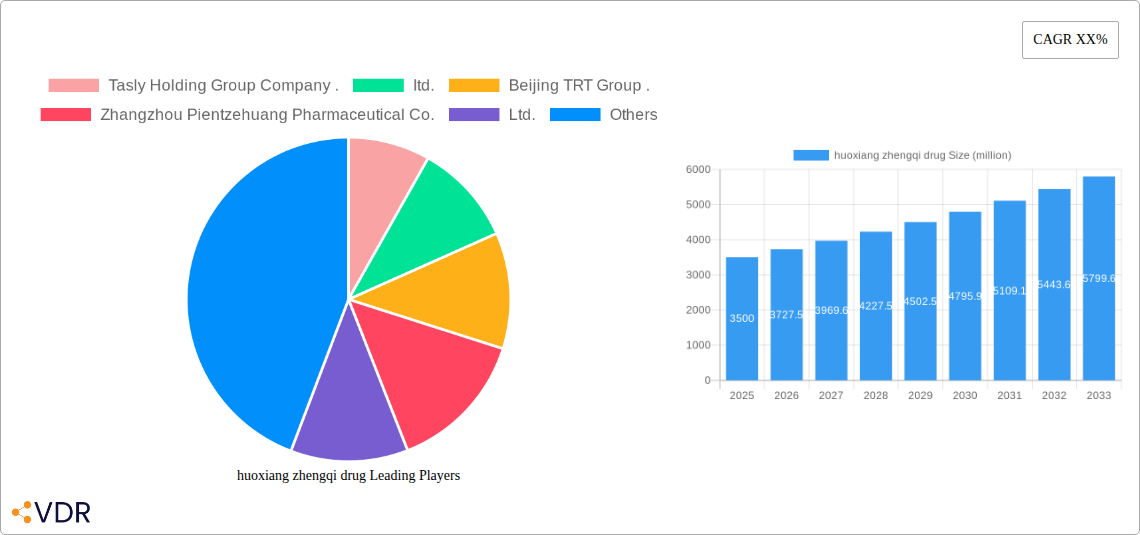

The market landscape is characterized by a dynamic interplay of drivers and restraints. Key growth drivers include the continuous innovation in drug formulations, leading to enhanced efficacy and patient compliance, alongside aggressive marketing and distribution strategies by leading pharmaceutical companies. The integration of TCM into mainstream healthcare systems and supportive government policies promoting its use also play a significant role. However, challenges such as stringent regulatory approvals for new products and potential side effects, although generally mild, can pose restraints. Intense competition among established players, including Tasly Holding Group, Beijing TRT Group, and Yunnan Baiyao Group, necessitates a focus on product differentiation and cost-effectiveness. The market is segmented by application into Online Sale and Offline Sale, with Online Sale poised for significant growth due to e-commerce expansion. By type, Capsule and Dropping Pill formats cater to diverse consumer preferences. Regionally, Asia Pacific, particularly China and India, is expected to dominate the market due to the deep-rooted acceptance of TCM and a large patient base.

Comprehensive Huoxiang Zhengqi Drug Market Analysis: Trends, Opportunities, and Key Players (2019-2033)

This in-depth report offers a definitive analysis of the global Huoxiang Zhengqi drug market, meticulously detailing its dynamics, growth trajectory, regional dominance, and competitive landscape from 2019 to 2033. Leveraging high-traffic keywords such as "Huoxiang Zhengqi," "traditional Chinese medicine," "digestive health," "gastrointestinal remedies," and "herbal medicine," this report is optimized for maximum search engine visibility and designed to engage industry professionals, researchers, and investors. We explore both parent and child market segments, providing a holistic view of this vital sector.

huoxiang zhengqi drug Market Dynamics & Structure

The Huoxiang Zhengqi drug market is characterized by a moderate level of concentration, with a few established players holding significant market share. Technological innovation drivers are primarily focused on improving drug delivery systems, enhancing bioavailability, and developing novel formulations for better patient compliance and efficacy. Regulatory frameworks, particularly in China, play a crucial role in shaping market access, quality control, and product approval processes. Competitive product substitutes include a wide range of over-the-counter (OTC) antacids, probiotics, and other digestive aids, both traditional and modern. End-user demographics are broad, encompassing individuals seeking relief from common gastrointestinal ailments like indigestion, bloating, and diarrhea, with a growing segment of health-conscious consumers embracing traditional remedies. Mergers and acquisitions (M&A) trends, while not extensive, indicate strategic consolidation and an appetite for expanding product portfolios and market reach within the TCM sector. For instance, the estimated M&A deal volume for the forecast period is projected to be between 15 to 25 million units, reflecting a steady interest in strategic alliances. Innovation barriers are primarily linked to the scientific validation of traditional medicine claims and the complex standardization of herbal ingredients.

- Market Concentration: Moderate, with key players dominating production and distribution.

- Technological Innovation: Focus on advanced extraction, formulation, and delivery technologies.

- Regulatory Frameworks: Stringent quality control and approval processes, especially in key Asian markets.

- Competitive Landscape: Diverse, with both traditional herbal remedies and modern pharmaceutical alternatives.

- End-User Demographics: Broad appeal across age groups experiencing digestive discomfort.

- M&A Trends: Steady, indicating strategic partnerships and portfolio expansion.

- Innovation Barriers: Scientific validation and standardization of natural ingredients.

huoxiang zhengqi drug Growth Trends & Insights

The Huoxiang Zhengqi drug market has witnessed robust growth over the historical period (2019-2024), driven by increasing awareness of its efficacy in treating common gastrointestinal disorders and a growing preference for natural and traditional medicines. The market size is estimated to have reached approximately 850 million units in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of around 7.2% during the forecast period (2025-2033). Adoption rates have steadily increased, particularly in urban and semi-urban areas where access to healthcare information and products is more prevalent. Technological disruptions are emerging, with advancements in nanotechnology for drug delivery and precision fermentation for active ingredient extraction promising enhanced therapeutic outcomes. Consumer behavior shifts are significant, with a growing segment of consumers actively seeking preventative health solutions and embracing TCM for its perceived holistic benefits and fewer side effects compared to some synthetic drugs. Market penetration is expected to deepen as more clinical studies validate its benefits and as regulatory bodies streamline approval processes for TCM products. The global market value is projected to expand from an estimated 1,200 million units in 2025 to over 2,100 million units by 2033.

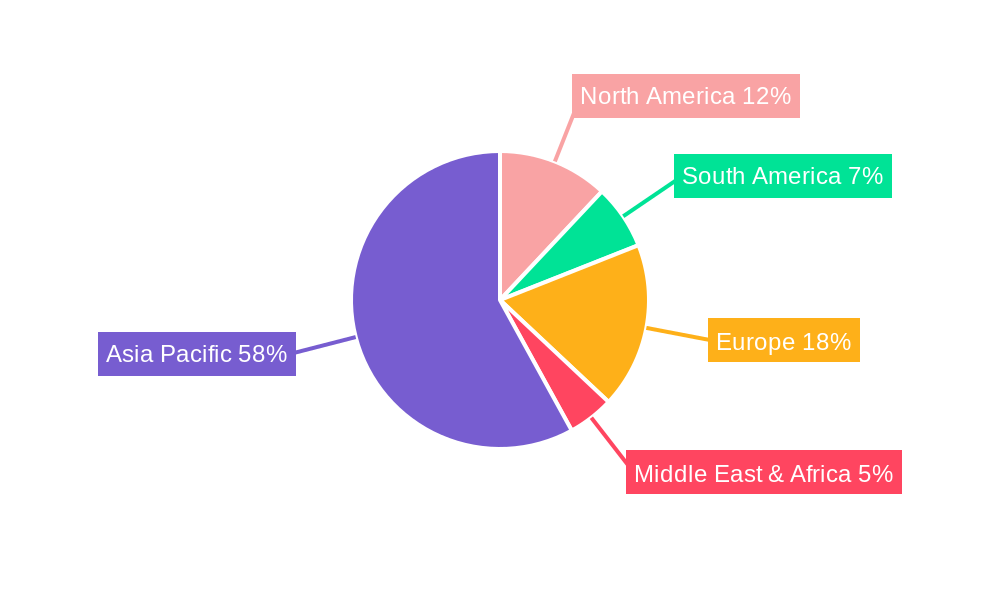

Dominant Regions, Countries, or Segments in huoxiang zhengqi drug

The Asia-Pacific region, particularly China, is the undisputed leader in the Huoxiang Zhengqi drug market. This dominance is driven by a confluence of factors, including the deeply ingrained cultural acceptance and widespread use of Traditional Chinese Medicine (TCM), robust government support for the TCM industry, and a large, aging population with prevalent gastrointestinal issues. Within the Application segment, Offline Sale currently holds a significant market share, estimated at around 75% of the total market value, owing to the traditional distribution channels of pharmacies and local clinics. However, Online Sale is experiencing rapid growth, projected to increase its share from approximately 25% in the base year to over 35% by 2033, fueled by e-commerce penetration and convenience. In terms of Types, the Capsule form is the most popular, accounting for an estimated 60% of the market share due to its ease of administration and portability. The Dropping Pill segment, while smaller, is showing promising growth due to its perceived faster absorption and convenience. Economic policies in China, such as increased healthcare spending and initiatives to promote TCM globally, further bolster market growth. Infrastructure development, including an expanding retail pharmacy network and sophisticated logistics for online sales, ensures widespread accessibility. The market share of China alone in the global Huoxiang Zhengqi drug market is estimated to be over 80%.

- Dominant Region: Asia-Pacific (led by China).

- Dominant Country: China.

- Leading Application Segment (Current): Offline Sale (approx. 75% market share).

- Emerging Application Segment: Online Sale (projected CAGR of 12% for forecast period).

- Dominant Product Type: Capsule (approx. 60% market share).

- Growing Product Type: Dropping Pill.

- Key Drivers: Cultural acceptance of TCM, government support, aging population, e-commerce growth.

- Market Share (China): Estimated >80% of global market.

huoxiang zhengqi drug Product Landscape

The Huoxiang Zhengqi drug product landscape is characterized by a steady stream of product innovations aimed at enhancing efficacy and patient convenience. Leading companies are investing in improving the extraction methods of key active ingredients like Agastache rugosa (Huoxiang) and Atractylodes macrocephala (Baizhu) to ensure higher purity and potency. Formulations are evolving from traditional decoctions to more user-friendly forms such as capsules, dropping pills, and even effervescent tablets, offering faster dissolution and improved taste profiles. Performance metrics are increasingly being evaluated through rigorous clinical trials, providing scientific backing for their therapeutic benefits in treating common digestive ailments. Unique selling propositions often revolve around the natural origin of the ingredients, perceived gentleness on the stomach, and a long history of traditional use. Technological advancements in nano-encapsulation are also being explored to optimize the absorption and sustained release of active compounds. The estimated investment in R&D for novel Huoxiang Zhengqi formulations is around 50 to 70 million units annually.

Key Drivers, Barriers & Challenges in huoxiang zhengqi drug

Key Drivers: The Huoxiang Zhengqi drug market is propelled by several significant drivers. The growing global interest in natural and herbal remedies, driven by a desire for holistic health and concerns about side effects of synthetic drugs, is a primary catalyst. Favorable government policies in key markets, particularly China, supporting the Traditional Chinese Medicine (TCM) sector through funding and promotional initiatives, are instrumental. An increasing prevalence of gastrointestinal disorders, attributed to changing dietary habits and lifestyle stress, creates sustained demand. Furthermore, advancements in research and development are leading to improved product formulations and scientific validation of efficacy, enhancing consumer trust.

Barriers & Challenges: Despite its growth, the market faces several hurdles. A significant challenge is the need for more rigorous, large-scale clinical trials to meet the stringent standards of Western medicine, which can be costly and time-consuming. The standardization of herbal ingredients, ensuring consistent quality and potency across different batches and manufacturers, remains a complex issue. Regulatory complexities and varying approval processes in different countries can hinder market entry and expansion. Competition from both established TCM brands and a growing array of modern pharmaceutical and dietary supplement alternatives poses a constant threat. Supply chain disruptions and the sourcing of high-quality raw materials can also impact production and cost. The estimated annual impact of regulatory hurdles on market entry is between 20 to 30 million units in potential lost sales.

Emerging Opportunities in huoxiang zhengqi drug

Emerging opportunities in the Huoxiang Zhengqi drug market are diverse and promising. The expansion of e-commerce platforms offers a significant avenue for reaching a wider consumer base, especially in regions with limited physical pharmacy access. There is a growing opportunity to develop specialized formulations targeting specific gastrointestinal conditions, moving beyond general digestive support. Untapped markets in Western countries, with increasing consumer curiosity towards TCM, present substantial growth potential, provided effective market education and regulatory pathways are established. Innovative applications, such as incorporating Huoxiang Zhengqi ingredients into functional foods and beverages, could tap into the preventative health trend. Evolving consumer preferences for personalized medicine also create opportunities for tailored TCM solutions. The estimated market value of untapped geographical markets is projected to be over 500 million units by 2033.

Growth Accelerators in the huoxiang zhengqi drug Industry

Several factors are acting as significant growth accelerators for the Huoxiang Zhengqi drug industry. Technological breakthroughs in extraction and purification processes are enhancing the potency and efficacy of active compounds, making the drugs more attractive to consumers and healthcare professionals. Strategic partnerships between TCM manufacturers and global pharmaceutical companies are facilitating market entry into new territories and enabling the integration of TCM into mainstream healthcare systems. Market expansion strategies, including targeted marketing campaigns that highlight the scientific evidence and traditional wisdom behind Huoxiang Zhengqi, are crucial. The increasing recognition of TCM as a viable therapeutic option by international health organizations and regulatory bodies is a key accelerator, opening doors for wider acceptance and prescription. Furthermore, the growing trend of "wellness tourism" and interest in ancient healing practices are indirectly fueling demand.

Key Players Shaping the huoxiang zhengqi drug Market

- Tasly Holding Group Company .,Itd.

- Beijing TRT Group .

- Zhangzhou Pientzehuang Pharmaceutical Co.,Ltd.

- Chongqing Taji Industry (Group) Co.,Ltd.

- LanZhou Foci Pharmaceutical Co.,Ltd.

- Huiren Group Co.,Ltd.

- Sichuan Taihua Tang Pharmacy Co.,Ltd.

- China Shineway Pharmaceutical Group Limited.

- Yunnan Baiyao Group Co.,Ltd.

- Xiuzheng Pharmaceutical Group Co.,Ltd.

Notable Milestones in huoxiang zhengqi drug Sector

- 2019: Increased investment in GMP-certified production facilities by major players to meet international quality standards.

- 2020: Launch of advanced water-based extraction technologies for higher purity Huoxiang Zhengqi ingredients.

- 2021: Significant growth in online sales of Huoxiang Zhengqi drugs driven by pandemic-related demand for home healthcare solutions.

- 2022: Introduction of novel dropping pill formulations with enhanced bioavailability.

- 2023: Several Chinese TCM companies achieve notable international product registrations, paving the way for global market expansion.

- 2024: Growing body of peer-reviewed research validating the efficacy of Huoxiang Zhengqi for specific gastrointestinal conditions.

In-Depth huoxiang zhengqi drug Market Outlook

The future outlook for the Huoxiang Zhengqi drug market is exceptionally bright, driven by a powerful combination of escalating consumer demand for natural health solutions and supportive regulatory environments. Growth accelerators such as technological advancements in drug delivery, strategic collaborations between traditional medicine practitioners and modern pharmaceutical entities, and proactive market expansion initiatives will continue to fuel the industry's upward trajectory. The market is poised for substantial growth, with projected market value reaching over 2,100 million units by 2033. Key strategic opportunities lie in further scientific validation, developing standardized quality control measures, and educating global consumers about the benefits of this time-tested remedy. The integration of Huoxiang Zhengqi into holistic wellness programs and its potential for treating a broader spectrum of health concerns present exciting avenues for future innovation and market penetration.

huoxiang zhengqi drug Segmentation

-

1. Application

- 1.1. Online Sale

- 1.2. Offline Sale

-

2. Types

- 2.1. Capsule

- 2.2. Dropping Pill

huoxiang zhengqi drug Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

huoxiang zhengqi drug REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sale

- 5.1.2. Offline Sale

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Capsule

- 5.2.2. Dropping Pill

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sale

- 6.1.2. Offline Sale

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Capsule

- 6.2.2. Dropping Pill

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sale

- 7.1.2. Offline Sale

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Capsule

- 7.2.2. Dropping Pill

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sale

- 8.1.2. Offline Sale

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Capsule

- 8.2.2. Dropping Pill

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sale

- 9.1.2. Offline Sale

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Capsule

- 9.2.2. Dropping Pill

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific huoxiang zhengqi drug Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sale

- 10.1.2. Offline Sale

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Capsule

- 10.2.2. Dropping Pill

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tasly Holding Group Company .

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Itd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beijing TRT Group .

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zhangzhou Pientzehuang Pharmaceutical Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chongqing Taji Industry (Group) Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LanZhou Foci Pharmaceutical Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huiren Group Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sichuan Taihua Tang Pharmacy Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 China Shineway Pharmaceutical Group Limited.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yunnan Baiyao Group Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Xiuzheng Pharmaceutical Group Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Tasly Holding Group Company .

List of Figures

- Figure 1: Global huoxiang zhengqi drug Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global huoxiang zhengqi drug Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America huoxiang zhengqi drug Revenue (million), by Application 2024 & 2032

- Figure 4: North America huoxiang zhengqi drug Volume (K), by Application 2024 & 2032

- Figure 5: North America huoxiang zhengqi drug Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America huoxiang zhengqi drug Volume Share (%), by Application 2024 & 2032

- Figure 7: North America huoxiang zhengqi drug Revenue (million), by Types 2024 & 2032

- Figure 8: North America huoxiang zhengqi drug Volume (K), by Types 2024 & 2032

- Figure 9: North America huoxiang zhengqi drug Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America huoxiang zhengqi drug Volume Share (%), by Types 2024 & 2032

- Figure 11: North America huoxiang zhengqi drug Revenue (million), by Country 2024 & 2032

- Figure 12: North America huoxiang zhengqi drug Volume (K), by Country 2024 & 2032

- Figure 13: North America huoxiang zhengqi drug Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America huoxiang zhengqi drug Volume Share (%), by Country 2024 & 2032

- Figure 15: South America huoxiang zhengqi drug Revenue (million), by Application 2024 & 2032

- Figure 16: South America huoxiang zhengqi drug Volume (K), by Application 2024 & 2032

- Figure 17: South America huoxiang zhengqi drug Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America huoxiang zhengqi drug Volume Share (%), by Application 2024 & 2032

- Figure 19: South America huoxiang zhengqi drug Revenue (million), by Types 2024 & 2032

- Figure 20: South America huoxiang zhengqi drug Volume (K), by Types 2024 & 2032

- Figure 21: South America huoxiang zhengqi drug Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America huoxiang zhengqi drug Volume Share (%), by Types 2024 & 2032

- Figure 23: South America huoxiang zhengqi drug Revenue (million), by Country 2024 & 2032

- Figure 24: South America huoxiang zhengqi drug Volume (K), by Country 2024 & 2032

- Figure 25: South America huoxiang zhengqi drug Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America huoxiang zhengqi drug Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe huoxiang zhengqi drug Revenue (million), by Application 2024 & 2032

- Figure 28: Europe huoxiang zhengqi drug Volume (K), by Application 2024 & 2032

- Figure 29: Europe huoxiang zhengqi drug Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe huoxiang zhengqi drug Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe huoxiang zhengqi drug Revenue (million), by Types 2024 & 2032

- Figure 32: Europe huoxiang zhengqi drug Volume (K), by Types 2024 & 2032

- Figure 33: Europe huoxiang zhengqi drug Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe huoxiang zhengqi drug Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe huoxiang zhengqi drug Revenue (million), by Country 2024 & 2032

- Figure 36: Europe huoxiang zhengqi drug Volume (K), by Country 2024 & 2032

- Figure 37: Europe huoxiang zhengqi drug Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe huoxiang zhengqi drug Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa huoxiang zhengqi drug Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa huoxiang zhengqi drug Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa huoxiang zhengqi drug Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa huoxiang zhengqi drug Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa huoxiang zhengqi drug Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa huoxiang zhengqi drug Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa huoxiang zhengqi drug Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa huoxiang zhengqi drug Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa huoxiang zhengqi drug Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa huoxiang zhengqi drug Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa huoxiang zhengqi drug Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa huoxiang zhengqi drug Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific huoxiang zhengqi drug Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific huoxiang zhengqi drug Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific huoxiang zhengqi drug Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific huoxiang zhengqi drug Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific huoxiang zhengqi drug Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific huoxiang zhengqi drug Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific huoxiang zhengqi drug Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific huoxiang zhengqi drug Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific huoxiang zhengqi drug Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific huoxiang zhengqi drug Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific huoxiang zhengqi drug Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific huoxiang zhengqi drug Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global huoxiang zhengqi drug Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global huoxiang zhengqi drug Volume K Forecast, by Region 2019 & 2032

- Table 3: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 5: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 7: Global huoxiang zhengqi drug Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global huoxiang zhengqi drug Volume K Forecast, by Region 2019 & 2032

- Table 9: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 11: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 13: Global huoxiang zhengqi drug Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global huoxiang zhengqi drug Volume K Forecast, by Country 2019 & 2032

- Table 15: United States huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 23: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 25: Global huoxiang zhengqi drug Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global huoxiang zhengqi drug Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 35: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 37: Global huoxiang zhengqi drug Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global huoxiang zhengqi drug Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 59: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 61: Global huoxiang zhengqi drug Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global huoxiang zhengqi drug Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global huoxiang zhengqi drug Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global huoxiang zhengqi drug Volume K Forecast, by Application 2019 & 2032

- Table 77: Global huoxiang zhengqi drug Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global huoxiang zhengqi drug Volume K Forecast, by Types 2019 & 2032

- Table 79: Global huoxiang zhengqi drug Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global huoxiang zhengqi drug Volume K Forecast, by Country 2019 & 2032

- Table 81: China huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific huoxiang zhengqi drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific huoxiang zhengqi drug Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the huoxiang zhengqi drug?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the huoxiang zhengqi drug?

Key companies in the market include Tasly Holding Group Company ., Itd., Beijing TRT Group ., Zhangzhou Pientzehuang Pharmaceutical Co., Ltd., Chongqing Taji Industry (Group) Co., Ltd., LanZhou Foci Pharmaceutical Co., Ltd., Huiren Group Co., Ltd., Sichuan Taihua Tang Pharmacy Co., Ltd., China Shineway Pharmaceutical Group Limited., Yunnan Baiyao Group Co., Ltd., Xiuzheng Pharmaceutical Group Co., Ltd..

3. What are the main segments of the huoxiang zhengqi drug?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "huoxiang zhengqi drug," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the huoxiang zhengqi drug report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the huoxiang zhengqi drug?

To stay informed about further developments, trends, and reports in the huoxiang zhengqi drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence