Key Insights

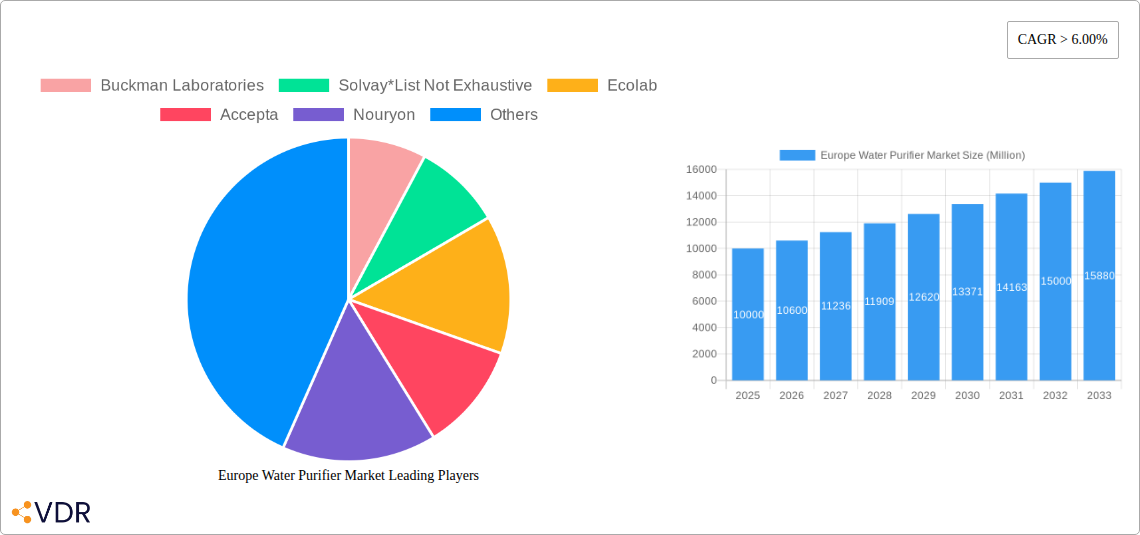

The European water purifier market, valued at approximately €10 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% through 2033. This expansion is driven by several key factors. Increasing environmental concerns regarding water quality, coupled with stringent regulatory standards across the region, are fueling demand for effective water purification solutions. The rise in industrialization and urbanization, particularly in major economies like Germany, France, and the UK, is further accelerating market growth as various end-use industries, including municipal water treatment, food and beverage processing, and power generation, require advanced water purification technologies. Technological advancements in membrane filtration (reverse osmosis, ultrafiltration, nanofiltration) are improving efficiency and reducing costs, making these solutions more accessible across various market segments. Moreover, rising consumer awareness regarding health benefits associated with purified water is driving adoption in residential settings.

Europe Water Purifier Market Market Size (In Billion)

The market is segmented by technology (microfiltration, ultrafiltration, nanofiltration, reverse osmosis) and end-user industry (municipal, pulp and paper, chemical, food and beverage, healthcare, power, and others). Reverse osmosis currently dominates due to its high efficiency in removing contaminants, but other technologies are gaining traction driven by specific application needs and cost-effectiveness. Germany, France, and the UK represent the largest national markets, benefiting from strong economies and established infrastructure. However, growth potential exists across other European nations, particularly as water scarcity issues become more pronounced and investments in water infrastructure increase. The competitive landscape is diverse, with established players like Solvay, Ecolab, and Suez alongside specialized companies offering innovative solutions. Continued industry consolidation and strategic partnerships can be expected as companies seek to expand their market share and product portfolios.

Europe Water Purifier Market Company Market Share

Europe Water Purifier Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Water Purifier Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report segments the market by technology (Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis) and end-user industry (Municipal, Pulp and Paper, Chemical, Food and Beverage, Healthcare, Power, Other End-user Industries). Market values are presented in million units.

Europe Water Purifier Market Dynamics & Structure

The European water purifier market is characterized by moderate concentration, with several large multinational companies and numerous smaller, specialized players. Technological innovation, driven by increasing demand for efficient and sustainable water treatment solutions, is a key market driver. Stringent regulatory frameworks regarding water quality further shape market dynamics. Competitive product substitutes, such as bottled water, present challenges, although the growing awareness of environmental sustainability is shifting consumer preference towards water purification systems. End-user demographics, particularly the rising urban population and industrial expansion, contribute to market growth. The market has witnessed several M&A activities in recent years, aiming at expanding market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Significant investments in R&D for advanced filtration technologies, including membrane-based systems and AI-powered monitoring.

- Regulatory Landscape: Stringent EU water quality regulations drive adoption of advanced purification technologies.

- Competitive Substitutes: Bottled water remains a competitor, but its environmental impact increasingly favors water purifiers.

- M&A Activity: xx major mergers and acquisitions recorded between 2019 and 2024, representing a total value of xx million units.

- Innovation Barriers: High initial investment costs for advanced technologies and lack of skilled labor can hinder innovation.

Europe Water Purifier Market Growth Trends & Insights

The Europe water purifier market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Market size reached xx million units in 2024. This growth is attributed to factors such as increasing awareness about waterborne diseases, rising disposable incomes, and the growing adoption of advanced purification technologies across diverse end-user industries. Technological disruptions, such as the introduction of IoT-enabled systems and AI-powered monitoring, are transforming the market landscape. Consumer behavior is shifting towards preference for energy-efficient and user-friendly water purifiers. Market penetration is expected to increase further, driven by government initiatives promoting water conservation and the rising adoption of water purification systems in both residential and commercial sectors. The forecast period (2025-2033) projects a CAGR of xx%, reaching a market size of xx million units by 2033.

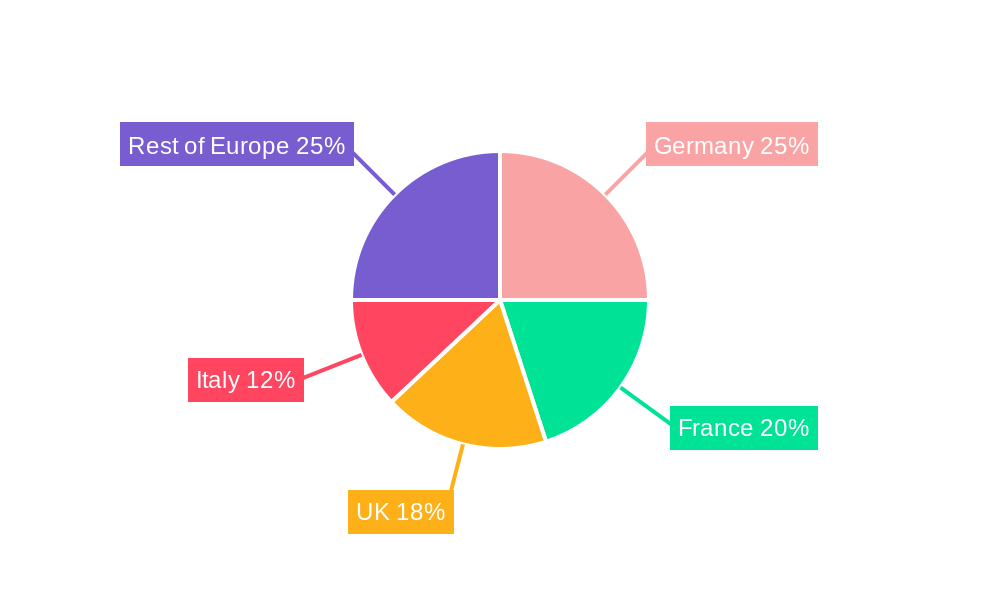

Dominant Regions, Countries, or Segments in Europe Water Purifier Market

Germany, France, and the UK are the leading markets within Europe, driven by robust industrial growth, stringent environmental regulations, and high consumer awareness. The Municipal segment dominates the end-user industry, owing to significant public investment in water infrastructure upgrades. Within technologies, Reverse Osmosis holds the largest market share due to its high efficiency and versatility. Key drivers vary across regions and segments:

- Germany: Strong industrial sector, high technological adoption, and supportive government policies.

- France: Significant investments in water infrastructure modernization and a growing focus on water conservation.

- UK: Expanding residential sector and increasing consumer preference for high-quality water.

- Municipal Segment: High government spending on water infrastructure projects and stringent water quality standards.

- Reverse Osmosis Technology: Superior performance, ability to remove a wide range of contaminants, and proven reliability in various applications.

Europe Water Purifier Market Product Landscape

The market offers a wide array of water purifiers, ranging from basic filtration systems to advanced multi-stage purification technologies incorporating reverse osmosis, UV sterilization, and mineral addition. Product innovations focus on enhanced efficiency, reduced energy consumption, compact designs, and user-friendly interfaces. Unique selling propositions include smart features like mobile app connectivity for monitoring and control, integrated water dispensers, and customizable filtration stages tailored to specific water quality needs.

Key Drivers, Barriers & Challenges in Europe Water Purifier Market

Key Drivers: Increasing awareness of waterborne diseases, stringent government regulations on water quality, rising disposable incomes, and technological advancements in filtration technologies. Government initiatives promoting water conservation and the growing adoption of water purification systems in both residential and commercial sectors also significantly contributes to the market growth.

Challenges & Restraints: High initial investment costs for advanced systems, competition from bottled water, and potential supply chain disruptions. Regulatory hurdles and complex compliance procedures can hinder market growth. Furthermore, intense competition among established players and the emergence of new entrants may put downward pressure on prices.

Emerging Opportunities in Europe Water Purifier Market

Untapped markets in rural and less developed regions of Europe present significant growth opportunities. The increasing demand for sustainable and eco-friendly water purification solutions drives opportunities for innovative technologies, such as bio-based filters and energy-efficient systems. Consumer preference for smart and connected water purifiers creates an avenue for enhanced product features and user experiences.

Growth Accelerators in the Europe Water Purifier Market Industry

Technological breakthroughs in membrane technology, AI-powered water quality monitoring, and IoT-enabled systems are accelerating market growth. Strategic partnerships between water purifier manufacturers and water management companies are expanding market reach and promoting integrated water solutions. Expansion into new markets, particularly in developing regions, and effective marketing strategies targeting environmentally conscious consumers are vital factors for long-term growth.

Key Players Shaping the Europe Water Purifier Market Market

- Buckman Laboratories

- Solvay

- Ecolab

- Accepta

- Nouryon

- BWA Water Additives

- Kurita Water Industries Ltd

- Evoqua Water Technologies LLC

- Albemarle Corp

- Arch Chemicals Inc

- Chemtura Corp

- Kemira

- Dow

- Solenis

- Suez

- Ashland Water Technologies

- Chemtreat Inc

- General Chemical Performance Products LLC

Notable Milestones in Europe Water Purifier Market Sector

- 2020, Q3: Introduction of a new line of energy-efficient reverse osmosis systems by Ecolab.

- 2021, Q1: Merger between two major water treatment companies, resulting in a significant market share increase.

- 2022, Q4: Launch of AI-powered water quality monitoring system by a leading technology company.

- 2023, Q2: Implementation of new EU regulations on water quality standards impacting the market.

In-Depth Europe Water Purifier Market Market Outlook

The European water purifier market is poised for substantial growth in the coming years, driven by several factors including growing urbanization, increasing awareness of water scarcity and quality concerns, and continuous technological advancements. Strategic partnerships, expansion into emerging markets, and focused investments in R&D will be crucial for companies to capitalize on the significant opportunities presented by this dynamic market. The focus on sustainable and energy-efficient solutions will further define market evolution and consumer choices.

Europe Water Purifier Market Segmentation

-

1. Technology

- 1.1. Microfiltration

- 1.2. Ultrafiltration

- 1.3. Nanofiltration

- 1.4. Reverse Osmosis

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Pulp and Paper

- 2.3. Chemical

- 2.4. Food and Beverage

- 2.5. Healthcare

- 2.6. Power

- 2.7. Other End-user Industries

Europe Water Purifier Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Water Purifier Market Regional Market Share

Geographic Coverage of Europe Water Purifier Market

Europe Water Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for Low Pressure Membrane Technology; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Membrane Water Treatment Technology; Other Restraints

- 3.4. Market Trends

- 3.4.1. Reverse Osmosis to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Microfiltration

- 5.1.2. Ultrafiltration

- 5.1.3. Nanofiltration

- 5.1.4. Reverse Osmosis

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Pulp and Paper

- 5.2.3. Chemical

- 5.2.4. Food and Beverage

- 5.2.5. Healthcare

- 5.2.6. Power

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Microfiltration

- 6.1.2. Ultrafiltration

- 6.1.3. Nanofiltration

- 6.1.4. Reverse Osmosis

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Municipal

- 6.2.2. Pulp and Paper

- 6.2.3. Chemical

- 6.2.4. Food and Beverage

- 6.2.5. Healthcare

- 6.2.6. Power

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Microfiltration

- 7.1.2. Ultrafiltration

- 7.1.3. Nanofiltration

- 7.1.4. Reverse Osmosis

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Municipal

- 7.2.2. Pulp and Paper

- 7.2.3. Chemical

- 7.2.4. Food and Beverage

- 7.2.5. Healthcare

- 7.2.6. Power

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Microfiltration

- 8.1.2. Ultrafiltration

- 8.1.3. Nanofiltration

- 8.1.4. Reverse Osmosis

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Municipal

- 8.2.2. Pulp and Paper

- 8.2.3. Chemical

- 8.2.4. Food and Beverage

- 8.2.5. Healthcare

- 8.2.6. Power

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Microfiltration

- 9.1.2. Ultrafiltration

- 9.1.3. Nanofiltration

- 9.1.4. Reverse Osmosis

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Municipal

- 9.2.2. Pulp and Paper

- 9.2.3. Chemical

- 9.2.4. Food and Beverage

- 9.2.5. Healthcare

- 9.2.6. Power

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Europe Europe Water Purifier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Microfiltration

- 10.1.2. Ultrafiltration

- 10.1.3. Nanofiltration

- 10.1.4. Reverse Osmosis

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Municipal

- 10.2.2. Pulp and Paper

- 10.2.3. Chemical

- 10.2.4. Food and Beverage

- 10.2.5. Healthcare

- 10.2.6. Power

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Buckman Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ecolab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accepta

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nouryon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BWA Water Additives

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kurita Water Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evoqua Water Technologies LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Albemarle Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arch Chemicals Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chemtura Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kemira

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dow

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solenis

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Suez

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ashland Water Technologies

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Chemtreat Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 General Chemical Performance Products LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Buckman Laboratories

List of Figures

- Figure 1: Europe Water Purifier Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Water Purifier Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Water Purifier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Water Purifier Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 17: Europe Water Purifier Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Europe Water Purifier Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Water Purifier Market?

The projected CAGR is approximately 8.28%.

2. Which companies are prominent players in the Europe Water Purifier Market?

Key companies in the market include Buckman Laboratories, Solvay*List Not Exhaustive, Ecolab, Accepta, Nouryon, BWA Water Additives, Kurita Water Industries Ltd, Evoqua Water Technologies LLC, Albemarle Corp, Arch Chemicals Inc, Chemtura Corp, Kemira, Dow, Solenis, Suez, Ashland Water Technologies, Chemtreat Inc, General Chemical Performance Products LLC.

3. What are the main segments of the Europe Water Purifier Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for Low Pressure Membrane Technology; Other Drivers.

6. What are the notable trends driving market growth?

Reverse Osmosis to dominate the Market.

7. Are there any restraints impacting market growth?

; High Cost of Membrane Water Treatment Technology; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Water Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Water Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Water Purifier Market?

To stay informed about further developments, trends, and reports in the Europe Water Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence