Key Insights

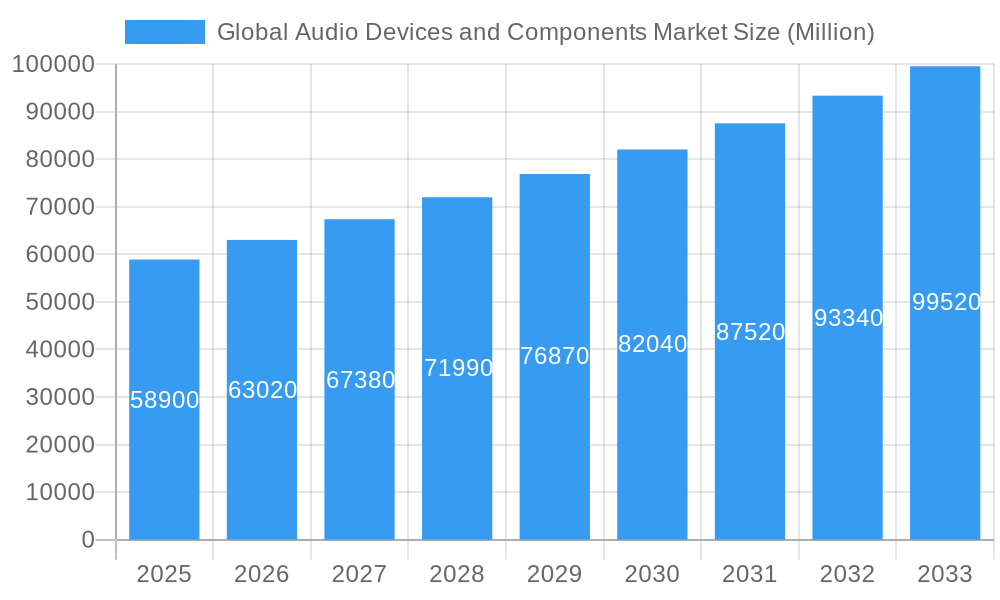

The Global Audio Devices and Components Market is poised for significant expansion, projected to reach a substantial $58.9 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.7%, indicating a dynamic and evolving industry landscape. The market's trajectory is being propelled by a confluence of factors, primarily driven by the escalating demand for immersive and high-fidelity audio experiences across both consumer and professional sectors. The proliferation of smart home ecosystems, coupled with the increasing adoption of advanced audio technologies like spatial audio and AI-powered sound optimization, is creating new avenues for market players. Furthermore, the continuous innovation in audio device components, such as MEMS microphones and advanced audio codecs, is enabling the development of more sophisticated and feature-rich products. The rising disposable incomes globally and a growing appreciation for premium audio quality are further fueling consumer spending.

Global Audio Devices and Components Market Market Size (In Billion)

The market's expansion is also influenced by emerging trends such as the integration of audio into wearable technology, the growing popularity of wireless and portable audio solutions, and the demand for professional audio equipment in the booming content creation and live event industries. While the market enjoys strong growth drivers, certain restraints may temper its pace. These include the intense price competition among manufacturers, the complexity of supply chains for specialized components, and the ongoing need for substantial investment in research and development to keep pace with technological advancements. Nonetheless, the sheer breadth of segmentation, encompassing everything from sophisticated A/V receivers and high-fidelity systems to essential audio device components and professional mixing consoles, ensures a diverse and resilient market. Leading companies like Samsung, Sony, Apple, and Bose are actively shaping this landscape through strategic product launches and technological advancements.

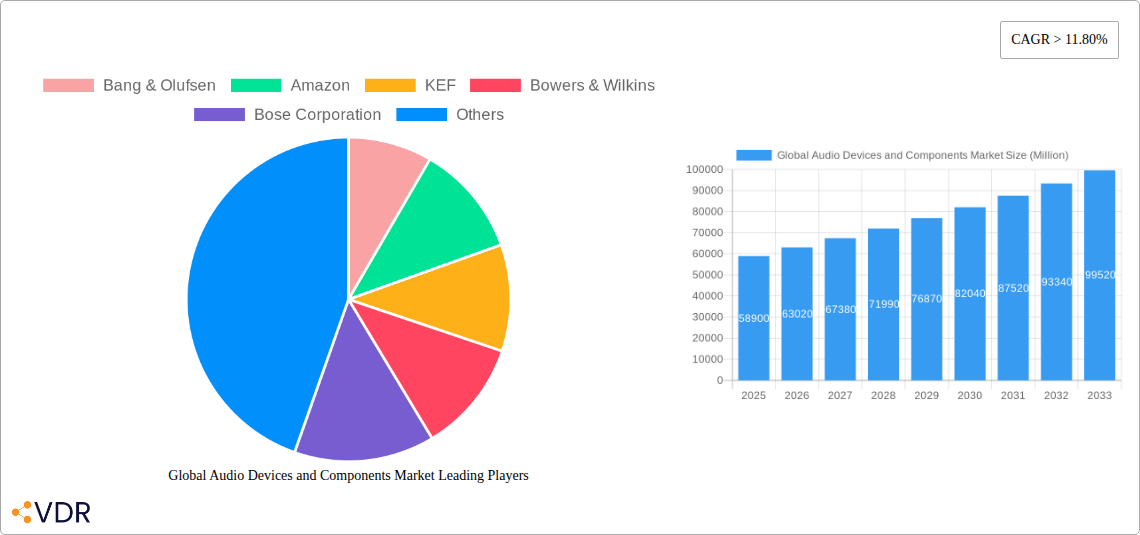

Global Audio Devices and Components Market Company Market Share

Global Audio Devices and Components Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global audio devices and components market, encompassing consumer audio, professional audio, and audio device components. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report leverages extensive data to deliver actionable insights for industry stakeholders. Explore market dynamics, growth trends, dominant regions, product innovations, key drivers, challenges, and emerging opportunities within the rapidly evolving audio landscape. This report is meticulously structured for SEO optimization, incorporating high-traffic keywords such as wireless speakers, soundbars, headphones, microphones, audio codecs, and SoCs to maximize visibility and engagement for professionals in the audio technology, consumer electronics, and semiconductor industries.

Global Audio Devices and Components Market Market Dynamics & Structure

The global audio devices and components market is characterized by dynamic shifts driven by rapid technological advancements and evolving consumer preferences. Market concentration varies significantly across segments, with dominant players like Apple, Samsung (including Harman and JBL), and Sony Corporation leading in consumer audio, while specialized firms cater to professional audio needs. Technological innovation, particularly in areas like MEMS microphones, SoC and DSP integration for enhanced audio processing, and advancements in wireless audio streaming protocols, acts as a primary driver. Regulatory frameworks concerning audio quality standards, digital signal processing patents, and electromagnetic compatibility also play a crucial role in shaping market entry and product development. Competitive product substitutes, ranging from high-fidelity wired systems to ultra-portable wireless solutions, continuously challenge established product categories. End-user demographics are broadening, with increasing demand from younger, tech-savvy consumers for smart audio devices and a sustained interest from audiophiles for premium, high-resolution systems. Mergers and acquisitions (M&A) are a significant trend, with larger conglomerates acquiring niche technology providers to expand their product portfolios and technological capabilities.

- Market Concentration: Highly competitive, with some consolidation observed in consumer electronics giants acquiring specialized audio brands.

- Technological Innovation: Driven by advancements in DSP, wireless technologies (e.g., Bluetooth 5.3, Wi-Fi 6), and AI-powered audio enhancement.

- Regulatory Frameworks: Impacting product certifications, safety standards, and intellectual property.

- Competitive Product Substitutes: Constant evolution from wired to wireless, from basic functionality to smart integrated systems.

- End-User Demographics: Diverse, encompassing casual listeners, gamers, content creators, and professional musicians.

- M&A Trends: Strategic acquisitions to gain market share, technological expertise, and intellectual property.

Global Audio Devices and Components Market Growth Trends & Insights

The global audio devices and components market is poised for robust growth, projected to expand at a significant CAGR of xx% from 2025 to 2033. This expansion is fueled by a confluence of factors including escalating consumer demand for immersive audio experiences, the proliferation of smart home ecosystems, and the increasing integration of audio technologies in diverse applications. Market size, estimated at USD xx billion in 2025, is anticipated to reach USD xx billion by 2033. Adoption rates for wireless speakers, soundbars, and noise-cancelling headphones are witnessing exponential growth, driven by their convenience and superior performance. Technological disruptions, such as the advancement of Spatial Audio and Dolby Atmos technologies, are creating new listening paradigms and driving consumer upgrades. Consumer behavior shifts are evident in the growing preference for personalized audio experiences, subscription-based audio content, and the demand for multi-room audio solutions. The increasing adoption of audio device components like consumer audio ICs (audio codecs) and SoC and DSP within smartphones, wearables, and automotive systems further underpins the market's upward trajectory. The report forecasts a steady increase in market penetration for advanced audio solutions, with a projected xx% market penetration for smart audio devices by 2030.

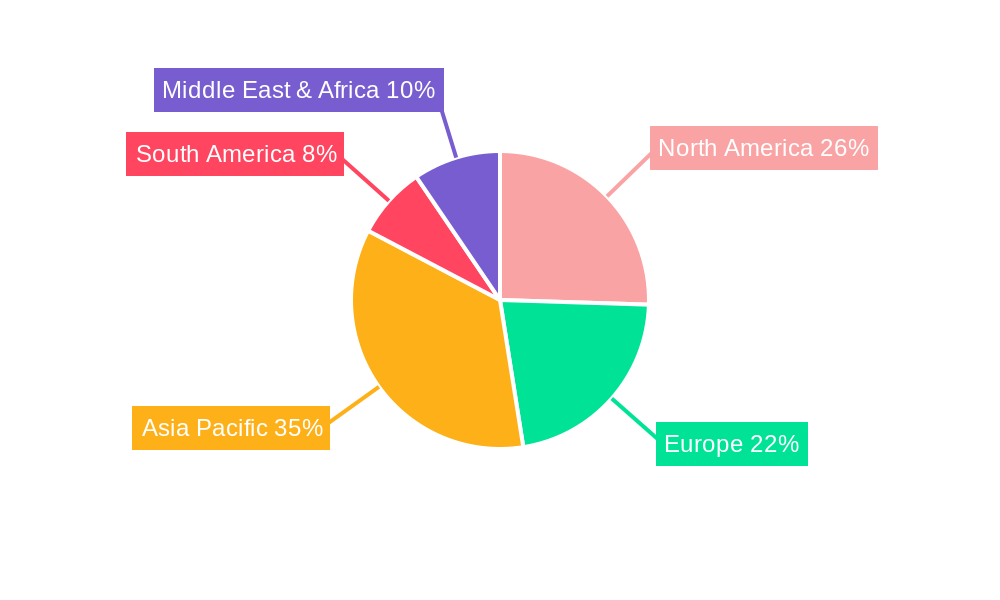

Dominant Regions, Countries, or Segments in Global Audio Devices and Components Market

The global audio devices and components market is experiencing significant growth across multiple regions and segments. North America and Europe currently lead in terms of market value and adoption of premium audio solutions, driven by higher disposable incomes, a strong consumer electronics culture, and early adoption of new technologies. Asia Pacific, however, is emerging as the fastest-growing region, propelled by a rapidly expanding middle class, increasing urbanization, and a growing demand for affordable yet high-quality audio products, especially in countries like China and India.

Within the segments, wireless speakers are dominating the Home Audio category, projected to capture a significant market share due to their versatility, ease of use, and seamless integration with smart home devices. Soundbars are also witnessing substantial growth, appealing to consumers seeking an enhanced home entertainment experience without the complexity of traditional A/V receiver setups. In the Professional Audio segment, microphones and headphones are critical components for content creators, musicians, and broadcast professionals, experiencing steady demand. The Audio Device Components segment, particularly consumer audio ICs (audio codecs) and SoC and DSP chips, forms the backbone of this entire market, with widespread adoption across virtually all audio-enabled devices. The increasing complexity of audio processing and the demand for higher fidelity are driving innovation and growth in these foundational components.

- Dominant Segment (Home Audio): Wireless Speakers, experiencing strong demand due to portability and smart home integration.

- Fastest Growing Segment (Home Audio): Soundbars, offering enhanced TV audio experience with simplified setup.

- Key Segment (Professional Audio): Microphones and Headphones, driven by content creation and broadcast industries.

- Foundational Segment (Audio Device Components): Consumer Audio ICs (Audio Codecs) and SoC/DSP, enabling advanced audio features across all device categories.

- Leading Regions: North America and Europe for premium products, with Asia Pacific showing the highest growth potential.

- Key Drivers in Asia Pacific: Rising disposable incomes, expanding middle class, and increasing demand for affordable premium audio.

Global Audio Devices and Components Market Product Landscape

The global audio devices and components market is characterized by a relentless pace of product innovation, focusing on enhanced sound quality, user convenience, and smart functionality. Leading manufacturers are continuously pushing boundaries with advancements in driver technology, acoustic engineering, and digital signal processing. For instance, KEF's LS50 Collection, recognized with prestigious EISA Awards, highlights advancements in wireless standmount loudspeakers offering unparalleled audio fidelity. Bose Corporation's SoundLink Flex wireless Bluetooth speaker exemplifies innovation in portable, ruggedized design for outdoor use, featuring extended battery life and multi-speaker pairing capabilities. The integration of AI-powered noise cancellation, personalized audio profiles, and adaptive sound technologies are becoming standard features across a wide range of audio devices. In the components realm, the development of ultra-low power consumption MEMS microphones and highly integrated SoCs are enabling smaller, more powerful, and energy-efficient audio devices.

Key Drivers, Barriers & Challenges in Global Audio Devices and Components Market

Key Drivers:

- Technological Advancements: Innovations in DSP, wireless connectivity, and AI-powered audio processing are continuously enhancing product performance and creating new user experiences. The development of advanced consumer audio ICs and SoCs is crucial for enabling these features.

- Growing Demand for Immersive Audio: Consumers increasingly seek high-fidelity and multi-dimensional audio experiences, driving sales of soundbars, wireless surround sound systems, and headphones with advanced features like Dolby Atmos.

- Smart Home Ecosystem Integration: The proliferation of smart speakers and voice assistants, powered by SoC and DSP technologies, is a significant growth accelerator, integrating audio into daily life.

- Content Streaming Growth: The expansion of music and video streaming services fuels demand for high-quality audio playback devices.

Barriers & Challenges:

- Supply Chain Disruptions: Global semiconductor shortages and logistics challenges can impact production timelines and increase costs for audio device components.

- High R&D Costs: Continuous innovation in audio amplifier technology and SoC design requires significant investment, posing a barrier for smaller players.

- Price Sensitivity: While demand for premium audio is growing, a significant segment of the market remains price-sensitive, particularly in emerging economies, impacting the adoption of high-end solutions.

- Interoperability and Standardization: Ensuring seamless compatibility between different brands and platforms for wireless audio remains a challenge.

- Environmental Regulations: Growing scrutiny on electronic waste and material sourcing can add complexity to manufacturing processes.

Emerging Opportunities in Global Audio Devices and Components Market

The global audio devices and components market presents a wealth of emerging opportunities, particularly in niche and rapidly evolving sectors. The increasing adoption of virtual and augmented reality (VR/AR) is creating a demand for highly immersive and spatially accurate audio solutions, driving innovation in headphones and audio device components designed for these platforms. The growth of the e-sports and gaming industries is fueling demand for high-performance gaming headsets with advanced microphones and surround sound capabilities. Furthermore, the integration of advanced audio technologies into the automotive sector, offering enhanced in-car entertainment and driver assistance systems, represents a significant untapped market. The burgeoning creator economy also presents opportunities for specialized, portable, and high-quality microphones, mixers, and audio interfaces.

Growth Accelerators in the Global Audio Devices and Components Market Industry

Several key catalysts are accelerating the growth of the global audio devices and components market. Technological breakthroughs in low-latency audio transmission protocols are crucial for real-time applications like online gaming and professional audio production, exemplified by partnerships like RealTime Audio with iCON Pro Audio. The continuous evolution of SoC and DSP capabilities, enabling more sophisticated audio processing and AI-driven features within compact devices, is a significant accelerator. Strategic partnerships between audio hardware manufacturers and content streaming platforms are fostering a symbiotic growth environment, where enhanced audio experiences drive content consumption and vice-versa. Furthermore, market expansion strategies targeting emerging economies, coupled with the increasing affordability of advanced audio components, are opening up new consumer bases and driving volume growth.

Key Players Shaping the Global Audio Devices and Components Market Market

- Apple

- Samsung (including Harman and JBL)

- Sony Corporation

- Bose Corporation

- Amazon

- Sonos Inc

- KEF

- Bowers & Wilkins

- Bang & Olufsen

- Dynaudio

- Boston Acoustics

- Klipsch Audio Technologies

Notable Milestones in Global Audio Devices and Components Market Sector

- December 2021: Latency technology house RealTime Audio partnered with audio manufacturer iCON Pro Audio to supply the latter's next line of audio interfaces with RealTime Audio technology. These iCONs 'ultra-low latency boxes' would be available as a standalone box for any audio interface and all-in-one audio interface complete with embedded RealTime Audio technology. This development signifies a push towards ultra-low latency solutions critical for professional audio applications.

- October 2021: Bose launched its new SoundLink Flex wireless Bluetooth speaker. The wireless speaker has a portable, lightweight design meant for the outdoors, with its IP67 build allowing for considerable exposure to dirt and water. It also features a long battery life per charge and can be paired with other Bose speakers. This launch highlights the continued innovation in the portable wireless speaker segment, emphasizing durability and user experience.

- August 2021: KEF announced that three leading KEF loudspeaker models had been declared the best in their categories in this year's prestigious EISA Awards. Both models in the LS50 Collection have earned the best-in-class accolade, with KEF LS50 Wireless II being named Best Product, Wireless Standmount Loudspeakers 2021-22 and KEF LS50 Meta selected as Best Product, Standmount Loudspeakers 2021-2022. This recognition underscores KEF's commitment to high-fidelity sound and advanced loudspeaker design, driving consumer interest in premium home audio.

In-Depth Global Audio Devices and Components Market Market Outlook

The global audio devices and components market is projected for sustained and significant growth, driven by an unyielding consumer appetite for enhanced audio experiences and the relentless pace of technological innovation. Future market potential lies in the deeper integration of artificial intelligence for personalized audio, the expansion of spatial audio technologies across more devices, and the increasing demand for robust, low-latency solutions in emerging applications like VR/AR and cloud gaming. Strategic opportunities abound for companies that can effectively navigate the complexities of global supply chains, invest in cutting-edge audio device components like advanced SoC and DSPs, and develop intuitive, feature-rich audio products that seamlessly blend into the evolving digital lifestyles of consumers worldwide. The increasing focus on sustainability within the electronics sector will also present opportunities for companies adopting eco-friendly manufacturing and material sourcing practices.

Global Audio Devices and Components Market Segmentation

-

1. Home Audio

- 1.1. A/V Receivers

- 1.2. Hi-Fi Systems

- 1.3. Soundbars

- 1.4. Wireless Speakers

- 1.5. Dedicated Docks

-

2. Professional Audio

- 2.1. Power Amplifiers

- 2.2. Mixing Consoles

- 2.3. Microphones

- 2.4. Headphones

-

3. Audio Device Components

- 3.1. MEMS Microphones

- 3.2. Microspeakers

- 3.3. Consumer Audio IC (Audio Codec)

- 3.4. APU, SoC and DSP

- 3.5. Audio Amplifiers

Global Audio Devices and Components Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Global Audio Devices and Components Market Regional Market Share

Geographic Coverage of Global Audio Devices and Components Market

Global Audio Devices and Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Mobile Devices; Decreasing Cost of E-books

- 3.3. Market Restrains

- 3.3.1. Privacy and Copyright Issues among E-sellers and Book Writers

- 3.4. Market Trends

- 3.4.1. The Home Audio Segment is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Home Audio

- 5.1.1. A/V Receivers

- 5.1.2. Hi-Fi Systems

- 5.1.3. Soundbars

- 5.1.4. Wireless Speakers

- 5.1.5. Dedicated Docks

- 5.2. Market Analysis, Insights and Forecast - by Professional Audio

- 5.2.1. Power Amplifiers

- 5.2.2. Mixing Consoles

- 5.2.3. Microphones

- 5.2.4. Headphones

- 5.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 5.3.1. MEMS Microphones

- 5.3.2. Microspeakers

- 5.3.3. Consumer Audio IC (Audio Codec)

- 5.3.4. APU, SoC and DSP

- 5.3.5. Audio Amplifiers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Home Audio

- 6. North America Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Home Audio

- 6.1.1. A/V Receivers

- 6.1.2. Hi-Fi Systems

- 6.1.3. Soundbars

- 6.1.4. Wireless Speakers

- 6.1.5. Dedicated Docks

- 6.2. Market Analysis, Insights and Forecast - by Professional Audio

- 6.2.1. Power Amplifiers

- 6.2.2. Mixing Consoles

- 6.2.3. Microphones

- 6.2.4. Headphones

- 6.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 6.3.1. MEMS Microphones

- 6.3.2. Microspeakers

- 6.3.3. Consumer Audio IC (Audio Codec)

- 6.3.4. APU, SoC and DSP

- 6.3.5. Audio Amplifiers

- 6.1. Market Analysis, Insights and Forecast - by Home Audio

- 7. South America Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Home Audio

- 7.1.1. A/V Receivers

- 7.1.2. Hi-Fi Systems

- 7.1.3. Soundbars

- 7.1.4. Wireless Speakers

- 7.1.5. Dedicated Docks

- 7.2. Market Analysis, Insights and Forecast - by Professional Audio

- 7.2.1. Power Amplifiers

- 7.2.2. Mixing Consoles

- 7.2.3. Microphones

- 7.2.4. Headphones

- 7.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 7.3.1. MEMS Microphones

- 7.3.2. Microspeakers

- 7.3.3. Consumer Audio IC (Audio Codec)

- 7.3.4. APU, SoC and DSP

- 7.3.5. Audio Amplifiers

- 7.1. Market Analysis, Insights and Forecast - by Home Audio

- 8. Europe Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Home Audio

- 8.1.1. A/V Receivers

- 8.1.2. Hi-Fi Systems

- 8.1.3. Soundbars

- 8.1.4. Wireless Speakers

- 8.1.5. Dedicated Docks

- 8.2. Market Analysis, Insights and Forecast - by Professional Audio

- 8.2.1. Power Amplifiers

- 8.2.2. Mixing Consoles

- 8.2.3. Microphones

- 8.2.4. Headphones

- 8.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 8.3.1. MEMS Microphones

- 8.3.2. Microspeakers

- 8.3.3. Consumer Audio IC (Audio Codec)

- 8.3.4. APU, SoC and DSP

- 8.3.5. Audio Amplifiers

- 8.1. Market Analysis, Insights and Forecast - by Home Audio

- 9. Middle East & Africa Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Home Audio

- 9.1.1. A/V Receivers

- 9.1.2. Hi-Fi Systems

- 9.1.3. Soundbars

- 9.1.4. Wireless Speakers

- 9.1.5. Dedicated Docks

- 9.2. Market Analysis, Insights and Forecast - by Professional Audio

- 9.2.1. Power Amplifiers

- 9.2.2. Mixing Consoles

- 9.2.3. Microphones

- 9.2.4. Headphones

- 9.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 9.3.1. MEMS Microphones

- 9.3.2. Microspeakers

- 9.3.3. Consumer Audio IC (Audio Codec)

- 9.3.4. APU, SoC and DSP

- 9.3.5. Audio Amplifiers

- 9.1. Market Analysis, Insights and Forecast - by Home Audio

- 10. Asia Pacific Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Home Audio

- 10.1.1. A/V Receivers

- 10.1.2. Hi-Fi Systems

- 10.1.3. Soundbars

- 10.1.4. Wireless Speakers

- 10.1.5. Dedicated Docks

- 10.2. Market Analysis, Insights and Forecast - by Professional Audio

- 10.2.1. Power Amplifiers

- 10.2.2. Mixing Consoles

- 10.2.3. Microphones

- 10.2.4. Headphones

- 10.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 10.3.1. MEMS Microphones

- 10.3.2. Microspeakers

- 10.3.3. Consumer Audio IC (Audio Codec)

- 10.3.4. APU, SoC and DSP

- 10.3.5. Audio Amplifiers

- 10.1. Market Analysis, Insights and Forecast - by Home Audio

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bang & Olufsen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KEF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bowers & Wilkins

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bose Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynaudio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boston Acoustics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sonos Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Google

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung (including Harman and JBL)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Klipsch Audio Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sony Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Bang & Olufsen

List of Figures

- Figure 1: Global Global Audio Devices and Components Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Global Audio Devices and Components Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 4: North America Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 5: North America Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 6: North America Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 7: North America Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 8: North America Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 9: North America Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 10: North America Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 11: North America Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 12: North America Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 13: North America Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 14: North America Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 15: North America Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 20: South America Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 21: South America Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 22: South America Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 23: South America Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 24: South America Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 25: South America Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 26: South America Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 27: South America Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 28: South America Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 29: South America Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 30: South America Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 31: South America Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 36: Europe Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 37: Europe Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 38: Europe Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 39: Europe Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 40: Europe Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 41: Europe Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 42: Europe Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 43: Europe Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 44: Europe Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 45: Europe Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 46: Europe Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 47: Europe Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 52: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 53: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 54: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 55: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 56: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 57: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 58: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 59: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 60: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 61: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 62: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 63: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 68: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 69: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 70: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 71: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 72: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 73: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 74: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 75: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 76: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 77: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 78: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 79: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 2: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 3: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 4: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 5: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 6: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 7: Global Audio Devices and Components Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Audio Devices and Components Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 10: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 11: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 12: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 13: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 14: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 15: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 24: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 25: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 26: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 27: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 28: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 29: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Brazil Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 38: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 39: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 40: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 41: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 42: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 43: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Germany Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: France Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Italy Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Spain Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Russia Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Benelux Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Nordics Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 64: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 65: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 66: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 67: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 68: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 69: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Turkey Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Israel Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: GCC Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: North Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: South Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 84: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 85: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 86: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 87: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 88: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 89: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 90: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: China Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: India Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: Japan Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: South Korea Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Oceania Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Audio Devices and Components Market?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Global Audio Devices and Components Market?

Key companies in the market include Bang & Olufsen, Amazon, KEF, Bowers & Wilkins, Bose Corporation, Dynaudio, Boston Acoustics, Sonos Inc, Google, Samsung (including Harman and JBL), Apple, Klipsch Audio Technologies, Sony Corporation.

3. What are the main segments of the Global Audio Devices and Components Market?

The market segments include Home Audio, Professional Audio, Audio Device Components.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Mobile Devices; Decreasing Cost of E-books.

6. What are the notable trends driving market growth?

The Home Audio Segment is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Privacy and Copyright Issues among E-sellers and Book Writers.

8. Can you provide examples of recent developments in the market?

December 2021 - Latency technology house RealTime Audio partnered with audio manufacturer iCON Pro Audio to supply the latter's next line of audio interfaces with RealTime Audio technology. These iCONs 'ultra-low latency boxes' would be available as a standalone box for any audio interface and all-in-one audio interface complete with embedded RealTime Audio technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Audio Devices and Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Audio Devices and Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Audio Devices and Components Market?

To stay informed about further developments, trends, and reports in the Global Audio Devices and Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence