Key Insights

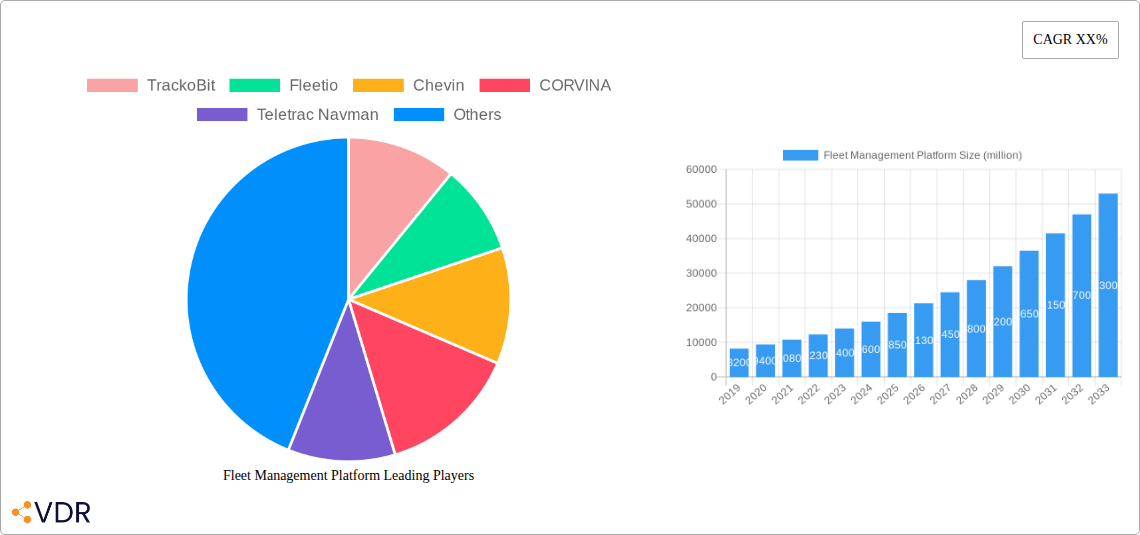

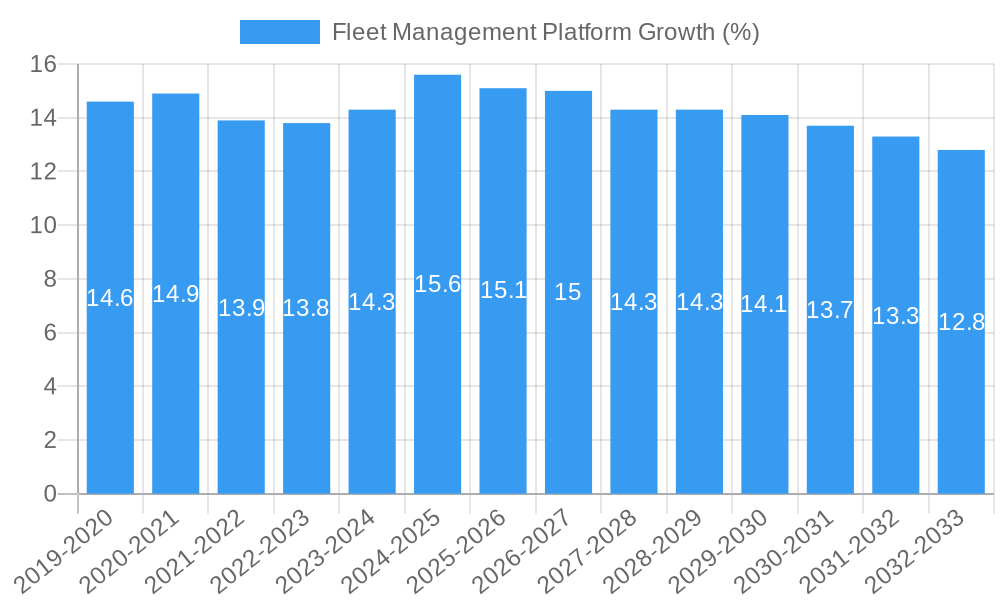

The global Fleet Management Platform market is experiencing robust growth, projected to reach an estimated market size of $18,500 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 15%. This expansion is fueled by the increasing need for operational efficiency, cost reduction, and enhanced safety across various industries. The logistical complexities of modern supply chains, coupled with stricter regulatory compliance, necessitate sophisticated fleet management solutions. The integration of advanced technologies such as AI, IoT, and telematics is revolutionizing how fleets are managed, enabling real-time tracking, predictive maintenance, and optimized routing. Key applications like Logistics and Transportation are leading this adoption, leveraging these platforms to streamline operations, reduce fuel consumption, and improve delivery times. The architectural sector also shows significant potential as construction projects become more complex and require efficient management of heavy machinery and material transport.

The market's trajectory is further bolstered by the growing emphasis on sustainability and environmental regulations, pushing companies to adopt greener fleet practices. Fleet maintenance is a crucial segment, with platforms offering tools for proactive upkeep, thereby minimizing downtime and extending vehicle lifespan. While the market presents immense opportunities, certain restraints, such as the initial investment costs for some advanced solutions and concerns surrounding data privacy and security, need to be addressed. However, the continuous innovation in software development and the increasing availability of scalable, cloud-based solutions are mitigating these challenges. Leading companies are actively investing in research and development, introducing feature-rich platforms that cater to diverse fleet sizes and operational needs, ensuring sustained market expansion throughout the forecast period up to 2033.

Fleet Management Platform Market Dynamics & Structure

The global Fleet Management Platform market is characterized by a dynamic competitive landscape, with significant market concentration driven by technological innovation and strategic mergers and acquisitions. Leading companies like Geotab, Webfleet, and Platform Science are actively investing in advanced telematics, AI-powered analytics, and IoT integrations to enhance fleet efficiency and safety. Regulatory frameworks, particularly concerning emissions standards and driver behavior monitoring, are increasingly influencing platform development and adoption. Competitive product substitutes, including manual tracking methods and less integrated software solutions, are gradually being overshadowed by comprehensive platform offerings. End-user demographics span diverse sectors, from large logistics and transportation conglomerates to smaller utility and construction firms, each with unique operational needs driving platform customization. M&A trends are on the rise, with larger players acquiring innovative startups to expand their technological capabilities and market reach. The market is expected to see a substantial increase in deal volumes in the coming years as companies seek to consolidate their positions. Innovation barriers include the high cost of advanced hardware integration and the need for robust cybersecurity measures to protect sensitive fleet data.

- Market Concentration: Moderate to High, with key players holding significant shares.

- Technological Innovation Drivers: AI, IoT, Big Data Analytics, Predictive Maintenance, Real-time Tracking, Electric Vehicle (EV) Integration.

- Regulatory Frameworks: Emissions mandates, driver safety regulations, data privacy laws.

- Competitive Product Substitutes: Basic GPS trackers, manual logs, standalone dispatch software.

- End-User Demographics: Logistics & Transportation (70% of market), Public Utility (15%), Others (15%).

- M&A Trends: Increasing consolidation, acquisition of niche technology providers.

Fleet Management Platform Growth Trends & Insights

The Fleet Management Platform market is poised for robust expansion, driven by the escalating need for operational efficiency, cost reduction, and enhanced safety across a multitude of industries. The global market size is projected to reach approximately $35,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 14.5% from the base year of 2025. Adoption rates are surging as businesses recognize the tangible benefits of integrated fleet management solutions, moving beyond basic telematics to embrace comprehensive platforms offering advanced analytics and automation. Technological disruptions are a constant, with the integration of AI for predictive maintenance, route optimization powered by real-time traffic data, and the increasing adoption of Electric Vehicles (EVs) requiring specialized management features. Consumer behavior shifts are also playing a crucial role; fleet managers are demanding more intuitive user interfaces, mobile accessibility, and sophisticated reporting capabilities to make data-driven decisions. The historical period from 2019-2024 saw steady growth, with market penetration expanding from roughly 35% to an estimated 50% by the end of 2024. This trend is expected to accelerate, with market penetration potentially reaching over 75% by 2033. The focus is shifting from merely tracking assets to actively optimizing entire fleet operations, leading to significant improvements in fuel efficiency (estimated 10-15% reduction), reduced maintenance costs (estimated 15-20% decrease), and enhanced driver safety records (estimated 20-25% improvement). The rise of integrated platforms that offer a holistic view of fleet performance, driver behavior, and vehicle health is a testament to this evolving market landscape.

Dominant Regions, Countries, or Segments in Fleet Management Platform

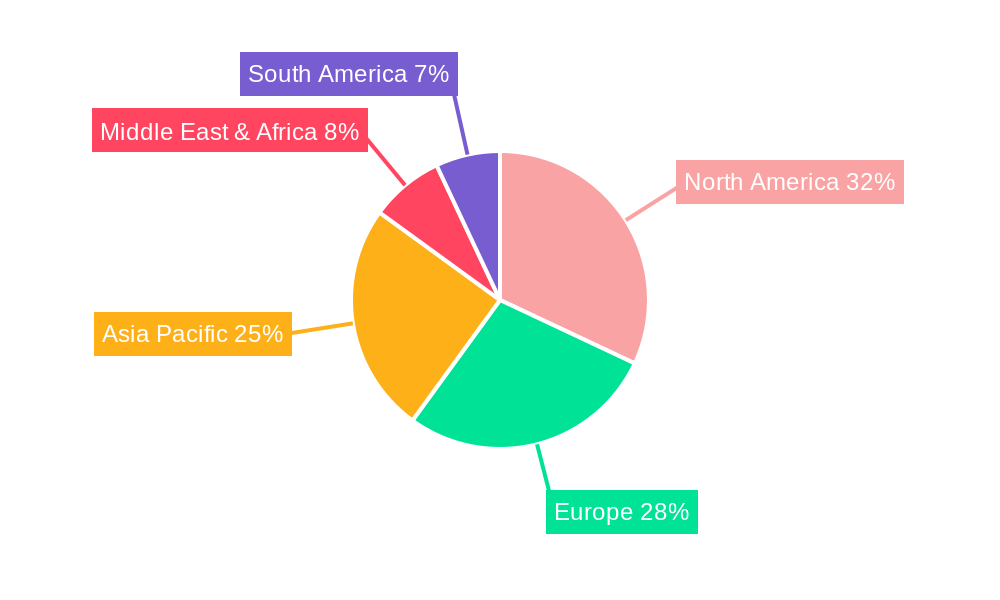

The Logistics and Transportation segment within the Application category is unequivocally the dominant force driving growth in the global Fleet Management Platform market. This segment is expected to account for a substantial market share, projected at 70% of the total market value by 2025, and continue its lead throughout the forecast period. The sheer volume of commercial vehicles, complex supply chains, and the critical need for efficient route planning, real-time tracking, and delivery optimization in this sector makes fleet management platforms indispensable. North America, particularly the United States, consistently emerges as a leading country due to its extensive logistics infrastructure, high adoption of advanced technologies, and a significant number of large fleet operators. Economic policies supporting trade and efficient transportation, coupled with substantial investments in smart city initiatives and intelligent transportation systems, further bolster its dominance. The Fleet Operation type is intrinsically linked to the dominance of Logistics and Transportation, encompassing core functionalities such as dispatching, routing, driver management, and real-time monitoring. This type is anticipated to hold over 60% of the market share within the "Types" segment. Key drivers for this segment's growth include the relentless pursuit of fuel efficiency, the imperative to comply with evolving Hours of Service (HoS) regulations, and the demand for enhanced visibility across the entire supply chain. The integration of telematics data with AI-powered predictive analytics for proactive maintenance and the growing adoption of Electric Vehicles (EVs) are further accelerating the need for sophisticated fleet operation platforms. Countries like Germany and the UK in Europe also exhibit strong growth due to robust trucking industries and stringent regulatory environments. Asia Pacific, with its rapidly expanding e-commerce sector and manufacturing output, presents a significant and rapidly growing market, albeit with a more fragmented adoption curve currently.

Fleet Management Platform Product Landscape

The product landscape of Fleet Management Platforms is continuously evolving, with a strong emphasis on integrating Artificial Intelligence (AI), Internet of Things (IoT), and advanced data analytics. Innovations focus on delivering real-time vehicle diagnostics, predictive maintenance alerts, and AI-driven route optimization to minimize downtime and fuel consumption, estimated at a 12% improvement in efficiency. Enhanced driver behavior monitoring, including fatigue detection and safe driving scoring, is a critical feature, contributing to a projected 18% reduction in accidents. Unique selling propositions often revolve around seamless integration with other business systems, mobile-first user experiences, and specialized modules for Electric Vehicle (EV) fleet management, including charging station monitoring and battery health analysis. Technological advancements are also pushing towards greater automation of administrative tasks, such as compliance reporting and invoice processing.

Key Drivers, Barriers & Challenges in Fleet Management Platform

Key Drivers:

- Technological Advancements: The integration of AI, IoT, and Big Data analytics enables predictive maintenance, optimized routing, and real-time visibility, driving efficiency.

- Cost Reduction Imperative: Businesses are increasingly focused on reducing operational expenses, including fuel, maintenance, and labor costs, making fleet management platforms a necessity.

- Enhanced Safety and Compliance: Stricter regulations on driver behavior, emissions, and safety standards necessitate advanced monitoring and reporting capabilities.

- Growing E-commerce and Logistics Demands: The surge in online retail and the complexity of modern supply chains drive the need for efficient and agile fleet operations.

Barriers & Challenges:

- High Initial Investment: The cost of hardware installation, software subscriptions, and training can be a significant barrier, especially for small and medium-sized enterprises.

- Data Security and Privacy Concerns: Managing vast amounts of sensitive fleet and driver data requires robust cybersecurity measures, posing a challenge for some organizations.

- Integration Complexity: Integrating new fleet management platforms with existing legacy systems can be technically challenging and time-consuming.

- Resistance to Change: Driver and operational staff may resist the adoption of new technologies and workflows, requiring effective change management strategies. Supply chain disruptions impacting hardware availability can also pose short-term challenges, with potential delays of up to 20%.

Emerging Opportunities in Fleet Management Platform

Emerging opportunities lie in the burgeoning demand for specialized Electric Vehicle (EV) fleet management solutions, addressing unique challenges like charging infrastructure optimization and battery lifecycle management. The expansion of telematics into areas like asset tracking for non-vehicle assets and predictive maintenance for a wider range of industrial equipment presents untapped markets. Furthermore, the increasing adoption of IoT devices for real-time cargo monitoring, including temperature and humidity control, opens new avenues for integrated fleet management. The growing trend towards sustainability and ESG reporting creates a demand for platforms that can accurately measure and report on a fleet's environmental impact, driving demand for eco-friendly routing and fuel efficiency features.

Growth Accelerators in the Fleet Management Platform Industry

The Fleet Management Platform industry's long-term growth is significantly accelerated by continuous technological breakthroughs, particularly in AI for advanced analytics and machine learning. Strategic partnerships between platform providers and hardware manufacturers, as well as telecommunications companies, are crucial for seamless integration and expanded service offerings. Market expansion strategies targeting underserved regions and niche industry segments, such as last-mile delivery and specialized construction fleets, are also critical growth catalysts. The development of standardized APIs and open platforms fosters a more interconnected ecosystem, encouraging innovation and broader adoption across diverse fleet types.

Key Players Shaping the Fleet Management Platform Market

- TrackoBit

- Fleetio

- Chevin

- CORVINA

- Teletrac Navman

- RTA

- Gurtam

- Geotab

- Platform Science

- ToolSense

- IntelliSoft

- Azuga

- Webfleet

- Axelor

- FleetCheck

Notable Milestones in Fleet Management Platform Sector

- 2019: Increased adoption of AI for predictive maintenance, leading to an estimated 15% reduction in unexpected breakdowns.

- 2020: Launch of integrated EV fleet management solutions by major players like Webfleet and Geotab.

- 2021: Significant growth in M&A activity, with several smaller telematics providers acquired by larger entities.

- 2022: Introduction of advanced driver-assist systems (ADAS) integration within fleet management platforms, enhancing safety.

- 2023: Greater emphasis on sustainability features and ESG reporting capabilities within platforms, driven by regulatory pressures.

- 2024: Expansion of IoT capabilities for real-time cargo monitoring in specialized logistics segments.

In-Depth Fleet Management Platform Market Outlook

The future of the Fleet Management Platform market is exceptionally promising, fueled by ongoing digital transformation across industries. Growth accelerators such as advancements in AI, the increasing adoption of Electric Vehicles, and the demand for comprehensive data analytics will continue to shape the market's trajectory. Strategic partnerships and the expansion into new geographic and industry verticals will unlock further potential. The market is moving towards highly intelligent, integrated, and sustainable fleet operations, presenting significant opportunities for innovation and market leadership.

Fleet Management Platform Segmentation

-

1. Application

- 1.1. Architectural

- 1.2. Logistics and Transportation

- 1.3. Public Utility

- 1.4. Others

-

2. Types

- 2.1. Fleet Operation

- 2.2. Fleet Maintenance

- 2.3. Others

Fleet Management Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fleet Management Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Architectural

- 5.1.2. Logistics and Transportation

- 5.1.3. Public Utility

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fleet Operation

- 5.2.2. Fleet Maintenance

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Architectural

- 6.1.2. Logistics and Transportation

- 6.1.3. Public Utility

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fleet Operation

- 6.2.2. Fleet Maintenance

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Architectural

- 7.1.2. Logistics and Transportation

- 7.1.3. Public Utility

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fleet Operation

- 7.2.2. Fleet Maintenance

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Architectural

- 8.1.2. Logistics and Transportation

- 8.1.3. Public Utility

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fleet Operation

- 8.2.2. Fleet Maintenance

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Architectural

- 9.1.2. Logistics and Transportation

- 9.1.3. Public Utility

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fleet Operation

- 9.2.2. Fleet Maintenance

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fleet Management Platform Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Architectural

- 10.1.2. Logistics and Transportation

- 10.1.3. Public Utility

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fleet Operation

- 10.2.2. Fleet Maintenance

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TrackoBit

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fleetio

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CORVINA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teletrac Navman

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RTA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gurtam

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Geotab

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Platform Science

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ToolSense

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IntelliSoft

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Azuga

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Webfleet

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Axelor

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 FleetCheck

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 TrackoBit

List of Figures

- Figure 1: Global Fleet Management Platform Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fleet Management Platform Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fleet Management Platform Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fleet Management Platform Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fleet Management Platform Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fleet Management Platform Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fleet Management Platform Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fleet Management Platform Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fleet Management Platform Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fleet Management Platform Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fleet Management Platform Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fleet Management Platform Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fleet Management Platform Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fleet Management Platform Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fleet Management Platform Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fleet Management Platform Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fleet Management Platform Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fleet Management Platform Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fleet Management Platform Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fleet Management Platform Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fleet Management Platform Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fleet Management Platform Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fleet Management Platform Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fleet Management Platform Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fleet Management Platform Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fleet Management Platform Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fleet Management Platform Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fleet Management Platform Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fleet Management Platform Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fleet Management Platform Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fleet Management Platform Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fleet Management Platform Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fleet Management Platform Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fleet Management Platform Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fleet Management Platform Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fleet Management Platform Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fleet Management Platform Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fleet Management Platform Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fleet Management Platform Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fleet Management Platform Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fleet Management Platform Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fleet Management Platform?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fleet Management Platform?

Key companies in the market include TrackoBit, Fleetio, Chevin, CORVINA, Teletrac Navman, RTA, Gurtam, Geotab, Platform Science, ToolSense, IntelliSoft, Azuga, Webfleet, Axelor, FleetCheck.

3. What are the main segments of the Fleet Management Platform?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fleet Management Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fleet Management Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fleet Management Platform?

To stay informed about further developments, trends, and reports in the Fleet Management Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence