Key Insights

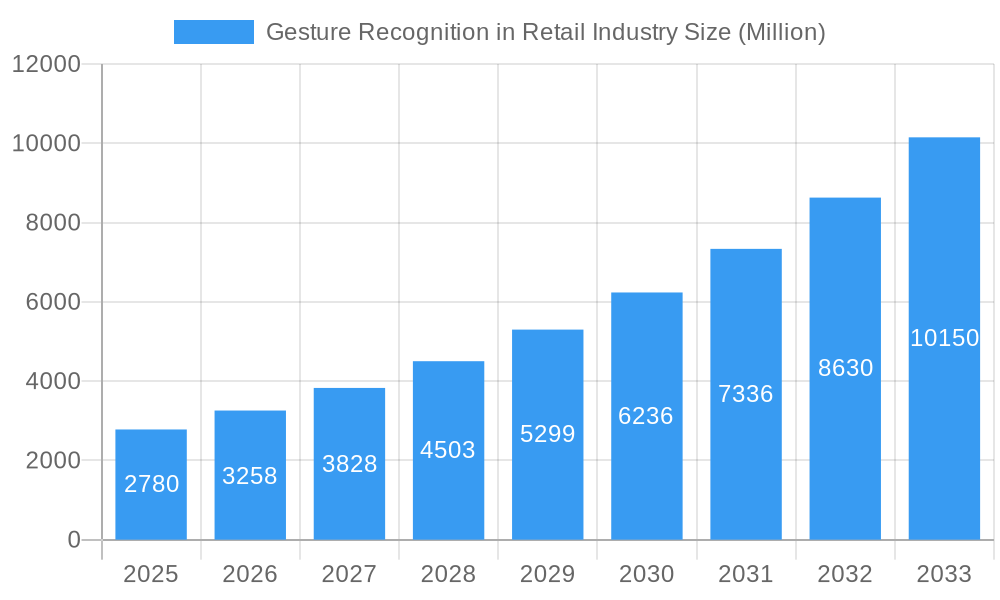

The gesture recognition market in the retail industry is experiencing robust growth, projected to reach $2.78 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.26% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of contactless technologies, fueled by hygiene concerns post-pandemic and the desire for quicker checkout experiences, is significantly boosting demand for gesture-based interfaces. Secondly, advancements in computer vision and machine learning are enabling more accurate and responsive gesture recognition systems, overcoming previous limitations in reliability and robustness. Retailers are increasingly integrating gesture recognition into various applications, such as interactive displays, self-checkout kiosks, and inventory management systems, to enhance customer engagement, streamline operations, and improve overall efficiency. The market segmentation reveals a strong preference for touchless solutions, driven by hygiene concerns and the potential for a more seamless user experience. Major players like Apple, Google, and Microsoft are heavily invested in this technology, fostering innovation and driving wider adoption.

Gesture Recognition in Retail Industry Market Size (In Billion)

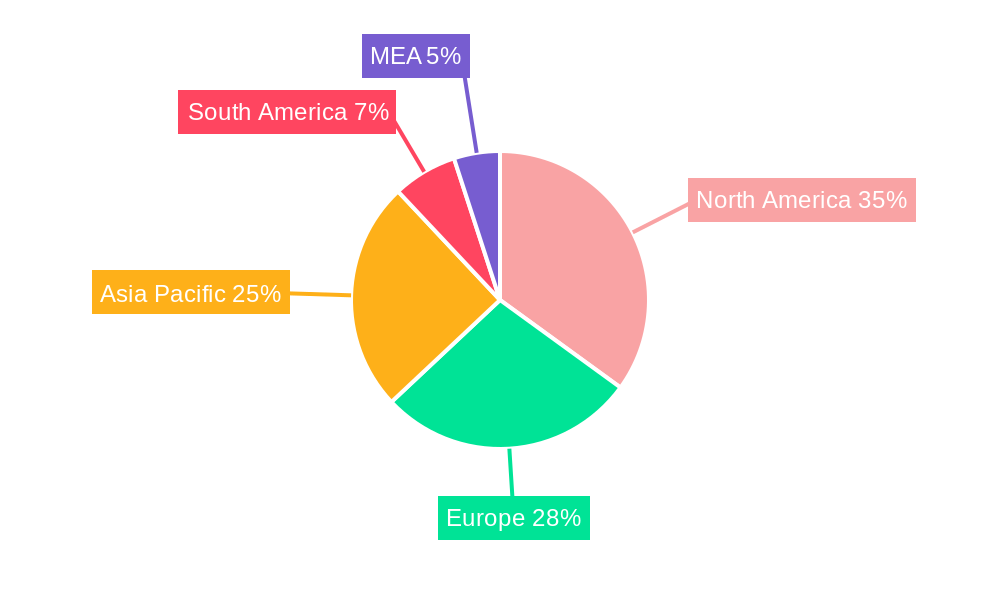

The North American market currently holds a significant share, reflecting high technological adoption rates and a robust retail infrastructure. However, rapid growth is anticipated in the Asia-Pacific region, driven by increasing smartphone penetration, rising disposable incomes, and a burgeoning e-commerce sector. While the high initial investment costs for implementing gesture recognition systems present a restraint, the long-term return on investment in terms of improved customer experience, operational efficiency, and reduced labor costs is increasingly outweighing this hurdle. Furthermore, ongoing research and development efforts are focusing on enhancing accuracy, reducing costs, and expanding the functionalities of gesture recognition technology, promising further market expansion in the coming years. Competition is fierce, with established tech giants and specialized companies vying for market dominance. Future growth will likely be influenced by the successful integration of gesture recognition into augmented reality and virtual reality shopping experiences, further blurring the lines between the physical and digital retail landscapes.

Gesture Recognition in Retail Industry Company Market Share

Gesture Recognition in Retail Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Gesture Recognition in Retail Industry market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report focuses on two key parent markets: Human-Machine Interface (HMI) and Retail Technology, with child markets segmented by technology (Touch-based and Touchless Gesture Recognition). The market size is projected in million units.

Keywords: Gesture Recognition, Retail Technology, Touchless Gesture Recognition, Touch-based Gesture Recognition, Human-Machine Interface (HMI), Retail Automation, AI, Virtual Smart Sensors, Market Size, Market Share, CAGR, Market Growth, Infineon Technologies AG, Cognitec Systems GmbH, Crunchfish AB, Google LLC, GestureTek Inc, Microsoft Corporation, Omron Corporation, Elliptic Labs, Sony Corporation, Apple Inc, Intel Corporation.

Gesture Recognition in Retail Industry Market Dynamics & Structure

The Gesture Recognition in Retail Industry market exhibits a moderately concentrated structure, with key players like Infineon Technologies AG, Microsoft Corporation, and Apple Inc holding significant market share. However, the emergence of smaller, innovative companies is driving competition. Technological innovation, particularly in AI and machine learning, is a key driver, pushing the boundaries of accuracy and responsiveness. Regulatory frameworks related to data privacy and security influence market development, while the rising adoption of contactless technologies further fuels growth. Existing technologies like barcode scanners and POS systems act as competitive substitutes, but gesture recognition offers a more streamlined and intuitive user experience. The market is driven by younger demographics who readily adopt new technologies. M&A activity is expected to remain moderate, with strategic acquisitions primarily focusing on enhancing technological capabilities and expanding market reach. The total M&A deals closed between 2019-2024 are estimated at xx.

- Market Concentration: Moderately Concentrated

- Technological Innovation: AI, Machine Learning, Enhanced Accuracy

- Regulatory Frameworks: Data Privacy Regulations (GDPR, CCPA)

- Competitive Substitutes: Barcode Scanners, POS Systems

- End-User Demographics: Younger Generations (18-45 years) demonstrating higher adoption rates.

- M&A Trends: xx deals between 2019 and 2024, focusing on technology acquisition and market expansion.

Gesture Recognition in Retail Industry Growth Trends & Insights

The Gesture Recognition in Retail Industry market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including the increasing adoption of contactless technologies, rising consumer demand for seamless shopping experiences, and technological advancements leading to enhanced accuracy and reliability of gesture recognition systems. The market size in 2024 was estimated at xx million units. The forecast period (2025-2033) projects continued expansion, driven by the increasing integration of gesture recognition into various retail applications, such as self-checkout kiosks, interactive displays, and inventory management systems. Technological disruptions, such as the integration of AI and computer vision, will further propel market growth. Consumer behavior shifts toward personalized and contactless shopping experiences are key factors boosting adoption rates. Market penetration is anticipated to reach xx% by 2033. The forecasted market size for 2033 is projected at xx million units.

Dominant Regions, Countries, or Segments in Gesture Recognition in Retail Industry

North America currently holds the leading position in the Gesture Recognition in Retail Industry market, driven by high technological adoption rates and a strong focus on enhancing customer experience in the retail sector. The region's robust technological infrastructure and the presence of major technology companies significantly contribute to its dominance. Within North America, the United States and Canada are experiencing rapid market growth due to favorable government policies and regulations supporting technological advancements and digitalization in retail. Europe is another rapidly growing market, fueled by increasing adoption of smart retail solutions and rising investments in technology across major economies like Germany, the UK, and France. Asia Pacific is also expected to witness significant growth driven by increasing smartphone penetration, rising disposable incomes and a large base of retail businesses eager to improve customer engagement through innovative technologies. Touchless gesture recognition is experiencing faster growth compared to touch-based technology due to hygiene concerns and the desire for contactless interactions, particularly post-pandemic.

- Key Drivers in North America: Strong technological infrastructure, high consumer adoption rates, presence of major tech companies.

- Key Drivers in Europe: Investment in smart retail technologies, favorable government policies.

- Key Drivers in Asia Pacific: High smartphone penetration, rising disposable income, large retail sector.

- Technology Segment Growth: Touchless Gesture Recognition showing faster growth due to hygiene concerns and contactless interaction preferences.

Gesture Recognition in Retail Industry Product Landscape

The Gesture Recognition in Retail Industry boasts a diverse product landscape, ranging from simple touch-based systems for interactive kiosks to sophisticated AI-powered touchless solutions offering advanced features like 3D gesture recognition and personalized interactions. These systems incorporate various technologies, including computer vision, machine learning, and deep learning algorithms, providing high accuracy and responsiveness. The unique selling propositions often center on ease of use, enhanced customer experience, and improved efficiency in retail operations. Technological advancements focus on increasing accuracy in challenging environments, reducing latency, and enhancing security.

Key Drivers, Barriers & Challenges in Gesture Recognition in Retail Industry

Key Drivers: The primary drivers are the increasing demand for contactless interactions post-pandemic, advancements in AI and machine learning, and the need for enhanced customer engagement in the retail sector. Government initiatives promoting digitalization in retail also contribute. For example, many governments are incentivizing contactless payments and technology upgrades.

Key Challenges and Restraints: High implementation costs for retailers can hinder adoption, especially for smaller businesses. Data security and privacy concerns are significant barriers, influencing regulatory requirements and consumer trust. The need for robust and reliable technology that functions accurately across various environments and conditions poses a technical challenge. Supply chain disruptions and component shortages can also impact market growth. These factors collectively could reduce market growth by xx% in the coming years.

Emerging Opportunities in Gesture Recognition in Retail Industry

Emerging opportunities lie in the integration of gesture recognition into augmented reality (AR) and virtual reality (VR) shopping experiences, personalized recommendations based on gesture analysis, and advanced inventory management systems. The growing adoption of smart shelves and interactive displays presents opportunities for incorporating gesture-based interactions. Expansion into untapped markets, especially in developing economies, holds significant growth potential.

Growth Accelerators in the Gesture Recognition in Retail Industry Industry

Strategic partnerships between technology providers and retailers are crucial accelerators, facilitating seamless integration of gesture recognition solutions into existing retail infrastructure. Technological breakthroughs, particularly in improving accuracy and reducing latency, will drive widespread adoption. Market expansion strategies focused on targeting smaller businesses and expanding into new geographic regions are vital for sustaining growth.

Key Players Shaping the Gesture Recognition in Retail Industry Market

Notable Milestones in Gesture Recognition in Retail Industry Sector

- March 2023: Sohar University researchers developed a hand gesture detection system using neural networks, image processing, and IoT, translating hand motions into text and audio. This signifies progress in accessible gesture recognition technology.

- March 2022: Elliptic Labs partnered with AMD to integrate its AI Virtual Smart Sensor Platform into AMD Ryzen PRO 5000 Series laptops, enabling features like 3D touchless gesture recognition. This collaboration broadened touchless technology's reach to a wider market.

In-Depth Gesture Recognition in Retail Industry Market Outlook

The future of the Gesture Recognition in Retail Industry market looks promising, with continued growth driven by technological advancements, increasing demand for seamless customer experiences, and expansion into new applications. Strategic partnerships and market expansion initiatives will play a crucial role in unlocking the full potential of this market. The focus on enhancing accuracy, reliability, and security of gesture recognition systems will further drive adoption, leading to significant growth over the forecast period.

Gesture Recognition in Retail Industry Segmentation

-

1. Technology

- 1.1. Touch-based Gesture Recognition

- 1.2. Touch-less Gesture Recognition

Gesture Recognition in Retail Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Gesture Recognition in Retail Industry Regional Market Share

Geographic Coverage of Gesture Recognition in Retail Industry

Gesture Recognition in Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Dependence on Gestures to Communicate with Machines; Increasing Use of Devices Supporting Gesture Recognition Across the Retail Sector

- 3.3. Market Restrains

- 3.3.1 Algorithms

- 3.3.2 Mathematical and Other Complexities Associated with the Gesture Recognition Technology

- 3.4. Market Trends

- 3.4.1. Touchless Technology is Expected to hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Touch-based Gesture Recognition

- 5.1.2. Touch-less Gesture Recognition

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Touch-based Gesture Recognition

- 6.1.2. Touch-less Gesture Recognition

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Touch-based Gesture Recognition

- 7.1.2. Touch-less Gesture Recognition

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Touch-based Gesture Recognition

- 8.1.2. Touch-less Gesture Recognition

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Touch-based Gesture Recognition

- 9.1.2. Touch-less Gesture Recognition

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Gesture Recognition in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Touch-based Gesture Recognition

- 10.1.2. Touch-less Gesture Recognition

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cognitec Systems GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Crunchfish AB

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GestureTek Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Omron Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elliptic Labs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sony Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Intel Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Gesture Recognition in Retail Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gesture Recognition in Retail Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Gesture Recognition in Retail Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Gesture Recognition in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Gesture Recognition in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Gesture Recognition in Retail Industry Revenue (Million), by Technology 2025 & 2033

- Figure 7: Europe Gesture Recognition in Retail Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Europe Gesture Recognition in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Gesture Recognition in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Gesture Recognition in Retail Industry Revenue (Million), by Technology 2025 & 2033

- Figure 11: Asia Pacific Gesture Recognition in Retail Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Asia Pacific Gesture Recognition in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Gesture Recognition in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Gesture Recognition in Retail Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Latin America Gesture Recognition in Retail Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Latin America Gesture Recognition in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Gesture Recognition in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Gesture Recognition in Retail Industry Revenue (Million), by Technology 2025 & 2033

- Figure 19: Middle East Gesture Recognition in Retail Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East Gesture Recognition in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Gesture Recognition in Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Gesture Recognition in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gesture Recognition in Retail Industry?

The projected CAGR is approximately 17.26%.

2. Which companies are prominent players in the Gesture Recognition in Retail Industry?

Key companies in the market include Infineon Technologies AG, Cognitec Systems GmbH, Crunchfish AB, Google LLC, GestureTek Inc, Microsoft Corporation, Omron Corporation, Elliptic Labs, Sony Corporation, Apple Inc, Intel Corporation.

3. What are the main segments of the Gesture Recognition in Retail Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Dependence on Gestures to Communicate with Machines; Increasing Use of Devices Supporting Gesture Recognition Across the Retail Sector.

6. What are the notable trends driving market growth?

Touchless Technology is Expected to hold the Major Share.

7. Are there any restraints impacting market growth?

Algorithms. Mathematical and Other Complexities Associated with the Gesture Recognition Technology.

8. Can you provide examples of recent developments in the market?

March 2023: Sohar University researchers created a hand gesture detection system based on neural networks, image processing techniques, and the Internet of Things. The device identifies hand motions and converts them to written text and audio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gesture Recognition in Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gesture Recognition in Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gesture Recognition in Retail Industry?

To stay informed about further developments, trends, and reports in the Gesture Recognition in Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence