Key Insights

The French ceramic tiles market is projected for robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 6.2%. With a current market size valued at 78.88 billion Euros in the base year 2025, this expansion is propelled by consistent demand for aesthetic and durable surfacing solutions in both residential and commercial applications. Key growth drivers include extensive renovation projects and the increasing preference for glazed and porcelain tiles, recognized for their design flexibility, resilience, and low maintenance. A growing consumer focus on scratch-resistant and long-lasting surfaces further bolsters market performance. The construction sector, a primary demand driver, continues to fuel market expansion through new builds and significant investments in property refurbishment.

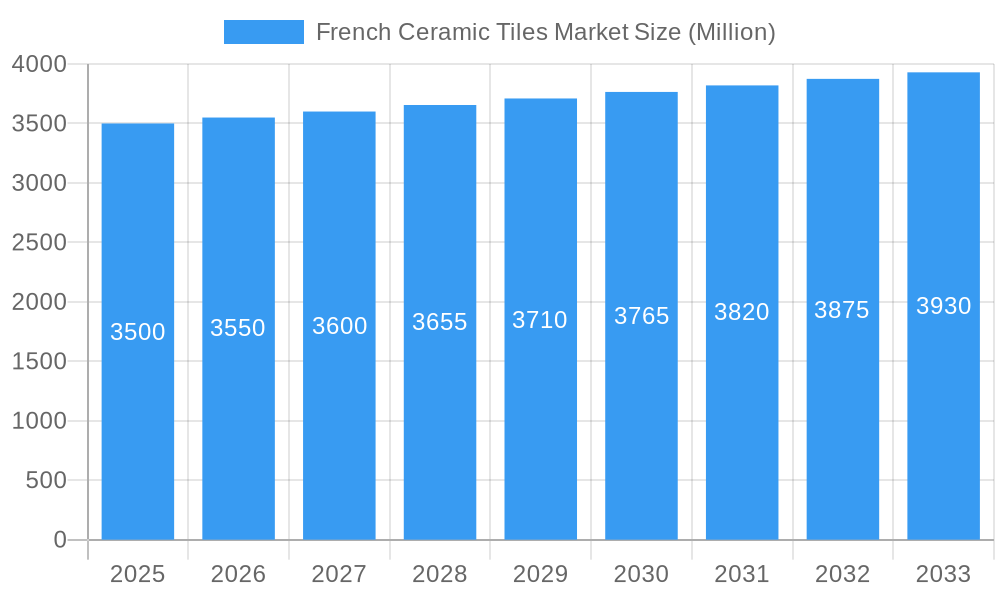

French Ceramic Tiles Market Market Size (In Billion)

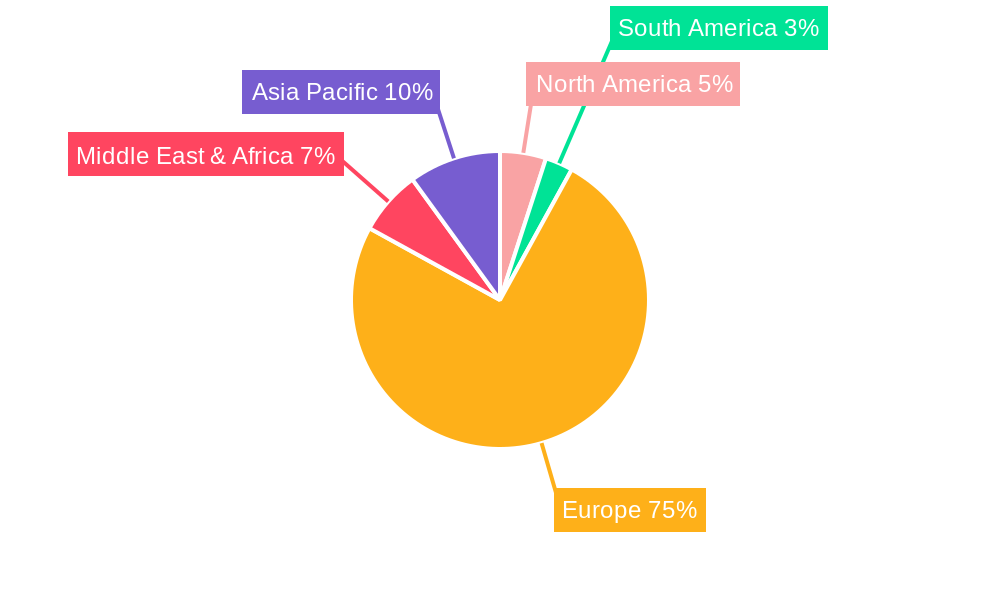

The market is segmented by product type, with glazed and porcelain tiles leading due to their broad utility and aesthetic appeal. Floor tiles constitute the largest application segment, followed by wall tiles, addressing diverse architectural and interior design requirements. Demand is balanced between new constructions and the substantial replacement and renovation segment, indicating a mature yet active market. Residential end-users, influenced by home improvement trends and new housing developments, represent a significant market share, while the commercial sector, including retail, hospitality, and office spaces, also contributes substantially. Geographically, Europe, with France at its forefront, holds a dominant position, supported by a well-established construction industry and discerning consumers. Potential restraints may arise from fluctuating raw material costs and competition from alternative surfacing materials; however, the inherent durability and aesthetic advantages of ceramic tiles are expected to maintain their strong market standing.

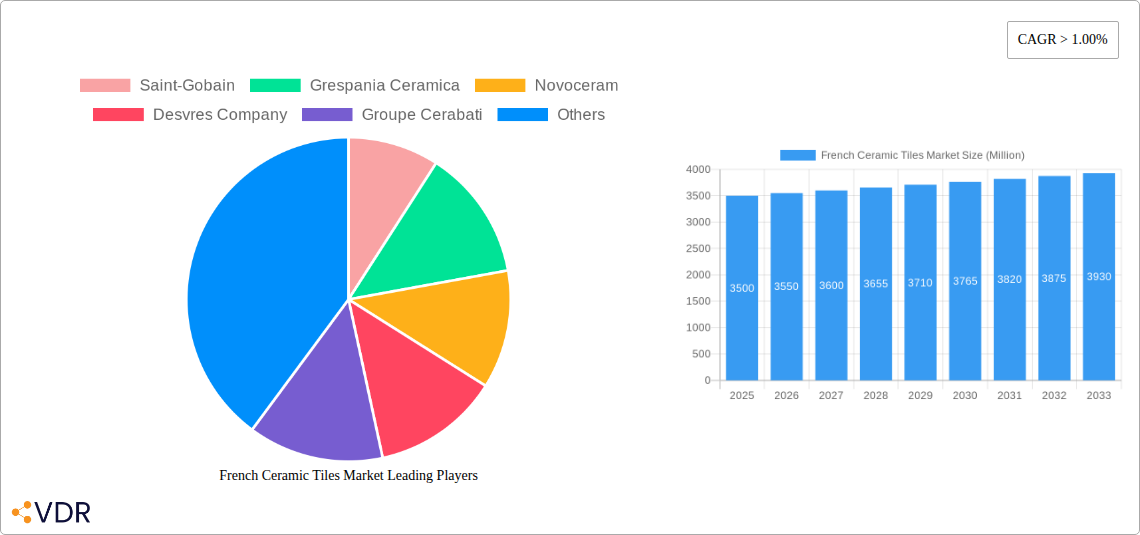

French Ceramic Tiles Market Company Market Share

This report delivers an in-depth analysis of the French ceramic tiles market, a dynamic sector shaped by innovation, sustainability, and evolving consumer preferences. We examine market dynamics, structure, concentration, key technological drivers, and evolving regulatory frameworks influencing the industry. Understand the impact of competitive substitutes, shifting end-user demographics, and crucial M&A trends reshaping the competitive landscape. This report provides quantitative insights into market share percentages and M&A deal volumes, alongside qualitative factors illuminating innovation barriers, essential for stakeholders navigating this complex market.

French Ceramic Tiles Market Market Dynamics & Structure

The French ceramic tiles market is characterized by a blend of established players and emerging innovators, contributing to a moderate market concentration. Technological innovation is primarily driven by the pursuit of enhanced durability, aesthetic appeal, and sustainable manufacturing processes. Key advancements include the development of scratch-free and ultra-large format tiles, catering to sophisticated design requirements in both residential and commercial applications. The regulatory framework within France, aligned with broader EU directives, emphasizes environmental sustainability and product safety, influencing material sourcing and manufacturing standards. The market faces competition from alternative flooring solutions such as natural stone, LVT, and SPC, requiring continuous innovation to maintain market share. End-user demographics are increasingly sophisticated, with a growing demand for aesthetically pleasing, low-maintenance, and eco-friendly ceramic tile solutions for floor tiles and wall tiles. M&A trends are evident as larger conglomerates seek to consolidate their market position and expand their product portfolios, further influencing market structure. For instance, the strategic acquisition of smaller, specialized manufacturers can enhance technological capabilities and broaden distribution networks, driving market share percentages for acquiring entities. Innovation barriers are often linked to high capital investment for advanced production machinery and stringent certification processes for new product introductions.

- Market Concentration: Moderate, with a mix of multinational corporations and specialized domestic producers.

- Technological Innovation Drivers: Focus on durability, aesthetics, sustainability, and digital printing for intricate designs.

- Regulatory Frameworks: Adherence to EU environmental and safety standards, promoting sustainable practices.

- Competitive Product Substitutes: Natural stone, luxury vinyl tile (LVT), stone plastic composite (SPC), and engineered wood.

- End-User Demographics: Growing demand for high-performance, design-forward, and sustainable options across residential, commercial, and industry sectors.

- M&A Trends: Consolidation of market share, acquisition of innovative technologies, and expansion of distribution channels.

French Ceramic Tiles Market Growth Trends & Insights

The French ceramic tiles market is poised for robust growth, driven by increasing construction activities and a heightened consumer focus on home aesthetics and durability. Projections indicate a steady upward trajectory in market size evolution, fueled by a significant CAGR of approximately 4.5% over the forecast period of 2025–2033. The adoption rates for advanced ceramic tiles, particularly porcelain and scratch-free variants, are accelerating as consumers recognize their superior performance and longevity compared to conventional options. Technological disruptions, such as advancements in digital inkjet printing and the development of eco-friendly manufacturing processes, are significantly influencing product offerings and consumer choices. Consumer behavior shifts are leaning towards sustainable and high-performance materials that enhance living and working spaces. The demand for large-format tiles, mimicking natural stone and wood textures with enhanced durability, is particularly strong in both new construction and replacement & renovation projects. The integration of smart technologies, though nascent, presents a future avenue for growth, with potential for tiles that offer enhanced functionality. The market penetration of premium ceramic tiles is expected to rise, reflecting an increased disposable income and a growing appreciation for quality and design. The growth trends are further supported by government initiatives promoting energy-efficient buildings and sustainable construction practices. The increasing popularity of DIY home improvement projects also contributes to the sustained demand for high-quality floor tiles and wall tiles.

Dominant Regions, Countries, or Segments in French Ceramic Tiles Market

Within the French ceramic tiles market, the Residential end-user segment demonstrates a commanding dominance, driven by ongoing construction and renovation activities across the nation. France's thriving real estate sector, coupled with a consistent demand for aesthetically pleasing and durable home interiors, positions the Residential segment as the primary growth engine. This is further amplified by a strong cultural emphasis on home design and renovation, leading to higher per capita expenditure on interior finishing materials. The New Construction type further bolsters this dominance, as developers integrate modern ceramic tile solutions into new housing projects to meet evolving buyer preferences. The Porcelain product segment is a significant contributor to this dominance, valued for its exceptional durability, water resistance, and versatility, making it an ideal choice for various applications, including high-traffic floor tiles and stylish wall tiles.

- Dominant End-User: Residential sector, accounting for an estimated 65% of the total market share, driven by home renovation and new housing developments.

- Key Application Drivers: Floor Tiles and Wall Tiles represent the largest application segments within the residential sphere, catering to kitchens, bathrooms, living areas, and exteriors.

- Leading Product Segment: Porcelain tiles, known for their durability and aesthetic versatility, capture approximately 40% of the product market share, followed closely by Glazed tiles.

- Construction Type Influence: New Construction projects are instrumental, contributing an estimated 55% to the overall demand, while Replacement & Renovation projects account for the remaining 45%.

- Economic Policies: Government incentives for homeownership and renovation, coupled with favorable interest rates for mortgages, stimulate demand in the Residential sector.

- Infrastructure Development: While more impactful on Commercial and Industry segments, infrastructure improvements indirectly support economic growth, boosting disposable income for Residential upgrades.

- Consumer Preferences: A rising preference for low-maintenance, aesthetically appealing, and sustainable materials in homes significantly drives the demand for advanced ceramic tiles.

French Ceramic Tiles Market Product Landscape

The French ceramic tiles market product landscape is defined by continuous innovation and diversification. Leading manufacturers are focusing on developing scratch-free and stain-resistant finishes, significantly enhancing product durability and longevity. The advent of advanced digital printing technologies allows for the replication of natural materials like wood, marble, and stone with unparalleled realism, offering a wide range of aesthetic possibilities for both floor tiles and wall tiles. Large-format slabs are gaining traction, providing seamless installations and a more modern, minimalist appeal. Furthermore, the industry is witnessing a growing emphasis on sustainable production methods, with manufacturers exploring recycled materials and energy-efficient manufacturing processes. The performance metrics of modern ceramic tiles, including high breaking strength, low water absorption, and excellent frost resistance, continue to set them apart from alternative materials.

Key Drivers, Barriers & Challenges in French Ceramic Tiles Market

The French ceramic tiles market is propelled by several key drivers. A burgeoning residential construction sector, coupled with sustained replacement & renovation activities, forms the bedrock of demand. Growing consumer preference for durable, aesthetically appealing, and low-maintenance flooring and wall coverings, particularly porcelain and scratch-free variants, acts as a significant catalyst. Technological advancements in digital printing and manufacturing processes enable greater design flexibility and product innovation, meeting evolving market demands. Furthermore, an increasing focus on sustainable building practices and eco-friendly materials aligns with the inherent sustainability of ceramic tiles.

However, the market faces notable barriers and challenges. The high initial investment cost for state-of-the-art manufacturing equipment can be a deterrent for smaller players. Intense competition from imported tiles, particularly from lower-cost manufacturing regions, exerts downward pressure on prices. Fluctuations in raw material prices, such as clay and energy costs, can impact profit margins. Stringent environmental regulations, while promoting sustainability, can also increase operational costs. Additionally, the availability of alternative flooring materials like LVT and SPC presents a continuous competitive threat.

Emerging Opportunities in French Ceramic Tiles Market

Emerging opportunities in the French ceramic tiles market lie in the growing demand for large-format tiles and thin porcelain slabs, which offer superior aesthetics and installation benefits for both residential and commercial projects. The trend towards sustainable living is driving interest in ceramic tiles produced using recycled materials and eco-friendly manufacturing processes, presenting a significant opportunity for environmentally conscious brands. Furthermore, the integration of digital printing technology opens avenues for highly customized and artistic tile designs, catering to niche markets and luxury segments. The increasing adoption of smart home technology also presents potential for innovation in areas like integrated heating or self-cleaning surfaces.

Growth Accelerators in the French Ceramic Tiles Market Industry

Several catalysts are accelerating the growth of the French ceramic tiles market. Technological breakthroughs in digital printing and glaze application are enabling manufacturers to create highly realistic imitations of natural materials, expanding design possibilities and consumer appeal. Strategic partnerships between tile manufacturers and architects or interior designers are crucial for driving product innovation and market penetration. The ongoing global emphasis on sustainable construction and renovation is a significant growth accelerator, as ceramic tiles are inherently durable and can be produced with a lower environmental footprint than many alternatives. Expansion into untapped segments, such as specialized industrial applications or the growing demand for outdoor living spaces, also presents substantial growth potential.

Key Players Shaping the French Ceramic Tiles Market Market

- Saint-Gobain

- Grespania Ceramica

- Novoceram

- Desvres Company

- Groupe Cerabati

- Porcelanosa Group

- Marazzi Group

- Diffusion Ceramique

- Sembach Technical Ceramics

- Keros Ceramica

Notable Milestones in French Ceramic Tiles Market Sector

- November 2022: The Spanish Ceramic Tile Manufacturer's Association announced plans to launch its region-centric ceramic tile brand -Tile of Spain - across the GCC region amid a burgeoning demand for sustainable living and working spaces in the region.

- April 2022: Saint-Gobain Group has agreed to sell Tadmar, its Polish distribution brand specialized in plumbing, heating, and sanitaryware products, to the Polish company 3W.

- February 2022: Grespania, The manufacturer of ceramic products, large-format slabs, and sintered stone for kitchen countertops, expanded its distribution network with a new showcase in Madrid, Spain, and expands its reach with a new sales location in Spain.

In-Depth French Ceramic Tiles Market Market Outlook

The French ceramic tiles market outlook is exceptionally positive, fueled by persistent demand for high-quality, aesthetically pleasing, and sustainable building materials. The continued expansion of the residential construction and replacement & renovation sectors will remain a primary growth driver. Innovations in digital printing and the increasing popularity of large-format porcelain tiles are expected to shape product development and consumer preferences. The global shift towards eco-friendly construction practices further augments the market's potential, with a growing emphasis on tiles produced from recycled materials and through energy-efficient processes. Strategic collaborations and market expansion into burgeoning segments like outdoor tiling and specialized industrial applications will be key to unlocking future growth. The market is well-positioned for sustained expansion, driven by technological advancements and evolving consumer demands for durable and beautiful interior and exterior finishes.

French Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Others

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User

- 4.1. Residential

- 4.2. Commercial

French Ceramic Tiles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

French Ceramic Tiles Market Regional Market Share

Geographic Coverage of French Ceramic Tiles Market

French Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions

- 3.4. Market Trends

- 3.4.1. Real Estate Investment is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific French Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Saint-Gobain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Grespania Ceramica

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novoceram

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Desvres Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Groupe Cerabati

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Porcelanosa Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marazzi Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Diffusion Ceramique

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sembach Technical Ceramics**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Keros Ceramica

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Saint-Gobain

List of Figures

- Figure 1: Global French Ceramic Tiles Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America French Ceramic Tiles Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America French Ceramic Tiles Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America French Ceramic Tiles Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America French Ceramic Tiles Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America French Ceramic Tiles Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 7: North America French Ceramic Tiles Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 8: North America French Ceramic Tiles Market Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America French Ceramic Tiles Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America French Ceramic Tiles Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America French Ceramic Tiles Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America French Ceramic Tiles Market Revenue (billion), by Product 2025 & 2033

- Figure 13: South America French Ceramic Tiles Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America French Ceramic Tiles Market Revenue (billion), by Application 2025 & 2033

- Figure 15: South America French Ceramic Tiles Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America French Ceramic Tiles Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 17: South America French Ceramic Tiles Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 18: South America French Ceramic Tiles Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America French Ceramic Tiles Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America French Ceramic Tiles Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America French Ceramic Tiles Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe French Ceramic Tiles Market Revenue (billion), by Product 2025 & 2033

- Figure 23: Europe French Ceramic Tiles Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: Europe French Ceramic Tiles Market Revenue (billion), by Application 2025 & 2033

- Figure 25: Europe French Ceramic Tiles Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe French Ceramic Tiles Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 27: Europe French Ceramic Tiles Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Europe French Ceramic Tiles Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe French Ceramic Tiles Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe French Ceramic Tiles Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe French Ceramic Tiles Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa French Ceramic Tiles Market Revenue (billion), by Product 2025 & 2033

- Figure 33: Middle East & Africa French Ceramic Tiles Market Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East & Africa French Ceramic Tiles Market Revenue (billion), by Application 2025 & 2033

- Figure 35: Middle East & Africa French Ceramic Tiles Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East & Africa French Ceramic Tiles Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 37: Middle East & Africa French Ceramic Tiles Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 38: Middle East & Africa French Ceramic Tiles Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa French Ceramic Tiles Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa French Ceramic Tiles Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa French Ceramic Tiles Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific French Ceramic Tiles Market Revenue (billion), by Product 2025 & 2033

- Figure 43: Asia Pacific French Ceramic Tiles Market Revenue Share (%), by Product 2025 & 2033

- Figure 44: Asia Pacific French Ceramic Tiles Market Revenue (billion), by Application 2025 & 2033

- Figure 45: Asia Pacific French Ceramic Tiles Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific French Ceramic Tiles Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 47: Asia Pacific French Ceramic Tiles Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 48: Asia Pacific French Ceramic Tiles Market Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific French Ceramic Tiles Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific French Ceramic Tiles Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific French Ceramic Tiles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 4: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global French Ceramic Tiles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 9: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global French Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 17: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global French Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 25: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global French Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 37: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 39: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global French Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global French Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 48: Global French Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 49: Global French Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 50: Global French Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global French Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific French Ceramic Tiles Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the French Ceramic Tiles Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the French Ceramic Tiles Market?

Key companies in the market include Saint-Gobain, Grespania Ceramica, Novoceram, Desvres Company, Groupe Cerabati, Porcelanosa Group, Marazzi Group, Diffusion Ceramique, Sembach Technical Ceramics**List Not Exhaustive, Keros Ceramica.

3. What are the main segments of the French Ceramic Tiles Market?

The market segments include Product, Application, Construction Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency.

6. What are the notable trends driving market growth?

Real Estate Investment is Driving the Market.

7. Are there any restraints impacting market growth?

Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions.

8. Can you provide examples of recent developments in the market?

November 2022 - The Spanish Ceramic Tile Manufacturer's Association announced plans to launch its region-centric ceramic tile brand -Tile of Spain - across the GCC region amid a burgeoning demand for sustainable living and working spaces in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "French Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the French Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the French Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the French Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence